Back

Contents

How to Start a Forex Brokerage in 2025?

Brokerage Business

Vitaly Makarenko

Chief Commercial Officer

Iva Kalatozishvili

Business Development Manager

Starting a Forex brokerage in 2025 calls for strategic planning, rigorous regulatory compliance, modern technologies and clever market positioning. Understanding and adapting to these elements will help one to have a strong presence in the Forex market among sophisticated trading platforms, knowledgeable traders, and fierce worldwide competitiveness.

How to Start a Forex Brokerage in 12 Steps:

- Identify Your Target Market

- Formulate a Business Plan

- Decide on Brokerage Type

- Select Jurisdiction and Acquire License

- Choose a Trading Platform

- Secure a Back Office Solution

- Address Liquidity Needs

- Integrate Payment Solutions

- Implement Risk Management Protocols

- Develop an Affiliate Program

- Design a Marketing Strategy

- Initiate Client Acquisition

Now, let’s explore each of these steps in detail.

1. Identify Your Target Market

Begin with thorough market research. Identify the main types of traders in your region—retail newcomers, experienced professionals, or institutional clients—and note their priorities. This initial mapping sets the direction for every decision that follows.

Demographics and Trading Preferences

Match platform features to the audience’s profile. Younger, tech-savvy users respond to mobile trading and automation tools, while more experienced traders often value deep research, stable execution, and a wide range of currency pairs.

Tailoring Your Offerings

Use the data you gather to customize your platform and services. For novices, provide tutorials and a clean interface. For advanced users, integrate sophisticated charting tools and rare currency instruments. Align each element with the audience’s needs.

Assessing Local Regulations and Cultural Factors

In each region, understand language needs, local regulations, holidays, and cultural attitudes toward risk. Localizing content and ensuring compliance with local guidelines can improve credibility and attract users who feel their unique context is understood.

Evaluating Competition and Differentiation

Identify existing brokers serving your target group. Note their strengths, weaknesses, and pricing. Differentiate your brokerage by offering a better user experience, more responsive support, or unique trading options that fill gaps left by competitors.

Preferred Payment Methods and Support Channels

Study how your audience typically deposits and withdraws funds—credit cards, local e-wallets, bank wires—then integrate those methods. Decide on customer support channels (live chat, email, phone) that match client expectations for speed and convenience.

2. Formulate a Business Plan

Specify precisely what you want to accomplish—niche market presence, emphasis on high-volume traders, or specialty currency pair offering. Establish measurable goals that include a target profit margin within 24 months or a set number of active customers at the conclusion of the first year.

Financial Projections and Budgeting

Outline all startup costs, including technology licenses, regulatory fees, and initial marketing campaigns, and detail ongoing expenses like staff salaries, platform maintenance, and liquidity costs. Create realistic revenue forecasts based on spreads, commissions, and add-on services, and consider various market conditions—volatile times may boost volume, but quiet periods could reduce earnings.

Market Positioning and Differentiation

Examine the competitive landscape and identify how you will stand out. Perhaps you’ll focus on exceptional customer support, unique currency offerings, educational resources, or cutting-edge analytical tools.

Scalability and Adaptability

Plan for growth and changing market conditions by building flexible infrastructure and processes. Choose platforms that can handle higher trading volumes and integrate new instruments easily, and maintain a compliance framework ready to adjust as regulations evolve.

Investor and Stakeholder Confidence

Investors, partners, and potential lenders are reassured by a well-organized company plan showing your research. Show them that you have ideas for overcoming obstacles and that you considered operational complexities, financial hazards, and legal constraints.

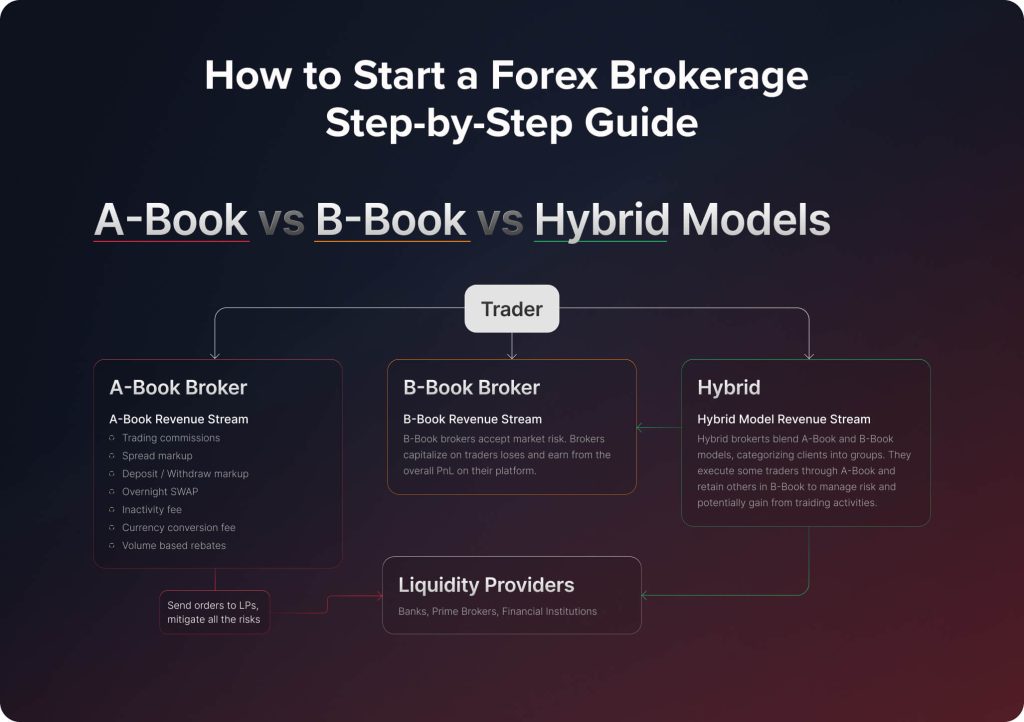

3. Decide on Brokerage Type

Selecting the operating model for your Forex brokerage will affect your risk profile, income flow, and Forex industry market positioning. With different features and operating approaches, the three main models accessible are the A-Book, B-Book, and Hybrid models.

A-Book Model Considerations

In the A-Book model, your role as a Forex broker is akin to an intermediary. You pass your clients’ trades directly to liquidity providers or the interbank market. This model is lauded for its transparency, aligning your brokerage’s interests with those of your clients. Earning revenue mainly through commissions and spreads requires strong connections with reputable liquidity providers to ensure competitive prices and trade execution for your traders. However, this model necessitates a deep understanding of liquidity in the FX market and a robust technological infrastructure for efficient trade execution.

B-Book Model Dynamics

The B-Book model presents a different approach where you internalize the risk by acting as the counterparty to your clients’ trades. In this scenario, profitability hinges on your clients’ trading losses, setting up a scenario where the broker’s interests might contrast with those of the clients. This model offers control over trading operations and can be lucrative if you have a keen grasp of market trends and client behavior. However, it also bears higher risk and requires excellent risk management strategies and analytical tools to balance potential losses against gains.

Hybrid Model Flexibility

Combining the A-Book and B-Book ideas, a hybrid model offers adaptability and a varied income source. Depending on the risk assessment of each customer transaction, it lets you route some to outside liquidity providers (A-Book) and retain others in-house (B-Book). This model enables effective risk management by diversifying trading exposures. Implementing a Hybrid model requires advanced systems for accurately analyzing and categorizing trades and a nuanced understanding of various trading strategies and their associated risks.

Your brokerage’s particular objectives, risk management capacity, and target market audience preferences should guide your decision on an A-Book, B-Book, or hybrid model. Every model has different benefits and drawbacks; the best one for your Forex traders will rely on how closely it fits their demands and your general company strategy.

4. Select Jurisdiction and Acquire License

Establishing a Forex broker requires a crucial decision: selecting the right jurisdiction and obtaining a license. This step is fundamental for legal compliance and establishing trust and legitimacy in the eyes of Forex traders and the wider financial markets.

Navigating Regulatory Frameworks and Jurisdiction Choice

Starting a Forex brokerage calls for an important decision on jurisdiction and regulatory compliance. Although respected authorities like the Australian Securities and Investments Commission (ASIC) or the UK’s Financial Conduct Authority (FCA) have great reputation, getting their licenses may be difficult, particularly for smaller or new brokerages. This challenge leads many to consider alternative options in offshore jurisdictions.

You may also like

Exploring Offshore Jurisdictions as Alternatives

Offshore jurisdictions often provide a more accessible entry point for new Forex brokerages. While they may not carry the same prestige as the FCA or ASIC, they offer several practical advantages:

- Easier Licensing Process: Offshore jurisdictions typically have a more straightforward and faster licensing process, which can be crucial for brokerages eager to enter the market without prolonged delays.

- Cost-Effectiveness: Startups or smaller businesses might find it more financially feasible as the expenses of acquiring and keeping permits in offshore countries are usually less.

- Flexible Regulations: Usually having lenient regulations, these nations provide brokerages more operating freedom and less strict compliance obligations.

- Global Market Access: Offshore licenses still provide access to a large spectrum of foreign markets, which lets brokerages serve a varied customer base.

Understanding the Licensing Process

Getting a Forex broker license is a thorough and difficult procedure. It means satisfying certain legal criteria, proving financial soundness, putting in place sensible risk control policies, and making sure the management team has the required knowledge and credentials. Along with this, the procedure entails getting ready and turning in comprehensive paperwork and going over it closely by the authorities.

The jurisdiction will substantially affect the time and expenses involved in acquiring a Forex broker license. These charges include the legal fees, license fees, running expenses required to match your company with legal requirements. Therefore, you should include these expenses into the initial business plan and be ready for the time commitment needed.

Enlisting professional guidance can be immensely beneficial, given the complexity of Forex regulations and the licensing process. Legal experts and specialized consultancy firms can offer invaluable insights and support, helping to streamline the application process, ensure adherence to regulatory standards, and potentially expedite obtaining your Forex license.

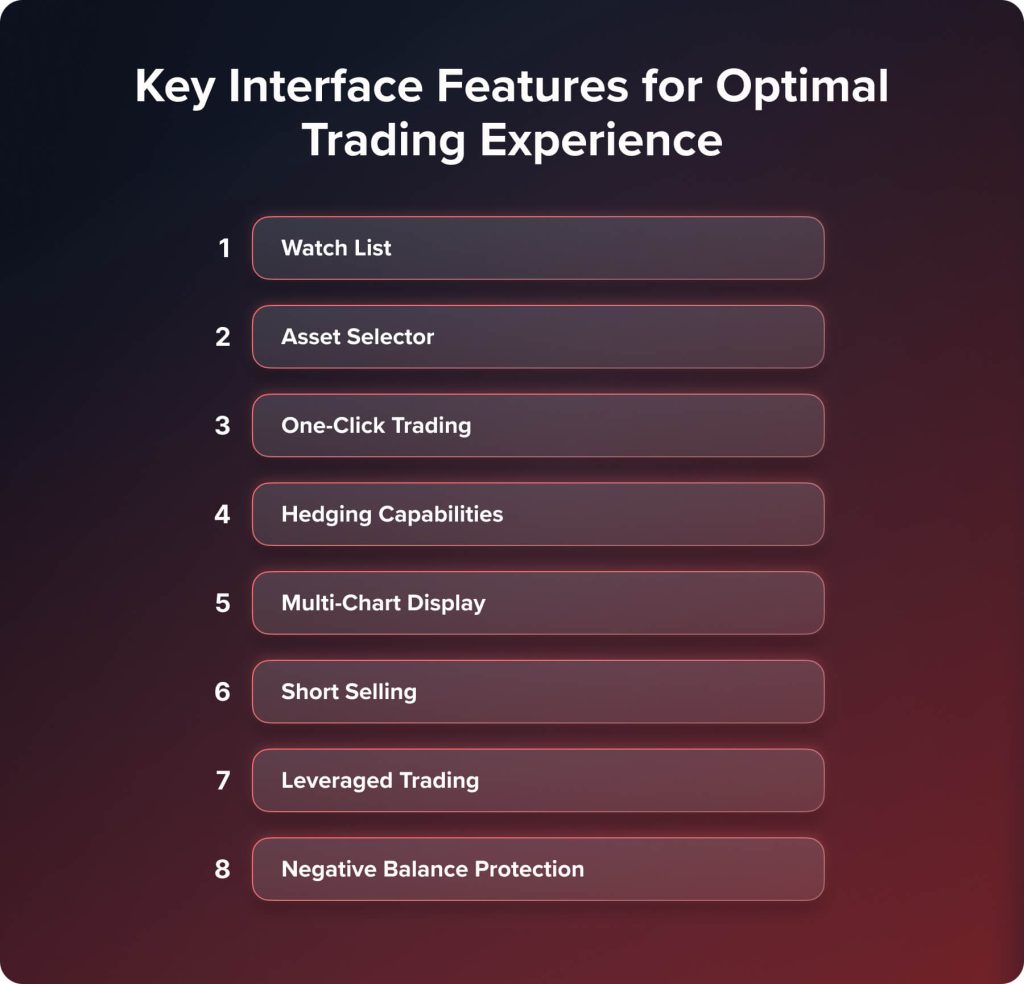

5. Choose a Trading Platform

Choosing the appropriate trading platform is pivotal in establishing a Forex broker. This platform is not just a tool; it’s the gateway through which your clients will interact with the dynamic FX market. The decision involves carefully evaluating different platforms, considering their features, reliability, and user experience, and balancing these factors with the technical specifications crucial for smooth and efficient trading operations.

Evaluating Trading Platforms

The Forex trading scene offers a range of systems with special benefits. Due in great part to their proven dependability, extensive capabilities, and general recognition among Forex traders, popular sites like MetaTrader are generally the first option for many brokerages. For both new and seasoned traders, MetaTrader 4 and 5 combine sophisticated trading tools, customizing choices, and a helpful user community.

However, while MetaTrader has long held a dominant position in the market, it is increasingly viewed as somewhat prehistoric, particularly in the face of newer, more technologically advanced platforms. As the market evolves, traders seek platforms that offer more modern interfaces, enhanced functionalities, and greater integration capabilities. In this context, platforms like the Quadcode trading platform are gaining attention. These modern platforms are designed with cutting-edge technology, offering various features beyond traditional trading. They provide intuitive user experiences, advanced analytical tools, and greater customization to meet the specific needs of today’s diverse trading community.

Moreover, some brokerages might gravitate towards developing a custom trading platform. This option makes additional customizing possible, thereby matching the platform to particular customer requirements or market niche. Custom platforms need a significant technological investment and ongoing development to stay up with the changing industry, even if they might provide different competitive advantages and special selling factors. The rise of sites like Quadcode demonstrates a change in the sector where attracting a new generation of traders looking for more than what conventional platforms provide depends on innovation and modernization.

Technical Specifications Considerations

To improve customer involvement and trading efficiency when choosing a trading platform for your Forex brokerage, give technical criteria and user-friendly characteristics top priority. Rich features on the platform should help to enhance user experience and raise engagement, therefore directly influencing customers’ Average Revenue Per User (ARPU) and Lifetime Value (LTV).

Balancing Functional Richness with Technical Excellence

The chosen trading platform should boast rich features and excel in technical aspects. While factors like execution speed are often associated with liquidity providers or internal dealing mechanisms, the platform’s ability to support these operations seamlessly is vital. It should be capable of handling high volumes of trades efficiently and offer robust integration capabilities with other key systems such as liquidity providers, back-office solutions, and payment processing services.

Choosing the appropriate trading platform for your Forex brokerage company is essentially about juggling excellent technical capability with a feature-rich user interface. Eventually, the platform should fit your strategic goals, satisfy the needs of your target market, and be part of a coherent operational environment, thus helping to elevate client involvement and company development.

6. Secure a Back Office Solution

In the realm of establishing a successful Forex brokerage company, selecting an appropriate back-office solution is paramount. This solution serves as the operational core of your business, impacting everything from client management to financial reporting. A well-chosen back office system ensures operational efficiency and robust functionality, which is crucial for the smooth running of various business processes.

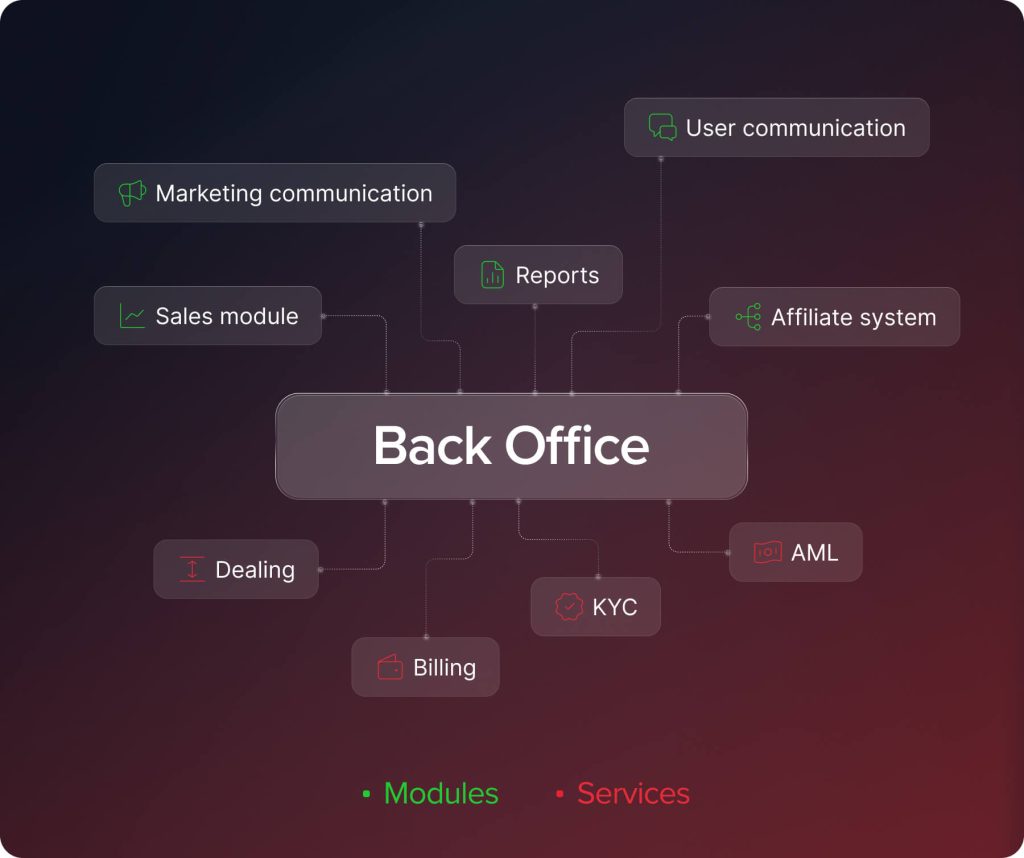

Key Modules and Services of an Effective Back Office System

A comprehensive back office system for a Forex brokerage should encompass a range of modules, each addressing a specific operational need:

- User Communication: A platform for seamless communication with clients, facilitating interactions and addressing queries, enhancing client service quality.

- Sales Modules: Tools for tracking sales activities, managing leads, and converting prospects into clients, crucial for driving business growth.

- Reports: Advanced reporting capabilities for a clear view of business operations, including trade, client activity, and financial reports, aiding in informed decision-making.

- Marketing Communications: Integrated marketing tools for executing effective campaigns, managing promotions, and engaging with potential and existing clients.

- Affiliate Systems: A system to manage and track the performance of affiliate partners, ensuring accurate reward distribution and fostering profitable partnerships.

- Dealing: Tools for managing trading activities, including order execution, risk management, and monitoring market positions.

- Billing: Efficient handling of all billing and financial transactions, ensuring accuracy in invoicing, payments, and financial reconciliations.

- KYC and AML Compliance: Comprehensive modules for anti-money laundering checks and customer validation guarantee regulatory compliance and help to reduce risk.

Basically, for a Forex broker, a complete back office system with all these important components is a strategic advantage rather than just a backend need. It guarantees flawless operational efficiency and conformability with legal requirements, thereby providing the required instruments for good company management and client interaction. Therefore, the choice of the appropriate back office system has a major influence on the performance and expansion path of a Forex brokerage.

7. Address Liquidity Needs

Addressing liquidity needs is a crucial aspect of establishing a Forex brokerage, significantly influencing the quality of client services. The approach to liquidity varies depending on the chosen brokerage model—A-Book, B-Book, or Hybrid. Each model requires a different strategy in terms of liquidity management and risk.

A-Book and Hybrid Models: Necessity for Liquidity Providers

Partnering with reputable liquidity providers is vital for brokerages operating on A-Book and Hybrid models. These models involve passing client orders directly to the interbank market or to external liquidity providers.

- Partnerships with Liquidity Providers: FAccessing deep liquidity pools depends on having strong relationships with big banks or financial institutions within the interbank market. Crucially for drawing in high- volume or high-frequency traders, this guarantees a constant flow of liquidity and attractive bid-ask spreads. These providers’ dependability and execution speed strongly influence the trading experience offered to customers.

- Liquidity Aggregators: Using liquidity aggregator services helps to improve trading conditions even further. Compiling prices from several sources, aggregators provide more competitive trading choices and a larger array of instruments. In fast-paced markets specifically, this guarantees customers may receive the best possible rates.

B-Book Model: Focus on Risk Management

Conversely, the emphasis shifts from liquidity providers to robust risk management for brokerages following the B-Book model. In this model, the brokerage acts as the counterparty to client trades, meaning it profits when clients lose and vice versa.

- Reduced Dependence on External Liquidity: B-Book brokerages do not pass trades to external markets; thus, the need for liquidity providers is significantly diminished. The primary focus is on managing internal risks.

- Effective Risk Management Strategies: Implementing sophisticated risk management systems becomes paramount. This includes monitoring client trading activity, identifying risk exposure, and employing strategies to balance trades within the brokerage. Good risk management ensures the brokerage’s sustainability, particularly when clients are profitable.

The way a Forex brokerage addresses liquidity requirements is closely related to its operating philosophy. Building a successful Forex brokerage that properly serves its clientele depends on knowing and adjusting to the particular criteria of your selected model.

8. Integrate Payment Solutions

One of the key components to handle when building a Forex brokerage company is the use of a strong and flexible payment system. Not only is it a convenience, but your customers’ trading experience depends fundamentally on their capacity to quickly deposit and withdraw money. Your payment integrations’ effectiveness can significantly influence client satisfaction and operational fluidity.

Offering a Range of Payment Options

Serving a worldwide customer base depends on you diversifying your payment sources. Regarding how they manage money, various traders have varied tastes and restrictions. Especially for significant purchases, it is advisable to combine many payment methods including credit and debit cards for their general acceptability and convenience, e-wallets for their speed and simplicity, and conventional bank transfers for their security. This variety guarantees that your brokerage can satisfy the requirements and preferences of traders from different countries and backgrounds, therefore improving the usability of your offerings.

Prioritizing Security and Compliance

Regarding financial transactions, particularly in a sector as active as Forex trading, security, and regulatory compliance are non-negotiable. Protecting your customers’ money and personal data depends mostly on your payment solutions maintaining the highest security requirements, including encrypted transactions and strict data protection rules. Furthermore, especially for cross-border transactions, adherence to local rules and international norms is crucial. This includes guaranteeing openness in all financial transactions and fulfilling anti-money laundering (AML) criteria. Working with reliable payment service providers can help you control these complications by providing compliant, safe transaction solutions fit for the many demands of your worldwide customers.

The successful integration of diverse, secure, and compliant payment solutions is a key milestone in establishing your own Forex brokerage business. It’s not only about offering several means for financial transactions; it’s also about establishing an atmosphere in which customers feel confident and secure in their interactions with your brokerage. A well-considered payment system may greatly improve customer confidence, contentment, and—at last—the company’s reputation and success of your Forex brokerage firm.

9. Implement Risk Management Protocols

In the intricate world of Forex brokers, establishing robust risk management protocols is akin to setting up a comprehensive insurance policy for your brokerage business. It involves a meticulous approach to mitigating various risks, from those directly tied to trading activities to various operational challenges.

Strategizing Against Trading Risks

Forex trading has counterparty risks and a natural rollercoaster of market volatility. Your brokerage must have adaptable and strong risk management plans if it wants to negotiate this terrain. These techniques might include establishing reasonable leverage limits for customers, therefore protecting your brokerage and them from the higher dangers connected with too high of a leverage. Counterparty risk—where there is always a chance the opposite side engaged in a transaction may default—is another aspect of trading risk. Reducing this risk calls for careful due research on all those engaged, including liquidity providers, and creating agreements meant to protect your brokerage from any financial fallout.

Tackling Operational Risks

Operational risks in a Forex brokerage business stretch across various domains. Technological failures, for instance, can disrupt trading operations, leading to client dissatisfaction and potential financial losses. This necessitates a robust IT framework fortified with fail-safes and contingency plans. Regular system maintenance and updates are part of this defensive shield, ensuring that technological glitches don’t hamper trading activities.

Cybersecurity is another area that requires constant attention in the digital era of today. Managing sensitive customer information and large financial transactions puts a Forex broker directly in the sights of hackers. Establishing a protective shield around your digital assets means using cutting-edge cybersecurity tools like regular security audits, encryption, and firewalls to prevent possible cyberattacks.

Forex trading’s regulatory environment is very complex and ever changing. Maintaining a culture of compliance within your company in addition to staying current with legal developments helps you to stay ahead of compliance concerns. This include consistent staff compliance training as well as ongoing internal policy evaluation and improvement to match changing legal criteria.

Establishing strong risk management systems in your own Forex brokerage is about building a protected environment that resists the many threats of the Forex market. Every level of your company is impacted by a careful mix between strengthening your operational infrastructure and fostering a culture of risk awareness and readiness.

10. Develop an Affiliate Program

When establishing a robust affiliate module for a Forex brokerage, a key component is creating a network of influential partnerships with individuals and entities in the financial sector. This network can include influencers, trading educators, and other key players, each capable of extending the reach and enhancing the credibility of your brokerage. Apart from creating these strong bonds, one should also take into account the many ways a broker might pay associates for their efforts. Unique advantages and incentives abound from these models, which include Cost Per Acquisition (CPA), Revenue Share, and Spread Share.

Exploiting the Potential of Affiliate Networks

The cornerstone of a successful affiliate module lies in forging productive relationships with individuals and entities that have a commanding presence in the financial world. Influencers and trading educators, with their captive audiences, can act as powerful conduits for your brokerage’s marketing efforts. Identifying and collaborating with partners whose followers align with your target audience is key. For example, an educator with a following of novice traders could be an invaluable asset for a brokerage focusing on new entrants to the Forex market.

These affiliations go beyond mere reach; they add layers of credibility and trust to your brokerage. When respected figures in the financial community vouch for your services, it naturally enhances your appeal to potential clients. This aspect of credibility is especially crucial in the Forex market, where trust and reputation play significant roles in client decisions.

Diverse Compensation Models

- Cost Per Acquisition: Under the CPA model, associates are paid for every customer they promote that satisfies certain requirements, including depositing money or completing a minimum number of transactions. For each qualifying recommendation, the simple mechanism guarantees a payback for affiliates.

- Revenue Share: Under this arrangement, recommended customers’ trading activity generates a portion of the revenue shared. Since the affiliate’s revenues depend on the client’s trading volume over time, it motivates associates to recommend customers who are presumably long-term, active traders.

- Spread Share: Like revenue sharing, spread share awards associates depending on the trading volume generated by their recommendations. In the Forex market, where spreads define trading expenses, this concept is very intriguing.

Efficient Tracking and Fair Compensation Structures

Implementing a robust tracking system is vital for managing and rewarding affiliate contributions effectively. This involves setting up a transparent mechanism to monitor referrals, client conversions, and other essential metrics that gauge the efficacy of your affiliate partnerships. The compensation model for your affiliates is a critical aspect of this system. Whether it’s a commission-based model, where affiliates earn a cut from the revenue generated through their referrals, or a fixed fee for specific actions like client sign-ups, the structure should be both enticing for the affiliates and sustainable for your brokerage.

The key to a thriving affiliate program lies in striking the right balance – offering enticing rewards to affiliates while ensuring these partnerships are profitable for your brokerage. Additionally, maintaining transparency, providing real-time data, and clear reporting to affiliates is essential. It fosters trust and motivates them to put their best efforts into promoting your services.

In essence, developing an affiliate module for your own Forex brokerage is about building a mutually beneficial partnership network that extends your brand’s reach and enhances its market presence. A well-structured affiliate program, backed by efficient tracking and equitable compensation, can significantly contribute to your brokerage’s growth and prominence in the competitive FX market.

11. Design a Marketing Strategy

Creating a complete marketing plan is a difficult task for a Forex company that goes beyond simple service advertising. It’s about building a strong brand identification that appeals to your target market and using many digital marketing platforms for successful interaction and outreach.

Building a Strong Brand Identity and Market Positioning

Your marketing plan revolves mostly on building a unique brand identification. This method entails delving deeply into the values of your Forex trading organization and your desired market impression. Are you targeting seasoned traders with sophisticated trading tools and statistics, or are you trying to be the go-to platform for newbies with simple-to-use interfaces and substantial instructional resources? Whatever your emphasis, your brand should reflect these ideas.

Consistency across all branding elements – from visual designs like logos and website layouts to the tone of your communications – is crucial. It fosters among your possible customers awareness and confidence. Knowing who your competitors are and knowing what distinguishes you from them can enable you to create your own niche in the market. Are you unique in your cutting-edge technology, reasonable price, or exceptional customer service? Clearly communicating this unique selling proposition is key to standing out in the crowded Forex market.

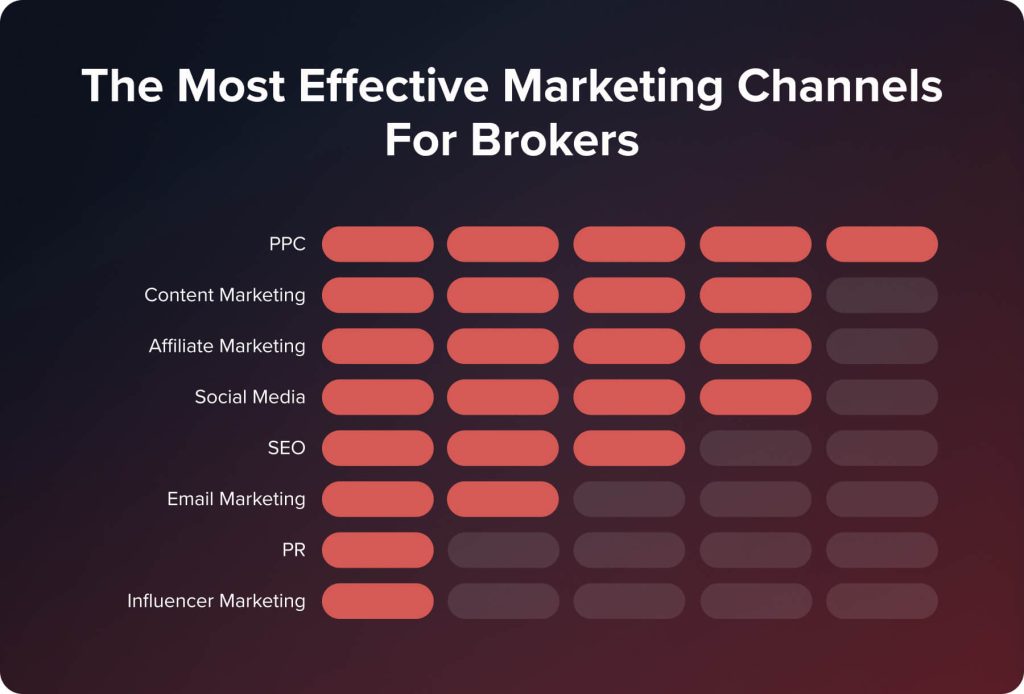

Utilizing Digital Marketing to Broaden Reach and Engagement

An effective online presence is very essential in the digital terrain of today. A well-considered SEO plan will improve your internet footprint, increase your exposure, and attract organic customers. But it doesn’t end there; adopting social media marketing is as crucial. LinkedIn, Twitter, and Instagram are platforms that help you interact with your audience, create a community, and provide content that enhances their trading experience, they are not simply tools for promotion.

Email marketing remains an effective tool for establishing direct communication with your audience. You can keep your clientele informed and engaged with your brokerage’s offerings through insightful newsletters and updates. Including a mix of additional digital marketing techniques like pay-per-click advertising, content marketing, and influencer partnerships can help you to reach more customers.

All things considered, a good marketing plan for your own Forex brokerage is a harmonic combination of a dynamic digital marketing approach and a well defined brand identification. It’s about properly establishing your brokerage in the market, attracting and retaining the appropriate customers, and creating a brand that connects with traders and endures over time.

12. Initiate Client Acquisition

Launching the client acquisition phase is pivotal for your Forex brokerage, marking the transition from setup to active operation. Following the direction of the findings from your market study, this stage is about attracting new clients and implementing a well-crafted plan honed in on your target audience. The focus on customer retention is equally important for this process as it guarantees that the clients you acquire will always appreciate and be satisfied with the products or services you provide.

Targeting the Right Audience with Precision

Regarding client acquisition, the success of your initiatives depends on your degree of target accuracy for possible customers. Your knowledge of your market niche should now guide your outreach projects. For example, if your research shows that there is demand for a platform designed for inexperienced traders, your marketing and correspondence should highlight elements like simplicity of use and instructional tools. The secret is to write your message to fit the particular demands and tastes of your target demographic.

A Dual Focus on Attracting and Retaining Clients

Although acquiring fresh business is important, the viability and expansion of your brokerage depend much on the skill of retention. Retention of clients depends mostly on outstanding customer service. This covers everything from guarantees of a flawless and user-friendly trading experience to prompt and efficient service.

Competitive offerings also contribute significantly to client retention. This might include offering attractive spreads, a diverse range of trading instruments, and access to cutting-edge trading technology. These factors draw clients to your platform and give them reasons to stay.

Regular engagement is another dimension of retention. You can keep your clients actively involved with your brokerage through various channels like educational webinars, market updates, and personalized communication. These ongoing interactions reinforce the value your platform offers, solidifying client loyalty.

Starting customer acquisition for your Forex company is a complex task. It calls for a sophisticated strategy aimed at the appropriate audience and a strategic concentration on attracting customers and maintaining their involvement and satisfaction over the long run. This combination of targeted acquisition and dedicated retention strategies ultimately drives your brokerage’s success and growth.

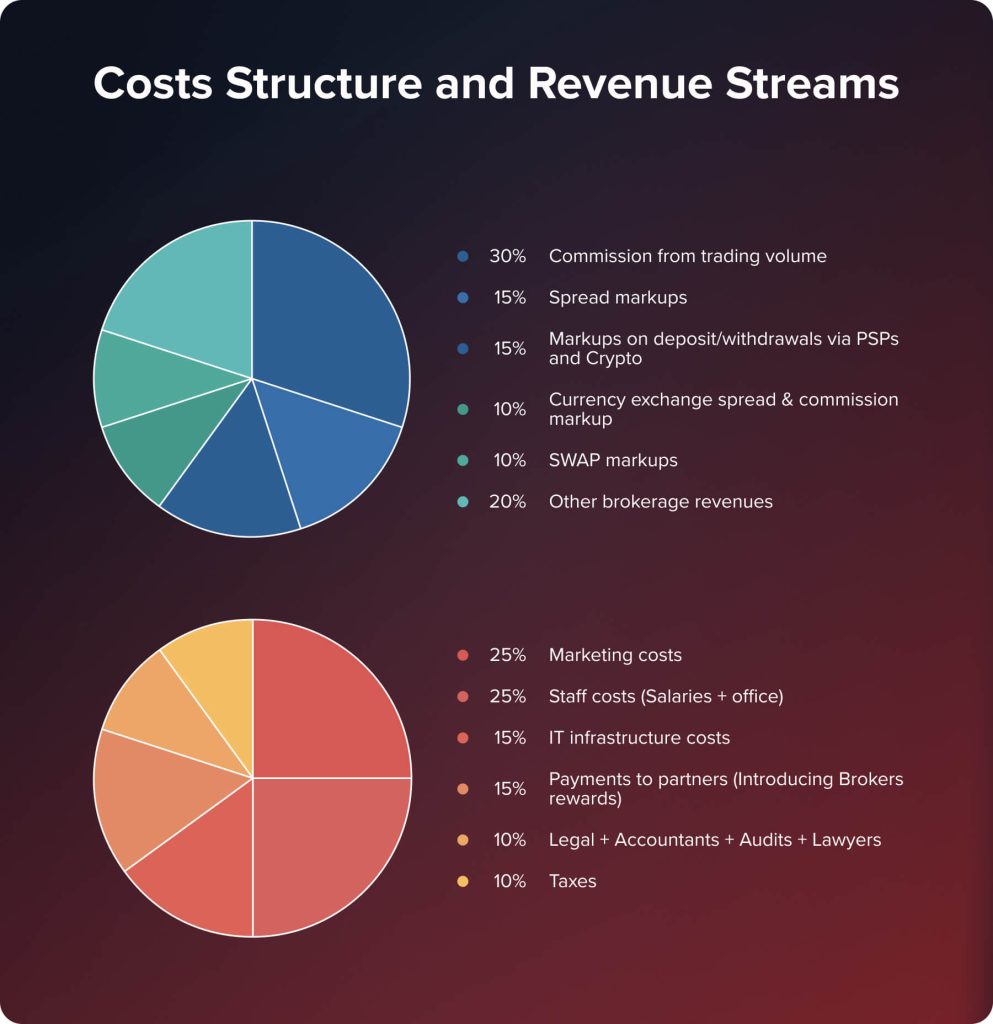

Costs and Revenue Streams for Different Brokerage Types

A sustainable company strategy in the Forex industry depends on knowing the sources of income and the kind of expenses before you enter the environment. Regardless of their particular operating model, forex brokers have many ways to make money and deal with different company running expenditures.

Revenue Streams in Forex Brokerages

- Commissions and Spreads: Forex brokers’ primary income source is the commission on trades and the spread – the difference between the bid and ask prices of currency pairs. Brokerages earn by marking up these spreads or charging a commission on each trade executed.

- B-Book Profits: In the B-Book model, the brokerage acts as the counterparty to client trades, essentially betting against them. This means when clients lose their trades, the brokerage profits. However, this also entails risk management considerations, as large client winnings can impact the brokerage’s finances.

- Additional Services: Many brokerages augment their income by offering additional services such as premium trading tools, educational resources, managed accounts, or VPS (Virtual Private Server) services for enhanced trading.

- Swap Fees: Brokerages can also earn from swap fees – charges or credits applied to accounts for holding positions overnight. These are based on the interest rate differentials between the traded currencies.

- Currency Conversion Fees: Should a brokerage provide multi-currency accounts, customers’ deposits or withdrawals in other currencies would result in currency translation costs.

Costs Associated with Running a Forex Brokerage

- Operational and Staff Costs: Daily functioning of a profitable brokerage company entails several operational expenditures including personnel pay for traders, analysts, customer service agents, and IT support.

- Technology and Infrastructure: Forex trading platforms, server maintenance, and IT infrastructure—all of which are absolutely vital for efficient and secure trading operations—take up a significant portion of the budget on the technical stack.

- Marketing and Advertising: Brokerages make significant investments in marketing and advertising to attract and keep customers. This includes internet marketing, affiliate programs, and promotional efforts..

- Legal and Compliance Costs: Ensuring regulatory compliance incurs fees for licensing, legal advice, compliance personnel, and continuous regulatory filings and audits.

- Risk Management: Managing client trade risk especially for B-Book brokerages may result in expenditures either in hedging customer transactions in the market or in applying internal risk management techniques.

To guarantee profitability and sustainability in the competitive foreign exchange market, a successful Forex firm efficiently balances the income sources and expenses, thereby adjusting to market dynamics and customer demands.

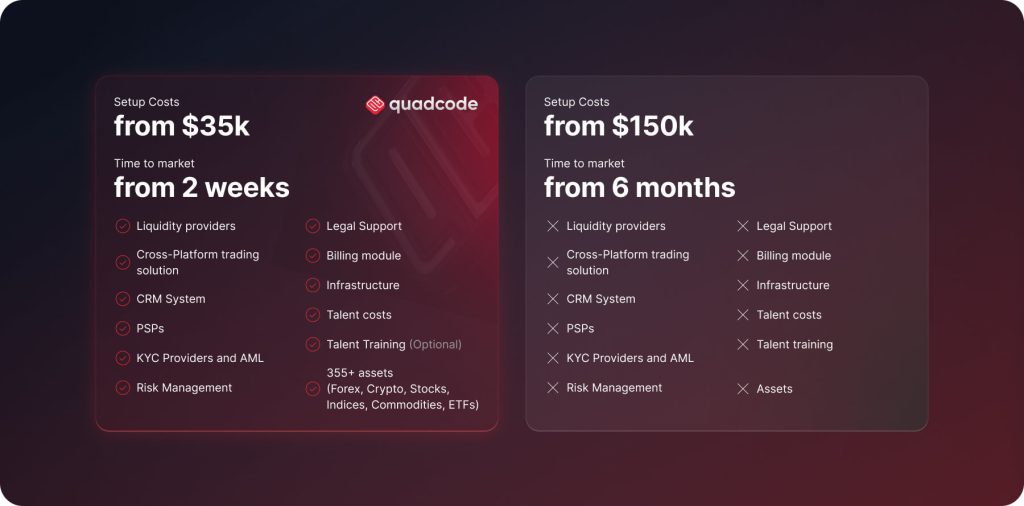

Comparing Starting from Scratch vs. White Label Solution

In the competitive realm of Forex company, deciding between starting from scratch and opting for a white label solution is pivotal. While each approach has its merits, the white label solution emerges as a distinctly more advantageous option, especially when considering the aspects of cost, time efficiency, and operational simplicity.

Starting from Scratch: A Costly and Time-Consuming Venture

Embarking on building a Forex brokerage from the ground up offers full control and the potential for deep customization. However, this route is marked by significant financial and temporal demands. The costs of developing your own trading platform, securing licenses, and establishing compliance and IT infrastructures can easily escalate. Additionally, the time frame to launch a fully functional brokerage from scratch extends over several months, if not years. This prolonged development period can be a critical drawback in the rapidly evolving Forex market.

White Label Solution: Cost-Effective and Quick Market Entry

On the other hand, dealing with a Forex white label provider presents a more easily available route to have a Forex brokerage. Usually between $10,000 to $70,000, the expenses for establishing a white label brokerage are much less than those of beginning from nothing. This affordability lets more small company owners and entrepreneurs into the currency market.

Perhaps the most appealing feature of a white label product is its quickness of implementation. A white label Forex brokerage may be up and operating in a few weeks, providing for a quick entrance into the market. This rapid setup is crucial for capitalizing on current market possibilities and establishing a footing in the sector without the significant delays involved with starting a brokerage from the bottom up.

One other major advantage of white label systems is operational simplicity. By relieving much of the technical and legal load, they free the brokerage to concentrate on client acquisition, service improvement, and brand building. Although personalizing might be somewhat limited when compared to a customized solution, most white label systems provide enough flexibility and functionality to establish a clear market presence.Interested people could look into tools like the webinar “How to Start a White Label Brokerage from Scratch” to have a better understanding about starting a white label brokerage from scratch. This webinar guides you through the key stages and issues of starting up a profitable white label Forex brokerage by providing useful information and practical advice.

Conclusion

Starting a Forex brokerage in 2024 is a demanding yet prospectively profitable business. You will build the foundation for a profitable Forex brokerage company by carefully reading and applying these guidelines. Whether you begin from nothing or rely on a white label solution, the secret to success is strategic planning, market knowledge, and regulatory restriction adherence.

Updated:

December 25, 2024