Арбитражная торговля: что такое и как она работает

В статье

Арбитражная торговля — использование разницы цен между различными рынками или классами активов — широко известная тактика в финансовом секторе. Основная идея этого подхода заключается в использовании разницы цен для покупки по низкой цене на одном рынке и продажи по высокой на другом. Эта подробная статья расскажет вам о тонкостях арбитражной торговли, её преимуществах и недостатках, состоянии регулирования и точке зрения брокера.

Как работает арбитраж?

Арбитражная торговля предназначена для извлечения прибыли из колебаний цен на активы. Арбитраж позволяет трейдеру зарабатывать, покупая и продавая актив одновременно на нескольких рынках с разными ценами. Хотя эта стратегия кажется простой, она требует глубокого знания рынка, опыта и инструментов, необходимых для использования возможностей.

Арбитражная торговля в основном основана на рыночных различиях, которые могут возникать из-за таких переменных, как изменения рыночной ликвидности, несоответствия спроса и предложения или разрывы в обновлении цен на разных платформах. Успешность арбитражной торговли зависит от скорости, точности и высокой пропускной способности транзакций; эти различия обычно мало влияют друг на друга.

You may also like

Различные стили арбитражной торговли

Хотя арбитражная торговля может применяться в различных методах, охватывающих различные рынки и виды активов, она не является универсальным подходом. Ниже приведены некоторые типичные варианты.

- Пространственный арбитраж — это соглашение, при котором один и тот же товар покупается и продаётся в нескольких географических точках. Пример акций, котирующихся на двух биржах, упомянутый ранее, относится к этой категории. Географический арбитраж также может включать в себя любой актив, обмениваемый между рынками, валютами или товарами.

- Треугольный арбитраж использует колебания обменных курсов трёх валют. Если курсы USD, EUR и GBP меняются, для получения прибыли арбитражёр конвертирует USD в EUR, EUR в GBP, а затем GBP обратно в USD.

- Статистический арбитраж использует статистический анализ для выявления торговых возможностей. Обычно он подразумевает торговлю парами акций или активов, демонстрирующих корреляцию. Когда их цены расходятся, трейдер делает ставку на то, что они воссоединятся, купив недооцененный актив и продав переоцененный.

- Конвертируемый арбитраж подразумевает покупку облигаций или привилегированных акций и короткую продажу базовых акций. Целью арбитража, особенно в случаях, когда рыночные условия позволяют конвертировать активы выгодно, является извлечение прибыли из разницы в цене между ценной бумагой и базовым активом.

- Арбитраж по ценным бумагам с фиксированной доходностью — это подход, применяемый на рынке облигаций, где спекулянты извлекают выгоду из разницы цен на инвестиции с фиксированной доходностью. Например, они могут инвестировать в государственные облигации и их производные инструменты или торговать облигациями с разными сроками погашения одного и того же эмитента, чтобы извлечь выгоду из колебаний доходности.

Риски и соображения

Арбитражная торговля не лишена рисков, несмотря на потенциальную прибыль. Основным фактором риска является исполнение, поскольку трейдеры могут столкнуться с трудностями при проведении транзакций, что может привести к убыткам. Также следует учитывать рыночный риск, поскольку стоимость активов может измениться в худшую сторону между приобретением и продажей, что приведет к снижению прибыли. Кроме того, на прибыльность арбитражной деятельности влияют транзакционные издержки, такие как налоги и брокерские комиссии.

Ликвидность Это ещё один аспект, который следует учитывать. На неликвидных рынках покупка или продажа активов в необходимых объёмах без влияния на цены может оказаться сложной задачей, что может свести на нет возможности арбитража. Кроме того, с ростом эффективности рынков частота и прибыльность арбитражных сделок могут со временем снижаться, что создаёт трудности для тех, кто полагает на эту стратегию.

Является ли арбитражная торговля незаконной?

В своей базовой и фундаментальной форме арбитражная торговля считается законной. Она признана законным методом торговли в большинстве юрисдикций.

Арбитраж служит на рынках, минимизируя разницу в ценах и повышая эффективность рынка. Эта практика не только законна, но и полезна, поскольку она способствует приведению цен в соответствие с их реальной стоимостью, способствуя справедливости на различных торговых платформах.

Во многих странах разрешена арбитражная торговля, разумеется, в рамках регулирования, поскольку она помогает устранить расхождения в ценах и повысить ликвидность рынка. На развитых рынках, таких как США, Великобритания и ЕС, арбитражная торговля считается законной практикой рыночных операций. Трейдеры, занимающиеся арбитражной деятельностью, обычно считаются действующими в рамках установленных ограничений, если они соблюдают нормативные требования.

Законность арбитража может варьироваться в зависимости от типа применяемой арбитражной стратегии и способа её реализации. Простые формы арбитража, такие как треугольный арбитраж, широко распространены во всем мире и считаются законными.

Однако существуют случаи, когда арбитражная торговля может выходить за рамки границ. Например, инсайдерская торговля и арбитраж, основанный на информации, подразумевают использование конфиденциальной информации для совершения сделок в целях личной выгоды. Подобные практики являются незаконными в большинстве стран мира, и регулирующие органы применяют строгие законы для борьбы с инсайдерской торговлей. Кроме того, существуют такие методы арбитража, как манипулирование рынком и опережение.

Можно ли зарабатывать на жизнь арбитражем?

Безусловно, арбитраж может стать источником дохода. Однако он требует знаний, опыта и значительных капиталовложений. Арбитражная торговля подразумевает выявление и использование разницы в ценах на разных рынках или активах. Хотя сама идея может показаться простой, на первый взгляд, для стабильного получения прибыли посредством арбитража требуется нечто большее, чем простое понимание рыночной динамики. Для успеха в арбитражной торговле необходимо понимание и экспертные знания рынков, на которых они работают. Это подразумевает хорошее знание рыночных тенденций, уровней ликвидности и оптимального времени для совершения сделок. Преуспевающие в арбитраже специалисты часто тратят годы на совершенствование своих навыков и развитие способности выявлять возможности, которые другие могут упустить из виду.

Каковы недостатки арбитража?

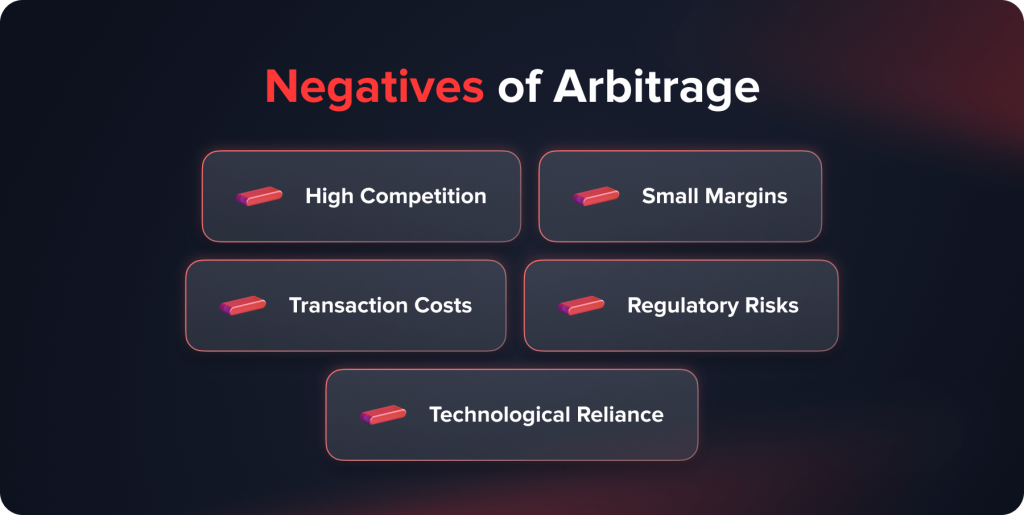

Несмотря на потенциальную прибыльность, арбитражная торговля сопряжена с существенными сложностями, которые могут усложнить её применение в качестве стратегии. Эти сложности обусловлены спецификой рынка, необходимостью использования передовых технологий и наличием непредвиденных рисков.

Высокая конкуренция

Одним из недостатков арбитражной торговли является конкуренция. Концепция арбитража широко распространена на финансовых рынках, привлекая трейдеров, от крупных институтов до хедж-фондов и частных торговых компаний, — все они борются за одинаковые возможности.

Крупные корпорации в этой сфере располагают огромными ресурсами, такими как передовые технологии, доступ к рыночной информации и значительные финансовые резервы. Эти преимущества дают им преимущество перед трейдерами, работающими независимо.

Высокая конкуренция в этом секторе приводит к быстрому выявлению и корректировке разницы цен, практически не оставляя трейдерам времени для использования возможностей арбитража. Этот ограниченный период возможностей требует от трейдеров быстрых и эффективных действий, что затрудняет достижение успеха в этой среде тем, у кого нет инструментов или опыта.

Небольшие поля

Другим заметным недостатком арбитражной торговли является обычно высокая маржа прибыли. Эта стратегия основана на использовании разницы цен между рынками, составляющей всего доли процента. Хотя эта небольшая прибыль может накапливаться со временем, для её получения требуется большой объём сделок.

Например, арбитражный шанс может давать прибыль в размере 0,1%. Чтобы получить доход от возможностей, трейдеру потребуется совершать сделки на общую сумму в сотни тысяч или даже миллионы долларов. Такая зависимость от объёмов торговли не увеличивает риск, но также предъявляет значительные требования к капиталу и торговым ресурсам трейдера.

Более того, даже незначительная ошибка при совершении сделки или неожиданное изменение рыночных условий могут превратить прибыль в убыток, что подчеркивает трудности, связанные с размером прибыли в арбитражной торговле.

Транзакционные издержки

Сборы и комиссии, связанные с транзакциями, такие как комиссии за транзакции, налоги и сборы, представляют собой ещё один недостаток арбитражной торговли. Учитывая низкую маржу прибыли, эти расходы могут существенно снизить прибыльность арбитражных операций. Каждая сделка, проводимая в рамках арбитражного подхода, влечет за собой расходы, и при отсутствии разумного управления эти расходы могут быстро накапливаться, что может привести к превращению стратегии в единую.

Например, если трейдер обнаруживает арбитражную возможность с маржой прибыли 0,2%, а транзакционные издержки составляют 0,15%, то итоговая прибыль снижается до 0,05%. В некоторых случаях транзакционные издержки могут полностью превысить прибыль, что делает сделку нецелесообразной.

Чтобы успешно справиться с этой задачей, арбитражёрам необходимо тщательно оценить все расходы перед совершением сделок и найти брокеров или торговые платформы с самыми низкими комиссиями. Тем не менее, эта задача может оказаться непростой для мелких трейдеров, не обладающих переговорной силой, которой обладают крупные организации.

Регуляторные риски

Регуляторные риски представляют собой еще одну серьезную проблему для арбитражной торговли.

Финансовые рынки подвержены влиянию постоянно меняющихся правил, которые могут существенно различаться в зависимости от региона. Изменения в нормативных актах, их толковании или методах обеспечения соблюдения могут напрямую влиять на осуществимость арбитражных стратегий. Например, новые правила могут налагать ограничения на транзакции, вводить сборы за сделки или требовать раскрытия дополнительной информации, что может снизить прибыльность арбитражных возможностей. Иногда власти могут даже запрещать виды арбитражной деятельности, связанные с финансовыми инструментами или рыночной практикой, которые воспринимаются как манипулятивные. Чтобы справиться с этими вызовами, участники арбитража должны быть в курсе ситуации на своих торговых рынках. Они должны быть готовы корректировать свои подходы в свете изменений в законодательстве. Это требует не только понимания существующих правил, но и способности предвидеть и реагировать на потенциальные будущие изменения.

Технологическая зависимость

Успешная арбитражная торговля в современном динамичном мире автоматизированной торговли во многом зависит от передовых технологий. Системы высокочастотной торговли (HFT), сложные алгоритмы и современные торговые платформы зачастую необходимы для точного выявления и реализации арбитражных возможностей. Тем не менее, такая зависимость от технологий имеет свои недостатки.

Первоначальные затраты на приобретение, поддержку и развитие технологий могут быть весьма существенными для отдельных трейдеров или малого бизнеса. Более того, сложность этих систем требует определённого уровня знаний для работы с ними. Это означает, что арбитражёрам необходимо либо обладать этими навыками самостоятельно, либо нанимать персонал.

Кроме того, технологические системы не защищены от ошибок. Они подвержены сбоям, задержкам и другим техническим проблемам, которые могут привести к упущенным возможностям или финансовым неудачам. В сфере, где скорость и точность имеют решающее значение, любой технический сбой может негативно сказаться на прибыльности арбитражера.

Брокеры и арбитражная торговля

Хотя брокеры в целом признают арбитражную торговлю как стратегию, она сопряжена с рядом условий и ограничений. Хотя и брокеры, и букмекеры рассматривают арбитраж как тактику, они часто устанавливают правила и механизмы мониторинга для защиты своих интересов. Понимание этих тонкостей крайне важно для тех, кто занимается арбитражем, чтобы избежать споров, ограничений и даже закрытия счетов.

Большинство брокеров разрешают арбитражную торговлю, поскольку эта стратегия способствует повышению эффективности рынка. Позволяя трейдерам извлекать выгоду из разницы цен, брокеры способствуют корректировке рынка, гармонизируя цены на всех платформах и обеспечивая более стабильную торговую среду.

Однако взаимодействие между брокерами и арбитражными трейдерами может быть сложным. Брокеры, как правило, применяют правила и условия, определяющие допустимые виды арбитражной тактики. Эти правила в основном направлены на предотвращение действий, которые могут негативно повлиять на бизнес-модель брокера или создать благоприятную торговую обстановку.

Заключение

Арбитражная торговля — это подход, требующий тщательного анализа, быстрого принятия решений и осознания сопутствующих рисков. Хотя она открывает возможности для получения прибыли за счёт использования неэффективности рынка, она также сопряжена с такими препятствиями, как надзор и технологические требования. Для тех, кто заинтересован в освоении этой торговой техники, критически важны понимание рынков и готовность к постоянному обучению и адаптации.

Обновлено:

19 декабря 2024 г.