15 самых популярных торговых стратегий 2025 года

В статье

На сложных финансовых рынках надежная торговая стратегия — это путеводная звезда. Эта стратегия освещает путь трейдерам, помогая им ориентироваться в непредсказуемой ситуации покупки и продажи различных классов активов. Знание их нюансов крайне важно даже при наличии нескольких стратегий. В этой статье представлен подробный обзор пятнадцати наиболее известных торговых техник, разработанных для преодоления трудностей различных рынков. Эти тактики и приверженность управлению рисками помогут трейдерам уверенно использовать торговые возможности по мере их появления.

Основы торговых стратегий

Прежде чем углубляться в детали каждого торгового плана, важно понять его основную цель. Торговая тактика По сути, это организованный метод ведения дел, или набор правил, которым следуют трейдеры для принятия разумных торговых решений. Эти правила помогают контролировать эмоции, чтобы решения принимались на основе разума и исследований, а не эмоций.

Выбор подходящей стратегии подобен выбору инструмента для конкретной задачи. Разработка стратегии должна учитывать цели трейдера, его готовность к риску и инвестиционный период. Например, тот, кто заботится о долгосрочной перспективе, может выбрать позиционную торговлю, а тот, кому нужны деньги немедленно, — внутридневную торговлю или краткосрочную ликвидность. Аналогично, более осторожный трейдер предпочтет покупать акции известных компаний или валюту; трейдер, готовый рисковать, может изучить более волатильную криптовалюту.

Понимание фундаментальных идей каждой стратегии и их согласование со своим торговым профилем поможет трейдерам улучшить результаты и максимально эффективно использовать каждое движение рынка. Хотя различные тактики могут более или менее подходить под требования каждого трейдера, следует отметить, что перечисленные ниже методы не расположены в какой-либо определённой последовательности.

15 самых популярных торговых стратегий

- Следование тренду

- Торговля импульсом

- Свинг-трейдинг

- Позиционная торговля

- Дневная торговля

- Скальпинг

- Среднее возвращение

- Высокочастотная торговля (HFT)

- Торговля прорывами

- Новости торговли

- Арбитраж

- Создание рынка

- Стратегии опционов

- Парный трейдинг

- Усреднение долларовой стоимости

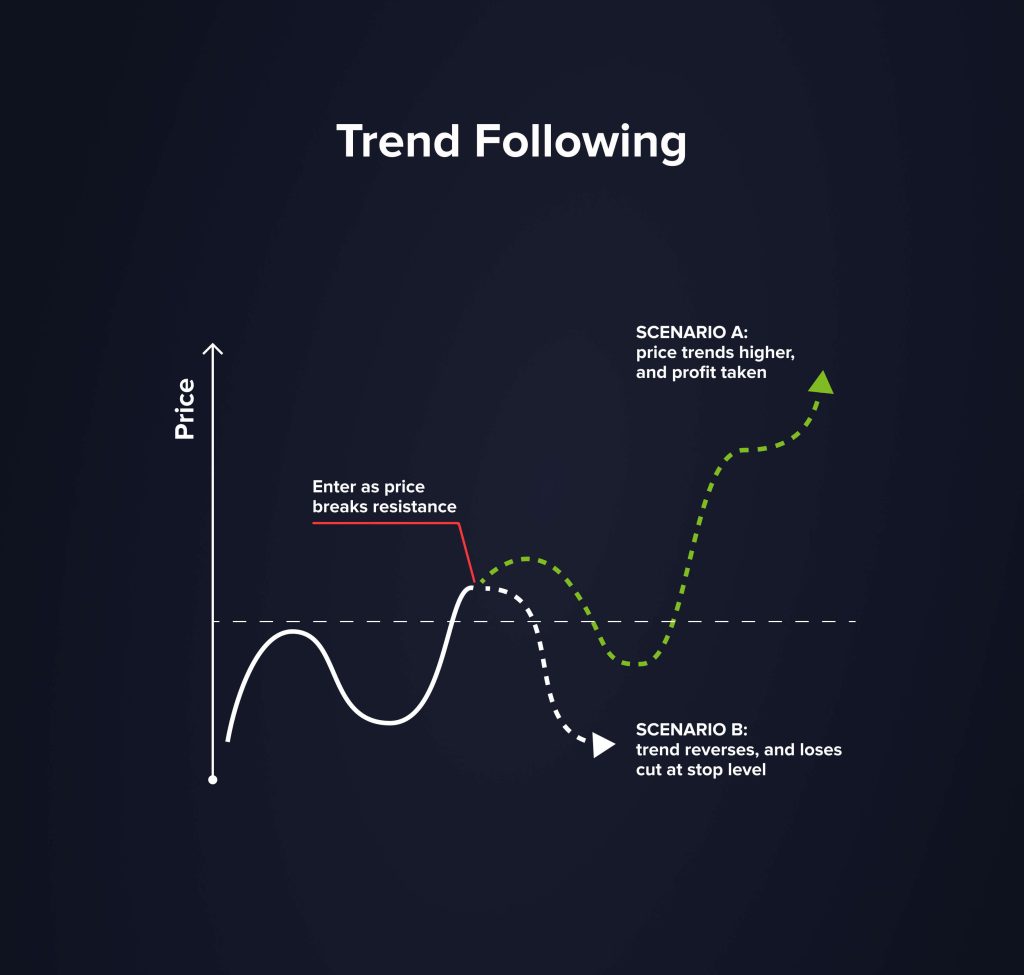

1. Следование тренду

Следование за трендом становится надёжной стратегией в различных финансовых сферах. Её суть проста: извлекать выгоду из динамики активов в определённом направлении, будь то акции, криптовалюты или опционы. Вы, вероятно, слышали поговорку «Тренд — твой друг». Ключевым элементом этой стратегии являются различные технические индикаторы, такие как скользящая средняя, которые помогают трейдерам определить общее направление тренда.

Используя силу трендов, трейдеры могут управлять рыночными приливами и отливами, получая прибыль на фоне движения активов по длительным траекториям. Однако определение реальной продолжительности тренда остаётся сложной задачей. Инструменты и технические торговые индикаторы играют ключевую роль в прояснении этого вопроса, предоставляя сигналы, помогающие точно определить начало и конец значительных рыночных движений.

Следование тренду на практике

Технические индикаторы для активации: СМА 200, СМА 50, СМА 20.

Открывайте длинную позицию, когда:

- Цена актива находится выше линии SMA 200.

- Цена актива касается линии SMA 20 как минимум три раза (позицию следует открывать после третьего касания). Закрывайте позицию, когда свеча закрывается выше линии SMA 50.

Открывайте короткую позицию, когда:

- Цена актива находится ниже линии SMA 200.

- Цена актива касается линии SMA 20 как минимум три раза (позицию следует открывать после третьего касания). Закрывайте позицию, когда свеча закрывается выше линии SMA 50.

2. Торговля по импульсу

Торговля на импульсе, как следует из названия, направлена на максимизацию текущего импульса движения цены актива. Основная идея — покупка активов, которые растут, и продажа тех, которые падают. В основе этой стратегии лежит убеждение, что активы, двигающиеся в определённом направлении, сохранят эту тенденцию в течение некоторого времени.

Однако, чтобы использовать потенциал импульсной торговли, необходимы глубокие аналитические навыки. Такие инструменты, как скользящие средние и объём торгов, могут дать бесценную информацию о том, достаточно ли силён тренд для продолжения. Несмотря на заманчивые перспективы, важно отметить, что импульсная торговля может быть подвержена внезапным разворотам рынка, что делает грамотное управление рисками незаменимым.

Торговля импульсом на практике

Технические индикаторы для активации: SMA 5, SMA 10, RSI (настройки по умолчанию), Stochastic (14, 3, 3).

Открывайте длинную позицию, когда:

- SMA 5 пересекает линию SMA 10. Стохастик движется вверх. RSI выше 50.

Открывайте короткую позицию, когда:

- SMA 10 пересекает линию SMA 5. Стохастик направлен вниз. RSI ниже 50.

3. Свинг-трейдинг

Свинг-трейдинг обеспечивает баланс между дневная торговля и позиционная торговля. Стратегия основана на использовании ценовых колебаний или краткосрочных и среднесрочных движений. Вместо того, чтобы ловить длинные рыночные волны или мимолетные дневные колебания, свинг-трейдеры преуспевают в среднесрочной перспективе, получая прибыль от роста цены акций или любого финансового инструмента в течение периода от нескольких дней до нескольких недель.

Свинг-трейдинг требует терпения. Хотя активным внутридневным трейдерам он может показаться медленным, а позиционным — хаотичным, свинг-трейдеры наслаждаются темпом, который позволяет им принимать обоснованные торговые решения. Уровни поддержки и сопротивления играют в их арсенале решающую роль, выступая в качестве маркеров для покупки и продажи.

Свинг-трейдинг на практике

Технические индикаторы для активации: Разворотные графические модели.

Открывайте длинную позицию, когда:

- На графике появились фигуры «Двойное дно», «Перевернутая голова и плечи», «Чашка с ручкой» и другие.

Открывайте короткую позицию, когда:

- На графике появились фигуры «Двойная вершина», «Голова и плечи», «Расширяющийся треугольник» и другие.

4. Позиционная торговля

Позиционная торговля, считающаяся более стратегическим подходом, подразумевает удержание финансовых инструментов, будь то акции, валюта или криптовалюты, в течение длительного времени — от нескольких недель до нескольких лет. Эта стратегия основана на тщательном фундаментальном анализе, а технический анализ служит дополнительным инструментом.

Позиционные трейдеры меньше беспокоятся о краткосрочной волатильности или колебаниях рынка. Они играют в долгосрочную игру, ориентируясь на общее направление рынка. Их выбор, зачастую основанный на обширных исследованиях, охватывающих корпоративную эффективность, отраслевые тенденции и более общие экономические показатели, является результатом тщательного анализа.

Позиционная торговля на практике

Технические индикаторы для активации: Полосы Боллинджера

Открывайте длинную позицию, когда:

- Цена актива пробивает верхнюю границу полос Боллинджера.

Открывайте короткую позицию, когда:

- Цена актива пробивает нижнюю границу полос Боллинджера.

5. Дневная торговля

Среди наиболее распространённых методов во многих областях финансов — внутридневная торговля. Внутридневная торговля, как следует из названия, заключается в открытии и закрытии позиций в течение одного торгового дня. Этот подход направлен на получение прибыли от временных колебаний цен, избегая при этом потенциальных рисков, связанных с переносом позиций на следующий день, таких как неблагоприятные новости или глобальные события, влияющие на цены акций или валют. Современные торговые системы позволяют трейдерам быстро исполнять ордера на покупку и продажу, оптимизируя даже небольшие колебания цен.

Внутридневная торговля сопряжена с большими рисками, даже если трейдеров привлекает быстрая прибыль. В этой суматошной среде требуются острое мышление, быстрая реакция и технический анализ. Реалистичные ожидания и хорошая стратегия управления рисками крайне важны в высокочастотной торговле, где даже незначительные ошибки могут привести к крупным убыткам.

Дневная торговля на практике

Технические индикаторы для активации: RSI (14, 35, 65), Стохастик (14, 1, 3), CCI (14)

Открывайте длинную позицию, когда:

- Все упомянутые технические индикаторы находятся в зоне перепроданности и начинают разворачиваться.

Открывайте короткую позицию, когда:

- Все упомянутые технические индикаторы находятся в зоне перекупленности и начинают разворачиваться.

6. Скальпинг

Скальпинг — это воплощение высокочастотных торговых стратегий. Цель скальперов — использовать очень небольшие ценовые разрывы, создаваемые потоками ордеров или спредами. Этот подход, позволяющий удерживать позицию всего несколько минут или даже секунд, особенно эффективен при небольших, кратковременных колебаниях цены. Скальпинг стал довольно популярным среди трейдеров благодаря быстрому развитию компьютерных торговых систем и общему размеру валютного рынка.

Привлекательность скальпинга заключается в возможности быстрого получения небольшой прибыли. Однако это трудоёмкий метод, требующий от трейдеров сосредоточенности на своих экранах и быстрого принятия решений. Более того, учитывая объём транзакций, брокерские комиссии могут быстро снизить прибыль, поэтому выбор торговой платформы с минимальными транзакционными издержками имеет решающее значение.

Скальпинг на практике

Технические индикаторы для активации: MACD, Parabolic SAR

Открывайте длинную позицию, когда:

- Линии MACD пересекаются внизу, далеко от средней линии. Parabolic SAR подтверждает сигнал тремя или более отметками под свечами.

Открывайте короткую позицию, когда:

- Линии MACD пересекаются в верхней части графика, далеко от средней линии. Parabolic SAR подтверждает сигнал тремя или более отметками над свечами.

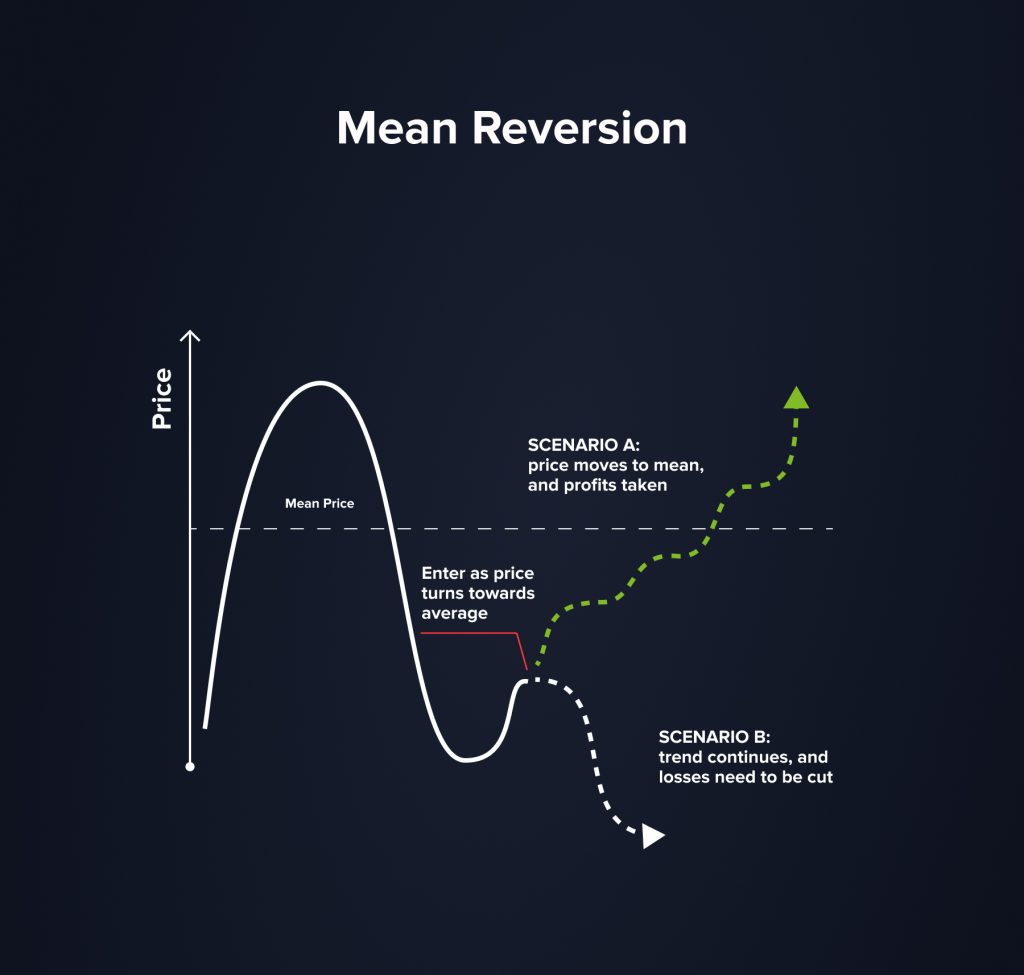

7. Возврат к среднему значению

Возврат к среднему основан на простой идее о том, что активы со временем будут стремиться вернуться к своей средней цене. Этот подход основан на убеждении, что даже на волатильных рынках цены в конечном итоге будут следовать своему историческому среднему значению. Таким образом, трейдеры, использующие эту стратегию, покупают активы с ценой ниже среднего и продают те, что выше среднего, ожидая возврата к среднему значению. К часто используемым техническим индикаторам для выявления возможных вариантов возврата к среднему значению относятся скользящие средние или Индекс относительной силы (RSI) Хотя такой подход может быть прибыльным, особенно на рынках с ограниченным диапазоном, важно помнить, что важные внешние события или новости могут сбить прошлые тренды и привести к возможным убыткам.

Возврат к среднему на практике

Технические индикаторы для активации: СМА 30, СМА 90

Открывайте длинную позицию, когда:

- SMA 30 пересекает линию SMA 90 снизу вверх.

Открывайте короткую позицию, когда:

- SMA 30 пересекает линию SMA 90 сверху вниз.

8. Высокочастотная торговля (HFT)

Передовой метод торговли, известный как высокочастотная торговля (HFT), использует суперкомпьютеры для обработки множества ордеров за несколько миллисекунд. Благодаря этому алгоритмическому подходу можно получать прибыль даже при небольших колебаниях цен на разных торговых платформах или классах активов. Способность HFT совершать транзакции с беспрецедентной скоростью сделала его доминирующей силой, особенно в стратегиях торговли акциями.

Преимущества HFT включают скорость и эффективность. Однако этот метод не бесспорен. Некоторые полагают, что HFT может вызывать искажения рынка, даже «мгновенные обвалы». Учитывая его сложность, этот метод часто недоступен для обычных трейдеров и в основном используется институциональными трейдерами с соответствующей технологической инфраструктурой.

9. Торговля на прорыве

Торговля на прорывах — это стратегия, основанная на идее, что после того, как актив пробивает уровень сопротивления (или падает ниже уровня поддержки), он продолжит движение в этом направлении некоторое время. Эта стратегия основана на предположении, что после преодоления ценой определенного барьера усиление импульса, вероятно, подтолкнет её вверх, что потенциально может принести прибыль.

Технические индикаторы играют здесь важную роль. Чтобы обнаружить возможные прорывы, трейдеры часто обращаются к таким ценовым фигурам, как треугольники, флаги, голова и плечи. Хотя эта стратегия может быть очень прибыльной, особенно при правильном определении настоящих прорывов, ложные прорывы остаются рискованными. Правильные методы управления рисками и установка жестких стоп-лоссов могут помочь снизить потенциальные потери в таких ситуациях.

Торговля на прорыве на практике

Технические индикаторы: Канал Кельтнера, канал Дончиана, полосы Боллинджера

Открывайте длинную позицию, когда:

- Цена актива пробивает верхнюю границу канала, построенного одним из указанных индикаторов.

Открывайте короткую позицию, когда:

- Цена актива пробивает нижнюю границу канала, построенного одним из указанных индикаторов

10. Торговля новостями

Новостные события оказывают большое влияние на финансовые рынки — будь то акции, торговля на Форексе или криптовалютах. Будь то решения центральных банков, квартальные прибыли крупных корпораций или геополитические события, новости могут вызывать значительные колебания цен. Торговля на новостях подразумевает извлечение выгоды из этих резких, вызванных новостями изменений цен.

Хотя существует потенциал для получения значительной прибыли, особенно если трейдер способен действовать на опережение рынка, волатильность, связанная с новостными событиями, может быть палкой о двух концах. Даже после позитивных новостей возможны внезапные развороты, что подчёркивает важность хорошей торговой стратегии и надёжных стоп-лоссов.

11. Арбитраж

Арбитраж — это использование колебаний цен для одновременной покупки и продажи товара на нескольких рынках. Если акции продаются по более низкой цене на одной бирже и по более высокой на другой, арбитражёр покупает акции на одном рынке и продаёт на другом, тем самым получая разницу.

Благодаря современным передовым инструментам и платформам многие из этих несоответствий быстро обнаруживаются и устраняются, что делает перспективы арбитража ограниченными. Однако такие возможности всё ещё существуют на менее ликвидных или менее взаимосвязанных рынках, например, на некоторых криптовалютных биржах.

12. Маркет-мейкинг

Поддержание ликвидность На финансовых рынках многое зависит от маркет-мейкеров. Стремясь получить прибыль от разницы цен покупки и продажи, они устанавливают как цену покупки, так и цену продажи финансового инструмента. Обычно, независимо от рыночной конъюнктуры, их непрерывные покупки и продажи всегда обеспечивают наличие покупателя или продавца для трейдеров. Маркет-мейкинг Может быть прибыльным, особенно на нестабильных рынках с огромными спредами, но и здесь есть свои риски. Резкие колебания рынка могут оставить маркет-мейкеров с большим объёмом обесценивающегося актива.

13. Стратегии опционов

Опционы — это финансовые инструменты, которые предоставляют трейдерам право, но не обязательство, купить или продать базовый актив по заранее определенной цене в течение определенного периода времени. Существует множество стратегий, связанных с опционами: от простых колл-опционов и пут-опционов до сложных, таких как железные кондоры или стрэддлы. Они позволяют трейдерам хеджировать, спекулировать или увеличивать кредитное плечо, но это влечет за собой повышенную сложность и риск.

Для новичков крайне важно знать основы опционов, включая внутреннюю стоимость, временной распад и подразумеваемую волатильность. Стремясь извлечь выгоду из волатильности или стабильности (в зависимости от выбранного подхода), продвинутые трейдеры могут использовать техники, включающие одновременное открытие нескольких опционных позиций.

14. Парный трейдинг

Парная торговля — это стратегия, предполагающая одновременную покупку и продажу двух коррелирующих ценных бумаг. Предположим, что одна акция исторически двигалась в тандеме с другой, а затем внезапно расхождение. В этом случае трейдер может купить хуже торгующуюся акцию и продать лучше, рассчитывая на возвращение к своему историческому уровню.

Поскольку эта стратегия основана на относительной доходности двух активов, а не на рыночных условиях, будь то благоприятных или негативных, она считается рыночно-нейтральной. Успех в парной торговле зависит от точного обнаружения связанных пар и понимания того, когда они расходятся.

15. Усреднение долларовой стоимости

Усреднение долларовой стоимости — это практика постоянного инвестирования определённой суммы денег, независимо от рыночных условий. Этот метод может помочь снизить волатильность с течением времени за счёт покупки меньшего количества акций в периоды высоких цен и большего количества в периоды низких цен.

Эта стратегия особенно привлекательна для долгосрочных инвесторов, желающих снизить риски, связанные с выбором времени для торговли. Она представляет собой скорее инвестиционную, чем торговую стратегию. Несмотря на более пассивный подход, её преимущества определяются простотой и системным подходом.

Управление рисками в торговой стратегии

В сфере трейдинга по-прежнему сохраняется одна базовая истина: каждая сделка сопряжена с риском. Но эффективные трейдеры понимают, что контроль и сокращение возможных убытков важнее для долгосрочной прибыльности, чем выбор наиболее прибыльной сделки. Эффективный контроль рисков критически важен для гарантии того, что даже серия неудачных сделок не окажет значительного влияния на общий капитал.

You may also like

Инструменты и методы

Трейдеры могут использовать несколько инструментов для управления рисками. Стоп-лосс-ордера ограничивают возможные потери, позволяя трейдерам выбрать фиксированную цену, по достижении которой сделка автоматически завершится. Тейк-профит-ордера, напротив, устанавливают целевую цену, по которой сделка закроется, фиксируя прибыль. Трейлинг-стопы являются динамическими: они корректируются при движении рыночной цены в благоприятном направлении, но фиксируются при развороте рынка, обеспечивая сохранение прибыли.

Соотношение риска и прибыли

Хороший трейдер обычно оценивает возможную доходность по отношению к риску перед открытием сделки. Обычно он воздерживается от открытия сделки до тех пор, пока возможная доходность не превысит риск как минимум в три раза, гарантируя тем самым, что со временем прибыль от выигрышных сделок превысит убытки от проигрышных.

Психологические аспекты

Торговля — это игра ума в той же степени, что и игра со статистикой и графиками цен. Неудачная сделка может привести к «торговле местью», когда трейдеры действуют импульсивно, пытаясь отыграться. Сохранять хладнокровие и следовать заранее составленному плану, а не поддаваться эмоциям, действительно важно. Необходимо освоить важнейшую способность понимать, когда следует прекратить торговлю.

Выбор правильной стратегии для вас

Каждый трейдер имеет свой набор целей, уровень готовности к риску и инвестиционный горизонт. Поэтому необходимо выбрать торговый подход, соответствующий этим личным качествам.

Признание личной толерантности к риску

Оцените свою толерантность к риску, прежде чем исследовать мир трейдинга. Выберете ли вы более осторожную стратегию или будете спокойно реагировать на крупные рыночные колебания? Понимание этого поможет вам выбрать стратегии, которые соответствуют вашему уровню комфорта.

Важность понимания рыночных условий

Не каждый подход подходит к любому состоянию рынка. Хотя методы следования за трендом могут быть неэффективны в условиях нестабильности рынка, внутридневная торговля может быть весьма эффективна в таких условиях. Важно корректировать свой подход с учётом текущей рыночной ситуации.

Эксперименты и практика

Демо-счета позволяют трейдерам экспериментировать с различными стратегиями, не рискуя реальными деньгами. Этот практический опыт может дать бесценные знания, помогающие понять, какие стратегии соответствуют стилю трейдера, а какие — нет.

Постоянное обучение и адаптация

Финансовые рынки постоянно меняются под влиянием геополитики, экономических данных и многих других факторов. Эффективные трейдеры — это те, кто умеет адаптироваться, постоянно обучаться и корректировать свои подходы в соответствии с меняющимися рыночными условиями.

Однако, ориентируясь в этом динамичном мире, трейдерам следует также проявлять бдительность, опасаясь потенциальных мошеннических сделок. Привлекательные идеи «гарантированной прибыли» или «секретных стратегий» могут показаться заманчивыми, но за ними часто скрываются коварные намерения. К сожалению, многие трейдеры потеряли значительные суммы из-за подобных мошеннических схем. Торговые сигналы могут оказаться настоящим минным полем ложной информации, если их не проверить должным образом, хотя они и являются полезным инструментом, полученным из надежных источников. Всегда уделяйте первостепенное внимание проверке; подходите к новым торговым перспективам с проницательным взглядом; помните: в торговой среде все, что кажется слишком хорошим, чтобы быть правдой, обычно таковым и является.

Заключение

В трейдинге существует множество стратегий, каждая из которых имеет свои преимущества и сложности. От методов торговли на Форекс до следования тренду — спектр широк и подходит трейдерам любого уровня и с любым уровнем готовности к риску. Как мы уже говорили, секрет не в выборе «лучшей» стратегии, а в выборе той, которая подходит именно вам. Успех на рынках не просто возможен; он достижим, если вы используете правильные стратегии управления рисками, постоянно корректируете их и выбираете стратегию, которая соответствует вашим конкретным торговым целям и готовности к риску. Начиная торговать, помните о ценности знаний, гибкости и практического опыта. Удачной торговли!

Обновлено:

27 декабря 2024 г.