As 15 estratégias de negociação mais populares em 2025

Conteúdo

Em mercados financeiros complexos, uma estratégia de negociação robusta é um guia. Essa estratégia ilumina o caminho para os traders, oferecendo um senso de direção em meio à imprevisibilidade de comprar e vender em diversas classes de ativos. Conhecer suas nuances torna-se essencial, mesmo que se tenha múltiplas estratégias à disposição. Este artigo fornece uma análise completa de quinze das técnicas de negociação mais reconhecidas, todas projetadas para lidar com as dificuldades específicas de vários mercados. Essas táticas e a dedicação à gestão de risco ajudarão os traders a aproveitar com confiança as oportunidades de negociação à medida que elas se apresentam.

Noções básicas de estratégias de negociação

É importante entender o propósito básico de cada plano de negociação antes de entrar nos detalhes de cada um. Táticas de negociação são basicamente um método organizado de fazer as coisas, ou um conjunto de regras que os traders seguem para fazer escolhas inteligentes de negociação. Essas regras ajudam a manter os sentimentos sob controle para que as escolhas sejam feitas com base na razão e na pesquisa, em vez da emoção.

Selecionar a estratégia apropriada é como selecionar o instrumento apropriado para uma determinada tarefa. O desenvolvimento de uma estratégia deve incluir os objetivos do trader, a tolerância ao risco e o período de investimento. Por exemplo, alguém preocupado com o longo prazo pode optar por position trading, enquanto alguém que precisa de dinheiro imediatamente pode optar por day trading ou cutting. Da mesma forma, um trader mais cauteloso prefere comprar ações reconhecidas ou Forex; um trader disposto a correr muitos riscos pode investigar as criptomoedas mais voláteis.

Compreender os conceitos fundamentais de cada estratégia e alinhá-los ao seu perfil de negociação ajudará os traders a melhorar seu desempenho e maximizar cada movimento do mercado. Embora diferentes táticas possam ser mais ou menos adequadas às necessidades de cada trader, vale mencionar que os métodos listados abaixo não estão organizados em nenhuma sequência específica.

15 Estratégias de Negociação Mais Populares

- Seguindo tendências

- Negociação de Momentum

- Swing Trading

- Negociação de posição

- Day Trading

- Escalpelamento

- Reversão à média

- Negociação de alta frequência (HFT)

- Negociação de Breakout

- Negociação de notícias

- Arbitragem

- Criação de mercado

- Estratégias de Opções

- Negociação em pares

- Média do custo do dólar

1. Acompanhamento de tendências

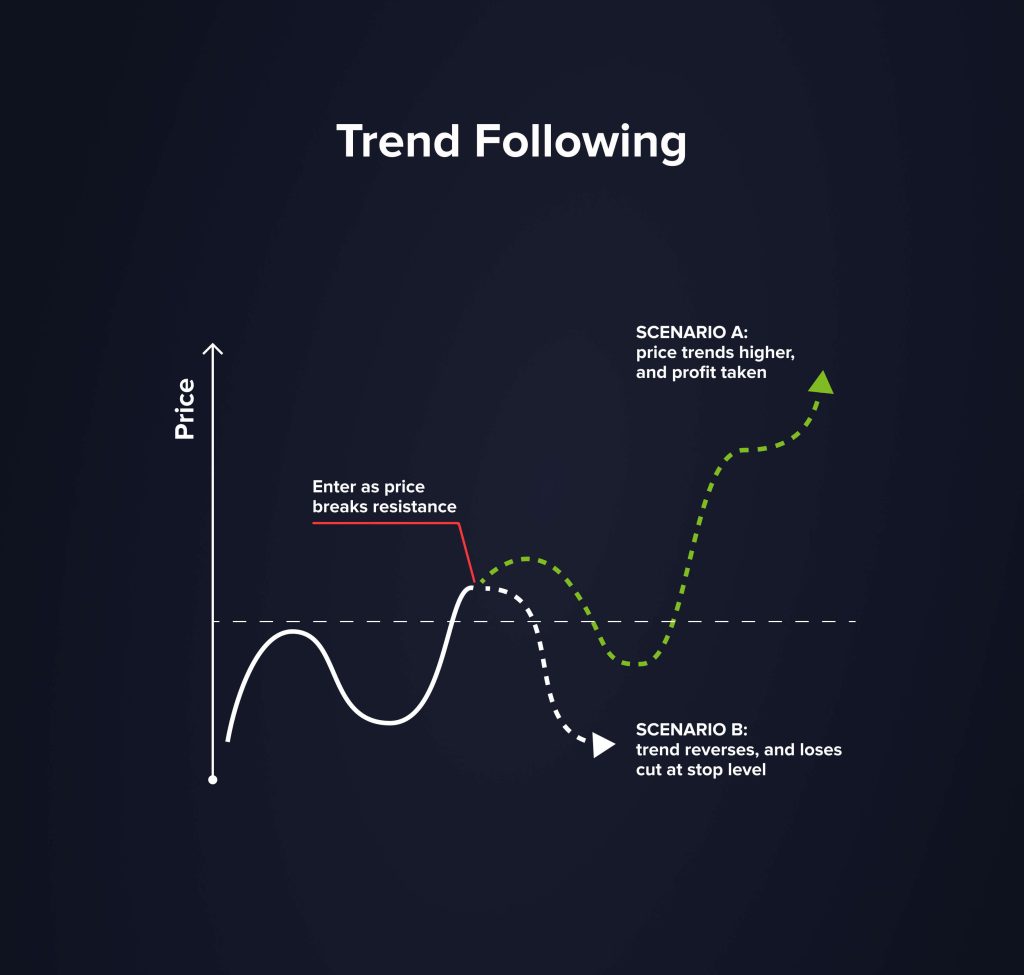

Em diversos cenários financeiros, seguir tendências surge como uma estratégia confiável. Sua premissa é simples: capitalizar o momentum dos ativos em uma direção específica, sejam ações, criptomoedas ou opções. Você provavelmente já ouviu o ditado "A tendência é sua amiga". A chave para essa estratégia são diversos indicadores técnicos, como a média móvel, que auxiliam os traders a discernir a direção geral da tendência.

Ao aproveitar o poder das tendências, os traders podem navegar pelos altos e baixos dos mercados, capturando ganhos à medida que os ativos se movem em trajetórias mais longas. No entanto, discernir a real longevidade de uma tendência continua sendo um desafio. Ferramentas e indicadores técnicos de negociação são cruciais para desmistificar isso, fornecendo sinais que podem ajudar a identificar o início e o fim de movimentos significativos do mercado.

Acompanhamento de tendências na prática

Indicadores técnicos para ativar: SMA 200, SMA 50, SMA 20.

Abra uma posição longa quando:

- O preço de um ativo está acima da linha SMA 200.

- O preço de um ativo toca a linha da MMS 20 pelo menos três vezes (deve-se abrir uma posição após o terceiro toque). Feche uma posição quando o candlestick fechar acima da linha da MMS 50.

Abra uma posição curta quando:

- O preço de um ativo está abaixo da linha SMA 200.

- O preço de um ativo toca a linha da MMS 20 pelo menos três vezes (deve-se abrir uma posição após o terceiro toque). Feche uma posição quando o candlestick fechar acima da linha da MMS 50.

2. Negociação de Momentum

A negociação de momentum, como o próprio nome indica, concentra-se em maximizar o momentum atual no movimento de preço de um ativo. Comprar ativos que estão subindo e vender aqueles em trajetória de queda é a principal ideia norteadora. A crença subjacente a essa estratégia é que os ativos que se movem em uma determinada direção continuarão nessa trajetória por um tempo.

No entanto, é preciso ter habilidades analíticas aguçadas para aproveitar o poder da negociação de momentum. Ferramentas como médias móveis e volume de negociação podem oferecer insights valiosos sobre se uma tendência tem força suficiente para continuar. Embora as perspectivas sejam atraentes, é crucial observar que a negociação de momentum pode ser suscetível a reversões repentinas do mercado, tornando indispensável uma gestão de risco adequada.

Negociação de Momentum na Prática

Indicadores técnicos para ativar: SMA 5, SMA 10, RSI (configurações padrão), Estocástico (14, 3, 3).

Abra uma posição longa quando:

- A SMA 5 cruza a linha da SMA 10. O estocástico sobe. O RSI está acima de 50.

Abra uma posição curta quando:

- A SMA 10 cruza a linha da SMA 5. O estocástico cai. O RSI está abaixo de 50.

3. Swing Trading

O swing trading estabelece um equilíbrio entre negociação diária e negociação de posição. A estratégia gira em torno da captura de "oscilações" de preços, ou movimentos de preço de curto a médio prazo. Em vez de surfar nas ondas longas do mercado ou nas flutuações diárias passageiras, os swing traders prosperam no intermediário, capturando ganhos no preço de ações ou de qualquer instrumento financeiro ao longo de um período de alguns dias a várias semanas.

O swing trading exige paciência. Enquanto day traders ativos podem achá-lo lento e position traders podem considerá-lo errático, os swing traders se deleitam com o ritmo, o que permite decisões de negociação bem informadas. Os níveis de suporte e resistência são essenciais para seu arsenal, atuando como marcadores para compra e venda.

Swing Trading na Prática

Indicadores técnicos para ativar: Padrões gráficos de reversão.

Abra uma posição longa quando:

- Fundo duplo, cabeça e ombros invertidos, xícara e alça e outros padrões apareceram em um gráfico.

Abra uma posição curta quando:

- Topo Duplo, Cabeça e Ombros, Triângulo em Expansão e outros padrões apareceram em um gráfico.

4. Negociação de posição

Considerada uma abordagem mais estratégica, a negociação posicional envolve manter seus instrumentos financeiros, sejam ações, Forex ou criptomoedas, por períodos prolongados – que variam de semanas a anos. Essa estratégia se baseia em uma análise fundamentalista completa, com a análise técnica servindo como ferramenta complementar.

Os position traders se preocupam menos com a volatilidade ou flutuações do mercado a curto prazo. São operadores de longo prazo, que dependem da direção geral do mercado. Frequentemente baseadas em pesquisas abrangentes sobre desempenho corporativo, tendências do setor e indicadores econômicos mais gerais, suas escolhas refletem uma análise meticulosa.

Negociação de posição na prática

Indicadores técnicos para ativar: Bandas de Bollinger

Abra uma posição longa quando:

- O preço de um ativo rompe a borda superior das Bandas de Bollinger.

Abra uma posição curta quando:

- O preço de um ativo rompe a borda inferior das Bandas de Bollinger.

5. Negociação diária

Entre as técnicas mais comumente mencionadas em diversos setores financeiros está o day trading. O day trading, como o nome sugere, consiste em abrir e fechar posições ao longo de um dia de negociação. Essa abordagem visa lucrar com movimentos temporários de preços, evitando riscos potenciais durante a noite, como notícias desfavoráveis ou eventos globais que influenciam os preços das ações ou o valor das moedas. Os sistemas de negociação modernos permitem que os traders executem ordens de compra e venda rapidamente, otimizando até mesmo pequenas oscilações de preço.

O day trading apresenta grandes riscos, mesmo que ganhos rápidos sejam uma tentação para os traders. Neste ambiente agitado, é preciso ter raciocínio rápido, reflexos rápidos e capacidade analítica técnica. Expectativas realistas e uma boa estratégia de gestão de risco são essenciais em um ambiente de negociação de alta frequência, onde pequenos erros podem causar grandes perdas.

Day Trading na Prática

Indicadores técnicos para ativar: RSI (14, 35, 65), Estocástico (14, 1, 3), CCI (14)

Abra uma posição longa quando:

- Todos os indicadores tecnológicos mencionados estão na área de sobrevenda e começam a reverter.

Abra uma posição curta quando:

- Todos os indicadores tecnológicos mencionados estão na área de sobrecompra e começam a reverter.

6. Escalpelamento

O scalping é o epítome das estratégias de negociação de alta frequência. Os scalpers buscam aproveitar pequenas lacunas de preço criadas por fluxos de ordens ou spreads. Muitas vezes, mantendo uma posição por apenas alguns minutos ou até segundos, essa abordagem se destaca em pequenas oscilações de preço. O scalping se tornou bastante popular entre os traders devido ao rápido crescimento dos sistemas de negociação computadorizados e ao tamanho geral do mercado de câmbio.

O apelo do scalping advém da possibilidade de lucros rápidos e reduzidos. No entanto, trata-se de um método trabalhoso que exige que os traders fiquem de olho em suas telas e façam escolhas rápidas. Além disso, considerando o volume de transações, as taxas de corretagem podem reduzir rapidamente os ganhos; portanto, selecionar uma plataforma de negociação com custos de transação mínimos é crucial.

Scalping na prática

Indicadores técnicos para ativar: MACD, SAR Parabólico

Abra uma posição longa quando:

- As linhas do MACD se cruzam na parte inferior, bem distantes da linha média. O SAR Parabólico confirma o sinal por três ou mais marcas abaixo dos candlesticks.

Abra uma posição curta quando:

- As linhas do MACD se cruzam no topo, bem distantes da linha média. O SAR Parabólico confirma o sinal por três ou mais marcas acima dos candlesticks.

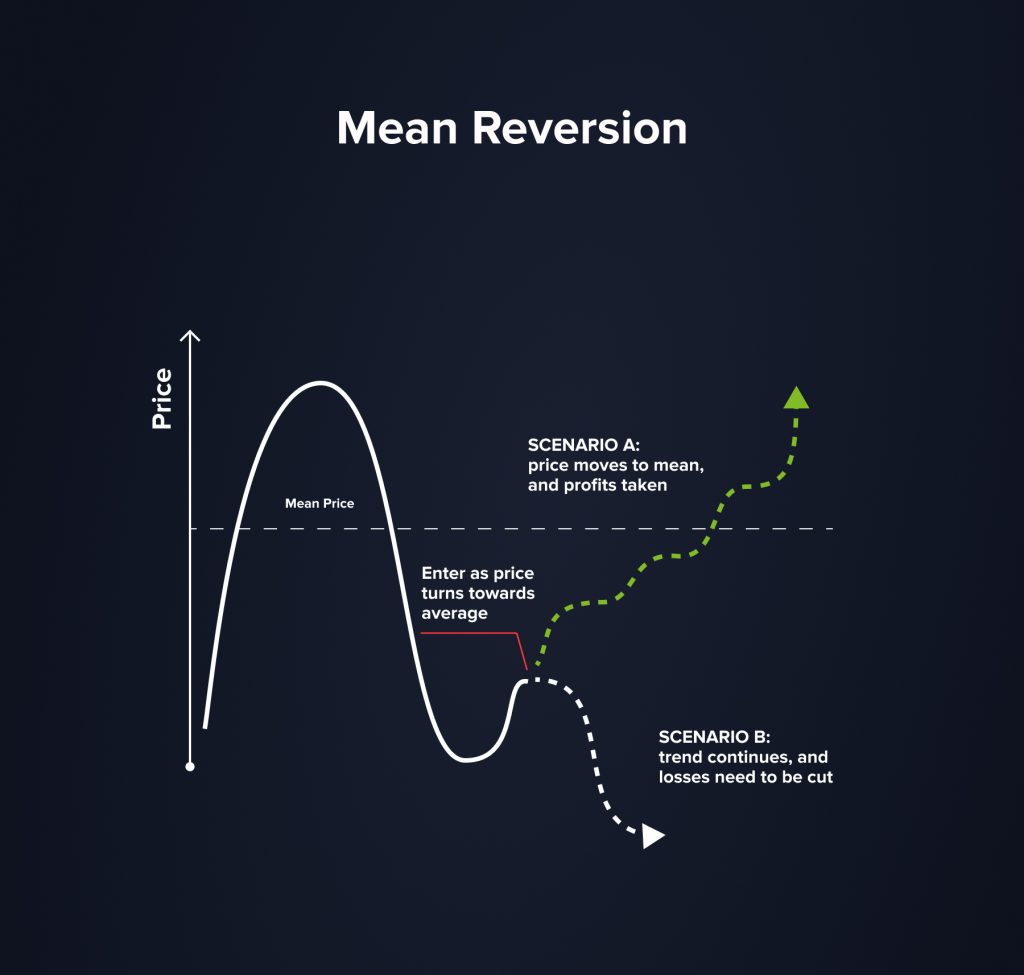

7. Reversão à média

A reversão à média baseia-se na ideia simples de que os ativos, ao longo do tempo, tendem a retornar ao seu preço médio. Essa abordagem decorre da convicção de que, mesmo em mercados voláteis, os preços, em última análise, seguirão sua média histórica. Assim, os traders que utilizam essa estratégia comprarão ativos abaixo da média e venderão aqueles acima da média, antecipando um retorno à média. Indicadores técnicos frequentemente utilizados para identificar possíveis possibilidades de reversão à média incluem médias móveis ou Índice de Força Relativa (IFR) . Embora essa abordagem possa ser lucrativa — especialmente em mercados com limites definidos — é importante ter em mente que grandes eventos externos ou notícias podem alterar tendências passadas e resultar em possíveis perdas.

Reversão à média na prática

Indicadores técnicos para ativar: Média móvel simples 30, Média móvel simples 90

Abra uma posição longa quando:

- A SMA 30 cruza a linha SMA 90 de baixo para cima.

Abra uma posição curta quando:

- A SMA 30 cruza a linha SMA 90 de cima para baixo.

8. Negociação de alta frequência (HFT)

Um método avançado de negociação conhecido como negociação de alta frequência, ou HFT, utiliza supercomputadores para executar muitas ordens em poucos milissegundos. Com essa abordagem baseada em algoritmos, é possível lucrar com pequenas variações de preço entre plataformas de negociação ou classes de ativos. A capacidade do HFT de concluir transações em velocidades incomparáveis o tornou uma força dominante, especialmente em estratégias de negociação de ações.

Os benefícios do HFT incluem sua velocidade e eficiência. No entanto, há controvérsias sobre o assunto. Alguns sugerem que o HFT pode causar distorções no mercado, até mesmo "flash crashes". Dada a sua complexidade, essa técnica costuma estar fora do alcance de traders comuns e é usada principalmente por traders institucionais com a infraestrutura tecnológica adequada.

9. Negociação de Breakout

Breakout trading é uma estratégia baseada no conceito de que, assim que um ativo rompe um nível de resistência (ou cai abaixo de um nível de suporte), ele continuará nessa direção por um tempo. Essa estratégia opera com base na premissa de que, assim que um preço rompe uma barreira definida, um momentum maior provavelmente o impulsionará para cima, potencialmente gerando lucro.

Os indicadores técnicos desempenham um papel significativo aqui. Para identificar possíveis rompimentos, os traders frequentemente recorrem a padrões gráficos de preços, como triângulos, bandeiras e cabeça e ombros. Embora a estratégia possa ser altamente lucrativa, especialmente ao identificar corretamente rompimentos genuínos, rompimentos falsos continuam sendo um risco. Técnicas adequadas de gerenciamento de risco e a definição de stop loss apertados podem ajudar a mitigar perdas potenciais em tais cenários.

Breakout Trading na prática

Indicadores de tecnologia: Canal Keltner, Canal Donchian, Bandas de Bollinger

Abra uma posição longa quando:

- O preço de um ativo rompe a borda superior de um canal construído por um dos indicadores mencionados.

Abra uma posição curta quando:

- O preço de um ativo rompe a borda inferior de um canal construído por um dos indicadores mencionados

10. Negociação de notícias

Notícias têm um grande impacto nos mercados financeiros — ações, Forex e, especialmente, criptomoedas. Sejam decisões de bancos centrais, lucros trimestrais de uma grande corporação ou acontecimentos geopolíticos, as notícias podem causar oscilações significativas nos preços. A negociação de notícias envolve capitalizar essas mudanças bruscas de preço impulsionadas por notícias.

Embora exista potencial para lucro significativo, especialmente se o trader puder antecipar-se ao mercado, a volatilidade associada a notícias pode ser uma faca de dois gumes. Mesmo após notícias positivas, reversões repentinas podem ocorrer, destacando a importância de uma boa estratégia de negociação e ordens stop-loss sólidas.

11. Arbitragem

Arbitragem é o uso de variações de preços para comprar e vender um produto simultaneamente em vários mercados. Se a ação fosse vendida a um preço mais baixo em uma bolsa e a um preço mais alto em outra, o arbitrador compraria a ação em um mercado e a venderia em outro, embolsando assim a diferença.

Com as ferramentas e plataformas sofisticadas de hoje, muitas dessas disparidades são descobertas e corrigidas rapidamente, tornando as perspectivas de arbitragem limitadas. No entanto, essas oportunidades ainda podem existir em mercados menos líquidos ou menos interconectados, como algumas corretoras de criptomoedas.

12. Criação de mercado

Manutenção liquidez Nos mercados financeiros, depende muito dos formadores de mercado. Visando o lucro com o spread entre compra e venda, eles cotam tanto um preço de compra quanto um de venda em um instrumento financeiro. Normalmente, independentemente das condições de mercado, suas compras e vendas contínuas garantem sempre um comprador ou um vendedor para os traders. Criação de mercado pode ser lucrativo, especialmente em mercados turbulentos com spreads enormes, mas não é isento de riscos. Oscilações repentinas no mercado podem deixar os formadores de mercado com uma grande quantidade de um ativo em desvalorização.

13. Estratégias de Opções

Opções são instrumentos financeiros que dão aos traders o direito, mas não a obrigação, de comprar ou vender um ativo subjacente a um preço predeterminado dentro de um prazo definido. As estratégias envolvendo opções são inúmeras, desde simples calls e puts até jogadas complexas como condores de ferro ou straddles. Eles permitem que os traders façam hedge, especulem ou aumentem sua alavancagem, mas isso traz consigo maior complexidade e risco.

Para iniciantes, conhecer os fundamentos das opções — incluindo valor intrínseco, decaimento temporal e volatilidade implícita — é crucial. Visando se beneficiar da volatilidade ou da estabilidade, dependendo da abordagem, traders avançados podem usar técnicas que envolvam várias posições em opções simultaneamente.

14. Negociação em pares

Pair trading é uma estratégia que envolve a compra e venda simultânea de dois títulos correlacionados. Suponha que uma ação historicamente se mova em conjunto com outra e, de repente, diverja. Nesse caso, um trader pode comprar a ação com desempenho inferior e vender a com desempenho superior, apostando em um retorno à sua média histórica.

Como essa estratégia se baseia no desempenho relativo de dois ativos em vez das condições de mercado, sejam elas boas ou negativas, ela é considerada neutra em relação ao mercado. O sucesso no pair trading depende da identificação precisa de pares vinculados e da compreensão de quando eles divergem.

15. Média do custo do dólar

A média do custo em dólar é a prática de investir uma certa quantia de dinheiro de forma constante, independentemente das condições de mercado. Esse método pode ajudar a reduzir a volatilidade ao longo do tempo, comprando menos ações quando os preços estão altos e mais quando estão baixos.

Particularmente atraente entre investidores de longo prazo que desejam reduzir os perigos relacionados ao timing do mercado, esta é mais uma estratégia de investimento do que de negociação. Embora seja uma técnica mais passiva, sua simplicidade e abordagem sistemática definem seu poder.

Gestão de Riscos em uma Estratégia de Negociação

Uma realidade básica ainda se mantém na esfera do trading: toda transação envolve risco. Mas traders eficazes percebem que controlar e reduzir possíveis perdas é mais importante para a lucratividade a longo prazo do que necessariamente selecionar a operação mais lucrativa. O controle eficaz dos riscos é crucial para garantir que mesmo uma sequência de operações fracassadas não afete significativamente o capital total.

You may also like

Ferramentas e Técnicas

Os traders podem utilizar diversas ferramentas para gerenciar riscos. Ordens stop-loss limitam possíveis perdas, permitindo que os traders escolham um preço fixo no qual a transação será encerrada automaticamente. Ordens take-profit, por outro lado, definem um preço-alvo no qual a operação será fechada, garantindo os lucros. Trailing stops são dinâmicos, ajustando-se conforme o preço de mercado se move em uma direção favorável, mas se fixando quando o mercado reverte, garantindo a preservação dos ganhos.

Relação risco/recompensa

Um bom trader geralmente avalia o possível retorno em relação ao risco antes de iniciar uma operação. Normalmente, evita-se iniciar uma operação até que o possível retorno seja pelo menos três vezes o risco, garantindo assim que, ao longo do tempo, os lucros das operações vencedoras superem as perdas das operações perdidas.

Aspectos Psicológicos

O ambiente de negociação é um jogo mental, tanto quanto um jogo de estatísticas e gráficos de preços. Uma negociação fracassada pode levar a uma "negociação de vingança", em que os traders agem impulsivamente na tentativa de recuperar as perdas. Manter a calma e seguir um plano pré-determinado, em vez de reagir emocionalmente, é realmente vital. É preciso aprender a habilidade crucial de saber quando parar de negociar.

Escolhendo a estratégia certa para você

Cada trader traz consigo um conjunto diferente de objetivos, tolerância ao risco e horizonte de investimento. Portanto, é preciso escolher uma abordagem de negociação que se adapte a essas qualidades pessoais.

Reconhecendo a tolerância ao risco pessoal

Avalie sua tolerância ao risco antes de explorar o universo do trading. Você escolherá uma estratégia mais cautelosa ou se sente confortável com as grandes oscilações do mercado? Entender isso pode orientá-lo para estratégias que se alinhem ao seu nível de conforto.

Importância de compreender as condições de mercado

Nem todas as abordagens se adaptam a todas as situações do mercado. Embora as técnicas de acompanhamento de tendências possam falhar em mercados turbulentos, o day trading pode prosperar nessas condições. É importante mudar sua abordagem considerando a condição do mercado no momento.

Experimentação e Prática

Começar com contas demo permite que os traders experimentem diversas estratégias sem arriscar dinheiro real. Essa experiência prática pode oferecer insights valiosos, destacando quais estratégias combinam com o estilo de cada trader e quais não.

Aprendizagem e adaptação contínuas

Impulsionados pela geopolítica, dados econômicos e muitos outros elementos, os mercados financeiros estão em constante mudança. Traders eficazes são aqueles que se adaptam, sempre aprendendo e modificando suas abordagens para se adaptar às circunstâncias de mercado em constante mudança.

No entanto, à medida que os traders navegam neste cenário dinâmico, eles também devem permanecer vigilantes contra potenciais golpes de negociação. O fascínio por "lucros garantidos" ou "estratégias secretas" pode parecer tentador, mas muitas vezes escondem intenções nefastas. Infelizmente, muitos traders perderam somas substanciais com esses esquemas enganosos. Os sinais de negociação podem ser um campo minado de informações falsas se não forem devidamente verificados, embora sejam uma ferramenta útil quando obtidos de fontes confiáveis. Sempre dê prioridade à due diligence; aborde novos clientes em potencial com um olhar criterioso; lembre-se: no ambiente de negociação, tudo o que parece bom demais para ser verdade geralmente é.

Conclusão

Existem diversas estratégias disponíveis no setor de trading, cada uma com benefícios e dificuldades específicas. De técnicas de trading em Forex a acompanhamento de tendências, o espectro é amplo e adequado para traders de todos os tipos e tolerâncias a riscos. Como já dissemos, o segredo não é necessariamente escolher a "melhor" estratégia, mas sim a certa para você. O sucesso nos mercados não é apenas possível; está ao seu alcance se você usar boas estratégias de gerenciamento de risco, fizer ajustes constantes e escolher uma estratégia que corresponda aos seus objetivos de trading específicos e à sua tolerância a riscos. Ao começar a negociar, lembre-se do valor do conhecimento, da flexibilidade e da experiência prática. Boas negociações!

Atualizado:

27 de dezembro de 2024