As 10 principais classes de ativos de negociação populares para 2024

Conteúdo

À medida que entramos em 2024, os mercados financeiros continuam a evoluir, apresentando desafios e oportunidades para os traders. Neste cenário dinâmico, selecionar os instrumentos de negociação certos é mais crucial do que nunca. Esses instrumentos, que vão de ativos digitais a ações tradicionais, oferecem diversas maneiras de capitalizar as tendências do mercado e atingir objetivos de investimento. Este artigo analisa as dez classes de ativos de negociação mais populares, prontas para grandes movimentos em 2024, fornecendo um roteiro para os traders navegarem neste terreno financeiro em constante mudança.

Lista das 10 principais classes de ativos para 2024

- Criptomoedas

- Fundos negociados em bolsa (ETFs)

- Fundos de Ações de Crescimento

- Pares Forex

- Fundos de ações de grande capitalização

- Commodities

- Fundos de Investimento Imobiliário (REITs)

- Ações de Energia Verde

- Títulos do Governo

- Ações de mercados emergentes

Vamos nos aprofundar em cada classe de ativos e também considerar alguns candidatos promissores em cada classe.

Criptomoedas

As criptomoedas evoluíram de um nicho de interesse para um instrumento de negociação popular. Moedas digitais como Bitcoin, Ethereum e diversas altcoins são agora participantes importantes no setor financeiro, muito além de meros ativos especulativos.

Esta mudança é impulsionada pelo crescente apelo de finanças descentralizadas (DeFi), o uso de ativos digitais para proteção contra a volatilidade do mercado e a integração mais ampla da tecnologia blockchain em diferentes setores econômicos. No entanto, a volatilidade inerente continua sendo uma característica definidora das criptomoedas, apresentando riscos e oportunidades para altos retornos.

Para uma negociação eficaz de criptomoedas em 2024, a diversificação é fundamental. Os traders devem equilibrar seus portfólios com uma combinação de criptomoedas estabelecidas e emergentes. Manter-se informado sobre as regulamentações em evolução e utilizar ferramentas de negociação avançadas também será crucial. Além disso, acompanhar os desenvolvimentos contínuos na tecnologia blockchain e nas tendências de mercado é essencial para o sucesso neste espaço dinâmico e em rápida inovação.

Estrelas emergentes no mercado de criptomoedas em 2024

Bitcoin

À medida que o cenário das criptomoedas evolui em direção a 2024, certas moedas digitais estão atraindo atenção por suas características únicas e potencial de crescimento. O Bitcoin (BTC), conhecido como "ouro digital", continua liderando o grupo com seu desempenho robusto em 2023 e crescente adoção institucional. Sua oferta limitada, seu status como reserva de valor e o enorme burburinho em torno dos ETFs de Bitcoin sugerem um papel significativo na alta das criptomoedas no próximo ano.

Solana

Solana (SOL) está conquistando seu nicho com velocidades de transação extremamente rápidas e taxas baixas, tornando-o atraente nos reinos em expansão de DeFi e NFTs . Essa eficiência técnica posiciona Solana como uma forte concorrente na esperada recuperação do mercado.

Algorand

A Algorand (ALGO) se destaca por sua abordagem ecologicamente correta, combinando transações rápidas com baixo consumo de energia. Com parcerias estratégicas e aplicações em finanças e infraestrutura de blockchain, a Algorand está pronta para um crescimento notável, especialmente entre investidores com consciência ambiental.

Fundos negociados em bolsa (ETFs)

Os fundos negociados em bolsa (ETFs) estão se tornando cada vez mais a escolha preferida dos traders, reconhecidos por sua versatilidade em diversas estratégias de investimento. O fascínio dos ETFs reside em sua combinação única de variedade, adaptabilidade e facilidade de acesso aos mercados financeiros voláteis.

Os ETFs transformaram as abordagens de investimento ao oferecer exposição a diversos setores, desde a indústria de tecnologia em constante evolução até segmentos econômicos estáveis e consolidados. Isso os torna adequados para diversos objetivos de investimento, seja para acessar setores de tecnologia de alto crescimento ou buscar estabilidade em índices de mercado mais amplos.

Sua adaptabilidade é um diferencial, atendendo a diferentes estilos de investimento, desde estratégias conservadoras de crescimento de longo prazo até abordagens mais agressivas de curto prazo. A ampla gama de ETFs, abrangendo setores específicos, commodities, títulos e mercados internacionais, permite que os investidores adaptem suas carteiras à sua tolerância ao risco e objetivos de investimento.

Para muitos, os ETFs oferecem o equilíbrio perfeito entre o potencial de crescimento de ações individuais e a diversificação de risco típica dos fundos mútuos. Esse equilíbrio é especialmente valioso em um mercado pronto para crescer em certas áreas, mas ainda enfrentando a potencial volatilidade em outras.

You may also like

Principais ETFs para ficar de olho em 2024

Portfólio SPDR S&P 500 ETF

O SPDR Portfolio S&P 500 ETF (SPLG) continua sendo uma escolha de destaque, especialmente para quem busca aproveitar a estabilidade e o potencial de crescimento do S&P 500. Com um índice de despesas acessível e um histórico de forte desempenho, o SPLG oferece uma maneira eficiente de obter exposição a algumas das maiores empresas dos EUA. Sua combinação de um rendimento de dividendos modesto e retornos históricos consistentes o posiciona como uma opção equilibrada para investidores em crescimento e renda.

ETF de peso igual Invesco S&P 500

Diversificando a abordagem típica do S&P 500, o Invesco S&P 500 Equal Weight ETF (RSP) pondera igualmente suas participações em diversas empresas, aprimorando sua diversificação. Essa estratégia de ponderação igual pode levar a uma exposição de mercado mais equilibrada, potencialmente oferecendo melhores retornos ao dar mais peso a empresas menores e em crescimento. O RSP se destaca por sua abordagem única de balanceamento de portfólio, aliada a um índice de despesas razoável, tornando-o uma opção viável para quem busca um spread de investimento diversificado dentro do S&P 500.

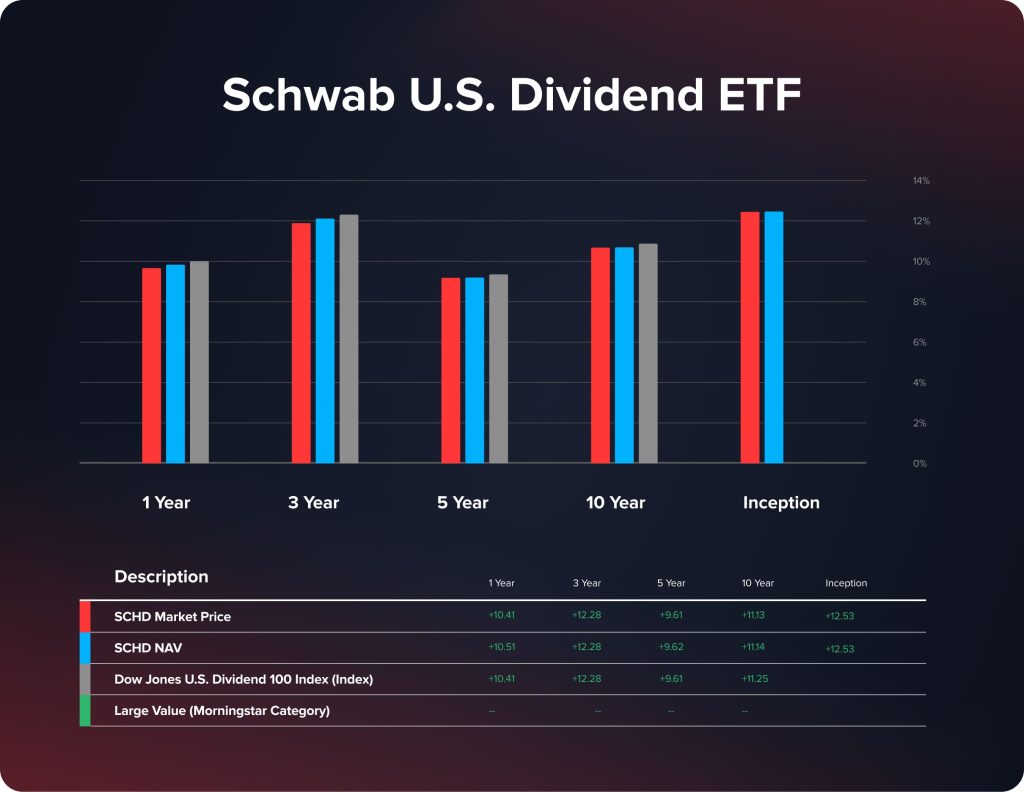

Schwab US Dividend ETF

Para investidores focados em dividendos, o Schwab US Dividend ETF (SCHD) tem como alvo ações blue-chip conhecidas por seus dividendos confiáveis. A abordagem deste ETF de investir em empresas financeiramente estáveis com histórico de pagamento de dividendos oferece um rendimento atrativo. O SCHD combina o potencial de valorização com uma renda consistente, tornando-se uma escolha atraente para investidores que buscam o benefício duplo de crescimento e renda.

Fundos de Ações de Crescimento

Os fundos de ações de crescimento estão atraindo interesse significativo à medida que nos aproximamos de 2024, especialmente em setores com potencial de rápida expansão. Focados em empresas com alto potencial de crescimento, esses fundos buscam alavancar o dinamismo de setores como tecnologia e saúde.

Potencial de crescimento em tecnologia e saúde

Esses fundos investem em empresas na vanguarda da inovação, frequentemente reinvestindo os lucros para impulsionar o crescimento. Essa estratégia é particularmente eficaz no setor de tecnologia, onde os avanços em IA, computação em nuvem e segurança cibernética estão impulsionando o crescimento. Para os investidores, isso representa uma oportunidade de retornos substanciais, à medida que essas tecnologias continuam a se integrar a diversos aspectos da vida e dos negócios.

O setor de saúde também apresenta oportunidades lucrativas impulsionadas pelos avanços em biotecnologia, produtos farmacêuticos e tecnologia da saúde. A mudança para a medicina personalizada e a telessaúde, acelerada pelo cenário global da saúde, posiciona o setor de saúde como outra área atraente para investidores focados em crescimento.

Embora o potencial de altos retornos seja um atrativo significativo para fundos de ações de crescimento, eles inerentemente carregam mais risco. Essa volatilidade decorre das altas avaliações de empresas que apostam no crescimento futuro, tornando esses fundos mais adequados para investidores com maior tolerância ao risco.

Uma abordagem estratégica para traders pode envolver a incorporação de fundos de ações de crescimento como parte de uma carteira diversificada. Equilibrar esses investimentos de alto crescimento com ativos mais estáveis e geradores de renda pode proporcionar exposição ao potencial de valorização desses setores dinâmicos, ao mesmo tempo em que gerencia o risco geral.

Destacando ações de crescimento para ficar de olho em 2024

À medida que avançamos para 2024, algumas ações de crescimento são particularmente notáveis por seu potencial e desempenhos recentes, atraindo a atenção dos investidores.

Floco de neve

Floco de neve destaca-se no segmento de dados em nuvem com seu desempenho impressionante em 2023. A capacidade de lidar com grandes volumes de dados e atrair clientes de alto valor, incluindo aqueles que contribuem com mais de US$ 1 milhão anualmente, é fundamental para o seu apelo. A abordagem inovadora da empresa para o gerenciamento de dados não estruturados e novos recursos como Tabelas Dinâmicas a posicionam como um investimento promissor para 2024.

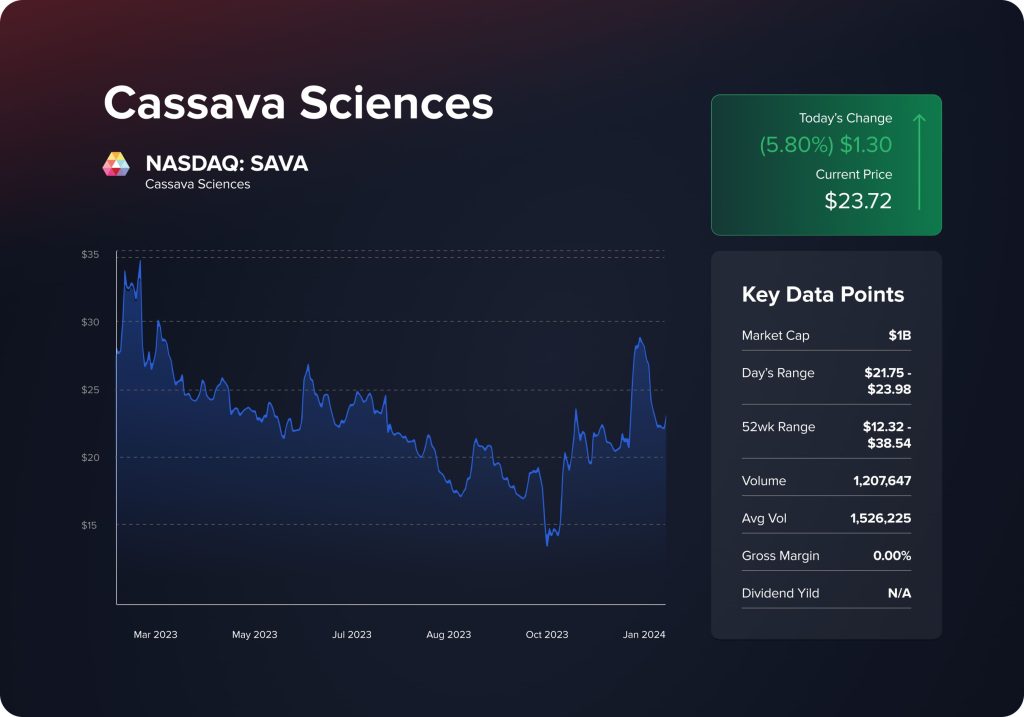

Ciências da Mandioca

Ciências da Mandioca , focada no tratamento do Alzheimer, apresenta um cenário de alto risco, mas potencialmente de alta recompensa. Com resultados iniciais promissores de seus testes com medicamentos para Alzheimer e apoio financeiro substancial, é uma ação a ser observada. No entanto, os investidores devem ser cautelosos, considerando os desafios e as dificuldades históricas no desenvolvimento de medicamentos para Alzheimer.

Força de vendas

Força de vendas continues to excel in the enterprise software market, consistently outperforming financial expectations. A strong product lineup, effective integration strategies, and advances in AI technology fuel its growth. With its robust client base and innovative approach, Força de vendas is positioned as a solid growth stock for 2024.

Essas ações, cada uma em setores distintos, oferecem uma visão geral das diversas oportunidades do mercado de fundos de ações de crescimento. À medida que os investidores consideram essas opções, equilibrar as recompensas potenciais com os riscos inerentes será fundamental para navegar no cenário de ações de crescimento em 2024.

Pares Forex

O mercado Forex continua sendo uma arena essencial para os traders, apresentando muitas oportunidades por meio de pares de moedas importantes e emergentes.

Negociar pares de moedas Forex envolve navegar pela complexa interação das economias globais. A fluidez desse mercado é impulsionada por fatores que vão desde as políticas dos bancos centrais e indicadores econômicos até a estabilidade política e eventos globais. Portanto, a negociação Forex envolve prever os movimentos das moedas e compreender o contexto econômico mais amplo que impulsiona esses movimentos.

O sucesso no mercado Forex depende tanto de estratégia quanto de conhecimento. Os traders devem desenvolver um senso aguçado de sentimento do mercado, aproveitando dados econômicos e notícias para tomar decisões informadas. Além disso, a gestão de risco é um componente crítico da negociação Forex. Dada a volatilidade inerente do mercado, os traders devem empregar técnicas eficazes de gestão de risco, como definir ordens stop-loss e diversificar suas posições em moedas, para proteger seus investimentos.

Principais pares de moedas para ficar de olho em 2024

Certos pares de Forex se destacam por seu potencial e características únicas, oferecendo oportunidades variadas para traders no mercado Forex.

EUR/USD

O par EUR/USD detém o título de um dos pares Forex mais populares, e por um bom motivo. Conhecido por ter o menor spread entre muitas corretoras Forex, ele atrai traders que buscam estabilidade e análises técnicas simples. Sua volatilidade relativamente baixa o torna uma opção ideal para traders que preferem minimizar riscos. A popularidade do par EUR/USD também significa que há uma abundância de análises e dados disponíveis online, auxiliando os traders a tomar decisões bem informadas e evitando erros comuns de negociação.

GBP/USD

O par GBP/USD é conhecido por seu potencial de gerar pips lucrativos e oscilações de preço significativas, o que contribui para sua popularidade entre os traders de Forex. No entanto, é importante observar que o maior potencial de lucro traz consigo um risco maior. Este par se enquadra na categoria mais volátil do mercado Forex. Apesar disso, muitos traders preferem o par GBP/USD devido à ampla disponibilidade de informações de análise de mercado online, que fornecem insights valiosos para estratégias de negociação.

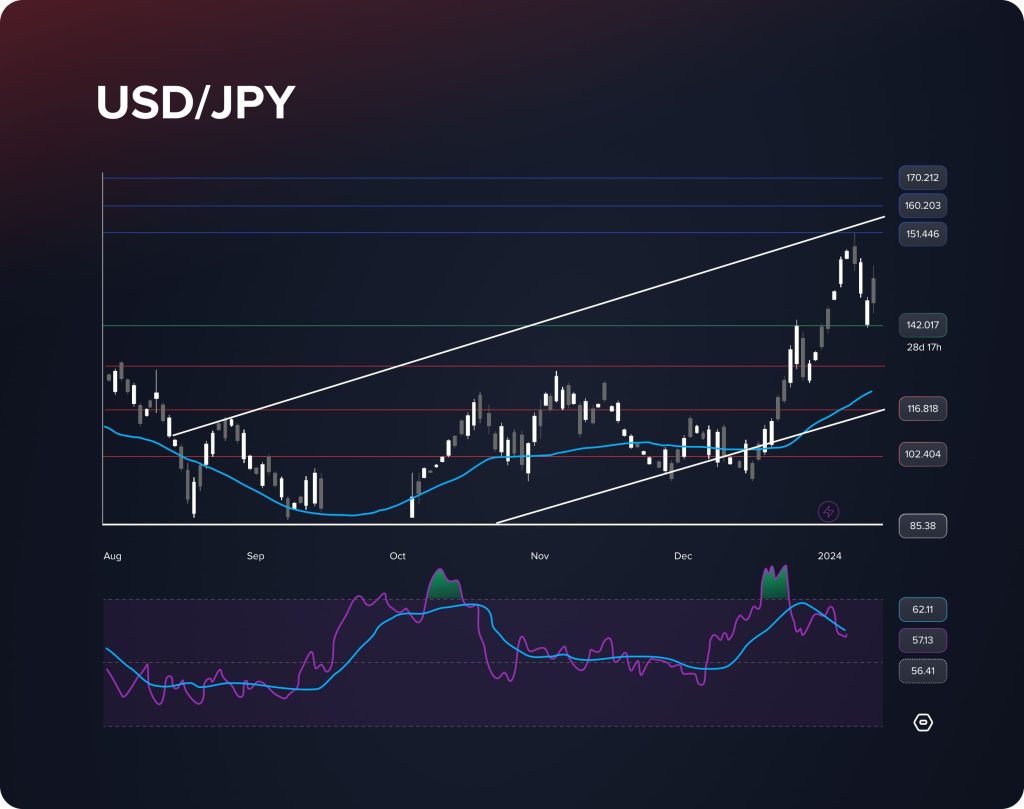

USD/JPY

O USD/JPY é outro par frequentemente negociado no mercado Forex. É conhecido por seus spreads baixos e pela tendência de seguir tendências mais suaves em comparação com outros pares de moedas, tornando-o uma escolha preferencial para traders que buscam movimentos previsíveis. O USD/JPY também oferece oportunidades interessantes para negociações lucrativas, com seus padrões de tendência e comportamento de mercado distintos.

Fundos de ações de grande capitalização

Fundos de ações de grande capitalização continuam sendo uma escolha fundamental para traders que buscam confiabilidade e crescimento constante. Investindo predominantemente em empresas bem estabelecidas com sólida presença no mercado, esses fundos são conhecidos por seu desempenho consistente e resiliência, mesmo em condições de mercado flutuantes.

Fundos de ações de grande capitalização concentram-se em empresas que geralmente são líderes do setor e têm um histórico de desempenho financeiro estável. Essas empresas costumam ser menos voláteis do que suas contrapartes menores, oferecendo uma sensação de segurança aos investidores. Essa estabilidade é particularmente atraente para investidores que buscam crescimento a longo prazo sem a montanha-russa frequentemente associada a investimentos mais voláteis.

No cenário econômico imprevisível de 2024, os fundos de ações de grande capitalização se destacam como uma escolha prudente para aqueles que priorizam o crescimento constante e gradual em vez de estratégias de investimento de alto risco e alta recompensa. Sua capacidade de resistir às tempestades do mercado e gerar retornos consistentes os torna um pilar fundamental de qualquer portfólio bem diversificado.

Fundos de ações de grande capitalização: principais escolhas para 2024

Berkshire Hathaway (BRK-A, BRK-B)

Apesar de um recente rebaixamento da classificação de “comprar” para “manter” pela empresa de investimentos Edward Jones, Berkshire Hathaway continua sendo uma ação a ser observada. A postura cautelosa da empresa se baseia no desempenho significativamente superior da Berkshire em comparação com seus pares do setor financeiro, com as ações BRK-B subindo 11% este ano. No entanto, apostar contra o longo histórico de sucesso de Warren Buffett pode ser prematuro. Os lucros recentes da Berkshire Hathaway permanecem sólidos e a empresa possui uma reserva de caixa significativa de US$ 150 bilhões. Nos últimos 12 meses, as ações Classe B da Berkshire valorizaram-se 24%, superando o ganho de 12% do S&P 500 no mesmo período.

CrowdStrike Holdings (CRWD)

CrowdStrike Holdings A CRWD vivenciou uma notável alta, beneficiando-se da alta geral das ações de tecnologia. O desempenho financeiro da empresa tem sido impressionante, com lucros e receitas do segundo trimestre superando as expectativas e um aumento significativo no fluxo de caixa livre em relação ao ano anterior. Com projeções futuras mais altas, a trajetória ascendente das ações da CRWD, de 58% neste ano e um aumento de 155% em cinco anos, a torna uma ação de grande capitalização atraente no setor de tecnologia.

PepsiCo (PEP)

Apesar das recentes retrações do mercado, PepsiCo Destaca-se como uma ação de grande capitalização resiliente. Embora suas ações tenham desvalorizado acompanhando as tendências mais amplas do mercado, a empresa continua apresentando sólidos relatórios de lucros e tem elevado consistentemente sua projeção para o ano inteiro. A natureza defensiva da PepsiCo a torna uma opção atraente, especialmente se ocorrer uma contração econômica em 2024. Negociada a 28 vezes os lucros futuros e oferecendo um rendimento de dividendos substancial, a PepsiCo é um investimento acessível e estável, com um aumento de 52% em cinco anos.

Commodities

À medida que nos aproximamos de 2024, commodities como ouro e petróleo mantêm seu status de elementos fundamentais nas negociações. Esses ativos são especialmente valorizados por seu papel de proteção contra a inflação e crises econômicas, um aspecto crucial em tempos de incerteza financeira.

Commodities como o ouro são há muito consideradas refúgios seguros em condições de mercado voláteis. Seu valor intrínseco frequentemente se correlaciona inversamente com o mercado de ações, proporcionando uma proteção durante a instabilidade econômica. O ouro, por exemplo, é procurado não apenas por seu valor tradicional, mas também por seu potencial de manter o poder de compra em períodos de alta da inflação.

O petróleo, outra commodity essencial, desempenha um papel fundamental devido ao seu impacto direto nas economias globais. Seus preços são influenciados por uma complexa interação entre oferta e demanda, estabilidade geopolítica e avanços tecnológicos em energia. A negociação de petróleo exige um profundo conhecimento desses fatores e seu potencial impacto nos preços.

O sucesso na negociação de commodities envolve mais do que apenas um conhecimento básico desses ativos. Exige uma análise aprofundada das tendências econômicas globais, uma análise dos ciclos de mercado e a capacidade de prever potenciais mudanças na oferta e na demanda. Os traders devem se manter informados sobre eventos geopolíticos, mudanças políticas e desenvolvimentos tecnológicos que possam impactar os mercados de commodities.

You may also like

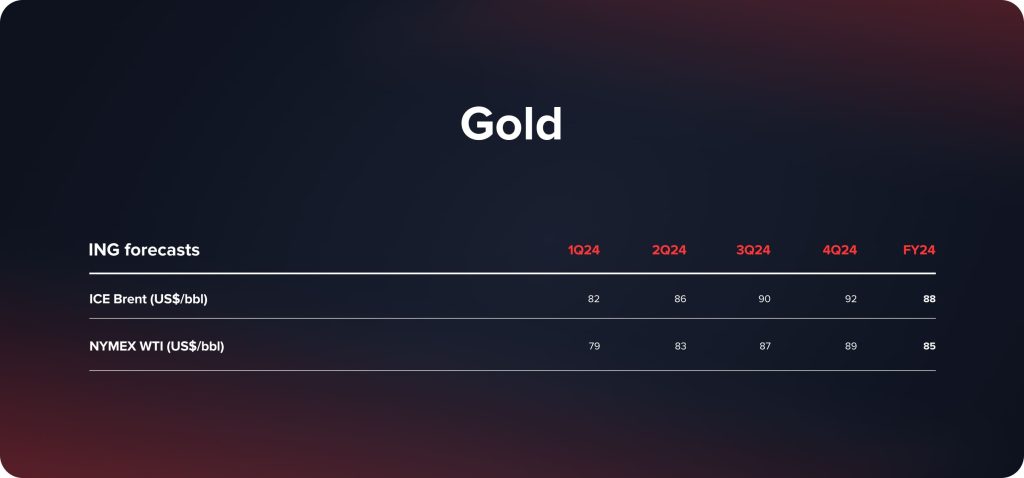

Commodities para Negociar em 2024

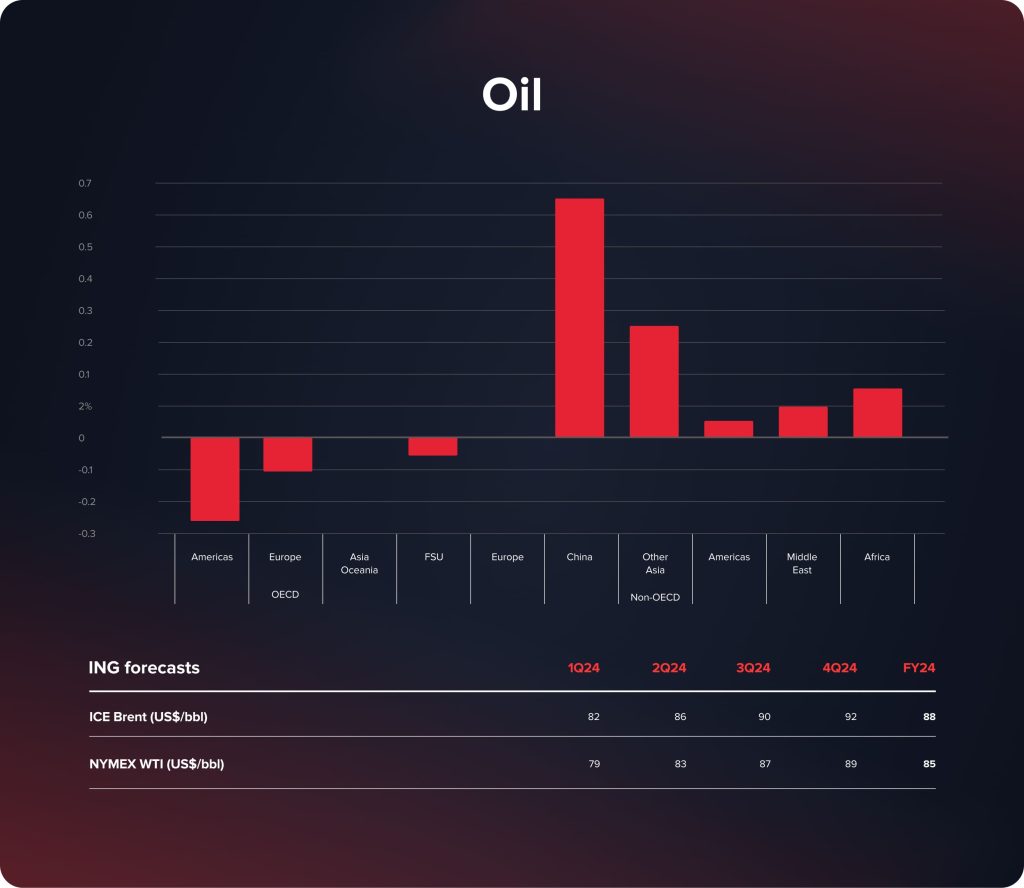

Óleo

Em 2024, o petróleo continua sendo uma commodity essencial, fortemente influenciada pelas políticas da OPEP+ e pelas tensões geopolíticas. Espera-se que o mercado se estabilize inicialmente, mas potenciais déficits no final do ano sugerem alta nos preços. Em particular, ações de grandes players como a Arábia Saudita e mudanças geopolíticas, como as tensões no Oriente Médio e as relações EUA-Irã, podem impactar significativamente a oferta e os preços, tornando o petróleo uma commodity a ser observada de perto.

Ouro

O ouro está prestes a apresentar uma recuperação significativa em 2024, impulsionado por fatores macroeconômicos como cortes antecipados nas taxas de juros pelo Fed e um dólar americano mais fraco, aumentando seu apelo como investimento. Quando a guerra entre Israel e o Hamas eclodiu em 7 de outubro, o ouro quase atingiu sua máxima anterior de US$ 2.075 a onça, estabelecida em 2020. O forte interesse de compra dos bancos centrais reforça ainda mais a perspectiva otimista, posicionando o ouro como um ativo favorável em meio às incertezas econômicas e como uma proteção tradicional contra a inflação.

Grãos

O mercado de grãos apresenta um cenário misto: enquanto os preços do milho e da soja podem sofrer pressão de baixa devido ao excedente de produção, o trigo surge como o grão a ser observado. A redução dos estoques globais, influenciada por fatores ambientais e geopolíticos, elevará os preços do trigo, tornando-o uma commodity de grãos relevante no cenário de mercado de 2024.

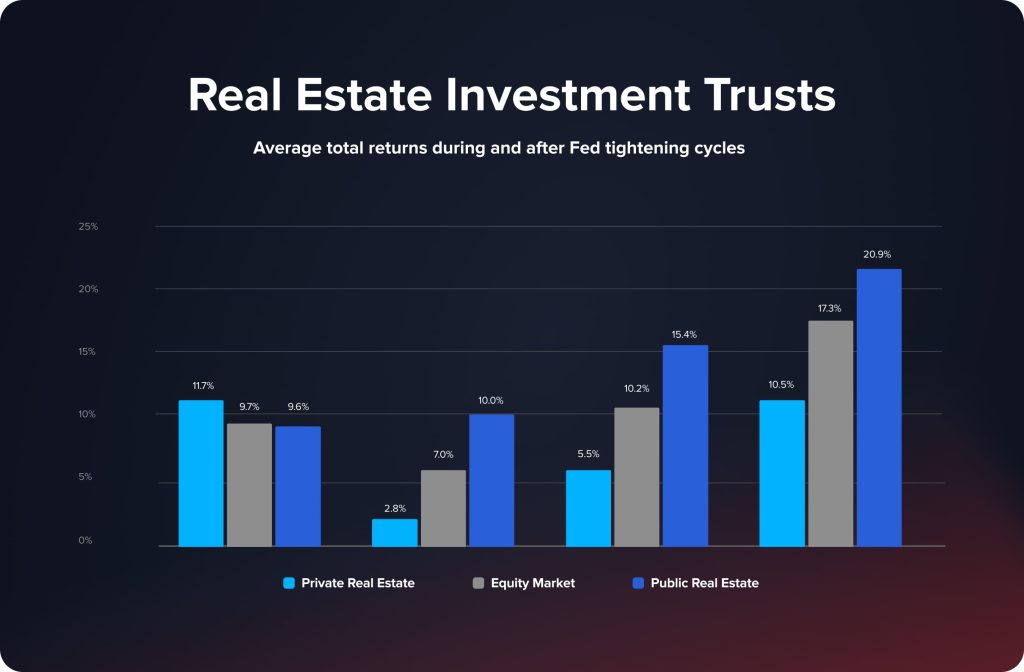

Fundos de Investimento Imobiliário

Os Fundos de Investimento Imobiliário (FIIs) surgem como um instrumento notável para investidores que buscam estabilidade aliada a potencial crescimento. Os FIIs oferecem uma oportunidade única de investir indiretamente no mercado imobiliário, proporcionando exposição a diversos setores imobiliários sem as complexidades da propriedade direta.

Principais características dos REITs no mercado

Os REITs investem principalmente em imóveis comerciais, incluindo prédios de escritórios, shopping centers, apartamentos e hotéis. O atrativo dos REITs reside em sua estrutura, que exige que distribuam a maior parte de sua renda tributável aos acionistas na forma de dividendos, o que frequentemente resulta em retornos mais altos do que outras ações. Essa característica os torna particularmente atraentes para investidores em busca de renda.

Uma das principais vantagens dos REITs é seu papel na diversificação da carteira. Ao contrário de ações e títulos típicos, o mercado imobiliário, que sustenta os REITs, frequentemente segue ciclos econômicos distintos. Essa característica proporciona aos investidores uma proteção contra a volatilidade em classes de ativos mais tradicionais, aumentando assim a estabilidade geral de sua carteira de investimentos.

Outro aspecto fundamental dos REITs é sua liquidez. Por serem negociados nas principais bolsas de valores, os REITs oferecem um nível de liquidez normalmente não encontrado em investimentos imobiliários diretos. Essa facilidade de negociação permite que os investidores comprem e vendam ações com a mesma simplicidade e rapidez de outras ações negociadas em bolsa, adicionando um nível de flexibilidade à sua estratégia de investimento.

Além disso, os REITs democratizam o acesso a investimentos imobiliários. Eles abrem as portas do mercado imobiliário para uma gama mais ampla de investidores, eliminando o capital substancial normalmente necessário para compras diretas de imóveis. Essa acessibilidade facilita o acesso de pessoas físicas ao setor imobiliário, muitas vezes lucrativo, sem o alto investimento inicial.

A gestão profissional de REITs acrescenta uma camada de conveniência e expertise. Esses fundos são administrados por profissionais experientes que supervisionam todos os aspectos da gestão imobiliária, desde a aquisição e manutenção até a melhoria. Essa gestão reduz o ônus e a complexidade para investidores individuais, que poderiam ser dissuadidos pelas demandas operacionais dos investimentos imobiliários.

Principais REITs a serem considerados em 2024

Prologis Inc. (PLD)

Especializada em imóveis logísticos, Prologis A Prologis se destaca por seu valioso portfólio de terrenos e pela forte demanda por seus centros logísticos estrategicamente localizados. Apesar das preocupações com o crescimento do e-commerce, a necessidade por espaço industrial permanece alta. Analistas preveem um sólido crescimento da receita da Prologis em 2024, tornando-a uma escolha promissora no setor de fundos de investimento imobiliário (REITs).

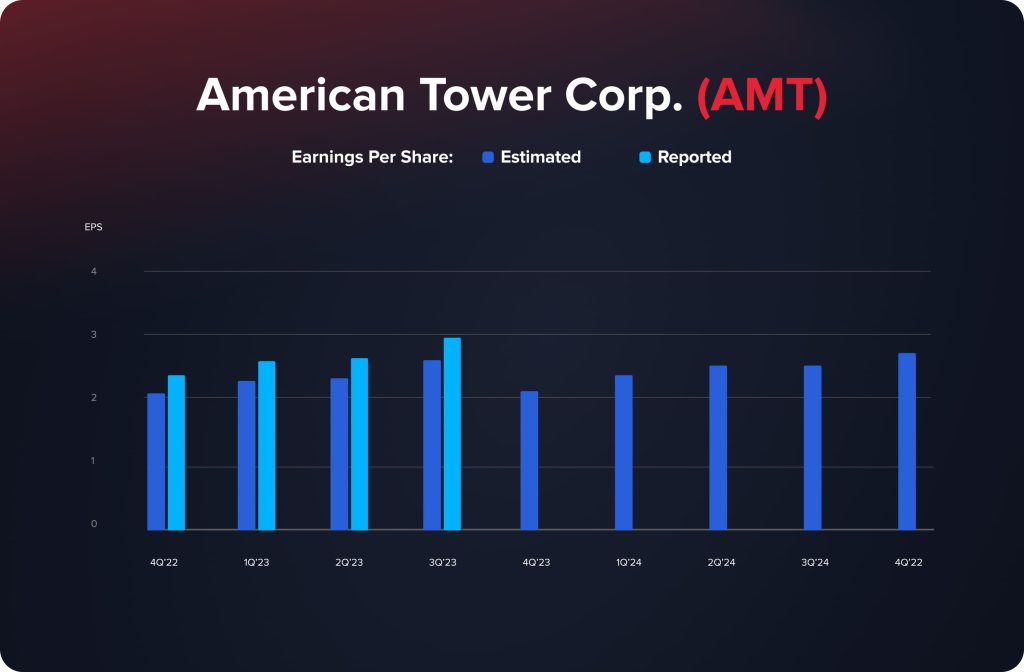

American Tower Corp. (AMT)

Operando o maior portfólio independente de torres de transmissão e comunicações sem fio do mundo, Torre Americana está bem posicionada para o crescimento. Os principais impulsionadores da AMT incluem a expansão do 5G e o potencial em mercados internacionais onde a penetração de telecomunicações avançadas ainda é baixa. É vista como um investimento sólido, especialmente se a economia mantiver seu vigor.

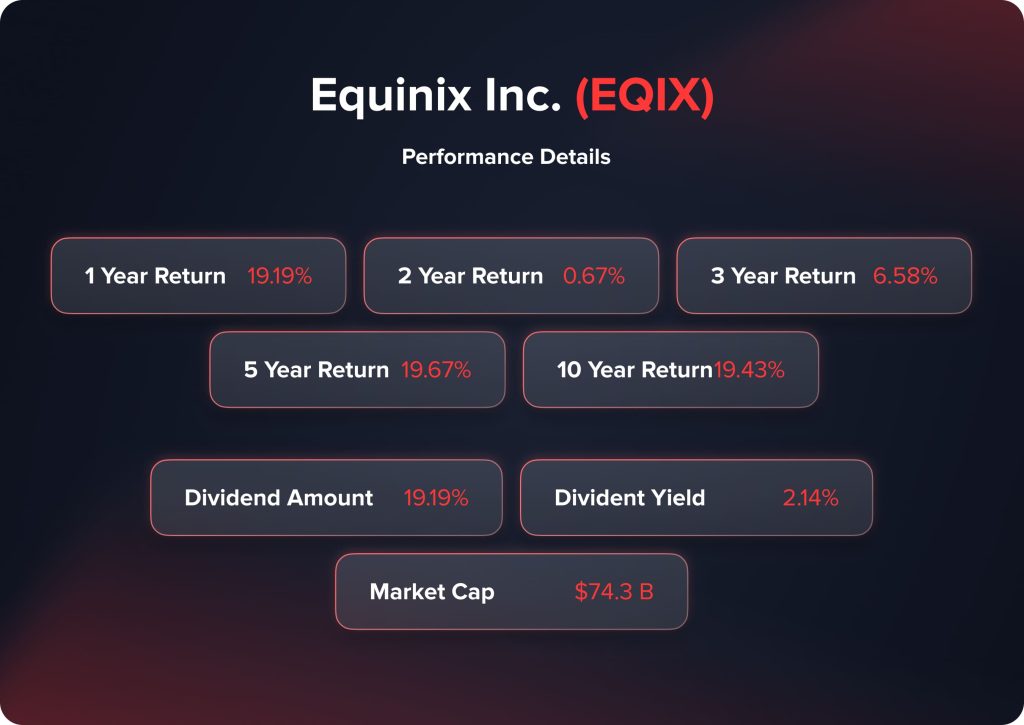

Equinix Inc. (EQIX)

Como a maior operadora de data center do mundo, Equinix desfruta de uma posição única com concorrência limitada. O foco da empresa na expansão de suas unidades e uma base de receita estável a tornam atraente para investidores. Seu status como parceira preferencial das principais empresas de tecnologia e o crescimento projetado da receita posicionam a Equinix como um REIT de ponta para 2024.

Ações de Energia Verde

As ações de energia verde representam mais do que uma tendência passageira; elas estão na vanguarda de uma mudança significativa em direção ao investimento sustentável. O impulso global para fontes de energia renováveis posicionou essas ações não apenas como opções éticas de investimento, mas também como veículos para retornos potencialmente substanciais.

O apelo das ações de energia verde advém de seu papel na promoção de um futuro mais sustentável e ambientalmente consciente. Investir neste setor alinha-se aos esforços globais para reduzir as emissões de carbono e fazer a transição para energias renováveis, tornando-se um empreendimento consciente e potencialmente lucrativo. Governos e empresas em todo o mundo estão cada vez mais comprometidos com iniciativas verdes, o que é um bom sinal para o crescimento e desenvolvimento de empresas neste setor.

No entanto, o setor de energia verde traz consigo suas próprias considerações. O mercado pode ser volátil e influenciado por diversos fatores, incluindo mudanças políticas, avanços tecnológicos e mudanças nas atitudes dos consumidores. Além disso, muitas empresas do setor de energia verde estão em estágios iniciais de desenvolvimento. Esse estágio inicial de muitas empresas significa que riscos maiores podem estar envolvidos, mas também a possibilidade de recompensas maiores para investidores que se aventuram cedo em empreendimentos promissores.

Ações de energia verde para ficar de olho em 2024

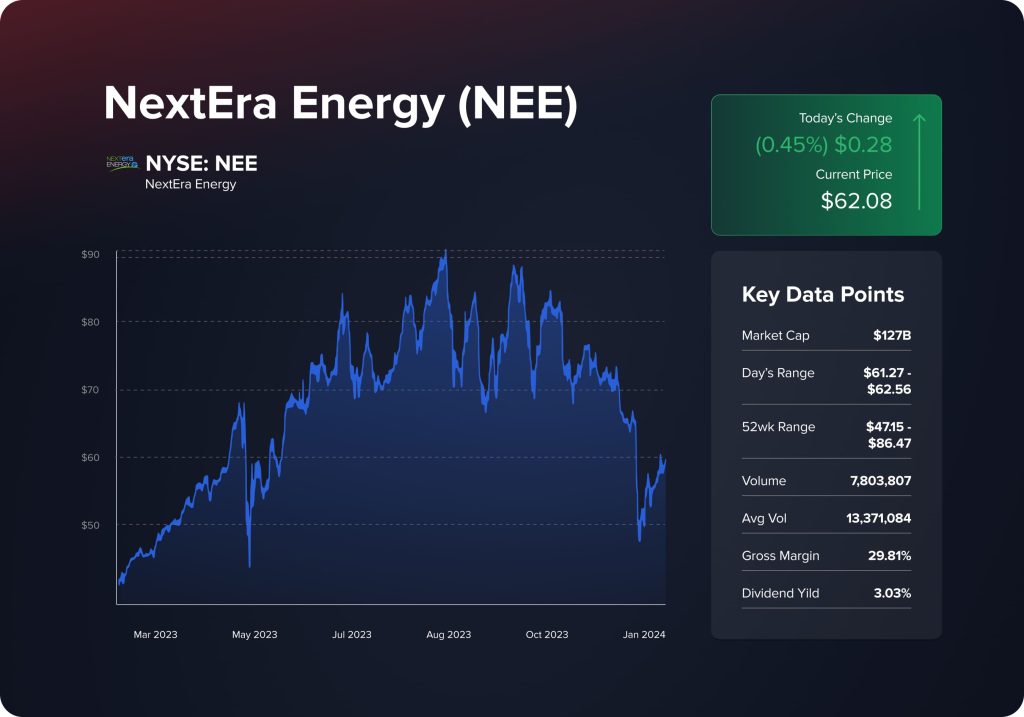

NextEra Energy (NEE)

NextEra Energy Destaca-se como um híbrido único no setor de energia verde, combinando a estabilidade de uma concessionária de serviços públicos com o potencial de crescimento de uma empresa de energia solar e eólica. Apesar da flutuação dos rendimentos dos títulos impactar as ações de concessionárias de serviços públicos, a NextEra Energy continua sendo uma opção atraente, em parte graças ao seu sólido rendimento de dividendos acima de 3%. A empresa tem apresentado consistentemente lucros acima do consenso, oferecendo uma fonte estável de renda e potencial de crescimento. Com as ações de energia verde recuperando o foco e o desempenho estável da NextEra, ela se posiciona como uma forte escolha para investidores em 2024.

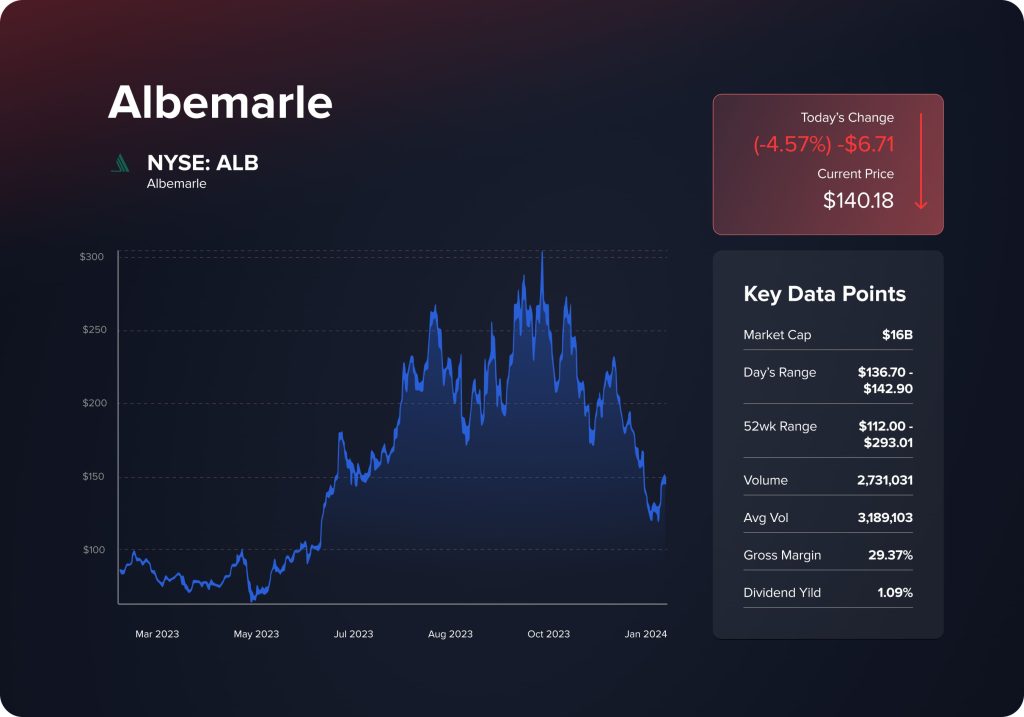

Albemarle (ALB)

Albemarle enfrenta um cenário adverso como a maior produtora mundial de lítio. Apesar da recente queda nos preços do carbonato de lítio e dos desafios no setor de veículos elétricos, há motivos para otimismo. Analistas apontam para um déficit projetado na produção de lítio para as metas de zero líquido até 2050, indicando demanda de longo prazo. Com suas ações sendo negociadas abaixo dos preços-alvo de consenso e tendências recentes de alta, a Albemarle pode se beneficiar de potenciais cortes de juros em 2024, tornando-se uma ação a ser considerada por aqueles que apostam no futuro do lítio e dos veículos elétricos.

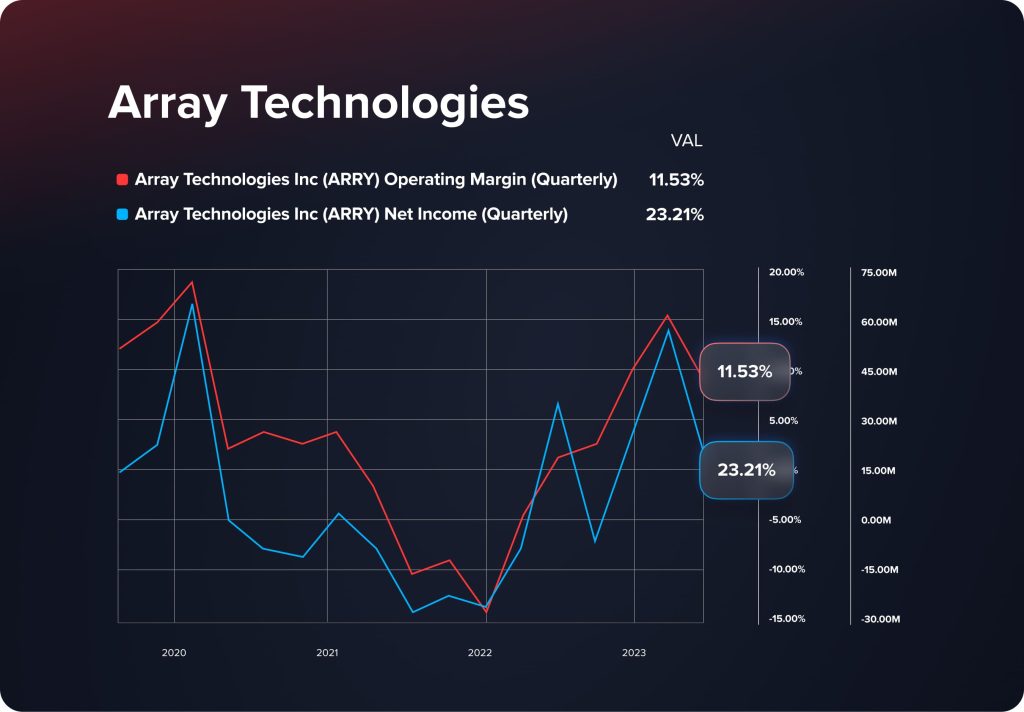

Tecnologias de matriz (ARRY)

Tecnologias de matriz is a noteworthy player in the solar industry, specializing in ground mounting systems for solar panels. The company has demonstrated strong fundamentals, with a notable increase in gross profit despite a revenue dip. Its shift from an operational loss to a gain within a year highlights its robust business model. With expectations of lower interest rates in 2024, Tecnologias de matriz could see reduced financial burdens and improved profitability, making ARRY an attractive option for investors eyeing the solar sector.

Títulos do Governo

Os títulos públicos continuam sendo um pilar fundamental para investidores avessos ao risco. Conhecidos por sua estabilidade e retornos fixos, esses títulos são um porto seguro, especialmente valiosos em meio às incertezas do mercado. Eles servem como elemento de equilíbrio para carteiras que contêm investimentos de maior risco.

O apelo dos títulos públicos reside em sua relativa segurança em comparação com outros instrumentos de mercado. Esses títulos oferecem uma sensação de segurança em um ano marcado por incertezas econômicas, proporcionando renda previsível por meio de pagamentos de juros fixos. Os títulos públicos representam uma opção de menor risco para investidores cautelosos com a volatilidade do mercado.

No entanto, para negociar com sucesso títulos do governo, é necessário um profundo conhecimento do ambiente das taxas de juros e das perspectivas econômicas gerais. As taxas de juros impactam diretamente os rendimentos dos títulos, tornando essencial que os traders se mantenham informados sobre as políticas dos bancos centrais e as tendências econômicas. Esse conhecimento permite que os investidores tomem decisões estratégicas sobre quando comprar ou vender títulos do governo, otimizando seus investimentos de acordo com as condições de mercado.

Ações de mercados emergentes

À medida que entramos em 2024, as ações de mercados emergentes continuam a ser um atrativo para investidores que buscam oportunidades de alto risco e alta recompensa. Esses mercados, que abrangem Ásia, África e América do Sul, oferecem potencial de crescimento significativo, mas também apresentam riscos mais elevados em comparação com mercados mais consolidados.

O fascínio das ações de mercados emergentes reside em seu potencial de crescimento, impulsionado por economias em rápido desenvolvimento, mercados consumidores em expansão e recursos frequentemente subexplorados. Taxas de crescimento econômico mais rápidas frequentemente caracterizam esses mercados em comparação com países desenvolvidos, o que pode se traduzir em retornos substanciais para investidores experientes.

No entanto, o sucesso em investimentos em mercados emergentes depende de uma compreensão profunda de vários fatores:

- Motores Econômicos Regionais:Cada mercado emergente tem sua dinâmica econômica única, influenciada por fatores como comportamento do consumidor, políticas governamentais e crescimento setorial.

- Clima político: A estabilidade política desempenha um papel crucial no desempenho desses mercados. Os traders precisam estar atentos à situação política nessas regiões, pois mudanças na governança, nas regulamentações e nas relações internacionais podem impactar significativamente o desempenho do mercado.

Ações de mercados emergentes a serem consideradas em 2024

FaçaMinhaViagem (MMYT)

FaçaMinhaViagem , India's largest online travel agency, stands out as a promising emerging market stock for 2024. Capitalizing on India's growing middle class and increasing discretionary income, FaçaMinhaViagem operates through platforms like Goibibo and Redbus, offering extensive hotel, travel, and tour services. The company has shown strong performance, with gross bookings exceeding $1.8 billion and a significant year-over-year increase in adjusted EBIT. As India's economy grows, the demand for travel and experiences is expected to surge, positioning FaçaMinhaViagem favorably in the market. The company's expansion into new cities and segments, like homestays, further strengthens its potential, making it a promising pick for investors looking at the Indian market.

MercadoLibre (MELI)

MercadoLibre , frequentemente apelidada de Amazon da América Latina, tem apresentado um crescimento impressionante, principalmente em mercados-chave como Brasil, Argentina e México. Com um aumento de 100% em 2023, o Mercado Livre consolidou sua liderança de mercado apesar das pressões competitivas. O modelo de negócios diversificado da empresa, incluindo fintechs e serviços de publicidade, contribuiu para o robusto crescimento de sua receita. Com usuários ativos e receitas em crescimento, especialmente nos mercados mexicano e brasileiro, o Mercado Livre se posiciona como uma ação atraente para 2024, oferecendo aos investidores exposição ao crescente setor de e-commerce latino-americano.

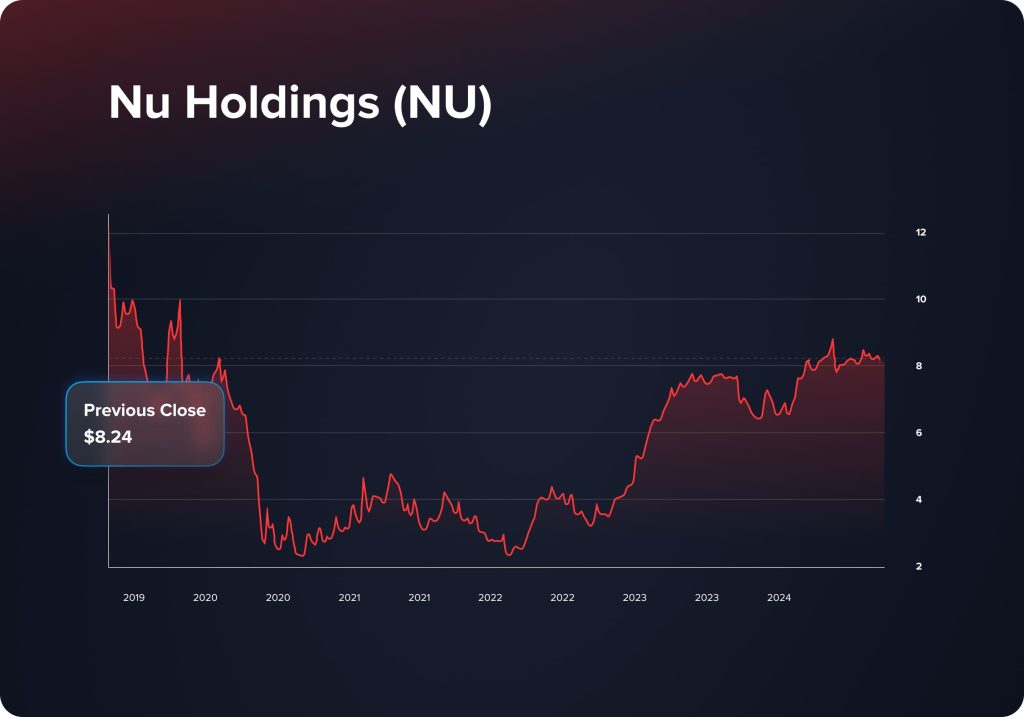

Nu Holdings Ltda. (Nu)

Nu Holdings A Nu Holdings, uma plataforma de banco digital com atuação no Brasil, México, Colômbia e internacionalmente, apresenta uma forte trajetória ascendente. Com projeção de crescimento de vendas e lucros, a Nu Holdings demonstra um potencial considerável para 2024. As ações já apresentaram crescimento significativo no acumulado do ano, superando a média do setor. O robusto desempenho operacional, o crescimento contínuo e a crescente lucratividade da Nu a tornam atraente para investidores que buscam explorar o setor de serviços financeiros e bancos digitais em mercados emergentes.

Conclusão

À medida que olhamos para 2024, a chave para o sucesso no trading reside numa abordagem estratégica e bem informada a estes instrumentos de topo. Manter-se atualizado com as tendências do mercado, compreender as nuances de cada instrumento e adaptar as estratégias à evolução do cenário financeiro será crucial. Seja aderindo à onda digital das criptomoedas ou aproveitando o crescimento constante dos fundos de ações de grande capitalização, as oportunidades para os traders são tão diversas quanto os próprios instrumentos. O futuro do trading em 2024 passa por fazer escolhas informadas, gerir riscos de forma eficaz e aproveitar as oportunidades destes principais instrumentos de trading.

É fundamental ressaltar que o conteúdo deste artigo tem caráter meramente informativo e não deve ser interpretado como aconselhamento financeiro. A situação financeira e a tolerância ao risco de cada investidor são únicas, e as opções de investimento discutidas podem não ser adequadas para todos. É altamente recomendável que os indivíduos consultem um consultor financeiro qualificado ou realizem suas próprias pesquisas e análises aprofundadas antes de tomar qualquer decisão de investimento. As informações aqui compartilhadas têm como objetivo oferecer insights sobre potenciais oportunidades de investimento, mas não servem como recomendação ou endosso de nenhuma estratégia de investimento ou produto financeiro específico.

Atualizado:

18 de dezembro de 2024