Os 15 principais indicadores técnicos de negociação para 2025

Conteúdo

No mundo dinâmico do trading, dominar indicadores técnicos é essencial para navegar pelos mercados com precisão e confiança. Com a chegada de 2024, certos indicadores técnicos ganharam destaque, oferecendo aos traders insights valiosos sobre tendências e oportunidades de mercado. Este artigo analisa os 10 principais indicadores técnicos de trading, fornecendo uma compreensão detalhada de cada um para equipar os traders, especialmente os iniciantes na área, com as ferramentas necessárias para uma análise de mercado eficaz.

Indicadores de negociação mais populares

1. Convergência e Divergência da Média Móvel (MACD)

2. Índice de Força Relativa (IFR)

3. Bandas de Bollinger

4. Retração de Fibonacci

5. Oscilador Estocástico

6. Médias Móveis

7. Amplitude média real (ATR)

8. Nuvem Ichimoku

9. Oscilador de Volume

10. SAR Parabólico

Agora, vamos considerar cada um desses indicadores com mais detalhes.

Convergência e Divergência da Média Móvel

A Convergência Divergência de Médias Móveis (MACD) é uma ferramenta popular que os traders usam para entender as tendências do mercado. Em termos simples, ela ajuda os traders a determinar em que direção o preço de um ativo pode estar se movendo e quão forte é esse movimento.

Como funciona o MACD?

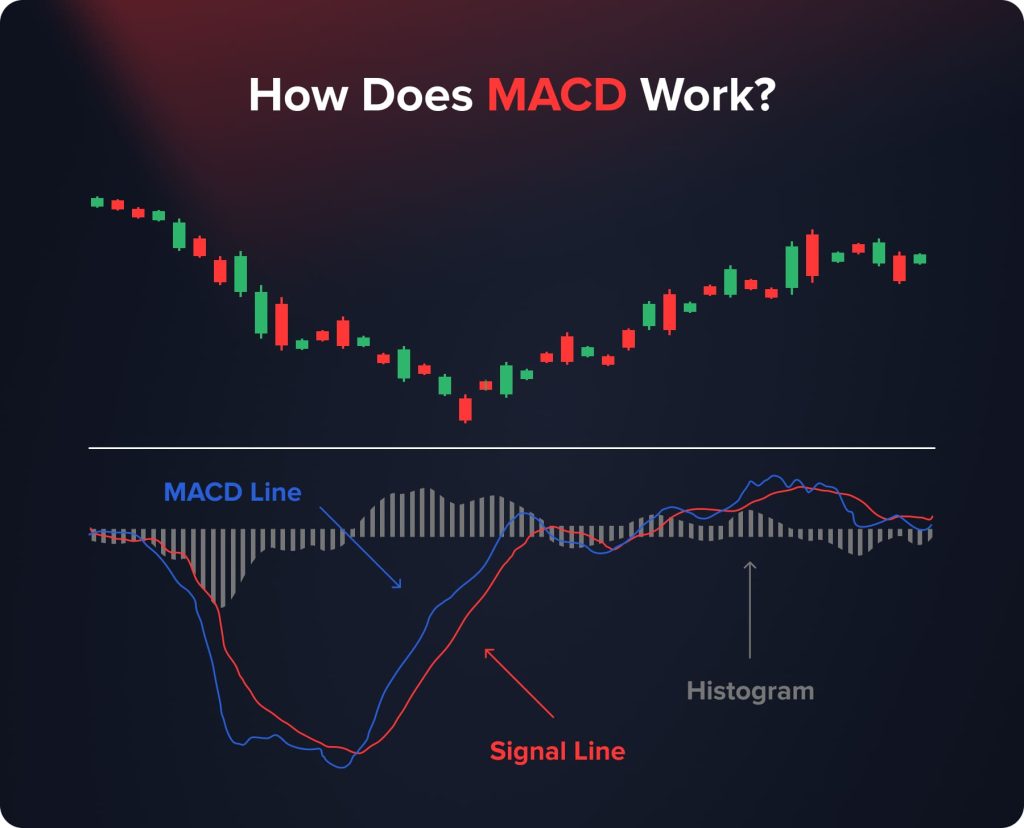

O MACD envolve três componentes principais:

- Linha MACD: Esta é a parte principal do indicador. É calculada pela diferença entre duas médias móveis (geralmente as Médias Móveis Exponenciais de 12 e 26 dias) do preço de um ativo.

- Linha de Sinal: Esta linha é normalmente a Média Móvel Exponencial de 9 dias da linha MACD. Ela atua como um gatilho para sinais de compra e venda.

- Histograma: Esta é uma representação visual que mostra a diferença entre a linha MACD e a linha de sinal. Ajuda a entender a força do movimento do preço.

Como interpretar o MACD

Interpretar o MACD envolve reconhecer certos sinais-chave que indicam potenciais oportunidades de compra ou venda. Quando a linha do MACD, que representa a diferença entre duas médias móveis, cruza acima da linha de sinal, isso é comumente interpretado como um sinal de alta, sugerindo um momento ideal para comprar.

Por outro lado, quando a linha MACD cruza abaixo da linha de Sinal, isso costuma ser visto como um sinal de baixa, indicando um possível ponto de venda. Além disso, o histograma MACD, que ilustra a diferença entre a linha MACD e a linha de Sinal, é uma ferramenta útil para avaliar o momentum do mercado. Um histograma crescente sugere fortalecimento do movimento, enquanto um histograma em contração indica enfraquecimento do momentum.

Por que o MACD é útil?

A utilidade do MACD reside em sua clareza e acessibilidade, tornando-o uma ferramenta valiosa tanto para traders iniciantes quanto experientes. Ele simplifica os movimentos complexos do mercado em sinais claros e compreensíveis. Um de seus principais pontos fortes é sinalizar o início de novas tendências de alta ou baixa, fornecendo aos traders insights sobre potenciais mudanças no mercado.

Além disso, o aspecto visual do MACD, particularmente o histograma, fornece uma representação gráfica da força da tendência, auxiliando os traders a tomar decisões de negociação mais informadas e estratégicas.

Índice de Força Relativa

O Índice de Força Relativa (RSI) é um indicador de momentum amplamente utilizado no mundo do trading, oferecendo insights sobre a velocidade e as variações nos movimentos de preços. É particularmente útil para identificar condições de sobrecompra ou sobrevenda de um ativo, moeda ou commodity.

Como funciona o RSI?

O RSI é calculado com base nos ganhos e perdas médios de um ativo ao longo de um período específico, normalmente 14 dias. É expresso como um oscilador, um gráfico de linhas que se move entre dois extremos e pode ter uma leitura de 0 a 100. O indicador inclui:

- Linha RSI: Esta linha se move em uma escala de 0 a 100, fornecendo indicações sobre a dinâmica do preço de um ativo.

- Níveis de sobrecompra e sobrevenda: Normalmente, são definidos em 70 e 30, respectivamente. Um RSI acima de 70 sugere que um ativo pode estar sobrecomprado, enquanto abaixo de 30 indica que pode estar sobrevendido.

Como interpretar o RSI

A interpretação do RSI gira em torno de sua capacidade de sinalizar potenciais reversões do mercado. Um aspecto fundamental da análise do RSI é observar quando a linha cruza certos limites. Se a linha do RSI ultrapassar 70, isso sugere que o mercado está sobrecomprado, indicando que uma liquidação pode ser iminente.

Por outro lado, se a linha do RSI cair abaixo de 30, isso indica que o mercado está sobrevendido, o que pode ser um sinal de uma potencial oportunidade de compra. Esses sinais são cruciais para traders que buscam capitalizar as mudanças no sentimento do mercado.

Por que o RSI é útil?

O Índice de Força Relativa simplifica e esclarece as complexidades da dinâmica do mercado, tornando-se um ativo valioso para os traders. Um dos principais pontos fortes do RSI reside em sua capacidade de fornecer indicações claras sobre a avaliação dos ativos. Ao analisar o momentum de negociação, o RSI ajuda os traders a discernir se um ativo está potencialmente supervalorizado ou subvalorizado em um determinado momento. Esse aspecto do RSI é particularmente útil em mercados voláteis, onde as flutuações de preço podem ser rápidas e significativas, como o de criptomoedas, permitindo que os traders identifiquem oportunidades de compra de ativos subvalorizados ou de venda de ativos supervalorizados.

Além disso, o RSI vai além da simples identificação das condições de mercado; ele desempenha um papel fundamental na tomada de decisões estratégicas. Identificar potenciais pontos de entrada e saída auxilia efetivamente os traders a cronometrar seus movimentos de mercado. Essa capacidade é essencial, especialmente em mercados de rápida movimentação, onde o timing é crucial para maximizar os retornos ou minimizar as perdas. A capacidade do RSI de destacar esses momentos-chave ajuda os traders a executar operações em momentos ideais, aumentando assim o potencial de resultados bem-sucedidos.

Bandas de Bollinger

As Bandas de Bollinger são uma ferramenta de análise técnica versátil e amplamente utilizada em negociações. Desenvolvidas por John Bollinger na década de 1980, essas bandas se tornaram essenciais para traders que buscam entender a volatilidade do mercado e os níveis de preços.

Como funcionam as Bandas de Bollinger

As Bandas de Bollinger consistem em três linhas: a banda do meio, normalmente uma média móvel simples (MMS) do preço de um ativo em um período específico, e duas bandas externas que representam desvios-padrão da MMS. A configuração padrão é uma MMS de 20 dias, com as bandas externas definidas em dois desvios-padrão acima e abaixo dessa média. Essa configuração cria um envelope dinâmico em torno do movimento do preço de um ativo.

Como interpretar as Bandas de Bollinger

As Bandas de Bollinger são usadas principalmente para avaliar a volatilidade do mercado. A chave está na expansão e contração das bandas:

- Quando as faixas se expandem ou se distanciam, isso sinaliza um aumento na volatilidade do mercado, sugerindo movimentos de preços mais significativos.

- Por outro lado, quando as bandas se contraem ou se aproximam, isso indica uma diminuição da volatilidade do mercado, sugerindo que os movimentos de preços podem ser mais contidos.

Além disso, as Bandas de Bollinger podem ajudar a identificar condições de sobrecompra e sobrevenda. Quando o preço de um ativo atinge a banda superior, ele pode ser considerado sobrecomprado, potencialmente sinalizando uma oportunidade de venda. Da mesma forma, se o preço atingir a banda inferior, o ativo pode estar sobrevendido, indicando uma oportunidade de compra.

Por que as Bandas de Bollinger são úteis?

As Bandas de Bollinger são particularmente úteis para traders, pois representam visualmente a volatilidade do mercado e os níveis de preços em relação aos movimentos históricos. Elas se adaptam às condições de mercado, fornecendo insights em tempo real para embasar decisões de negociação. Ao compreender o comportamento das bandas, os traders podem antecipar melhor potenciais rompimentos ou reversões de preços. Além disso, as Bandas de Bollinger podem ser combinadas com outros indicadores técnicos, como o MACD ou o RSI, para uma análise e validação mais robustas dos sinais de negociação.

Retração de Fibonacci

A Retração de Fibonacci é uma ferramenta de análise técnica baseada na ideia de que os mercados frequentemente retraçam uma parte previsível de um movimento antes de continuar na direção original. Nomeada em homenagem ao famoso matemático italiano, esta ferramenta é baseada em uma série de números conhecida como sequência de Fibonacci.

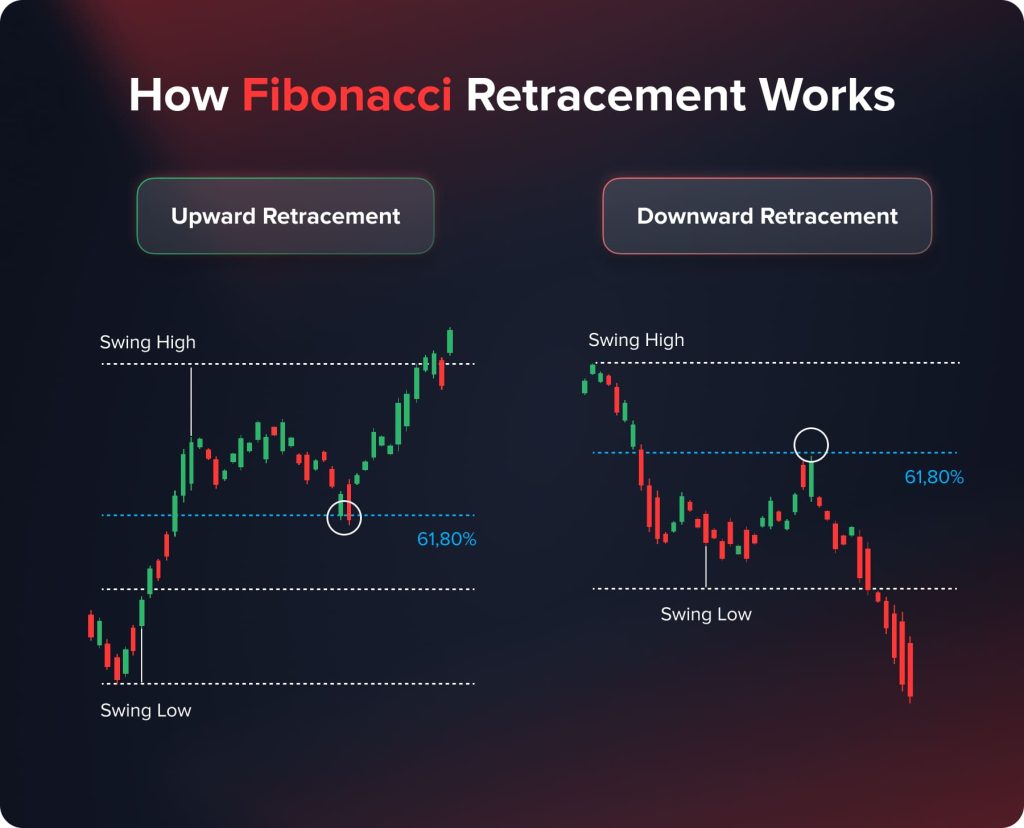

Como funciona a retração de Fibonacci

A retração de Fibonacci envolve a identificação de indicadores-chave Razões de Fibonacci – 23,6%, 38,2%, 61,8% e, às vezes, 50% e 78,6% – que são usados para prever potenciais níveis de reversão nos mercados. Essas proporções são derivadas da sequência de Fibonacci e aplicadas a gráficos para prever onde os preços podem encontrar suporte ou resistência.

Os traders plotam essas proporções em um gráfico, desenhando linhas horizontais em cada nível percentual. Essas linhas se tornam pontos de interesse para os movimentos do mercado, partindo da ideia de que, à medida que o mercado sobe ou desce, ele tende a retornar ou recuar para esses níveis antes de continuar sua tendência original.

Como interpretar a retração de Fibonacci

Entender a retração de Fibonacci significa reconhecer esses níveis como áreas potenciais onde os preços podem pausar ou reverter:

- Se o preço de um ativo cair para o nível de Fibonacci durante uma tendência de alta, ele poderá encontrar suporte e começar a subir novamente.

- Por outro lado, durante uma tendência de baixa, um nível de Fibonacci pode atuar como resistência, onde o preço pode ter dificuldade para cair e pode se recuperar.

Por que a retração de Fibonacci é útil?

A Retração de Fibonacci se destaca como uma ferramenta particularmente útil na análise técnica por suas qualidades preditivas e adaptabilidade a diversas condições de mercado. Essa ferramenta auxilia significativamente os traders, auxiliando-os a antecipar potenciais pontos de reversão no mercado. Ao identificar os principais níveis de suporte e resistência alinhados com os índices de Fibonacci, os traders podem identificar áreas onde o mercado provavelmente sofrerá uma reversão. Esses níveis tornam-se cruciais para a elaboração de estratégias de negociação, especialmente em mercados com rápida movimentação.

Além disso, os níveis de Retração de Fibonacci podem ser fundamentais na definição de preços-alvo e ordens stop-loss. Os traders costumam usar esses níveis para determinar pontos estratégicos de entrada e saída, otimizando assim suas estratégias de negociação. Esse aspecto da Retração de Fibonacci é particularmente benéfico para o planejamento de operações e a gestão de riscos, pois oferece pontos estruturados e bem definidos para realizar lucros ou reduzir perdas, alinhando-se estreitamente com as estratégias de gestão de risco do trader.

Oscilador Estocástico

O Oscilador Estocástico é um indicador de momentum que compara o preço de fechamento de um ativo com sua faixa de preço ao longo de um período específico. Desenvolvido por George C. Lane na década de 1950, ele foi projetado para prever pontos de inflexão de preços comparando o preço de fechamento de um ativo com sua faixa de preço.

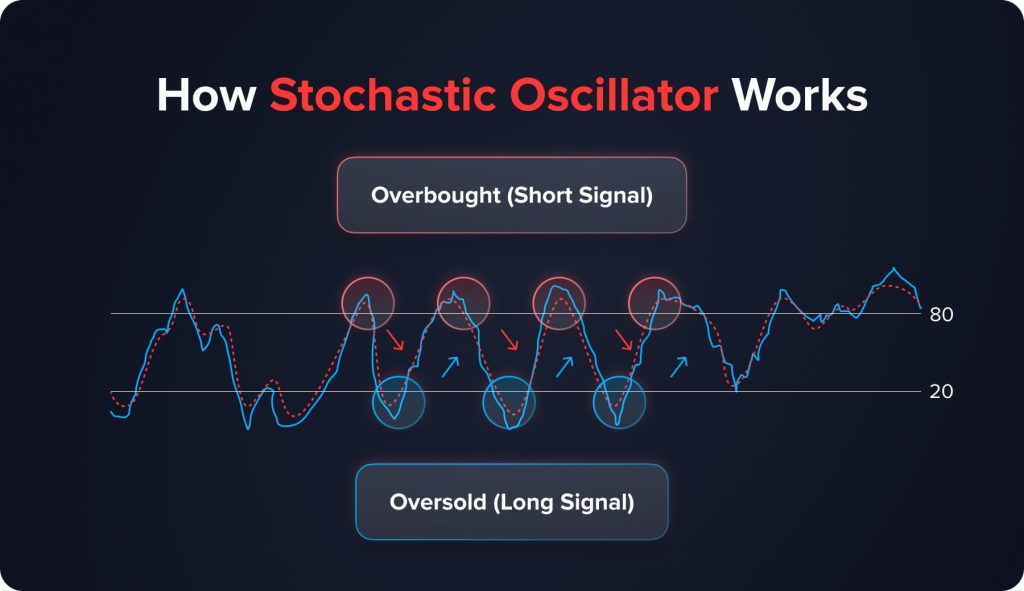

Como funciona o oscilador estocástico

O Oscilador Estocástico é calculado usando duas linhas: a linha %K, que mede os níveis de preço atuais em relação à faixa de máxima e mínima, e a linha %D, que é uma média móvel da linha %K. Normalmente, a linha %K é calculada usando um período de 14 períodos e é uma proporção expressa em termos percentuais. A linha %D geralmente é uma média móvel de 3 períodos da linha %K.

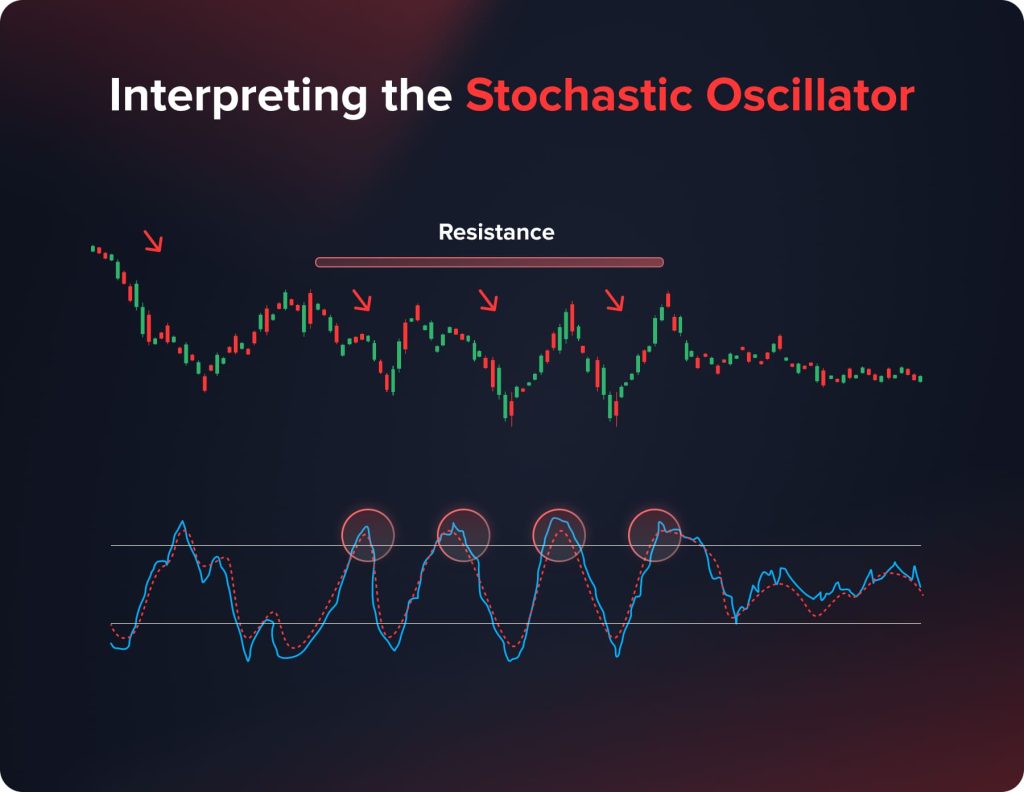

Interpretando o Oscilador Estocástico

A chave para usar o Oscilador Estocástico de forma eficaz está na compreensão de seus sinais:

- Condições de sobrecompra e sobrevenda: O oscilador varia entre 0 e 100. Leituras acima de 80 são geralmente consideradas sobrecompradas, enquanto leituras abaixo de 20 são consideradas sobrevendidas. Essas condições sugerem potenciais reversões no preço do ativo.

- Cruzamentos: Um sinal de compra é gerado quando a linha %K cruza para cima a linha %D, especialmente abaixo do nível 20. Por outro lado, um sinal de venda ocorre quando a linha %K cruza para baixo a linha %D acima do nível 80.

Por que o oscilador estocástico é útil?

O Oscilador Estocástico se destaca no cenário de trading por sua excepcional capacidade de fornecer alertas antecipados de potenciais reversões de preço. Essa qualidade é imensamente benéfica para os traders, principalmente na identificação de condições de sobrecompra ou sobrevenda no mercado. Quando um ativo atinge essas condições extremas, isso geralmente indica uma mudança iminente na direção do preço, permitindo que os traders se preparem para oportunidades de compra ou venda.

Além disso, o oscilador é fundamental para auxiliar os traders a cronometrar entradas e saídas do mercado. Os cruzamentos dentro do Oscilador Estocástico – pontos onde suas duas linhas se cruzam – servem como indicadores cruciais. Esses cruzamentos podem sinalizar os momentos certos para iniciar ou fechar posições, dando aos traders uma vantagem na capitalização dos movimentos do mercado.

Médias Móveis (Simples e Exponenciais)

As Médias Móveis, que abrangem as Médias Móveis Simples e as Médias Móveis Exponenciais, são ferramentas fundamentais na análise técnica. Esses indicadores suavizam os dados de preços ao longo de um período específico, fornecendo uma visão clara da direção da tendência.

Como funcionam as médias móveis

Médias Móveis Simples (MMS): A MMS é calculada pela média dos preços de fechamento de um ativo ao longo de um determinado número de dias. Por exemplo, uma MMS de 20 dias somaria os preços de fechamento dos últimos 20 dias e dividiria o resultado por 20. Essa média é então plotada em um gráfico e atualizada continuamente.

Médias Móveis Exponenciais (MME): A MME, semelhante à MMS, concentra-se nos preços recentes. Ela dá mais peso aos dados mais recentes, tornando-a mais sensível às variações recentes de preço. As MME são calculadas aplicando uma ponderação aos dados mais recentes.

Interpretando Médias Móveis

As médias móveis ajudam a identificar a direção da tendência e potenciais pontos de reversão:

- Identificação de Tendências: Se o preço de um ativo estiver acima de sua média móvel, isso sugere uma tendência de alta e, inversamente, se estiver abaixo, indica uma tendência de baixa.

- Cruzamentos: Quando uma média móvel de curto prazo cruza uma média móvel de longo prazo, isso pode sinalizar uma mudança na direção da tendência. Por exemplo, se uma MME de 10 dias cruzar acima de uma MME de 50 dias, isso pode indicar uma virada de alta.

Por que as médias móveis são úteis?

As Médias Móveis são particularmente apreciadas na comunidade de traders por sua simplicidade e eficácia. Esses indicadores fornecem uma visualização lúcida das tendências de mercado, filtrando com eficácia a volatilidade e o "ruído" diários que podem obscurecer a direção subjacente do mercado. Essa clareza é inestimável para traders que precisam distinguir entre variações de preço de curta duração e mudanças de tendência genuínas.

Além disso, a versatilidade das Médias Móveis é um atributo fundamental que aumenta sua utilidade. Elas podem ser personalizadas para se adequar a diferentes períodos de tempo, tornando-as igualmente relevantes para day traders de curto prazo que buscam pontos de entrada e saída rápidos do mercado, e para investidores de longo prazo focados em movimentos mais amplos do mercado. Essa adaptabilidade permite que traders de todos os tipos adaptem suas análises aos seus estilos e objetivos específicos de negociação.

Outra vantagem significativa das Médias Móveis é sua função como níveis dinâmicos de suporte e resistência. Esses níveis não são fixos, mas mudam com a média móvel, fornecendo aos traders informações atualizadas para decidir quando entrar ou sair de uma operação. Essa natureza dinâmica das Médias Móveis as torna uma ferramenta proativa no arsenal de um trader, oferecendo insights em tempo real que são cruciais para estratégias de negociação bem-sucedidas.

Faixa média verdadeira

A Amplitude Média Verdadeira (ATR) é uma ferramenta de análise técnica que mede a volatilidade do mercado. Desenvolvida por J. Welles Wilder Jr., não é usada para prever a direção dos preços, mas sim para avaliar o grau de interesse ou desinteresse em um movimento.

Como funciona a média de alcance real

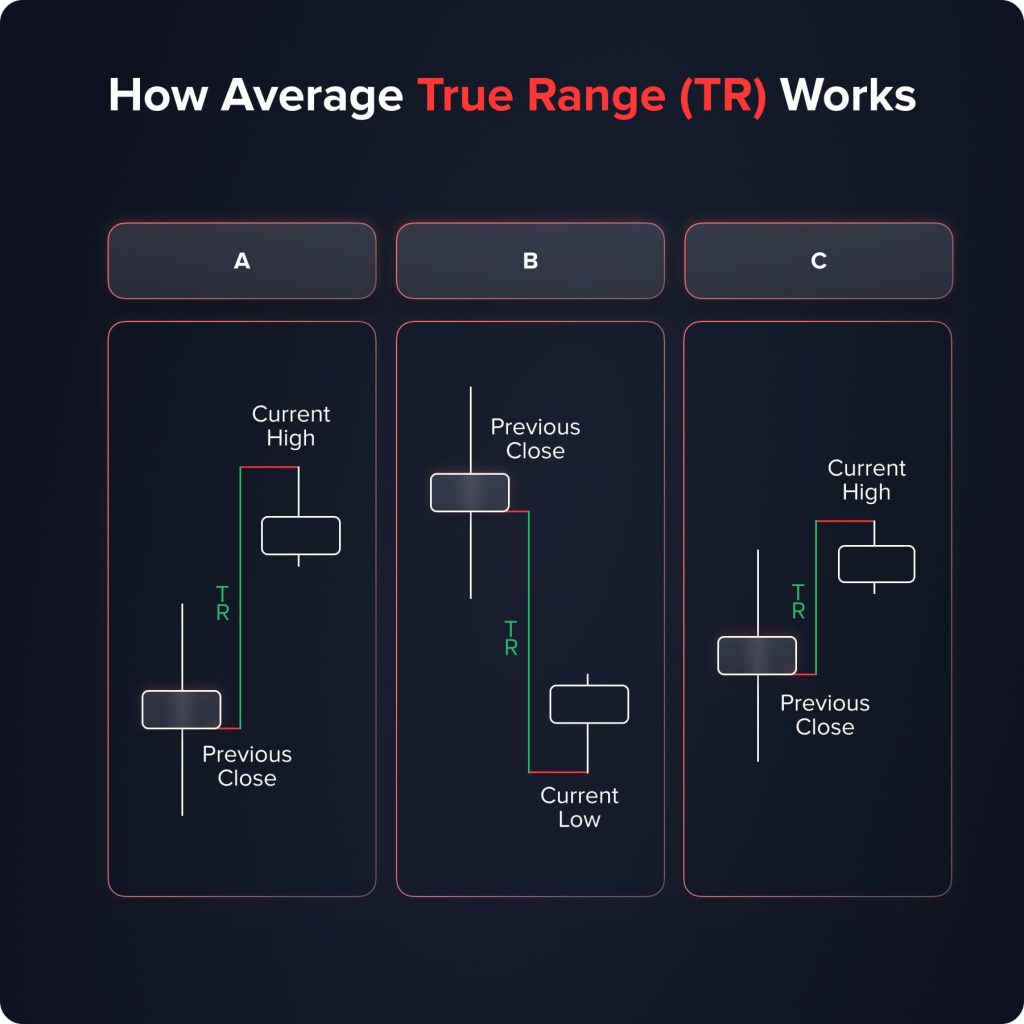

O ATR calcula o grau de volatilidade dos preços calculando a média das amplitudes reais ao longo de um período especificado. A amplitude real é a maior das seguintes:

- A máxima atual menos a mínima atual.

- O valor absoluto da máxima atual menos o fechamento anterior.

- O valor absoluto da mínima atual menos o fechamento anterior.

Esse valor é então calculado como a média ao longo de um período, geralmente de 14 dias, para obter o ATR. Ele é expresso como um único número que representa a média da flutuação do preço de um ativo nos últimos 14 dias.

Interpretando a Média da Amplitude Verdadeira

O ATR é particularmente útil para entender a volatilidade de um ativo:

- Um ATR alto indica alta volatilidade, com grandes movimentos de preços, para cima ou para baixo.

- Um ATR baixo sugere menor volatilidade com movimentos de preços menos drásticos.

Por que a Média da Amplitude Verdadeira é Útil?

O ATR surge como uma ferramenta inestimável para traders, especialmente em relação à gestão de risco e dimensionamento de posições. Sua principal utilidade reside na capacidade de transmitir a volatilidade do mercado de forma clara e objetiva. Para a gestão de risco, compreender a volatilidade destacada pelo ATR pode informar os traders sobre a distância que suas ordens stop-loss devem percorrer em relação aos seus pontos de entrada. Essa abordagem permite uma gestão mais eficaz de perdas potenciais, alinhando-as às condições atuais do mercado e à tolerância individual ao risco do trader.

Em termos de dimensionamento de posições, o ATR desempenha um papel crucial. Fornecer uma medida da volatilidade do mercado permite que os traders tomem decisões informadas sobre o tamanho das posições que devem assumir. Este aspecto do ATR é particularmente importante para garantir que os traders não se encontrem superexpostos a riscos em condições de mercado turbulentas. A orientação do ATR ajuda a equilibrar a busca por oportunidades de lucro e a mitigação de perdas potenciais, um equilíbrio vital para negociações bem-sucedidas.

Nuvem Ichimoku

A Nuvem de Ichimoku, também conhecida como Ichimoku Kinko Hyo, é um indicador abrangente que fornece informações sobre níveis de suporte e resistência, direção da tendência, momentum e potenciais pontos de entrada. Desenvolvido por Goichi Hosoda no Japão, este indicador é um dos favoritos entre os traders por sua profundidade de informações e facilidade de interpretação visual.

Como funciona o Ichimoku Cloud

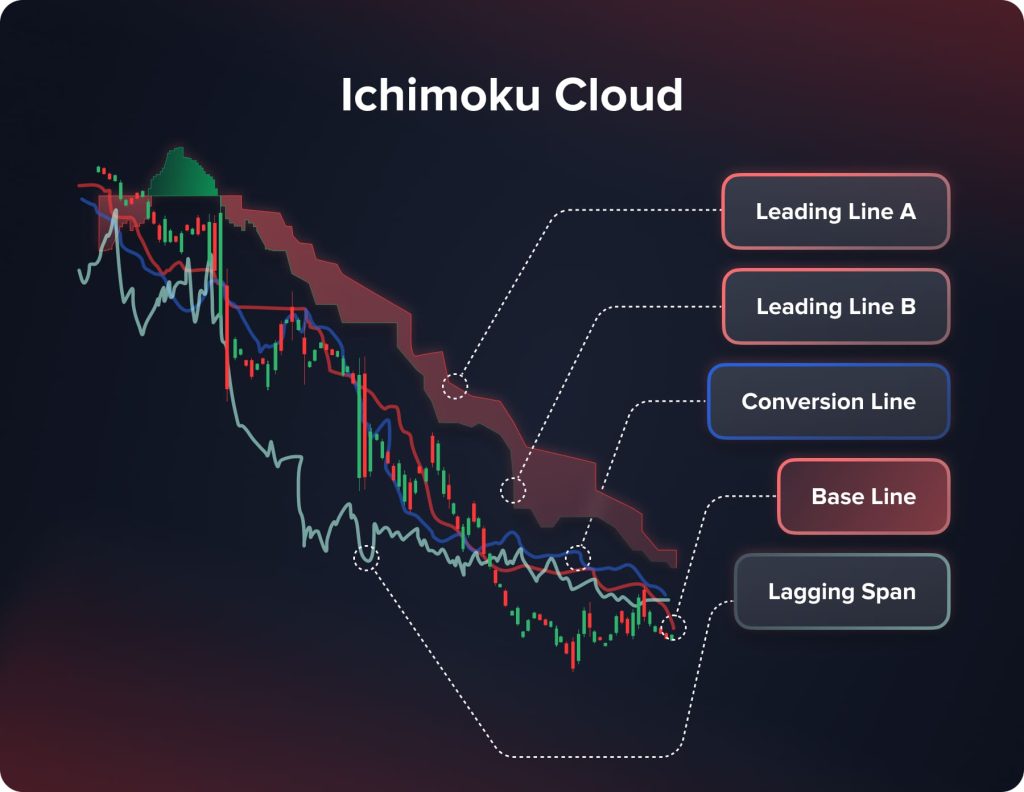

A Nuvem Ichimoku consiste em cinco componentes principais:

- Tenkan-sen (Linha de Conversão): Calculada como a média da maior máxima e da menor mínima dos últimos nove períodos.

- Kijun-sen (Linha de Base): A média da maior máxima e da menor mínima dos últimos 26 períodos.

- Senkou Span A (Linha de Abertura A): A média do Tenkan-sen e do Kijun-sen, plotada 26 períodos à frente.

- Senkou Span B (Leading Span B): A média da maior máxima e da menor mínima dos últimos 52 períodos, plotada 26 períodos à frente.

- Chikou Span (Span de Atraso): O preço de fechamento do período atual é plotado 26 períodos atrás.

O espaço entre Senkou Span A e Senkou Span B forma a "nuvem", que pode indicar potenciais áreas de suporte e resistência.

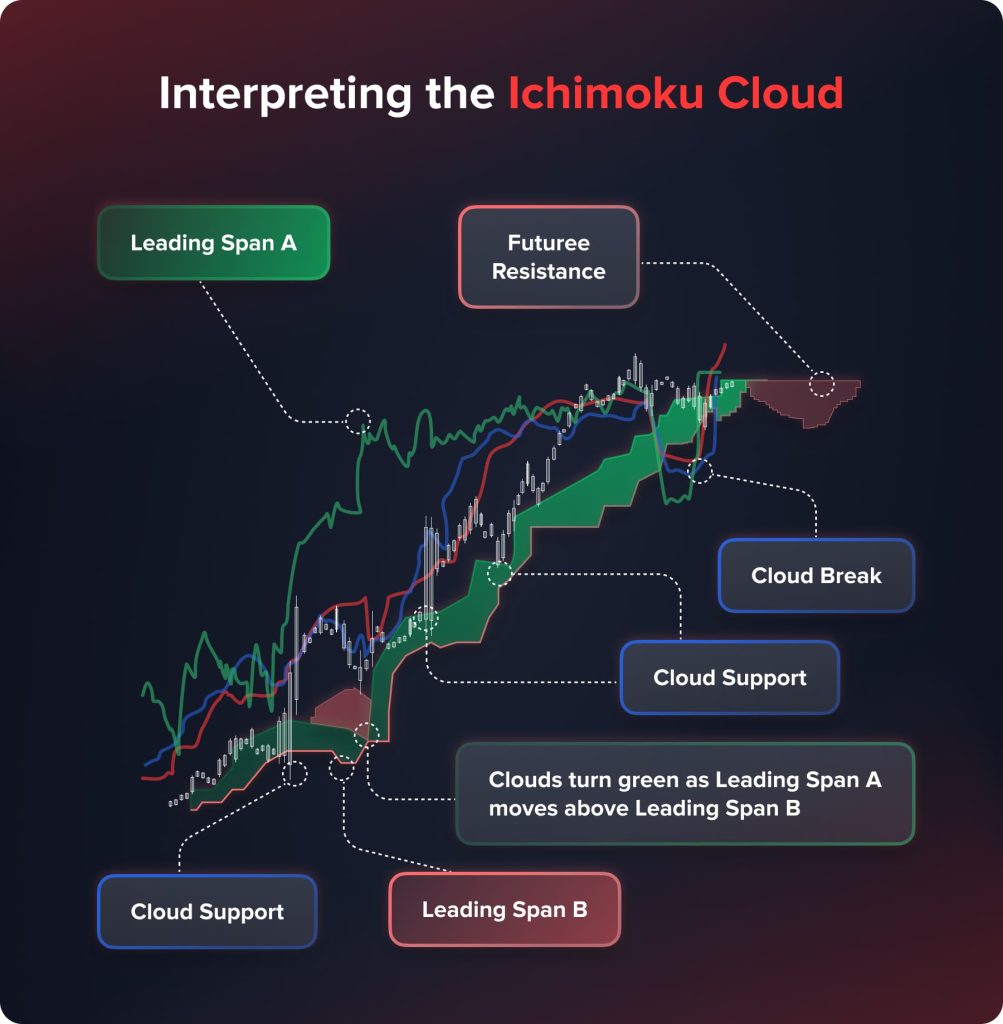

Interpretando a Nuvem Ichimoku

A Nuvem de Ichimoku é conhecida por sua abordagem multifacetada à análise de mercado, oferecendo aos traders uma riqueza de sinais. Ela serve como um guia para discernir a direção da tendência, o momentum e os potenciais níveis de suporte e resistência. A nuvem mede a direção da tendência formada pelo Senkou Span A e B. Quando o preço flutua acima da nuvem, isso sugere uma tendência de alta, enquanto uma posição abaixo da nuvem indica uma tendência de baixa.

Em termos de momentum e força, a Nuvem de Ichimoku é particularmente reveladora. A interação e o cruzamento das linhas Tenkan-sen e Kijun-sen, representando momentum de curto e médio prazo, respectivamente, são monitorados de perto em busca de sinais de força ou fraqueza do mercado.

Além disso, a nuvem se ajusta dinamicamente às condições de mercado, atuando como uma área de suporte e resistência em constante evolução. Esse aspecto da Nuvem de Ichimoku é crucial para identificar potenciais zonas de compra e venda, à medida que se adapta aos movimentos mais recentes do mercado.

Por que o Ichimoku Cloud é útil?

A Nuvem Ichimoku é uma ferramenta abrangente e adaptável para análise técnica. Ela oferece uma visão completa do mercado, integrando perfeitamente análise de tendências, acompanhamento de momentum e volatilidade em um único e coerente visual. Esta visão holística do mercado é inestimável para traders que buscam entender o contexto completo dos movimentos do mercado.

Além disso, a estrutura de nuvem do sistema Ichimoku oferece indicações visuais intuitivas. Essas indicações são particularmente úteis para identificar os principais níveis de suporte e resistência, auxiliando os traders a identificar pontos estratégicos de entrada e saída em suas operações.

Outra vantagem significativa da Nuvem Ichimoku é sua capacidade de previsão. Ao contrário de muitos indicadores tradicionais que se concentram apenas em dados passados e presentes, a Nuvem Ichimoku projeta certos elementos para o futuro.

Oscilador de volume

O Oscilador de Volume é uma valiosa ferramenta de análise técnica que mede a diferença entre duas médias móveis do volume de um ativo. É um excelente indicador para entender a força por trás dos movimentos de preços e tendências de mercado.

Como funciona o oscilador de volume

O Oscilador de Volume opera calculando a diferença entre duas médias móveis de volume, normalmente uma média de curto prazo e uma média de longo prazo. Configurações comuns usam uma média móvel de 5 e 20 dias. O oscilador pode ser apresentado como uma porcentagem ou em termos absolutos. A ideia principal é observar como as tendências de volume de curto prazo se comparam às tendências de volume de longo prazo.

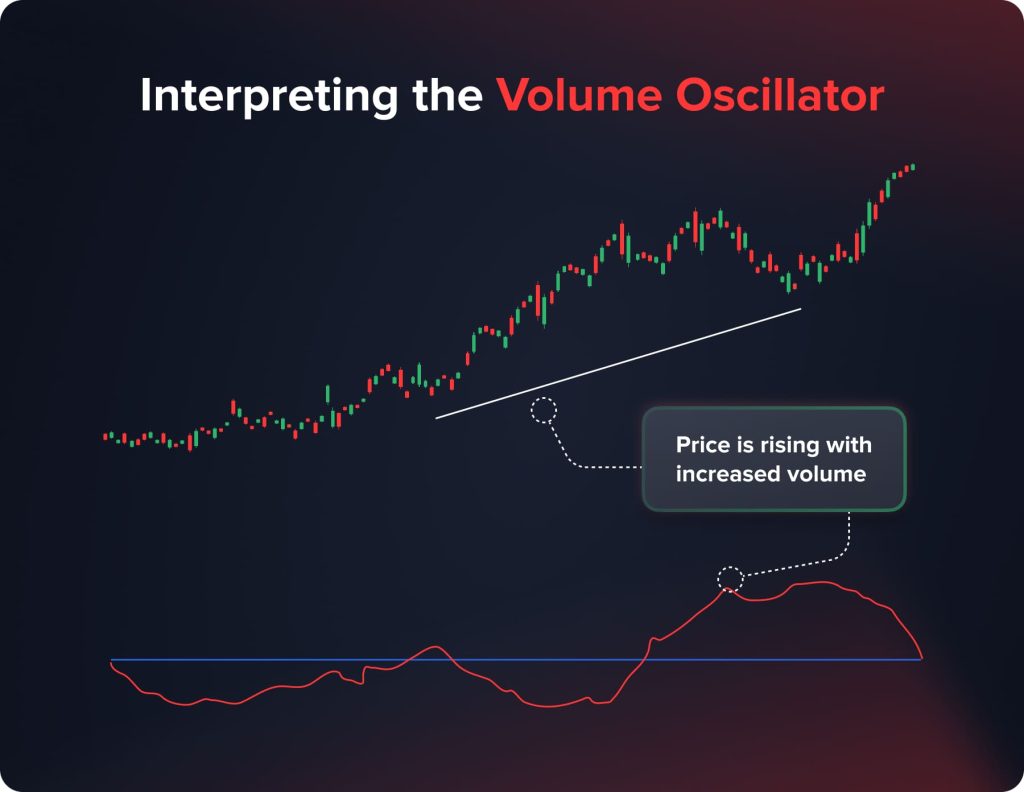

Interpretando o oscilador de volume

Interpretar o Oscilador de Volume envolve entender o que significam as diferenças nas médias móveis:

- Uma leitura positiva, em que o volume de curto prazo excede o volume de longo prazo, indica forte interesse do mercado e pressão de compra. Isso pode sugerir a continuação da tendência atual, especialmente se acompanhada de alta nos preços.

- Por outro lado, uma leitura negativa, em que o volume de curto prazo cai abaixo do volume de longo prazo, sugere declínio do interesse do mercado e pressão de venda. Isso pode sinalizar uma potencial reversão ou enfraquecimento da tendência.

Por que o oscilador de volume é útil?

O Oscilador de Volume é um recurso poderoso no kit de ferramentas de um trader, principalmente devido à sua eficácia em afirmar ou desafiar as tendências de mercado predominantes. Ele aprimora a análise das ações de preço, oferecendo insights mais profundos sobre os níveis de participação no mercado. Por exemplo, em um mercado em trajetória ascendente, um Oscilador de Volume ascendente confere credibilidade à tendência de alta. Este cenário indica que o movimento de alta é apoiado por um aumento de volume, o que demonstra forte interesse do comprador e suporte do mercado para a continuidade da tendência.

Por outro lado, em um mercado em tendência de baixa, um Oscilador de Volume em declínio desempenha um papel crucial na corroboração da tendência de baixa. Ele revela uma redução no interesse do mercado ou um aumento da pressão de venda, sinalizando que o movimento de baixa não é apenas uma flutuação temporária, mas uma tendência sustentada pelo consenso do mercado.

SAR parabólico

O Stop and Reverse Parabólico (Parabolic SAR) é uma ferramenta de análise técnica exclusiva e amplamente utilizada, projetada para identificar potenciais reversões na direção dos preços do mercado. Desenvolvido por J. Welles Wilder Jr., é particularmente conhecido por sua eficácia em capturar tendências de curto prazo.

Como funciona o SAR parabólico

O SAR Parabólico é representado como pontos em um gráfico, abaixo ou acima da linha de preço. Esses pontos são calculados por meio de uma fórmula complexa que leva em consideração a taxa de movimento do preço, com a posição dos pontos indicando a direção da tendência e potenciais pontos de reversão:

- Quando os pontos estão abaixo do preço, isso sinaliza uma tendência de alta, sugerindo um momento de alta.

- Por outro lado, pontos acima do preço indicam uma tendência de baixa, apontando para um momento de queda.

Interpretando o SAR Parabólico

A interpretação do SAR Parabólico se concentra na observação do posicionamento dos pontos em relação ao preço do ativo em um gráfico. Este método oferece um guia visual para a compreensão do momentum do mercado e de potenciais mudanças de tendência. Quando os pontos que constituem o SAR Parabólico mudam de posição acima da linha de preço para abaixo dela, isso é frequentemente interpretado como um sinal de reversão de alta. Essa mudança sugere um aumento na pressão de compra, apresentando uma potencial oportunidade de compra para os traders. Por outro lado, quando esses pontos se movem de abaixo para acima da linha de preço, isso indica uma reversão de baixa. Essa mudança é normalmente vista como um sinal para uma potencial oportunidade de venda, sinalizando um aumento na pressão de venda e uma possível tendência de queda no preço.

Por que o SAR Parabólico é útil?

O SAR Parabólico é uma ferramenta muito apreciada pelos traders, graças à sua capacidade de fornecer sinais claros e inequívocos. Essa clareza é particularmente crucial para cronometrar entradas e saídas de mercado com eficácia, pois ajuda a identificar momentos de reversão de tendência. Um dos recursos de destaque do SAR Parabólico é sua apresentação única em gráficos — os pontos não são apenas fáceis de interpretar, mas também auxiliam significativamente na definição de pontos de stop-loss. Esse recurso é particularmente benéfico para gerenciar riscos e proteger investimentos contra oscilações repentinas do mercado.

O SAR Parabólico é conhecido por sua adaptabilidade a diversas condições de mercado. Seja em tendência ou em movimento lateral, o SAR Parabólico ajusta seus sinais de acordo, tornando-se uma ferramenta flexível para diferentes cenários de negociação. Essa versatilidade o torna um ativo inestimável para traders em 2024, permitindo o desenvolvimento de estratégias de negociação dinâmicas adequadas às constantes mudanças no mercado.

Índice de Movimento Direcional

Apresentado por J. Welles Wilder Jr., o Índice de Movimento Direcional está entre os indicadores de tecnologia mais procurados para entender a direção e a força de uma tendência de mercado atual.

Como funciona o Índice de Movimento Direcional

O indicador contém três “subindicadores”:

- Indicador direcional positivo (+DI);

- Indicador direcional negativo (-DI);

- Índice direcional médio (ADX).

Ao falar sobre a fórmula DMI, os cálculos são um tanto complicados, pois tanto os indicadores direcionais positivos quanto os negativos são construídos com a ajuda de movimentos direcionais suavizados (máximas/mínimas atuais – máximas/mínimas anteriores) e intervalo real médio.

Como interpretar o índice de movimento direcional?

Ao interpretar o indicador técnico DMI, os traders levam em consideração principalmente a localização das linhas +DI e –DI.

- Se a linha +DI for maior que a linha –DI, o preço de um ativo subirá.

- Caso a linha –DI prevaleça sobre a linha +DI, o mercado está esperando o preço cair.

Os cruzamentos das linhas +DI e –DI são entendidos como sinais para abertura ou fechamento de posições. Tais momentos são indicadores da reversão da tendência em andamento.

Por que o Índice de Movimento Direcional é útil?

O indicador tecnológico DMI é um instrumento excepcionalmente útil para identificar a direção e a força de uma tendência. O índice é igualmente eficaz em diferentes mercados financeiros e prazos. Por outro lado, o DMI é um instrumento defasado; veja por que os traders ativam alguns instrumentos adicionais para confirmar uma tendência atual.

Aroon

O Aroon se enquadra na categoria de indicadores de tendências tecnológicas. O instrumento ajuda os traders a identificar a força de uma tendência atual. Esse indicador foi introduzido por Tushar Chande, um analista de tecnologia americano.

Como funciona o Aroon

O indicador Aroon consiste em duas linhas:

- Aroon para cima;

- Aroon para baixo.

As linhas mencionadas acima estão vinculadas aos preços mais altos e mais baixos de um ativo dentro do período determinado. Por exemplo, um trader ativou o indicador Aroon com o comprimento padrão (14). Temos a seguinte situação:

- Aroon Up = ((14 – o número de dias após o aparecimento do preço mais alto) / 14) * 100;

- Aroon Down ((14 - número de dias após o aparecimento do preço mínimo) / 14) * 100.

É por isso que as linhas de Aroon são representadas pelos números entre 0 e 100.

Como interpretar Aroon?

O Aroon é excepcionalmente simples de interpretar. Os traders entendem o instrumento como qualquer outro indicador oscilador:

- Quanto mais próximo de 100, mais forte é a tendência atual;

- Quanto mais próximo de 0, mais fraca é a tendência atual;

- Quando o indicador está próximo de 50, ocorre a consolidação.

Ao interpretar o indicador, é importante ficar de olho em ambas as linhas:

- Quando a linha Aroon Up é maior que 50 e vai até 100, e a linha Aroon Down é menor que 50, a tendência de baixa domina o mercado.

- Quando a linha Aroon Down é maior que 50 e vai até 100, e a linha Aroon Up é menor que 50, a tendência de alta domina o mercado.

Por que o Aroon é útil?

O indicador ajuda os traders a identificar quais tendências dominam o mercado e sua força. Os traders usam os cruzamentos e divergências das linhas de Aroon como sinais para abrir posições. O instrumento pode ser usado como indicador básico ou combinado com outros indicadores de tecnologia.

Williams Alligator

O Alligator está entre os indicadores mais utilizados, introduzidos pelo trader e analista mundialmente conhecido, Bill Williams. O instrumento fornece aos traders sinais para a abertura e o fechamento de suas posições. O Alligator está entre as melhores soluções para iniciantes, pois funciona como um sistema de negociação independente.

Como funciona o Williams Alligator?

Alligator é um indicador tecnológico baseado em três Médias Móveis. Em termos de configurações padrão, as Médias Móveis têm os seguintes comprimentos: 13, 8 e 5. Além disso, o offset é ativado para cada Média Móvel: 8, 5 e 3, respectivamente.

As três Médias Móveis que formam o indicador são chamadas

- Mandíbula (MA 13);

- Dentes (MA 8);

- Lábios (MA 5).

Os traders podem ativar outras configurações, mas é importante manter a proporção entre o comprimento e o deslocamento das Médias Móveis; caso contrário, o instrumento gerará sinais falsos.

You may also like

Como interpretar o Williams Alligator?

Segundo o próprio Bill Williams, os dentes (MM 8) são a parte mais importante do jacaré; por isso, os traders precisam prestar mais atenção a essa linha. Deve-se abrir uma posição nos seguintes casos:

- A linha dos Lábios cruza a linha dos Dentes de cima para baixo. Os traders abrem posições compradas.

- A linha dos Lábios cruza a linha dos Dentes de baixo para cima. Os traders abrem posições vendidas.

Por que o Williams Alligator é útil?

Em primeiro lugar, este indicador pode ser usado como um sistema de negociação independente. O Williams Alligator é igualmente eficaz em diferentes mercados e períodos. Bill Williams utilizou o instrumento em seu sistema de negociação Profitunity.

Canal Keltner

O Canal de Keltner é um indicador tecnológico baseado na volatilidade de um ativo. Por um lado, o instrumento ajuda os traders a identificar a tendência atual do mercado. Por outro, o instrumento constrói um canal dentro do qual o preço de um ativo se moverá. Este indicador foi introduzido por Charles Keltner, um comerciante de grãos americano, na década de 1960.

Como funciona o canal de Keltner?

O Canal Keltner é composto por três linhas:

- A linha do meio é representada pela Média Móvel Exponencial (MME) com comprimento 20 (configurações padrão).

- As bordas superior e inferior do canal são construídas com a ajuda do ATR (Average True Range) multiplicado por 2.

Ao ativar o instrumento, os traders podem alterar as seguintes configurações: Comprimento da EMA, Comprimento do ATR, Multiplicador de ATR.

Como interpretar o canal de Keltner?

Os comerciantes obtêm as seguintes informações do indicador:

- Quando o preço de um ativo atinge a borda superior do canal, a tendência de alta domina o mercado.

- Quando o preço de um ativo atinge a borda inferior do canal, a tendência de baixa domina o mercado.

- A direção do Canal de Keltner mostra a direção da tendência atual.

- O preço de um ativo pode se mover dentro do canal. Nesse caso, as bordas inferior e superior do canal são entendidas como níveis de suporte e resistência.

Por que o Canal Keltner é útil?

O Canal de Keltner pode ser usado para identificar a tendência atual do mercado e sua direção. O instrumento também é eficaz para prever reversões de tendência em andamento. Ao mesmo tempo, os traders podem abrir e fechar posições usando as bordas do Canal de Keltner como níveis de suporte e resistência.

Volume em equilíbrio

O On Balance Volume está entre os primeiros instrumentos VSA (Análise de Spread de Volume). O indicador OBV surgiu em 1963, inventado por Joe Granville. Inicialmente, o instrumento foi utilizado no mercado de ações e, posteriormente, transferido para outros mercados financeiros.

Como funciona o On Balance Volume

O Volume de Balanço mostra a interdependência entre as variações de preço e os volumes correspondentes. O indicador está localizado abaixo do gráfico principal, na janela independente. A linha mostra quantas ações, unidades, lotes, etc., são negociados em um determinado período. O instrumento fornece aos traders as seguintes informações:

- O OBV mostra a proporção entre mudanças de preço e mudanças no volume de negociação e permite que os traders prevejam impulsos de preço.

- O instrumento mostra a situação do mercado e o comportamento dos principais players.

You may also like

Como interpretar o volume em equilíbrio?

Existem várias situações de mercado possíveis que podem ser identificadas por um trader:

- Confirmação de tendência. O indicador sobe junto com o crescimento do preço ou cai junto com o preço. A tendência atual se manterá por mais tempo.

- Divergência. A linha OBV está subindo quando o preço de um ativo cai, ou vice-versa. Essa situação é um indicador de reversão de tendência em andamento.

- Crescimento explosivo dos volumes de negociação. Quando um trader observa um movimento acentuado do indicador OBV, é altamente previsível que o preço de um ativo suba/desça rapidamente na mesma direção.

- Cruzamento da Média Móvel. Quando a linha do OBV é cruzada por sua Média Móvel, os traders devem abrir posições compradas (cruzamento de baixo para cima) ou vendidas (de cima para baixo).

Por que o On Balance Volume é útil?

O On Balance Volume não pode ser usado como uma estratégia de negociação independente, mas o indicador é um instrumento excepcionalmente útil para a confirmação de tendências. O OBV pode ser aplicado a todos os mercados financeiros e períodos gráficos.

Conclusão

À medida que nos aproximamos de 2024, o cenário do trading técnico continua a evoluir, trazendo desafios e oportunidades. Os dez indicadores discutidos neste artigo oferecem insights e estratégias únicas para navegar pelos mercados. Quando utilizadas de forma eficaz, essas ferramentas podem proporcionar aos traders uma compreensão mais profunda das tendências de mercado, do momentum e dos potenciais pontos de entrada e saída. Da avaliação da volatilidade do mercado com o ATR à identificação de reversões de tendência com o Parabolic SAR, cada indicador adiciona uma camada de sofisticação à análise do trader. À medida que os mercados financeiros se tornam cada vez mais complexos, a importância desses indicadores técnicos na formulação de estratégias de trading abrangentes não pode ser exagerada.

Isenção de responsabilidade

Este artigo destina-se apenas a fins informativos e não deve ser considerado aconselhamento financeiro. O uso de indicadores técnicos envolve riscos e está sujeito à interpretação individual. Os traders devem conduzir suas próprias pesquisas e consultar consultores financeiros antes de tomar decisões de investimento. A eficácia desses indicadores pode variar de acordo com as condições de mercado e as estratégias de negociação individuais, e o desempenho passado não é indicativo de resultados futuros.

Atualizado:

13 de janeiro de 2025