10 популярных классов торговых активов в 2024 году

В статье

В начале 2024 года финансовые рынки продолжают развиваться, создавая для трейдеров как вызовы, так и возможности. В этой динамичной ситуации выбор правильных торговых инструментов важен как никогда. Эти инструменты, от цифровых активов до традиционных акций, предлагают разнообразные способы извлечения выгоды из рыночных тенденций и достижения инвестиционных целей. В этой статье рассматриваются десять самых популярных классов торговых активов, которые ожидают значительных изменений в 2024 году, и предлагается дорожная карта для трейдеров, помогающая им ориентироваться в этой постоянно меняющейся финансовой сфере.

Список 10 лучших классов активов на 2024 год

- Криптовалюты

- Биржевые инвестиционные фонды (ETF)

- Фонды акций роста

- Валютные пары

- Фонды акций с большой капитализацией

- Товары

- Инвестиционные фонды недвижимости (REIT)

- Акции зеленой энергетики

- Государственные облигации

- Акции развивающихся рынков

Давайте подробнее рассмотрим каждый класс активов, а также рассмотрим некоторые перспективные кандидаты в каждом классе.

Криптовалюты

Криптовалюты превратились из нишевого интереса в популярный торговый инструмент. Цифровые валюты, такие как биткоин, эфириум и различные альткоины, теперь играют важную роль в финансовом секторе, выходя далеко за рамки просто спекулятивных активов.

Этот сдвиг обусловлен растущей привлекательностью децентрализованные финансы (DeFi), использование цифровых активов для хеджирования рыночной волатильности и более широкая интеграция технологии блокчейн в различные секторы экономики. Однако присущая криптовалютам волатильность остаётся определяющей чертой, создавая как риски, так и возможности для высокой доходности.

Для эффективной торговли криптовалютами в 2024 году диверсификация имеет решающее значение. Трейдерам следует сбалансировать свои портфели, используя сочетание известных и новых криптовалют. Также крайне важно быть в курсе изменений в законодательстве и использовать передовые торговые инструменты. Кроме того, для успеха в этой динамичной и быстро развивающейся сфере необходимо быть в курсе последних разработок в области блокчейна и рыночных тенденций.

Восходящие звезды на рынке криптовалют 2024 года

Биткойн

По мере развития криптовалютного ландшафта в преддверии 2024 года некоторые цифровые валюты привлекают внимание своими уникальными особенностями и потенциалом роста. Биткоин (BTC), известный как «цифровое золото», продолжает лидировать, демонстрируя высокие результаты в 2023 году и растущее институциональное признание. Его ограниченное предложение, статус средства сбережения и огромный ажиотаж вокруг биткоин-ETF указывают на важную роль в росте популярности криптовалют в предстоящем году.

Солана

Solana (SOL) занимает свою нишу благодаря молниеносной скорости транзакций и низким комиссиям, что делает ее привлекательной в растущих сферах DeFi и NFT-ы . Эта техническая эффективность делает Solana сильным претендентом на ожидаемый подъем рынка.

Алгоранд

Algorand (ALGO) выделяется своим экологичным подходом, сочетающим быстрые транзакции с низким энергопотреблением. Благодаря стратегическим партнёрствам и приложениям в сфере финансов и блокчейн-инфраструктуры, Algorand готов к значительному росту, особенно среди инвесторов, заботящихся об окружающей среде.

Биржевые инвестиционные фонды (ETF)

Биржевые инвестиционные фонды (ETF) становятся всё более популярным выбором для трейдеров, известных своей универсальностью и возможностью использования в самых разных инвестиционных стратегиях. Привлекательность ETF заключается в их уникальном сочетании разнообразия, адаптивности и простоты доступа на изменчивых финансовых рынках.

ETF преобразили подходы к инвестированию, предлагая доступ к различным секторам: от постоянно развивающейся технологической индустрии до стабильных и устоявшихся экономических сегментов. Это делает их подходящими для различных инвестиционных целей, будь то доступ к быстрорастущим технологическим секторам или поиск стабильности в более широких рыночных индексах.

Их отличительной особенностью является адаптивность, позволяющая им подходить к различным инвестиционным стилям: от консервативных долгосрочных стратегий роста до более агрессивных краткосрочных подходов. Широкий спектр ETF, охватывающий конкретные отрасли, сырьевые товары, облигации и международные рынки, позволяет инвесторам адаптировать свои портфели к своей индивидуальной готовности к риску и инвестиционным целям.

Для многих ETF представляют собой идеальный баланс между потенциалом роста отдельных акций и характерной для паевых инвестиционных фондов диверсификацией рисков. Этот баланс особенно ценен на рынке, готовом к росту в одних областях и одновременно сталкивающимся с потенциальной волатильностью в других.

You may also like

Ключевые ETF, за которыми стоит следить в 2024 году

Портфель SPDR S&P 500 ETF

ETF SPDR Portfolio S&P 500 (SPLG) остаётся популярным выбором, особенно для тех, кто стремится использовать потенциал стабильности и роста индекса S&P 500. Благодаря доступному коэффициенту издержек и истории высоких показателей, SPLG предлагает эффективный способ получить доступ к акциям некоторых крупнейших американских компаний. Сочетание умеренной дивидендной доходности и стабильной исторической доходности делает его сбалансированным вариантом для инвесторов, ориентированных на рост и доход.

ETF Invesco S&P 500 с равным весом

Диверсифицируя типичный подход к индексу S&P 500, ETF Invesco S&P 500 Equal Weight ETF (RSP) равномерно распределяет свои активы по различным компаниям, усиливая диверсификацию. Такая стратегия равномерного распределения может привести к более сбалансированному участию на рынке и потенциально повысить доходность за счет увеличения доли небольших, растущих компаний. RSP выделяется своим уникальным подходом к балансировке портфеля в сочетании с разумным коэффициентом расходов, что делает его привлекательным вариантом для тех, кто ищет диверсифицированный инвестиционный спред в рамках индекса S&P 500.

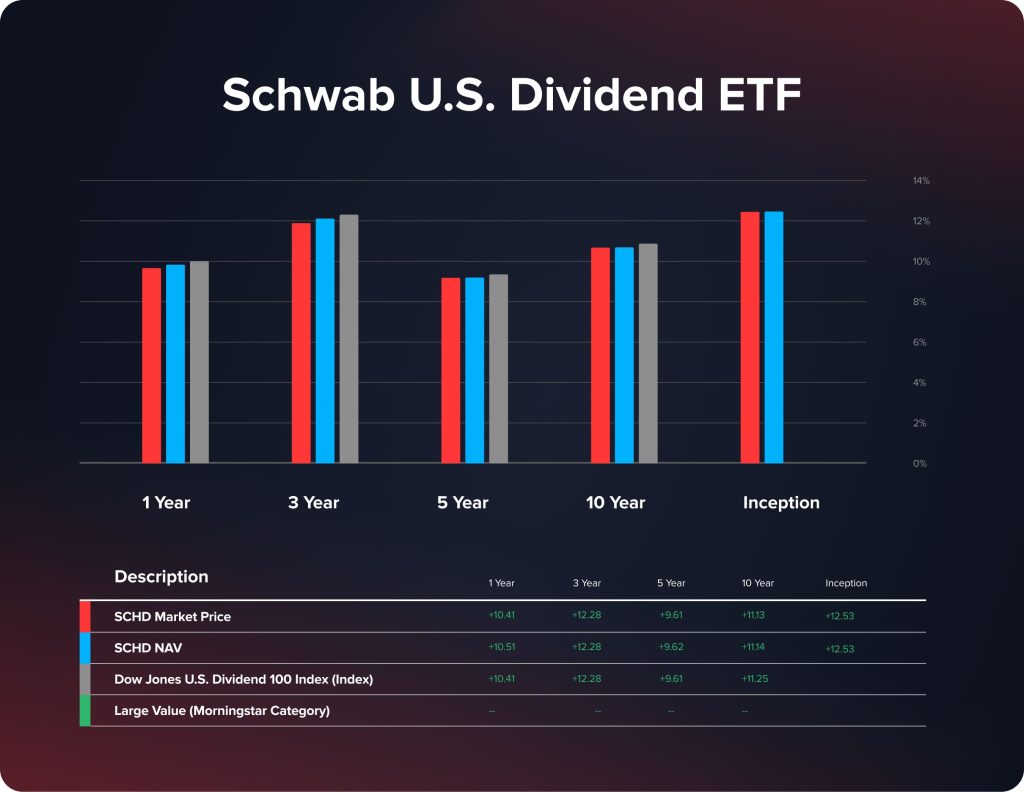

Schwab US Dividend ETF

Для инвесторов, ориентированных на дивиденды, фонд Schwab US Dividend ETF (SCHD) ориентирован на акции «голубых фишек», известных своими надежными дивидендами. Подход этого ETF к инвестированию в финансово стабильные компании с историей выплаты дивидендов обеспечивает привлекательную доходность. SCHD сочетает в себе потенциал роста стоимости со стабильным доходом, что делает его привлекательным выбором для инвесторов, стремящихся к одновременному росту и получению дохода.

Фонды акций роста

Фонды акций роста привлекают значительный интерес в преддверии 2024 года, особенно в секторах, готовых к быстрому росту. Ориентируясь на компании с высоким потенциалом роста, эти фонды стремятся использовать динамизм таких отраслей, как технологии и здравоохранение.

Потенциал роста в сфере технологий и здравоохранения

Эти фонды инвестируют в компании, находящиеся на переднем крае инноваций, часто реинвестируя прибыль для стимулирования дальнейшего роста. Эта стратегия особенно эффективна в технологическом секторе, где драйверами роста являются разработки в области искусственного интеллекта, облачных вычислений и кибербезопасности. Для инвесторов это означает возможность получения значительной прибыли по мере того, как эти технологии продолжают интегрироваться в различные аспекты жизни и бизнеса.

Сектор здравоохранения также предлагает прибыльные возможности, обусловленные достижениями в области биотехнологий, фармацевтики и медицинских технологий. Переход к персонализированной медицине и телемедицине, ускоренный глобальной ситуацией в здравоохранении, делает сектор здравоохранения ещё одной привлекательной сферой для инвесторов, ориентированных на рост.

Хотя потенциал высокой доходности является существенным преимуществом фондов акций роста, они по своей природе несут в себе больше риска. Эта волатильность обусловлена высокой оценкой компаний, делающих ставку на будущий рост, что делает эти фонды более подходящими для инвесторов с более высокой толерантностью к риску.

Стратегический подход для трейдеров может заключаться в включении фондов акций роста в диверсифицированный портфель. Баланс этих быстрорастущих инвестиций с более стабильными, приносящими доход активами может обеспечить доступ к потенциальному росту этих динамичных секторов, одновременно управляя общим риском.

Акции роста, за которыми стоит следить в 2024 году

В преддверии 2024 года несколько акций роста заслуживают особого внимания благодаря своему потенциалу и недавним результатам, привлекая внимание инвесторов.

Снежинка

Снежинка Компания выделяется на рынке облачных данных впечатляющими результатами в 2023 году. Ключ к её привлекательности — способность обрабатывать огромные объёмы данных и привлекать ценных клиентов, в том числе тех, кто вносит более 1 миллиона долларов в год. Инновационный подход компании к управлению неструктурированными данными и новые функции, такие как динамические таблицы, делают её перспективным объектом инвестиций в 2024 году.

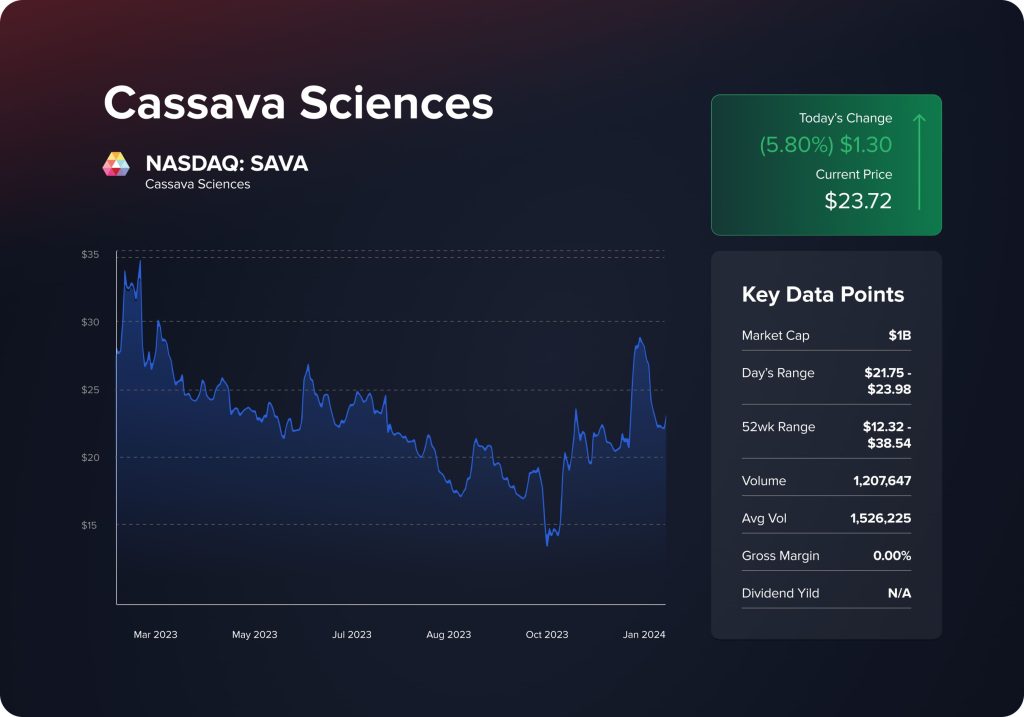

Науки о маниоке

Науки о маниоке Компания, специализирующаяся на лечении болезни Альцгеймера, представляет собой высокорискованный, но потенциально высокодоходный сценарий. Учитывая многообещающие первоначальные результаты испытаний препарата для лечения болезни Альцгеймера и существенную финансовую поддержку, её акции заслуживают внимания. Однако инвесторам следует проявлять осторожность, учитывая сложности и исторические трудности в разработке лекарств от болезни Альцгеймера.

Salesforce

Salesforce Продолжая успешно развиваться на рынке корпоративного программного обеспечения, стабильно превосходя финансовые ожидания. Широкая линейка продуктов, эффективные стратегии интеграции и достижения в области технологий искусственного интеллекта способствуют росту компании. Благодаря обширной клиентской базе и инновационному подходу Salesforce позиционируется как компания с устойчивым потенциалом роста к 2024 году.

Эти акции, каждая из которых относится к определённому сектору, дают представление о разнообразных возможностях фондов акций роста. При рассмотрении этих вариантов инвесторами баланс между потенциальной доходностью и присущими рисками будет иметь ключевое значение для ориентации на рынке акций роста в 2024 году.

Валютные пары

Рынок Форекс остается ключевой ареной для трейдеров, предоставляя множество возможностей посредством основных и развивающихся валютных пар.

Торговля валютными парами Форекс предполагает умение ориентироваться в сложном взаимодействии мировых экономик. Гибкость этого рынка определяется различными факторами: от политики центральных банков и экономических показателей до политической стабильности и глобальных событий. Таким образом, торговля на Форексе заключается в прогнозировании движения валютных курсов и понимании более широкого экономического контекста, определяющего эти движения.

Успех на рынке Форекс зависит не только от знаний, но и от стратегии. Трейдерам необходимо тонко чувствовать рыночные настроения, используя экономические данные и новости для принятия обоснованных решений. Кроме того, управление рисками является важнейшим компонентом торговли на Форекс. Учитывая присущую рынку волатильность, трейдерам необходимо использовать эффективные методы управления рисками, такие как установка стоп-лосс ордеров и диверсификация валютных активов, чтобы защитить свои инвестиции.

Лучшие валютные пары для наблюдения в 2024 году

Некоторые пары Форекс выделяются своим потенциалом и уникальными характеристиками, предлагая разнообразные возможности для трейдеров на рынке Форекс.

евро/доллар США

Пара EUR/USD по праву считается одной из самых популярных валютных пар, и не без оснований. Известная самым низким спредом среди многих форекс-брокеров, она привлекает трейдеров, ищущих стабильность и простой технический анализ. Относительно низкая волатильность делает её идеальным вариантом для трейдеров, предпочитающих минимизировать риски. Популярность пары EUR/USD также означает, что в интернете доступно множество аналитических материалов и данных, что помогает трейдерам принимать обоснованные решения и избегать распространённых торговых ошибок.

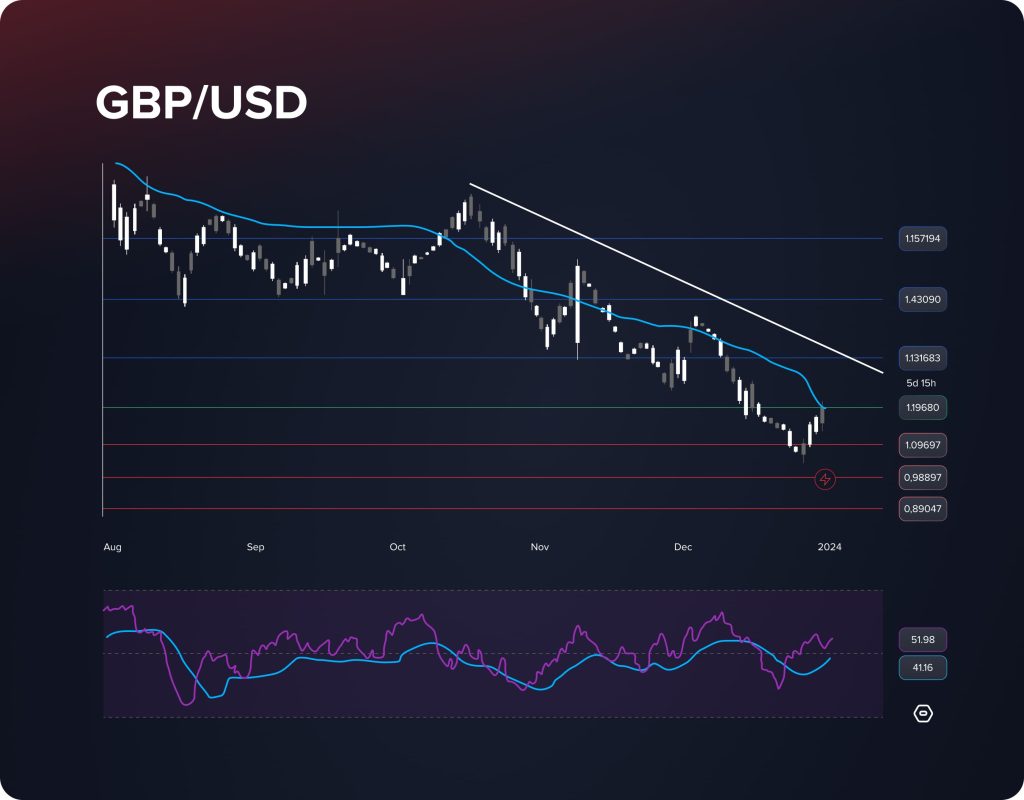

Фунты стерлингов/доллары США

Пара GBP/USD известна своим потенциалом прибыльных пипсов и значительными ценовыми колебаниями, что способствует её популярности среди форекс-трейдеров. Однако важно отметить, что более высокий потенциал прибыли сопряжен с повышенным риском. Эта пара относится к более волатильной категории валютной торговли. Несмотря на это, многие трейдеры отдают предпочтение GBP/USD благодаря обширной информации для анализа рынка, доступной в интернете, которая предоставляет ценную информацию для разработки торговых стратегий.

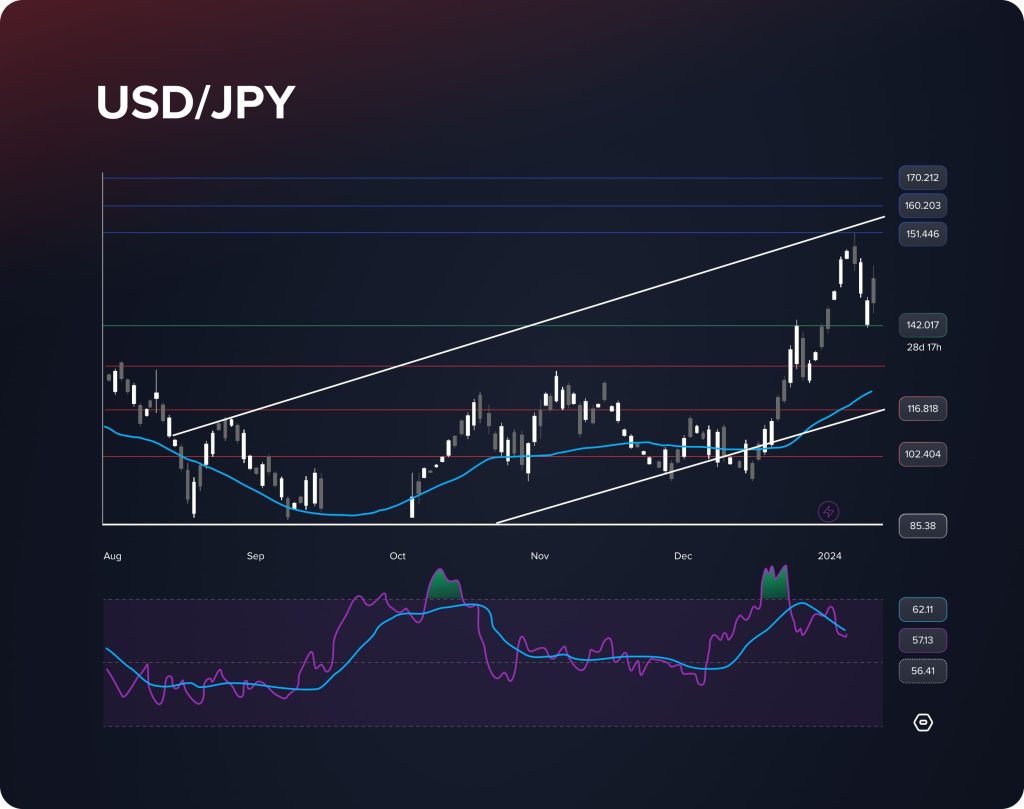

доллар США/иена

USD/JPY — ещё одна часто торгуемая пара на рынке Форекс. Она известна своими низкими спредами и более плавным движением по сравнению с другими валютными парами, что делает её предпочтительным выбором для трейдеров, ищущих предсказуемые движения. USD/JPY также предлагает захватывающие возможности для прибыльной торговли благодаря своим чётким трендовым моделям и рыночным тенденциям.

Фонды акций с большой капитализацией

Фонды акций компаний с высокой капитализацией остаются основным выбором для трейдеров, стремящихся к надежности и устойчивому росту. Инвестируя преимущественно в хорошо зарекомендовавшие себя компании с прочными рыночными позициями, эти фонды известны своей стабильной доходностью и устойчивостью даже в условиях нестабильных рыночных условий.

Фонды акций компаний с высокой капитализацией ориентированы на компании, которые часто являются лидерами отрасли и имеют историю стабильных финансовых показателей. Эти компании, как правило, менее волатильны, чем их более мелкие аналоги, что даёт инвесторам чувство безопасности. Эта стабильность особенно привлекательна для трейдеров, стремящихся к долгосрочному росту без резких колебаний, часто связанных с более волатильными инвестициями.

В непредсказуемой экономической ситуации 2024 года фонды акций компаний с высокой капитализацией представляют собой разумный выбор для тех, кто ценит стабильный, постепенный рост, а не высокорискованные, но высокодоходные инвестиционные стратегии. Их способность выдерживать рыночные штормы и обеспечивать стабильную доходность делает их краеугольным камнем любого хорошо диверсифицированного портфеля.

Фонды акций компаний с большой капитализацией: лучшие варианты на 2024 год

Berkshire Hathaway (BRK-A, BRK-B)

Несмотря на недавнее понижение рейтинга с «покупать» до «удерживать» инвестиционной компанией Edward Jones, Беркшир Хэтэуэй remains a stock to watch. The firm's cautious stance is based on Berkshire's significant outperformance compared to its financial sector peers, with BRK-B shares up 11% this year. However, betting against Warren Buffett's long track record of success might be premature. Беркшир Хэтэуэй's recent earnings remain strong, and the company sits on a significant cash reserve of $150 billion. Over the last 12 months, Berkshire’s Class B stock has gained 24%, outperforming the S&P 500's 12% gain in the same period.

CrowdStrike Holdings (CRWD)

CrowdStrike Holdings Компания пережила впечатляющий рост, воспользовавшись общим ростом акций технологических компаний. Финансовые показатели компании впечатляют: прибыль и выручка во втором квартале превзошли ожидания, а свободный денежный поток значительно увеличился по сравнению с предыдущим годом. Благодаря повышенному прогнозу, рост акций CRWD на 58% в этом году и 155% за пять лет делают её привлекательной акцией среди компаний с высокой капитализацией в технологическом секторе.

PepsiCo (PEP)

Несмотря на недавний откат рынка, ПепсиКо stands out as a resilient large-cap stock. While its stock has declined alongside broader market trends, the company continues to deliver strong earnings reports and has consistently raised its full-year guidance. ПепсиКо's defensive nature makes it an attractive option, especially if economic contraction occurs in 2024. Trading at 28 times future earnings and offering a substantial dividend yield, ПепсиКо is an affordable and stable investment with a five-year increase of 52%.

Товары

В 2024 году такие товары, как золото и нефть, сохранят свой статус основополагающих элементов торговли. Эти активы особенно ценны благодаря своей роли хеджирования от инфляции и экономических спадов, что особенно важно в периоды финансовой нестабильности.

Такие товары, как золото, долгое время считались безопасными убежищами в условиях нестабильного рынка. Их внутренняя стоимость часто обратно пропорциональна фондовому рынку, обеспечивая буфер в период экономической нестабильности. Например, золото ценится не только за свою традиционную стоимость, но и за способность поддерживать покупательную способность в условиях роста инфляции.

Нефть, ещё один ключевой товар, играет ключевую роль благодаря своему непосредственному влиянию на мировую экономику. Её цены формируются под влиянием сложного взаимодействия спроса и предложения, геополитической стабильности и технологического прогресса в энергетике. Торговля нефтью требует глубокого понимания этих факторов и их потенциального влияния на цены.

Успешная торговля сырьевыми товарами требует не только базового понимания этих активов. Она требует глубокого понимания мировых экономических тенденций, анализа рыночных циклов и способности прогнозировать потенциальные изменения спроса и предложения. Трейдеры должны быть в курсе геополитических событий, изменений в политике и технологических разработок, которые могут повлиять на сырьевые рынки.

You may also like

Товары для торговли в 2024 году

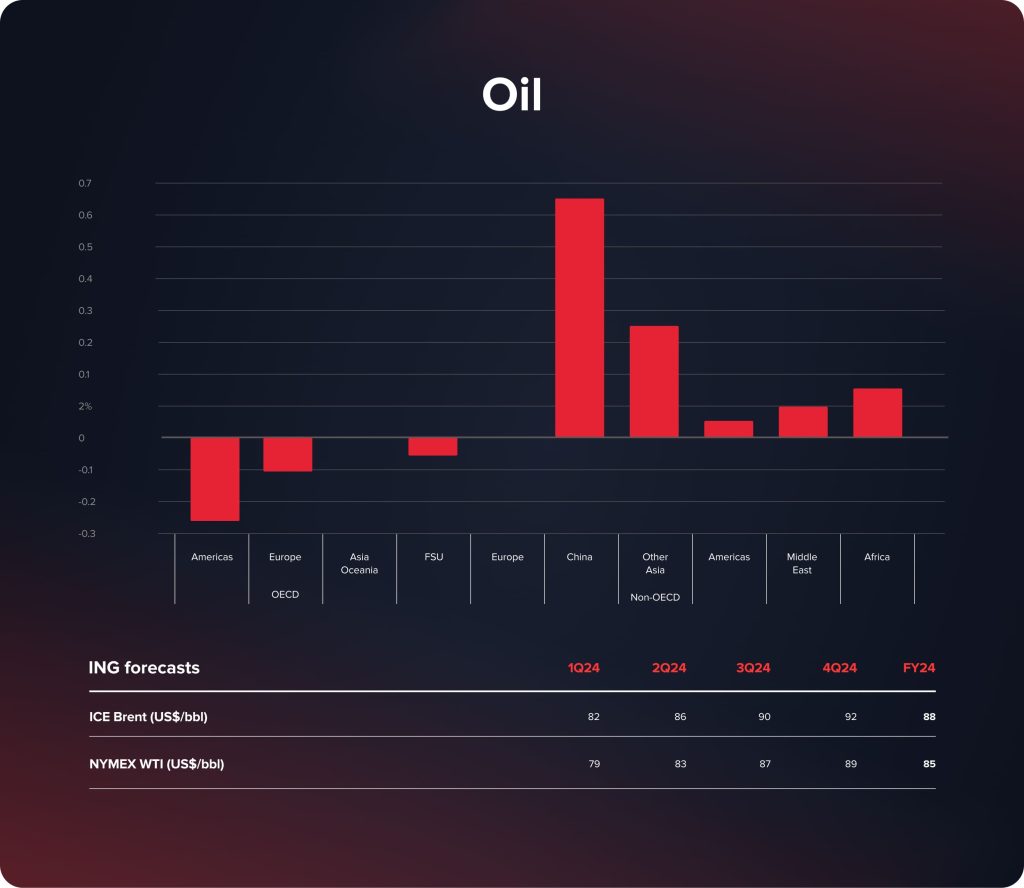

Масло

В 2024 году нефть останется ключевым сырьевым товаром, на который существенное влияние окажут политика ОПЕК+ и геополитическая напряженность. Ожидается, что рынок сначала стабилизируется, но потенциальный дефицит в конце года может привести к росту цен. В частности, действия крупных игроков, таких как Саудовская Аравия, и геополитические изменения, такие как напряженность на Ближнем Востоке и отношения между США и Ираном, могут существенно повлиять на предложение и цены, что делает нефть товаром, требующим пристального внимания.

Золото

Золото ожидает значительного роста в 2024 году благодаря таким макроэкономическим факторам, как ожидаемое снижение ставки ФРС и ослабление доллара США, что повышает его инвестиционную привлекательность. Когда 7 октября разразилась война между Израилем и ХАМАС, цена на золото почти достигла своего предыдущего максимума в 2075 долларов за унцию, установленного в 2020 году. Высокий интерес центральных банков к покупке золота дополнительно укрепляет оптимистичные прогнозы, позиционируя золото как выгодный актив в условиях экономической неопределенности и традиционный инструмент хеджирования инфляции.

Зерна

На рынке зерна наблюдается неоднозначная картина: в то время как цены на кукурузу и сою могут столкнуться с понижением из-за перепроизводства, пшеница становится наиболее заметным зерном. Сокращение мировых запасов, обусловленное экологическими и геополитическими факторами, подтолкнет цены на пшеницу вверх, сделав её заметным зерновым товаром в рыночном ландшафте 2024 года.

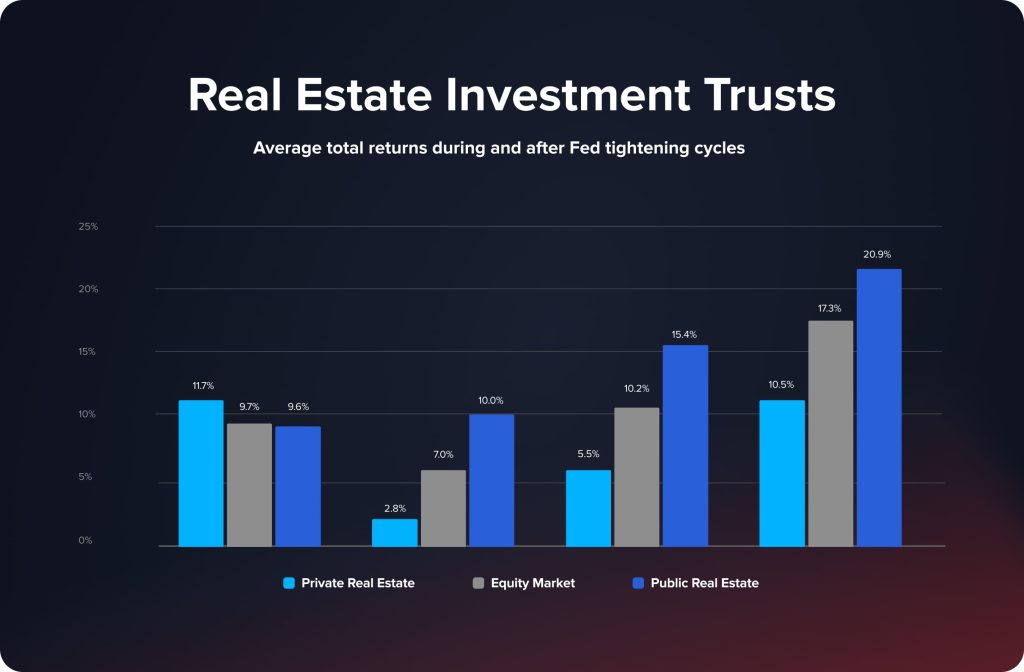

Инвестиционные трасты недвижимости

Инвестиционные фонды недвижимости (REIT) становятся важным инструментом для инвесторов, стремящихся к стабильности в сочетании с потенциальным ростом. REIT предлагают уникальную возможность косвенно инвестировать в рынки недвижимости, обеспечивая доступ к различным секторам недвижимости без сложностей, связанных с прямым владением недвижимостью.

Ключевые особенности REIT на рынке

Фонды недвижимости (REIT) инвестируют преимущественно в коммерческую недвижимость, включая офисные здания, торговые центры, апартаменты и отели. Привлекательность REIT заключается в их структуре, которая предполагает распределение большей части налогооблагаемого дохода акционерам в виде дивидендов, что часто приводит к более высокой доходности по сравнению с другими акциями. Эта особенность делает их особенно привлекательными для инвесторов, стремящихся к получению дохода.

Одно из основных преимуществ REIT — их роль в диверсификации портфеля. В отличие от традиционных акций и облигаций, рынок недвижимости, лежащий в основе REIT, часто следует различным экономическим циклам. Эта особенность предоставляет инвесторам защиту от волатильности в более традиционных классах активов, тем самым повышая общую стабильность их инвестиционного портфеля.

Ещё одним ключевым аспектом REIT является их ликвидность. Поскольку акции REIT торгуются на крупных фондовых биржах, они обеспечивают уровень ликвидности, обычно не характерный для прямых инвестиций в недвижимость. Эта простота торговли позволяет инвесторам покупать и продавать акции так же просто и быстро, как и другие публично торгуемые акции, что добавляет гибкости их инвестиционной стратегии.

Кроме того, фонды недвижимости (REIT) демократизируют доступ к инвестициям в недвижимость. Они открывают доступ к рынку недвижимости более широкому кругу инвесторов, устраняя необходимость в значительном капитале, обычно необходимом для прямой покупки недвижимости. Такая доступность облегчает частным лицам выход на зачастую прибыльный рынок недвижимости без значительных первоначальных вложений.

Профессиональное управление инвестиционными фондами недвижимости (REIT) добавляет удобства и опыта. Этими фондами управляют опытные специалисты, которые контролируют все аспекты управления недвижимостью, от приобретения и обслуживания до улучшения. Такое управление снижает нагрузку и сложность для индивидуальных инвесторов, которых в противном случае могли бы отпугнуть операционные требования, связанные с инвестициями в недвижимость.

Ключевые инвестиционные фонды недвижимости, которые стоит рассмотреть в 2024 году

Prologis Inc. (PLD)

Специализируясь на логистической недвижимости, Прологис stands out for its valuable land portfolio and strong demand for its strategically located logistics centers. Despite the e-commerce growth concerns, the need for industrial space remains high. Analysts predict a solid revenue growth for Прологис in 2024, making it a promising pick in the REIT sector.

Американская башня Корпорация (AMT)

Управляя крупнейшим в мире независимым портфелем беспроводных коммуникационных и вещательных вышек, Американская башня Имеет хорошие перспективы для роста. Ключевые факторы развития AMT включают распространение 5G и потенциал на международных рынках, где уровень проникновения передовых телекоммуникационных услуг пока низок. AMT рассматривается как надёжная инвестиция, особенно если экономика сохранит свой высокий уровень.

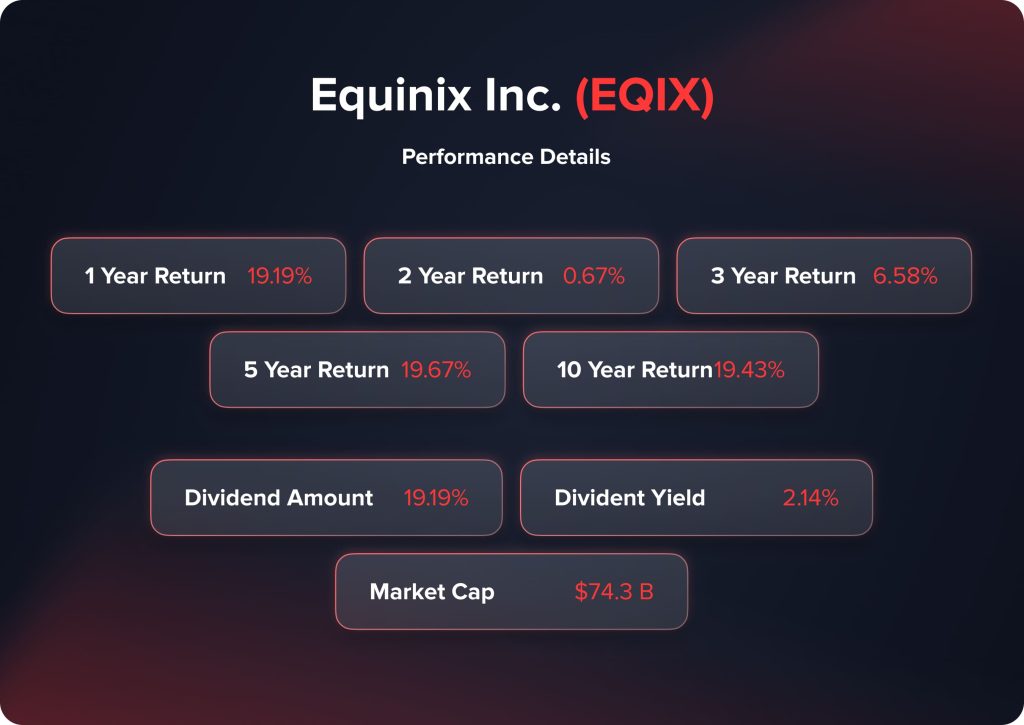

Equinix Inc. (EQIX)

Будучи крупнейшим в мире оператором центров обработки данных, Равноденствие enjoys a unique position with limited competition. The company's focus on site expansions and a stable revenue base makes it attractive to investors. Its status as a preferred partner for top tech companies and projected revenue growth positions Равноденствие as a top REIT for 2024.

Акции зеленой энергетики

Акции компаний, занимающихся зелёной энергетикой, представляют собой не просто мимолётную тенденцию; они находятся на переднем крае значительного перехода к устойчивому инвестированию. Глобальный тренд на возобновляемые источники энергии позиционирует эти акции не только как этичный инвестиционный выбор, но и как инструменты потенциально значительной доходности.

Привлекательность акций компаний, занимающихся зелёной энергетикой, обусловлена их ролью в продвижении более устойчивого и экологически сознательного будущего. Инвестиции в этот сектор согласуются с глобальными усилиями по сокращению выбросов углерода и переходу на возобновляемые источники энергии, что делает их ответственным и потенциально прибыльным начинанием. Правительства и корпорации по всему миру всё чаще поддерживают зелёные инициативы, что благоприятно сказывается на росте и развитии компаний в этой сфере.

Однако сектор зеленой энергетики имеет свои особенности. Рынок может быть нестабильным и на него влияют различные факторы, включая изменения в политике, технологический прогресс и изменение потребительского поведения. Кроме того, многие компании в секторе зеленой энергетики находятся на ранних стадиях развития. Эта стадия развития многих компаний подразумевает более высокие риски, но также и возможность получения более высокой прибыли для инвесторов, которые рано вкладывают средства в перспективные проекты.

Акции компаний, занимающихся зеленой энергетикой, за которыми стоит следить в 2024 году

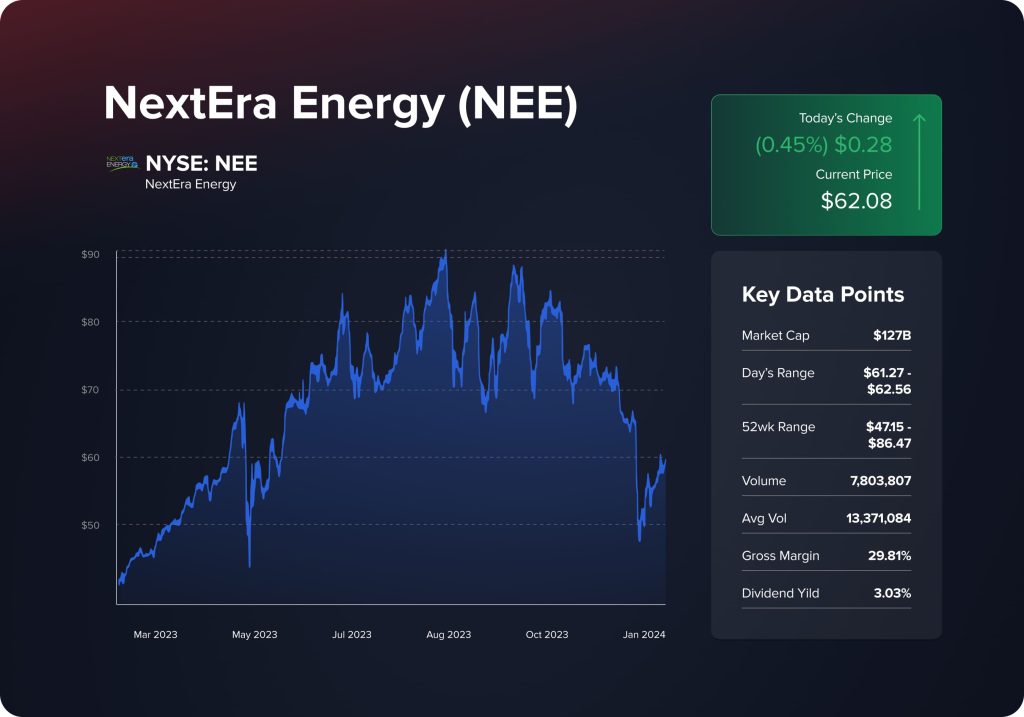

NextEra Energy (NEE)

NextEra Energy Компания выделяется как уникальный гибрид в секторе зеленой энергетики, сочетающий в себе стабильность коммунальной компании с потенциалом роста компании солнечной и ветровой энергетики. Несмотря на колебания доходности облигаций, влияющие на акции коммунальных компаний, NextEra Energy остается привлекательным вариантом, отчасти благодаря стабильной дивидендной доходности, превышающей 3%. Компания стабильно демонстрирует прибыль, превышающую консенсус-прогноз, предлагая стабильный источник дохода и потенциал роста. Благодаря восстановлению интереса к акциям компаний зеленой энергетики и стабильной доходности NextEra, она позиционируется как надежный выбор для инвесторов в 2024 году.

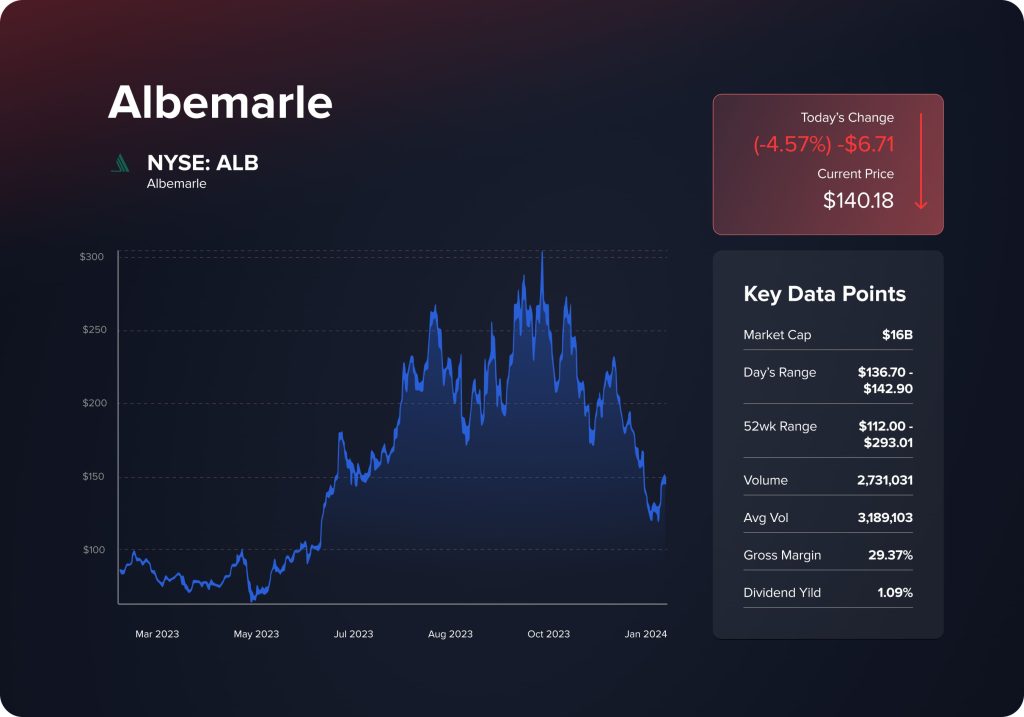

Альбемарл (ALB)

Альбемарл faces a contrarian scenario as the world’s largest lithium producer. Despite a recent collapse in lithium carbonate prices and challenges in the EV sector, there are reasons for optimism. Analysts point to a projected shortfall in lithium production for net-zero goals by 2050, indicating long-term demand. With its shares trading below consensus target prices and recent upward trends, Альбемарл could benefit from potential rate cuts in 2024, making it a stock to consider for those betting on the future of lithium and EVs.

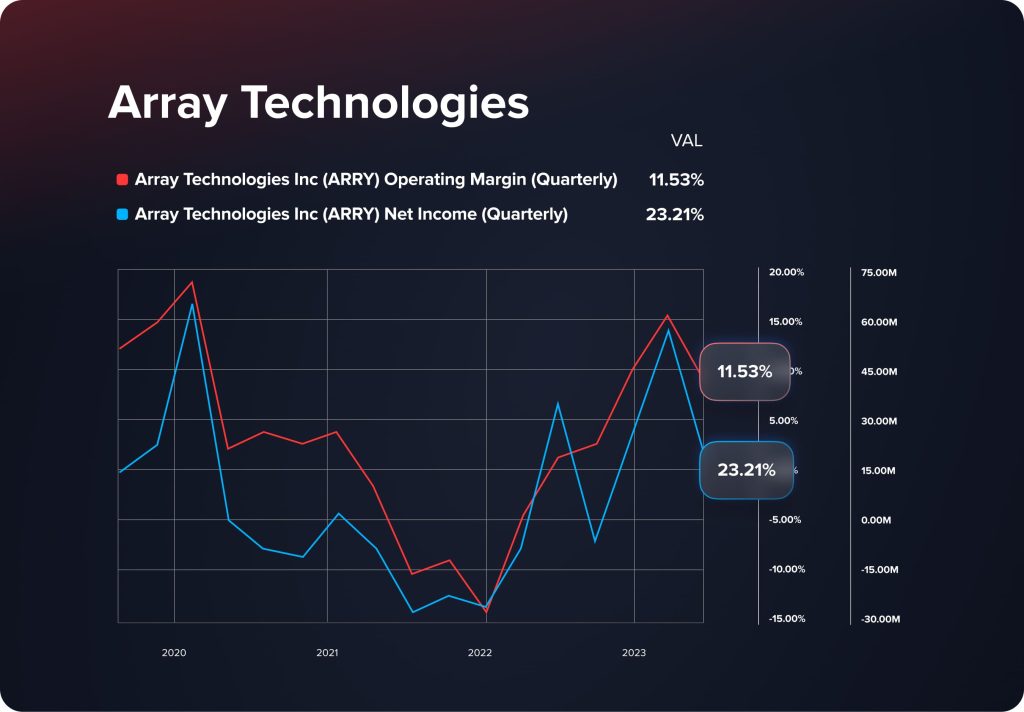

Массивные технологии (ARRY)

Массивные технологии is a noteworthy player in the solar industry, specializing in ground mounting systems for solar panels. The company has demonstrated strong fundamentals, with a notable increase in gross profit despite a revenue dip. Its shift from an operational loss to a gain within a year highlights its robust business model. With expectations of lower interest rates in 2024, Массивные технологии could see reduced financial burdens and improved profitability, making ARRY an attractive option for investors eyeing the solar sector.

Государственные облигации

Государственные облигации продолжают оставаться краеугольным камнем для трейдеров, не склонных к риску. Известные своей стабильностью и фиксированной доходностью, эти облигации представляют собой тихую гавань, особенно ценную в условиях сохраняющейся рыночной неопределенности. Они служат балансирующим элементом для портфелей, содержащих высокорисковые инвестиции.

Привлекательность государственных облигаций заключается в их относительной безопасности по сравнению с другими рыночными инструментами. Эти облигации дают чувство уверенности в год экономической неопределенности, обеспечивая предсказуемый доход за счет фиксированных процентных платежей. Государственные облигации представляют собой менее рискованный вариант для инвесторов, осторожных с волатильностью рынка.

Однако успешная торговля государственными облигациями требует глубокого понимания конъюнктуры процентных ставок и общих экономических перспектив. Процентные ставки напрямую влияют на доходность облигаций, поэтому трейдерам крайне важно быть в курсе политики центральных банков и экономических тенденций. Эти знания позволяют инвесторам принимать стратегические решения о покупке или продаже государственных облигаций, оптимизируя свои инвестиции в соответствии с рыночной конъюнктурой.

Акции развивающихся рынков

В преддверии 2024 года акции развивающихся рынков по-прежнему остаются привлекательными для трейдеров, ищущих высокорискованные и высокодоходные возможности. Эти рынки, охватывающие Азию, Африку и Южную Америку, предлагают потенциал для значительного роста, но также сопряжены с повышенными рисками по сравнению с более развитыми рынками.

Привлекательность акций развивающихся рынков заключается в их потенциале роста, обусловленном быстро развивающимися экономиками, расширяющимися потребительскими рынками и зачастую неиспользуемыми ресурсами. Эти рынки часто характеризуются более высокими темпами экономического роста по сравнению с развитыми странами, что может обеспечить значительную доходность для опытных инвесторов.

Однако успех инвестиций в развивающиеся рынки зависит от глубокого понимания различных факторов:

- Региональные экономические драйверы: Каждый развивающийся рынок имеет свою уникальную экономическую динамику, на которую влияют такие факторы, как поведение потребителей, государственная политика и рост секторов.

- Политический климатПолитическая стабильность играет решающую роль в работе этих рынков. Трейдерам необходимо быть в курсе политической ситуации в этих регионах, поскольку изменения в управлении, регулировании и международных отношениях могут существенно повлиять на рыночные показатели.

Акции развивающихся рынков, которые стоит рассмотреть в 2024 году

MakeMyTrip (MMYT)

MakeMyTrip MakeMyTrip, крупнейшее онлайн-турагентство Индии, выделяется как перспективный инструмент для развивающихся рынков в 2024 году. Используя преимущества растущего среднего класса и увеличения дискреционных доходов в Индии, MakeMyTrip работает через такие платформы, как Goibibo и Redbus, предлагая широкий спектр услуг в сфере гостиничного бизнеса, путешествий и экскурсий. Компания продемонстрировала высокие результаты: валовой объем бронирований превысил 1,8 млрд долларов США, а скорректированная прибыль до вычета процентов и налогов (EBIT) значительно выросла по сравнению с прошлым годом. По мере роста экономики Индии ожидается рост спроса на путешествия и впечатления, что обеспечит MakeMyTrip выгодные позиции на рынке. Выход компании на новые города и в новые сегменты рынка, такие как проживание в семье, еще больше укрепляет ее потенциал, делая ее перспективным выбором для инвесторов, рассматривающих индийский рынок.

MercadoLibre (MELI)

MercadoLibre Компания MercadoLibre, которую часто называют «латиноамериканским Amazon», продемонстрировала впечатляющий рост, особенно на таких ключевых рынках, как Бразилия, Аргентина и Мексика. Благодаря 100%-ному росту в 2023 году, MercadoLibre укрепила свои лидирующие позиции на рынке, несмотря на конкурентное давление. Диверсифицированная бизнес-модель компании, включающая финтех и рекламные услуги, способствовала устойчивому росту выручки. Благодаря росту числа активных пользователей и росту выручки, особенно на мексиканском и бразильском рынках, акции MercadoLibre позиционируются как привлекательные для инвестиций в 2024 году, предлагая инвесторам доступ к растущему сектору электронной коммерции в Латинской Америке.

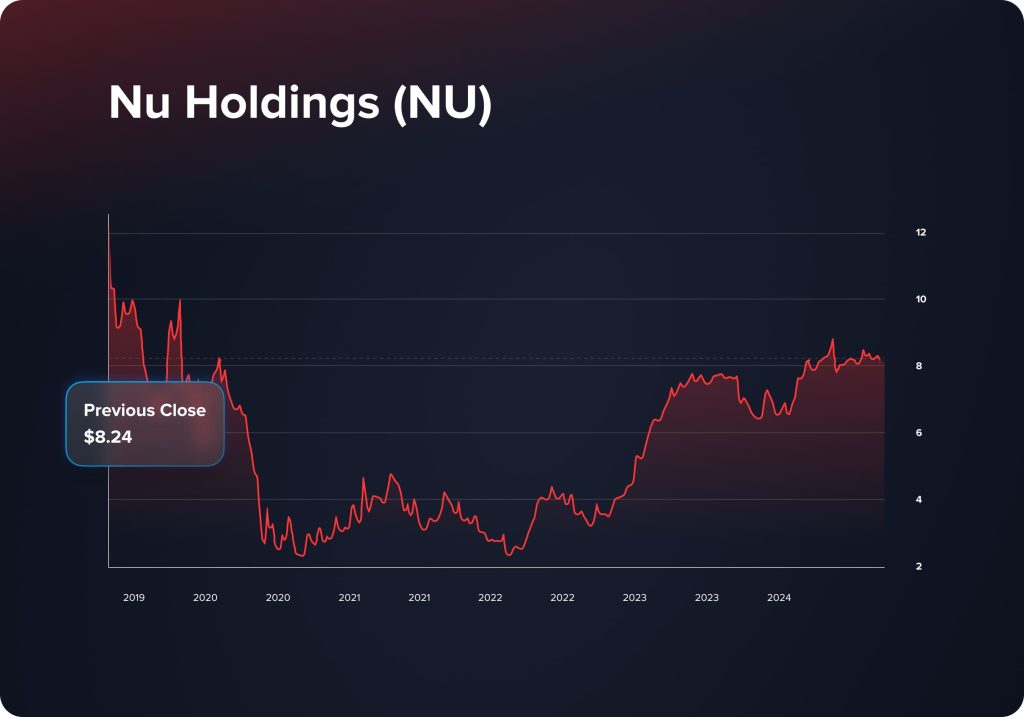

Nu Holdings Ltd. (Nu)

Nu Holdings Nu Holdings, платформа цифрового банкинга, работающая в Бразилии, Мексике, Колумбии и по всему миру, демонстрирует уверенный рост. Прогнозируемый рост продаж и прибыли Nu Holdings демонстрирует значительный потенциал на 2024 год. С начала года акции компании уже продемонстрировали значительный рост, превысив среднеотраслевые показатели. Высокие операционные показатели, продолжающийся рост и растущая прибыльность Nu делают её привлекательной для инвесторов, стремящихся инвестировать в сектор цифрового банкинга и финансовых услуг развивающихся рынков.

Заключение

В преддверии 2024 года ключ к успеху в трейдинге кроется в грамотном стратегическом подходе к этим ведущим инструментам. Ключевую роль будет играть отслеживание рыночных тенденций, понимание тонкостей каждого инструмента и адаптация стратегий к меняющемуся финансовому ландшафту. Будь то цифровая волна криптовалют или использование устойчивого роста фондов акций с высокой капитализацией, возможности для трейдеров столь же разнообразны, как и сами инструменты. Будущее трейдинга в 2024 году — это осознанный выбор, эффективное управление рисками и использование возможностей, предоставляемых этими ведущими торговыми инструментами.

Важно отметить, что представленная в этой статье информация носит исключительно информационный характер и не должна рассматриваться как финансовая консультация. Финансовое положение и уровень риска каждого инвестора уникальны, и обсуждаемые инвестиционные решения могут не подходить всем. Настоятельно рекомендуется проконсультироваться с квалифицированным финансовым консультантом или провести собственное тщательное исследование и анализ, прежде чем принимать какие-либо инвестиционные решения. Представленная здесь информация предназначена для ознакомления с потенциальными инвестиционными возможностями, но не является рекомендацией или одобрением какой-либо конкретной инвестиционной стратегии или финансового продукта.

Обновлено:

18 декабря 2024 г.