Как открыть брокерскую фирму? — Подробное руководство

В статье

Международный мир, в котором мы живем, делает финансовые рынки более доступными и привлекательными, чем когда-либо. С новыми классами активов, такими как криптовалюты, и постоянным интересом к рынку Forex, желание ускорить торговлю и извлечь прибыль из ажиотажа очевидно. Брокерские компании, как традиционные, так и те, которые фокусируются на новых классах активов, играют значительную роль в этом изменяющемся мире, и открытие собственного брокерского бизнеса может быть хорошим способом заработать деньги.

[видео id="1"]

Ключевые выводы

Вот что вам нужно знать перед входом:

- Будь то полный сервис, криптовалюта или форекс, определите свою специализацию на раннем этапе и адаптируйте свою модель под требования рынка.

- Получите соответствующую лицензию и регуляторное одобрение в юрисдикции по вашему выбору.

- Чтобы ускорить выход на рынок, подумайте о внедрении решения под частный бренд и инвестировании в надежную технологическую инфраструктуру.

- Оставайтесь гибкими, потому что финансовые рынки быстро меняются, и ваши инструменты и стратегия тоже должны меняться.

- От этапа вовлечения до выполнения сделок ставьте опыт клиента на первое место. Доверие приобретается благодаря бесперебойной работе.

- Соберите квалифицированный и разнообразный персонал, который занимается анализом, информационными технологиями, соблюдением норм и обслуживанием клиентов.

Обзор брокерских компаний

В постоянно меняющемся финансовом ландшафте возникло несколько архетипов брокеров, каждый из которых отвечает различным потребностям и предпочтениям инвесторов. Давайте исследуем эти типы более детально.

Полнофункциональные брокерские компании

Часто брокерские компании полного цикла рассматриваются как гиганты брокерской системы. От индивидуального консультирования до управления портфелем, они предоставляют полный набор финансовых услуг. Обычно на мировом уровне эти компании имеют широкий спектр операций и привлекают состоятельных людей и организации в качестве клиентов. Их преданность индивидуальному обслуживанию выделяет их среди остальных. Каждый клиент получает выгоду от работы с преданными финансовыми профессионалами, которые активно управляют и перераспределяют активы. Это дополняется обширным исследовательским и аналитическим отделом компании, который производит углубленные рыночные отчеты и аналитические материалы.

Дисконтные брокеры

На противоположной стороне спектра находятся дисконтные брокерские компании, в первую очередь ориентированные на современных инвесторов, обладающих навыками работы с технологиями. Эффективность и экономия стоят на первом месте на этих сайтах. Хотя они предоставляют основные инструменты для самостоятельной торговли, они исключают дополнительные уровни руководства, которые обычно ассоциируются с их полносервисными аналогами. Их удобные интерфейсы, сложные инструменты графического анализа и, в некоторых случаях, рекомендации робо-советников по инвестиционным выборам подчеркивают их стратегию ориентированности на цифровые технологии.

Форекс Брокеры

Обращаясь к специализированной области, форекс-брокеры становятся хранителями крупнейшего финансового рынка в мире. Работая круглосуточно, этот рынок привлекает инвесторов, стремящихся заработать на изменениях в стоимости денег. Благодаря большому кредитному плечу, эти брокеры позволяют трейдерам контролировать гораздо больше, чем позволяют их первоначальные средства. Здесь торговля уникальна, акцентируя внимание на парах валют, таких как EUR/USD или GBP/JPY. Понимая сложности этого рынка, несколько форекс-брокеров также предоставляют трейдерам обучающие инструменты, чтобы помочь им отточить свои торговые навыки.

Крипто-Брокеры

Криптоброкеры заняли свое место с началом цифровой эпохи, выступая в качестве центра между традиционными финансами и авангардной сферой криптовалют. С ростом Биткойна началась новая эра, и эти брокеры играют ключевую роль в предоставлении доступа к этому быстрорастущему классу активов. Они предлагают широкий спектр цифровых активов, включая несколько криптовалют, помимо известных Биткойна и Эфириума. Приоритетом является безопасность, что побуждает многих использовать холодное хранение для обеспечения того, чтобы значительная часть их цифровых активов оставалась свободной от интернет-уязвимостей.

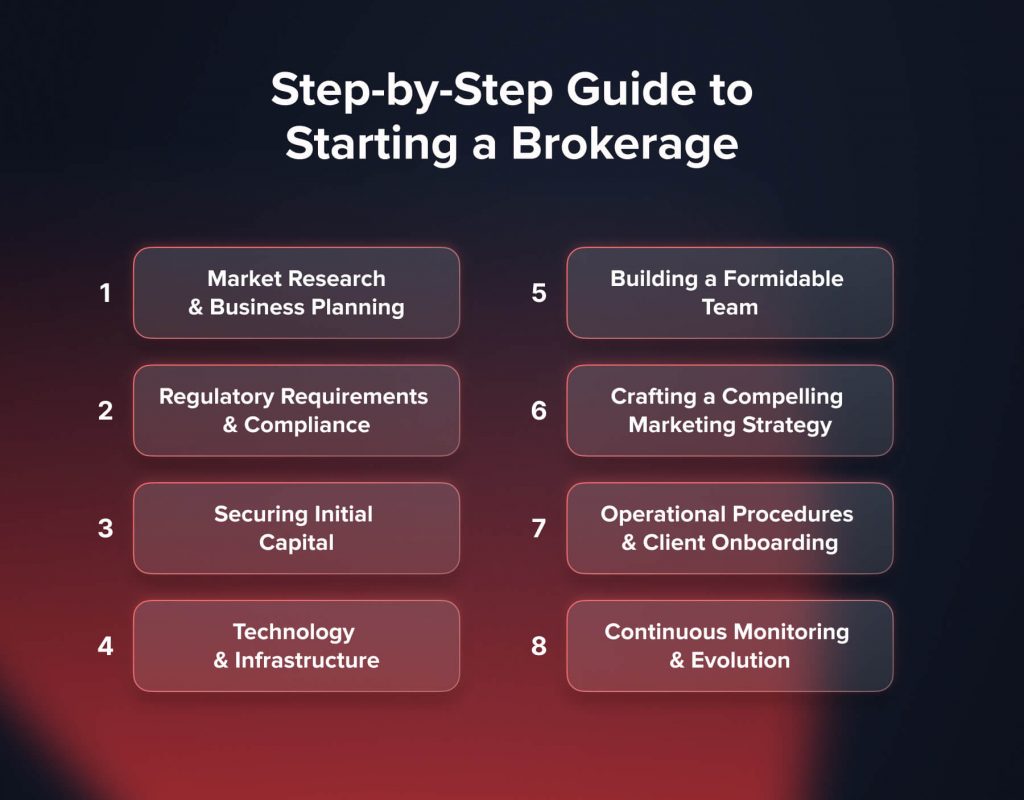

Пошаговое руководство по открытию брокерской компании

Вход в брокерский сектор требует тщательной подготовки, знания регуляторной среды и расчетливого подхода к позиционированию на рынке. Этот путь подробно описан здесь:

- Непрерывный мониторинг и эволюция

- Маркетинговые исследования и бизнес-планирование

- Регуляторные требования и соблюдение норм

- Обеспечение начального капитала

- Технологии & Инфраструктура

- Создание впечатляющей команды

- Создание убедительной маркетинговой стратегии

- Операционные процедуры & Введение клиентов

Маркетинговые исследования и бизнес-планирование

Прежде чем входить в брокерскую сферу, необходимо хорошо понимать рынок. Начните с определения ниши, которая явно соответствует рыночному спросу и соответствует вашему опыту. Форекс и криптовалюты могут предоставить интересные перспективы благодаря своей привлекательности, но у них также есть свои трудности. Узнайте о динамике вашей выбранной ниши и профиле ваших потенциальных клиентов.

Определив нишу, следующим шагом является создание надежной бизнес-модели. Здесь вы решаете, насколько широким будет спектр предлагаемых вами услуг. Вы склоняетесь к модели полного обслуживания или видите преимущества в эффективности дисконтового брокериджа? Ваша структура сборов, стратегии управления рисками и технологические платформы также являются ключевыми решениями на этом этапе.

А SWOT-анализ может быть мощным инструментом на этом этапе. Анализ ваших сильных и слабых сторон, перспектив и угроз помогает не только выявить возможные препятствия, но и позволяет вам извлечь выгоду из рыночных пробелов.

Регуляторные требования и соблюдение норм

Как и все другие финансовые предприятия, брокерские компании следуют определенным правилам. Эти рекомендации существуют для обеспечения целостности финансовой системы, защиты потребителей и прозрачности.

Ландшафт варьируется в зависимости от юрисдикций. SEC и FINRA ведут среди регулирующих органов США. ASIC контролирует в Австралии, тогда как FCA регулирует в Великобритании. Из-за его влияния на законы о форекс-брокерах, Кипрская CySEC имеет значение в форекс-индустрии.

Изучение требований этих регулирующих органов имеет первостепенное значение. Это включает получение необходимых разрешений, внедрение строгих политик «Знай своего клиента» (KYC) и обеспечение соблюдения правил по противодействию отмыванию денег (AML). Соблюдение норм не может быть второстепенным приоритетом, особенно в области Форекс и криптовалют. Это основополагающе.

Обеспечение начального капитала

Капитал является жизненной силой любого бизнес-проекта, и брокерские компании по своей природе требуют значительных затрат капитала. Требования могут различаться, при этом форекс и криптоброкеры часто требуют значительного начального капитала для защиты от рыночной волатильности. Традиционные пути, такие как банковские кредиты, являются вариантом, но в эпоху финтеха появляются инновационные решения для финансирования, от венчурных инвестиций до краудфандинговых платформ.

Технологии и инфраструктура

В эпоху, когда сделки происходят за миллисекунды, передовые технологии не являются роскошью; это необходимость. Ваша технологическая основа определит торговый опыт для ваших клиентов, особенно в высокочастотных областях, таких как Форекс и криптовалюты. Сотрудничество с установленными поставщиками технологических решений может предоставить вам конкурентное преимущество. Безопасность данных является еще одним важным аспектом, учитывая цифровую природу сегодняшних транзакций.

You may also like

Создание мощной команды

Суть операций вашего брокерского бизнеса находится в руках вашей команды. Хотя ваше видение является направляющей силой, команда превращает это видение в реальность. На вершине находятся ваши руководители, чья опытность и связи в отрасли помогают преодолевать многогранный финансовый ландшафт. Эти лидеры не просто принимают решения; они закладывают основу для ethos и направления компании.

Гранулярный анализ рыночных тенденций и финансовых данных ложится на плечи аналитиков. Их преданность пониманию рыночных движений и формированию обоснованных взглядов может стать решающим фактором между обычным и выдающимся брокерским сервисом, особенно если вы склоняетесь к комплексному предложению услуг.

Но брокерская компания в современную эпоху — это не только графики, тренды и финансовые стратегии. Цифровая платформа, которую вы предлагаете клиентам, является интерфейсом вашего сервиса. Это делает IT-специалистов краеугольным камнем ваших операций. Их роль выходит за рамки обслуживания серверов. Они обеспечивают каждому клиенту бесшовный торговый опыт, одновременно укрепляя ваши цифровые активы против угроз.

Конечно, хотя технологии имеют ключевое значение, человеческое участие остается незаменимым. Вот где на помощь приходит ваша служба поддержки клиентов, соединяя цифровую эффективность и человеческую эмпатию. Их взаимодействие, руководство и навыки решения проблем отражают приверженность компании своим клиентам.

И среди этого обширного механизма кто-то должен следить за тем, чтобы шестеренки работали плавно, в унисон с юридическими и регуляторными требованиями. Офицеры по соблюдению норм носят эту шляпу. Их непоколебимое внимание к соблюдению регуляторных требований гарантирует, что, пока компания достигает новых высот, она всегда остается основанной на юридической целостности.

Создание убедительной маркетинговой стратегии

Как только ваша инфраструктура будет закреплена, пришло время осветить ваш бренд в свете финансового рынка. Ваш бренд — это не просто логотип или слоган; это обещание вашим клиентам. Визуальные и тональные элементы должны отражать доверие, экспертизу и инновации.

В эпоху цифрового доминирования ваше онлайн-присутствие имеет огромное значение. Стратегические цифровые кампании, проницательные блоги и активное участие в социальных сетях — это не просто пункты для отметки; это пути к установлению отношений с вашей аудиторией. Более того, знания — это валюта в финансовом мире. Предоставление учебных материалов, таких как семинары, вебинары и электронные книги, укрепляет силу вашего бренда и создает осведомленную и преданную клиентскую базу. Посмотрите этот полезный вебинар , который предлагает подробные идеи и полезные советы по ведению переговоров в сложной брокерской отрасли для тех, кто заинтересован в более глубокой беседе о создании брокерской компании. Этот дополнительный инструмент стремится углубить ваши знания и помочь вам построить крепкую бизнес-основу.

Операционные процедуры и onboarding клиентов

Бесперебойные операции являются тихими, но мощными движущими силами успешного брокерского дела. Каждое выполнение сделки, каждая рекомендация финансовой стратегии и каждое взаимодействие с клиентом должны быть отточены до совершенства. Эта операционная изысканность гарантирует, что клиенты не просто довольны; они в восторге.

Но прежде чем клиенты углубятся в финансовые стратегии, они проходят процедуру внедрения. Эта инициатива должна быть быстрой, но тщательной, с использованием цифровых инструментов для ускорения процессов, при этом обеспечивая строгое соблюдение процедур KYC.

Непрерывный мониторинг & эволюция

Финансовые ландшафты динамичны, и почивать на лаврах для брокерской компании с амбициями не вариант. Оставайтесь в курсе изменений на рынке, будь то технологические инновации или меняющиеся настроения инвесторов. Регулярный мониторинг рынка, обратная связь с клиентами и неуклонное стремление к улучшению обеспечивают не просто существование вашей брокерской компании; она процветает.

Вызовы, которые нужно предвидеть

Начало брокерской деятельности — это не простой путь. Он полон сложных вызовов, которые проверяют не только вашу отраслевую экспертизу, но и вашу стратегическую смекалку. Здесь мы более глубоко исследуем некоторые из этих вызовов и тонкости, которые они приносят:

Динамическая регуляторная среда мира Форекс и криптовалют

Переговоры на финансовых просторах Форекса и криптовалют предполагают хождение по постоянно меняющемуся грунту. В глобальном масштабе регулирующие органы постоянно изменяют свои структуры, чтобы адаптироваться к изменениям на рынке, новым технологическим разработкам и глобальному социально-экономическому климату. Например, хотя юрисдикция может быть дружественной к криптовалютам сегодня, изменения в политике, вызванные рыночными инцидентами или изменениями в правительстве, могут быстро изменить эту позицию.

Кроме того, децентрализованный характер криптовалют часто ставит их под повышенное внимание. Многие регулирующие органы пытаются классифицировать их: являются ли они активами? Товарами? Валютами? Каждая классификация несет с собой свои требования к соблюдению норм. Следить за этой постоянно меняющейся картиной, будучи развивающимся брокером, — это не только вопрос законности, но и сохранения доверия клиентской базы, ищущей гарантии в вашем соблюдении норм.

Технологические достижения: обоюдоострый меч

Технология имеет несколько недостатков, даже если она явно является преимуществом, поскольку улучшает скорость торговли, упрощает процедуры и увеличивает доступ. С одной стороны, такие технологии, как блокчейн и искусственный интеллект, кажутся трансформирующими прозрачность транзакций и торговые стратегии . С другой стороны, они показывают уязвимости безопасности, так как хакеры становятся все более продвинутыми.

Брокерские компании сегодня не только сражаются с рыночными колебаниями; они также постоянно укрепляют свои цифровые рубежи. Каждое техническое развитие – от клиентского сайта до торгового алгоритма – должно рассматриваться в контексте любых рисков безопасности, поэтому необходимо сбалансировать постоянные инновации и защиту.

You may also like

Выделяясь на переполненном рынке

Привлечение Форекса и криптовалюты привело к появлению множества брокеров, каждый из которых борется за свою долю прибыльного финансового пирога. В этом бурлящем рынке дифференциация становится первостепенной задачей. Но выделиться среди остальных проще сказать, чем сделать.

Речь идет о создании уникального предложения ценности, а не только о сложных торговых системах или конкурентных тарифных политиках. Независимо от того, делаете ли вы акцент на устойчивых инвестициях, первоклассных учебных материалах или инновационных технологиях, определение и улучшение вашего уникального торгового предложения в переполненной области становится трудной, но необходимой задачей.

Непредсказуемость крипторынков

Традиционные финансовые рынки похожи на реки с их приливами и отливами; криптовалютные рынки больше похожи на бурное море. Их волатильность легендарна. Цены могут расти или падать за минуты в зависимости от всего, начиная от правительственных объявлений и технологических прорывов до твитов влиятельных людей.

Для брокерских компаний эта непредсказуемость — не просто торговый вызов; это вызов репутации. Направлять клиентов через эти бурные воды означает не только предлагать стратегические советы, но и управлять ожиданиями, обеспечивать финансовую грамотность и развивать доверие. Цель состоит в том, чтобы позиционировать себя не как простую транзакционную платформу, а как путеводный маяк среди криптоштормов.

Предвидение трудностей связано с готовностью, а не с порождением отчаяния. Как говорит пословица: "Предупреждён - значит, вооружён." Зная о этих трудностях, брокерские компании могут планировать, корректировать свои действия и, в конечном итоге, процветать, превращая возможные препятствия в ступеньки к новому успеху.

Глоссарий: ключевые термины, которые должен знать каждый брокер

Для того чтобы принимать обоснованные решения на ранних этапах, необходимо знать основы брокерской индустрии, которая имеет свой собственный язык. Этот глоссарий охватывает ключевую терминологию, с которой должен быть знаком любой потенциальный брокер, независимо от того, начинаете ли вы только что или обновляете свои знания в области языка индустрии.

- Поставщик ликвидности (LP) - Компания или организация, которая предоставляет средства, необходимые для проведения сделок, обеспечивая вашим клиентам беспрепятственные транзакции и доступ к рынку.

- Спред - Разница между ценой покупки актива, или ценой заявки, и ценой продажи, или ценой предложения. Это важный источник дохода для большинства брокерских компаний.

- Решение под собственным брендом - Готовая торговая платформа, которую вы можете персонализировать с вашим логотипом, идеально подходит для быстрого запуска без необходимости начинать с нуля с технологиями.

- AML (Противодействие отмыванию денег) - Свод правил и руководств, которые помогают выявлять и предотвращать финансовые преступления, такие как финансирование терроризма или отмывание денег.

- Знай своего клиента (KYC) - Обязательный процесс, который проверяет личность клиентов и их документацию для защиты от мошенничества и обеспечения соблюдения норм.

- MetaTrader 4 и MetaTrader 5 (MT4 и MT5) - Ведущие платформы, известные своими мощными функциональными возможностями, возможностями технического анализа и поддержкой автоматизированных торговых техник.

- Кредитное плечо - Торговый инструмент, который увеличивает возможные вознаграждения и риски, позволяя пользователям управлять большими активами с меньшими начальными затратами.

- Управление взаимоотношениями с клиентами (CRM) - Система, упрощающая отслеживание взаимодействий с клиентами, управление потенциальными клиентами, автоматизацию onboarding и улучшение обслуживания клиентов.

- Онбординг - Процедура приема и подтверждения новых клиентов, которая включает создание учетной записи и проведение проверок на соответствие, таких как KYC.

Сотрудник по соблюдению норм - Важный член команды, отвечающий за обеспечение соответствия вашей брокерской компании всем применимым законам и нормативным актам.

Сбор плодов хорошо спланированного брокерского предприятия

Начать и управлять прибыльным брокерским бизнесом в сложных секторах Форекс и криптовалюты не для слабонервных. Это требует тщательной подготовки, неустанной преданности и способности адаптироваться к постоянно изменяющимся нотам финансовой симфонии. Однако для тех, кто находит правильные аккорды, преимущества значительны как в плане доходов, так и в плане удовлетворения от того, что они оставляют значительный след на финансовой арене.

Каждое осознанное решение, каждая внедренная технологическая инновация и каждый мост доверия, построенный с клиентами, culminates в успешном брокерском предприятии. Но этот успех измеряется не только цифрами в отчетах о прибыли. Он отражается в доверии клиентов, которые обращаются к вашей платформе за советом, уважении со стороны коллег, которые признают ваш вклад в отрасль, и удовлетворении команды, которая находит смысл в своих ролях. Путь к созданию брокерской компании интенсивен, но горизонт возможностей, который он открывает, не что иное, как захватывающее приключение.

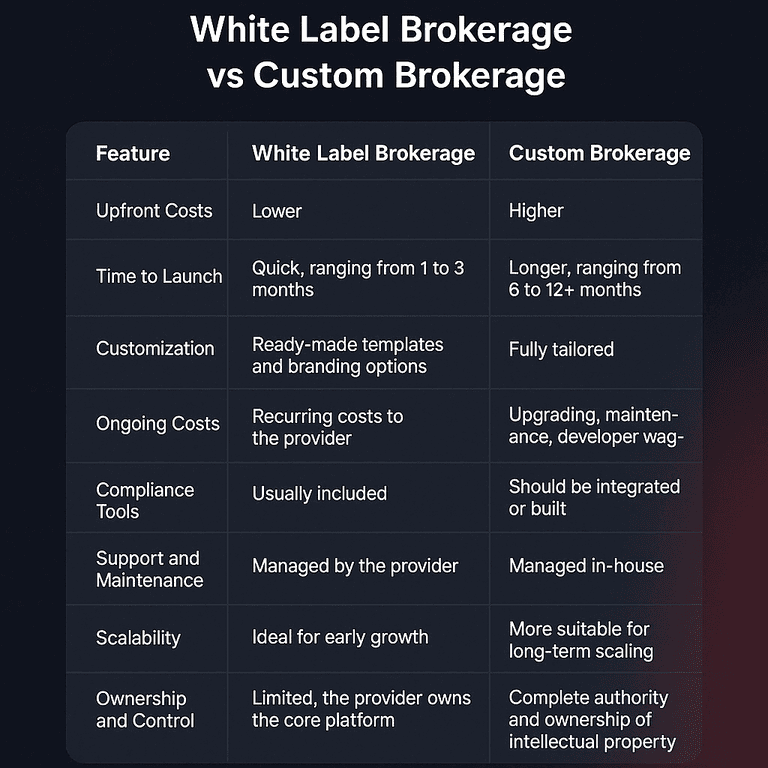

Белая марка против кастомного брокерства: что выбрать?

Выбор правильной модели настройки - это одно из самых важных решений, которое вам придется принять при запуске вашего брокерского бизнеса. Должны ли вы использовать готовую платформу и запустить быстрее, выбрав путь с белой маркой? Или стоит инвестировать, чтобы начать с нуля и создать свое уникальное решение?

Каждый подход предлагает свои преимущества, и тот, который подходит вам лучше всего, будет зависеть от вашего долгосрочного плана, технических навыков, целей и доступных ресурсов. Вот краткий обзор различий:

Заключение

В постоянно меняющемся мире финансов успех требует не только стратегии, но и преданности постоянному обучению, чтобы гарантировать, что брокерские компании остаются гибкими и опережают время. Независимо от того, касаются ли они рыночных тенденций, технологических новшеств или законодательных изменений, брокерские компании, поддерживающие культуру постоянного обучения, устанавливают себя как участников рынка и лидеров рынка.

Начать брокерское дело — это как сочинять шедевр в великой симфонии финансов. С правильными нотами подготовки, стратегии и адаптивности музыка не просто гармонична; она легендарна. Начав это путешествие с ясным видением, непоколебимой преданностью и адаптивной стратегией, вы гарантируете, что безбрежность финансового океана, со всеми его вызовами и возможностями, станет захватывающим приключением, ожидающим своего исследования.

FAQ

Минимальная сумма от $50,000 до $150,000 требуется большинством брокерских компаний для финансирования маркетинга, персонала, технологий и лицензирования, в зависимости от юрисдикции и стиля бизнеса. Операции, которые более сложные, могут потребовать гораздо больше.

Если вы используете решение с белой этикеткой, вы можете начать в одиночку или с небольшой командой. Тем не менее, для того чтобы расширяться устойчивым образом, вам понадобятся эксперты в области маркетинга, ИТ, соблюдения нормативных требований и обслуживания клиентов.

Требует ли ведение брокерской деятельности всегда наличие лицензии?

Да, для законной деятельности почти в каждой юрисдикции требуется соответствующая лицензия. Завоевание доверия и минимизация юридических рисков также имеют решающее значение. В каждом регионе есть свои правила и регуляции.

В чём разница между белой маркой и индивидуальным брокерством?

Брокерские компании с белой этикеткой идеально подходят для быстрого и экономичного запуска, поскольку они используют готовые платформы с вашим брендингом. Хотя они требуют больше времени, денег и внутренних технических знаний, индивидуальные брокерские компании предлагают полный контроль и гибкость.

Как мне получить моих первых клиентов?

Убедитесь, что ваш процесс адаптации проходит гладко и надежно, сосредоточьтесь на маркетинге, основанном на образовании (блоги, вебинары), создайте сильное присутствие в Интернете и предоставьте демонстрационные аккаунты. Для более быстрого достижения результатов подумайте о региональных кампаниях или партнерских отношениях.

Обновлено:

25 сентября 2025 г.