จะเริ่มต้นบริษัทนายหน้าซื้อขายหุ้นในปี 2024 ได้อย่างไร?

เนื้อหา

การเริ่มต้นบริษัทนายหน้าซื้อขายหลักทรัพย์ในปี 2567 โดยเฉพาะบริษัทที่เน้นการซื้อขาย CFD ของหุ้น จำเป็นต้องผ่านขั้นตอนเชิงกลยุทธ์และข้อกำหนดด้านกฎระเบียบต่างๆ คู่มือนี้นำเสนอแผนงานโดยละเอียด ตั้งแต่การทำความเข้าใจภูมิทัศน์ตลาดไปจนถึงการสร้างความแข็งแกร่ง เพื่อให้มั่นใจว่าบริษัทนายหน้าซื้อขายหลักทรัพย์ของคุณอยู่ในสถานะที่พร้อมสำหรับความสำเร็จ

สัญญาซื้อขายส่วนต่าง (CFD) – อนุพันธ์ทางการเงินที่อนุญาตให้ผู้ซื้อขายเก็งกำไรจากการเคลื่อนไหวของราคาของสินทรัพย์ต่างๆ เช่น หุ้น สินค้าโภคภัณฑ์ หรือสกุลเงิน โดยไม่ต้องเป็นเจ้าของสินทรัพย์อ้างอิง

ทำความเข้าใจเกี่ยวกับ CFD หุ้น

CFD หุ้น (สัญญาซื้อขายส่วนต่าง) คือตราสารอนุพันธ์ทางการเงินประเภทหนึ่งที่อนุญาตให้เทรดเดอร์เก็งกำไรจากการเคลื่อนไหวของราคาหุ้นได้โดยไม่ต้องเป็นเจ้าของสินทรัพย์อ้างอิง แทนที่จะซื้อหุ้นโดยตรง เทรดเดอร์จะทำสัญญากับโบรกเกอร์เพื่อแลกเปลี่ยนส่วนต่างของราคาหุ้นนับตั้งแต่เปิดสัญญาจนถึงปิดสัญญา รูปแบบนี้มีข้อดีและข้อควรพิจารณาหลายประการ ทำให้เป็นตัวเลือกที่น่าสนใจสำหรับเทรดเดอร์และโบรกเกอร์

การปฏิบัติตามกฎระเบียบ

การปรับตัวให้เข้ากับกฎระเบียบถือเป็นก้าวแรกที่สำคัญยิ่งในการจัดตั้งบริษัทนายหน้าซื้อขายหลักทรัพย์ของคุณ การปฏิบัติตามกฎระเบียบที่เกี่ยวข้องเป็นสิ่งสำคัญยิ่งต่อการดำเนินงานด้านกฎหมาย การสร้างความไว้วางใจของลูกค้า และการรักษาชื่อเสียงที่แข็งแกร่ง ต่อไปนี้คือวิธีการปฏิบัติตามกฎระเบียบอย่างมีประสิทธิภาพ:

การออกใบอนุญาตและการดำเนินงานหลายภูมิภาค

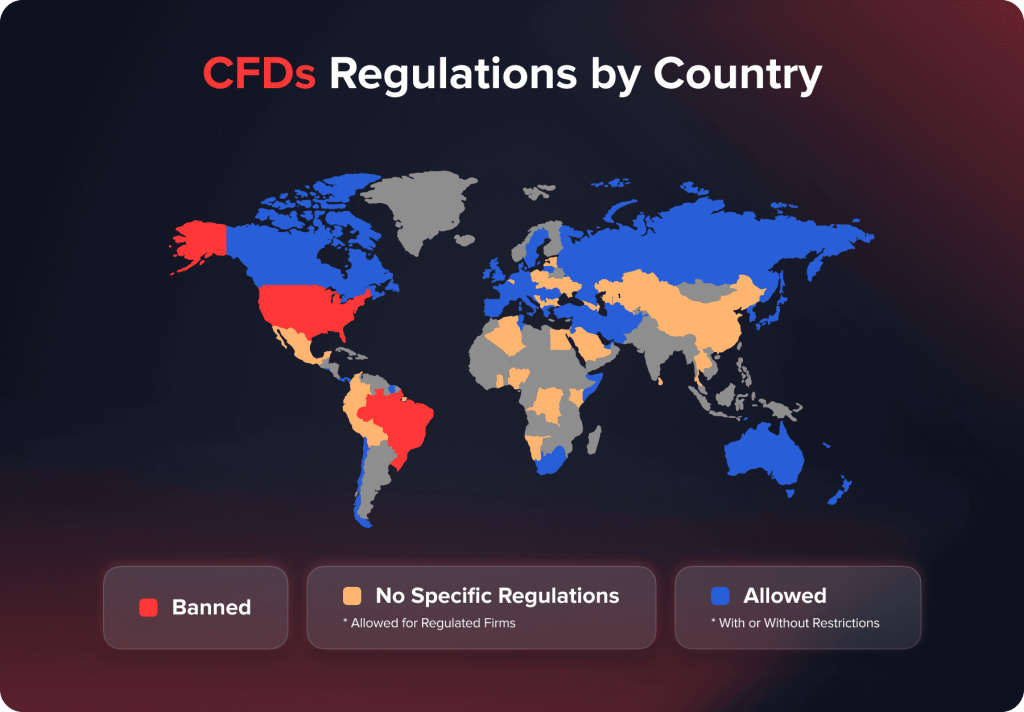

กำหนดใบอนุญาตเฉพาะที่คุณต้องการตามภูมิภาคที่คุณดำเนินงาน แต่ละเขตอำนาจศาลมีหน่วยงานกำกับดูแลและข้อกำหนดการออกใบอนุญาตของตนเอง ตัวอย่างเช่น คุณต้องปฏิบัติตาม สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ (SEC) ในสหรัฐอเมริกา ในเวลาเดียวกัน ในสหราชอาณาจักร หน่วยงานกำกับดูแลด้านการเงิน (FCA) กำกับดูแลการดำเนินงานนายหน้า สำนักงานหลักทรัพย์และตลาดหลักทรัพย์แห่งยุโรป (ESMA) มีบทบาทสำคัญในสหภาพยุโรป หากคุณวางแผนที่จะดำเนินธุรกิจในหลายภูมิภาค โปรดเตรียมพร้อมที่จะปฏิบัติตามกฎระเบียบของแต่ละตลาด ซึ่งมักเกี่ยวข้องกับการขอใบอนุญาตหลายใบและการปฏิบัติตามมาตรฐานที่แตกต่างกัน เช่น ภาระผูกพันในการรายงานที่แตกต่างกัน มาตรฐานความเพียงพอของเงินทุน และกฎเกณฑ์ด้านการดำเนินการ

ป้องกันการฟอกเงินและรู้จักลูกค้าของคุณ

ดำเนินการต่อต้านการฟอกเงินที่แข็งแกร่งและ ขั้นตอน KYC เพื่อป้องกันอาชญากรรมทางการเงิน เช่น การฟอกเงินและการฉ้อโกง ซึ่งรวมถึงการตรวจสอบตัวตนของลูกค้าโดยใช้เอกสารที่เชื่อถือได้ การตรวจสอบธุรกรรมเพื่อหากิจกรรมที่น่าสงสัย และการรายงานกิจกรรมที่น่าสงสัยใดๆ ต่อหน่วยงานที่เกี่ยวข้อง เพื่อทำให้กระบวนการปฏิบัติตามกฎระเบียบเหล่านี้เป็นระบบอัตโนมัติและคล่องตัว ควรใช้โซลูชันซอฟต์แวร์ขั้นสูง เพื่อให้มั่นใจว่าการตรวจสอบจะครอบคลุมและมีประสิทธิภาพ

You may also like

กฎหมายคุ้มครองข้อมูลและความเป็นส่วนตัว

ให้แน่ใจว่าเป็นไปตามกฎระเบียบการคุ้มครองข้อมูล เช่น ข้อบังคับทั่วไปเกี่ยวกับการคุ้มครองข้อมูล (GDPR) ในสหภาพยุโรปและ พระราชบัญญัติความเป็นส่วนตัวของผู้บริโภคแห่งรัฐแคลิฟอร์เนีย (CCPA) ในสหรัฐอเมริกา กฎหมายเหล่านี้กำหนดแนวทางปฏิบัติที่เข้มงวดเกี่ยวกับการเก็บรวบรวม การจัดเก็บ และการใช้งานข้อมูล ควรใช้นโยบายคุ้มครองข้อมูลที่เข้มงวดและดำเนินการตรวจสอบอย่างสม่ำเสมอเพื่อหลีกเลี่ยงบทลงโทษที่รุนแรงและรักษาความไว้วางใจของลูกค้า มาตรการคุ้มครองข้อมูลที่เข้มงวดมีความสำคัญอย่างยิ่งต่อการปกป้องข้อมูลลูกค้าและรักษาชื่อเสียงของบริษัทของคุณ

ความต้องการเงินทุนและเสถียรภาพทางการเงิน

ทำความเข้าใจและปฏิบัติตามข้อกำหนดด้านเงินทุนที่กำหนดโดยหน่วยงานกำกับดูแล ข้อกำหนดเหล่านี้ช่วยให้มั่นใจได้ว่าบริษัทของคุณจะสามารถปฏิบัติตามภาระผูกพันทางการเงินและรักษาเสถียรภาพทางการเงินในสภาวะตลาดที่ไม่เอื้ออำนวย การรักษาเงินสำรองเงินทุนให้เพียงพอเป็นสิ่งสำคัญเพื่อปกป้องลูกค้าและเสถียรภาพทางการเงินของบริษัท ควรตรวจสอบและปรับเงินสำรองเงินทุนของคุณอย่างสม่ำเสมอเพื่อให้สอดคล้องกับมาตรฐานการกำกับดูแลและสภาวะตลาด

ทีมตรวจสอบ การรายงาน และการปฏิบัติตามกฎระเบียบประจำ

การปฏิบัติตามกฎระเบียบเกี่ยวข้องกับการตรวจสอบและการรายงานต่อหน่วยงานกำกับดูแลอย่างสม่ำเสมอ ซึ่งรวมถึงการตรวจสอบทางการเงินเพื่อทบทวนงบการเงิน การตรวจสอบการปฏิบัติตามกฎระเบียบเพื่อให้มั่นใจว่าเป็นไปตามมาตรฐานกฎระเบียบทั้งหมด และการตรวจสอบการปฏิบัติงานเพื่อทบทวนขั้นตอนการปฏิบัติงานของคุณ ส่งรายงานที่ถูกต้องและตรงเวลาเพื่อหลีกเลี่ยงบทลงโทษและการตรวจสอบที่เข้มงวดขึ้นจากกฎระเบียบ จัดตั้งทีมกฎหมายและการปฏิบัติตามกฎระเบียบโดยเฉพาะเพื่อรับผิดชอบในการอัปเดตข้อมูลล่าสุดเกี่ยวกับการเปลี่ยนแปลงของกฎระเบียบ ปฏิบัติตามขั้นตอนการปฏิบัติตามกฎระเบียบ และดูแลให้การดำเนินงานทั้งหมดเป็นไปตามมาตรฐานที่กำหนด การฝึกอบรมและพัฒนาอย่างสม่ำเสมอสำหรับทีมนี้มีความสำคัญอย่างยิ่งต่อการรับมือกับสถานการณ์ด้านกฎระเบียบที่เปลี่ยนแปลงไปอย่างมีประสิทธิภาพ

การพัฒนาแผนธุรกิจ

การสร้างแผนธุรกิจที่ครอบคลุมเป็นสิ่งจำเป็นสำหรับการเปิดตัวและการเติบโตของบริษัทนายหน้าซื้อขายหลักทรัพย์ของคุณให้ประสบความสำเร็จ นี่คือวิธีการพัฒนาแผนธุรกิจที่มีประสิทธิภาพ:

กำหนดรูปแบบธุรกิจและตลาดเป้าหมายของคุณ

ตัดสินใจว่าคุณจะเป็นโบรกเกอร์แบบบริการเต็มรูปแบบหรือแบบลดราคา พร้อมระบุประเภทบัญชีและผลิตภัณฑ์ที่คุณจะนำเสนอ เช่น หุ้น CFD หุ้น และตราสารทางการเงินอื่นๆ ดำเนินการวิจัยตลาดเพื่อระบุและทำความเข้าใจตลาดเป้าหมายของคุณ ไม่ว่าจะเป็นนักลงทุนรายย่อย ลูกค้าสถาบัน หรือทั้งสองอย่าง การวิจัยนี้จะช่วยปรับแต่งบริการและกลยุทธ์ทางการตลาดของคุณเพื่อดึงดูดลูกค้าที่เหมาะสม

การวิเคราะห์การแข่งขันและข้อเสนอขายที่เป็นเอกลักษณ์

วิเคราะห์คู่แข่งของคุณเพื่อทำความเข้าใจจุดแข็ง จุดอ่อน โมเดลธุรกิจ ตลาดเป้าหมาย กลยุทธ์ด้านราคา และข้อเสนอบริการต่างๆ ระบุช่องว่างทางการตลาดและโอกาสในการสร้างความแตกต่างให้กับโบรกเกอร์ของคุณ กำหนดข้อเสนอขายที่เป็นเอกลักษณ์ (USP) ของคุณเพื่อสร้างความแตกต่างให้กับโบรกเกอร์ของคุณ เช่น เทคโนโลยีที่เหนือกว่า การบริการลูกค้าที่เป็นเลิศ หรือเครื่องมือการซื้อขายที่เป็นนวัตกรรม

กลยุทธ์การตลาดและการคาดการณ์ทางการเงิน

พัฒนากลยุทธ์การตลาดที่แข็งแกร่งโดยใช้เทคนิคดิจิทัล (SEO, การตลาดเนื้อหา, โซเชียลมีเดีย) และวิธีการดั้งเดิม (การโฆษณาสิ่งพิมพ์, กิจกรรม) คุณมีเป้าหมายที่จะสร้างการรับรู้ถึงแบรนด์ สร้างโอกาสในการขาย และเปลี่ยนผู้มีโอกาสเป็นลูกค้าให้กลายเป็นลูกค้า จัดทำประมาณการทางการเงิน ซึ่งรวมถึงรายได้ ค่าใช้จ่าย และผลกำไรสำหรับสามถึงห้าปีแรก วิเคราะห์กระแสรายได้และประมาณการค่าใช้จ่ายในการดำเนินงานเพื่อประเมินความยั่งยืนทางการเงินและดึงดูดนักลงทุน

การจัดการความเสี่ยงและกำหนดเวลาการดำเนินการ

ก่อตั้ง กรอบการบริหารความเสี่ยง เพื่อระบุและบรรเทาความเสี่ยงต่างๆ เช่น ความผันผวนของตลาด ความเสี่ยงด้านปฏิบัติการ การเปลี่ยนแปลงด้านกฎระเบียบ และภัยคุกคามด้านความมั่นคงปลอดภัยไซเบอร์ พัฒนากลยุทธ์ต่างๆ เช่น มาตรการความมั่นคงปลอดภัยไซเบอร์ที่แข็งแกร่ง และการรักษาเงินทุนสำรองให้เพียงพอ จัดทำแผนงานการดำเนินงานพร้อมเป้าหมายสำคัญต่างๆ เช่น การขอใบอนุญาต การติดตั้งเทคโนโลยี การจ้างพนักงาน และการพัฒนาสื่อการตลาด เพื่อให้มั่นใจว่าทุกขั้นตอนจะเสร็จสมบูรณ์ตามกำหนดเวลาเพื่อให้การเปิดตัวประสบความสำเร็จ

เทคโนโลยีและแพลตฟอร์มการซื้อขาย

การลงทุนในเทคโนโลยีที่ทันสมัยเป็นสิ่งสำคัญอย่างยิ่งต่อความสำเร็จของบริษัทนายหน้าซื้อขายหลักทรัพย์ของคุณ แพลตฟอร์มการซื้อขายที่แข็งแกร่งและเชื่อถือได้คือหัวใจสำคัญของการดำเนินงานของคุณ ซึ่งส่งผลต่อทุกด้าน ตั้งแต่ความพึงพอใจของลูกค้าไปจนถึงประสิทธิภาพในการดำเนินงาน นี่คือวิธีที่จะช่วยให้คุณมั่นใจว่าคุณได้เลือกและนำเทคโนโลยีที่ดีที่สุดมาใช้กับบริษัทนายหน้าซื้อขายหลักทรัพย์ของคุณ

You may also like

การเลือกแพลตฟอร์มและการดำเนินการซื้อขาย

เลือกแพลตฟอร์มการซื้อขายที่รองรับสินทรัพย์หลากหลายประเภท ทั้งหุ้น CFD หุ้น และตราสารทางการเงินอื่นๆ ตรวจสอบให้แน่ใจว่าแพลตฟอร์มมีความหลากหลายเพียงพอที่จะตอบสนองความต้องการที่หลากหลายของลูกค้า ตั้งแต่นักลงทุนรายย่อยไปจนถึงนักลงทุนสถาบัน มองหาแพลตฟอร์มที่ใช้งานง่าย มีอินเทอร์เฟซที่ใช้งานง่าย ช่วยให้ลูกค้าใช้งานและดำเนินการซื้อขายได้อย่างง่ายดาย นอกจากนี้ ตรวจสอบให้แน่ใจว่าแพลตฟอร์มมีการดำเนินการซื้อขายที่ราบรื่น มีเวลาแฝงต่ำ ประมวลผลคำสั่งซื้อขายได้อย่างรวดเร็วและแม่นยำ โดยเฉพาะอย่างยิ่งในตลาดที่มีความผันผวน

เครื่องมือขั้นสูงและข้อมูลเรียลไทม์

เครื่องมือสร้างกราฟขั้นสูงเป็นสิ่งจำเป็นสำหรับการให้ข้อมูลเชิงลึกแก่เทรดเดอร์เพื่อประกอบการตัดสินใจอย่างชาญฉลาด ตรวจสอบให้แน่ใจว่าแพลตฟอร์มของคุณมีตัวบ่งชี้ทางเทคนิค เครื่องมือวาด และประเภทกราฟที่หลากหลาย การเข้าถึงข้อมูลตลาดแบบเรียลไทม์เป็นสิ่งสำคัญ ดังนั้นควรผสานรวมฟีดข้อมูลแบบเรียลไทม์ที่เชื่อถือได้ ซึ่งให้ข้อมูลล่าสุดเกี่ยวกับราคาหุ้น การเคลื่อนไหวของตลาด และข่าวสารทางการเงิน คุณสมบัติเหล่านี้ช่วยให้เทรดเดอร์สามารถวิเคราะห์แนวโน้มตลาดและพัฒนากลยุทธ์การซื้อขายที่มีประสิทธิภาพ

ความปลอดภัยและการจัดการความเสี่ยง

ใช้ฟีเจอร์ความปลอดภัยที่แข็งแกร่งเพื่อปกป้องข้อมูลและเงินทุนของลูกค้า ซึ่งรวมถึงการยืนยันตัวตนแบบสองปัจจัย (2FA) การเข้ารหัส ใบรับรอง Secure Socket Layer (SSL) และการตรวจสอบความปลอดภัยอย่างสม่ำเสมอ ร่วมมือกับผู้ให้บริการเทคโนโลยีที่มีชื่อเสียงเพื่อให้มั่นใจว่าแพลตฟอร์มของคุณเป็นไปตามมาตรฐานความปลอดภัยสูงสุด นอกจากนี้ แพลตฟอร์มของคุณควรมีเครื่องมือบริหารความเสี่ยงที่มีประสิทธิภาพ เช่น คำสั่ง Stop-Loss คำสั่ง Take-Profit การตรวจสอบมาร์จิ้น และเครื่องมือประเมินความเสี่ยง เพื่อช่วยให้เทรดเดอร์สามารถจัดการสถานะและลดความเสี่ยงที่อาจเกิดขึ้นจากการขาดทุนได้

การซื้อขายและบูรณาการผ่านมือถือ

ด้วยการใช้งานอุปกรณ์พกพาในการซื้อขายที่เพิ่มมากขึ้น การนำเสนอแพลตฟอร์มที่ใช้งานง่ายบนมือถือจึงเป็นสิ่งสำคัญ ตรวจสอบให้แน่ใจว่าแพลตฟอร์มการซื้อขายของคุณรองรับทั้งอุปกรณ์ Android และ iOS เพื่อมอบประสบการณ์การซื้อขายที่ราบรื่นในทุกอุปกรณ์ ความสามารถในการซื้อขายบนมือถือช่วยให้ลูกค้าสามารถติดตามและดำเนินการซื้อขายได้ทุกที่ทุกเวลา ช่วยเพิ่มความยืดหยุ่นและการมีส่วนร่วม การผสานรวมแพลตฟอร์มการซื้อขายของคุณเข้ากับบริการของบุคคลที่สามจะช่วยเพิ่มประสิทธิภาพการใช้งานและเพิ่มมูลค่าให้กับลูกค้าของคุณ ลองพิจารณาความร่วมมือกับผู้ให้บริการข่าวสารทางการเงิน เครื่องมือวิเคราะห์ และบริการเทคโนโลยีทางการเงินอื่นๆ เพื่อนำเสนอข้อมูลเชิงลึกและบริการที่เป็นเอกลักษณ์

ความสามารถในการปรับขนาด การปรับแต่ง และการสนับสนุน

เมื่อธุรกิจนายหน้าของคุณเติบโตขึ้น แพลตฟอร์มการซื้อขายของคุณควรจะสามารถปรับขนาดให้สอดคล้องกับธุรกิจของคุณได้ เลือกแพลตฟอร์มที่มีความยืดหยุ่นเพื่อรองรับจำนวนผู้ใช้และธุรกรรมที่เพิ่มขึ้น ความสามารถในการปรับแต่งแพลตฟอร์มให้ตรงกับความต้องการและความชอบเฉพาะเจาะจงจะช่วยเพิ่มความได้เปรียบในการแข่งขันและเพิ่มความพึงพอใจของลูกค้า ตรวจสอบให้แน่ใจว่าผู้ให้บริการเทคโนโลยีของคุณให้การสนับสนุนและการบำรุงรักษาแพลตฟอร์มการซื้อขายอย่างต่อเนื่อง การอัปเดตอย่างสม่ำเสมอ การสนับสนุนทางเทคนิค และการแก้ไขปัญหาอย่างรวดเร็ว เป็นสิ่งสำคัญอย่างยิ่งต่อการรักษาประสิทธิภาพและความน่าเชื่อถือของแพลตฟอร์ม ลดระยะเวลาหยุดทำงานและการหยุดชะงักของลูกค้าของคุณ

การจัดหาเงินทุนและความต้องการเงินทุน

การมีเงินทุนเพียงพอเป็นสิ่งสำคัญอย่างยิ่งสำหรับการเปิดตัวและรักษาความสำเร็จของบริษัทนายหน้าซื้อขายหลักทรัพย์ เงินทุนที่เพียงพอช่วยให้คุณครอบคลุมค่าใช้จ่ายที่จำเป็นทั้งหมด ปฏิบัติตามข้อกำหนดด้านกฎระเบียบ และลงทุนในโอกาสการเติบโต นี่คือแนวทางที่ครอบคลุมในการทำความเข้าใจและจัดหาเงินทุนและเงินทุนที่จำเป็นสำหรับบริษัทนายหน้าซื้อขายหลักทรัพย์ของคุณ:

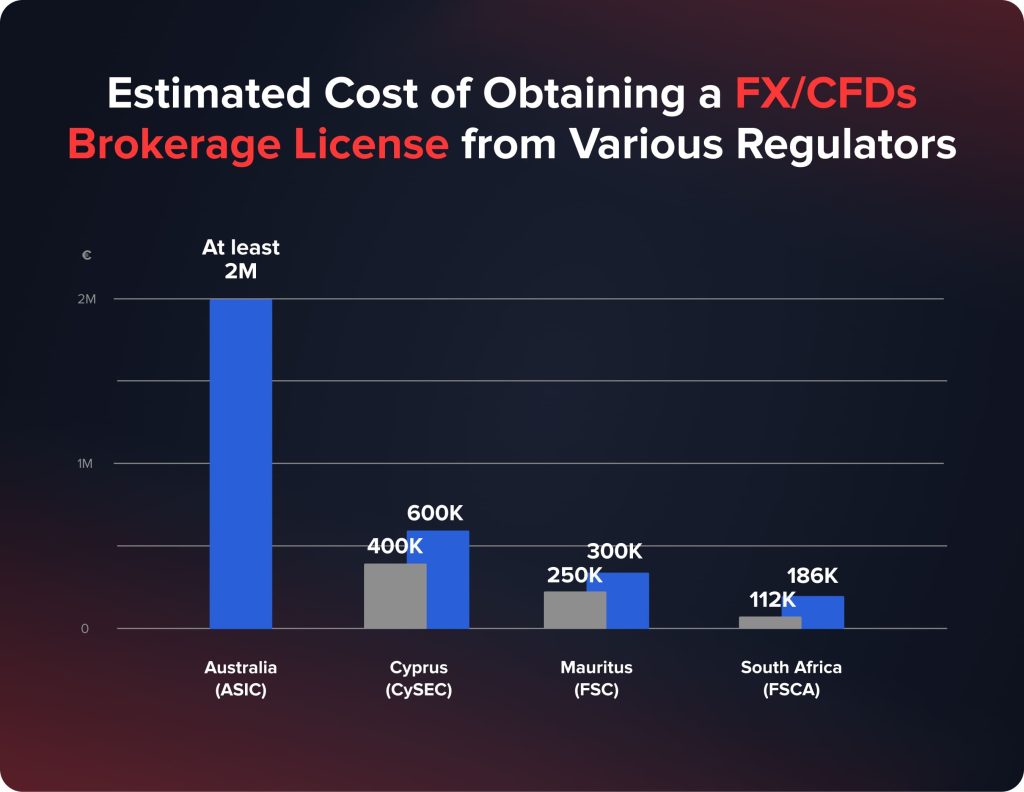

ต้นทุนการตั้งค่าเริ่มต้นและกฎระเบียบ

การเริ่มต้นบริษัทนายหน้าซื้อขายหลักทรัพย์นั้นมีค่าใช้จ่ายเริ่มต้นจำนวนมาก ซึ่งรวมถึงค่าธรรมเนียมทางกฎหมาย การขอใบอนุญาต การตั้งสำนักงาน การซื้ออุปกรณ์ และการจ้างพนักงานเบื้องต้น การประเมินค่าใช้จ่ายเหล่านี้อย่างแม่นยำและการวางแผนงบประมาณเป็นสิ่งสำคัญเพื่อหลีกเลี่ยงปัญหาการขาดทุนทางการเงินในช่วงเริ่มต้น ค่าธรรมเนียมการกำกับดูแลอาจสูงมาก โดยเฉพาะอย่างยิ่งหากคุณวางแผนที่จะดำเนินธุรกิจในหลายเขตอำนาจศาล หน่วยงานกำกับดูแลแต่ละแห่งมีโครงสร้างค่าธรรมเนียมของตนเองสำหรับการออกใบอนุญาตและการปฏิบัติตามกฎระเบียบ ซึ่งรวมถึงค่าธรรมเนียมการยื่นขอ ค่าธรรมเนียมการกำกับดูแลอย่างต่อเนื่อง และค่าธรรมเนียมการตรวจสอบกฎระเบียบ จัดสรรเงินทุนให้เพียงพอเพื่อครอบคลุมค่าใช้จ่ายเหล่านี้เพื่อรักษาการปฏิบัติตามกฎระเบียบและหลีกเลี่ยงปัญหาทางกฎหมาย

ค่าใช้จ่ายด้านเทคโนโลยีและการดำเนินงาน

การลงทุนในโครงสร้างพื้นฐานด้านเทคโนโลยีที่แข็งแกร่งเป็นสิ่งสำคัญอย่างยิ่งต่อความสำเร็จของโบรกเกอร์ของคุณ ซึ่งรวมถึงค่าใช้จ่ายในการจัดหาและบำรุงรักษาแพลตฟอร์มการซื้อขายที่เชื่อถือได้ การผสานรวมฟีดข้อมูลแบบเรียลไทม์ การนำมาตรการรักษาความปลอดภัยมาใช้ และการสนับสนุนด้านไอที ค่าใช้จ่ายด้านเทคโนโลยีอาจสูง แต่เป็นสิ่งจำเป็นต่อการมอบประสบการณ์การซื้อขายที่ราบรื่นและปลอดภัยให้กับลูกค้าของคุณ ค่าใช้จ่ายในการดำเนินงานประกอบด้วยค่าใช้จ่ายต่อเนื่อง เช่น เงินเดือน ค่าเช่าสำนักงาน ค่าสาธารณูปโภค และค่าใช้จ่ายในการบริหาร นอกจากนี้ ควรจัดสรรงบประมาณสำหรับการพัฒนาวิชาชีพอย่างต่อเนื่อง สวัสดิการพนักงาน และกองทุนสำรองฉุกเฉินสำหรับค่าใช้จ่ายที่ไม่คาดคิด การจัดทำงบประมาณค่าใช้จ่ายในการดำเนินงานโดยละเอียดและสมเหตุสมผลจะช่วยให้การดำเนินงานในแต่ละวันเป็นไปอย่างราบรื่น

แหล่งเงินทุนและการจัดการกระแสเงินสด

สำรวจทางเลือกในการระดมทุนที่หลากหลายเพื่อจัดหาเงินทุนที่จำเป็นสำหรับธุรกิจนายหน้าของคุณ การบริหารจัดการกระแสเงินสดอย่างมีประสิทธิภาพเป็นสิ่งสำคัญอย่างยิ่งต่อการรักษาธุรกิจนายหน้าของคุณให้ยั่งยืน ตรวจสอบกระแสเงินสดของคุณอย่างสม่ำเสมอเพื่อให้แน่ใจว่าคุณมีสภาพคล่องเพียงพอที่จะครอบคลุมค่าใช้จ่ายในการดำเนินงานและลงทุนในโอกาสการเติบโต ปฏิบัติตามการควบคุมทางการเงินและแนวปฏิบัติทางบัญชีที่แข็งแกร่งเพื่อรักษากระแสเงินสดให้แข็งแรงและหลีกเลี่ยงปัญหาทางการเงิน ตรวจสอบและปรับปรุงแผนทางการเงินและงบประมาณของคุณอย่างสม่ำเสมอเพื่อให้สอดคล้องกับการเปลี่ยนแปลงของตลาดและการดำเนินธุรกิจ การตรวจสอบทางการเงินอย่างต่อเนื่องช่วยให้คุณระบุปัญหาที่อาจเกิดขึ้นได้ตั้งแต่เนิ่นๆ และตัดสินใจอย่างชาญฉลาดเพื่อรักษาเสถียรภาพให้กับธุรกิจนายหน้าของคุณ

เจ้าหน้าที่และฝ่ายปฏิบัติการ

การจ้างพนักงานที่มีประสบการณ์และทักษะเป็นสิ่งสำคัญอย่างยิ่งต่อการให้บริการที่มีคุณภาพสูงและการรักษาการดำเนินงานที่ราบรื่นในบริษัทนายหน้าของคุณ การรวมทีมที่มีความสามารถจะสนับสนุนความสำเร็จของบริษัทนายหน้าของคุณ ตั้งแต่เจ้าหน้าที่ฝ่ายปฏิบัติตามกฎระเบียบ นักวิเคราะห์ทางการเงิน ตัวแทนฝ่ายบริการลูกค้า และผู้เชี่ยวชาญด้านไอที นี่คือวิธีการจัดการบุคลากรและการดำเนินงานอย่างมีประสิทธิภาพ:

การจ้างบุคลากรสำคัญ

ระบุและจ้างบุคลากรในตำแหน่งสำคัญๆ เช่น เจ้าหน้าที่ฝ่ายปฏิบัติตามกฎระเบียบ นักวิเคราะห์การเงิน ตัวแทนฝ่ายสนับสนุนลูกค้า ผู้เชี่ยวชาญด้านไอที ผู้เชี่ยวชาญด้านการตลาด และผู้เชี่ยวชาญด้านการบริหารความเสี่ยง แต่ละตำแหน่งต้องมีความเชี่ยวชาญและประสบการณ์เฉพาะด้าน เพื่อให้มั่นใจว่าการดำเนินงานมีประสิทธิภาพและประสิทธิผล

- เจ้าหน้าที่ปฏิบัติตามกฎระเบียบ:รับรองการปฏิบัติตามข้อกำหนดด้านกฎระเบียบและนโยบายภายในทั้งหมด การปฏิบัติตามขั้นตอนการตรวจสอบ การดำเนินการตรวจสอบ และการอัปเดตเกี่ยวกับการเปลี่ยนแปลงด้านกฎระเบียบ

- นักวิเคราะห์ทางการเงิน:ให้บริการวิเคราะห์ตลาด คำแนะนำการลงทุน และบริการจัดการพอร์ตโฟลิโอ ช่วยให้ลูกค้าตัดสินใจซื้อขายอย่างรอบรู้

- ตัวแทนฝ่ายสนับสนุนลูกค้า:ให้บริการลูกค้าอย่างเป็นเลิศ ตอบคำถามของลูกค้าและแก้ไขปัญหาอย่างทันท่วงที

- ผู้เชี่ยวชาญด้านไอที:บำรุงรักษาและจัดการโครงสร้างพื้นฐานด้านเทคโนโลยีของบริษัท เพื่อให้มั่นใจว่าแพลตฟอร์มการซื้อขายทำงานได้อย่างราบรื่นและปลอดภัย

- ผู้เชี่ยวชาญด้านการตลาด:พัฒนาและดำเนินกลยุทธ์การตลาดเพื่อดึงดูดและรักษาลูกค้าโดยใช้การตลาดดิจิทัล การสร้างเนื้อหา และการสร้างแบรนด์

- ผู้เชี่ยวชาญด้านการจัดการความเสี่ยง:ระบุ ประเมิน และบรรเทาความเสี่ยงที่เกี่ยวข้องกับปัจจัยด้านตลาด เครดิต การดำเนินงาน และสภาพคล่อง

การจัดทำขั้นตอนการปฏิบัติงาน

พัฒนาขั้นตอนการปฏิบัติงานที่ชัดเจนและครอบคลุม เพื่อเป็นแนวทางในการปฏิบัติงานประจำวันและสร้างความสอดคล้อง บันทึกขั้นตอนเหล่านี้ไว้ในคู่มือปฏิบัติงานที่ครอบคลุมทุกด้านของหน้าที่โบรกเกอร์ของคุณ ซึ่งรวมถึงกระบวนการซื้อขาย การรับลูกค้าใหม่ การตรวจสอบการปฏิบัติตามข้อกำหนด และระเบียบปฏิบัติการสนับสนุนลูกค้า

อธิบายขั้นตอนต่างๆ ที่เกี่ยวข้องกับการดำเนินการซื้อขาย ตั้งแต่การส่งคำสั่งซื้อขายไปจนถึงการชำระราคา เพื่อให้มั่นใจว่ากิจกรรมการซื้อขายทั้งหมดได้รับการติดตามและบันทึกเพื่อความโปร่งใสและเป็นไปตามข้อกำหนด กำหนดกระบวนการที่คล่องตัวสำหรับการรับลูกค้าใหม่ ตรวจสอบเพื่อยืนยันตัวตนของลูกค้า และประเมินความเสี่ยง ดำเนินการตรวจสอบการปฏิบัติตามข้อกำหนดอย่างสม่ำเสมอผ่านการตรวจสอบเป็นระยะ การติดตามธุรกรรม และการรายงานกิจกรรมที่น่าสงสัย พัฒนาระเบียบปฏิบัติสำหรับการจัดการข้อซักถาม ข้อร้องเรียน และข้อเสนอแนะของลูกค้า เพื่อให้มั่นใจว่าตัวแทนฝ่ายสนับสนุนลูกค้าได้รับการฝึกอบรมเพื่อให้บริการที่มีประสิทธิภาพและสุภาพ

การดำเนินการควบคุมภายใน

ดำเนินการควบคุมภายในที่เข้มงวดเพื่อเพิ่มประสิทธิภาพและสร้างความมั่นใจว่ามีการปฏิบัติตามกฎระเบียบ ป้องกันข้อผิดพลาด การฉ้อโกง และการไม่ปฏิบัติตามกฎระเบียบ ซึ่งรวมถึงการแบ่งแยกหน้าที่ความรับผิดชอบระหว่างพนักงานแต่ละคน เพื่อลดความเสี่ยงของข้อผิดพลาดและการฉ้อโกง ดำเนินการตรวจสอบภายในอย่างสม่ำเสมอเพื่อทบทวนกระบวนการ ระบุจุดอ่อน และรับรองการปฏิบัติตามนโยบายและกฎระเบียบ จัดทำระบบการติดตามและรายงานกิจกรรมอย่างต่อเนื่อง ซึ่งรวมถึงการติดตามกิจกรรมการซื้อขายแบบเรียลไทม์ การรายงานทางการเงินอย่างสม่ำเสมอ และการติดตามการปฏิบัติตามกฎระเบียบ

การฝึกอบรมและพัฒนา

ลงทุนในการฝึกอบรมและพัฒนาบุคลากรอย่างต่อเนื่อง การให้ข้อมูลอัปเดตเกี่ยวกับแนวโน้มอุตสาหกรรมล่าสุด การเปลี่ยนแปลงด้านกฎระเบียบ และความก้าวหน้าทางเทคโนโลยีแก่ทีมงานเป็นสิ่งสำคัญอย่างยิ่งต่อการรักษามาตรฐานการบริการและการปฏิบัติตามกฎระเบียบให้อยู่ในระดับสูง ส่งเสริมให้บุคลากรได้รับการรับรองมาตรฐานที่เกี่ยวข้องในอุตสาหกรรม เช่น นักวิเคราะห์การเงิน (CFA) สำหรับนักวิเคราะห์ทางการเงิน หรือใบรับรองผู้เชี่ยวชาญด้านการป้องกันการฟอกเงิน (CAMS) สำหรับเจ้าหน้าที่ปฏิบัติตามกฎระเบียบ เปิดโอกาสให้พนักงานพัฒนาตนเองผ่านการฝึกอบรมเชิงปฏิบัติการ สัมมนา และหลักสูตรออนไลน์ เพื่อช่วยให้พนักงานมีความรู้ความเข้าใจเกี่ยวกับแนวปฏิบัติที่ดีที่สุดและเสริมสร้างทักษะ มั่นใจว่าผู้เชี่ยวชาญด้านไอทีและบุคลากรที่เกี่ยวข้องอื่นๆ ได้รับการฝึกอบรมเกี่ยวกับเทคโนโลยีล่าสุดและมาตรการรักษาความปลอดภัยทางไซเบอร์ เพื่อปกป้องโครงสร้างพื้นฐานและข้อมูลลูกค้าของบริษัท

ข้อดีของการเลือกโซลูชัน White Label สำหรับนายหน้าของคุณ

การเลือกใช้ โซลูชันฉลากสีขาว อาจเป็นกลยุทธ์สำคัญในการเปิดบริษัทนายหน้าซื้อขายหลักทรัพย์ โซลูชัน White Label ช่วยลดต้นทุนการตั้งค่าเริ่มต้นได้อย่างมาก ด้วยแพลตฟอร์มที่พร้อมใช้งาน ช่วยให้คุณจัดสรรทรัพยากรได้อย่างมีประสิทธิภาพมากขึ้น ผู้ให้บริการเหล่านี้นำเสนอแพลตฟอร์มที่สร้างไว้ล่วงหน้าและเชื่อถือได้ ซึ่งสามารถปรับใช้งานได้อย่างรวดเร็ว ช่วยให้คุณเริ่มต้นดำเนินการและสร้างรายได้ได้เร็วขึ้น แพลตฟอร์มเหล่านี้มาพร้อมกับเทคโนโลยีและฟีเจอร์ที่ทันสมัย ซึ่งรวมถึงเครื่องมือการซื้อขายขั้นสูง การป้อนข้อมูลแบบเรียลไทม์ และมาตรการรักษาความปลอดภัยที่แข็งแกร่ง เพื่อสร้างประสบการณ์การซื้อขายคุณภาพสูงให้กับลูกค้าของคุณ

ผู้ให้บริการไวท์เลเบลหลายรายนำเสนอโซลูชันที่สอดคล้องกับมาตรฐานกฎระเบียบหลักๆ อยู่แล้ว ซึ่งช่วยลดความยุ่งยากของกระบวนการปฏิบัติตามกฎระเบียบ นอกจากนี้ คุณยังสามารถปรับแต่งแพลตฟอร์มให้สะท้อนถึงเอกลักษณ์ของแบรนด์ ช่วยสร้างการรับรู้และความไว้วางใจในแบรนด์ของลูกค้า ด้วยการดูแลด้านเทคนิคและกฎระเบียบจากผู้ให้บริการ คุณจึงสามารถมุ่งเน้นไปที่การตลาด การหาลูกค้า และการบริการลูกค้าได้อย่างเต็มที่

โซลูชัน White Label ออกแบบมาเพื่อปรับขนาดให้สอดคล้องกับธุรกิจของคุณ รองรับปริมาณการซื้อขายที่เพิ่มขึ้นและฟีเจอร์เพิ่มเติมตามการเติบโตของฐานลูกค้า ผู้ให้บริการยังให้การสนับสนุนและการบำรุงรักษาอย่างต่อเนื่อง เพื่อให้มั่นใจว่าแพลตฟอร์มยังคงทันสมัยและปลอดภัยอยู่เสมอ ด้วยการใช้โซลูชัน White Label คุณสามารถเปิดตัวโบรกเกอร์ของคุณได้อย่างมีประสิทธิภาพ พร้อมมอบสภาพแวดล้อมการซื้อขายที่เป็นมืออาชีพและแข่งขันได้ตั้งแต่เริ่มต้น แนวทางนี้ช่วยลดอุปสรรคในการเข้าสู่ตลาดและช่วยวางตำแหน่งบริษัทของคุณให้ประสบความสำเร็จในระยะยาวในตลาดการเงิน

บทสรุป

การเริ่มต้นบริษัทนายหน้าซื้อขายหลักทรัพย์ในปี 2567 จำเป็นต้องอาศัยการวางแผนอย่างพิถีพิถัน การปฏิบัติตามกฎระเบียบ และการดำเนินการเชิงกลยุทธ์ คุณสามารถสร้างความสำเร็จให้กับบริษัทนายหน้าซื้อขายหลักทรัพย์ได้ด้วยการทำความเข้าใจตลาด การลงทุนในเทคโนโลยี และการนำแนวทางการบริหารความเสี่ยงที่แข็งแกร่งมาใช้ ด้วยแนวทางที่ถูกต้องและพันธมิตร White Label ที่เหมาะสม บริษัทของคุณจะสามารถเติบโตในสภาพการแข่งขัน พร้อมมอบบริการอันทรงคุณค่าแก่เทรดเดอร์และนักลงทุนทั่วโลก

อัปเดต:

19 ธันวาคม 2567