Voltar

Contents

Castiçal do Enforcado: Definição e Táticas

Vitaly Makarenko

Chief Commercial Officer

Demetris Makrides

Senior Business Development Manager

O homem enforcado é um padrão de candlestick de reversão que prevê a mudança contínua do movimento de tendência de alta para o de tendência de baixa.

Principais conclusões:

- Como é um castiçal de homem enforcado?

- Como entender o padrão corretamente?

- Quais são os prós e os contras do padrão de velas do homem enforcado?

- Quais instrumentos e padrões são combinados com o homem enforcado?

- Como abrir ordens com base no padrão de velas do homem enforcado?

O que é um castiçal do homem enforcado?

O padrão de candlestick do homem enforcado se enquadra na categoria de padrões de reversão que aparecem no topo da tendência de alta e informam ao trader que o preço de um ativo se aproxima de uma barreira intransponível e que os touros estão exaustos o suficiente e não conseguem fazer o preço avançar.

Em um gráfico, o padrão se parece com um candlestick com um corpo pequeno e uma sombra inferior longa. É importante que a cor do candlestick não importe – um homem enforcado pode ser verde (altista) e vermelho (baixista); em ambos os casos, o padrão se refere a padrões de reversão de baixa.

Ao observar o padrão, ele se assemelha a um homem enforcado com pernas balançando; é por isso que o padrão de velas recebe esse apelido.

Características de um castiçal de homem enforcado

Aqui estão as características mais comuns que ajudam os traders a identificar um candlestick do homem enforcado:

- O padrão aparece apenas no topo da tendência de alta.

- Um pequeno corpo de vela é formado no topo da faixa de preço.

- A sombra superior do candle deve estar ausente ou quase imperceptível.

- A sombra inferior do candle deve ser pelo menos duas vezes maior que seu corpo.

Além disso, um trader precisa entender que quanto menor for o corpo do candle e quanto maior for sua sombra inferior, mais forte será o sinal de reversão.

Esse padrão de velas pode aparecer em diferentes mercados financeiros e em diversos períodos de tempo.

Observação! Um trader pode encontrar o mesmo candlestick no fundo da tendência de baixa. Com um corpo pequeno, uma sombra superior quase imperceptível e uma sombra inferior longa, este candlestick tem outro apelido: "Martelo". A diferença entre um candlestick do homem enforcado e um candlestick do martelo reside apenas na posição em que o padrão aparece.

Quando aparece o padrão de vela do Enforcado?

Esse padrão de candlestick significa que a tendência de alta chegou ao fim e prevê uma reversão de tendência em andamento. No entanto, o padrão em si não é uma indicação 100% segura de que o preço de um ativo mudará sua direção de movimento. Os traders precisam encontrar alguma confirmação da reversão da tendência.

Por exemplo, um candlestick do homem enforcado pode aparecer como parte do padrão "Estrela da Noite", o padrão de baixa de três candlesticks. Além disso, os traders também podem identificar outros padrões, como "Estrela Cadente" e "Engolfo de Baixa", juntamente com um candlestick do homem enforcado.

Explicação psicológica da aparência do padrão

Do ponto de vista psicológico, a abertura das negociações começa nas máximas. Em um dia, os vendedores exercem pressão significativa sobre o preço de um ativo, o que leva a vendas no início e no meio do dia. Ao final da sessão, os compradores recuperam suas posições de alguma forma. Ao mesmo tempo, apesar dos contra-ataques otimistas, o mercado está sob o controle dos vendedores.

A situação de mercado mencionada acima é uma explicação clara do que acontece quando um trader identifica um candle de homem enforcado em um gráfico.

Caso o próximo negociação diária Se a abertura for abaixo do corpo de um candlestick do homem enforcado, significa que muitos participantes do mercado enfrentam perdas. O padrão é entendido como um sinal para o fechamento de posições. Consequentemente, fechamentos e liquidações ocorrem, levando a uma queda mais acentuada dos preços. Como resultado, a tendência de alta se transforma em tendência de baixa.

A combinação de um castiçal de homem enforcado com outros padrões

Traders profissionais se acostumam a buscar confirmações antes de abrir uma posição. Quais são as confirmações para o padrão do homem enforcado?

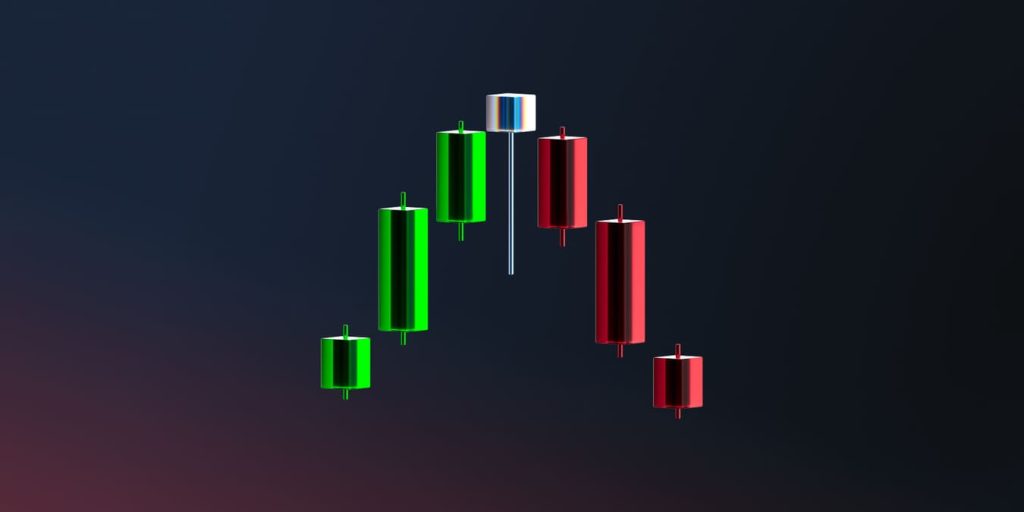

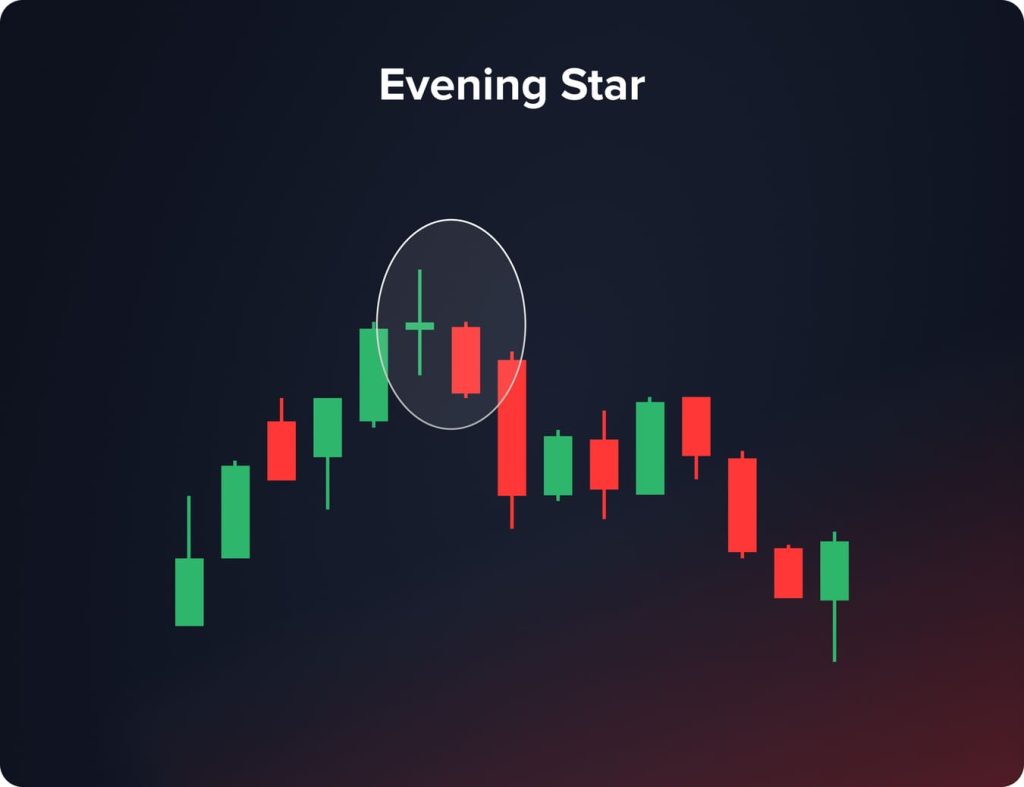

O Padrão da Estrela da Tarde

Antes de mais nada, precisamos entender em que consiste o padrão da estrela vespertina. É o padrão de três velas.

- O primeiro candle é longo e de alta.

- O segundo candle tem corpo curto e pode ser tanto de alta quanto de baixa. Ele reflete a incerteza do mercado.

- O terceiro candle é marcado por um longo corpo de baixa.

Um candlestick do homem enforcado pode aparecer como o segundo elemento do padrão estrela da noite. Nesse caso, esse padrão é considerado um forte sinal de reversão de tendência futura.

O Padrão de Topo Duplo

Topo duplo é outro poderoso padrão de baixa que se forma quando o preço de um ativo atinge seu pico máximo duas vezes e depois se move na direção oposta. Quando comparado a outros padrões gráficos, o topo duplo pode incluir múltiplas velas. Em um gráfico, você pode identificar o W invertido.

Quando velas do homem pendurado aparecem dentro do padrão de topo duplo, o sinal de reversão é excepcionalmente forte.

A combinação de um homem enforcado com Marubozu de baixa e Harami de baixa

Uma vela Marubozu de baixa é uma vela com um corpo longo que aparece logo após o movimento de tendência de alta.

Harami é mais um candle de reversão marcado por uma pequena queda no preço. Quando se fala em Harami de baixa, o candle é verde e segue ao lado do candle vermelho.

E quanto ao papel do candlestick do homem enforcado? Ele pode aparecer após um Marubozu de baixa e um Harami de baixa. Essa combinação informa aos traders que a tendência será alterada para descendente.

Características que Fortalecem o Padrão de Vela do Homem Enforcado

Além das combinações do candlestick do homem enforcado com outros padrões gráficos, existem alguns fatores que fortalecem esse sinal. Quais são esses fatores?

- Quando há uma lacuna entre uma vela do homem enforcado e uma vela anterior, a reversão da tendência é mais óbvia. Quanto maior essa lacuna, mais provável é o movimento de reversão.

- A sombra superior de um candlestick do homem enforcado deve estar ausente ou ser excepcionalmente curta. No modelo tradicional do padrão, o candlestick não tem sombra superior.

- O tamanho do corpo de uma vela importa. Quanto menor o corpo, mais forte é o sinal de reversão.

- O comprimento da sombra inferior também importa. A sombra inferior deve ser pelo menos duas vezes maior que o corpo de uma vela. Quanto maior a sombra inferior, mais forte é o sinal.

- O potencial do movimento de baixa depende diretamente da tendência de alta anterior. Quanto mais agressivo o movimento de alta anterior, maior o potencial dos vendedores após o surgimento do candlestick do homem enforcado.

- Por outro lado, a cor do castiçal do homem enforcado não importa. O padrão pode ser verde ( otimista ) e vermelho (de baixa), mas, por outro lado, um candle de baixa é um sinal muito mais forte que indica uma forte pressão dos vendedores no mercado.

Prós e contras de um castiçal de enforcamento

Entre as principais vantagens do padrão destacam-se:

- Um candle de homem enforcado ajuda os traders a encontrar o melhor ponto de reversão para abrir posições.

- O padrão é muito mais eficaz em prazos maiores (por exemplo, prazos H4 ou D1).

- O padrão do homem enforcado se enquadra na categoria de padrões de reversão clássicos que foram aplicados na prática diversas vezes; é por isso que a precisão de seus sinais é muito maior quando comparado a outros modelos.

- Na maioria dos casos, esse padrão é eficaz o suficiente sem quaisquer outros sinais adicionais. Enquanto isso, traders conservadores confiam em alguns sinais mais baixistas antes de abrir uma posição.

Quais são os pontos fracos de um castiçal do homem enforcado?

- O padrão pode fornecer sinais falsos aos traders, especialmente quando se trata de prazos baixos.

- Antes de abrir uma posição com base no padrão de velas do homem enforcado, os traders precisam entender todo o contexto do mercado.

- Os traders podem interpretar esse padrão subjetivamente, pois cada trader determina a força e a importância do padrão por conta própria.

Indicadores técnicos para confirmar o padrão do homem enforcado

Além dos padrões gráficos, traders profissionais utilizam amplamente indicadores técnicos que confirmam o sinal emitido pelo candlestick do homem enforcado. Aqui estão os principais indicadores de reversão:

- RSI (Índice de Força Relativa). O indicador mede a velocidade e a variação dos movimentos de preços, variando de 0 a 100. Com base nas medições do RSI, os traders entendem se um ativo está sobrecomprado ou sobrevendido.

- MACD ( Média Móvel Convergência Divergência). Tal indicador mostra a interdependência entre as duas MMs e a ilustra como um histograma.

- Estocástico. É um instrumento oscilador que compara os preços de fechamento de um ativo com seus preços em um determinado período.

Etapas principais para identificar o padrão no gráfico

Vamos analisar como identificar esse padrão no gráfico. Como exemplo, usamos o gráfico do preço do Brent e o período diário (D1).

Etapa 1. Identifique a tendência de alta atual

Acima de tudo, precisamos encontrar a tendência de alta bem formada. Use análise tecnológica ou outros padrões gráficos para garantir que o preço de um ativo esteja se movendo dentro da tendência de alta.

Passo 2. Encontre um castiçal de homem enforcado

Quando a tendência de alta é identificada, precisamos encontrar o padrão do homem enforcado em seu topo. Vemos o candlestick do homem enforcado no topo da tendência de alta. O candlestick tem uma sombra superior quase imperceptível, um corpo médio e uma sombra inferior longa. A cor do candlestick é verde; é por isso que o sinal não é forte o suficiente.

Etapa 3. Obtenha a confirmação do sinal e abra uma posição

Não importa quão forte seja o sinal, os traders profissionais precisam encontrar a confirmação por meio de outros padrões ou instrumentos técnicos de reversão.

Por exemplo, adicionamos o instrumento RSI para entender se uma vela de homem enforcado nos dá um sinal verdadeiro ou falso.

O instrumento mostra a medição de 61,61; é por isso que concluímos que o ativo está de alguma forma sobrecomprado. Juntamente com o indicador RSI, o sinal dado pelo candlestick do homem enforcado é muito mais forte.

Qual é o melhor ponto de entrada para abrir uma posição? Traders profissionais recomendam obter a confirmação ilustrada pelo próximo candle de baixa e, em seguida, abrir uma posição. Defina seu stop-loss para o nível superior do corpo do castiçal do homem enforcado. Quanto ao obter lucro instrumento, pode-se colocá-lo no nível de resistência mais próximo.

O resultado final

O padrão "Enforcado" é um padrão de reversão tradicional que fornece aos traders um sinal forte, prevendo a mudança contínua de uma tendência de alta para uma tendência de baixa. O padrão em si é bastante forte, especialmente em prazos mais altos, mas traders profissionais preferem confirmar o sinal com a ajuda de padrões adicionais e indicadores técnicos.

FAQ

O Enforcado se enquadra na categoria de padrões de reversão tradicionais; é por isso que os sinais emitidos por esse padrão estão entre os mais fortes. No entanto, traders profissionais recomendam confirmar os sinais com padrões e instrumentos adicionais.

Um candlestick do homem enforcado pode fazer parte do Estrela da Noite ou do Topo Duplo, que são padrões de reversão fortes. Quanto aos indicadores técnicos, o padrão pode ser confirmado por instrumentos RSI, MACD e Estocástico.

O padrão é excepcionalmente eficaz em todos os mercados financeiros. Quanto aos prazos, recomenda-se que os traders utilizem prazos maiores, começando pelo de 4 horas.

Atualizado:

3 de fevereiro de 2025