What is Stop Loss (SL) and Take Profit (TP) and How to Use It?

Contents

Most traders fail, not because of bad picks, but because they don’t watch their risk. That’s where Stop Loss (SL) and Take Profit (TP) orders are useful.

Consider them your safety net:

- SL stops big losses.

- TP makes sure you secure your gains before the market goes south.

Turns out, about 88% of day traders use stop-loss orders to keep their risk in check and protect their money. On the other hand, Capital.com did this study and found that most traders who skip stop-loss strategies, like 60% of them, were far less successful. Only 44% actually made money. So, using stop-loss isn’t just about following the rules; it’s about sticking around in the trading game for the long haul.

So, if you don’t use SL and TP, you’re gambling. If you do, you’re trading with discipline.

I would add a simple visual here, ideally a bar chart or donut chart. It would compare the percentage of traders who use stop losses versus those who don’t. For example, the chart could show that 88% of traders actively use stop-loss orders, while among those who don’t, only 44% end up profitable.

Key Takeaways

- A stop loss (SL) order allows you to limit your loss by automatically closing your position when the price falls below a specified level.

- A take profit (TP) order allows you to take your profits at a predetermined price point based on the market’s movement toward your target.

- Using SL and TP orders helps keep emotions out of trading and stresses the importance of having a disciplined approach to your trades.

- When the risk-to-reward ratio is favorable, trades can have a greater likelihood of being profitable, regardless of how often they win.

- The SL and TP should be established before entering any trade.

- Reliance on SL and TP orders to manage one’s trading activity makes it a structured and rule-based process rather than a speculative or gambling activity.

What is Stop Loss (SL)

A stop loss is like a safety net for your trades. It automatically closes a trade if the price moves against you to a certain point.

Say you buy EUR/USD at 1.1000 and set your stop loss at 1.0950. If the price drops to 1.0950, your broker will close the trade, so you only lose 50 pips. This type of protection is especially important in leveraged Forex markets, where volatility and position sizing heavily influence outcomes.

Here’s how to figure out your stop loss price:

Formula:

Stop Loss Price (Long) = Entry Price – Allowed Loss (in pips)

Stop Loss Price (Short) = Entry Price + Allowed Loss (in pips)

Why is it useful?

- It helps keep you from losing all your money.

- It takes emotions out of trading (Maybe it will come back up).

- It lets you decide exactly how much you’re willing to risk on each trade.

What is Take Profit (TP)?

A Take Profit is the opposite of a Stop Loss. It automatically locks in your profits.

For example, you buy EUR/USD at 1.1000. You set your TP at 1.1100. If the price goes up to that level, your broker closes the trade and you keep 100 pips in profit.

Formula:

TP Price (Long) = Price you bought at + How many pips you want to gain

TP Price (Short) = Price you sold at – How many pips you want to gain

Why is it useful?

- It makes sure you don’t lose the money you’ve made if the market changes direction.

- It helps you stay on track with your trading strategy.

- It can improve how steady your profits are in the long run.

You may also like

Differences between SL and TP

Purpose

- SL aims at restricting the loss and closing an adverse market.

- TP aims at securing the profits and closing a favourable trade.

Order Type

- Generally, SL employs the market type of orders, which are executed almost instantly; the disadvantage could be slippage in the execution.

- TP is a limit order to make sure a target price is received but does not fill in all scenarios.

Time Horizon

- SL is helpful for day trades or short-term swing trades that must ensure an exit from the position.

- TP can be applicably used in position trades where one’s positions are held for multiple timeframes.

Trailing Usage

- Trailing stop losses dynamically adjust the price barrier as favourable price action occurs.

- Trailing profits may not be as common since gains are to be secured at predetermined levels.

Risk Profile

- SL helps prevent small losses from transforming into drastic drawdowns if a trade reverses.

- TP allows one to take some profits but still holds on to some upside in case the price ventures into more significant gains.

Psychology

- SL ensures discipline and removes the emotion of cutting damaging positions, underpinning the importance of mastering trading psychology.

- TP targets lock in at least some gains to feel successful rather than greedy for maximum profit.

In summary: whereas both are risk management tools, SL focuses on downside protection by guaranteeing exits on deterioration; on the other hand, TP aims to secure upheld gains at optimal levels according to the original analysis and plan. Their roles are interlinked but distinct in their purposes.

Comparison Summary

| Feature | Stop Loss | Take Profit |

| Purpose | Limit losses | Secure profits |

| Order Type | Market order | Limit order |

| Psychology | Cuts fear | Controls greed |

| When Used | Anytime | In winning trades |

| Impact | Protects capital | Locks in gains |

You may also like

Pros of Stop Loss Orders

Flexible

Stop-loss orders give traders flexibility. With fancy ones like trailing stops, the stop price moves as the market goes your way. This protects your earnings without locking you into one exit point, so you can roll with the punches, get the most gains and keep risk in check.

No Feelings Involved

Stop-losses keep feelings out of trades. Once your exit is set, the trade closes itself: no doubts, no freak-outs, and no hoping it gets better. This helps you stick to your trading plan instead of letting feelings mess things up.

Risk Control

A stop-loss is a helpful risk control tool. It limits losses and keeps small issues from becoming big problems. Knowing your risk limit builds trust and protects your trading.

Saves Time

With stop-losses set, you don’t have to watch charts all day. Your exits happen on their own, so you have time to think, make plans, and look for new chances instead of watching trades non-stop.

Cons of Stop-Loss Orders

Execution Risks

In crazy, fast markets, prices can jump past your profit target. This could mean your order only gets partly filled, or you get a worse price than you wanted. Sometimes, your order might go off too soon, stopping your profits before they max out.

Rigidity

Profit-taking orders are set in stone. That gives some order, sure, but it’s not great when things change fast. If the market flips, your goal might be hit too quickly, ending the trade before it could have made more money.

Missed Chances

A profit order can hold you back. If you leave at a certain point, you might miss out on way bigger gains if the market keeps going your way. This can be annoying, making you wonder what if, especially when a trend just keeps going and going.

Pros of Take Profit Orders

Risk-Reward Management

Take-profit orders are great because they keep your risk and potential gains in check. When you set goals ahead of time, your trades get better, and you have a better shot at doing well later on. This way, you can put your attention on good trades and not just run after everything that goes on in the market.

Secure Your Gains

With a take-profit order, you automatically get the cash. Instead of staying in a good trade for too long and risking a loss, you get your money at the level you picked. This keeps your funds safe and sound as you figure out what to do in the future.

Cons of Take-Profit Orders

Execution Risks

Take-profit orders can get hit by market gaps or sudden price changes that jump over your set level. This may result in a partially closed position and hence you miss out on the full extent of the favorable price action that you were anticipating. In volatile markets, your take-profit level may trigger too quickly and will not allow you to fully capture the upside of a move before closing the position.

Rigidity

Take-profit orders can be rigid, which may prove to be a drawback in some markets. They provide a structured way to exit but may not fit into the fixed levels under changing market dynamics. In the case of a highly volatile environment, a take-profit order might get executed too early and miss further profits.

Lost Opportunities

Another disadvantage of take-profit orders is missing out on bigger gains. A take profit set at a certain level may close a position too early and therefore miss out on further profits. This can frustrate you if the market moves in the direction you first traded, leaving you in regret for the gains that were never realized.

How To Calculate Stop Loss and Take Profit Levels

With the basics understood, the next important question is how to determine optimal levels for stop loss and take profit placement. There are a few approaches, often used together for robust confirmation:

Support and Resistance

Looking for areas on the price chart with the highest trading volumes offers insight into zones that have acted as barriers in the past. Traders typically place protective stops below recent support zones breached on larger time frames like the daily or weekly. Take profits are then set at the next resistant target. These zones often act as reference points across indicator-driven strategies.

Moving Averages

Simple or exponential moving averages (SMA/EMA) are trend-following indicators that smooth out price action. Breaks and retests of a longer term SMA like the 50-period can provide guideposts for SLs, while shorter MA crossovers help with TPs.

Fibonacci Retracements

By drawing Fibonacci retracement levels between the extremes of a significant move on the chart, these define potential pullback areas in percentages (38.2%, 50%, 61.8%). SLs are placed below key Fib levels on larger retracements to maintain position.

Percentage Based

This simplistic approach fixes SL at a set percentage below entry, like 3-5%, to control risk. Conversely, TP levels are targeted 2-3x the risk amount to achieve an acceptable risk:reward.

A trader must weigh each method, always incorporating the overall market context and their personal risk tolerance. The goal is to establish a logical, consistent system for calculating dynamic SL and TP levels on each trade. This makes for a far more rewarding trading experience in the long run.

Importance of Risk-Reward Ratio

Calculating a trade’s risk-reward ratio is an important part of determining appropriate stop loss and take profit levels. The ratio compares the potential reward from a trade to the amount of risk undertaken. Traders aim to structure positions where the expected profit significantly outweighs any maximum possible loss.

A risk-reward ratio of 1:2 or 1:3 means the first take profit target is double or triple the distance from the entry price to the stop loss level. Understanding this ratio helps identify trades presenting an asymmetrical payoff should the original analysis prove accurate.

The risk-reward ratio is calculated using a simple formula:

RRR = Potential Profit / Potential Loss

For example,

Entry = $100

SL = $95 (Risk = $5)

TP = $110 (Reward = $10)

RRR = 10 / 5 =2: 1

The risk-reward ratio is calculated using a simple formula that divides the potential reward by the potential risk. For example, with an entry at $100, a stop loss at $95, and a first target at $105, the risk is $5 (Entry – Stop Loss) and the reward is $10 (Take Profit – Entry).

Plugging these numbers in gives a risk-reward ratio of 2:1. Targeting positions with favourable ratios emphasizes preserving capital while maintaining upside potential. Consistently focusing on trades with larger anticipated rewards compared to defined risks can produce a highly positive expectancy over numerous rounds.

Selecting entry points and accompanying stop loss and take profit levels directly impacts a trade’s risk-reward profile. Thorough back-testing can provide valuable statistics on which price levels tend to balance long-term viability with probabilistic outcomes.

Overall, comprehending risk-reward allows structuring activities for advantage probabilities that compound over the long run through reinvestment of profits and retention of capital. This steady optimization of processes eventually compounds wealth successfully over extended periods.

SL/TP Checklist

To ensure accuracy and consistency in your trades, be sure to check the following items:

- Entry Price is clearly outlined.

- Stop Loss is placed logically and not by chance.

- Take Profit is placed at levels of resistance, trending structure or your personal risk/reward target.

- The amount you risk on the trade (usually 1-2% of your capital) is within your own acceptable limits.

- You want to have a Risk/Reward ratio of at minimum 1:2.

- As soon as you open the package for your trade you must place Stop Loss and Take Profit orders.

- When you are missing any of these criteria, your trade is not yet ready.

Stop Loss and Take Profit Examples by Trading Style

Different trading styles use different SL and TP placement. Using the same SL and TP rules across different trading strategies will most likely lead to poor results.

Day Trading

- Tight SL is placed near intraday support or resistance.

- The TP target is typically close to liquidity zones or short-term price extensions.

- The trade is typically closed on the same day.

- Day trading usually has risk-to-reward ratios of 1:1.5 to 1:3.

Swing Trading

- SL is set just beyond the higher time frame support and resistance.

- TP targets are typically for multi-day or multi-week price targets.

- Positions are usually open 3-7 days up to 3-4 weeks.

- Swing trades typically have risk-to-reward ratios of at least 1:2.

Scalping

- Scalping usually involves much tighter stop losses because of smaller price targets.

- The target is to make small incremental gains, usually multiple times per day.

- The high frequency of trades requires a high degree of accuracy and stringent discipline.

Position Trading

- Stop loss will typically be much wider to allow for fluctuations related to longer-term price movements.

- Take profit targets are typically for extensions of significant trends or price levels driven by macro events.

- Much longer holding periods for positional trades (3-4 weeks to several months).

- Positional trades focus on capturing the larger price movement versus taking many trades in a short period of time.

How To Use SL/TP in Your Trading Plan

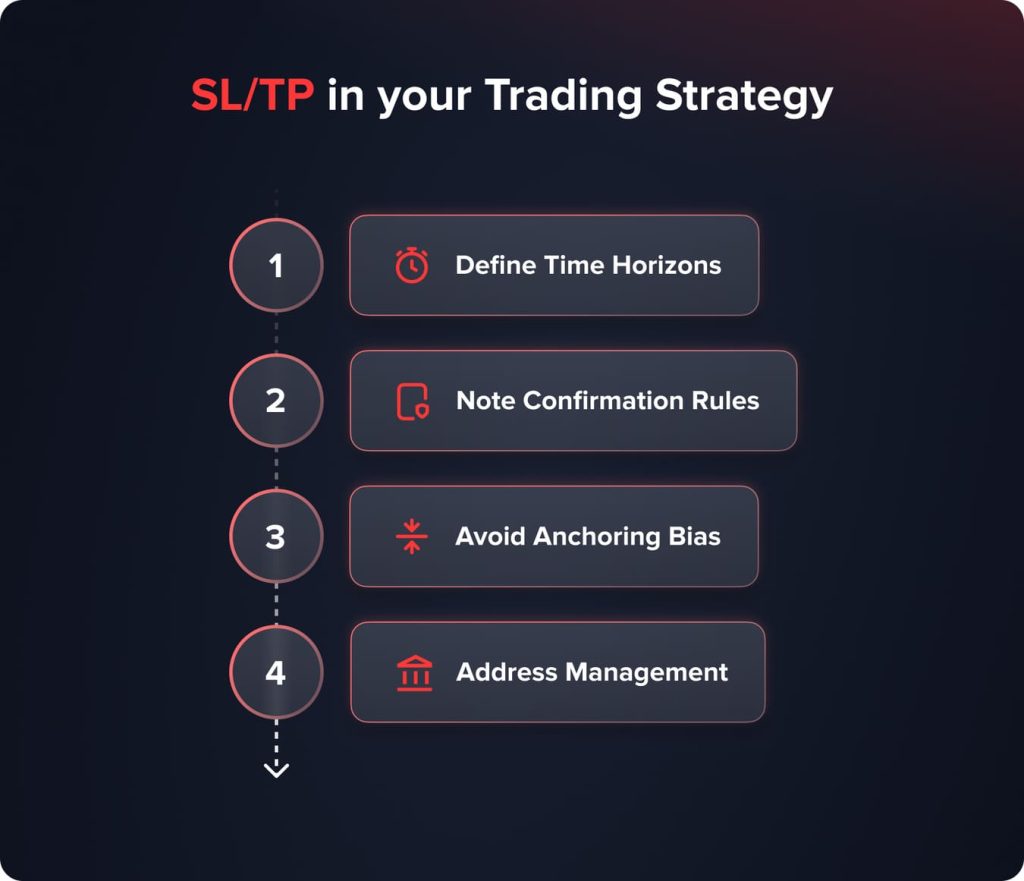

Now that we’ve explored various considerations behind level placement, it’s crucial to outline exactly how these orders will fit into one’s overall trading strategy and plan. This clarity minimizes emotional decision-making and guides exit based purely on the initial technical or fundamental factors triggering the trade. Some important factors:

- Define Time Horizons: Will this be a short-term scalp or swing trade held for weeks? Set SL/TP expectations accordingly on smaller versus larger timeframes.

- Note Confirmation Rules: How many indications like moving average crossovers are required before entering? Add guidelines on when to tighten stops or take partial profits.

- Avoid Anchoring Bias: Don’t stubbornly cling to initial levels if markets move considerably against the position. Be ready to adjust promptly vs. bigger losses.

- Address Management: Will orders be trailed manually or using automatic features? Know the rules for partial closes or adding to winners.

Importantly, place orders passively without adjustment once in the trade. This removes subjective feelings from the equation completely. Stick diligently to the trading plan and its rules come what may. Over time, a positive expectancy should result.

When to Adjust Stop Loss and Take Profit

It is important to not adjust your stop loss and take profit levels impulsively. There are circumstances where it makes sense to amend these levels based on price move, support & resistance levels forming on the charts post entry & strategy rules.

There are several reasons why it is acceptable to adjust your stop loss and/or take profit levels after entering into a position:

- When a new support/resistance level is created after entering a trade.

- When price structure changes e.g. Higher Low (HL) – Up Trend / Lower High (LH) – Down Trend.

- Major news announced, & elevated volume leads to large price fluctuation (increased volatility).

- Trailing your stop in order to lock in unrealized profits.

- Partially profits as per your trading plan.

Avoid moving your stop loss further away from the entry point to avoid being stopped out; this only increases risk and turns a controlled/loss into an uncontrolled/loss.

How To Avoid Common Mistakes When Using SL/TP?

While SL and TP are cornerstones of risk management, some traders still struggle with various behavioural biases:

- Chasing Losses: Being stubborn about weak positions and moving stops progressively farther to avoid taking the loss. Cut losses short aggressively instead.

- Taking Early Profits: Not letting winners run according to the original system. Resist booking small gains too readily, and let targets be actioned.

- Not Using Stops: Believing self-control is enough but emotional involvement changes perception of the trade. Protective orders are a must for all positions.

- Scaling out of Position Sizes: Rather than a single, risky all-or-nothing trade size, scale in and out incrementally with partial closes to bank profits safely.

By pre-empting these tendencies, traders can stay focused on the execution of their strategy and reach their performance goals over many months of consistent trading. Discipline and patience with the process are absolute requirements for long-term success.

Myths on Stop Loss and Take Profit

- “I will close the trade manually.”

Many traders are emotional, they hesitate or panic rather than execute based on their trading plan.

- “Having a very tight stop is less risky because the price won’t move against me as much.”

Your stop loss placement must reflect how volatile the markets are. A tight stop can be easily triggered by normal price fluctuations found in intraday trading. If you place a stop that is too tight, you will be stopped out many times due to the normal price noise.

- “The market stopped me out, so I was right.”

Getting stopped out of your trade reflects poor stop placement on your part, not bad luck or market manipulation.

- “I can make back everything I have lost with one large win.”

Long-term trading success is achieved by consistently managing your risk and losses, not by one single large win.

Advanced Stop Loss and Take Profit Strategies

While the basics should not be overlooked, more nuanced approaches can further optimize risk/reward profiles:

Trailing Stops

As winning trades progress favourably, trailing stops dynamically ride the trend higher to lock in increasing profits but cut losses early on pullbacks. Manual or auto options exist.

Multiple Time Frame Analysis

Higher time frames give a strategic macro view while lower frames provide intraday trade entries. Filter trades through converging signals across periods.

Bracket Orders

Use a combination of SL/entry and entry/TP levels to systematically scale into winning positions for a more flexible risk profile.

Swing Vs Day Trading SL/TP

Swing trades held 1-5 days require wider dynamic SL placements versus day trades exiting the same session. Adjust accordingly per style.

Hedging Strategies

Offset long versus short positions in correlated assets to neutralize sector risk through delta-neutral portfolios. Protects against sudden reversals.

Case studies demonstrate integrating such multi-layered approaches in practice. With experience, traders gain a sixth sense of opportunistic exits and entries that amplify returns. But foundations must first be grounded in discipline, preparation and proven basic strategies.

Conclusion

Stop-loss and take-profit orders are not extras – they’re a must-have.

- They keep your money safe.

- They make sure you get your profit.

- They help you trade without feelings getting in the way.

What makes a good trader different from someone just gambling? Often, it’s using stop-loss and take-profit orders every time, without fail.

FAQ

A stop loss closes a trade when market conditions are unfavorable, preventing further losses, while a take profit closes a trade once the trader has reached their desired profit target.

Yes, it is strongly advisable for traders to use a stop loss each time they trade. Trading without a stop loss leaves traders vulnerable to unlimited downside potential; thus, it exposes an account to potentially significant financial loss, particularly in times of extreme market volatility or rapid price movement.

A trader does not have to set a take profit but is strongly encouraged to do so to help ensure the trader realizes a finite amount of potential profit while avoiding holding onto winning trades for too long due to possible market reversals.

Typically, traders seek to have a risk to reward ratio of at least (1:2) for taking profits, indicating that the trader expects to earn at least double the amount that he/she is risking. This enables the trader to make a profit, even if he/she has a lower success rate.

Updated:

December 24, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]