¿Qué es el Stop Loss (SL) y el Take Profit (TP) y cómo se utiliza?

Contenidos

La mayoría de los traders fracasan, no por malas elecciones, sino porque no vigilan su riesgo. Ahí es donde las órdenes de Stop Loss (SL) y Take Profit (TP) son útiles.

Considéralos tu red de seguridad:

- SL detiene grandes pérdidas.

- TP se asegura de que asegures tus ganancias antes de que el mercado caiga.

Resulta que, alrededor del 88% de los traders diarios utilizan órdenes de stop-loss para mantener su riesgo bajo control y proteger su dinero. Por otro lado, Capital.com realizó este estudio y descubrió que la mayoría de los traders que omiten estrategias de stop-loss, como el 60% de ellos, fueron mucho menos exitosos. Solo el 44% realmente ganó dinero. Así que, usar stop-loss no se trata solo de seguir las reglas; se trata de mantenerse en el juego del trading a largo plazo.

Entonces, si no usas SL y TP, estás apostando. Si lo haces, estás operando con disciplina.

Agregaría un visual simple aquí, idealmente un gráfico de barras o un gráfico de dona. Compararía el porcentaje de traders que utilizan stop losses versus aquellos que no lo hacen. Por ejemplo, el gráfico podría mostrar que el 88% de los traders utilizan activamente órdenes de stop-loss, mientras que entre aquellos que no lo hacen, solo el 44% termina siendo rentable.

Conclusiones Clave

- Una orden de stop loss (SL) te permite limitar tu pérdida cerrando automáticamente tu posición cuando el precio cae por debajo de un nivel especificado.

- Una orden de toma de ganancias (TP) te permite tomar tus ganancias en un punto de precio predeterminado basado en el movimiento del mercado hacia tu objetivo.

- El uso de órdenes SL y TP ayuda a mantener las emociones fuera del trading y destaca la importancia de tener un enfoque disciplinado en tus operaciones.

- Cuando la relación riesgo-recompensa es favorable, las operaciones pueden tener una mayor probabilidad de ser rentables, independientemente de cuán a menudo ganen.

- El SL y el TP deben establecerse antes de entrar en cualquier operación.

- La dependencia de órdenes de SL y TP para gestionar la actividad de trading de uno convierte el proceso en algo estructurado y basado en reglas, en lugar de ser una actividad especulativa o de apuestas.

¿Qué es el Stop Loss (SL)?

Un stop loss es como una red de seguridad para tus operaciones. Cierra automáticamente una operación si el precio se mueve en tu contra hasta un cierto punto.

Supongamos que compras EUR/USD a 1.1000 y estableces tu stop loss en 1.0950. Si el precio cae a 1.0950, tu bróker cerrará la operación, por lo que solo perderás 50 pips. Este tipo de protección es especialmente importante en los mercados Forex con apalancamiento, donde la volatilidad y el tamaño de las posiciones influyen en gran medida en los resultados.

Aquí está cómo determinar tu precio de stop loss:

Fórmula:

Precio de Stop Loss (Largo) = Precio de Entrada - Pérdida Permitida (en pips)

Precio de Stop Loss (Corto) = Precio de Entrada + Pérdida Permitida (en pips)

¿Por qué es útil?

- Te ayuda a evitar perder todo tu dinero.

- Elimina las emociones del trading (Quizás vuelva a subir).

- Te permite decidir exactamente cuánto estás dispuesto a arriesgar en cada operación.

¿Qué es Take Profit (TP)?

Un Take Profit es lo opuesto de un Stop Loss. Automáticamente asegura tus ganancias.

Por ejemplo, compras EUR/USD a 1.1000. Fijas tu TP en 1.1100. Si el precio sube a ese nivel, tu bróker cierra la operación y tú mantienes 100 pips de beneficio.

Fórmula:

TP Precio (Largo) = Precio al que compraste + Cuántos pips deseas ganar

TP Precio (Corto) = Precio al que vendiste - Cuántos pips quieres ganar

¿Por qué es útil?

- Asegura que no pierdas el dinero que has ganado si el mercado cambia de dirección.

- Te ayuda a mantenerte en el camino con tu estrategia de trading.

- Puede mejorar la estabilidad de tus ganancias a largo plazo.

También te puede gustar

Diferencias entre SL y TP

Propósito

- SL tiene como objetivo restringir la pérdida y cerrar un mercado desfavorable.

- TP tiene como objetivo asegurar las ganancias y cerrar un comercio favorable.

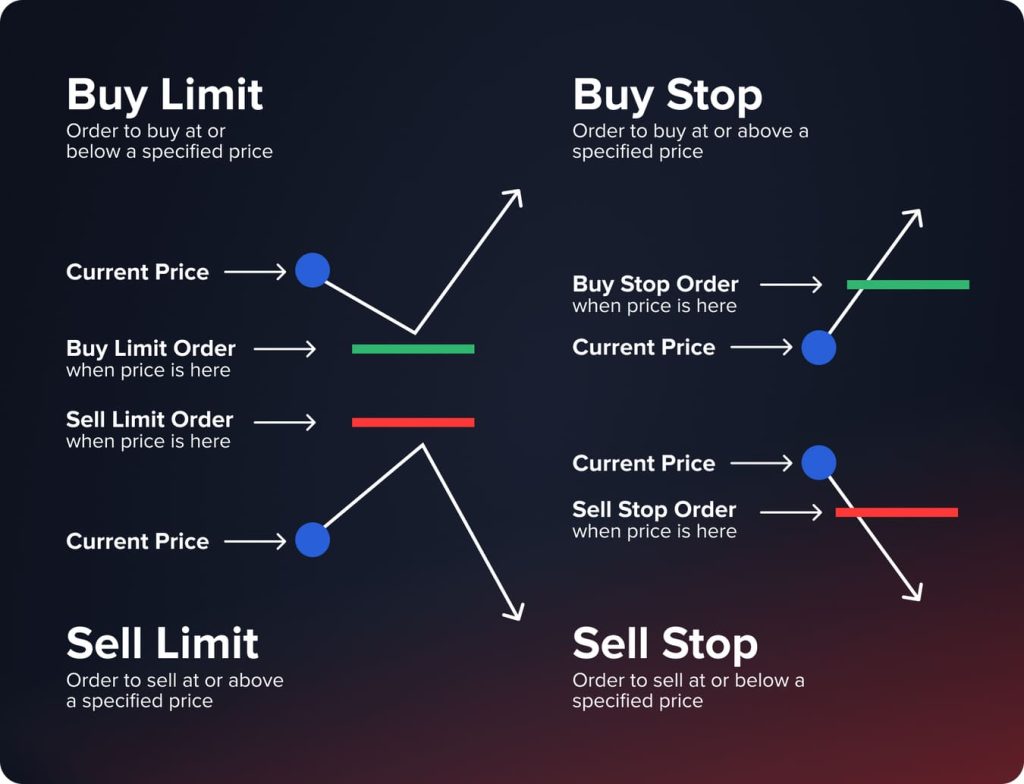

Tipo de Pedido

- Generalmente, SL emplea el tipo de órdenes de mercado, que se ejecutan casi al instante; la desventaja podría ser deslizamiento en la ejecución.

- TP es una orden limitada para asegurarse de que se reciba un precio objetivo, pero no se llena en todos los escenarios.

Horizonte Temporal

- SL es útil para operaciones diarias o operaciones de corto plazo que deben asegurar una salida de la posición.

- TP se puede utilizar de manera aplicable en operaciones de posición donde las posiciones de uno se mantienen durante múltiples marcos de tiempo.

Uso de Trailing

- Las órdenes de stop loss dinámico ajustan la barrera de precio a medida que ocurre una acción de precio favorable.

- Las ganancias de seguimiento pueden no ser tan comunes ya que las ganancias deben asegurarse en niveles predeterminados.

Perfil de Riesgo

- SL ayuda a prevenir que pequeñas pérdidas se transformen en drásticas caídas si una operación se invierte.

- TP permite tomar algunas ganancias pero aún mantiene algo de potencial en caso de que el precio se avente en ganancias más significativas.

Psicología

- SL asegura disciplina y elimina la emoción de cortar posiciones dañinas, subrayando la importancia de dominar la psicología del trading.

- Los objetivos de TP aseguran al menos algunas ganancias para sentirse exitosos en lugar de codiciosos por el máximo beneficio.

En resumen: mientras que ambos son herramientas de gestión de riesgos, SL se centra en la protección ante pérdidas garantizando salidas en caso de deterioro; por otro lado, TP tiene como objetivo asegurar ganancias mantenidas en niveles óptimos de acuerdo con el análisis y plan original. Sus roles están interconectados pero son distintos en sus propósitos.

Resumen de Comparación

| Característica | Stop Loss | Take Profit |

| Propósito | Limitar pérdidas | Asegurar ganancias |

| Tipo de Orden | Orden de mercado | Orden limitada |

| Psicología | Corta el miedo | Controla la codicia |

| Cuándo Usar | En cualquier momento | En operaciones ganadoras |

| Impacto | Protege el capital | Bloquea las ganancias |

También te puede gustar

Ventajas de las Órdenes de Stop Loss

Flexible

Las órdenes de stop-loss brindan flexibilidad a los traders. Con opciones avanzadas como los trailing stops, el precio de stop se mueve a medida que el mercado se mueve a tu favor. Esto protege tus ganancias sin encerrarte en un único punto de salida, para que puedas adaptarte a las circunstancias, obtener las mayores ganancias y mantener el riesgo bajo control.

No hay sentimientos involucrados

Los stop-losses mantienen las emociones fuera de las operaciones. Una vez que tu salida está establecida, la operación se cierra sola: sin dudas, sin pánicos y sin esperar que mejore. Esto te ayuda a apegarte a tu plan de trading en lugar de dejar que las emociones arruinen las cosas.

Control de Riesgos

Un stop-loss es una herramienta útil de control de riesgo. Limita las pérdidas y evita que pequeños problemas se conviertan en grandes problemas. Conocer tu límite de riesgo genera confianza y protege tu trading.

Ahorra Tiempo

Con los stop-loss configurados, no tienes que estar mirando gráficos todo el día. Tus salidas ocurren por sí solas, así que tienes tiempo para pensar, hacer planes y buscar nuevas oportunidades en lugar de estar observando operaciones sin parar.

Contras de las Órdenes de Stop-Loss

Riesgos de Ejecución

En mercados locos y rápidos, los precios pueden saltar más allá de tu objetivo de ganancias. Esto podría significar que tu orden solo se llena parcialmente, o que obtienes un precio peor del que querías. A veces, tu orden podría ejecutarse demasiado pronto, deteniendo tus ganancias antes de que alcancen su máximo.

Rigidez

Las órdenes de toma de ganancias están grabadas en piedra. Eso da cierto orden, claro, pero no es ideal cuando las cosas cambian rápido. Si el mercado se invierte, tu objetivo podría alcanzarse demasiado rápido, terminando la operación antes de que pudiera haber generado más dinero.

Oportunidades Perdidas

Una orden de beneficio puede retenerte. Si sales en un cierto punto, podrías perder ganancias mucho más grandes si el mercado sigue yendo a tu favor. Esto puede ser molesto, haciéndote preguntarte qué pasaría, especialmente cuando una tendencia sigue y sigue.

Ventajas de las Órdenes de Toma de Ganancias

Gestión de Riesgo y Recompensa

Las órdenes de toma de ganancias son excelentes porque mantienen tu riesgo y tus posibles ganancias bajo control. Cuando estableces objetivos con anticipación, tus operaciones mejoran y tienes una mejor oportunidad de hacerlo bien más adelante. De esta manera, puedes centrar tu atención en buenas operaciones y no solo correr tras todo lo que sucede en el mercado.

Asegura tus Ganancias

Con una orden de toma de ganancias, automáticamente obtienes el efectivo. En lugar de permanecer en una buena operación por demasiado tiempo y arriesgar una pérdida, obtienes tu dinero al nivel que elegiste. Esto mantiene tus fondos seguros mientras decides qué hacer en el futuro.

Contras de las Órdenes de Toma de Beneficios

Riesgos de Ejecución

Las órdenes de toma de ganancias pueden verse afectadas por brechas en el mercado o cambios de precio repentinos que superan tu nivel establecido. Esto puede resultar en una posición cerrada parcialmente y, por lo tanto, perderás la oportunidad de aprovechar completamente la acción de precio favorable que esperabas. En mercados volátiles, tu nivel de toma de ganancias puede activarse demasiado rápido y no te permitirá capturar completamente el potencial de un movimiento antes de cerrar la posición.

Rigidez

Las órdenes de toma de beneficios pueden ser rígidas, lo que puede resultar ser una desventaja en algunos mercados. Proporcionan una forma estructurada de salir, pero pueden no encajar en los niveles fijos bajo dinámicas de mercado cambiantes. En el caso de un entorno altamente volátil, una orden de toma de beneficios podría ejecutarse demasiado pronto y perder ganancias adicionales.

Oportunidades Perdidas

Otra desventaja de las órdenes de toma de ganancias es perderse ganancias más grandes. Una toma de ganancias establecida en un cierto nivel puede cerrar una posición demasiado pronto y, por lo tanto, perder la oportunidad de obtener más beneficios. Esto puede frustrarte si el mercado se mueve en la dirección en la que primero operaste, dejándote con el arrepentimiento de las ganancias que nunca se realizaron.

Cómo Calcular los Niveles de Stop Loss y Take Profit

Con los conceptos básicos entendidos, la siguiente pregunta importante es cómo determinar los niveles óptimos para la colocación de stop loss y take profit. Hay algunos enfoques, que a menudo se utilizan juntos para una confirmación robusta:

Soporte y Resistencia

Buscar áreas en el gráfico de precios con los volúmenes de trading más altos ofrece una visión de las zonas que han actuado como barreras en el pasado. Los traders normalmente colocan stops de protección por debajo de las zonas de soporte recientes que han sido superadas en marcos de tiempo más grandes como el diario o el semanal. Las tomas de ganancias se establecen entonces en el siguiente objetivo resistente. Estas zonas a menudo actúan como puntos de referencia en estrategias impulsadas por indicadores.

Medias Móviles

Las medias móviles simples o exponenciales (SMA/EMA) son indicadores que siguen la tendencia y suavizan la acción del precio. Las rupturas y re-pruebas de una SMA a largo plazo como la de 50 períodos pueden proporcionar puntos de referencia para los SL, mientras que los cruces de MA más cortos ayudan con los TPs.

Retrocesos de Fibonacci

Al trazar niveles de retroceso de Fibonacci entre los extremos de un movimiento significativo en el gráfico, estos definen áreas potenciales de retroceso en porcentajes (38.2%, 50%, 61.8%). Los SL se colocan por debajo de los niveles clave de Fibonacci en retrocesos más grandes para mantener la posición.

Basado en Porcentaje

Este enfoque simplista fija el SL a un porcentaje establecido por debajo de la entrada, como 3-5%, para controlar el riesgo. Por el contrario, los niveles de TP se fijan a 2-3 veces la cantidad de riesgo para lograr una relación riesgo:recompensa aceptable.

Un trader debe sopesar cada método, siempre incorporando el contexto general del mercado y su tolerancia al riesgo personal. El objetivo es establecer un sistema lógico y consistente para calcular los niveles dinámicos de SL y TP en cada operación. Esto hace que la experiencia de trading sea mucho más gratificante a largo plazo.

Importancia de la Relación Riesgo-Recompensa

Calcular la relación riesgo-recompensa de una operación es una parte importante para determinar los niveles apropiados de stop loss y take profit. La relación compara la recompensa potencial de una operación con la cantidad de riesgo asumido. Los traders buscan estructurar posiciones donde el beneficio esperado supere significativamente cualquier pérdida máxima posible.

Una relación riesgo-recompensa de 1:2 o 1:3 significa que el primer objetivo de toma de beneficios es el doble o el triple de la distancia desde el precio de entrada hasta el nivel de stop loss. Entender esta relación ayuda a identificar operaciones que presentan un pago asimétrico si el análisis original resulta ser preciso.

La relación riesgo-recompensa se calcula utilizando una fórmula simple:

RRR = Potencial de Ganancia / Potencial de Pérdida

Por ejemplo,

Entrada = $100

SL = $95 (Riesgo = $5)

TP = $110 (Recompensa = $10)

RRR = 10 / 5 = 2: 1

La relación riesgo-recompensa se calcula utilizando una fórmula simple que divide la recompensa potencial por el riesgo potencial. Por ejemplo, con una entrada a $100, un stop loss a $95 y un primer objetivo a $105, el riesgo es de $5 (Entrada - Stop Loss) y la recompensa es de $10 (Take Profit - Entrada).

Introducir estos números da una relación riesgo-recompensa de 2:1. Apuntar a posiciones con relaciones favorables enfatiza la preservación del capital mientras se mantiene el potencial de ganancias. Focalizarse consistentemente en operaciones con mayores recompensas anticipadas en comparación con los riesgos definidos puede producir una expectativa altamente positiva a lo largo de numerosas rondas.

Seleccionar puntos de entrada y los niveles de stop loss y take profit que los acompañan impacta directamente en el perfil de riesgo-recompensa de una operación. Un exhaustivo back-testing puede proporcionar estadísticas valiosas sobre qué niveles de precio tienden a equilibrar la viabilidad a largo plazo con resultados probabilísticos.

En general, comprender el riesgo-recompensa permite estructurar actividades para probabilidades de ventaja que se acumulan a lo largo del tiempo mediante la reinversión de ganancias y la retención de capital. Esta optimización constante de procesos eventualmente acumula riqueza con éxito durante períodos prolongados.

Lista de Verificación SL/TP

Para garantizar la precisión y la coherencia en tus operaciones, asegúrate de revisar los siguientes elementos:

- El precio de entrada está claramente definido.

- El Stop Loss se coloca lógicamente y no por casualidad.

- El Take Profit se coloca en niveles de resistencia, estructura de tendencia o tu objetivo personal de riesgo/recompensa.

- La cantidad que arriesgas en la operación (generalmente del 1 al 2% de tu capital) está dentro de tus propios límites aceptables.

- Quieres tener una relación Riesgo/Beneficio de al menos 1:2.

- Tan pronto como abras el paquete para tu comercio, debes colocar órdenes de Stop Loss y Take Profit.

- Cuando te falte alguno de estos criterios, tu comercio aún no está listo.

Ejemplos de Stop Loss y Take Profit por Estilo de Trading

Los diferentes estilos de trading utilizan diferentes colocaciones de SL y TP. Usar las mismas reglas de SL y TP en diferentes estrategias de trading probablemente conducirá a malos resultados.

Negociación Intradía

- SL ajustado se coloca cerca del soporte o resistencia intradía.

- El objetivo de TP suele estar cerca de zonas de liquidez o extensiones de precio a corto plazo.

- La operación generalmente se cierra el mismo día.

- El day trading generalmente tiene relaciones de riesgo-recompensa de 1:1.5 a 1:3.

Trading de oscilación

- SL está establecido justo más allá del soporte y resistencia del marco de tiempo superior.

- Los objetivos de TP suelen ser para objetivos de precio de varios días o varias semanas.

- Las posiciones suelen estar abiertas de 3 a 7 días hasta 3-4 semanas.

- Las operaciones de swing típicamente tienen ratios de riesgo-recompensa de al menos 1:2.

Escalping

- Scalping generalmente implica pérdidas de parada mucho más ajustadas debido a objetivos de precio más pequeños.

- El objetivo es hacer pequeñas ganancias incrementales, generalmente múltiples veces al día.

- La alta frecuencia de operaciones requiere un alto grado de precisión y una disciplina estricta.

Comercio de Posición

- El stop loss generalmente será mucho más amplio para permitir fluctuaciones relacionadas con movimientos de precios a largo plazo.

- Los objetivos de toma de ganancias suelen ser para extensiones de tendencias significativas o niveles de precios impulsados por eventos macroeconómicos.

- Períodos de mantenimiento mucho más largos para operaciones posicionales (de 3-4 semanas a varios meses).

- Las operaciones posicionales se centran en capturar el movimiento de precios más grande en lugar de realizar muchas operaciones en un corto período de tiempo.

Cómo Usar SL/TP en Tu Plan de Trading

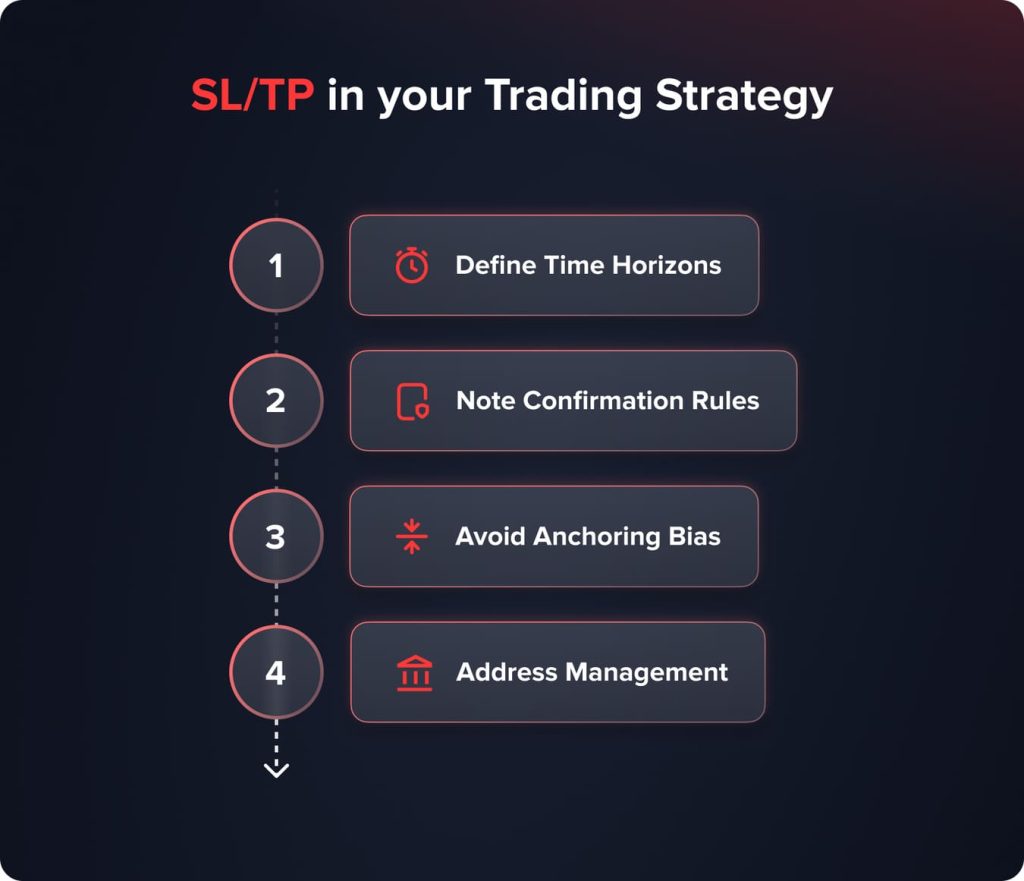

Ahora que hemos explorado diversas consideraciones sobre la colocación de niveles, es crucial delinear exactamente cómo estas órdenes encajarán en la estrategia y el plan de trading en general. Esta claridad minimiza la toma de decisiones emocionales y guía la salida basada puramente en los factores técnicos o fundamentales iniciales que desencadenan la operación. Algunos factores importantes:

- Definir Horizontes Temporales: ¿Será esta una operación de scalping a corto plazo o una operación swing mantenida durante semanas? Establezca las expectativas de SL/TP en consecuencia en marcos temporales más pequeños frente a más grandes.

- Reglas de Confirmación de Notas: ¿Cuántas indicaciones como los cruces de medias móviles se requieren antes de entrar? Agregue pautas sobre cuándo ajustar los stops o tomar ganancias parciales.

- Evitar el sesgo de anclaje: No te aferres obstinadamente a los niveles iniciales si los mercados se mueven considerablemente en contra de la posición. Esté listo para ajustarse rápidamente frente a pérdidas mayores.

- Gestión de Direcciones: ¿Se rastrearán los pedidos manualmente o utilizando funciones automáticas? Conozca las reglas para cierres parciales o adiciones a los ganadores.

Es importante realizar órdenes de manera pasiva sin ajustes una vez que se está en la operación. Esto elimina completamente las sensaciones subjetivas de la ecuación. Adhiérete diligentemente al plan de trading y sus reglas, pase lo que pase. Con el tiempo, debería resultar en una expectativa positiva.

Cuándo Ajustar el Stop Loss y el Take Profit

Es importante no ajustar tus niveles de stop loss y take profit de manera impulsiva. Hay circunstancias en las que tiene sentido modificar estos niveles en función del movimiento del precio, los niveles de soporte y resistencia que se forman en los gráficos después de la entrada y las reglas de la estrategia.

Hay varias razones por las que es aceptable ajustar tus niveles de stop loss y/o take profit después de entrar en una posición:

- Cuando se crea un nuevo nivel de soporte/resistencia después de entrar en una operación.

- Cuando la estructura de precios cambia, por ejemplo, un Mínimo Más Alto (HL) - Tendencia Alcista / un Máximo Más Bajo (LH) - Tendencia Bajista.

- Se anunciaron noticias importantes, & el aumento en el volumen conduce a una gran fluctuación de precios (aumento de la volatilidad).

- Arrastrar su stop para asegurar ganancias no realizadas.

- Beneficios parciales según tu plan de trading.

Evita mover tu stop loss más lejos del punto de entrada para no ser sacado; esto solo aumenta el riesgo y convierte una pérdida controlada en una pérdida incontrolada.

¿Cómo evitar errores comunes al usar SL/TP?

Aunque SL y TP son piedras angulares de la gestión de riesgos, algunos traders aún luchan con varios sesgos conductuales:

- Perseguir Pérdidas: Ser terco acerca de posiciones débiles y mover los stops progresivamente más lejos para evitar asumir la pérdida. Corta las pérdidas de manera agresiva en su lugar.

- Tomando ganancias tempranas: No dejar que los ganadores se desarrollen según el sistema original. Resistir la tentación de asegurar pequeñas ganancias demasiado pronto, y permitir que se actúe sobre los objetivos.

- No Usar Stops: Creer que el autocontrol es suficiente, pero la implicación emocional cambia la percepción de la operación. Las órdenes de protección son imprescindibles para todas las posiciones.

- Aumentar el tamaño de las posiciones: En lugar de un tamaño de operación arriesgado y todo o nada, escala de forma incremental con cierres parciales para asegurar las ganancias de manera segura.

Al anticipar estas tendencias, los traders pueden mantenerse enfocados en la ejecución de su estrategia y alcanzar sus objetivos de rendimiento durante muchos meses de trading consistente. La disciplina y la paciencia con el proceso son requisitos absolutos para el éxito a largo plazo.

Mitos sobre el Stop Loss y Take Profit

- "Cerraré la operación manualmente."

Muchos traders son emocionales, dudan o entran en pánico en lugar de ejecutar según su plan de trading.

- "Tener un stop muy ajustado es menos arriesgado porque el precio no se moverá en mi contra tanto."

La colocación de su stop loss debe reflejar cuán volátiles son los mercados. Un stop ajustado puede activarse fácilmente por las fluctuaciones de precios normales que se encuentran en el trading intradía. Si coloca un stop que es demasiado ajustado, será liquidado muchas veces debido al ruido de precios normal.

- "El mercado me sacó, así que tenía razón."

Ser detenido en tu operación refleja una mala colocación de stop por tu parte, no mala suerte o manipulación del mercado.

- "Puedo recuperar todo lo que he perdido con una gran victoria."

El éxito en el trading a largo plazo se logra gestionando consistentemente tu riesgo y pérdidas, no mediante una sola gran victoria.

Estrategias Avanzadas de Stop Loss y Take Profit

Aunque no se deben pasar por alto los aspectos básicos, enfoques más matizados pueden optimizar aún más los perfiles de riesgo/recompensa:

Órdenes de Stop Trailing

A medida que las operaciones ganadoras avanzan favorablemente, los stops dinámicos siguen la tendencia al alza para asegurar ganancias crecientes, pero cortan las pérdidas tempranamente en retrocesos. Existen opciones manuales o automáticas.

Análisis de Múltiples Marcos de Tiempo

Los marcos de tiempo más altos proporcionan una visión macro estratégica, mientras que los marcos más bajos ofrecen entradas de operaciones intradía. Filtra las operaciones a través de señales convergentes en diferentes períodos.

Órdenes de rango

Utiliza una combinación de niveles SL/entrada y entrada/TP para escalar sistemáticamente en posiciones ganadoras para un perfil de riesgo más flexible.

Swing Vs Day Trading SL/TP

Las operaciones de swing que se mantienen de 1 a 5 días requieren ubicaciones de SL dinámicas más amplias en comparación con las operaciones diarias que salen en la misma sesión. Ajusta según el estilo.

Estrategias de cobertura

Compense las posiciones largas y cortas en activos correlacionados para neutralizar el riesgo sectorial a través de carteras delta-neutras. Protege contra reversiones repentinas.

Los estudios de caso demuestran la integración de enfoques multilaterales en la práctica. Con la experiencia, los comerciantes adquieren un sexto sentido para salidas y entradas oportunistas que amplifican los retornos. Pero las bases deben estar primero fundamentadas en la disciplina, la preparación y estrategias básicas probadas.

Conclusión

Las órdenes de stop-loss y take-profit no son extras - son imprescindibles.

- Ellos mantienen tu dinero seguro.

- Se aseguran de que obtengas tu ganancia.

- Te ayudan a comerciar sin que los sentimientos se interpongan.

¿Qué hace que un buen trader sea diferente de alguien que solo está apostando? A menudo, es el uso de órdenes de stop-loss y take-profit cada vez, sin falta.

FAQ

Una orden de stop loss cierra una operación cuando las condiciones del mercado son desfavorables, previniendo mayores pérdidas, mientras que una orden de take profit cierra una operación una vez que el trader ha alcanzado su objetivo de beneficio deseado.

Sí, es muy recomendable que los traders utilicen un stop loss cada vez que operen. Operar sin un stop loss deja a los traders vulnerables a un potencial de pérdida ilimitado; por lo tanto, expone una cuenta a pérdidas financieras potencialmente significativas, particularmente en momentos de extrema volatilidad del mercado o movimientos de precios rápidos.

Un trader no tiene que establecer un take profit, pero se le recomienda encarecidamente que lo haga para ayudar a asegurar que el trader realice una cantidad finita de potencial ganancia mientras evita mantener operaciones ganadoras durante demasiado tiempo debido a posibles reversiones del mercado.

Típicamente, los traders buscan tener una relación de riesgo a recompensa de al menos (1:2) para tomar ganancias, lo que indica que el trader espera ganar al menos el doble de la cantidad que está arriesgando. Esto permite al trader obtener una ganancia, incluso si tiene una tasa de éxito más baja.

Actualizado:

24 de diciembre de 2025