Что такое Stop Loss (SL) и Take Profit (TP) и как их использовать?

В статье

Большинство трейдеров терпят неудачу не из-за плохих выборов, а потому что не следят за своим риском. Вот здесь и полезны ордера Stop Loss (SL) и Take Profit (TP).

Считайте их вашей страховкой:

- SL останавливает большие потери.

- TP гарантирует, что вы закрепите свои прибыли, прежде чем рынок пойдет вниз.

Оказалось, около 88% дневных трейдеров используют ордера стоп-лосс, чтобы контролировать свои риски и защищать свои деньги. С другой стороны, Capital.com провела исследование и выяснила, что большинство трейдеров, которые пропускают стратегии стоп-лосс, например, 60% из них, были гораздо менее успешными. Только 44% на самом деле заработали деньги. Таким образом, использование стоп-лосс не просто связано с соблюдением правил; это вопрос того, чтобы оставаться в торговле на длительный срок.

Итак, если вы не используете SL и TP, вы азартничаете. Если используете, вы торгуете с дисциплиной.

Я бы добавил простую визуализацию, идеальным вариантом будет столбчатая диаграмма или круговая диаграмма. Она сравнила бы процент трейдеров, которые используют стоп-лоссы, с теми, кто этого не делает. Например, на диаграмме можно показать, что 88% трейдеров активно используют стоп-лосс ордера, в то время как среди тех, кто не использует, только 44% оказываются прибыльными.

Ключевые выводы

- Ордер стоп-лосс (SL) позволяет ограничить ваши убытки, автоматически закрывая вашу позицию, когда цена падает ниже указанного уровня.

- Ордер на взятие прибыли (TP) позволяет вам зафиксировать вашу прибыль по заранее установленной цене, основываясь на движении рынка к вашей цели.

- Использование ордеров SL и TP помогает убрать эмоции из торговли и подчеркивает важность дисциплинированного подхода к вашим сделкам.

- Когда соотношение риска к вознаграждению благоприятно, сделки могут иметь большую вероятность быть прибыльными, независимо от того, как часто они выигрывают.

- SL и TP должны быть установлены перед входом в любую сделку.

- Полагание на SL и TP ордера для управления своей торговой активностью делает этот процесс структурированным и основанным на правилах, а не спекулятивной или азартной деятельностью.

Что такое Stop Loss (SL)

Стоп-лосс похож на страховочную сеть для ваших сделок. Он автоматически закрывает сделку, если цена движется против вас до определенной точки.

Предположим, вы покупаете EUR/USD по 1.1000 и устанавливаете стоп-лосс на 1.0950. Если цена упадет до 1.0950, ваш брокер закроет сделку, так что вы потеряете всего 50 пипсов. Этот тип защиты особенно важен на кредитных Forex рынках, где волатильность и размер позиции сильно влияют на результаты.

Вот как определить вашу цену стоп-лосса:

Формула:

Цена Стоп Лосс (Лонг) = Цена Входа - Допустимая Потеря (в пипсах)

Цена стоп-лосса (шорт) = Входная цена + Допустимый убыток (в пипсах)

Почему это полезно?

- Это помогает вам не потерять все свои деньги.

- Это убирает эмоции из торговли (Возможно, она снова поднимется).

- Это позволяет вам точно определить, сколько вы готовы рискнуть в каждой сделке.

Что такое Take Profit (TP)?

Take Profit - это противоположность Stop Loss. Он автоматически фиксирует вашу прибыль.

Например, вы покупаете EUR/USD по 1.1000. Вы устанавливаете свой TP на 1.1100. Если цена поднимается до этого уровня, ваш брокер закрывает сделку, и вы получаете 100 пипсов прибыли.

Формула:

TP Цена (Длинная) = Цена, по которой вы купили + Сколько пипсов вы хотите заработать

TP Price (Short) = Цена, по которой вы продали - Сколько пипсов вы хотите заработать

Почему это полезно?

- Это гарантирует, что вы не потеряете деньги, которые заработали, если рынок изменит направление.

- Это помогает вам придерживаться вашей торговой стратегии.

- Это может улучшить стабильность вашей прибыли в долгосрочной перспективе.

Вам также может понравиться

Различия между SL и TP

Цель

- SL направлена на ограничение убытков и закрытие неблагоприятного рынка.

- TP стремится обеспечить прибыль и завершить выгодную сделку.

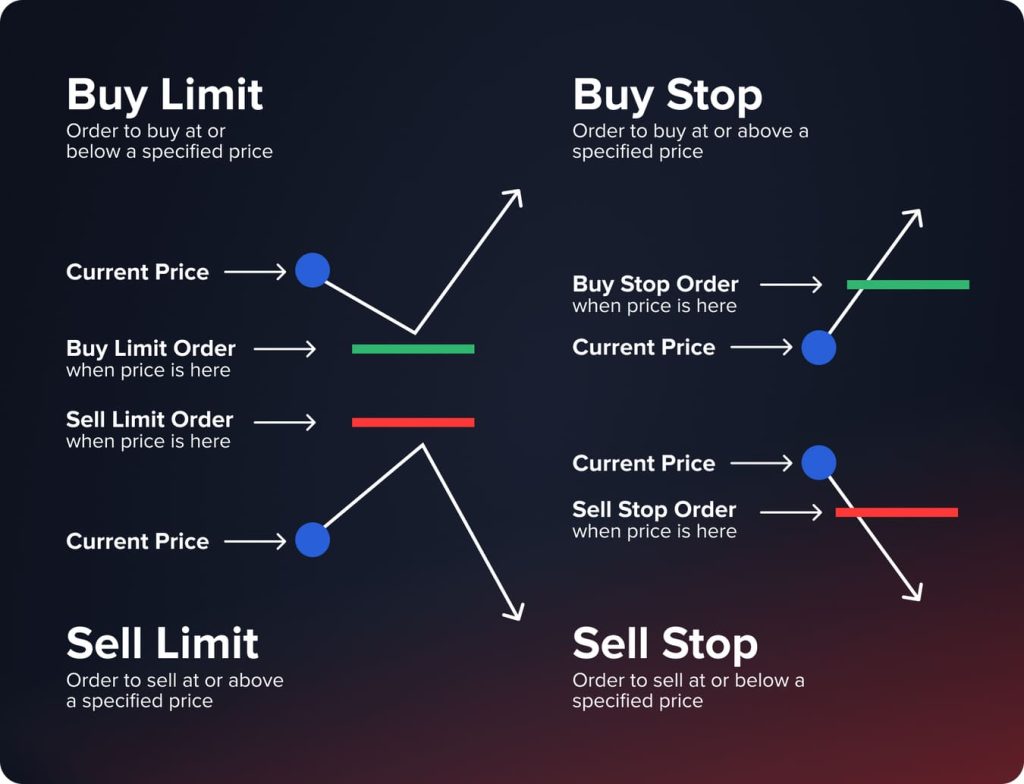

Тип заказа

- В общем, SL использует рыночный тип ордеров, которые исполняются почти мгновенно; недостатком может быть проскальзывание при исполнении.

- TP - это лимитный ордер, который обеспечивает получение целевой цены, но не выполняется во всех сценариях.

Горизонт времени

- SL полезен для дневных торгов или краткосрочных свинг-торгов, которые должны обеспечить выход из позиции.

- TP может быть применимо в позиционных торгах, где позиции удерживаются на нескольких временных интервалах.

Использование с задним ходом

- Трейлинг-стопы динамически настраивают ценовой барьер по мере наступления благоприятного ценового движения.

- Прибыль от сделок может быть менее распространенной, поскольку доходы должны быть зафиксированы на заранее определенных уровнях.

Профиль риска

- SL помогает предотвратить небольшие убытки от превращения в резкие просадки, если сделка разворачивается.

- TP позволяет зафиксировать некоторую прибыль, но при этом сохраняет возможность получения дополнительной прибыли в случае, если цена выйдет на более значительные уровни.

Психология

- SL обеспечивает дисциплину и устраняет эмоции, связанные с закрытием убыточных позиций, подчеркивая важность овладения психологией трейдинга.

- Цели TP фиксируют как минимум часть прибыли, чтобы чувствовать себя успешными, а не жадными за максимальной прибылью.

В заключение: хотя оба являются инструментами управления рисками, SL фокусируется на защите от убытков, гарантируя выходы при ухудшении ситуации; с другой стороны, TP стремится зафиксировать сохраненные прибыли на оптимальных уровнях в соответствии с оригинальным анализом и планом. Их роли взаимосвязаны, но различны по своим целям.

Сравнительный обзор

| Особенность | Стоп-лосс | Тейк-профит |

| Цель | Ограничить потери | Зафиксировать прибыль |

| Тип ордера | Рыночный ордер | Лимитный ордер |

| Психология | Снижает страх | Контролирует жадность |

| Когда используется | В любое время | В выигрышных сделках |

| Влияние | Защищает капитал | Фиксирует прибыль |

Вам также может понравиться

Преимущества ордеров стоп-лосс

Гибкий

Ордеры стоп-лосс предоставляют трейдерам гибкость. С такими сложными, как трейлинг-стопы, цена стопа движется по мере того, как рынок движется в вашу сторону. Это защищает ваши доходы, не фиксируя вас на одной точке выхода, так что вы можете адаптироваться к изменениям, получать максимальную прибыль и контролировать риск.

Без чувств

Стоп-лоссы помогают исключить эмоции из сделок. Как только ваш выход установлен, сделка закрывается сама собой: никаких сомнений, никаких паник и никаких надежд, что всё станет лучше. Это помогает вам придерживаться вашего торгового плана, а не позволять эмоциям всё испортить.

Контроль риска

Стоп-лосс — это полезный инструмент управления рисками. Он ограничивает убытки и предотвращает превращение мелких проблем в серьезные. Знание своего лимита риска создает доверие и защищает вашу торговлю.

Экономит время

С установленными стоп-лоссами вам не нужно следить за графиками весь день. Ваши выходы происходят сами по себе, так что у вас есть время подумать, составить планы и искать новые возможности вместо того, чтобы безостановочно следить за сделками.

Недостатки ордеров стоп-лосс

Риски исполнения

На безумных, быстрых рынках цены могут прыгнуть выше вашей цели по прибыли. Это может означать, что ваш ордер будет выполнен только частично, или вы получите худшую цену, чем хотели. Иногда ваш ордер может выполниться слишком рано, остановив вашу прибыль до того, как она достигнет максимума.

Жесткость

Заказы на фиксацию прибыли установлены в камне. Это придаёт некоторую стабильность, конечно, но это не очень хорошо, когда всё меняется быстро. Если рынок перевернётся, ваша цель может быть достигнута слишком быстро, завершив сделку, прежде чем она могла бы принести больше денег.

Упущенные шансы

Приказ на прибыль может удерживать вас. Если вы выйдете в определенный момент, вы можете упустить гораздо большие прибыли, если рынок продолжит двигаться в вашу сторону. Это может быть раздражающим, заставляя вас задумываться, что было бы, особенно когда тренд просто продолжается и продолжается.

Преимущества ордеров на фиксирование прибыли

Управление рисками и вознаграждением

Ордера на получение прибыли отличны, потому что они помогают контролировать ваш риск и потенциальные прибыли. Когда вы заранее устанавливаете цели, ваши сделки становятся лучше, и у вас есть больше шансов на успех в дальнейшем. Таким образом, вы можете сосредоточиться на хороших сделках, а не просто гоняться за всем, что происходит на рынке.

Обеспечьте свои прибыли

С помощью ордера на продажу с прибылью вы автоматически получаете деньги. Вместо того чтобы оставаться в хорошей сделке слишком долго и рисковать потерей, вы получаете свои деньги на уровне, который выбрали. Это сохраняет ваши средства в безопасности, пока вы решаете, что делать в будущем.

Недостатки ордеров на фиксацию прибыли

Риски исполнения

Приказа на получение прибыли могут быть затронуты рыночными разрывами или внезапными изменениями цен, которые превышают установленный вами уровень. Это может привести к частичному закрытию позиции, и, следовательно, вы упустите полную степень благоприятного движения цен, которого ожидали. На волатильных рынках ваш уровень получения прибыли может сработать слишком быстро и не даст вам возможности полностью воспользоваться ростом цены перед закрытием позиции.

Жесткость

Ордеры на фиксированную прибыль могут быть жесткими, что может стать недостатком на некоторых рынках. Они предоставляют структурированный способ выхода, но могут не соответствовать фиксированным уровням при изменяющейся рыночной динамике. В случае высоковолатильной среды ордер на фиксированную прибыль может быть исполнен слишком рано и упустить дальнейшую выгоду.

Упущенные возможности

Еще одним недостатком ордеров на фиксацию прибыли является упущение больших доходов. Ордер на фиксацию прибыли, установленный на определенном уровне, может закрыть позицию слишком рано и, следовательно, упустить дальнейшую прибыль. Это может вызвать у вас раздражение, если рынок движется в том направлении, в котором вы изначально торговали, оставляя вас с сожалением о доходах, которые так и не были реализованы.

Как рассчитать уровни стоп-лосса и тейк-профита

Поняв основы, следующий важный вопрос заключается в том, как определить оптимальные уровни для установки стоп-лосса и тейк-профита. Существует несколько подходов, которые часто используются вместе для надежного подтверждения:

Поддержка и Сопротивление

Поиск областей на ценовом графике с наибольшими объемами торговли дает представление о зонах, которые в прошлом действовали как барьеры. Трейдеры обычно устанавливают защитные стопы ниже недавних зон поддержки, пробитых на более крупных временных интервалах, таких как дневные или недельные. Тейк-профиты затем устанавливаются на следующей уровне сопротивления. Эти зоны часто выступают в качестве опорных точек в стратегиях, основанных на индикаторах.

Скользящие средние

Простые или экспоненциальные скользящие средние (SMA/EMA) являются индикаторами, следящими за трендом, которые сглаживают ценовое движение. Пробои и повторные тесты более длительной SMA, такой как 50-периодная, могут служить ориентирами для стоп-лоссов (SL), в то время как пересечения более коротких MA помогают с профитом (TP).

Фибоначчи коррекции

Наносив уровни коррекции Фибоначчи между экстремумами значительного движения на графике, они определяют потенциальные зоны отката в процентах (38.2%, 50%, 61.8%). Стоп-лоссы размещаются ниже ключевых уровней Фиб на больших коррекциях для поддержания позиции.

Процентное соотношение

Этот упрощенный подход устанавливает уровень SL на определенный процент ниже входа, например, 3-5%, для контроля риска. Напротив, уровни TP нацелены на 2-3 раза превышающие сумму риска, чтобы достичь приемлемого соотношения риск:вознаграждение.

Трейдер должен взвесить каждый метод, всегда учитывая общий рыночный контекст и свою личную толерантность к риску. Цель состоит в том, чтобы установить логичную и последовательную систему для расчета динамических уровней SL и TP для каждой сделки. Это делает торговлю гораздо более прибыльной в долгосрочной перспективе.

Важность соотношения риска и вознаграждения

Расчет соотношения риска и вознаграждения в сделке является важной частью определения соответствующих уровней стоп-лосса и тейк-профита. Это соотношение сравнивает потенциальное вознаграждение от сделки с суммой принятого риска. Трейдеры стремятся структурировать позиции так, чтобы ожидаемая прибыль значительно превышала любой максимальный возможный убыток.

Соотношение риска и вознаграждения 1:2 или 1:3 означает, что первая цель по прибыли вдвое или втрое превышает расстояние от цены входа до уровня стоп-лосса. Понимание этого соотношения помогает выявить сделки, представляющие асимметричную прибыль, если первоначальный анализ окажется точным.

Соотношение риска и прибыли рассчитывается с использованием простой формулы:

RRR = Потенциальная прибыль / Потенциальный убыток

Например,

Вход = $100

SL = $95 (Риск = $5)

TP = $110 (Награда = $10)

RRR = 10 / 5 =2: 1

Соотношение риска и вознаграждения рассчитывается с использованием простой формулы, которая делит потенциальное вознаграждение на потенциальный риск. Например, при входе на уровне $100, стоп-лоссе на уровне $95 и первой цели на уровне $105, риск составляет $5 (Вход - Стоп-Лосс), а вознаграждение составляет $10 (Тейк Профит - Вход).

Подставляя эти числа, мы получаем соотношение риска и вознаграждения 2:1. Нацеливание на позиции с благоприятными соотношениями подчеркивает важность сохранения капитала при поддержании потенциала роста. Постоянное внимание на сделках с большими ожидаемыми вознаграждениями по сравнению с определенными рисками может привести к высокому положительному ожиданию за множество раундов.

Выбор точек входа и сопутствующих уровней стоп-лосса и тейк-профита напрямую влияет на риск-вознаграждение сделки. Тщательное бэктестирование может предоставить ценные статистические данные о том, какие уровни цен, как правило, обеспечивают баланс между долгосрочной жизнеспособностью и вероятностными исходами.

В целом, понимание соотношения риска и вознаграждения позволяет структурировать действия для получения преимуществ вероятностей, которые накапливаются в долгосрочной перспективе за счет реинвестирования прибыли и сохранения капитала. Эта постоянная оптимизация процессов в конечном итоге успешно накапливает богатство на продолжительных сроках.

Чек-лист SL/TP

Чтобы обеспечить точность и согласованность в ваших сделках, обязательно проверьте следующие пункты:

- Цена входа четко указана.

- Стоп-лосс установлен логично, а не случайно.

- Take Profit устанавливается на уровнях сопротивления, трендовой структуре или вашей личной цели по риску/вознаграждению.

- Сумма, которую вы рискуете в сделке (обычно 1-2% вашего капитала), находится в пределах ваших собственных приемлемых границ.

- Вы хотите иметь соотношение риск/вознаграждение минимум 1:2.

- Как только вы откроете упаковку для вашей сделки, вы должны установить ордера на Stop Loss и Take Profit.

- Когда у вас отсутствует хотя бы один из этих критериев, ваша сделка еще не готова.

Примеры Стоп-Лосса и Тейк-Профита по Стилю Торговли

Разные стили торговли используют разные размещения SL и TP. Использование одних и тех же правил SL и TP в различных торговых стратегиях скорее всего приведет к плохим результатам.

Дневная торговля

- Точный SL размещен рядом с внутридневной поддержкой или сопротивлением.

- Цель TP обычно близка к зонам ликвидности или краткосрочным ценовым расширениям.

- Сделка, как правило, закрывается в тот же день.

- Дневная торговля обычно имеет соотношение риска к прибыли от 1:1.5 до 1:3.

Свинг-трейдинг

- SL установлен чуть выше уровней поддержки и сопротивления на более высоком временном промежутке.

- Цели TP обычно устанавливаются для многодневных или многонедельных ценовых целей.

- Позиции обычно открыты от 3 до 7 дней до 3-4 недель.

- Свинг-трейды обычно имеют соотношение риск/возврат как минимум 1:2.

Скальпинг

- Скалпинг обычно включает в себя гораздо более узкие уровни стоп-лосса из-за меньших ценовых целей.

- Цель состоит в том, чтобы достигать небольших постепенных улучшений, как правило, несколько раз в день.

- Высокая частота сделок требует высокой степени точности и строгой дисциплины.

Позиционная торговля

- Стоп-лосс, как правило, будет значительно шире, чтобы учесть колебания, связанные с долгосрочными движениями цен.

- Цели по прибыли, как правило, устанавливаются для продолжений значительных трендов или уровней цен, обусловленных макроэкономическими событиями.

- Гораздо более длительные сроки удержания для позиционных сделок (от 3-4 недель до нескольких месяцев).

- Позиционные сделки сосредоточены на захвате более крупных ценовых движений, а не на совершении множества сделок за короткий период времени.

Как использовать SL/TP в вашем торговом плане

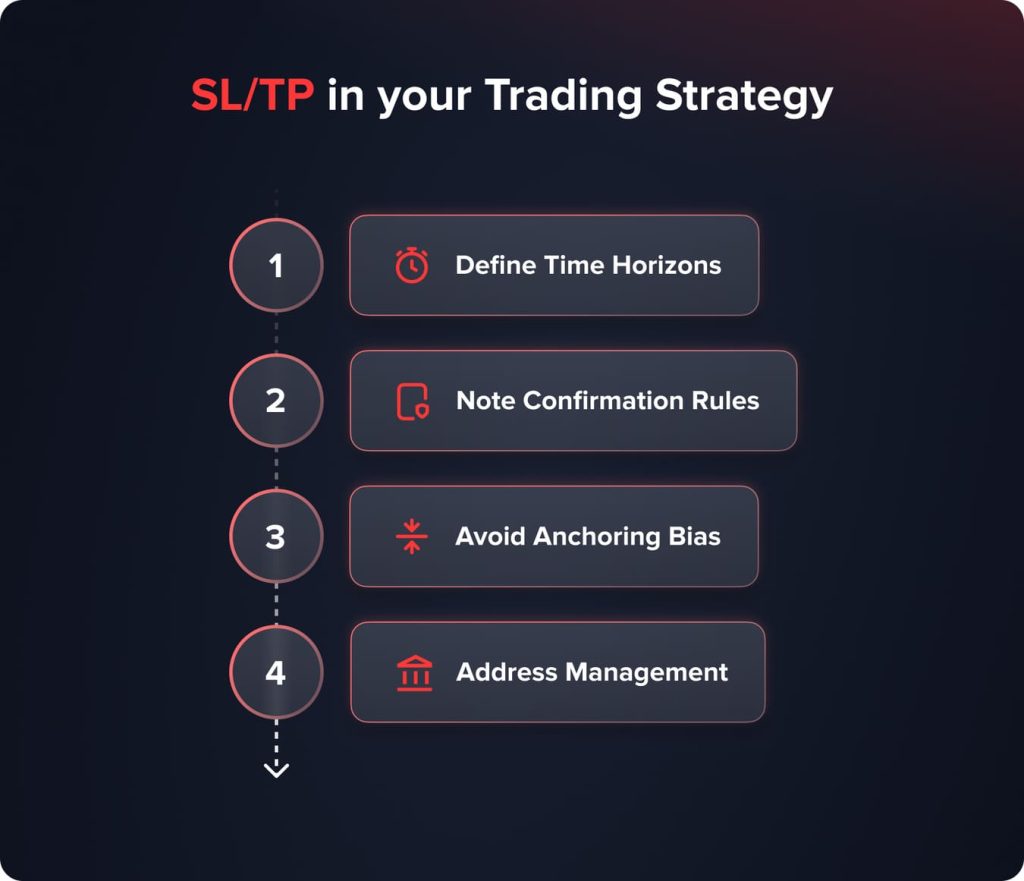

Теперь, когда мы рассмотрели различные аспекты размещения уровней, крайне важно четко определить, как эти ордера вписываются в общую торговую стратегию и план. Эта ясность минимизирует эмоциональные решения и направляет выход, основываясь исключительно на первоначальных технических или фундаментальных факторах, вызывающих сделку. Некоторые важные факторы:

- Определите временные горизонты: Будет ли это краткосрочная сделка на колебания или свинг-трейд, который будет держаться в течение недель? Соответственно установите ожидания по SL/TP для меньших и больших таймфреймов.

- Правила подтверждения заметок: Сколько сигналов, таких как пересечения скользящих средних, необходимо для входа? Добавьте рекомендации о том, когда следует ужесточить стопы или зафиксировать частичную прибыль.

- Избегайте якорной предвзятости: Не цепляйтесь упрямо за изначальные уровни, если рынки значительно движутся против позиции. Будьте готовы быстро корректировать свои действия, чтобы избежать больших потерь.

- Управление адресами: Будут ли заказы отслеживаться вручную или с использованием автоматических функций? Узнайте правила для частичных закрытий или добавления к выигравшим.

Важно размещать ордера пассивно, без корректировок после входа в сделку. Это полностью исключает субъективные чувства из уравнения. Строго придерживайтесь торгового плана и его правил, что бы ни случилось. Со временем это должно привести к положительному ожиданию.

Когда корректировать уровень стоп-лосса и тейк-профита

Важно не изменять уровни стоп-лосса и тейк-профита импульсивно. Существуют обстоятельства, при которых имеет смысл корректировать эти уровни на основе движения цены, формирования уровней поддержки и сопротивления на графиках после входа и правил стратегии.

Существует несколько причин, почему допустимо корректировать уровни стоп-лосса и/или тейк-профита после открытия позиции:

- Когда создается новый уровень поддержки/сопротивления после входа в сделку.

- Когда структура цен меняется, например, более высокая низкая (HL) - восходящий тренд / более низкая высокая (LH) - нисходящий тренд.

- Объявлены крупные новости, & увеличенный объем ведет к большим колебаниям цен (увеличенная волатильность).

- Перенос вашего стопа с целью зафиксировать нереализованную прибыль.

- Частично прибыли согласно вашему торговому плану.

Избегайте перемещения вашего стоп-лосса дальше от точки входа, чтобы избежать выбивания; это только увеличивает риск и превращает контролируемый/убыток в неконтролируемый/убыток.

Как избежать распространенных ошибок при использовании SL/TP?

Хотя SL и TP являются краеугольными камнями управления рисками, некоторые трейдеры все еще сталкиваются с различными поведенческими предвзятостями:

- Преследование потерь: Упорство в слабых позициях и постепенное перемещение стопов дальше, чтобы избежать потерь. Вместо этого агрессивно сокращайте потери.

- Фиксация ранних прибылей: Не позволять победителям развиваться согласно оригинальной системе. Сопротивляйтесь слишком быстрому бронированию небольших доходов и дайте целям быть реализованными.

- Не использовать стопы: Верить, что самоконтроль достаточен, но эмоциональное вовлечение изменяет восприятие сделки. Защитные ордера обязательны для всех позиций.

- Увеличение размеров позиций: Вместо одного рискованного торгового размера "всё или ничего", постепенно увеличивайте и уменьшайте объемы с частичными закрытиями, чтобы безопасно зафиксировать прибыль.

Предвосхищая эти тенденции, трейдеры могут оставаться сосредоточенными на выполнении своей стратегии и достигать своих целей по производительности на протяжении многих месяцев последовательной торговли. Дисциплина и терпение в процессе являются абсолютными требованиями для долгосрочного успеха.

Мифы о стоп-лоссе и тейк-профите

- "Я закрою сделку вручную."

Многие трейдеры эмоциональны, они колеблются или впадают в панику, вместо того чтобы действовать в соответствии со своим торговым планом.

- "Имея очень короткий стоп, я рискую меньше, потому что цена не будет двигаться против меня так сильно."

Ваш уровень стоп-лосса должен отражать, насколько волатильны рынки. Тесный стоп может быть легко сработан нормальными колебаниями цен, которые встречаются в дневной торговле. Если вы установите стоп, который слишком тесен, вас будут часто выбивать из позиции из-за нормального ценового шума.

- "Рынок выбил меня, так что я был прав."

Выход из вашей сделки из-за срабатывания стопа отражает плохое размещение стоп-лосса с вашей стороны, а не неудачу или манипуляции на рынке.

- "Я могу вернуть все, что потерял, с одной крупной выигрышем."

Долгосрочный успех в торговле достигается за счет последовательного управления своими рисками и убытками, а не благодаря одной большой победе.

Расширенные стратегии стоп-лосса и тейк-профита

Хотя основы не следует упускать из виду, более тонкие подходы могут дополнительно оптимизировать профили риска/вознаграждения:

Трейлинг-стопы

Когда выигрышные сделки развиваются благоприятно, трейлинг-стопы динамически следуют за трендом, чтобы зафиксировать растущую прибыль и сократить убытки на ранних этапах откатов. Существуют ручные или автоматические варианты.

Многоуровневый анализ временных рамок

Более высокие временные рамки дают стратегический макрообзор, в то время как более низкие временные рамки предоставляют возможности для внутридневной торговли. Фильтруйте сделки через конвергирующие сигналы на разных периодах.

Ордеры с границами

Используйте комбинацию уровней SL/entry и entry/TP, чтобы систематически увеличивать позиции в выигрышных сделках для более гибкого профиля риска.

Свинг-трейдинг против дневной торговли SL/TP

Свинг-трейды, удерживаемые 1-5 дней, требуют более широкого динамического размещения стоп-лоссов по сравнению с дневными трейдами, выходящими в ту же сессию. Настройте соответственно в зависимости от стиля.

Стратегии хеджирования

Компенсируйте длинные и короткие позиции в коррелирующих активах, чтобы нейтрализовать секторные риски с помощью дельта-нейтральных портфелей. Это защищает от резких разворотов.

Кейс-исследования демонстрируют интеграцию таких многослойных подходов на практике. С опытом трейдеры приобретают шестое чувство для оппортунистических выходов и входов, которые увеличивают доходность. Но основы должны быть сначала закреплены в дисциплине, подготовке и проверенных базовых стратегиях.

Заключение

Стоп-лосс и тейк-профит ордера - это не дополнения, а необходимость.

- Они хранят ваши деньги в безопасности.

- Они следят за тем, чтобы вы получили свою прибыль.

- Они помогают вам торговать, не позволяя эмоциям вмешиваться.

Что отличает хорошего трейдера от человека, который просто играет в азартные игры? Часто это использование ордеров на стоп-лосс и тейк-профит каждый раз, без исключений.

FAQ

Стоп-лосс закрывает сделку, когда рыночные условия неблагоприятны, предотвращая дальнейшие убытки, в то время как тейк-профит закрывает сделку, как только трейдер достигает своей цели по прибыли.

Да, трейдерам настоятельно рекомендуется использовать стоп-лосс каждый раз, когда они торгуют. Торговля без стоп-лосса оставляет трейдеров уязвимыми к неограниченному потенциалу убытков; таким образом, это подвергает аккаунт потенциально значительным финансовым потерям, особенно в периоды крайней рыночной волатильности или быстрого изменения цен.

Трейдер не обязан устанавливать уровень Take Profit, но настоятельно рекомендуется это делать, чтобы помочь обеспечить получение трейдером конечной суммы потенциальной прибыли, избегая удержания выигрышных сделок слишком долго из-за возможных разворотов на рынке.

Обычно трейдеры стремятся иметь соотношение риска к прибыли не менее (1:2) для получения прибыли, что указывает на то, что трейдер ожидает заработать как минимум вдвое больше суммы, которую он/она рискует. Это позволяет трейдеру получать прибыль, даже если у него/нее низкий уровень успеха.

Обновлено:

24 декабря 2025 г.