Что такое управление рисками в торговле и как оно работает?

В статье

Управление рисками в торговле — это методы, которые трейдеры используют для сокращения возможных потерь и защиты своего капитала с помощью стратегий управления рисками, включающих использование диверсификации, стоп-ордеров, рычагов и регулярный пересмотр сделок, особенно после убыточных сделок, с целью использования возможностей в меняющихся рыночных условиях.

По сути, управление рисками — это осознание, оценка и управление возможными убытками в торговле. В трейдинге управление рисками — это не только защита себя и своих средств, но и неотъемлемая часть эффективных стратегий. В следующей статье мы рассмотрим, как управление рисками может помочь защитить деньги и обеспечить успех в торговле.

Ключевые моменты

- Управление рисками является необходимой функцией для защиты капитала и снижения потерь в торговле.

- Инструменты управления рисками, такие как стоп-приказ, контроль кредитного плеча и диверсификация портфелей, предназначены для ограничения рисков.

- Соотношение риска и доходности — это инструмент, позволяющий оценить возможную прибыль от сделки по сравнению с возможными убытками перед открытием сделки.

- Регулярный пересмотр стратегий гарантирует, что ваш подход будет отражать изменения на рынке, а также ваши цели в области эффективности.

- Более эффективное управление рисками развивает дисциплину, снижает эмоциональную составляющую торговли и увеличивает вероятность получения прибыли в долгосрочной перспективе.

Основные принципы управления рисками

Управление рисками основано на ряде принципов, охватывающих различные аспекты риска, связанного с торговлей. Эти принципы составляют основу эффективного плана управления рисками. Понимая и эффективно применяя эти принципы, трейдеры могут принимать обоснованные решения, поддерживать сбалансированный портфель и минимизировать потенциальные убытки, одновременно максимизируя возможности получения прибыли.

Принцип 1: Диверсификация

В мире трейдинга и управления рисками диверсификация является основополагающей концепцией. Она подразумевает распределение активов по рынкам и инструментам для снижения влияния низкой доходности одного актива на весь портфель.

Распределяя инвестиции между секторами и классы активов Учитывая разную реакцию на экономические изменения, диверсификация, по сути, направлена на защиту от нестабильности и часто неустойчивости рынков. Например, стоимость одного сектора может снижаться, в то время как другой процветает, тем самым сохраняя баланс в доходности инвестиционного портфеля. Если технологический сектор испытывает трудности, здравоохранение может процветать, и наоборот. В этом смысле развитие в одном регионе может компенсировать колебания или спады в экономике другой страны.

Реализация разнообразного портфеля

Создание сбалансированного инвестиционного портфеля требует понимания взаимосвязей между различными активами и того, как они влияют на общий риск портфеля, а не только выбора различных активов. Это также подразумевает объединение денежных эквивалентов, акций, облигаций и сырьевых товаров. Кроме того, диверсификация подразумевает балансировку инвестиций между такими секторами, как технологии, здравоохранение, финансы и потребительские товары, для минимизации рисков и повышения стабильности портфеля.

Географическая диверсификация обеспечивает определенный уровень защиты за счет распределения инвестиций по разным странам и регионам, что позволяет смягчить последствия экономического спада в конкретных областях. Такой подход имеет жизненно важное значение на современном взаимосвязанном рынке, где политические события в одном регионе могут иметь последствия во всем мире.

Балансировка портфеля

Управление рисками требует диверсификации активов. Однако важно найти баланс, чтобы избежать чрезмерного распыления средств и потенциального снижения потенциального дохода. Достижение такого баланса требует понимания рынков и отраслей и может повлечь за собой решение дополнительных сложностей, особенно при инвестировании на международном уровне.

Диверсификация как непрерывный процесс

Важно понимать, что диверсификация — это не одноразовая настройка, которую вы просто устанавливаете один раз и затем забываете о ней, поскольку рынки со временем меняются, и планы диверсификации должны меняться соответственно, проверяя и адаптируя инвестиционный портфель с учетом меняющейся динамики рынка и индивидуальных финансовых целей.

По сути, диверсификация в трейдинге подразумевает поиск баланса между минимизацией риска и использованием потенциальных возможностей роста. Чтобы соответствовать уровню толерантности к риску и инвестиционным целям каждого трейдера, эта процедура требует постоянного наблюдения и корректировки. Использование стратегий диверсификации помогает трейдерам сформировать портфель, способный более успешно справляться с колебаниями финансовых рынков.

Принцип 2: Понимание и управление рычагами

Торговое кредитное плечо может значительно увеличить прибыль, одновременно увеличивая убытки. Кредитное плечо подразумевает использование заёмных средств для увеличения доходности инвестиций. Поскольку кредитное плечо обычно подразумевает заёмные средства, оно пересекается с основными концепциями маржинальная торговля .

Хоть это и может показаться привлекательным, эта стратегия требует продуманного подхода и стратегии для ее правильного применения.

Механика кредитного плеча в торговле

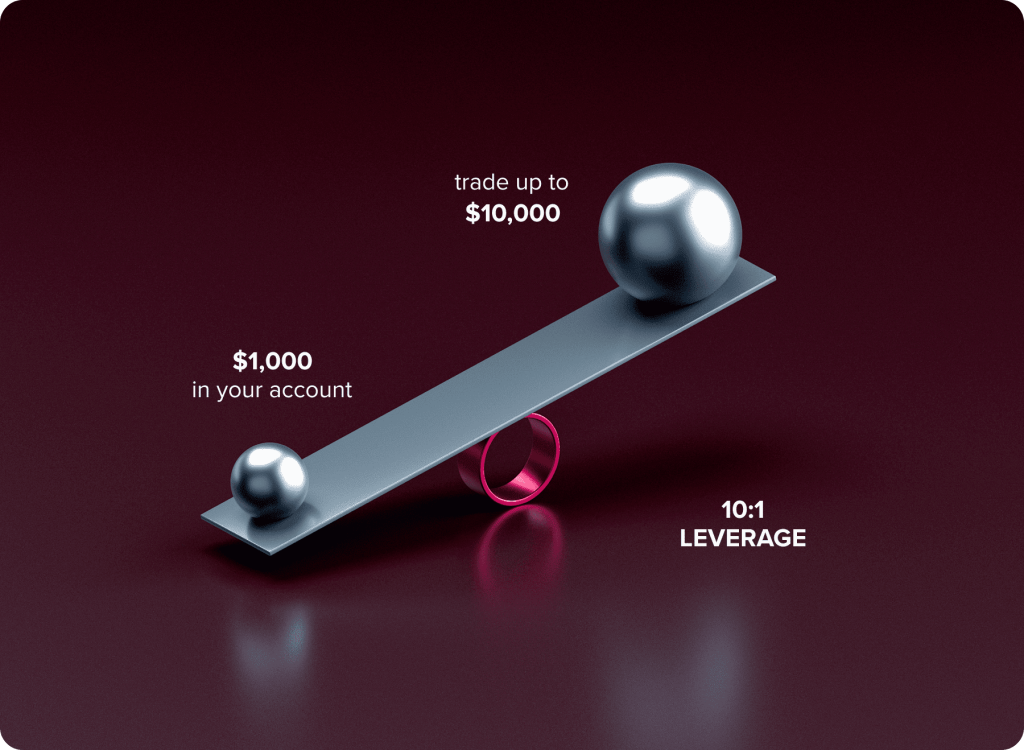

Трейдеры используют кредитное плечо для управления крупными позициями, имея в распоряжении довольно скромный капитал. Например, при кредитном плече 10x трейдер может управлять позицией в 10 000 долларов, инвестировав всего 1000 долларов собственных средств. Эта стратегия может принести значительную прибыль при благоприятном движении рынка. Тем не менее, она также сопряжена с рисками, поскольку даже незначительное неблагоприятное изменение может привести к быстрым убыткам, превышающим первоначальные инвестиции.

Управление рисками и выгодами

Привлечение более высоких доходов посредством торговли с использованием кредитного плеча необходимо сопоставлять с осознанием связанных с этим рисков. Кредитное плечо увеличивает как преимущества, так и недостатки торговых операций, тем самым повышая ставки для трейдеров. Трейдеры должны понимать, что, хотя кредитное плечо может повысить их покупательную способность, оно также увеличивает риск в периоды резкой волатильности рынка.

Разумное использование кредитного плеча

Ответственное использование кредитного плеча подразумевает соблюдение ряда правил. Прежде чем трейдеры решат использовать кредитное плечо в торговле и начать безопасно управлять уровнем риска, им необходимо оценить потенциальные риски, связанные с использованием кредитного плеча, проанализировав текущую рыночную ситуацию и учтя возможность внезапных и значительных колебаний. Трейдерам крайне важно иметь достаточный капитал для покрытия любых требований о внесении маржи и предотвращения финансовых перерасходов. Также необходимо понимать динамику рынка и обладать обширным опытом торговли, учитывая все тонкости рыночных изменений и влияние кредитного плеча на различные типы активов.

Кредитное плечо как стратегический инструмент

Кредитное плечо, безусловно, считается активом и силой, приносящей пользу трейдерам, несмотря на то, что оно сопряжено с определенными рисками. Опытные трейдеры используют кредитное плечо в своей торговле. торговая стратегия along with risk management methods to enhance their торговая стратегия as a whole. Trading leverage can be a tool with both benefits and drawbacks to consider carefully before diving in headfirst.

Принцип 3: Установка точек стоп-лосса и тейк-профита

Стоп-лосс и тейк-профит служат своего рода «сторожевыми псами», защищающими портфель трейдера. Эти инструменты — не просто механизмы управления транзакциями; они необходимы для поддержания дисциплины и стратегического планирования в зачастую нестабильном мире трейдинга.

Роль стоп-ордеров

Обычно трейдеры используют стоп-ордера, размещаемые в точке, где они готовы понести определенный убыток, но не более того, чтобы выйти за его пределы, чтобы отменить позиции на заранее определенном уровне цены и тем самым ограничить возможные убытки по транзакциям.

Представьте себе: трейдер платит 50 долларов за акцию, надеясь на рост её рыночной стоимости. Учитывая волатильность рынка, трейдер затем устанавливает стоп-лосс на уровне 45 долларов, чтобы ограничить убытки в случае падения цены акций до этого уровня, тем самым гарантируя ограничение потерь и закрытие позиции. На рынках, где цены быстро меняются, и ручные действия могут быть недостаточно быстрыми, такой подход особенно важен.

Значение ордеров «Тейк-профит»

Напротив, ордер «тейк-профит» призван гарантировать прибыль, прекращая сделку при достижении ею заранее заданного уровня прибыли. Это позволяет трейдерам максимизировать прибыль, не поддаваясь жадности или страху упустить прибыль.

Например, трейдер может установить ордер на фиксацию прибыли по акциям, купленным по 50 долларов и проданным по 60 долларов. Этот ордер срабатывает, когда цена акций достигает этой отметки, тем самым гарантируя прибыль. Эта функция чрезвычайно полезна, когда трейдер не может следить за рынком и не упускает возможности получить прибыль от движения цен.

Баланс риска и вознаграждения

Баланс риска и прибыли — это цель ордеров стоп-лосс и тейк-профит. Они позволяют трейдерам устанавливать цели по допустимому риску и прибыли, предлагая при этом метод торговли, не требующий постоянного наблюдения за рынком или чрезмерной эмоциональной зависимости при принятии решений.

На рынке, где цены растут во время бычьего тренда, трейдеры могут корректировать эти ордера в соответствии со своими торговыми планами и стратегиями оценки рынка. Например, трейдер может использовать более высокие уровни тейк-профита или корректировать стоп-лоссы на более высокие ценовые уровни, чтобы максимизировать потенциальную прибыль, эффективно управляя при этом риском потерь.

Стратегическая реализация

Чтобы правильно использовать стоп-лосс и тейк-профит, необходимо сначала понять рыночные модели и разработать собственную торговую стратегию. Выбирая, насколько плотно или свободно размещать эти ордера, необходимо учитывать доступные варианты. Слишком близкое расположение может привести к раннему закрытию сделки, а слишком далекое — к чрезмерному риску.

Установка стоп-лосс и тейк-профит ордеров выходит за рамки управления рисками; она демонстрирует отношение трейдера к рынку, а также его дисциплинированность и понимание динамики торговли. Размещая эти ордера, трейдеры могут уверенно ориентироваться в сложных условиях рынка, будучи уверенными в защите своих инвестиций и прибыли.

Принцип 4: Соотношение риска и доходности

Один из способов оценить риск сделки — это посмотреть на соотношение риска и доходности. Оно помогает инвесторам взвесить возможную прибыль и возможный убыток в конкретной сделке. Соотношение риска и доходности 1:3 соответствует ситуации, когда трейдер готов рискнуть 1 долларом в надежде заработать 3 доллара. С помощью этого соотношения трейдеры могут определить, какие опционы соответствуют их торговым целям и уровню готовности к риску.

Применение в торговых стратегиях

Соотношение риска и доходности влияет на подходы, стратегии и решения в трейдинге. Чтобы оценить вероятный успех сделки, трейдеры оценивают соотношение риска и доходности. Сделка, демонстрирующая такое соотношение, обычно вызывает интерес и соответствует стратегическому подходу, ориентированному на разумное управление рисками и достижение прибыльных результатов.

Трейдеры используют соотношение риска и доходности для оценки потенциала сделки перед её открытием. Расчет соотношения риска и доходности также требует понимания торговых издержек, таких как спреды . В целом, сделка с хорошим соотношением более привлекательна, поскольку соответствует плану, направленному на эффективное сочетание риска и возможной прибыли.

Эта стратегия фокусируется на взвешивании рисков и выгод для принятия продуманных торговых решений, тщательно учитывающих как положительные, так и отрицательные результаты. Она подчёркивает важность разумного выбора в условиях меняющихся и неопределённых рынков. Уделяя внимание соотношению риска и выгоды при торговле акциями или активами, инвесторы могут разрабатывать планы, которые не только снижают риски, но и нацелены на получение существенной прибыли, что в конечном итоге приводит к стабильной и долгосрочной торговой стратегии.

Адаптация к индивидуальным стилям торговли

У трейдеров есть свои предпочтения в отношении соотношения риска и прибыли, основанные на их готовности к риску и подходе к торговле в различных рыночных условиях. Некоторые выбирают осторожный подход, другие же занимают более смелую позицию. Ключ к успеху — найти соотношение, которое соответствует вашим торговым убеждениям и взгляду на рынок.

Принцип 5: Регулярный пересмотр и корректировка

В мире, где рынки постоянно меняются и адаптируются к новым условиям и тенденциям, трейдерам крайне важно постоянно переоценивать и совершенствовать свои стратегии управления рисками. Это не просто упражнение. Это практика, которая гарантирует эффективность стратегий и их способность реагировать на изменения рынка.

Необходимость регулярных обзоров стратегии

В мире финансов и инвестиций навигация на рынках подобна решению головоломки, которая постоянно меняется. Именно поэтому так важно постоянно пересматривать свои стратегии с помощью регулярных обзоров, поскольку они играют ключевую роль в обеспечении успеха и адаптивности в этой динамичной среде.

- Будьте в курсе событий на рынке

Рынки могут быстро меняться под воздействием таких факторов, как обновление данных, геополитические события или изменения настроений инвесторов. Важно быть в курсе этих тенденций, чтобы соответствующим образом корректировать свои торговые стратегии.

- Анализ эффективности текущих стратегий

Важнейшим аспектом является оценка эффективности существующих тактик в свете рыночной среды для получения представления об их успешности и областях, требующих улучшения.

- Выявление новых рисков и возможностей

Оценка ситуации и обстоятельств также требует внимания к будущим вызовам и потенциальным возможностям. По мере изменения рыночной конъюнктуры могут возникать новые трудности, требующие переоценки и корректировки стратегий управления рисками. Аналогичным образом могут появиться новые возможности, которые ранее не были замечены.

Гибкость: ключ к адаптации

В основе таких пересмотров и корректировок лежит идея гибкости. Ключевым моментом здесь является открытость к изменениям и корректировка стратегий на основе имеющейся информации или меняющихся рыночных условий. Гибкость в торговле — это понятие, которое выходит за рамки корректировки цифр или смены позиций. Она заставляет пересматривать свою толерантность к риску, которая может меняться в зависимости от индивидуальной жизненной ситуации и волатильности рынка. Пересматривайте и корректируйте свой торговый план по мере необходимости, чтобы убедиться, что он по-прежнему соответствует вашим целям и состоянию рынка.

Кроме того, гибкость подразумевает внесение необходимых корректировок на основе информации, полученной в результате анализа рынка и оценки эффективности текущих стратегий. Например, трейдер может счесть целесообразным скорректировать свои инвестиционные позиции, уточнить стоп-лосс и тейк-профит ордера или изучить классы активов или секторы. Эта способность к адаптации критически важна в сфере торговли, поскольку рыночные обстоятельства могут меняться внезапно и непредсказуемо. Необходимо уметь адаптироваться и быстро реагировать, быть готовым к переменам и изменениям, используя надежную, но гибкую стратегию, способную адаптироваться к постоянно меняющейся торговой среде.

Ваш контрольный список управления рисками

Используйте этот контрольный список как краткое руководство по снижению риска и укреплению дисциплины в каждой сделке:

- Устанавливайте стоп-лосс и тейк-профит ордера для каждой сделки

- Используйте правильный размер позиции с учетом вашего капитала и устойчивости к риску.

- Избегайте чрезмерного использования заемных средств — никогда не рискуйте больше, чем можете позволить себе потерять.

- Распределяйте капитал по классам активов, секторам и регионам, чтобы диверсифицировать свой портфель.

- Регулярно пересматривайте и корректируйте свою стратегию с учетом результатов вашей деятельности и изменений на рынке.

Почему управление рисками важно на рынке 2025 года

В 2025 году финансовые рынки станут самыми рискованными за всю историю. В условиях геополитической неопределенности высокие процентные ставки и повсеместное распространение искусственного интеллекта (например, алгоритмов, управляющих торговлей автоматически, и динамичной и рискованной экосистемы) снижают вероятность ошибок как для розничных, так и для институциональных трейдеров.

Управление рисками — это не просто приятное дополнение, это средство выживания.

Трейдерам необходимо применять проактивные подходы для защиты капитала, управления волатильностью и адаптации к резким колебаниям рынка. Работая в условиях постпандемических изменений политики, изменения торговых потоков в алгоритмической торговле или отхода от глобальной экономики, управление рисками обеспечит дисциплинированную, последовательную и конкурентоспособную торговлю.

На современном рынке отсутствие политики управления рисками само по себе является риском.

Частые ошибки в управлении рисками (и как их избежать)

Избегание эмоциональных сделок требует глубокого понимания психология трейдинга Даже опытные трейдеры могут поддаться психологическим ловушкам или совершить ошибки, но выявление этих распространённых ошибок — это начало построения надёжной торговой стратегии.

Переоценка рыночных колебаний

Чрезмерная торговля часто связана с совершением дополнительных сделок во время нестабильных движений рынка.

Кончик: Придерживайтесь своего торгового плана и совершайте максимальное количество сделок в день. Следуйте заданным вами параметрам риска. Все эти дополнительные сделки, совершённые в рыночном шуме, будут импульсивными решениями.

Неиспользование стоп-лосс-ордеров

Пропуск стоп-ордеров подвергает ваш капитал риску неограниченного падения, когда вас застигает врасплох внезапное падение рынка.

Кончик: Перед открытием позиции всегда следует устанавливать стоп-лосс. Он должен основываться на техническом анализе, а не на убытках налогоплательщиков. Если вам необходимо скорректировать стоп-лосс, делайте это по мере развития сделки.

Месть Торговля

После того как вы потерпели поражение, желание «отыграться» часто приводит к еще большим ошибкам, особенно если вы испытываете чувство безотлагательности, страха или разочарования.

Кончик: После убытка сделайте перерыв. Подумайте о своём торговом плане и о том, что в нём нужно улучшить, и думайте о выходе на рынок только с чистым разумом.

Соотношение риска и доходности

Перед открытием сделки необходимо правильно оценить соотношение риска и доходности! Если вы открываете сделку, не оценив потенциальный рост или падение, вы исказите все свои прибыльные и убыточные позиции.

Заключение

Управление торговыми рисками — сложная задача, требующая не только теоретических знаний. Торговля на волатильных финансовых рынках требует от трейдеров передовых инструментов управления рисками, аналитических навыков и психологической стойкости для принятия взвешенных решений. Эти разнообразные аспекты можно объединить в единый подход к управлению рисками, который поможет трейдерам справиться со сложностью и волатильностью финансовых рынков, превратив управление рисками из защитной тактики в ключевую торговую стратегию.

FAQ

Типичным примером управления рисками в трейдинге является стоп-лосс. Например, трейдер покупает акции по цене 100 долларов, а затем устанавливает стоп-лосс на уровне 95 долларов. Таким образом, если цена акций падает до 95 долларов, позиция автоматически закрывается по рыночной цене, ограничивая убыток трейдера 5%. Это помогает не только управлять рисками, но и снизить эмоциональность при принятии решений, а также сохранить капитал на волатильных рынках.

Соотношение риска и прибыли помогает трейдеру определить, стоит ли открывать сделку. Например, если он торгует с соотношением риска и прибыли 1:3, он может заработать 300 долларов на каждые 100 долларов риска. Даже если у трейдера была полоса неудачных сделок, если он выработал дисциплину, позволяющую ему торговать с хорошим соотношением риска и прибыли, он может быть прибыльным.

– Стоп-лосс автоматически закроет сделку, когда она упадет до установленной вами цены убытка. – Ордер тейк-профит закрывает позицию трейдера при достижении заданной цели, фиксируя прибыль. – Оба варианта автоматически предоставляют трейдерам стратегию выхода и устраняют эмоциональный стресс.

Новичок может управлять рисками при торговле следующими способами: – Начните с демо-счета для практики. – Используйте низкое кредитное плечо или торгуйте без него. – Установите четкие уровни стоп-лосса и тейк-профита. – Используйте разнообразные сделки и методы для разных ценных бумаг. – Никогда не рискуйте более чем 1–2% своего капитала на сделку. – Регулярно пересматривайте свою стратегию в зависимости от результатов.

Обновлено:

25 июля 2025 г.