Everything You Should Know About Margin Trading

Contents

Margin trading means that you need to invest the margin (a certain percentage of the overall investment costs), and the rest of the funds are borrowed from a brokerage company or from a crypto exchange.

When talking about trading, users have two paths to pave: spot trading and margin trading. Many trading platforms combine both paths empowering their clients to either choose one of the ways or prefer a hybrid model.

Why is the popularity of margin trading rising, and what are the core advantages and risks related to such type of investment?

Quick Takeaways

- Margin trading = borrowed capital => You pay a fraction of the trade size and borrow the rest from a broker or crypto exchange.

- Leverage magnifies outcomes => It maximizes both profit and loss according to price movement.

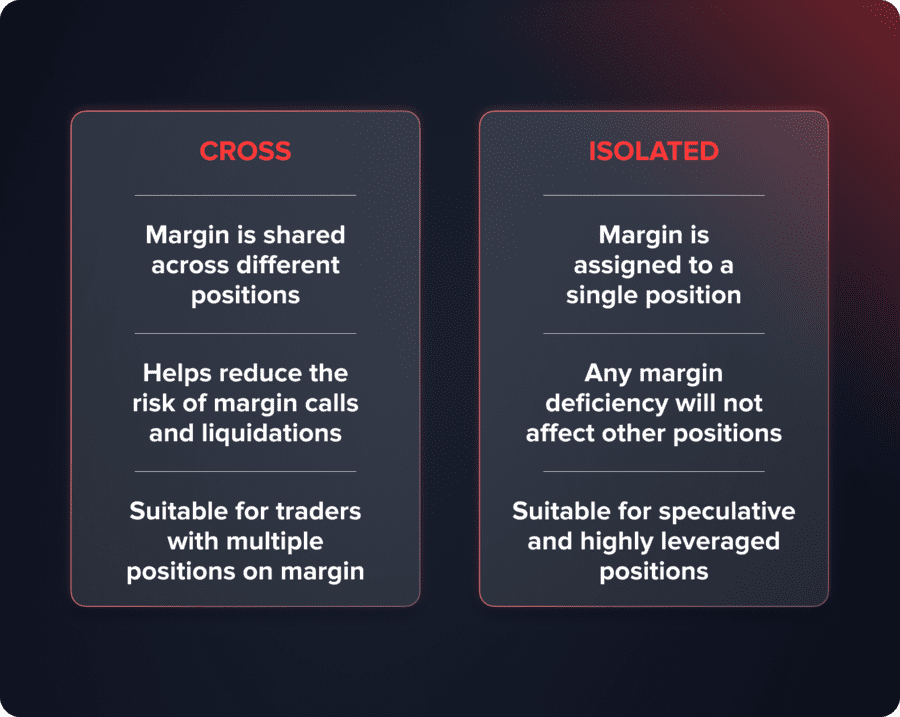

- Two types of margin => Isolated margin contains risk to one position, while cross margin assigns risk to your whole balance.

- There are concealed costs => Expect trading fees, commissions, as well as funding rates that reduce net profit.

Liquidation risk is the biggest risk => As soon as equity falls below required margin, your broker can automatically close the position.

What is Margin Trading?

Margin trading enables you to open a position without paying the entire value of the asset. You put up a margin (a proportion of the value of the trade) and borrow the rest from your broker or exchange. This amplifies your exposure to the market – and your risk.

How it works (step by step, simply)

- Choose an asset and leverage (e.g., 5x, 10x, 30x).

- Deposit the initial margin.

- The rest is covered by the platform.

- Your P/L is on your full position size, not your margin.

- If equity goes below the maintenance margin, you get a margin call or liquidation.

Important formulas (useful to readers)

- Position size = Margin x Leverage

- Required margin = Notional value + Leverage

Example (BTC)

- Spot buy 0.5 BTC at $60,000 = $30,000.

- 10x leverage => margin required ≈ $3,000.

- 100x leverage => margin required ≈ $300.

- Same price movement, bigger P/L swings because returns are applied to the $30,000 notional.

Another easy example (stocks)

- Buy $10,000 of TSLA with 5x leverage => margin = $2,000.

- A +2% price movement ≈ +$200 on $10,000 notional (+10% on your $2,000 margin, before fees).

- A -2% movement ≈ -$200 (-10% on margin). Losses can compound if the market continues to fall.

You may also like

Heads-up: More leverage lowers upfront cost but raises the danger of margin calls and forced liquidation. Always factor in fees/funding into your breakeven.

How Leverage Works in Practice

Leverage comes in the form of a ratio (e.g., 1:10). It defines how much of the position you pay for using your own money and how much using borrowed money.

- 1:10 leverage – you invest 10% of your own money, 90% borrowed.

- 1:30 leverage – retail limit in most EU jurisdictions (CySEC, ESMA).

- 1:2000 leverage – offered by some offshore brokers, but extremely risky.

Profit & Loss Examples

Leverage amplifies every market move:

- With 10x leverage, +2.5% price appreciation = +25% profit on your margin.

- With 20x leverage, -3% price drop = -60% loss on your margin.

Rule of thumb: The higher the leverage, the lower the margin you need – but the faster your account balance can change, and the higher the liquidation risk.

Isolated Vs Cross Margin. Which Margin Type is the Best One to Choose?

When a trader opens a margin position, two possible options are available – he may select either isolated When a trader opens a margin position, two possible options are available – he may select either isolated margin or cross margin. What are the differences between those options and which margin type is the best decision?

Isolated margin enables a trader to define the exact amount of money used as a margin. The platform cannot charge more funds.

Cross margin means that your margin position may take funds from your deposit. In such a case the whole deposit is understood as margin. This setup is somewhat similar to managed accounts, where account-wide balances are tapped to maintain positions.

Let’s compare those types in examples.

- A trader opens a margin position and invests $100 selecting the isolated margin type. When the invested $100 doesn’t cover the losses, the platform closes the position forcedly, and a trader loses the invested funds.

- A trader opens a margin position and invests $100 but selects cross margin. The overall deposit is $500 which means that the platform will access other funds to cover losses in case an asset’s price will go in the opposite direction.

What is the best solution for a trader? Both isolated and cross margin types have pros and cons. The isolated type enables traders to get the fullest control over their positions and add margin when they want. As for the cross margin type, it minimizes risks; meanwhile, this type is not the best decision when a trader opens many positions. The same concerns high leverages – when a trader uses a high multiplier (1:20 and higher), cross margin may rapidly eat up his deposit.

Long and Short Positions in Margin Trading

Margin trading enables you to gain in both bull and bear markets – something you can’t achieve with spot trading:

- Long position – You buy an asset, expecting its price to rise. You profit when you sell it later at the elevated price.

- Short position – You sell borrowed assets, expecting the price to drop. You profit when you buy them cheaper to return to the exchange or broker.

Important point to note: Spot traders can make money only when markets rise, but margin traders can trade either way – long in uptrends, short in downtrends.

Fees and Commissions Related to Margin Trading

Borrowed money is never free. In margin trading, you’ll face several types of costs that can significantly impact your net results:

- Trading fees – Platforms charge to open and hold positions.

Example: Kraken takes 0.02% to open + 0.02% every 4 hours.

- Funding fees – Common in futures contracts. These payments balance the difference between spot and futures prices.

Traders may pay or receive funding depending on market conditions.

- Brokerage commissions – Some brokers include flat fees or charge a percentage of the position size.

Tip: Always include these fees in your profit/loss calculation. Under high leverage, fees compound the same way profits and losses do.

Benefits of Margin Trading

Margin trading offers traders opportunities that are not available in spot markets:

- Trade bigger positions with less capital – Leverage allows you to control large positions with only a fraction of the price.

- Make money in both rising and falling markets – Go long during bull runs or short during bear runs.

- Access more strategies – Margin allows for strategies used in forex, stocks, indices, and crypto markets.

- Lower barrier to entry – Small deposits can be used to initiate large positions.

Bottom line: Margin trading increases your flexibility, capital efficiency, and strategy choices.

Risks of Margin Trading

Although margin trading provides opportunities, it also involves substantial risks that all traders must be aware of:

- Leverage amplifies losses – As much as it increases profits, leverage increases losses when the market goes against you.

- Forced liquidation can happen quickly – Even minor price movements can lead to automatic liquidation of your position.

- Margin calls – Brokers can require you to add more money to hold a position. Failure to do so leads to liquidation.

- Temptation to overtrade – Beginners open too many positions, increasing exposure and putting you at greater risk.

Key point: Greater leverage reduces capital requirements but makes risk management essential.What are the margin call and liquidation price as the core risks of margin trading?

You may also like

Margin Call & Liquidation Explained

Margin trading means that a trader uses funds borrowed from a broker or a crypto exchange. Trading plaTwo key terms dictate your risk in margin trading:

- Liquidation price – The asset’s price at which your margin is fully eaten up and your broker forcefully closes your position.

- Margin call – A warning that you must add more money to keep your trade open. Ignoring it can lead to liquidation.

Example

- You long TSLA at $209 with 20x leverage.

- Your margin = $41.8 (instead of $836).

- 5% price drop wipes out your margin.

- Liquidation price = $198.55.

Takeaway: Monitor the margin call level and liquidation price at all times – they determine how long your position can survive adverse price movement.

Practical Advice for Safer Margin Trading

Margin trading is more dangerous, but you can reduce risks by following some best practices:

- Start with low leverage (1:3 – 1:5) – High multipliers are not for newbies.

- Set stop-loss orders always – Protects your capital from sudden fluctuations.

- Trade with regulated brokers – Provides fair pricing, good liquidity, and protection for investors.

- Practice on demo accounts first – Risk-free testing of strategies before trading live.

- Avoid cross margin if trading multiple positions – Prevents losses from cascading across your entire balance.

Top tip: Your focus should be on risk management, not on maximum leverage chasing.

Bottom Line

Margin trading enlarges the opportunities available for traders. They access much larger capitals and may get profits on both bullish and bearish markets. On the other hand, margin trading implies higher risks – users may easily lose their deposits. This trading mode is definitely useful but traders need to make profound analysis and follow the risk management strategies strictly.

FAQ

No. Regulations differ by country. For example, ESMA (EU) and ASIC (Australia) restrict retail leverage to 1:30. Offshore brokers (those based outside these regions) can offer significantly higher leverage, but usually without the same investor protections. Licensing rules, such as those applied when getting a brokerage license, often define maximum leverage.

Yes, it's possible with cross margin and high leverage, as losses can bleed into your entire account balance. With isolated margin, your losses are contained to the individual amount allocated to that trade. These risks are also why brokers pair margin accounts with strict KYC checks for compliance.

Margin trading involves borrowing to leverage a spot position. Futures trading uses contracts that don't involve borrowing but do have funding fees (to keep futures and spot prices in sync) and usually have expiry dates.

Updated:

September 22, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]