Buy Side and Sell Side Liquidity – How Does It Work?

Contents

The concepts of buy and sell side liquidity play an important role in financial markets. Liquidity refers to the ease with which assets can be purchased or sold, and identifying areas of strong liquidity can provide valuable insights into market behaviour. This article will define the buy and sell sides, explain the concept of liquidity, and explore how liquidity works in practice.

The buy side encompasses institutional investors like hedge funds, pension funds, and asset managers who purchase securities. The sell side refers to brokers, banks and other firms involved in issuing and trading assets. Both sides interact to facilitate markets, with liquidity emerging from their aggregate activities. By understanding where liquidity accumulates, we can anticipate potential price moves and improve our trading.

Key Takeaways

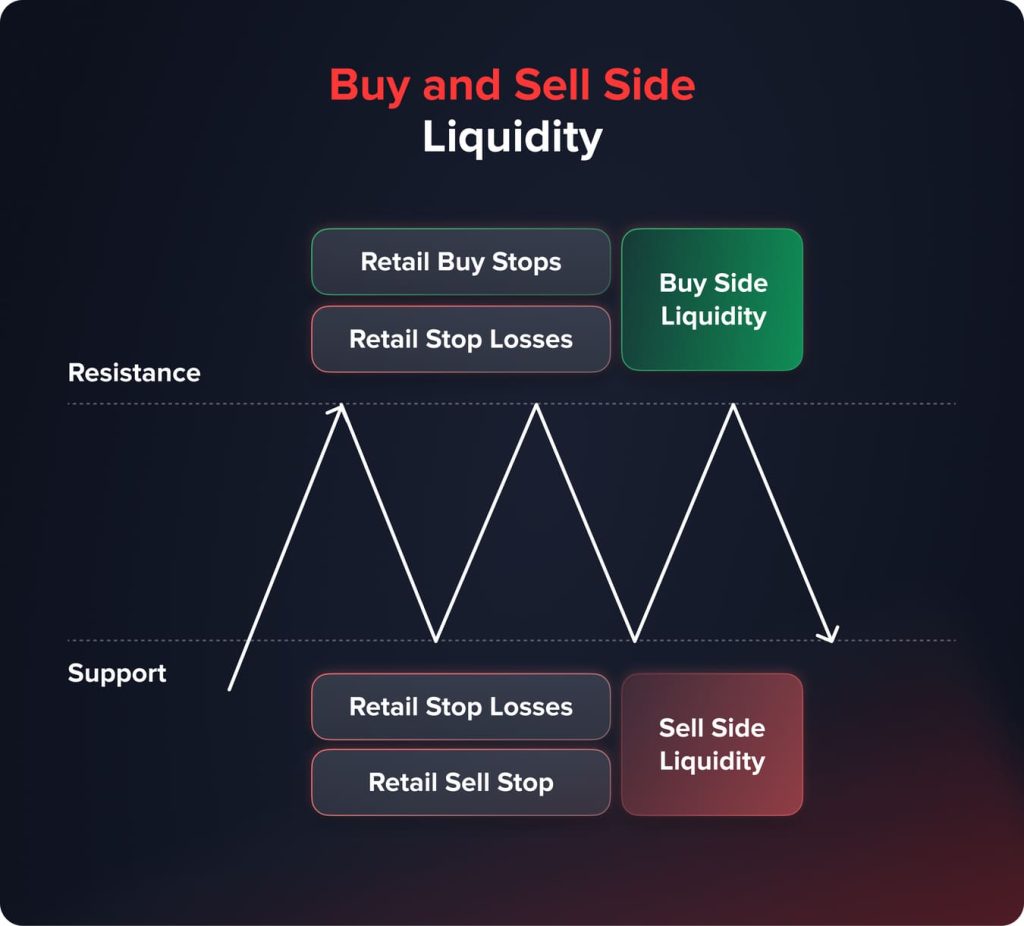

- Buy Side liquidity is formed above resistance levels due to stop losses of short sellers.

- Sell-Side liquidity is created from protective stop losses of long traders.

- Liquidity zones illustrate clusters of resting orders, i.e. the zone may not act as a definitive reversal.

- Liquidity zones may also produce large price fluctuations when breached or swept out and trigger multiple cascades of stop losses.

- Analysis of liquidity helps the trader in forecasting volatility spikes, false breakouts, and momentum changes.

- Liquidity analysis can best be used in conjunction with the following elements: market structure; volume; classification.

These dynamics explain why price can sometimes move fastest at obvious technical levels rather than between them.

What is Buy Side Liquidity?

Buy side liquidity emerges from the positions of traders who have sold short. Understanding where these short sellers typically place their protective stop-loss orders provides valuable insight into potential buy side liquidity zones.

Buy side zones typically form above prominent resistance levels. Resistance is where an uptrend fails to continue climbing higher, marked by decreased buying enthusiasm and increased short-term positions taking place above that price level. For active assets, there is often clustering of short-term short positions that create visible buy side zones just above psychologically round numbers or technical price levels where prior selling was seen.

Traders will watch for important resistance levels to potentially attract short-term short sellers, such as whole numbers, moving averages, trendlines from peaks or troughs, and Fibonacci retracement levels useful for identifying possible short-term resistance turned potential buy side zones. Short sellers reasoning the upside momentum has expired may enter shorts at or above these technical levels.

For instance, if a stock runs into resistance at $50 and therefore entices short positions, the short sellers’ rationale for a pullback would have them place protective stop losses $1-2 above at $51-52 as their lowest acceptable exit price.

Now, if the selloff starts running out of steam and some buyers come to force, in trading and are able to push through this identified buy side zone of $51-52, the buying orders will start queuing up through and above $51-52 as stops are triggered, which in turn catalyzes lots of short covering, fueling the price ever higher.

In consolidating markets where support and resistance are redefined, buy side liquidity may get tested multiple times. As levels are retested, short sellers may carefully lift the location of higher stop orders on a pullback after a level is reproved. The clustered stopping zones above evolving resistance can be especially revealing of shorts if they are broken in a manner that sparks short-covering-driven accelerations higher.

You may also like

What is Sell Side Liquidity?

Sell side liquidity zones emerge from the positions of traders who have established long positions within an asset. These are formed below key support price levels, where traders on the long side of the market will have an interest in defending any latent downside risk.

It forms support as it finds a price level at which it doesn’t want to push below and acts as the staging ground for further thrust upward. Traders try to figure out where a potential uptrend found a constructive base, such as whole numbers, moving averages, or recent lows trendline touches. And in such technical locations, longs will tend to congregate.

As security climbs from foundational support areas, emboldened bulls defend each subsequent higher low by strategically placing their protective sell stops below these successive support checkpoints. This clustering of long exit orders underneath evolving foundation levels carves out distinct sell side liquidity zones.

If selling unexpectedly resumes, piercing through a deeply fortified accumulate zone can spark a wave of long liquidation. As stops are triggered off in rapid succession below, the released supply dumps the price further downward at an accelerated clip.

In protracted downtrends, repeated tests of lows see additional sell side liquidity levels stack up successively lower as longs steadily raise their hedged stopping zones. More short-term selloffs are often precipitated by violations of these dense zones.

Sell side liquidity offers clues about potential pivot points by understanding how prevailing market participants have strategically hedged their risk. Its monitoring adds context for traders when seeking entry/exit spots around imminent support levels.

You may also like

Differences Between Buy and Sell Side Liquidity

While buy side and sell side liquidity emerge from comparable mechanisms involving the strategic hedging of positions by market participants, there are some important distinctions between the two in terms of overarching goals, clientele served, core functions, compensation structures, and regulatory frameworks.

Goals

The buy side primarily focuses on outperforming over a more extended time horizon through superior investment selection and portfolio management. Its aim is profitability and asset under-management growth.

While the Sell side functions target the relatively different goal of enabling market transactions through a new offering of securities, liquidity, and research, which can be further described as revenue generation through fees, commission, and spread. They basically act as an agent between the issuer and the investor.

Clients

The buy side caters mainly to significant institutional investors, including pension funds, endowments, hedge funds and high-net-worth individuals. These clients are looking for an edge in terms of best risk-adjusted returns.

The sell side serves both the corporations issuing the securities, and all classes of investors from retail traders to larger financial institutions looking to transact. As a result, their client base is significantly more varied.

Functions

Functional activities of the buy side core involve in-house research analysis of securities and investment followed by direct deployment through portfolio management to create alpha. The sell side entails underwriting new issues, making markets, sales/trading, investment banking advisory work, and investment banking research distribution. Where issuers are connected to investors through a wide range of services in capital markets.

All of these activities depend heavily on execution infrastructure, particularly the role played by matching engines in trading systems.

Compensation

Buy side compensation structures also tend to place more emphasis on performance-based bonuses that directly link pay to the investment outcomes achieved for clients. In comparison, those who work on the sell side generally earn fixed salaries but can also receive additional transaction- or commission-based compensation, which will depend on deal flow and the number or size of trades executed.

Regulations

Although both are controlled by the SEC and related state regulators, fiduciary responsibilities for the buy side go so far as advice. The strict legal boundaries aim at minimizing conflicts of interest in dealing with the customers’ funds. On the sell side, the regulation aims more at market integrity and transparency in being middlemen.

In summary, there are meaningful distinctions between the ultimate goals, functions and incentives driving behaviour on the buy versus sell sides of global financial markets. An appreciation of these differences goes a long way towards understanding liquidity dynamics.

Pros and Cons of Buy vs Sell Side Careers

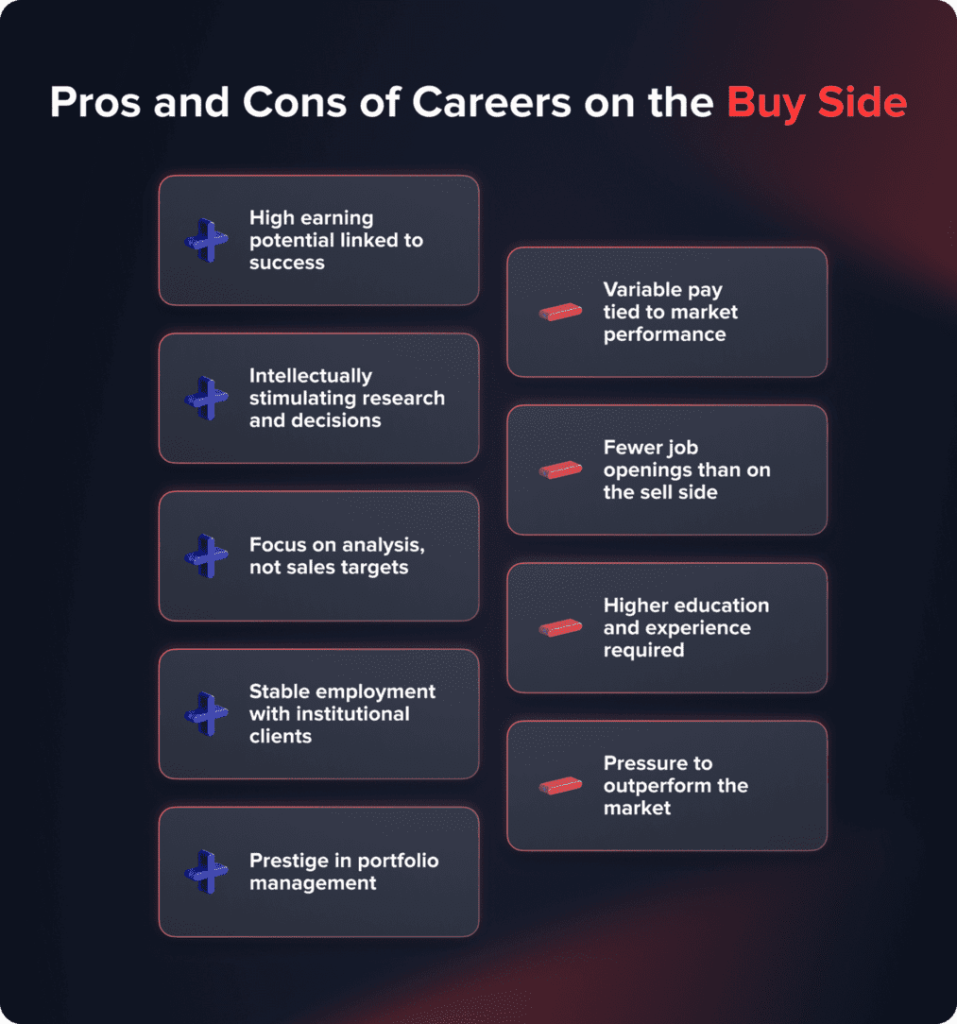

Pros and Cons of Careers on the Buy Side

Potential Pros

- Compensation structures directly link pay to investment performance outcomes via bonuses, offering the potential for higher earnings in successful years

- Intellectually stimulating nature of conducting independent research to identify overlooked opportunities

- The focus is on analyzing companies and making well-informed investment decisions rather than sales targets

- Typically more stable employment given clients are primarily large institutional investors

- Prestige associated with portfolio management roles at sizeable investment firms

Potential Cons

- Total compensation is variable year-to-year depending on market conditions and investment returns generated for clients

- Substantially fewer available positions relative to the sell side given the buy side represents a smaller segment of the overall financial industry

- Higher educational and experience prerequisites are generally required to gain access to coveted buy side analyst/portfolio manager roles

- Greater pressure to outperform market indexes and defend investment decisions/theses during difficult periods

These career trade-offs closely mirror broader brokerage business models seen across the industry.

Pros and Cons of Careers on the Sell Side

Potential Cons

- Far more entry-level jobs are available in sales, trading, investment banking, and research providing multiple options to break into the industry

- Excellent training grounds that develop real-world client interfacing skills highly transferable to other domains

- Fixed salary compensation still applies even during equity market downturns or deal droughts

- Career advancement attainable within comparatively larger organization structures

- Various practice areas allow flexibility to explore different career paths

Potential Cons

- Revenue generation obligations and individual production targets introduce stress around business generation

- Compensation consists primarily of base pay with bonuses geared towards transaction volume metrics rather than investment outcomes

- Longer hours are typically required in client-facing sales/banking roles supporting rigorous travel schedules

- Potential conflicts of interest may exist when recommendations meet corporate banking objectives

- Early exits are often required to transition onto more lucrative buy side opportunities

Overall, both the buy side and sell side offer fulfilling long-term careers in finance, each with its advantages and trade-offs to consider carefully depending on individual interests, skills, and lifestyle preferences. With experience, both paths can establish a strong professional foundation.

The Behavioral Aspect of Buy Side and Sell Side Liquidity

Understanding that traders create liquidity zones based on repeated behaviors, we can see why liquidity zones are formed in financial markets.

Majority of traders tend to:

- When entering positions, they use well-known technical levels as their “buy” or “sell” trigger.

- Placing Stop Loss orders slightly above or below those technical levels to hedge against losses.

- When the price moves against them, traders will react emotionally to the situation.

As a result of the above behaviors of traders, traders group their orders at specific technical levels and therefore provide a predictable area of liquidity. The same crowd-driven patterns sit behind many commonly used trading strategies.

Buy Side Liquidity Psychology

For short sellers, the thought that “resistance will hold” will drive them to set their stop-loss buy orders up slightly above that resistance zone, so as to manage the risk. If the price breaks through that resistance zone without notification, “fear” will take over from “conviction”.

When the trader’s Stop-Loss is activated, they must buy back (cover) their existing short position at an accelerated rate compared to what they would have done otherwise.

From these activities of short-selling traders result in:

- Accelerated price momentum upside.

- Emotional buying occurs at an accelerated rate.

- Price temporarily overshoots fair value.

Sell-Side Liquidity Psychology

When entering positions, long traders place their confidence in established support levels and protect themselves by placing their stop-loss orders below those support levels.

If the price breaks through support without notification, traders immediately lose hope and revert to a panic state.

Consequently, when the traders’ Stop-Loss orders are activated, the trader will find themselves forced to close their long position quickly.

From the above process, the following occurs:

- Sharply downward trend movement of prices.

- Temporary liquidity void below support.

- Accelerated drawdown.

Liquidity zones are not “smart money” levels by default.

They are crowded consensus areas where emotional reactions are most likely to peak.

Indicators to Spot Liquidity Zones More Accurately

Liquidity is not visible on a chart but through the use of some technical indicators: it can be inferred where most orders are clustered. The following technical tools assist the trader in determining areas of liquidity:

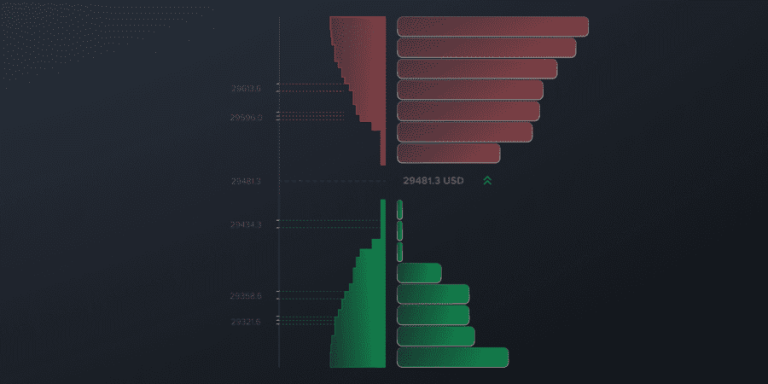

Volume Profile

The volume profile displays high volume areas for specific price levels where a majority of the trading took place. The Point of Control (POC) on a volume profile typically serves as a strong liquidity magnet. Sharp low volume areas above and/or below the POC highlight areas where prices could move rapidly. Price levels that are revisited multiple times with volume typically demonstrate a strong reaction.

Equal Highs and Equal Lows

When an asset is tested numerous times (by price touching that level) at the same level numerous times, it becomes a candidate for clustering of stop loss orders. These equal highs and equal lows are common around range extremes. When significant amounts of equal high price levels form, it typically indicates liquidity in buy-side positions. When significant amounts of equal low price levels form, it indicates liquidity in sell-side positions. It is not uncommon for price to travel into these levels prior to making a more significant directional move.

VWAP and Anchored VWAP

Institutions actively monitor the daily VWAP levels and use them as reference points to guide their trading activity. A large percentage of trading is done at or around these levels. Because institutions will often buy and/or sell at the VWAP level, if price breaks above or below this level, liquidity runs can occur. Anchoring VWAP to major highs/lows and/or news events provides additional reference points to assess liquidity.

Fibonacci

Fibonacci retracement levels are often close to resting orders. The key Fibonacci retracement levels of 38.2%, 50%, and 61.8%, are the most likely to receive stop placement as they all correlate very closely to an individual trader’s sentiment about where they feel comfortable breaking even; therefore, these price levels can be viewed as areas of high liquidity. As well, the higher significance an individual trader perceives these levels to be, the more significant the level of liquidity associated with the Fibonacci retracement level.

Moving Averages

Commonly tracked average movements typically function as an area for liquidity

accumulation by traders. Some of the most popular moving averages consist of the 50 Moving Average, the 100 MA & the 200 MA. Commonly utilized stop placements are typically placed just outside of these average price levels. Breakthroughs of these important MAs typically result in accelerated price movement.

Moving averages rarely operate in isolation and often align with other widely used technical indicators. When multiple indicators occur and align at the same price level, they provide the ideal potential area for strong liquidity formation/re-accumulation or consolidation at that same price level (i.e. many orders concentrated at or near that same level).

How To Identify Liquidity Zones

Technical tools can help to identify liquidity zones. More often than not, Fibonacci retracement and extension levels identify the buy and sell side areas nearby that can equate to proportionate movements. Zones regularly see convergence with simple moving averages weighted for different periods. Horizontal and trend line analysis also indicates boundaries where the momentum was stalling before.

Breakout and reversal candlestick patterns provide visual clues about ongoing battles between bulls and bears near prominent liquidity territories. Formation types such as spinning tops or downs signal heightened indecision while engulfing bars flag decisive moves breaking thresholds.

There is a layered form of history in volume profile indicators, which graphically display price levels that differentiate where the bulk of trading activity has occurred—thus identifying key supply and demand centres in the market. Formations of spikes validate the intensification as the zones are disintegrated under pressure. The point of control pinpoints the most traded price.

Real market examples prove instructive. One stock declined to support under $15 and consolidated sideways for weeks within a $13.50 sell side zone where buying repeatedly absorbed downside tests. Heavy turnover marked this level as a substantial supply. Its puncture catalyzed a surprising two-dollar plunge lower as hopeful short-term bulls bailed en masse, with stops triggered in tow below.

Monitoring confirmed liquidity zones offer actionable insight into potential support/resistance flips. Case studies apply this framework demonstrating identifiable behaviors traders can integrate. Ongoing observation strengthens pattern recognition when seeking opportune times to trade evolving market structures.

Common Liquidity Traps

Liquidity trapping occurs when the price reaches a known liquidity zone and then reverses direction. When traders enter too quickly or aggressively, they can be caught by the liquidity trap. There are two types of liquidity traps for traders:

Common Buy Side Liquidity Traps

- The price breaks above support for a very short period of time

- Short seller stops are triggered

- Upside momentum fails to sustain

- Price reverses sharply lower

This sequence can trap both:

- Traders who entered late on the breakout

- The short sellers who were forced to exit positions at or near the tops of their sell stops and reverse.

Common Sell Side Liquidity Traps

- The price breaks below support before recovering to above the level.

- Long trader stops are triggered

- Price quickly reclaims the level

- The move continues higher

Typically the following individuals will be trapped:

- Those who panic-sold

- Those who entered on aggressive breakdowns

The majority of the time, liquidity traps occur either:

- During low volume or illiquid periods

- Volatile price movement as a result of news announcements

- During periods of price compression or end-of-range.

How To Avoid Liquidity Traps

- Wait for confirmation after an initial break and not the initial break.

- The market often reacts to liquidity immediately after it has been taken.

- Use higher timeframe structures to confirm/validate breakouts.

- Don’t place your stops above or below areas that are obviously equal highs/lows, as this is generally where the market will reverse quickly as liquidity is taken from those stops.

- Reduce your position size prior to entering trades in well-defined liquidity areas.

Professional traders usually enter after liquidity was taken from the area rather than on the first test of that liquidity area.

You may also like

How To Trade with Liquidity in Mind

Finding liquidity zones sets the stage for planning strategic manoeuvring. When the accumulation and distribution territories take form, the traders can position themselves relative to those concentrations. Doing so provides potential pivots to regain or protect exposures.

Breaking above buy side resistance or below sell side support often sets up an extension that is not sustainable. Selling into runs or going short targets the next stacked zone once momentum stalls. Outcomes during these phases are strongly influenced by execution quality and overall trading platform selection. Weak, delayed breakdowns through the sell side areas create a gap that traditional traders target to buy. The aggressive long entries chasing holds above these lower-value pockets.

Zones invite periodic retests, keeping the implied volatility elevated. Selling out-of-the-money puts collects income as zones prove resilient. Stops respecting untested adjacent zones balance rewarding trends with minimizing the drawdowns if reversed. Trailing breaks improve risk-defined holds.

Upside purchase constraints use higher-level expansion in time frames, with downside profit objectives pointing to the proximity of underlying support. Integrating structure given through supply and demand areas, either buying with, against, or in the absence of the prevailing sentiment, improves trade construction.

The perceptions of those zones remain in tune with the changing market conditions and the shifting behaviour of participants since the updating is constant. Keeping an eye on changing liquidity maximizes opportunity around confirmed zones. The framework is useful for assessing what the potential risk/reward could be between the fluctuations within the cycles.

Tips For Monitoring Liquidity Levels

For a trader, it’s still important to monitor changes in liquidity and market structures through time. Groups inclined to one side will consolidate in the range, all the while narrowing on which sides are building conviction, while breakouts will reveal which bias took control. Diminishing conviction in a direction is what will be shown if the bands of volume are receding, while for the opposite, expanding bands are shown.

Charting liquidity patterns daily is a very valuable context during emerging moves. An update makes it easy not to hang onto the outdated perceptions that offend the language of the market for that day. Liquidity not only evolves over the course of days but it changes during the day, as different groups of participants come into and out of the market.

Phases of auction into the open will shape the prevailing structure for the near term. Later then into the close, selling exhaustion often results in range contraction. Knowing how these factors impact the day will help in the timing of entries in terms of the prevailing conditions.

In trending states, liquidity gradually flows deeper in the prevailing direction as zones stack closely along, following the momentum. Consolidating markets see this liquidity flip-flop between defined levels. Here, traders engage in a debate as to which side the range might eventually find a resolution to and the force set for a reevaluation.

The major news can trigger sharp moves as the market resumes an established trend or if the range eventually breaks out of indecision. In quiet periods with no big news or events, the ranges widen in a free test of wills on both sides. Measuring the broader macroeconomic variables and changes in policy will keep expectations for the potential for stability or volatility on the ground.

Monitoring liquidity levels closely will enable an outline of the market structure to be laid out, including shifts in sentiment and potential turning points for trade selection. It helps us steer through the various phases of a broad cycle.

Conclusion

Defining buy and sell side liquidity levels advantages traders. Locating major order flow zones informs potential support/resistance flips fueling reversals. Monitoring changing structures empowers adapting strategy according to market mood and participant behaviour. While not predictive, integrating liquidity awareness improves understanding of mechanics driving prices across cycles.

FAQ

Not necessarily. Liquidity on the buy side provides an avenue for buy side price movement if enough buyers are still in the market. However, it may represent a point of exhaustion if prices cannot maintain above this level.

No. Sell side liquidity may create large downward movements, but those movements may be followed by an equally strong movement upward if buyers step in to buy after all of the stops were cleared.

No. While support/resistance levels refer to past price behavior, liquidity zones represent where orders may be concentrated. Therefore, a support/resistance level may exist without a significant amount of liquidity.

Updated:

December 18, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]