Liquidez do lado da compra e do lado da venda – como funciona?

Conteúdo

Os conceitos de liquidez do lado da compra e do lado da venda desempenham um papel importante nos mercados financeiros. Liquidez refere-se à facilidade com que os ativos podem ser comprados ou vendidos, e identificar áreas de forte liquidez pode fornecer insights valiosos sobre o comportamento do mercado. Este artigo definirá os lados da compra e da venda, explicará o conceito de liquidez e explorará como a liquidez funciona na prática.

O lado comprador abrange investidores institucionais como fundos de hedge, fundos de pensão e gestores de ativos que compram valores mobiliários. O lado vendedor refere-se a corretores, bancos e outras empresas envolvidas na emissão e negociação de ativos. Ambos os lados interagem para facilitar os mercados, com a liquidez emergindo de suas atividades agregadas. Ao entender onde a liquidez se acumula, podemos antecipar movimentos de preços potenciais e melhorar nossa negociação.

Principais Conclusões

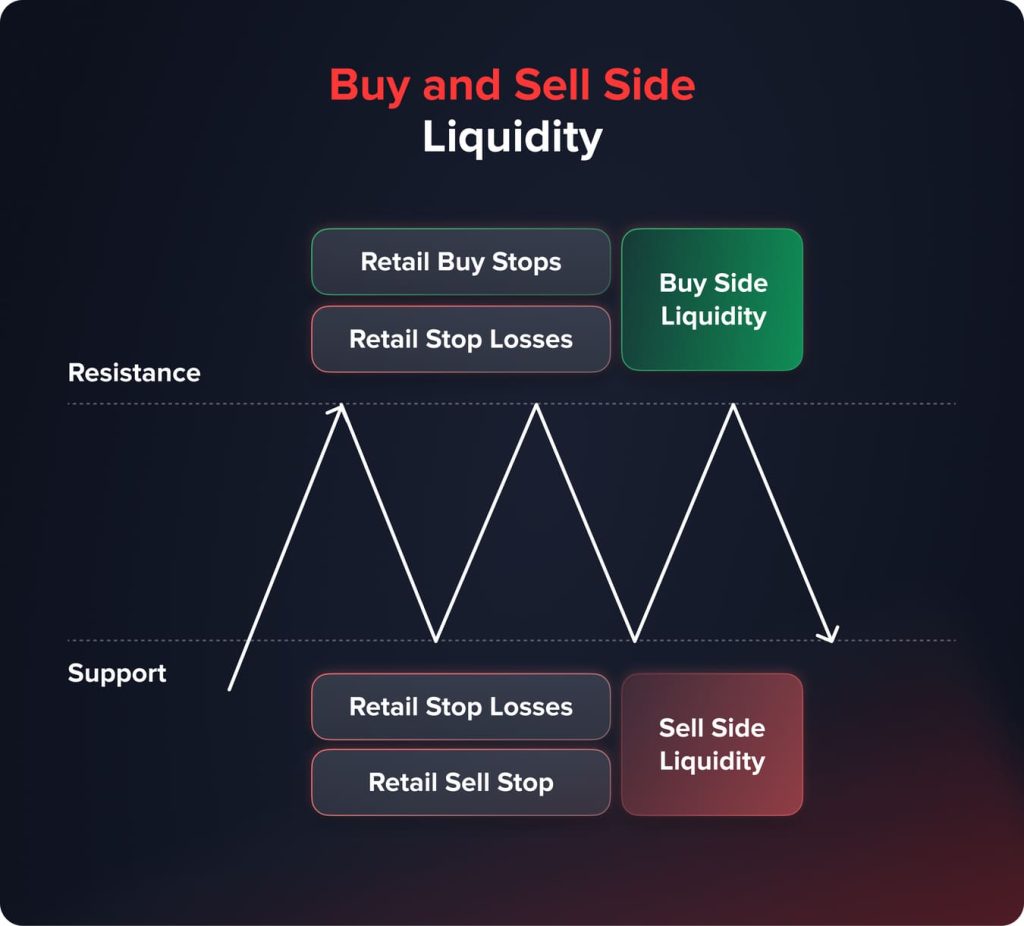

- A liquidez do lado da compra é formada acima dos níveis de resistência devido às ordens de stop loss dos vendedores a descoberto.

- A liquidez do lado da venda é criada a partir de ordens de stop loss protetivas de traders comprados.

- Zonas de liquidez ilustram aglomerados de ordens pendentes, ou seja, a zona pode não atuar como uma reversão definitiva.

- As zonas de liquidez também podem produzir grandes flutuações de preço quando violadas ou removidas, e desencadear múltiplas cascatas de ordens de stop loss.

- A análise de liquidez ajuda o trader a prever picos de volatilidade, falsos rompimentos e mudanças de momentum.

- A análise de liquidez pode ser melhor utilizada em conjunto com os seguintes elementos: estrutura de mercado; volume; classificação.

Essas dinâmicas explicam por que o preço pode às vezes se mover mais rapidamente em níveis técnicos óbvios do que entre eles.

O que é Liquidez do Lado da Compra?

A liquidez do lado da compra surge das posições de traders que venderam a descoberto. Compreender onde esses vendedores a descoberto costumam colocar suas ordens de stop-loss protetivas oferece uma visão valiosa sobre potenciais zonas de liquidez do lado da compra.

As zonas de compra normalmente se formam acima de níveis de resistência proeminentes. A resistência é onde uma tendência de alta não consegue continuar subindo, marcada pela diminuição do entusiasmo de compra e pelo aumento de posições de venda a descoberto de curto prazo ocorrendo acima desse nível de preço. Para ativos ativos, muitas vezes há um agrupamento de posições vendidas de curto prazo que criam zonas de compra visíveis logo acima de números redondos psicológicos ou níveis de preço técnicos onde vendas anteriores foram observadas.

Os traders estarão atentos a níveis de resistência importantes que podem atrair vendedores a descoberto de curto prazo, como números inteiros, médias móveis, linhas de tendência a partir de picos ou vales, e níveis de retração de Fibonacci úteis para identificar possíveis zonas de resistência de curto prazo que se tornaram zonas de compra potenciais. Vendedores a descoberto que acreditam que o momento de alta expirou podem entrar em posições vendidas nesses níveis técnicos ou acima deles.

Por exemplo, se uma ação enfrenta resistência a $50 e, portanto, atrai posições vendidas, a razão dos vendedores a descoberto para uma correção os faria colocar ordens de stop loss protetoras $1-2 acima, a $51-52, como seu preço de saída mínimo aceitável.

Agora, se a venda começar a perder força e alguns compradores aparecerem, no trading, e conseguirem ultrapassar essa zona de compra identificada de $51-52, as ordens de compra começarão a se acumular através e acima de $51-52 à medida que os stops forem acionados, o que, por sua vez, catalisa muitas coberturas de posições vendidas, impulsionando o preço cada vez mais alto.

Em mercados consolidados onde o suporte e a resistência são redefinidos, a liquidez do lado da compra pode ser testada várias vezes. À medida que os níveis são retestados, os vendedores a descoberto podem cuidadosamente elevar a localização das ordens de stop mais altas em um recuo após um nível ser reprobatório. As zonas de parada agrupadas acima da resistência em evolução podem ser especialmente reveladoras para os vendedores a descoberto se forem quebradas de uma maneira que desencadeie acelerações para cima impulsionadas pela cobertura de posições vendidas.

Você também pode gostar

O que é Liquidez do Lado da Venda?

As zonas de liquidez do lado da venda surgem das posições dos traders que estabeleceram posições longas dentro de um ativo. Estas são formadas abaixo dos níveis de preço de suporte chave, onde os traders no lado longo do mercado terão interesse em defender qualquer risco de queda latente.

Ele forma suporte à medida que encontra um nível de preço abaixo do qual não quer empurrar e atua como a base para um novo impulso para cima. Os traders tentam descobrir onde uma potencial tendência de alta encontrou uma base construtiva, como números inteiros, médias móveis ou toques em linhas de tendência de baixos recentes. E em tais locais técnicos, os comprados tendem a se reunir.

À medida que a segurança sobe a partir das áreas de suporte fundamentais, os touros encorajados defendem cada mínimo mais alto subsequente, posicionando estrategicamente suas ordens de venda de proteção abaixo desses pontos de suporte sucessivos. Esse agrupamento de ordens de saída longas abaixo dos níveis de fundação em evolução esculpe zonas distintas de liquidez do lado da venda.

Se a venda retomar inesperadamente, atravessar uma zona de acumulação fortemente consolidada pode desencadear uma onda de liquidação de posições longas. À medida que as ordens de stop são acionadas em rápida sucessão abaixo, a oferta liberada derruba o preço ainda mais para baixo em um ritmo acelerado.

Em tendências de queda prolongadas, testes repetidos de mínimas veem níveis adicionais de liquidez do lado da venda se acumularem sucessivamente mais baixos à medida que os comprados aumentam constantemente suas zonas de parada protegidas. Vendas de curto prazo são frequentemente precipitados por violações dessas zonas densas.

A liquidez do lado da venda oferece pistas sobre potenciais pontos de pivô ao entender como os participantes do mercado prevalentes têm estrategicamente protegido seu risco. Seu monitoramento adiciona contexto para os traders ao buscar pontos de entrada/saída em torno de níveis de suporte iminentes.

Você também pode gostar

Diferenças Entre Liquidez do Lado da Compra e do Lado da Venda

Enquanto a liquidez do lado da compra e do lado da venda emerge de mecanismos comparáveis envolvendo a cobertura de posições por participantes do mercado, existem algumas distinções importantes entre os dois em termos de objetivos gerais, clientela atendida, funções principais, estruturas de compensação e estruturas regulatórias.

Objetivos

A compra se concentra principalmente em superar ao longo de um horizonte de tempo mais prolongado por meio de seleção de investimentos superior e gestão de portfólio. Seu objetivo é a rentabilidade e o crescimento dos ativos sob gestão.

Enquanto as funções do lado da venda visam o objetivo relativamente diferente de possibilitar transações de mercado por meio de uma nova oferta de títulos, liquidez e pesquisa, que podem ser descritas como geração de receita através de taxas, comissões e spread. Eles atuam basicamente como um agente entre o emissor e o investidor.

Clientes

O lado comprador atende principalmente a investidores institucionais significativos, incluindo fundos de pensão, doações, fundos de hedge e indivíduos com alta renda líquida. Esses clientes estão em busca de uma vantagem em termos de melhores retornos ajustados ao risco.

O lado da venda atende tanto as corporações que emitem os valores mobiliários quanto todas as classes de investidores, desde traders de varejo até grandes instituições financeiras que buscam realizar transações. Como resultado, sua base de clientes é significativamente mais variada.

Funções

As atividades funcionais do lado comprador envolvem análise de pesquisa interna de valores mobiliários e investimentos, seguidas pela implantação direta através da gestão de portfólio para criar alfa. O lado vendedor envolve subscrição de novas emissões, criação de mercados, vendas/negociação, trabalho de consultoria em banco de investimento e distribuição de pesquisa em banco de investimento. Onde emissores estão conectados a investidores através de uma ampla gama de serviços nos mercados de capitais.

Todas essas atividades dependem fortemente da infraestrutura de execução, particularmente do papel desempenhado pelos motores de correspondência em sistemas de negociação.

Compensação

As estruturas de compensação do lado da compra também tendem a colocar mais ênfase em bônus baseados em desempenho que vinculam diretamente o pagamento aos resultados de investimento alcançados para os clientes. Em comparação, aqueles que trabalham do lado da venda geralmente ganham salários fixos, mas também podem receber compensação adicional baseada em transações ou comissões, que dependerá do fluxo de negócios e do número ou tamanho das negociações executadas.

Regulamentos

Embora ambos sejam controlados pela SEC e reguladores estaduais relacionados, as responsabilidades fiduciárias para o lado comprador vão até o ponto de dar conselhos. Os rígidos limites legais visam minimizar conflitos de interesse no manuseio dos fundos dos clientes. No lado vendedor, a regulamentação visa mais à integridade do mercado e à transparência ao atuar como intermediários.

Em resumo, existem distinções significativas entre os objetivos finais, funções e incentivos que impulsionam o comportamento nos lados de compra e venda dos mercados financeiros globais. Uma apreciação dessas diferenças é fundamental para entender a dinâmica da liquidez.

Prós e Contras de Carreiras do Lado da Compra vs Lado da Venda

Prós e Contras das Carreiras do Lado Comprador

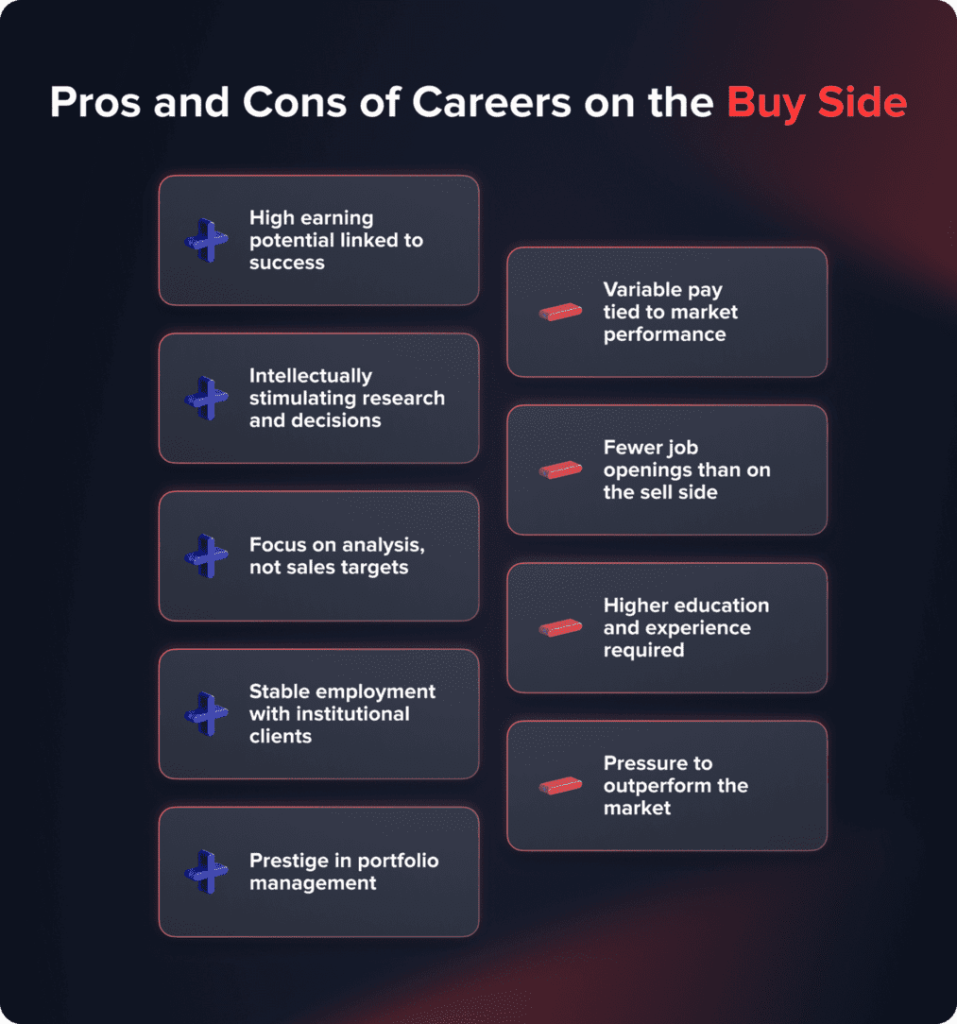

Potenciais Vantagens

- As estruturas de compensação vinculam diretamente o pagamento aos resultados de desempenho de investimento por meio de bônus, oferecendo a possibilidade de ganhos maiores em anos de sucesso

- Natureza intelectualmente estimulante de conduzir pesquisas independentes para identificar oportunidades negligenciadas

- O foco está na análise de empresas e na tomada de decisões de investimento bem informadas, em vez de metas de vendas

- Normalmente, emprego mais estável, uma vez que os clientes são principalmente grandes investidores institucionais

- Prestígio associado a funções de gestão de portfólio em grandes empresas de investimento

Possíveis Desvantagens

- A compensação total é variável de ano para ano, dependendo das condições de mercado e dos retornos de investimento gerados para os clientes

- Substantivamente menos posições disponíveis em relação ao lado da venda, uma vez que o lado da compra representa um segmento menor da indústria financeira como um todo

- Pré-requisitos educacionais e de experiência mais elevados são geralmente necessários para obter acesso a cobiçados papéis de analista do lado comprador/gestor de portfólio

- Maior pressão para superar os índices de mercado e defender decisões/teses de investimento durante períodos difíceis

Essas trocas de carreira refletem de perto os modelos de negócios de corretagem mais amplos vistos em toda a indústria.

Prós e Contras das Carreiras no Lado da Venda

Desvantagens Potenciais

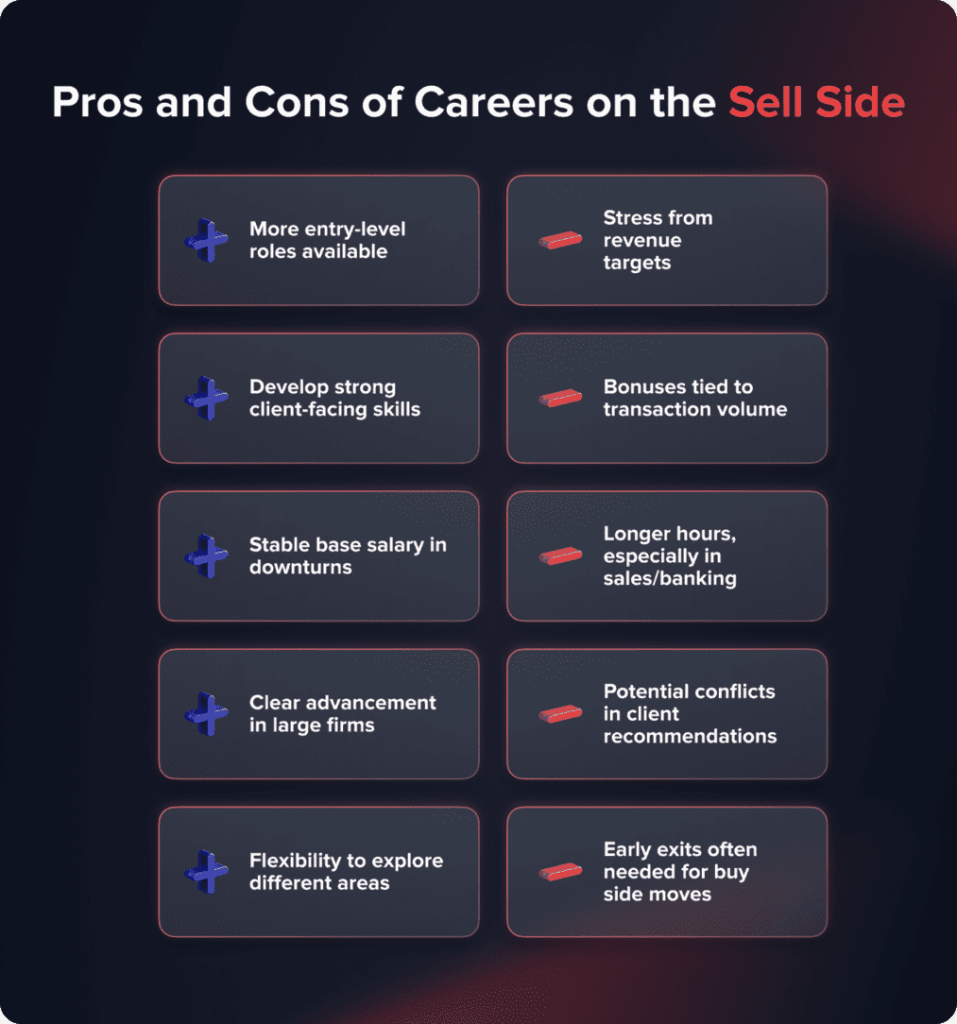

- Há muito mais empregos de nível inicial disponíveis em vendas, negociação, banco de investimento e pesquisa, oferecendo múltiplas opções para ingressar na indústria

- Excelentes campos de treinamento que desenvolvem habilidades de interação com clientes do mundo real altamente transferíveis para outros domínios

- A compensação salarial fixa ainda se aplica mesmo durante quedas no mercado de ações ou períodos sem negócios

- Aumento de carreira alcançável dentro de estruturas organizacionais comparativamente maiores

- Diversas áreas de prática permitem flexibilidade para explorar diferentes caminhos de carreira

Potenciais Contras

- Obrigações de geração de receita e metas de produção individuais introduzem estresse em torno da geração de negócios

- A compensação consiste principalmente em salário base com bônus voltados para métricas de volume de transações em vez de resultados de investimento

- Horas mais longas são normalmente necessárias em funções de vendas/banco voltadas para o cliente que suportam horários de viagem rigorosos

- Podem existir potenciais conflitos de interesse quando as recomendações atendem aos objetivos bancários corporativos

- Saídas antecipadas são frequentemente necessárias para transitar para oportunidades de compra mais lucrativas

No geral, tanto o lado comprador quanto o lado vendedor oferecem carreiras gratificantes a longo prazo em finanças, cada um com suas vantagens e desvantagens a serem consideradas com cuidado, dependendo dos interesses individuais, habilidades e preferências de estilo de vida. Com a experiência, ambos os caminhos podem estabelecer uma base profissional sólida.

O Aspecto Comportamental da Liquidez do Lado da Compra e do Lado da Venda

Entendendo que os traders criam zonas de liquidez com base em comportamentos repetidos, podemos ver por que as zonas de liquidez são formadas nos mercados financeiros.

A maioria dos traders tende a:

- Ao entrar em posições, eles usam níveis técnicos bem conhecidos como seu gatilho de "compra" ou "venda".

- Colocando ordens de Stop Loss ligeiramente acima ou abaixo desses níveis técnicos para se proteger contra perdas.

- Quando o preço se move contra eles, os traders reagirão emocionalmente à situação.

Como resultado dos comportamentos acima dos traders, os traders agrupam suas ordens em níveis técnicos específicos e, portanto, fornecem uma área de liquidez previsível. Os mesmos padrões impulsionados pela multidão estão por trás de muitas estratégias de negociação comumente usadas.

Psicologia da Liquidez do Lado da Compra

Para os vendedores a descoberto, a ideia de que "a resistência vai se manter" os levará a definir suas ordens de compra de stop-loss ligeiramente acima daquela zona de resistência, para gerenciar o risco. Se o preço romper essa zona de resistência sem aviso, o "medo" tomará conta da "convicção".

Quando o Stop-Loss do trader é ativado, ele deve recomprar (cobrir) sua posição vendida existente a uma taxa acelerada em comparação com o que teria feito de outra forma.

Das atividades desses traders de venda a descoberto resultam em:

- Impulso acelerado de preços para cima.

- A compra emocional ocorre a uma taxa acelerada.

- O preço temporariamente supera o valor justo.

Psicologia da Liquidez do Lado da Venda

Ao entrar em posições, os traders de compra colocam sua confiança em níveis de suporte estabelecidos e se protegem colocando suas ordens de stop-loss abaixo desses níveis de suporte.

Se o preço romper o suporte sem aviso, os traders imediatamente perdem a esperança e retornam a um estado de pânico.

Consequentemente, quando as ordens de Stop-Loss dos traders são ativadas, o trader se verá forçado a fechar sua posição longa rapidamente.

Do processo acima, ocorre o seguinte:

- Tendência de movimento de preços acentuadamente para baixo.

- Vazio de liquidez temporária abaixo do suporte.

- Redução acelerada.

As zonas de liquidez não são níveis de “dinheiro inteligente” por padrão.

Elas são áreas de consenso lotadas onde reações emocionais são mais propensas a atingir o pico.

Indicadores para Identificar Zonas de Liquidez com Mais Precisão

A liquidez não é visível em um gráfico, mas através do uso de alguns indicadores técnicos: pode-se inferir onde a maioria das ordens estão agrupadas. As seguintes ferramentas técnicas ajudam o trader a determinar áreas de liquidez:

Perfil de Volume

O perfil de volume exibe áreas de alto volume para níveis de preço específicos onde a maior parte da negociação ocorreu. O Ponto de Controle (POC) em um perfil de volume geralmente serve como um forte ímã de liquidez. Áreas de baixo volume acentuadas acima e/ou abaixo do POC destacam áreas onde os preços podem se mover rapidamente. Níveis de preço que são revisitados várias vezes com volume normalmente demonstram uma forte reação.

Alturas e Baixos Iguais

Quando um ativo é testado inúmeras vezes (com o preço tocando esse nível) no mesmo nível várias vezes, ele se torna um candidato para o agrupamento de ordens de stop loss. Esses altos e baixos iguais são comuns em torno dos extremos de faixa. Quando quantias significativas de níveis de preço altos iguais se formam, isso geralmente indica liquidez em posições de compra. Quando quantias significativas de níveis de preço baixos iguais se formam, isso indica liquidez em posições de venda. Não é incomum que o preço viaje para esses níveis antes de fazer um movimento direcional mais significativo.

VWAP e VWAP Ancorado

As instituições monitoram ativamente os níveis diários de VWAP e os utilizam como pontos de referência para guiar sua atividade de negociação. Uma grande porcentagem das negociações é realizada em ou em torno desses níveis. Como as instituições costumam comprar e/ou vender no nível de VWAP, se o preço ultrapassar para cima ou para baixo esse nível, podem ocorrer corridas de liquidez. Ancorar o VWAP a máximas/mínimas importantes e/ou eventos de notícias fornece pontos de referência adicionais para avaliar a liquidez.

Fibonacci

Os níveis de retração de Fibonacci estão frequentemente próximos a ordens de descanso. Os principais níveis de retração de Fibonacci de 38,2%, 50% e 61,8% são os mais propensos a receber colocação de stop, pois todos eles se correlacionam muito de perto com o sentimento de um trader individual sobre onde se sentem confortáveis em alcançar o ponto de equilíbrio; portanto, esses níveis de preço podem ser vistos como áreas de alta liquidez. Além disso, quanto maior a importância que um trader individual percebe que esses níveis têm, mais significativo é o nível de liquidez associado ao nível de retração de Fibonacci.

Médias Móveis

Os movimentos médios comumente rastreados geralmente funcionam como uma área para liquidez

acumulação por traders. Algumas das médias móveis mais populares consistem na Média Móvel de 50, na Média Móvel de 100 & na Média Móvel de 200. Os locais de stop comumente utilizados são geralmente colocados logo fora desses níveis médios de preço. Quebras dessas MAs importantes geralmente resultam em movimento acelerado de preços.

Médias móveis raramente operam isoladamente e muitas vezes se alinham com outros indicadores técnicos amplamente utilizados. Quando múltiplos indicadores ocorrem e se alinham no mesmo nível de preço, eles fornecem a área potencial ideal para formação de liquidez forte/re-acumulação ou consolidação naquele mesmo nível de preço (ou seja, muitos pedidos concentrados naquele ou perto daquele mesmo nível).

Como Identificar Zonas de Liquidez

Ferramentas técnicas podem ajudar a identificar zonas de liquidez. Mais frequentemente do que não, níveis de retração e extensão de Fibonacci identificam as áreas de compra e venda próximas que podem equivaler a movimentos proporcionais. As zonas regularmente veem convergência com médias móveis simples ponderadas para diferentes períodos. A análise de linhas horizontais e de tendência também indica limites onde o momentum estava estagnado anteriormente.

Padrões de velas de quebra e reversão fornecem pistas visuais sobre batalhas em andamento entre touros e ursos perto de territórios de liquidez proeminentes. Tipos de formação, como topos giratórios ou barras de baixa, sinalizam indecisão acentuada, enquanto barras engolfadoras indicam movimentos decisivos rompendo limites.

Há uma forma em camadas da história nos indicadores de perfil de volume, que exibem graficamente os níveis de preço que diferenciam onde a maior parte da atividade de negociação ocorreu—identificando assim os principais centros de oferta e demanda no mercado. Formaçõe de picos validam a intensificação à medida que as zonas são desintegradas sob pressão. O ponto de controle aponta o preço mais negociado.

Exemplos reais do mercado provam ser instrutivos. Uma ação caiu para suporte abaixo de $15 e consolidou-se lateralmente por semanas dentro de uma zona de venda de $13,50, onde a compra absorveu repetidamente os testes de baixa. Um grande volume marcou esse nível como um suprimento substancial. Sua perfuração catalisou uma surpreendente queda de dois dólares para baixo, enquanto os otimistas de curto prazo saíram em massa, com stops acionados abaixo.

O monitoramento de zonas de liquidez confirmadas oferece insights acionáveis sobre potenciais inversões de suporte/resistência. Estudos de caso aplicam esta estrutura demonstrando comportamentos identificáveis que os traders podem integrar. A observação contínua fortalece o reconhecimento de padrões ao buscar momentos oportunos para negociar estruturas de mercado em evolução.

Armadilhas Comuns de Liquidez

A armadilha de liquidez ocorre quando o preço atinge uma zona de liquidez conhecida e então inverte a direção. Quando os traders entram muito rapidamente ou de forma agressiva, podem ser pegos pela armadilha de liquidez. Existem dois tipos de armadilhas de liquidez para os traders:

Traps de Liquidez Comuns do Lado da Compra

- O preço rompe acima do suporte por um período de tempo muito curto

- As paradas de vendedores a descoberto são acionadas

- O momento de alta não consegue se sustentar

- O preço reverte acentuadamente para baixo

Esta sequência pode prender ambos:

- Traders que entraram tarde na ruptura

- Os vendedores a descoberto que foram forçados a sair de posições em ou perto dos topos de suas ordens de venda e reverter.

Traps Comuns de Liquidez do Lado da Venda

- O preço quebra abaixo do suporte antes de se recuperar para acima do nível.

- Stops de long trader são acionados

- O preço rapidamente retoma o nível

- A movimentação continua alta

Tipicamente, os seguintes indivíduos serão atrapados:

- Aqueles que venderam em pânico

- Aqueles que entraram em quebras agressivas

A maioria das vezes, armadilhas de liquidez ocorrem ou:

- Durante períodos de baixo volume ou ilíquidos

- Movimento de preço volátil como resultado de anúncios de notícias

- Durante períodos de compressão de preços ou no final da faixa.

Como Evitar Armadilhas de Liquidez

- Aguarde a confirmação após uma pausa inicial e não a pausa inicial.

- O mercado frequentemente reage à liquidez imediatamente após ter sido retirada.

- Use estruturas de prazos mais altos para confirmar/validar quebras.

- Não coloque suas ordens de parada acima ou abaixo de áreas que são claramente máximas/mínimas iguais, pois geralmente é onde o mercado irá reverter rapidamente à medida que a liquidez é retirada dessas ordens.

- Reduza o tamanho da sua posição antes de entrar em negociações em áreas de liquidez bem definidas.

Traders profissionais geralmente entram após a liquidez ter sido retirada da área, em vez de no primeiro teste daquela área de liquidez.

Você também pode gostar

Como Negociar com a Liquidez em Mente

Encontrar zonas de liquidez prepara o terreno para planejar manobras estratégicas. Quando os territórios de acumulação e distribuição tomam forma, os traders podem se posicionar em relação a essas concentrações. Fazer isso proporciona potenciais pivôs para recuperar ou proteger exposições.

Romper acima da resistência de compra ou abaixo do suporte de venda muitas vezes configura uma extensão que não é sustentável. Vender durante os movimentos ou ir vendido mira a próxima zona acumulada uma vez que o momento estanca. Os resultados durante essas fases são fortemente influenciados pela qualidade da execução e pela seleção da plataforma de negociação. Quebras fracas e atrasadas através das áreas de venda criam um gap que os traders tradicionais visam comprar. As entradas longas agressivas perseguindo posições acima desses bolsões de menor valor.

Zonas convidam a retestes periódicos, mantendo a volatilidade implícita elevada. Vender puts fora do dinheiro coleta renda à medida que as zonas se mostram resilientes. Stops respeitando zonas adjacentes não testadas equilibram tendências recompensadoras com a minimização das quedas, se revertidas. Quebras de trailing melhoram as posições definidas por risco.

As restrições de compra para o lado positivo utilizam uma expansão de nível superior em intervalos de tempo, com objetivos de lucro para o lado negativo indicando a proximidade do suporte subjacente. Integrar a estrutura dada através das áreas de oferta e demanda, seja comprando com, contra, ou na ausência do sentimento predominante, melhora a construção do comércio.

As percepções dessas zonas permanecem em sintonia com as condições de mercado em mudança e o comportamento variável dos participantes, uma vez que a atualização é constante. Manter um olho na liquidez em mudança maximiza a oportunidade em torno das zonas confirmadas. A estrutura é útil para avaliar qual poderia ser o potencial risco/recompensa entre as flutuações dentro dos ciclos.

Dicas Para Monitorar Níveis de Liquidez

Para um trader, ainda é importante monitorar as mudanças na liquidez e nas estruturas de mercado ao longo do tempo. Grupos inclinados para um lado se consolidarão na faixa, enquanto se estreitam sobre quais lados estão construindo convicção, enquanto os rompimentos revelarão qual viés assumiu o controle. A diminuição da convicção em uma direção é o que será mostrado se as faixas de volume estiverem recuando, enquanto para o oposto, faixas em expansão são mostradas.

Registrar padrões de liquidez diariamente é um contexto muito valioso durante movimentos emergentes. Uma atualização facilita não se apegar às percepções desatualizadas que ofendem a linguagem do mercado naquele dia. A liquidez não apenas evolui ao longo dos dias, mas também muda durante o dia, à medida que diferentes grupos de participantes entram e saem do mercado.

As fases do leilão em aberto moldarão a estrutura predominante para o curto prazo. Mais tarde, ao se aproximar do fechamento, a exaustão de vendas muitas vezes resulta em contração de intervalo. Saber como esses fatores impactam o dia ajudará no momento das entradas em termos das condições predominantes.

Em estados em alta, a liquidez flui gradualmente mais fundo na direção prevalente à medida que as zonas se acumulam de forma próxima, seguindo o momentum. Mercados em consolidação veem essa liquidez oscilar entre níveis definidos. Aqui, os traders se envolvem em um debate sobre qual lado a faixa pode eventualmente encontrar uma resolução e a força preparada para uma reavaliação.

As principais notícias podem desencadear movimentos acentuados à medida que o mercado retoma uma tendência estabelecida ou se a faixa eventualmente romper a indecisão. Em períodos tranquilos, sem grandes notícias ou eventos, as faixas se alargam em um teste livre de vontades de ambos os lados. Medir as variáveis macroeconômicas mais amplas e as mudanças na política manterá as expectativas para o potencial de estabilidade ou volatilidade no terreno.

Monitorar os níveis de liquidez de perto permitirá delinear a estrutura do mercado, incluindo mudanças no sentimento e potenciais pontos de virada para a seleção de trades. Isso nos ajuda a navegar pelas várias fases de um ciclo amplo.

Conclusão

Definir níveis de liquidez do lado da compra e da venda beneficia os traders. Localizar zonas de fluxo de ordens importantes informa possíveis inversões de suporte/resistência que alimentam reversões. Monitorar estruturas em mudança capacita a adaptação da estratégia de acordo com o humor do mercado e o comportamento dos participantes. Embora não seja preditivo, integrar a conscientização sobre liquidez melhora a compreensão dos mecanismos que impulsionam os preços ao longo dos ciclos.

FAQ

Não necessariamente. A liquidez do lado da compra oferece uma avenida para o movimento de preços do lado da compra se houver compradores suficientes ainda no mercado. No entanto, pode representar um ponto de exaustão se os preços não conseguirem se manter acima deste nível.

No. A liquidez do lado da venda pode criar grandes movimentos descendentes, mas esses movimentos podem ser seguidos por um movimento igualmente forte para cima se os compradores entrarem para comprar depois que todas as ordens de parada foram limpadas.

Não. Enquanto os níveis de suporte/resistência se referem ao comportamento de preços passados, as zonas de liquidez representam onde as ordens podem estar concentradas. Portanto, um nível de suporte/resistência pode existir sem uma quantidade significativa de liquidez.

Atualizado:

18 de dezembro de 2025