O que são pools de liquidez? Definição, tipos e benefícios

Conteúdo

No cenário financeiro (DeFi), os pools de liquidez ajudam os usuários a realizar transações financeiras sem depender de intermediários convencionais. Esses pools contêm fundos bloqueados em um contrato inteligente, oferecendo liquidez para exchanges (DEXs), plataformas de empréstimo e outros aplicativos DeFi. Navegar no ambiente DeFi exige conhecimento sobre o funcionamento dos pools de liquidez.

Definição de Pools de Liquidez

Pools de liquidez orientados pela comunidade são tokens ou criptomoedas armazenados em um contrato inteligente. A liquidez que eles fornecem permite que transações ocorram, apoiando assim a negociação em bolsas de valores. O mercado financeiro a liquidez é mantida pelos fabricantes que compram e vendem ativos para facilitar a negociação. Pools de liquidez em DeFi reduzem a necessidade de intermediários, permitindo que os usuários depositem seus ativos no pool, tornando-os provedores de liquidez.

Grandes instituições financeiras, conhecidas como provedores de liquidez, geralmente detêm grandes quantidades de ativos para facilitar a negociação. Os formadores de mercado ganham dinheiro comprando ativos a taxas reduzidas e vendendo-os a preços mais altos. Essa configuração garante que sempre haja um indivíduo disposto a comprar ou vender um ativo, preservando assim a liquidez do mercado.

Em contraste, a abordagem DeFi democratiza esse sistema. Ao contribuir com seus ativos para um pool de liquidez, qualquer indivíduo que possua criptomoedas pode atuar como um provedor de liquidez (LP). Esses pools são regidos por contratos inteligentes, que são acordos autoexecutáveis diretamente inscritos no código. Uma vez que os ativos são incluídos em um pool, o contrato inteligente executa transações de forma autônoma e distribui taxas entre os LPs com base em suas informações.

A abordagem DeFi para pools de liquidez é muito abrangente. Ao contrário daqueles que implementam estratégias de formação de mercado que exigem fundos e infraestrutura sofisticada, aqueles com criptomoedas podem participar de um pool de liquidez. Investidores de pequena escala têm oportunidades, graças a essa acessibilidade, de gerar fundos para ajudar o ecossistema DeFi a se tornar mais líquido.

7. Governança e Participação Comunitária

Em muitos desses protocolos DeFi, quando os usuários possuem tokens LP, isso vem acompanhado de direitos de governança, permitindo que os indivíduos participem da tomada de decisões online. Isso permite que haja uma votação sobre mudanças feitas em um protocolo, alterações nas estruturas de taxas, implementação de novos recursos ou outras decisões essenciais que determinam o futuro roteiro que desenvolve um senso comum de propriedade e responsabilidade.

Esses blocos de construção dão aos usuários uma sensação de melhor navegação no cenário do pool de liquidez e permitem decisões informadas com base em seus benefícios e recursos, estendendo-se ao ecossistema DeFi mais amplo.

You may also like

Conceitos-chave em pools de liquidez

1. Mecânica de Negociação Descentralizada

Pools de liquidez podem ser usados para negociação descentralizada sem intermediários. Eles empregam o algoritmo de formador de mercado automatizado para precificar ativos em relação à oferta e demanda de cada um, o que, por sua vez, proporciona uma descoberta de preço adequada de forma justa e não opaca.

2. Algoritmos automatizados de criação de mercado

Os pools de liquidez dependem de algoritmos matemáticos sofisticados que ajustam automaticamente os preços dos ativos e mantêm o pool em uma proporção de tokens predeterminada. Dessa forma, os mecanismos dos AMMs garantem a continuidade da liquidez e a execução eficiente das negociações — sem os tradicionais formadores de mercado ou livros de ordens.

3. Eficiência de capital e componibilidade

Pools de liquidez são mais eficientes em termos de capital do que exchanges baseadas em livro de ordens. Um subconjunto de usuários no pool fornece liquidez para negociar entre si, sem a necessidade de correspondência de ordens. Isso reduz o capital agregado necessário para atingir um determinado volume de negociação. Devido à sua natureza componível, os pools de liquidez são facilmente integrados a outros protocolos e aplicações DeFi, aumentando o valor do ecossistema mais amplo.

4. Incentivos para provedores de liquidez

As recompensas são oferecidas de diferentes maneiras para provedores de liquidez ou para aqueles que contribuem com ativos para pools de liquidez. Elas podem incluir uma parcela das taxas de transação que ocorrem em um pool, yield farming, se aplicável, e, às vezes, até mesmo direitos de voto no processo de tomada de decisão referente ao protocolo.

5. Risco de Perda Impermanente

Um dos principais riscos de provisão de liquidez é a perda impermanente. Isso ocorre quando há uma grande variação nos preços dos ativos na carteira em comparação com a taxa de depósito original. Um LP receberá menos valor ao sacar do que receberia se os mesmos ativos fossem mantidos fora da carteira. Certamente, isso poderia mitigar o risco por meio de uma gestão ativa e diversificação de carteiras.

6. Algoritmos automatizados de criação de mercado

Os pools de liquidez dependem de algoritmos matemáticos sofisticados que ajustam automaticamente os preços dos ativos e mantêm o pool em uma proporção de tokens predeterminada. Dessa forma, os mecanismos dos AMMs garantem a continuidade da liquidez e a execução eficiente das negociações — sem os tradicionais formadores de mercado ou livros de ordens.

Como funcionam os pools de liquidez

Quando os usuários adicionam seus ativos a um pool de liquidez, esses ativos são usados para permitir negociações em bolsas. Cada negociação gera uma taxa compartilhada entre os provedores de liquidez de acordo com sua contribuição para o pool. Essa configuração garante que haja sempre liquidez para as negociações, reduzindo as flutuações de preço e melhorando a eficiência das negociações.

Depositando Ativos

O processo de depósito começa com os usuários depositando ativos no pool. Normalmente, isso envolve o fornecimento de quantidades iguais de dois tokens. Por exemplo, em um pool ETH/USDT, um usuário depositaria ETH e USDT em valor.

Manter uma mistura de ativos é essencial para o funcionamento do pool.

Cunhagem de Tokens de Liquidez

Quando os usuários depositam seus ativos, recebem tokens de liquidez (tokens LP) em troca, representando sua participação no pool e confirmando sua contribuição. Esses tokens são gerados com base no valor do ativo e concedem aos detentores um direito ao pool, incluindo quaisquer taxas cobradas. Com esses tokens, os provedores de liquidez têm a flexibilidade de sacar sua parte do pool, juntamente com quaisquer taxas acumuladas, sempre que desejarem.

Taxas de ganhos

À medida que as negociações ocorrem dentro do pool de liquidez, taxas de transação são cobradas. Essas taxas, uma porcentagem de cada negociação, são compartilhadas entre os provedores de liquidez de acordo com sua participação no pool. Esse mecanismo automatizado de compartilhamento de taxas oferece aos LPs uma fonte de renda. O aumento da atividade de negociação dentro do pool resulta em ganhos para os provedores de liquidez.

Execução de Negociações e Saldo de Pool

Um comerciante interage diretamente com o pool de liquidez ao executar uma ordem em uma exchange descentralizada (DEX). Por exemplo, o processo de negociação de ETH por USDT envolve a retirada de ETH do pool e a adição de uma quantidade equivalente de USDT após o cálculo dos custos de transação. O contrato inteligente que supervisiona o pool gerencia essa transação para garantir que seu saldo seja mantido. Quando o preço do ETH muda, o contrato inteligente ajusta automaticamente as quantidades de ETH e USDT para corresponder às condições de mercado. Isso garante que o pool opere de forma eficiente.

Recursos e mecanismos avançados

Os tokens LP não apenas representam a propriedade do usuário no pool de liquidez, mas também servem como um ativo versátil que pode ser utilizado em diversas outras atividades DeFi. Um uso comum dos tokens LP é em protocolos de yield farming e staking, onde os usuários fazem staking ou emprestam ativos para obter retornos ou recompensas em criptomoedas adicionais. Ao fazer staking de tokens LP em plataformas, os provedores de liquidez podem ganhar recompensas além das taxas do pool, aumentando seus ganhos gerais. Esse potencial de dupla renda torna o fornecimento de liquidez uma opção para investidores em criptomoedas que buscam maximizar seus lucros.

Outro recurso avançado oferecido pelos pools de liquidez é a concessão de direitos de governança aos detentores de LP. Em plataformas DeFi, a posse de tokens LP permite que os usuários participem das decisões de governança do protocolo. Isso abrange a votação de questões como mudanças na estrutura de preços, melhorias no protocolo, novos pools e outras sugestões de governança. Este modelo democrático garante a voz dos usuários na formação e gestão da comunidade da plataforma.

Tipos de Pools de Liquidez

Existem vários tipos de pools de liquidez, cada um com propósitos dentro do ecossistema DeFi. Conhecer as diversas formas de pools de liquidez permite que os indivíduos escolham as soluções adequadas com base em sua tolerância ao risco e abordagem de investimento .

Pools de ativos únicos

Pools de ativos únicos são onde os usuários depositam um tipo de ativo. São comumente encontrados em protocolos de empréstimo. Quando os usuários contribuem com seus ativos para um pool de ativos único, esses ativos são emprestados aos tomadores. Os juros pagos pelos tomadores geram lucros para os provedores de liquidez.

Principais recursos e benefícios

- Simplicidade:Os pools de ativos únicos são fáceis de entender porque envolvem um único tipo de ativo, o que os torna mais simples de gerenciar para iniciantes.

- Geração de interesse: Os ativos depositados rendem juros, criando uma fonte de renda para os LPs.

- Exposição reduzida:Como os LPs são expostos apenas ao desempenho de um ativo, isso simplifica o processo de mitigação de riscos.

You may also like

Exemplo de caso de uso

Um exemplo de pools de ativos únicos está em plataformas como Aave ou Composto . Users have the option to contribute stablecoins, such as USDT ou USDC, to the pool, which are subsequently lent to borrowers. The liquidity providers divide the interest earned from these loans.

Pools de múltiplos ativos

As DEXs geralmente utilizam pools de múltiplos ativos, onde os usuários depositam pares de ativos para facilitar as trocas. Provedores de liquidez apoiar a negociação entre esses ativos, oferecendo liquidez em pares de ativos. Os PLs recebem as taxas das transações.

Principais recursos e benefícios

- Facilitação de trocas de tokens: Diversos pools de ativos desempenham um papel nas operações DEX, permitindo a execução de negociações descentralizadas.

- Ganhos de taxas: Os provedores de liquidez recebem uma parte das taxas de transação para cada negociação dentro do pool.

- Estabilidade de preços:A exigência de ativos duplos auxilia na manutenção da estabilidade de preços dentro do pool, minimizando flutuações.

Exemplo de caso de uso

Uniswap , uma plataforma DEX utiliza pools multiativos. Por exemplo, em um pool ETH/DAI, os usuários depositam quantidades de ETH e DAI. Os traders podem trocar entre esses tokens, enquanto os provedores de liquidez ganham taxas por cada transação.

Pools de apostas

Pools de staking de tokens envolvem o bloqueio de tokens para aumentar a segurança e a funcionalidade de uma rede. Os participantes normalmente recebem tokens adicionais como incentivo para proteger seus tokens durante esse processo. Pools de staking são essenciais para a operação de redes que utilizam mecanismos de consenso delegado (DPoS) ou de prova de participação (PoS).

Principais recursos e benefícios

- Segurança de rede: Os usuários contribuem para proteger a rede e verificar transações por meio de staking de tokens.

- Ganhando recompensas: Os participantes recebem recompensas na forma de tokens incentivando seu envolvimento ativo.

- Baixa barreira de entrada: Os pools de staking geralmente permitem que os usuários participem com pequenas quantias, tornando a participação mais inclusiva.

Exemplo de caso de uso

Ethereum 2.0 é um ótimo exemplo de pool de staking. Os usuários podem fazer staking de seus ETH para receber recompensas enquanto transitam para um modelo de consenso, melhorando a segurança da rede.

Piscinas Híbridas

Certas plataformas oferecem pools híbridos que integram as características de pools de ativos únicos e múltiplos. Esses pools têm o potencial de oferecer maior adaptabilidade e atender aos requisitos específicos do ecossistema DeFi.

Principais recursos e benefícios:

- Versatilidade: Os pools híbridos podem ser adaptados para aplicações DeFi, oferecendo vantagens tanto em configurações de ativos únicos quanto múltiplos.

- Retornos aprimorados:Ao combinar diferentes tipos de ativos, os pools híbridos têm o potencial de gerar retornos mais altos e perfis de risco diversificados.

Exemplo de caso de uso

Balanceador se destaca nesse aspecto. Os usuários podem criar pools de liquidez, o que lhes permite personalizar suas estratégias de provisão de liquidez com base em suas preferências.

Pools Incentivados

Além de taxas e juros, os pools de incentivos oferecem recompensas, como tokens específicos da plataforma ou incentivos adicionais para atrair liquidez adicional.

Principais recursos e benefícios

- Recompensas atraentes: Os pools incentivados geralmente oferecem retornos maiores devido às recompensas adicionais, atraindo mais provedores de liquidez.

- Liquidez Impulsionada: Os incentivos extras ajudam a aumentar a liquidez disponível no pool, melhorando a eficiência geral da plataforma.

Exemplo de caso de uso

Plataformas DeFi populares como Sushiswap e PancakeSwap feature incentivized pools where users can earn platform tokens alongside trading fees. These incentives play a role in boosting liquidity e expanding user participation on the platform.

Fatores que influenciam o desempenho do pool de liquidez

Volume de negociação

O volume de negociação é o principal fator determinante no desempenho do pool de liquidez. Quanto maior o número de negociações realizadas em um determinado período no pool de liquidez, maiores as taxas de transação recebidas pela plataforma, que se traduzem em ganhos para os provedores.

Volatilidade do preço dos ativos

Grandes oscilações de preço dos ativos no pool levarão a uma perda temporária para os provedores de liquidez. Isso significa que, se o preço dos ativos se afastar muito do índice de depósito original, no momento do saque, poderá haver um valor menor em comparação a uma situação em que os ativos eram mantidos fora do pool.

Composição da piscina

A composição mais detalhada dos ativos no pool de liquidez afeta seu perfil de risco e retorno como um todo. Pools que contêm ativos mais voláteis ou com baixa correlação podem oferecer potencial para retornos mais elevados, mas também apresentam riscos maiores.

Estrutura de taxas

A porcentagem da taxa de transação, conforme determinada pelo protocolo, influencia diretamente o acúmulo de lucros para o provedor de liquidez. Quanto maior a taxa, mais atraente o pool será, enquanto taxas mais baixas podem reduzir o incentivo para fornecer liquidez.

Concorrência

A presença de pools concorrentes que oferecem pares de ativos iguais ou semelhantes pode impactar a atratividade e o desempenho de um pool específico. Os usuários acabariam transferindo sua liquidez para os pools que oferecem os melhores termos e incentivos.

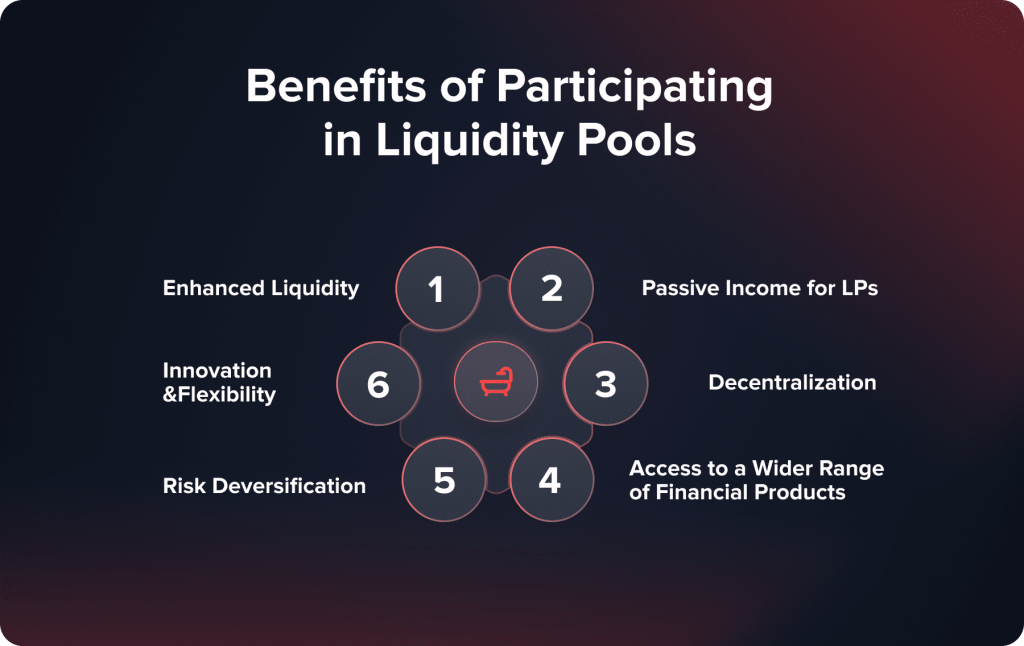

Vantagens dos Pools de Liquidez

Tanto os LPs quanto a comunidade DeFi em geral obtêm vantagens dos pools de liquidez. Ao promover a inclusão financeira, estimular a inovação e facilitar experiências de negociação, eles funcionam como um componente do DeFi.

Liquidez melhorada

A capacidade dos pools de liquidez de agregar fundos dos usuários é uma vantagem crucial, pois garante a disponibilidade de liquidez para negociação. Essa agregação ajuda a reduzir a derrapagem de preços que pode ocorrer quando grandes negociações impactam negativamente os preços de mercado.

Manter um suprimento de ativos por meio de pools pode ajudar a facilitar transações mais fluidas e garantir uma descoberta de preços mais precisa. Esse aspecto é importante em exchanges descentralizadas, onde a ausência de formadores de mercado pode levar a flutuações de preços consideráveis.

Renda passiva para LPs

Os provedores de liquidez podem ganhar uma parte das taxas de transação geradas dentro do pool. Essas taxas, incorridas em cada negociação, são distribuídas proporcionalmente entre os provedores de liquidez com base em sua participação no pool. Essa oportunidade de renda passiva pode ser bastante atraente em pools de alto volume, onde as atividades de negociação são frequentes.

Gestão de Riscos por meio da Diversificação

Ao agrupar ativos com outros usuários, os riscos são distribuídos. A exposição individual é reduzida. O desempenho e os fatores de risco são compartilhados entre todos os participantes de um pool de liquidez. Essa abordagem colaborativa ajuda a reduzir o impacto da volatilidade em qualquer ativo, resultando em um perfil de retorno estável para os LPs. Por exemplo, dentro de um pool de ativos, se o valor de um ativo cair, o efeito geral sobre o pool pode ser compensado pela estabilidade ou crescimento de outros ativos. Essa estratégia de diversificação torna os pools de liquidez menos arriscados em comparação com a manutenção de ativos.

Inovação e Flexibilidade

O uso de contratos inteligentes em pools de liquidez promove inovação e adaptabilidade. Os desenvolvedores têm a liberdade de lançar produtos e serviços que utilizam esses pools, oferecendo aos usuários uma gama mais ampla de opções e oportunidades.

Por exemplo, pools híbridos podem combinar elementos de pools de ativos únicos e múltiplos, oferecendo soluções personalizadas para atender às diversas demandas do mercado. Além disso, a natureza programável dos contratos inteligentes permite a incorporação de funcionalidades como proteção contra perdas impermanentes, otimização automatizada de rendimentos e modelos de taxas personalizáveis. Essa adaptabilidade nutre um ambiente DeFi onde produtos financeiros inovadores podem ser criados e implementados rapidamente.

Benefícios adicionais

Transparência: Cada transação e modificação dentro dos pools de liquidez é documentada na blockchain, garantindo transparência e rastreabilidade. Este sistema de registro transparente permite que os usuários validem a segurança e a confiabilidade das atividades do pool.

Eficiência: Os pools de liquidez simplificam o processo de negociação ao fornecer liquidez comercial, reduzindo o tempo e a complexidade envolvidos na correspondência entre compradores e vendedores em um sistema de livro de ordens .

Riscos dos Pools de Liquidez

Os riscos relacionados aos pools de liquidez também estão presentes. Embora esses pools ofereçam oportunidades de geração de renda e sejam essenciais no ecossistema DeFi, eles apresentam seus próprios riscos. É crucial para quem deseja se tornar um LP compreender esses riscos. Aqui estão alguns dos principais riscos associados aos pools de liquidez e maneiras de gerenciá-los de forma eficaz:

1. Perda Impermanente

Um dos riscos enfrentados pelos LPs é a perda impermanente. Isso ocorre quando os preços dos ativos em um pool de liquidez se desviam dos preços de depósito. Tais desvios podem resultar em um cenário em que, ao sacar seus ativos, o provedor recebe menos valor do que se simplesmente os tivesse mantido fora do pool.

2. Vulnerabilidades de contratos inteligentes

Contratos inteligentes impulsionam a liquidez e são acordos autoexecutáveis codificados na blockchain. Embora projetados para serem seguros, os contratos inteligentes ainda podem apresentar bugs e vulnerabilidades que hackers podem explorar para drenar o pool, causando perdas para os LPs. Por exemplo, em 2020 bZx sofreu um ataque de empréstimo relâmpago devido a uma falha em seu contrato, resultando em um prejuízo de US$ 1 milhão. Esses incidentes ressaltam a importância da auditoria de contratos antes de se envolver em pools de liquidez.

3. Volatilidade do mercado

Flutuações repentinas de preço podem resultar em perdas, como mencionado anteriormente. Elas também podem impactar o valor geral dos ativos no pool, potencialmente causando contratempos financeiros significativos para os LPs. Por exemplo, quando o mercado passa por uma retração, o valor dos ativos em um pool de liquidez pode despencar rapidamente, levando a uma queda no valor (TVL) e impactando a estabilidade do pool.

4. Riscos regulatórios

DeFi e pools de liquidez operam em um ambiente que pode gerar incertezas regulatórias. Governos e órgãos reguladores em todo o mundo ainda estão descobrindo como supervisionar e regular as operações de DeFi. Essa ambiguidade pode levar a alterações no status de plataformas DeFi específicas ou até mesmo de ativos dentro dos pools.

Conclusão

Compreender o significado, as variações, as vantagens e os riscos associados ao setor DeFi permite que as pessoas tomem decisões e operem com eficácia. Pools de liquidez oferecem oportunidades e vantagens que aprimoram a jornada DeFi, seja você um trader em busca de transações tranquilas ou um provedor de liquidez em busca de ganhos extras.

Atualizado:

13 de janeiro de 2025