What Are Liquidity Pools? Definition, Types, and Benefits

Contents

In the finance (DeFi) setting, liquidity pools help users engage in financial transactions free from dependence on conventional middlemen. These pools contain funds locked in a smart contract, offering liquidity for exchanges (DEXs), lending platforms and other DeFi apps. Navigating the DeFi environment requires knowing how liquidity pools function.

Definition of Liquidity Pools

Community-driven liquidity pools are tokens or cryptocurrencies that are stored in a smart contract. The liquidity they provide enables transactions to occur, thereby supporting exchange trading. The finance market’s liquidity is maintained by makers who purchase and sell assets to facilitate trading. Liquidity pools in DeFi reduce the need for intermediaries by allowing users to deposit their assets into the pool, thus making the users liquidity providers.

Large financial organizations, known as liquidity providers, usually hold large quantities of assets to make trading easier. Market makers gain money by buying assets at reduced rates and selling them at higher prices. This configuration guarantees that there is always an individual willing to purchase or sell an asset, thereby preserving market liquidity.

In contrast, the DeFi approach democratizes this system. By contributing their assets to a liquidity pool, any individual who possesses cryptocurrency may serve as a liquidity provider (LP). These pools are governed by smart contracts, which are self-executing agreements that are directly inscribed into code. Once assets are included in a pool, the smart contract autonomously executes transactions and distributes fees among LPs based on their input.

The DeFi approach to liquidity pools is very expansive. Unlike those implementing market-making strategies necessitating funds and sophisticated infrastructure, those with cryptocurrencies can participate in a liquidity pool. Small scale investors have opportunities thanks to this accessibility to generate funds to help the DeFi ecosystem to be more liquid.

7. Governance and Community Participation

In many of these DeFi protocols, when users own LP tokens, it comes hand in hand with governance rights where individuals can become involved with making decisions online. This enables a vote to take place regarding changes made to a protocol, changing fee structures, implementing new features, or other essential decisions determining the future road map that develops a communal sense of ownership and responsibility.

These building blocks give users a sense of better navigating the liquidity pool landscape and allow for informed decisions based on their benefits and features, extending into the larger DeFi ecosystem.

You may also like

Key Concepts in Liquidity Pools

1. Decentralised Trading Mechanics

Liquidity pools can be used for decentralised trading without intermediaries. They employ the automated market maker algorithm to price assets against the supply and demand of each, which in turn provides proper price discovery in a fair and non-opaque manner.

2. Automated Market Making Algorithms

Liquidity pools rely on sophisticated mathematical algorithms that automatically adjust asset prices and maintain the pool at a predetermined token ratio. This way, the mechanisms of AMMs give continuity in liquidity and efficient execution of trades-without traditional market makers or order books.

3. Capital Efficiency and Composability

Liquidity pools are more capital-efficient than order book-based exchanges. A subset of users in the pool provides liquidity with which to trade against each other, without the need for order matching. This lowers the aggregate capital required to achieve a given volume of trading. Due to their composable nature, liquidity pools are easily integrated with other DeFi protocols and applications, increasing the value of the broader ecosystem.

4. Liquidity Provider Incentives

Rewards come in different ways for liquidity providers or those who contribute assets to liquidity pools. It can include a share of the transaction fees that occur in a pool, yield farming if applicable, and sometimes even voting rights over the decision-making process concerning the protocol.

5. Impermanent Loss Risk

One of the major liquidity-providing risks is impermanent loss. This occurs when there is a large change in the prices of the assets in the pool compared to the original deposit ratio. An LP will receive less value when he/she withdraws than he/she would have if the same assets were kept outside of the pool. To be sure, this could mitigate the risk through active management and diversification of portfolios.

6. Automated Market Making Algorithms

Liquidity pools rely on sophisticated mathematical algorithms that automatically adjust asset prices and maintain the pool at a predetermined token ratio. This way, the mechanisms of AMMs give continuity in liquidity and efficient execution of trades-without traditional market makers or order books.

How Liquidity Pools Work

When users add their assets to a liquidity pool these assets are used to enable trades on exchanges. Each trade generates a fee shared among the liquidity providers according to their contribution to the pool. This setup ensures there’s always liquidity for trades, reducing price fluctuations and improving trading efficiency.

Depositing Assets

The deposit process starts with users depositing assets into the pool. Typically this involves supplying equal amounts of two tokens. For instance in an ETH/USDT pool a user would deposit both ETH and USDT in value.

Maintaining a mix of assets is essential for the functioning of the pool.

Minting Liquidity Tokens

When users deposit their assets they receive liquidity tokens (LP tokens) in return representing their stake in the pool and confirming their contribution. These tokens are generated based on the asset value and grant holders a claim to the pool inclusive of any collected fees. With these tokens, liquidity providers have the flexibility to withdraw their portion of the pool along with any accumulated fees whenever they choose.

Earning Fees

As trades occur within the liquidity pool, transaction fees are gathered. These fees, a percentage of each trade, are shared among liquidity providers according to their share in the pool. This automated fee sharing mechanism offers LPs an income source. Increased trading activity within the pool results in earnings for liquidity providers.

Trade Execution and Pool Balance

A merchant interacts directly with the liquidity pool when they execute an order on a decentralized exchange (DEX). For instance, the process of trading ETH for USDT involves the withdrawal of ETH from the pool and the addition of an equivalent quantity of USDT after calculating the transaction costs. The smart contract overseeing the pool manages this transaction to ensure that its balance is maintained. When the price of ETH changes the smart contract automatically adjusts the amounts of ETH and USDT to match the market conditions. This ensures the pool operates efficiently.

Advanced Features and Mechanisms

LP tokens not only represent a user’s ownership in the liquidity pool but also serve as a versatile asset that can be utilized in various other DeFi activities. One common use of LP tokens is in yield farming and staking protocols, where users stake or lend assets to earn returns or rewards in additional cryptocurrencies. By staking LP tokens on platforms, liquidity providers can earn rewards on top of fees from the pool, enhancing their overall gains. This dual income potential makes liquidity provision a choice for crypto investors looking to maximize their profits.

Another advanced feature offered by liquidity pools is granting governance rights to LP holders. In DeFi platforms, holding LP tokens allows users to partake in governing decisions for the protocol. This covers voting on issues including changes in the pricing structure, protocol improvements, new pools and other governance suggestions. This democratic model guarantees users’ voice in forming and running the platform community.

Types of Liquidity Pools

There are multiple types of liquidity pools, each having purposes inside the DeFi ecosystem. Knowing the many forms of liquidity pools enables individuals to choose appropriate solutions depending on their risk tolerance and investing approach.

Single-Asset Pools

Single asset pools are where users deposit one type of asset. They are commonly found in lending protocols. When users contribute their assets to a single asset pool, these assets are loaned to borrowers. The interest paid by borrowers generates profits for the liquidity providers.

Key Features and Benefits

- Simplicity: Single asset pools are straightforward to understand due to the fact that they involve a single asset type, which makes them simpler for novices to manage.

- Interest Generation: Deposited assets earn interest, creating an income source for LPs.

- Reduced Exposure: As LPs are exposed solely to the performance of one asset, it simplifies the risk mitigation process.

You may also like

Example Use Case

An example for single asset pools is in platforms like Aave or Compound. Users have the option to contribute stablecoins, such as USDT or USDC, to the pool, which are subsequently lent to borrowers. The liquidity providers divide the interest earned from these loans.

Multi-Asset Pools

DEXs commonly utilize multi-asset pools, where users deposit pairs of assets to facilitate exchanges. Liquidity providers support trading between these assets by offering liquidity in asset pairs. PLs receive the fees from thetransactions.

Key Features and Benefits

- Facilitation of Token Swaps: Diverse asset pools play a role in DEX operations, enabling decentralized trade execution.

- Fee Earnings: Liquidity providers receive a share of transaction fees for each trade within the pool.

- Price Stability: The requirement for dual assets aids in maintaining price stability within the pool minimizing fluctuations.

Example Use Case

Uniswap, a DEX platform employs multi-asset pools. For example in an ETH/DAI pool, users deposit quantities of ETH and DAI. Traders can swap between these tokens while liquidity providers earn fees from every transaction.

Staking Pools

Token staking pools involve locking tokens to enhance the security and functionality of a network. Participants are typically granted additional tokens as incentives for safeguarding their tokens during this process. Staking pools are essential for the operation of networks that employ delegated (DPoS) or proof of stake (PoS) consensus mechanisms.

Key Features and Benefits

- Network Security: Users contribute to securing the network and verifying transactions by staking tokens.

- Earning Rewards: Participants receive rewards in the form of tokens encouraging their active involvement.

- Low Barrier to Entry: Staking pools often enable users to join with small amounts, making participation more inclusive.

Example Use Case

Ethereum 2.0 is a great example of a staking pool. Users have the ability to stake their ETH in order to receive rewards while transitioning to a consensus model while improving the safety of the network.

Hybrid Pools

Certain platforms provide hybrid pools that integrate the characteristics of both single-asset and multi-asset pools. These pools have the potential to offer increased adaptability and meet the specific requirements of the DeFi ecosystem.

Key Features and Benefits:

- Versatility: Hybrid pools can be tailored for DeFi applications, offering advantages from both single and multi-asset setups..

- Enhanced Returns: By combining different asset types hybrid pools have the potential to generate higher returns and diversified risk profiles.

Example Use Case

Balancer stands out in this regard. Users can create liquidity pools, allowing them to tailor their liquidity provision strategies based on their preferences.

Incentivized Pools

In addition to fees and interest, incentive pools provide rewards, such as platform-specific tokens or further incentives to attract additional liquidity.

Key Features and Benefits

- Attractive Rewards: Incentivized pools often offer higher returns due to the additional rewards, attracting more liquidity providers.

- Boosted Liquidity: The extra incentives help increase the liquidity available in the pool, enhancing the platform’s overall efficiency.

Example Use Case

Popular DeFi platforms like Sushiswap and PancakeSwap feature incentivized pools where users can earn platform tokens alongside trading fees. These incentives play a role in boosting liquidity and expanding user participation on the platform.

Factors Influencing Liquidity Pool Performance

Trading Volume

Trading volume is the primary determining factor in liquidity pool performance. The greater the number of trades performed over a given period of time in the liquidity pool, the higher transaction fees earned by the platform translate to earnings for the providers.

Asset Price Volatility

Large price movements of the assets in the pool will lead to an impermanent loss for the liquidity providers. This means that if the price of the assets drifts too far away from the original deposit ratio, then upon withdrawal, one may get less value when compared to a situation whereby the assets were held outside the pool.

Pool Composition

The more detailed composition of the assets in the liquidity pool affects its risk and return profile as a whole. Pools that contain more volatile or lowly correlated assets may offer the potential for higher returns but also bear greater risks.

Fee Structure

The transaction fee percentage, as determined by the protocol, influences the earnings accrual to the liquidity provider directly. The higher the fee rate, the more the pool will be attractive, while lower fees may reduce the incentive to provide liquidity.

Competition

The presence of competing pools offering the same or similar asset pairs can impact the attractiveness and performance of a particular pool. Users would eventually shift their liquidity to the pools offering the best terms and incentives.

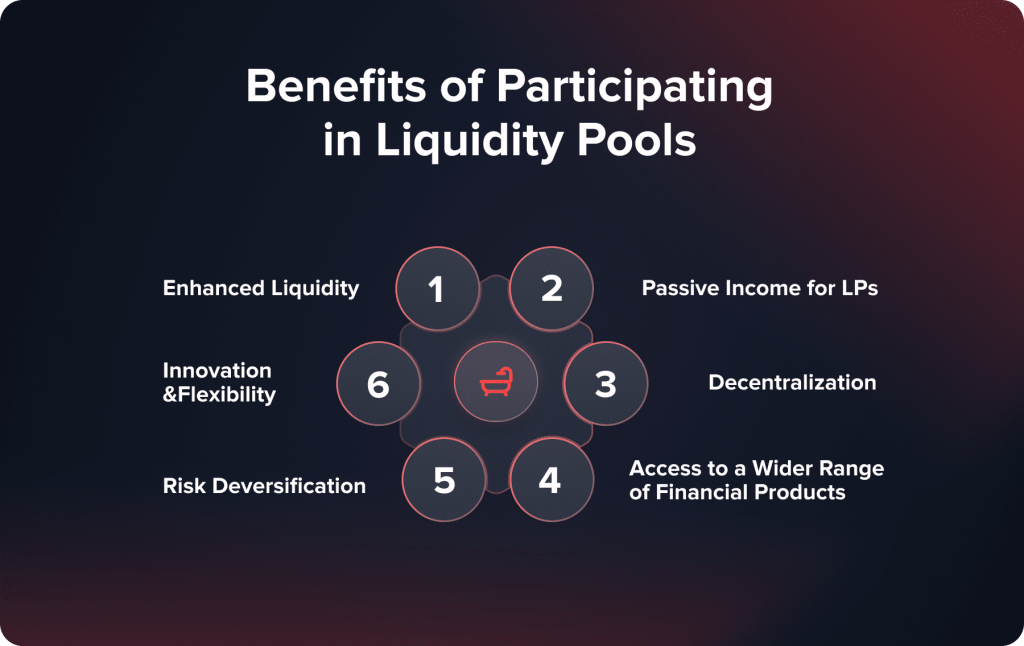

Pluses of Liquidity Pools

Both LPs and the broader DeFi community derive advantages from liquidity pools. By fostering financial inclusivity, spurring innovation, and facilitating trading experiences, they function as a component of DeFi.

Improved Liquidity

The capacity of liquidity pools to aggregate funds from users is a critical advantage, as it guarantees the availability of liquidity for trading. This pooling helps reduce price slippage that may occur when large trades impact market prices negatively.

Maintaining a supply of assets through pools can help facilitate smoother transactions and ensure more accurate price discovery. This aspect holds significance in decentralized exchanges where the absence of market makers could lead to considerable price fluctuations.

Passive Income for LPs

Liquidity providers stand to earn a share of the transaction fees generated within the pool. These fees, incurred with every trade, are distributed proportionally among liquidity providers based on their pool share. This passive income opportunity can be quite attractive in high volume pools where trading activities are frequent.

Risk Management through Diversification

By pooling assets with other users, risks are spread out. Individual exposure is reduced. The performance and risk factors are shared among all participants in a liquidity pool. This collaborative approach helps lessen the impact of volatility in any asset, resulting in a stable return profile for LPs. For instance, within an asset pool if one asset’s value drops, the overall effect on the pool may be offset by the stability or growth of other assets. This diversification strategy makes liquidity pools less risky compared to holding assets.

Innovation and Flexibility

The use of smart contracts in liquidity pools fosters innovation and adaptability. Developers have the freedom to introduce products and services that make use of these pools, giving users a wider range of choices and opportunities.

For example hybrid pools can blend elements from both single asset and multi-asset pools, offering customized solutions to meet diverse market demands. Moreover, the programmable nature of smart contracts allows for the incorporation of functionalities, like protection against impermanent loss, automated yield optimization and customizable fee models. This adaptability nurtures a DeFi environment where innovative financial products can be created and implemented quickly.

Additional Benefits

Transparency: Every transaction and modification within liquidity pools is documented on the blockchain, ensuring transparency and traceability. This transparent ledger system empowers users to validate the security and reliability of the pool’s activities.

Efficiency: Liquidity pools simplify the trading process by providing trade liquidity, reducing the time and complexity involved in matching buyers and sellers in an order book system.

Risks of Liquidity Pools

The risks related to liquidity pools are also present. Although these pools offer opportunities for earning income and’re essential in the DeFi ecosystem they come with their own set of risks. It’s crucial for anyone looking to become an LP to understand these risks. Here are some key risks associated with liquidity pools and ways to manage them effectively:

1. Impermanent Loss

One of the risks faced by LPs is impermanent loss. This occurs when the asset prices in a liquidity pool deviate from their deposit prices. Such deviations can result in a scenario where upon withdrawing their assets the provider receives less value than if they had simply held onto those assets outside the pool.

2. Smart Contract Vulnerabilities

Smart contracts power liquidity and are self executing agreements coded on the blockchain. Though designed to be secure, smart contracts can still have bugs and vulnerabilities that hackers may exploit to drain the pool causing losses for LPs. For instance in 2020 bZx experienced a flash loan attack due to a flaw in its contract, resulting in a loss of $1 million. These incidents underscore the importance of auditing contracts before engaging in liquidity pools.

3. Market Volatility

Sudden price fluctuations can result in losses as mentioned earlier. They can also impact the overall value of assets in the pool, potentially causing significant financial setbacks for LPs. For instance when the market experiences a downturn, the value of assets in a liquidity pool could plummet rapidly, leading to a decrease in the value (TVL) and impacting the stability of the pool.

4. Regulatory Risks

DeFi and liquidity pools function in a setting, which can bring about regulatory uncertainties. Governments and regulatory bodies globally are still figuring out how to supervise and regulate DeFi operations. This ambiguity could lead to alterations in the status of particular DeFi platforms or even assets within the pools.

Conclusion

Understanding the meaning, variations, advantages and risks linked to the DeFi sector allows individuals to make decisions and move through it effectively. Liquidity pools offer chances and perks that enhance the DeFi journey whether you’re a trader looking for smooth transactions or a liquidity provider aiming for extra earnings.

Updated:

January 13, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]