Forex Liquidity Provider: What it is and How it Works?

Contents

The world of finance is quite multifaceted, and the Forex market stands out as a testament to its complexity. In this vast structure, the principle of liquidity sits at the center as one of the primary components for effective trading operations.

Forex Liquidity Providers (FLPs) play a pivotal role in maintaining this liquidity and ensuring that traders can transact currencies seamlessly. They act as a bridge between buyers and sellers, with their key responsibility being the provision of depth and continuity of liquidity. Maintaining buy and sell orders across currency pairs also ensures fair and accessible pricing for traders of all types and sizes.

This article aims to explain what Forex liquidity providers are and how they operate behind the scenes. We will explore their functions, relationships with other market entities, and impact on trading conditions. The goal is to give readers a comprehensive understanding of these unseen but crucial market participants.

By the end, you’ll have a comprehensive knowledge of Forex Liquidity Providers and their indispensable role in the global trading ecosystem. With knowledge of liquidity providers’ inner workings, traders can make more informed choices and fully leverage the opportunities of the global Forex Market.

Key Takeaways

Forex Liquidity Providers serve as the groundwork upon which the Forex market exists and are critical to sustaining the operation of the Forex market by providing an ongoing flow of buy/sell orders, providing competitive pricing for transactions, and executing trades in a timely manner.

In summary,

- LPs always maintain constant bid/ask price offerings

- LPs help keep spreads down and reduce slippage

- Brokers depend on LPs for providing stable trading environment

- Strong liquidity improves execution speed and pricing fairness

- When there is limited liquidity, the costs of doing trades will increase, volatility of trading increases, and the chances of execution failing also increase.

The quality of liquidity for both brokers and traders determines how well they will perform in the Forex market.

The Basics of Forex Liquidity

Liquidity refers to readily buying or selling currency pairs without causing a significant change in the asset price.

It is quite important for traders as it affects the speed and price at which trades are executed. A highly liquid market allows for quick trade executions at predictable prices. Conversely, trades might not be executed promptly in a low liquidity environment, leading to possible slippages and unpredictable costs.

For traders, liquidity is crucial because it ensures they can enter and exit positions easily with minimal costs. Without adequate liquidity, bid-ask spreads would widen unpredictably, increasing trading risks and costs.

You may also like

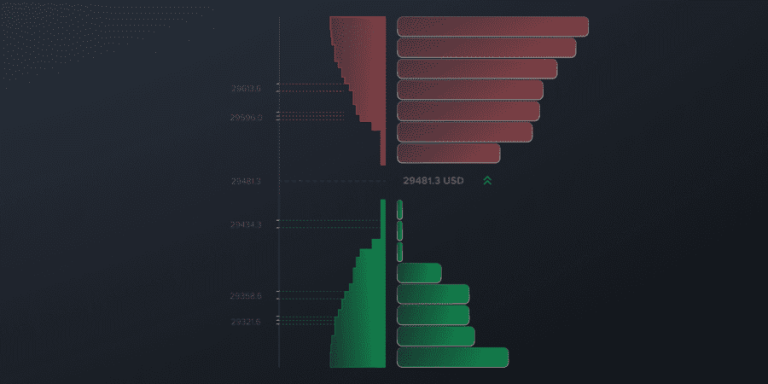

Forex liquidity refers to the ease with which a currency can be quickly bought or sold without causing significant price fluctuations. It’s the lifeblood of the Forex market, ensuring that trades are executed efficiently. High liquidity indicates a stable market with large volumes of trading activity, while low liquidity can lead to volatile price movements.

Impact of Forex Liquidity on Trading Conditions

Forex Liquidity is not just a technical term; it will ultimately affect the way traders experience trading conditions, including their trading spreads, fills, speed of fill and slippage. For example, while two different brokers could both offer the same currency pair, the way each broker’s platform operates may differ drastically based on the amount of liquidity that platform has available behind it.

When liquidity is high, traders generally will receive:

- A tighter spread in both average and fast-moving markets (i.e., news release, market opening, risk-off movements).

- A quicker fill time because there is enough volume on the prices offered to complete orders within a short time frame.

- Less slippage, particularly in larger takes and frequent trading methods such as scalping or algorithmic execution. This becomes even more noticeable in fast styles like scalping, day trading, or swing trading.

- Fewer ‘requotes’ and price gaps, due to the deeper liquidity of the order books.

- A stable rate of fill with no partial fills or changes in executed pricing.

When liquidity is low, common indicators of this include:

- Wider spreads (Example: sudden, dramatic widening during periods of volatility or low activity).

- Increased slippage as best available price disappears before the order fills.

- Increased number of rejected orders or delayed fills during periods of extreme volatility.

- Less reliable pricing and sudden jumps between levels of pricing during periods of extremely low activity or thin order books.

Thus, liquidity is defined by the amount of activity (the total amount of volume in the market within a defined period) that allows the market to execute orders. A greater volume = a greater pool of liquidity to trade from and therefore a smoother execution experience. Less volume = Increased costs associated with executing orders (increased risk and fees).

Market Participants in the Forex Ecosystem

- Retail Traders: Individual investors who trade Forex for profit or hedging purposes. They require consistent liquidity to place orders at competitive prices.

- Institutional Traders: Large commercial banks, investment funds, and corporations trading huge order flows. Their market participation depends on reliable liquidity providers.

- Forex Brokers: Firms facilitating trading by linking clients to the interbank market. They partner with liquidity providers to source liquidity and pricing.

- Liquidity Providers: These are specialized banks and independent market makers supplying buy and sell orders across currencies. They ensure that there’s enough volume in the market for trades to be executed. They maintain robust liquidity for all other participants.

What is a Forex Liquidity Provider?

Forex Liquidity Providers, often termed ‘market makers,’ ensure a continuous flow of buy and sell orders in the Forex market. A liquidity provider is a market participant that holds itself ready to buy or sell currency pairs at any given time, providing two-way prices. They bridge the gap between stakeholders in the market, ensuring that there’s always a counterparty available for every trade.

Forex Liquidity providers have two main classes: market makers who utilize their balance sheets and ECN/STP providers who focus on technological order matching. While market makers provide both buy and sell quotes and often take the opposite side of a trade, ECN (Electronic Communication Network) and STP (Straight Through Processing) providers act as intermediaries, connecting traders with sources of liquidity without taking positions themselves.

Forex Liquidity Providers vs Forex Brokers

Forex liquidity providers and Forex brokers are commonly spoken of within the same context, however, these two groups have very different responsibilities when it comes to facilitating trades. It is important for traders who are assessing a broker’s execution quality as well as brokers to understand the difference between these two groups.

Forex Liquidity Providers

The function of a Forex liquidity provider is primarily to give the necessary amounts of pricing information and volume to allow for a trader to perform a transaction. In general, Forex liquidity providers do the following:

- They provide a two-way price (bid and ask) for several currency pairs;

- They maintain a large order book with a large depth of orders at multiple prices;

- They have the ability to offset or absorb the order flow, depending on whether the provider is a market maker or an Electronic Communication Network (ECN);

- They provide the necessary amounts of pricing information and order volume to allow for traders to successfully execute trades, while limiting the amount of interaction with the traders themselves.

Forex liquidity providers do not typically interact directly with retail traders; however, they perform a critical role by ensuring that there is sufficient liquidity in the forex marketplace at all times.

Forex Brokers

Forex brokers serve as intermediaries between traders and the foreign exchange market, providing traders access to the market through liquidity.

Brokers usually do the following:

- Offer retail or professional traders a trading platform and user interface. This often happens through a white label brokerage setup.

- Aggregate liquidity from either one or more liquidity providers.

- Manage client accounts, onboarding, margin requirements, and compliance.

- Utilize pricing models, making money through spreads, commissions, and markups on their services.

- Provide customer support, education, and regulatory compliance.

So, brokers turn institutional-grade liquidity into ‘tradable’ conditions for various types of traders. In other words,

- Liquidity providers create market depth and pricing.

- Brokers deliver that liquidity to traders in a usable form.

There are several different types of forex liquidity providers. Brokers should understand which types of liquidity providers best suit their brokerage’s specific needs based on its volume of trades, types of clients and how their orders are executed.

Forex Liquidity Provider Types

The three main categories of forex liquidity provider include:

Tier 1 Forex Liquidity Provider

Tier 1 forex liquidity providers (or “Tier 1 banks”) are usually the world’s largest banks that serve as a “hub” to the interbank forex market. Tier 1 liquidity providers represent the highest and most reliable levels of provision for liquidity. Characteristics of Tier 1 liquidity providers are:

- Super-deep liquidity pools across all major and minor currency pairs;

- Institutional tight spreads throughout all active trading sessions;

- Consistency in order execution volumes over varying sizes;

- Direct interbank participation as a liquidity provider.

Tier 1 brokers are typically most suitable to use for brokers that trade large volumes or for institutional trading desks (hedge funds) and financial institutions that are very large. Most smaller brokers do not trade with tier 1 brokers because they do not meet the high capital and stringent on-boarding requirements set by the major banks that serve as Tier 1 providers. Smaller brokers will typically engage with those liquidity providers either indirectly via liquidity aggregators and/or with prime-of-prime liquidity brokers.

Non-Bank Liquidity Providers

Independent market makers, ECNs (Electronic Communication Networks), and established genealogies of non-traditional liquidity firms are considered to be ‘Non-Bank Liquidity Providers.’ These firms do not traditionally function as banks; therefore, they do not always adhere strictly to the traditional meanings of liquidity provider or market makers.

Many non-bank liquidity providers offer:

- The latest in Aggregation Technology and Advanced Pricing Engines

- Very Competitively Priced Financial Instruments Found at Multiple Venues

- Flexible Onboarding Processes and Commercial Agreements

- Expedited Integrations to Allow for Faster Access by Retail and Mid-Sized Brokers

Retail Forex Brokers, ECN & STP Platforms, and Proprietary Trading Firms are some of the other participants that rely most heavily on the use of non-bank liquidity providers for liquidity.

While liquifying entities may not always deliver comparable raw balance sheet capital on par with Leading Tier 1 Banks, some Leading Non-Bank Liquidity Providers compensate for this with advanced technology, high speed, and intelligent aggregation of liquidity.

Hybrid Liquidity Providers

Hybrid liquidity providers are the combined sources of liquidity from both bank and non-bank liquidity providers, thus providing:

- Greater Levels Of Redundancy As The User Is No Longer Dependent On Any One Source For Liquidity

- Improved Stability Of Pricing Across Multiple Trading Conditions

- Enhanced Execution In Times Of Volatility

- Providing a More Balanced Use Of Both Institutional Type Depth (Liquidity Available To All Users) and Flexible Technology.

Core Functions of Liquidity Providers

- Price Aggregation: They collect live price data from banks, brokers, and trading platforms to determine competitive benchmark rates.

- Order Matching: Liquidity providers match buy/sell orders from various market players to facilitate trading and reduce spreads.

- Risk Management: Sophisticated techniques like hedging help them stay balanced against currency fluctuations while providing liquidity.

- Pricing Models: Models factor in costs, risks, and market conditions to offer continuously updated bid-ask pricing across currencies.

By effectively performing these core roles, liquidity providers can maintain deep pools of liquidity for smooth and efficient Forex trading.

Why is Liquidity Aggregation Important?

Most brokers do business with multiple liquidity providers instead of having only one. It’s also common for multi-asset brokers, where liquidity needs differ across instruments.

Liquidity aggregation allows brokers to gather both the pricing and order flow of many LPs and share these together as one stream, thereby creating improved execution standards.

The benefits of using liquidity aggregation for brokers are:

- To collect prices from different LPs and build a deeper order book

- Automatically find the best bid and best ask in real-time

- Make it easier for larger or frequent orders to fill

- To minimise reliance on one counterparty for stability

Without aggregation, brokers will be at a higher risk of having pricing gaps, the widening of spreads, execution delays and outages, especially during times of high volatility in the market.

How do Forex Liquidity Providers Work?

The Forex market operates through a network of liquidity pools, with the “Interbank Market” being the most prominent. This market comprises the world’s largest banks and financial institutions, trading vast amounts of currencies daily.

The main liquidity pool is the global interbank market of larger banks and financial institutions trading vast order flows.

Liquidity in the Forex market is often categorized into two tiers:

- Tier 1: This comprises major international banks like Morgan Stanley, Goldman Sachs, and Barclays. They offer the highest level of liquidity and are the primary source for most Forex transactions.

- Tier 2: This includes smaller banks, financial institutions, and liquidity providers that act as intermediaries between brokers and Tier 1 entities. Examples include FXCM Pro, CFH Clearing, LMAX Exchange, Refinitiv FXall, Currenex, Integral, and Swissquote.

Liquidity providers source pricing and liquidity from these tiers and establish their pools accessible to other entities. The tiered models help to ensure that liquidity is cascaded down from major bank clients to smaller brokers and end users.

The Machinery Behind Liquidity Provision

Modern technology has revolutionized how liquidity is provided in the Forex market. Tools like Liquidity Bridges and Aggregators ensure that brokers can swiftly access the best prices from various liquidity providers. They help to collect proving days and large order flows from multiple tiers.

Advanced software solutions and electronic communication networks (ECNs) are pivotal in ensuring seamless liquidity provision. These technologies facilitate rapid order execution and price aggregation, enhancing the overall trading experience. Sophisticated trading platforms and infrastructure continuously poll incoming liquidity, analyze market conditions, and generate customized pricing.

The Order Execution Process

For market orders, liquidity providers match orders internally or externally and confirm execution as quickly as possible. Limit orders are matched if or when the limit price is reached, requiring liquidity providers to maintain substantial order books.

Slippage is known as the difference between the expected price and the executed price. It occurs when volatility causes exchange rates to shift between order placement and execution. Providers minimize this via tight spread pricing as it can significantly impact trade outcomes.

By leveraging technology, relationships, and financial resources, liquidity providers maintain the smooth flow of currency trading globally.

The Relationships Between Liquidity Providers and Forex Brokers

Liquidity providers and brokers share a symbiotic connection. While brokers rely on liquidity providers to ensure smooth order execution for their clients, liquidity providers benefit from the trading volume brought in by brokers. Such relationships are built on trust, with providers committed to transparent and fair treatment of brokers and clients.

Benefits of Using a Forex Liquidity Provider

Unlocking Market Access

With liquidity providers, traders can access a broader market, ensuring they can trade various currency pairs. With their extensive networks and order books, traders also gain access to currency pairs that would otherwise have low liquidity.

Narrower Spreads for Better Trading

By maintaining competitive buy-sell prices, liquidity providers ensure smaller bid-ask spreads. This translates to lower trading costs. High liquidity often results in tighter spreads, reducing trading costs.

Minimizing Slippage Risk

Tight pricing and bigger order sizes allow orders to be filled at posted rates rather than slipping to less favorable levels due to volatility. With ample liquidity, the chances of experiencing significant slippage are reduced.

Accelerated Execution Speed

State-of-the-art technology infrastructure enables ultra-fast order matching and confirmation, preventing delays from impacting trading strategies. Trades are performed promptly, ensuring traders have the best possible prices.

Transparency and Equitable Pricing

Traders receive fair access and consistent pricing regardless of order size, with no predatory practices like undisclosed requotes. Liquidity providers offer transparent pricing models, ensuring fair trading conditions.

Mistakes when Choosing a Liquidity Provider

Brokers typically pay attention to just the headline spreads while choosing their Forex liquidity provider because pricing does matter but providing a broker with high-quality and reliable executions, can in many cases, be of higher importance than pricing.

The following mistakes are most frequently made when selecting a Forex liquidity provider:

- Selecting the least expensive provider without considering their parameters such as fill rates, slippage, and rejections.

- Neglecting to determine a liquidity providers uptime and latency, both of which affect execution speed.

- Not investigating whether the liquidity provider is in compliance with your regulatory jurisdiction, leading to potential compliance or jurisdictional problems.

- Not testing how a provider will execute trades in volatile moments (e.g., news releases, market opens).

- Depending on a single source of liquidity.

Typically, a broker that chooses a liquidity provider with a slightly greater spread will have a significantly lower overall cost and improved long-term results due to the higher quality of the provider’s executions.

Challenges and Risks of Using a Forex Liquidity Provider

Navigating Risks from Counterparties

Liquidity providers do not work in isolation; they rely on additional market entities to source liquidity. This interconnectedness exposes them to a range of risks, primarily centered around the reliability of their counterparts. As they depend on other market entities to source liquidity, it exposes them to risks if these counterparties fail to deliver or default.

At the heart of every financial transaction lies the concept of counterparty risk. This concept emanates from the reliance on another party to fulfill its responsibilities in a trade. It is an inherent feature of financial markets, where transactions involve a multitude of counterparties, each with varying degrees of financial resilience and trustworthiness. Therefore, for FLPs, the dark cloud of counterparty risk is ever-present.

Technological Dependencies

The modern Forex landscape is heavily reliant on sophisticated automated systems. These systems are indispensable for executing trades, managing portfolios, and ensuring efficient pricing. However, their very complexity makes them vulnerable to technical glitches or cyberattacks. In an era where digital disruption is the norm, FLPs must contend with the threat of technology-related disruptions.

These disruptions can take many forms, ranging from system outages that bring trading to a halt to cyberattacks that manipulate prices or compromise sensitive data. The consequences of such incidents can be severe, including financial losses and reputational damage. Liquidity providers must, therefore, strike a delicate balance between maximizing technology for efficiency and countering the threats associated with technological vulnerabilities.

Dealing with Market Volatility

The Forex space is known for its inherent volatility. Price fluctuations are a common occurrence, driven by a multitude of factors, from economic events to geopolitical developments and market sentiment. When volatility spikes, FLPs face substantial challenges in maintaining liquidity depths and tight spreads.

The very nature of high volatility can disrupt market equilibrium, resulting in erratic price movements and liquidity gaps. This will invariably result in increased transaction costs and greater uncertainty for liquidity providers. The proficiency to navigate and adapt to changing market conditions is an important skill for anyone operating in the Forex space.

Regulatory Considerations

The Forex financial market is subject to a web of regulations designed to maintain market integrity and protect investors. These regulations, while necessary, come with their own set of challenges for liquidity providers. Stricter regulations often translate into higher operating expenses, as firms must allocate resources to ensure compliance.

Moreover, violations of regulatory norms can have severe consequences, ranging from sanctions and fines to reputational damage and even the withdrawal of licenses. In an environment where regulations continually evolve, liquidity providers must remain vigilant and adaptable, staying abreast of changes to avoid costly compliance pitfalls.

How to Choose the Right Forex Liquidity Provider?

There are some factors to consider when choosing the right Forex liquidity provider that meets your needs. Each factor must be considered alongside other factors before a conclusion is made.

Reputation and Reliability

A provider’s track record speaks volumes about its reliability. It’s the foundation on which trust is built, and an effective business relationship can be established. Longevity in the market is also an important factor to consider when choosing a Forex liquidity provider. These characteristics help you build confidence and ensure stability during volatile periods.

Liquidity Depth

The liquidity depth of the provider has to do with monetary resilience, also known as financial stability. This is the capacity with which the provider can ensure timely and effective fulfillment of its promises to customers. The degree of liquidity offered can also influence business performance and pricing. A provider that shows strong liquidity depth across multiple currency pairs guarantees execution needs will be met reliably.

Trading Costs

Understanding the cost structure of your provider is crucial to ensure profitable trading. Competitive pricing through narrow spreads is necessary while avoiding hidden fees and charges.

Technology and Infrastructure

When selecting a Forex liquidity provider, you must be conversant with the technology and infrastructure such a provider has in his arsenal. Modern and potent technology is important for seamless trading experiences. If a liquidity provider is to be worth your time, he must be properly equipped for proper output.

Regulatory Compliance

You don’t want to be caught in the cross-hairs of regulations when working with a non-compliant provider. So, ensure that your provider adheres perfectly to all relevant regulatory norms. It must also be backed up with proper licensing in major jurisdictions for legitimacy and capital security.

The Importance of Due Diligence and Thorough Research

Before settling on a liquidity provider, conducting thorough research, seeking recommendations, and even testing their services to gauge their efficacy is imperative. After considering the factors stated above, a couple of steps are still needed to ensure you make the best choice

Assess public reviews, credentials, locations, partnerships, and regulatory oversight well. This gives you a clearer image of what to expect from a potential provider before settling. It opens you up to possible risks that can be encountered and providers to avoid.

Also, check independently verifiable metrics like average spreads, fill rates, and platform uptime. This helps you to verify some of the claims of the potential provider to ensure trustworthiness. Consider needs based on trading styles, frequencies, currencies, and volume before commitments.

Choosing a liquidity provider is important for a smooth trading experience and mitigating risks. You need to take time to screen providers for the best combination of costs, trustworthiness, and support.

Future Trends in Forex Liquidity Provision

The Forex space is ever-evolving, with technological upgrades and regulatory changes shaping its future. Evolving technologies already paint a very good picture for the future of Forex liquidity provision. Advancements such as low-latency trading, artificial intelligence, and augmented analytics will progress pricing models and order-matching capabilities.

Regulatory changes also have a strong part to play in what is to come for Forex liquidity provision. Regulations around client segregation, transaction reporting, and market abuse monitoring are increasing globally. This will surely impact operations significantly and must be properly factored in.

The rise of Cryptocurrency and Blockchain technologies promises to bring about significant shifts in how liquidity is provided. Digital currencies and distributed ledger technologies may offer new possibilities for liquidity provision and market connectivity in the coming years.

Overall, the liquidity provision landscape will continue transforming alongside technological disruption and evolving participant needs. Forward-thinking providers investing in innovation will be best equipped to adapt efficiently.

Conclusion

The space of Forex trading is intricate, with liquidity lying at its core. FLPs play an indispensable role in ensuring the market’s smooth functioning, bridging the gap between buyers and sellers. By maintaining vast pools of liquidity through sophisticated technological platforms, these unseen market players are the lifeline for all Forex traders.

As we navigate the complexities of the Forex market, understanding the role and significance of these providers becomes paramount. With this knowledge, traders can easily make informed decisions, ensuring profitable and seamless trading experiences.

FAQ

A Forex liquidity provider is a company or institution that offers continuous quotes for currency pairs (buy/sell prices) and thus provides an avenue through which trades can be executed in an efficient manner, at competitive prices, and in a timely manner.

Retail traders do not deal directly with liquidity providers; instead, they utilize the services of Forex brokers, who acquire pricing and execution from one or more of the available liquidity providers.

Having multiple liquidity providers allows brokers to obtain better pricing, better execution quality, and better system reliability by reducing their reliance on one specific source of liquidity.

Generally, higher levels of liquidity result in narrower spreads and less slippage, whereas lower levels of liquidity result in greater execution risk and increased trading costs.

Updated:

January 13, 2026

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]