What is the Spread in Trading, and How Does It Work?

Contents

If you’ve ever looked at a trading app, you’ve probably noticed two different prices for the exact same stock or currency pair. You can’t buy it for the same price you can sell it for. That gap isn’t a glitch, it’s the spread.

In the simplest terms, the spread is the primary cost of doing business in the financial markets. Whether you are trading Bitcoin, Apple stock, or the Euro, the spread sits quietly in the background, influencing your profit margins from the second you click “buy.” Understanding how it works is the difference between a strategy that scales and one that slowly drains your account through “hidden” costs.

Defining the Bid-Ask Spread

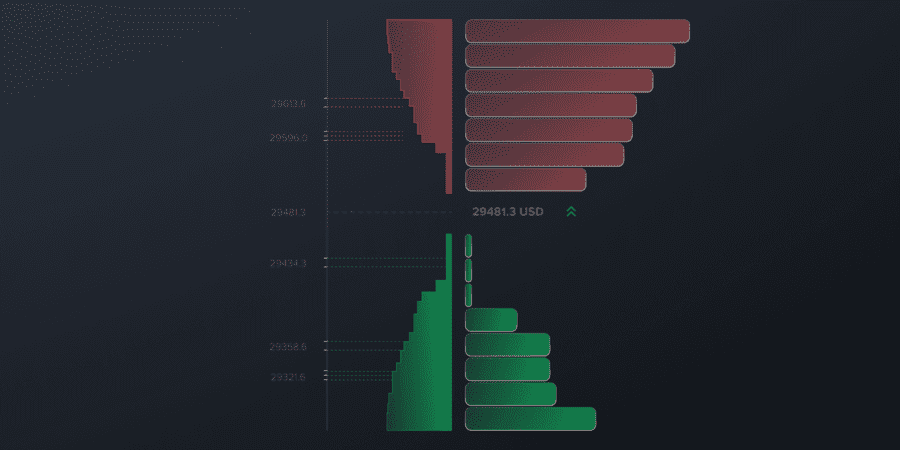

To understand the spread, you have to look at the two numbers on your screen: the Bid and the Ask.

- The Bid: This is the highest price a buyer is willing to pay. Think of it as the “sell” price for you. If you want to get out of a position right now, this is what you’ll get.

- The Ask: This is the lowest price a seller is willing to accept. This is your “buy” price. If you want to enter the market immediately, this is what you’ll pay.

The spread is simply the mathematical difference between these two.

Expert Insight #1: The “Instant Negative” Reality

In professional trading, we often say you start every trade in the red. Because you buy at the higher Ask and would immediately have to sell at the lower Bid, the spread is your ‘day one’ hurdle. If the spread is $0.05, the price must move $0.05 in your favor just for you to hit $0.00 profit.

The Different Faces of Spreads

Not all spreads are created equal. Depending on what you are trading and which broker you use, you’ll encounter different structures.

1. Fixed Spreads

Some brokers promise a spread that never changes, regardless of what is happening in the news. If the spread on a currency pair is 2 pips, it stays 2 pips.

- The Pro: You know exactly what your costs are before you trade.

- The Con: These are usually slightly wider than market rates to compensate the broker for taking on the risk.

2. Variable (Floating) Spreads

These move in real-time. When the market is quiet, the spread might be paper-thin. When a major economic report drops or a geopolitical crisis hits, the spread can blow wide open.

- The Pro: You can get very cheap entries during high-liquidity hours.

- The Con: You might get “slipped” during volatile times, paying way more than you expected to enter a trade.

Why Does the Spread Even Exist?

It helps to think of a broker or a market maker like a high-end used car dealership. They buy cars from the public at one price (the Bid) and sell them to other customers at a higher price (the Ask). The difference pays for their showroom, their staff, and the risk that the car sits on the lot and loses value.

In the digital markets, market makers provide liquidity. They ensure that when you want to sell, there is always a buyer. In exchange for providing this “always-on” service and taking the risk that prices might crash while they are holding an asset, they keep the spread as a fee.

How to Calculate the Spread

Calculating the spread is straightforward math, but the units change depending on what you’re trading.

In Stocks

If a stock is quoted at $150.10 (Bid) / $150.15 (Ask), the spread is $0.05. If you buy 100 shares, your total spread cost is $5.00.

In Forex

Forex uses “pips.” If the EUR/USD is 1.0850 / 1.0852, the spread is 2 pips. While two pips sounds tiny, if you are trading large “lots,” those pips add up to real money.

In Crypto

Crypto spreads can be wild. Because Bitcoin trades 24/7 across dozens of different exchanges, you might see a $10 spread on one platform and a $50 spread on another. Always check the “depth” of the order book before jumping in.

The Big Factors: What Makes Spreads Move?

Spreads aren’t pulled out of thin air. They react to the environment like a thermometer.

Market Liquidity

This is the most important factor. Liquidity refers to how much “action” is in the market.

- High Liquidity: Think of the EUR/USD or Apple stock. Millions of people are trading them. Because there are so many buyers and sellers, they compete with each other, which drives the prices closer together. This results in tight (narrow) spreads.

- Low Liquidity: Think of a “penny stock” or an obscure currency pair like the Turkish Lira vs. the Mexican Peso. Very few people are trading these. Because it’s harder to find a match for your trade, the spread is wide.

Volatility

Volatility is about speed. If a company suddenly announces it’s being investigated by the government, the price will start jumping frantically. Market makers get nervous during these times because they don’t want to get stuck holding an asset that is plummeting. To protect themselves, they widen the spread significantly.

Trading Sessions

In the Forex world, time is everything. When the London and New York markets are both open at the same time (the “overlap”), there is a massive amount of money moving. Spreads are usually at their thinnest. If you try to trade at 10:00 PM on a Sunday, you’ll likely pay a premium because fewer people are at their desks.

The Hidden Impact on Your Strategy

The spread isn’t just a fee; it dictates which trading styles will actually work.

Scalpers vs. Swing Traders

- Scalpers: These traders try to make small profits on dozens of trades a day. For them, the spread is a “strategy killer.” If you’re aiming for a 5-pip profit and your spread is 2 pips, you are giving away 40% of your gains to the broker. Scalpers need the tightest spreads possible to survive.

- Swing Traders: These traders hold positions for days or weeks, aiming for 200-pip gains. For them, a 2-pip spread is almost irrelevant. It’s a tiny fraction of their expected profit.

You may also like

Expert Insight #2: The “News Gap” Trap

New traders often try to trade during big news events like the Non-Farm Payrolls (NFP) report. They see the price move 50 pips and think it’s easy money. What they don’t see is that the spread often triples during the release. I’ve seen traders get stopped out of a ‘winning’ trade simply because the spread widened so much it hit their stop-loss, even though the actual market price hadn’t reached it yet.

Comparing Brokers: It’s Not Just About the Spread

When choosing a place to trade, don’t just look for the lowest spread. You have to look at the “total cost of ownership.”

- Raw Spreads + Commission: Many modern brokers offer “ECN” accounts. They give you the raw market spread (which can be $0.00) but charge you a flat commission (e.g., $3.50 per trade). Often, this is cheaper for active traders than using a “no-commission” account with a marked-up spread.

- Slippage: A broker might show a tiny spread on their website, but when you click “buy,” they execute your trade at a worse price. This is called slippage, and it’s effectively a hidden spread.

- Stop-Loss Hunting: Low-quality brokers might artificially widen their spreads during quiet hours to trigger “stop-loss” orders, closing out your trades prematurely. Stick with regulated, reputable brokers to avoid this.

Spread Sensitivity: Which Style Are You?

Your trading strategy should determine how much you care about the spread. Use the table below to see if your style is Spread Sensitive.

| Trading Style | Timeframe | Spread Sensitivity | Why? |

| Scalping | Seconds to Minutes | Critical | When your target is 5 pips, a 2-pip spread eats 40% of your profit. |

| Day Trading | Hours | High | Multiple trades per day add up; high spreads can turn a winning day into a losing one. |

| Swing Trading | Days to Weeks | Moderate | You are aiming for 100+ pips, so a 2-pip spread is a minor “cost of business.” |

| Investing | Months to Years | Low | Long-term growth usually dwarfs any minor entry/exit costs. |

The Role of Technology

We’ve come a long way from guys screaming in pits on Wall Street. Today, spreads are managed by Matching Engines and Algorithms.

Automated Market Makers

In the past, a human had to decide the Bid and Ask. Today, high-frequency trading (HFT) computers do it in microseconds. They scan thousands of orders and instantly calculate the optimal spread. This technology has actually been great for retail traders because it has made spreads much tighter than they were twenty years ago.

Aggregators

Top-tier brokers use liquidity aggregators. These are software systems that pull price feeds from 10 or 20 different banks simultaneously. The system then picks the best Bid from Bank A and the best Ask from Bank B to give the trader the tightest possible spread.

How to Manage Spread Costs

You can’t avoid the spread entirely, but you can be smart about how you pay it.

- Trade Major Assets: Stick to “The Majors” (EUR/USD, GBP/USD, Gold, S&P 500). These have the highest volume and the lowest spreads.

- Watch the Clock: Try to trade during peak hours for your specific asset. For US stocks, that’s the New York open. For Forex, it’s the London/New York overlap.

- Use Limit Orders: Instead of using a Market Order (which buys at the current Ask), use a Limit Order. This allows you to set the exact price you want to pay. While it doesn’t “eliminate” the spread, it prevents you from getting a bad fill during a sudden price spike.

- Check the Economic Calendar: If a big interest rate decision is coming up in ten minutes, wait. The spreads will likely be erratic until the dust settles.

You may also like

Spread Comparison by Asset Class

Not every market behaves the same way. While Forex is famous for its razor-thin spreads, other markets can be much more expensive to enter.

| Asset Class | Typical Spread Size | Why? |

| Major Forex (e.g., EUR/USD) | Very Tight (0.1 – 1.0 pips) | Massive global volume; hundreds of banks competing for your trade. |

| Blue-Chip Stocks(e.g., Apple) | Tight ($0.01 – $0.05) | High daily volume ensures buyers and sellers are always present. |

| Major Crypto (e.g., BTC/USD) | Moderate ($5 – $50) | High volatility means market makers need a larger safety buffer. |

| Exotic Forex (e.g., USD/ZAR) | Wide (50 – 200 pips) | Lower liquidity; fewer participants trading the South African Rand. |

| Small-Cap Stocks | Very Wide (2% – 5% of price) | Low volume; it might take hours to find someone to take the other side of your trade. |

Final Thoughts

The spread is the heartbeat of the market. It tells you how healthy, liquid, and volatile an asset is at any given moment. While it might seem like a small detail, it is the foundation of your transaction costs.

A successful trader doesn’t just look at where the price is going; they look at what it costs to get there. By choosing the right assets, trading at the right times, and picking a broker with transparent pricing, you can keep more of your profits and spend less on the “cost of admission.”

FAQ

Think of it like a currency exchange booth at the airport. You’ll see one price to buy Euros and a lower price to sell them back. That gap is the spread. In trading, it’s the difference between the Buy (Ask) price and the Sell (Bid) price. It is the basic "entry fee" you pay the market to execute your trade.

Because of the spread, you always buy at a slightly higher price than the current market average and sell at a slightly lower one. If you bought a stock at the Ask price of $10.05 and sold it one second later at the Bid price of $10.00, you would lose $0.05 instantly. The market has to move in your favor just for you to break even.

Generally, yes. A narrow (tight) spread means lower transaction costs. However, you should also look at the broker's execution speed. A "zero spread" is useless if the broker takes five seconds to fill your order, during which the price might move against you anyway.

No. Every broker has different "liquidity providers" (large banks or institutions). Some brokers also add a "markup" to the spread to make their own profit. This is why it pays to compare platforms before opening an account.

Not really. If you plan to hold a stock for five years, a $0.02 spread is a tiny drop in the bucket. However, for day traders or scalpers who enter dozens of trades a day, the spread is often their biggest expense.

In Forex, spreads are measured in pips. Formula: Ask Price - Bid Price = Spread Example: If EUR/USD is 1.1053 (Ask) and 1.1051 (Bid), the spread is 2 pips.

Updated:

February 17, 2026

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]