What is Risk Management in Trading, and How Does It Work?

Contents

Risk management in trading is about the practices traders take to reduce possible losses and protect their capital through risk management strategies consist of using diversification, stop-loss orders, levers, and reviewing trades at regular intervals, especially after they lose trades, in order to capture opportunities in changing market conditions.

Basically, risk management is the awareness, evaluation, and handling of possible trade losses. In trading, risk management is not only about protecting yourself and your funds but also a necessary component of good strategies. The following article will look at how risk management may help protect money and ensure trading success.

Key Points

- Managing risk is a necessary function for capital protection and reducing losses in trading.

- Risk tools like stop-loss order, controlling leverage, and diversifying portfolios are there to limit exposure.

- Risk-reward ratio is a tool to evaluate a trade’s possible return against possible loss before entering a trade.

- Reviewing strategies regularly ensures your approach reflects your market changes as well as your performance goals.

- Better risk management develops discipline, reduces emotion-driven trading, and increases the chance of profitability long-term.

Core Principles of Risk Management

Risk management is supported by a variety of principles that tackle various aspects of risk associated with trading. These principles are the foundation of a strong risk management plan. By grasping and implementing these principles effectively, traders can make well informed decisions, maintain a balanced portfolio and minimize potential losses while maximizing opportunities for profit.

Principle 1: Diversification

In the world of trading and risk control, diversification is a foundational concept. It means spreading assets around markets and instruments to lessen the effect of a poor performance of one asset on the whole portfolio.

By distributing investments among sectors and asset classes with different reactions to economic changes, diversification essentially seeks to offer protection against the turbulent and often erratic character of markets. For instance, one area can be declining in value while another sector is booming, therefore preserving the balance in the performance of the investment portfolio. Should the technological sector be struggling, the healthcare sector may be flourishing and vice versa. In this sense, development in one region might offset fluctuations or dips in the economy of another country.

Implementing a Diverse Portfolio

Creating a well-rounded investment portfolio requires understanding the linkages among several assets and how they affect the total risk of the portfolio, not only about choosing different assets. It also entails merging cash equivalents, stocks, bonds, and commodities. Additionally diversification extends to balancing investments across sectors such as technology, healthcare, finance and consumer goods to minimize risks and enhance portfolio stability.

Adding geographical diversification provides a level of protection by spreading investments across various countries and regions to mitigate the impact of economic downturn in specific areas.This approach is vital in today’s interconnected market where political events in one region can cause effects worldwide.

Balancing the Portfolio

Managing risk requires diversification of your assets. However it’s important to find the balance to prevent spreading yourself too thin and potentially reducing your earnings potential. Achieving this equilibrium calls for an understanding of markets and industries and may entail dealing with added intricacies, especially when it comes to investing internationally.

Diversification as an Ongoing Process

Knowing that diversification is not a one time setup, where you simply set it once and then forget all about it, is important because as markets change over time so must diversification plans evolve accordingly too by checking and adapting the investment portfolio to match the shifting market dynamics and individual financial objectives.

Essentially diversification in trading involves striking the balance between minimizing risk and seizing potential for growth opportunities. To fit the risk tolerance and investment objectives of every individual trader, this procedure requires constant observation and modification. Using diversification strategies helps traders build a portfolio that can more successfully negotiate the ups and downs of financial markets.

Principle 2: Understanding and Managing Leverage

Trading leverage can greatly boost profits while also amplifying losses. Leverage involves utilizing borrowed money to amplify the gains of an investment. Since leverage usually involves borrowing funds, it overlaps with core concepts of margin trading.

Although it may seem appealing, this strategy demands a thoughtful approach and strategy to handle it properly.

The Mechanics of Leverage in Trading

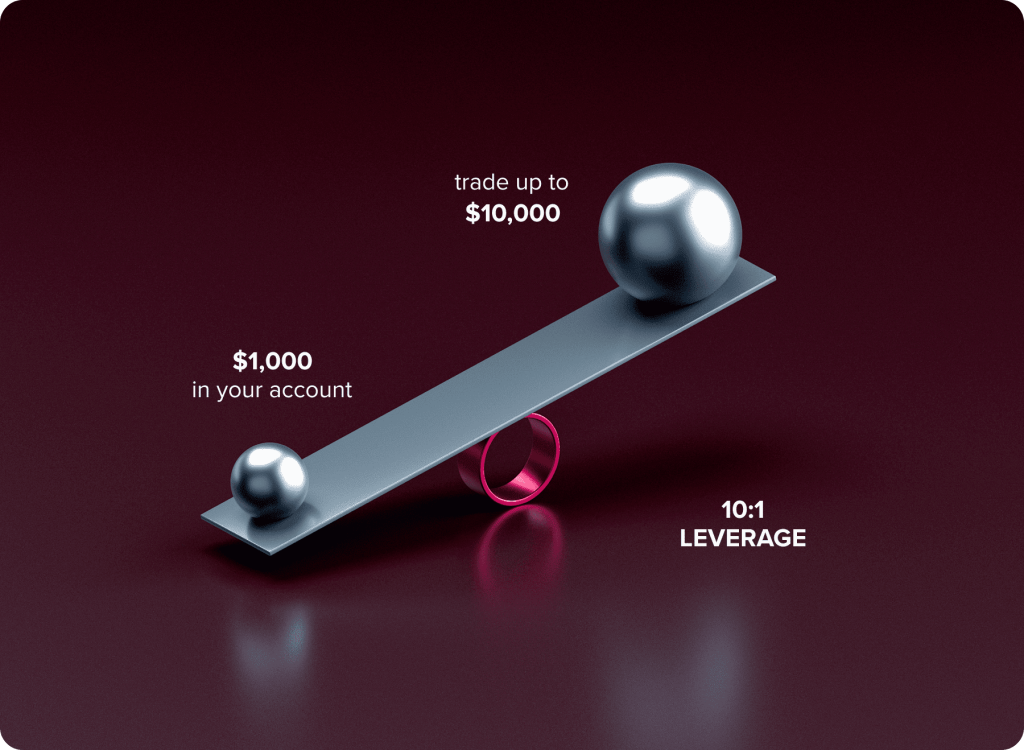

Traders utilize leverage to manage large positions with a fairly modest amount of capital at hand; for instance, with a leverage ratio of 10x, the trader can command a $10,000 position with just $1000 of his own funds invested. This strategy can result in significant gains when the market moves in their favor. Nonetheless, it also poses risks as even a slight unfavorable shift may result in swift losses that exceed the initial investment.

Navigating the Risks and Rewards

The attraction of higher earnings through leveraged trading must be weighed against the recognition of the associated dangers in the process. Leverage increases both the advantages as well as the drawbacks in trading operations, therefore increasing the stakes for the traders. Traders must realize that even although leverage could improve their buying power, it also increases their risk in instances of rapid market volatility.

Prudent Use of Leverage

Using leverage responsibly entails following a set of practices. Before traders decide to employ leverage in trading and safely manage risk levels, it is essential for them to conduct an evaluation of potential risks involved in the process of using leverage by observing current market conditions and being aware of the possibility of sudden and significant fluctuations. It’s crucial for traders to keep enough capital on hand to cover any margin calls and prevent overextending themselves financially. One must also possess an understanding of market dynamics and extensive experience in trading, taking into account the intricate details of market shifts and how leverage influences various types of assets.

Leverage as a Strategic Tool

Leverage is definitely considered an asset and a force for good for traders, even though it comes with its set of risks. Traders with experience incorporate leverage into their trading strategy along with risk management methods to enhance their trading strategy as a whole. Trading leverage can be a tool with both benefits and drawbacks to consider carefully before diving in headfirst.

Principle 3: Setting Stop-Loss and Take-Profit Points

Stop-loss and take-profit orders serve as watchdogs that protect a trader’s portfolio. These tools are not merely mechanisms for managing transactions; they are essential for enforcing discipline and strategic planning in the frequently turbulent world of trading.

The Role of Stop-Loss Orders

Usually placed at a point where they are ready to take a specific loss but not beyond that, traders use stop loss orders to cancel positions at a predefined price level, therefore limiting possible losses on transactions.

Imagine this: a trader pays $50 for a stock hoping for market value increase. Considering the volatility of the market, the trader then orders a stop loss at $45 to restrict losses should the stock price drop to that level, therefore guaranteeing the containment of losses and a position closure. In markets where prices change quickly and manually acting may not be quick enough, this approach is especially vital.

The Significance of Take-Profit Orders

Conversely, a take profit order seeks to guarantee gains by terminating the transaction whenever it crosses a predefined profit level. This enables traders to maximize rewards without caving in to avarice or the anxiety of missing out on earnings.

A trader may, for instance, set a profit-taking order on a stock bought at $50 and sold at $60. The process is carried out when the stock reaches that price point, therefore guaranteeing the profit. When a trader cannot monitor the market and ensures not to miss chances to profit from price movements, this feature is extremely helpful.

Balancing Risk and Reward

Balancing risk and reward is the focus of both stop loss and take profit orders. They allow traders to set goals for risk tolerance and profits, while offering a trading method that doesn’t require constant market watching or relying heavily on emotions when making decisions.

In a market where prices are rising during a bullish trend, traders can modify these orders based on their trading plans and market evaluation strategies. For instance, a trader may utilize higher take profit levels or adjust the stop loss orders to higher price points in order to maximize potential profits while still managing the risk of losses effectively.

Strategic Implementation

To properly deploy stop loss and take profit points, one must first understand market patterns and develop one’s own trading strategy. When selecting how tightly or loosely to place these orders, one must consider the options available. Placing them too near might result in early trade closing, but placing them too far away might result in excessive risk exposure.

Setting stop loss and take profit orders goes beyond risk management; it demonstrates a trader’s attitude to the market, as well as their discipline and understanding of trading dynamics. By placing these orders, traders may confidently navigate its complexities while knowing that their investments and gains are protected.

Principle 4: Risk-Reward Ratio

One way to evaluate a trade’s risk is by looking at the risk-reward ratio. It helps investors weigh the possible gain against the possible loss in a certain transaction. A 1:3 risk-reward ratio is when a trader is ready to risk $1 in the hopes of making $3. Traders may determine which options are suitable for their trading goals and risk tolerance with the help of this ratio.

Application in Trading Strategies

Approaches, strategies, and decisions in trading are influenced by the risk-reward balance. In order to gauge the probable success of a deal, traders look at the risk-reward ratio. A trade that presents a ratio typically attracts interest and is in line with a strategic approach focused on managing risk prudently while aiming for profitable outcomes.

Traders use the risk-reward ratio to assess a trade’s potential before committing to it. Calculating the risk-reward ratio also requires understanding trading costs like spreads. Generally speaking, a trade with a good ratio is more enticing as it fits a plan aiming at efficiently balancing risk with possible profits.

This strategy focuses on weighing the risks against the rewards to make thought out trade decisions that carefully consider both the positive and negative outcomes in a thoughtful manner. It highlights the significance of making wise choices when dealing with changing and uncertain markets. By giving importance to this ratio of risk to reward when trading stocks or assets, investors can develop plans that not only mitigate risks but also target substantial gains, ultimately leading to a stable and long lasting trading approach.

Tailoring to Individual Trading Styles

Traders have preferences when it comes to the risk reward ratio based on their risk tolerance and trading approach in various market conditions. Some opt for a cautious approach while others take a more bold stance. The key is to find a ratio that aligns with your trading beliefs and view of the market.

Principle 5: Regular Review and Adjustment

In the world where the markets are always changing and adapting to new conditions and trends, it’s crucial for traders to continuously reassess and refine their risk management strategies. This isn’t just an exercise. It’s a practice that guarantees strategies stay efficient and responsive to market shifts.

The Necessity of Regular Strategy Reviews

In the world of finance and investments¸ navigating the markets is like solving a puzzle that keeps changing all the time, which is why it’s vital to constantly reassess your strategies through regular reviews, as they play a key role in ensuring success and adaptability in this dynamic environment.

- Staying Informed About Market Developments

The markets can shift rapidly due to factors like data updates and geopolitical events or changes in investor sentiment. It’s essential to stay informed about these trends to adjust your trading strategies accordingly.

- Analyzing the Performance of Current Strategies

A crucial aspect lies in evaluating the effectiveness of existing tactics in light of the market environment to gain insights into their success and areas for improvement that may be needed.

- Identifying New Risks and Opportunities

An assessment of situations and circumstances also requires keeping an eye out for challenges and possible opportunities ahead. As the market landscape changes over time, new difficulties may surface, calling for a reassessment and tweaking of risk management strategies. Similarly fresh opportunities might present themselves that were not on the radar before.

Flexibility: The Key to Adaptation

In such reviews and readjustments, at the core lies the idea of being flexible. Being open minded to change and adjusting strategies based on information or shifting market conditions is key here. Flexibility in trading is a notion that goes beyond tweaking numbers or shifting positions. It forces one to review their risk tolerance, which may change depending on their individual situation in life and market volatility. Review and change your trading plan as needed to make sure it still fits your goals and the state of the market.

In addition to this, flexibility involves making needed revisions based on insights gathered from market analysis and evaluations of current strategies performance. For example, a trader may consider it wise to adjust their investment positions, refine their stop loss and take profit orders or explore asset classes or sectors. This ability to adapt is crucial in the realm of trading as market circumstances can shift abruptly and unpredictably. One must be adaptable and quick to react and be prepared to handle the shifts and changes with a strategy that is sturdy yet flexible, able to adjust to the constantly evolving trading environment.

Your Risk Management Checklist

Use this checklist as your go-to quick-start guide to reduce risk and foster discipline in every trade:

- Place stop-loss and take-profit orders with every trade

- Use proper position sizing for your capital and risk tolerance

- Stay away from overleveraging – never risk more than you can afford to lose

- Allocate capital across asset classes, sectors, and regions to diversify your portfolio

- Review and recalibrate your strategy regularly, based on your performance and changes in the market.

Why Risk Management Matters in 2025’s Market

In 2025, the financial markets are the riskiest we’ve seen to date. With geopolitical uncertainty, high interest rates and AI will be in the mainstream (e.g., algorithms running trading automatically, there is a fast-paced and risky ecosystem) are decreasing the margins of error for both retail and institutional traders.

Risk management isn’t a nice-to-have…it is a veil of survival.

Traders must take pro-active approaches to ensure protecting capital exposure, manage volatility exposure and remain adaptive to sudden fluctuations in the market. Whether working in post-pandemic policy changes, algorithmic trading trade flow shifts, or decoupling from the global economy, risk management will allow disciplined, consistent, and competitive trading.

In today’s market, not having a risk policy is in itself a risk.

Frequent Mistakes in Risk Management (And How to Avoid Them)

Avoiding emotional trades requires a strong grasp of trading psychology. Even seasoned traders can succumb to psychological traps or make errors of commission, but spotting these familiar mistakes is the start of building a robust trading strategy.

Over-Betting on Market Swings

Over-trading is often associated with jumping on extra trades during volatile market movements

Tip: Stick to your trading plan and use a max number of trades per day. Stick to your risk parameters you created. All of these additional trades made in the noise of the market will be impulsive decisions.

Not Using Stop-Loss Orders

Skipping stop-loss orders put your capital at risk for unlimited downside when you are taken by surprise during sudden drops in the market.

Tip: There should always be a stop-loss order in place before opening a position. It should be based on technical analysis, not taxpayer loss. If you need to adjust your stop, do it as the trade progresses.

Revenge Trading

Once you have a loss, the desire to “win it back” often results in even bigger mistakes particularly when you have a sense of urgency, fear or frustration.

Tip: After a loss, take a break. Reflect on your trading plan, and what needs to improve within the trading plan, and only think of entering the market again with the mind cleared.

The Risk-Reward Ratio

The risk-reward ratio needs to be properly understood before entering a trade! If you open a trade without identifying the potential upside vs downside you’ve skewed all your winning and losing positions.

Conclusion

Trade risk management is complex and requires more than theoretical knowledge. Trading in volatile financial markets requires traders to have advanced risk management tools, analytical skills, and psychological fortitude to make disciplined decisions. These varied aspects may be combined into a unified risk management approach to help traders traverse the financial markets’ complexity and volatilities, changing risk management from a defensive tactic into a key trading strategy.

FAQ

A typical example of risk management in trading is a stop-loss. An example of a stop-loss is when a trader buys a stock at $100, then sets a stop loss at $95. Thus, if the stock price falls to $95, the position closes automatically at the market price, limiting the trader's loss to 5%. This helps not only manage risk, but take the emotion out of decision making and can conserve capital in volatile markets.

Risk vs reward ratio for a trader helps them determine if it's worth taking the trade. For example, if they trade with a risk vs reward ratio of 1:3, they stand to gain $300 for every $100 risked. Even if a trader had a bad streak of losing trades, if they developed the discipline to take trade with good risk vs reward, they can be profitable.

– A stop-loss will automatically close the trade when it falls to the price you set for loss. – A take-profit order closes a trader's position when a preset target is achieved, locking in the profit. – Both automatically provide traders an exit strategy and remove emotional distress.

A beginner can manage risk when trading by: – Begin with a demo account to practice. – Use low leverage or trade without leverage. – Set clear stop-loss and take-profit points. – Diverse trades and methods across securities. – Never risk more than 1-2% of your capital per trade. – Regularly review their strategy dependent on performance.

Updated:

July 25, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]