Matching Engine: What is It and How Does it Work?

Contents

In the high-speed world of financial trading, the matching engine is the core technology that powers traditional and modern exchanges. These sophisticated systems ensure that trades are executed seamlessly and efficiently as the global linchpin for financial markets. Understanding how matching engines function is essential for anyone participating in financial markets, from traders to exchange operators. This article dives deep into the mechanics of matching engines, exploring their pivotal role in price discovery and the critical factors to consider when implementing or choosing a matching engine for trading platforms.

What Is a Matching Engine?

A matching engine is the cornerstone technology of financial exchanges, acting as the sophisticated engine room where buy and sell orders are paired. This software system is crucial for functioning equity, commodity, cryptocurrency exchanges, and derivatives markets. It processes and matches orders from market participants based on complex algorithms, thus enabling the seamless execution of trades. This mechanism supports the daily trading of vast volumes of assets and ensures that the market operates efficiently and transparently.

At its essence, the matching engine’s role is to create a venue where market liquidity— the ease with which assets can be bought or sold at stable prices—is maintained through the continuous matching of orders. By efficiently aligning buyers and sellers without significant price discrepancies, matching engines uphold the integrity of financial markets and facilitate the fair and orderly execution of trades.

Matching Engine vs. Order Management System (OMS)

Both matching engines and order management systems (OMS) are key parts of electronic trading, but they each have their own role.

A matching engine is what makes trades happen. It instantly pairs buy and sell orders using set rules and does this in real-time, often in just milliseconds. It connects directly to the exchange’s order book and liquidity sources to get the job done.

On the other side, an Order Management System (OMS) takes care of the behind-the-scenes work. It deals with creating, changing, and sending orders to different places. Brokers, asset managers, and big investors use OMS to streamline their trading process, keep things compliant, and manage their portfolios. Unlike matching engines, OMS doesn’t actually execute trades.

Here’s a quick comparison:

| Feature | Matching Engine | OMS |

| Function | Handles and matches buy and sell orders. | Handles and directs orders through different systems. |

| Users | Exchanges, brokers, and trading platforms. | Investment companies, brokers, and asset managers. |

| Speed Priority | Super quick execution in microseconds. | Doesn’t provide real-time updates; Focuses on managing orders and tracking. |

| Integrated With | Order books, liquidity pools, and pricing engines. | Portfolio systems, compliance tools, and front-office apps. |

Who Uses Matching Engines?

Matching engines are essential for today’s financial markets. Different trading groups use them based on their needs and setups:

- Stock and Commodity Exchanges – These places depend on super-fast matching engines to handle high-speed trading, especially for institutional investors.

- Cryptocurrency Trading Platforms – Crypto exchanges rely on matching engines to process orders in real time, helping ensure liquidity in volatile environments – a crucial factor in crypto trading success.

- Proprietary Trading Firms – Firms that have their own trading strategies often create custom matching engines to manage how fast they can execute trades and handle liquidity.

- Broker-Dealer Platforms – Brokers and dealers use matching engines to match client orders internally or to send them to other venues efficiently.

- Dark Pools & Alternative Trading Systems – These off-exchange spots use matching engines for anonymous trades, usually when handling large amounts of assets.

Whether it’s for a public exchange or a private trading space, matching engines are vital for making sure trades happen smoothly and follow the rules in various market conditions.

The Mechanics of a Matching Engine

Diving deeper into the mechanics of a matching engine reveals the critical role of the order book. This component records every transaction intent and actively shapes the market dynamics through real-time updates and interactions between buyers and sellers.

Order Books: The Foundation of a Matching Engine

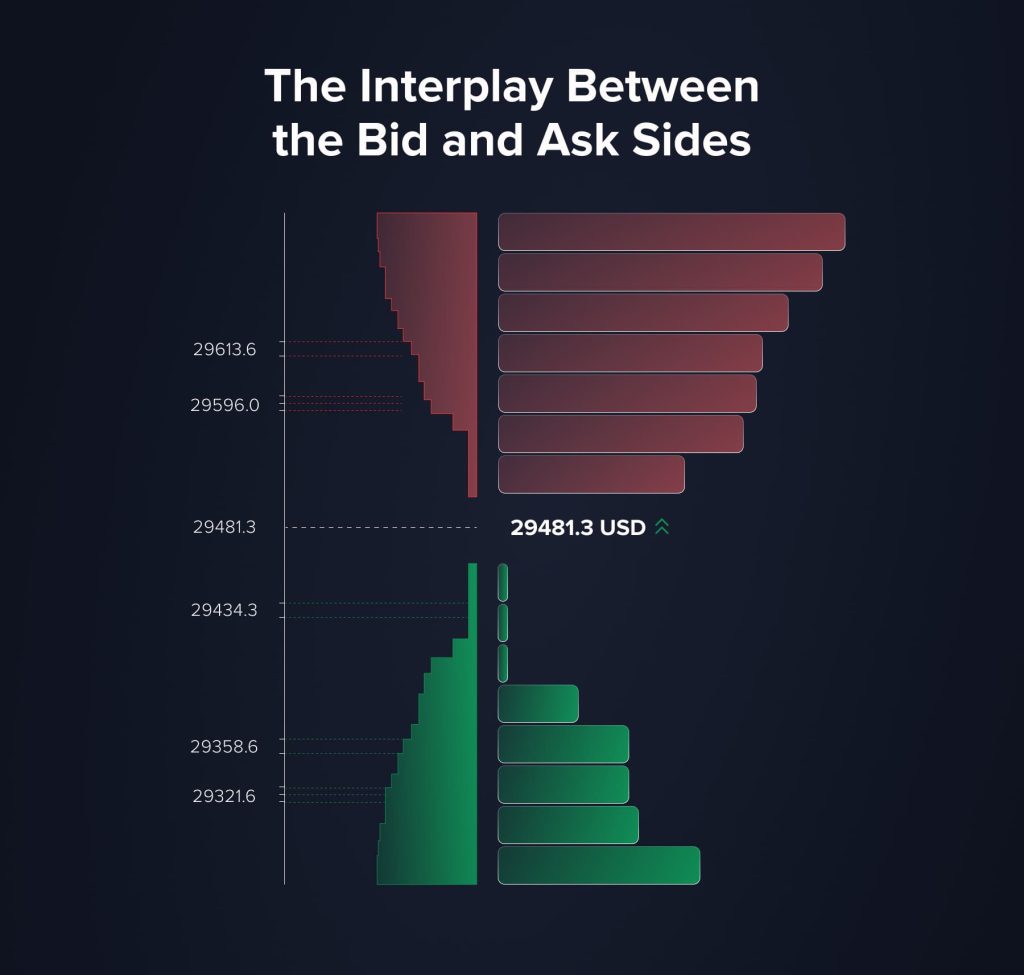

The order book is the fundamental component of a matching engine, meticulously organizing and displaying all open buy and sell orders for an asset. This real-time, dynamic ledger is categorized by price level and constantly updated as new orders are placed and existing ones are fulfilled or canceled. The order book is structurally divided into two distinct sides:

- The Bid Side: This side of the order book lists all buy orders, organized by the price buyers are willing to pay, from highest to lowest. This side reflects the demand in the market, with each order specifying the maximum price the buyer is willing to pay and the quantity desired.

- The Ask Side: Conversely, this side lists all sell orders, organized by the price sellers are asking, from lowest to highest. This side represents the supply in the market, with each order detailing the minimum price the seller is willing to accept and the quantity on offer.

The interplay between the bid and ask sides of the order book drives the price discovery process. Price discovery is the mechanism through which the market price of an asset is determined, essentially finding the equilibrium price where supply meets demand. As orders are executed and new orders enter the system, the order book evolves, reflecting the latest market conditions and, thus, the most current pricing of the asset. This ongoing adjustment is crucial for market transparency, allowing participants to react based on visible, real-time price movements and order flow.

Matching Algorithms: The Engine’s Core

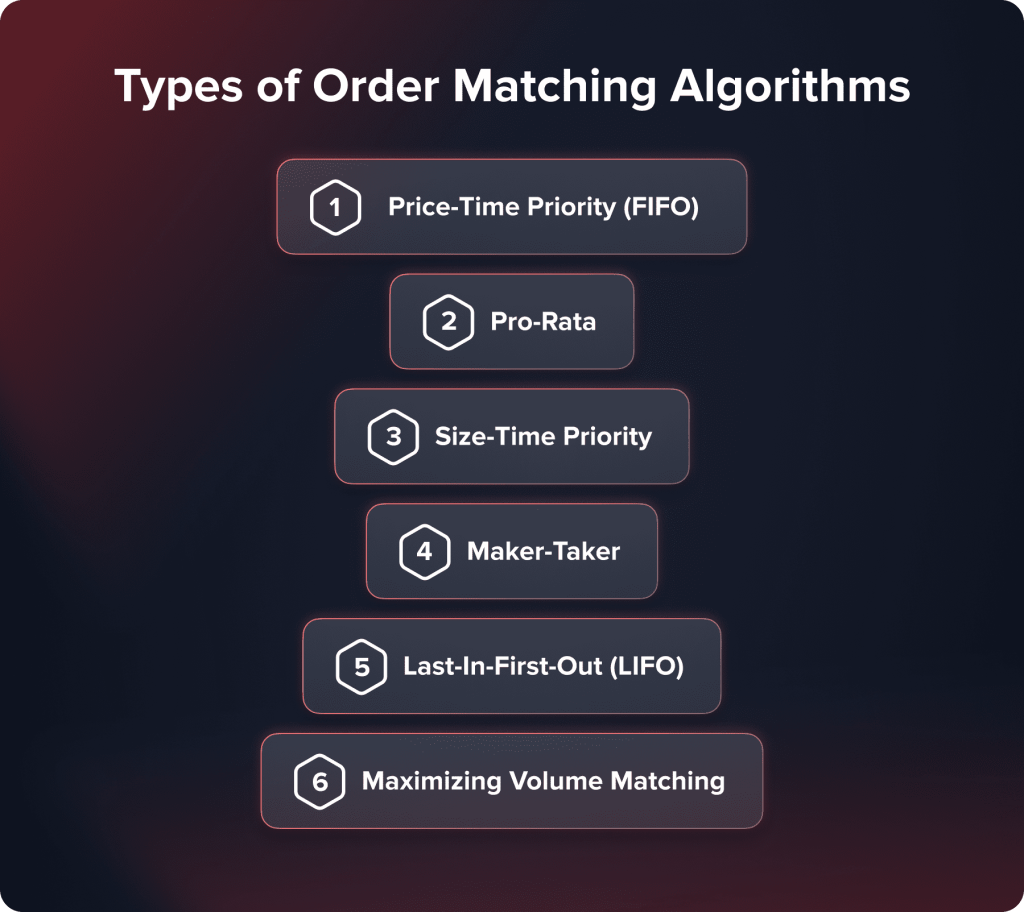

The efficacy of a matching engine is determined by its matching algorithms, which are designed to align buy and sell orders from the order book in a manner that promotes market efficiency. These algorithms operate under specific rules to decide which orders to match and execute, influencing the market’s liquidity and the participants’ trading experience. The most commonly utilized matching algorithms include:

Price-Time Priority (FIFO)

This widely adopted algorithm prioritizes orders not only by the best price but also by the order timing. Orders at the same price level are executed in the sequence they were received, thus the term ‘First-In, First-Out.’ This method ensures fairness and encourages market participants to place orders promptly, as earlier orders gain priority.

Pro-Rata

Particularly useful in markets handling large transaction sizes, such as certain commodities or derivatives, the Pro-Rata algorithm distributes executions among orders at the same price proportionally based on their size. This approach balances the market, allowing larger orders to be filled appropriately without overwhelming the order book.

Size-Time Priority

Similar to FIFO, this algorithm prioritizes orders not only by their entry time but also considers their size. Larger orders may be prioritized if placed simultaneously as smaller orders, making it particularly useful in markets where filling large volumes efficiently is critical. This method can help stabilize prices by ensuring significant market orders don’t cause excessive volatility.

Maker-Taker

This model incentivizes market participants to provide liquidity (maker) or take liquidity away (taker). Makers who add orders to the order book are often provided with rebates or reduced fees. In contrast, takers who remove liquidity by matching existing orders might pay a higher fee. This system encourages more trading and liquidity, which is vital for the overall health of the marketplace. The model is especially common in crypto markets, where understanding trading strategies can help traders benefit from liquidity incentives.

Last-In-First-Out (LIFO)

Opposite to FIFO, the LIFO algorithm prioritizes the most recently placed orders at a particular price level. This can be beneficial in fast-paced trading environments where the latest orders reflect the most current market sentiments and pricing.

Maximizing Volume Matching

Some matching engines use an algorithm to maximize trade volumes by finding the largest possible match between buy and sell orders. This method may delay executions slightly to aggregate and match larger volumes, potentially leading to higher overall market liquidity and reduced price slippage.

Each algorithm serves a specific purpose and is chosen based on a trading platform’s unique characteristics and needs. The selection of a matching algorithm is crucial as it directly affects trade execution speeds, the fairness of trade executions, market liquidity, and the volatility of asset prices. In environments where rapid execution and price stability are paramount, choosing the right matching algorithm becomes a strategic decision that can significantly influence the success of the trading platform and the satisfaction of its participants.

Here’s a quick look at the different types of matching algorithms and how they compare.

| Algorithm | Priority Basis | Best For | Key Advantage |

| Price-Time (FIFO) | Price + Time | Stock exchanges | Guarantees a fair deal for those who order early. |

| Pro-Rata | Order size | Commodities, derivatives | Distributes fills based on the size; great for big markets. |

| Size-Time Priority | Size + Time | High-volume institutional markets | Strikes a good balance between being efficient and fair for big trades. |

| Maker-Taker | Liquidity roles | Crypto | Boosts liquidity by rewarding passive participants |

| Last In, First Out (LIFO) | Recent activity | Fast-moving markets | Responds to the current market trends when deciding what to do next. |

| Maximize Volume Matching | Aggregate volume | Low-slippage environments | Reduces slippage by focusing on how much is being traded instead of how fast. |

The Impact of Matching Algorithms

Matching algorithms significantly influence the dynamics of financial markets by ensuring orderly and efficient trade execution. These algorithms are crucial for establishing a fair trading environment where orders are matched effectively according to predefined rules. For instance, algorithms like FIFO and Pro-Rata facilitate transparency and fairness and prevent market dominance by any single participant, thereby protecting the market from potential manipulations and ensuring a level playing field for all traders.

Moreover, by optimizing trade executions to enhance liquidity and reduce price volatility, these algorithms contribute to more stable and predictable market conditions. This stability is essential for attracting a broader participant base, further enhancing liquidity, and deepening the market. The strategic application of these algorithms supports core trading activities, underpinning the market’s operational integrity and promoting overall market health.

By efficiently matching buy and sell orders, matching algorithms do more than just process transactions; they shape the market’s character, influence its liquidity and volatility, and ensure that trading remains accessible and equitable for all market participants. Their impact extends beyond mere trade execution, pivotal in financial markets’ overall structure and functionality.

Benefits of Using Matching Engines

Matching engines are pivotal in modern trading infrastructure, driving efficiency and transparency across financial markets. Their integration into trading platforms brings many advantages that can transform market operations.

Enhanced Market Efficiency

Matching engines significantly improve market efficiency by ensuring that orders are executed swiftly and accurately. They automate the complex process of order matching, reducing the time it takes for orders to be filled and helping maintain an active and fluid market.

Increased Transparency

Matching engines create a transparent trading environment by systematically arranging and executing trades. All market participants have equal access to information regarding order flow and price changes, which promotes fairness and builds trust in the market.

Reduced Transaction Costs

Automation of trade matching reduces the need for manual intervention, thereby lowering operational costs associated with trading. This efficiency can lead to narrower spreads and less slippage, ultimately reducing transaction costs for traders.

Improved Liquidity

Matching engines facilitate continuous trading by efficiently handling large volumes of buy and sell orders. This capability is crucial for maintaining high liquidity, which makes it easier for traders to enter and exit positions and generally results in more stable prices.

Scalability

Advanced matching engines are designed to scale as trading volume grows. This scalability is vital for trading platforms anticipating increases in user numbers and trading activity, ensuring the engine can handle higher loads without compromising performance. Scalable matching engines are also essential for platforms aiming to grow, such as those targeting multi-asset diversification strategies.

Drawbacks of Using Matching Engines

Despite their significant advantages, matching engines have inherent challenges and potential drawbacks that can impact trading platforms and market participants. Understanding these limitations is crucial for managing risks and ensuring stable market operations.

Complexity and Cost of Implementation

Implementing a sophisticated matching engine can be technically complex and expensive. The initial setup requires significant investment in money and time, and there may be ongoing costs related to maintenance and upgrades.

Dependence on Technology

Reliance on technology introduces vulnerabilities, such as the risk of system failures or cyber-attacks. Any downtime can lead to missed trading opportunities and potential financial losses, not to mention the reputational damage that might follow.

Regulatory Challenges

As financial technology evolves, so too do the regulatory requirements governing them. Ensuring that a matching engine complies with all relevant laws and regulations can be challenging, particularly in regions with stringent financial oversight.

Risk of Market Manipulation

While matching engines promote market efficiency, they also need robust safeguards to prevent market manipulation, such as quote stuffing or spoofing. Without adequate checks, automated systems could be exploited by unscrupulous traders.

Technological Disparities

Not all market participants may have equal access to advanced matching technologies, leading to trading power and efficiency disparities. Smaller or less technologically advanced traders might be disadvantaged compared to larger, better-equipped entities.

Summary of Pros and Cons

| Pros | Cons |

| Better Market Efficiency: It automates trade execution and speeds up order processing. | Complex & Costly Implementation: Requires significant investment in setup, maintenance, and upgrades. |

| Better Transparency: Seeing the order book in real-time helps create fair and trustworthy trading. | Technology Dependence: Susceptible to system failures, downtime, and cyber threats. |

| Lower Transaction Costs: Automation cuts down on the need for manual work, which helps reduce slippage and spreads. | Regulatory Challenges: Need to keep up with changing financial laws and rules. |

| Better Liquidity: Makes it easier to deal with big orders, helping you get in and out of the market smoothly. | Risk of Market Manipulation: Like spoofing or quote stuffing, if there aren’t any protections in place. |

| Scalability: It can handle more trading and users as they increase. | Technological Gaps: Can hurt smaller traders who don’t have access to fast internet and systems. |

Key Considerations When Choosing a Matching Engine

Selecting the right matching engine is a crucial decision for any trading platform, directly impacting its ability to function effectively and meet users’ demands. This choice involves several key considerations, each of which must be carefully evaluated to ensure the engine supports the platform’s current needs and future growth and expansion. Here, we delve deeper into the essential factors to consider when choosing a matching engine.

Compatibility with Asset Classes

When selecting a matching engine, it’s essential to ensure it supports the specific asset classes that your trading platform will offer. Asset class compatibility varies among matching engines; some are specialized and designed to handle particular types like equities, commodities, or cryptocurrencies, while others are more versatile. Multi-asset matching engines are particularly beneficial for platforms that aim to offer a diverse range of trading options. Multi-asset engines are ideal for platforms planning to support instruments like REITs, options, and cryptocurrencies. These engines are built to facilitate trading various asset types without requiring multiple systems, simplifying operations and potentially reducing costs.

Performance Metrics: Latency and Throughput

The performance of a matching engine can be primarily assessed through two metrics: latency and throughput. Latency refers to the time it takes for an order to be executed once it has been placed. Low-latency systems are crucial in high-frequency trading environments, where orders are executed in milliseconds or microseconds. These systems help traders capitalize on very short-term market opportunities. On the other hand, throughput—the number of orders a system can handle within a given time frame—is particularly critical for retail-focused platforms or those in high-volume trading environments. Such platforms must ensure that the engine can manage large volumes of trades efficiently, especially during periods of high market activity, without slowing down or crashing.

Security and Reliability

Security is paramount in any financial trading system. A matching engine must incorporate robust security measures to safeguard against data breaches, unauthorized access, and cyber-attacks. These measures may include advanced encryption protocols, regular security audits, and compliance with international cybersecurity standards. Equally important is the reliability of the matching engine. The financial implications of downtime can be significant, not just in terms of lost trading opportunities but also in the potential damage to the platform’s reputation. Therefore, choosing a matching engine known for its uptime and failover mechanisms is crucial to handling unexpected issues.

Conclusion

Matching engines are the cornerstone of any trading platform, ensuring the market operates efficiently, fairly, and transparently. They are complex systems requiring careful consideration of their functionality, performance, and security. Whether you operate a traditional exchange or a cutting-edge cryptocurrency trading platform, the choice of a matching engine can fundamentally define the success of the trading venue. As technology evolves, so will these engines, continuing to redefine the landscape of financial markets.

FAQ

An order book shows a real-time list of buy and sell orders for an asset, sorted by price. A matching engine is the software that takes those orders and makes trades based on set rules. While the order book shows what people want to buy or sell, the matching engine decides how those orders get matched up.

For crypto exchanges, the Maker-Taker model is commonly used since it encourages liquidity. When combined with Price-Time Priority (FIFO), it helps trades happen quickly and fairly, which is important in the fast-paced world of cryptocurrency.

Latency is the delay between placing an order and when it's carried out. In high-frequency trading, even tiny delays can matter a lot. Lower latency means traders can respond to real-time data better, cut down on slippage, and get better trade executions.

Yes, some blockchain-based trading systems use decentralized matching engines, especially in decentralized exchanges (DEXs). But they usually have more issues with scalability and latency compared to centralized systems, making them less ideal for high-frequency trading.

Updated:

June 11, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]