What Is an Order Book? Definition and How It Works

Contents

An order book is a vital component in the financial trading landscape. It provides a detailed ledger of buy and sell orders for securities or financial instruments organized by price level. By showing the depth of market demand at several price points, this electronic list improves market transparency and provides insight into the number of shares being bid or offered. Traders and investors hoping to make intelligent choices in the dynamic worlds of stock, bond, and currency trading must first understand how an order book works.

Order Book Definition

| Side | Price | Quantity | Description |

| Bid (Buy) | 101.20 | 500 | Highest price buyers are willing to pay |

| Bid (Buy) | 101 | 350 | Next level of the buyer |

| Ask (Sell) | 101.40 | 600 | Lowest price sellers are willing to pay |

| Ask (Sell) | 101.60 | 450 | Next level of the seller |

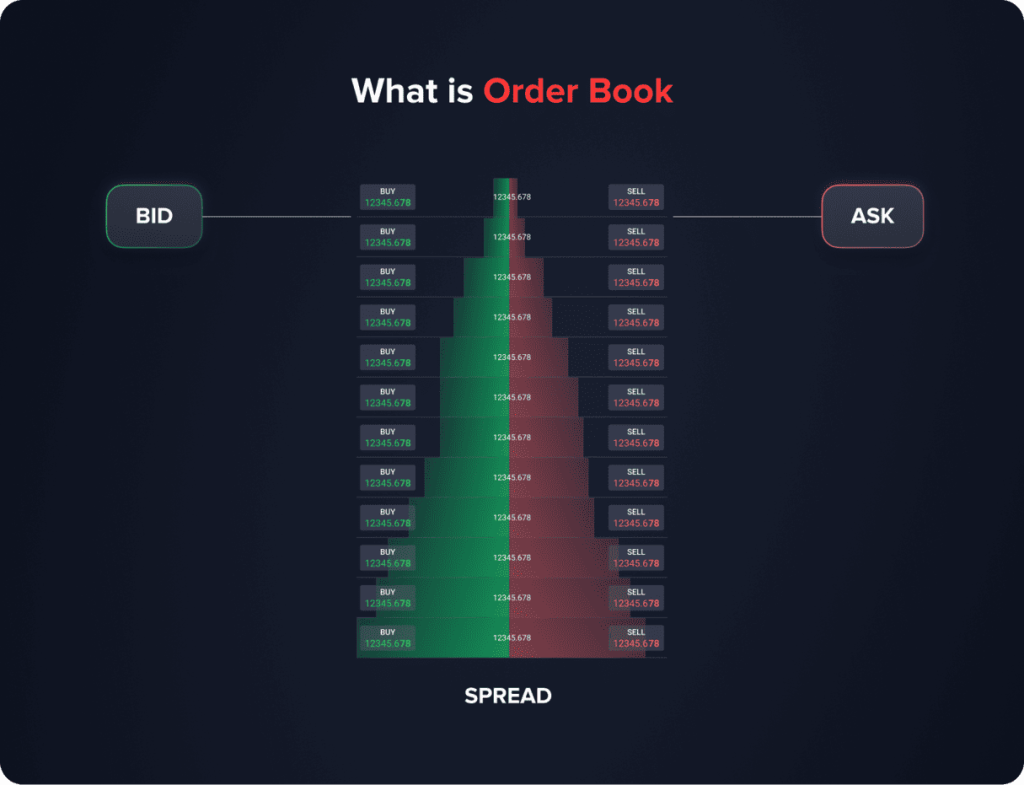

Recording live buy and sell orders within a marketplace for a certain asset class—stocks, bonds, currencies, or cryptocurrencies—an order book is a necessary instrument that promotes transparent trading. An order book’s basic purpose is to dynamically record and arrange real-time data on purchase and sell order pricing and quantity. This continuous update provides traders and investors with a clear, immediate snapshot of the market’s supply and demand dynamics.

Usually shown opposite each other in a tabular style, buy and sell orders have their related prices arranged either in ascending or declining sequence. Buy orders, or bids, for instance, are posted with the highest price first; sell orders, or asks, show the lowest price first. This arrangement offers a clear visual representation of market activity and sentiment, guiding trading strategies. Reflecting a particular price level, each row shows the number of shares or units accessible at that level, therefore providing information on market depth and liquidity. The “spread,” the variation between the highest bid and lowest ask, turns out to be a quite good gauge of market volatility and efficiency.

You may also like

Types of Orders in the Book

Orders in an order book can be either market or limit orders. Market orders are executed immediately at the best available price, affecting the ‘top of the book.’ In contrast, limit orders are executed at a specific price point or better, thus populating the buy or sell side of the book according to trader preferences.

Types of Order Books

Order books can be divided into two primary categories based on the timing of order execution:

- Continuous Books: These update in real-time throughout the trading day, providing a continuous record of market changes. They reflect every incoming and outgoing order, offering a comprehensive overview of the market’s evolving state. This type is widely used in most electronic exchanges, like Nasdaq or NYSE, and is essential for high-frequency trading and day trading.

- Opening and Closing Books: These types of books contain orders specifically designated for execution at the market’s opening or closing, respectively. Orders in these books are maintained separately until consolidated with the continuous book at the market’s opening and closing to generate the official opening and closing prices. These prices are vital for portfolio valuation and strategic decision-making as they indicate daily market trends.

Order book structures can vary significantly across global financial markets. For instance, U.S. stock exchanges primarily use electronic order books, while some Asian markets still incorporate hybrid auction systems. In forex trading, there is no centralized order book due to the decentralized nature of currency markets, so traders rely on aggregated liquidity from multiple sources. Cryptocurrency exchanges often operate with a different matching engine logic, allowing for features like decentralized order books in peer-to-peer trading environments. Understanding these variations is critical for traders operating in multiple asset classes or global markets.

Alternative Order Book Structures

In addition to the standard models discussed, there are variations in order book structures that cater to different market needs and strategies.

- Central Limit Order Book (CLOB): A CLOB is the most common form of order book, centralizing buy and sell orders to facilitate transparent price discovery. It’s widely used in exchanges to aggregate all visible orders, providing comprehensive market insights. However, its transparency may discourage some institutional traders due to potential market impact.

- Auction-Based Order Book: Commonly used during market opening and closing, this type of order book accumulates orders over a specific time frame, matching them through an auction process at a single equilibrium price. It provides a controlled trading environment, mitigating volatility while ensuring efficient pricing.

- Hybrid Order Book: A hybrid approach combines a CLOB with features like hidden orders or different execution priorities. This enables exchanges to accommodate various trading preferences, therefore giving flexibility for institutional investors, high-frequency traders, and retail participants.

Additional Considerations

Order books may also include hidden or iceberg orders, in which just a fraction of the whole amount is shown and the rest is exposed after the first part is completed. This feature enables institutional investors to place big orders without substantially impacting market pricing. The availability of several order types and execution procedures underscores the necessity of knowing how order books work for any serious trader or investor.

How Traders Use Order Books (Use Cases)

Order books aren’t just technical data: they’re practical tools that traders use to guide their decisions.

1. Scalping and Intraday Trading

Short-term traders use the order book to identify upcoming changes in liquidity or massive hidden orders. For example, a surge in buy orders on a pivotal price can signal an imminent bounce.

2. Identifying Support and Resistance

Support levels are created by bands of buy orders, and strong sell orders represent resistance. Traders put Entries/Exits near these levels.

Example: A trader sees 10,000 ETH buy orders at $2,000 => interprets as support and places stop-loss below.

3. Market Entry Timing

Look at order imbalances (more bids than asks) to gauge short-term sentiment – bull or bear.

4. Liquidity Check

Day traders avoid thin book instruments (wide spreads) and turn towards liquid markets with good execution.

5. Large Trade Execution

Institutions use strategies like iceberg orders to avoid revealing full size. Example: splitting a $10 million order into small visible bites.

How Order Books Work

An order book provides an organized snapshot of the market’s current state by categorizing and displaying different sections of trading information.

Buy Orders (Bids)

Starting with the highest price a buyer is ready to pay for a certain asset, purchase orders—also known as bids—represent buyers’ interest and are posted in decreasing order. These bids are matched with the desired purchase quantity. The bid section reveals the demand levels at varying price points and provides insights into the buying appetite for an asset.

Sell Orders (Asks)

Sell orders, or asks, represent sellers’ offers and are arranged in ascending order, starting with the lowest price at which a seller is willing to sell. Like bids, each ask is accompanied by the corresponding volume, revealing the supply levels across various price points. The ask section illustrates how much of the asset is available for sale and at what price, providing insights into the selling pressure.

Order History

The order history section records all previously completed transactions, presenting a historical account of executed trades and their respective prices and volumes. This historical data helps traders analyze past price trends and trading behaviors to identify patterns or predict future market movements.

Order book analysis plays a crucial role in understanding the depth of the market (DOM) and order flow. Traders use DOM to assess liquidity at various price levels, providing insight into supply and demand beyond the top bid and ask prices. Order flow analysis, on the other hand, helps traders determine market direction by tracking large orders, aggressive buying/selling, and momentum shifts. Many professional traders utilize volume-weighted average price (VWAP) strategies to execute large trades efficiently without significantly impacting price movements.

Market Dynamics and Indicators

In an order book, the relationship between buy and sell orders reveals important market dynamics and offers valuable indicators for traders and investors.

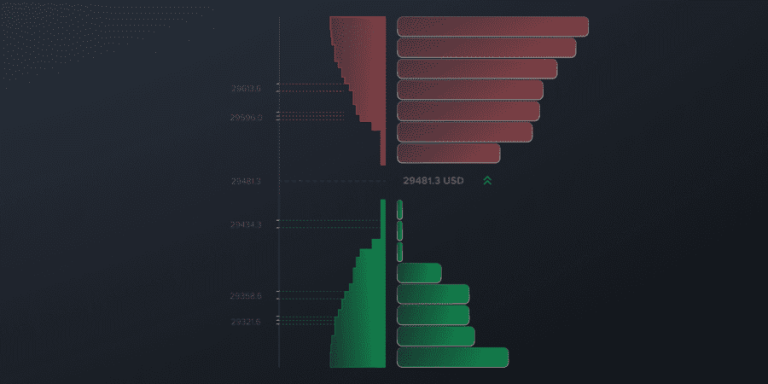

- Top of the Book: The highest bid price and the lowest ask price shape the “top of the book,” which displays the most competitive purchasing and selling pricing accessible at any one moment. These rates are vital markers of the state of the market, which let traders quickly evaluate demand and supply conditions.

- Bid-Ask Spread: The difference between the highest bid price and the lowest ask price is known as the bid-ask spread. This spread is a key metric for understanding market liquidity. A narrow spread typically indicates high liquidity and lower trading costs, while a wider spread signals lower liquidity and higher transaction costs.

- Support and Resistance Levels: Support and resistance levels refer to price ranges where the market will probably show notable buying or selling pressure. Large clusters of buy orders at a specific price often suggest a strong support level, indicating potential stability in price declines. Conversely, a concentration of sell orders at or near a certain price signals a resistance level, potentially capping upward price movements.

- Order Imbalance: A substantial imbalance in buy and sell orders might indicate short-term market changes. For example, an imbalance in favor of purchase orders might indicate optimistic feelings, whilst an excess of sell orders could indicate pessimistic sentiment. Identifying these imbalances enables traders to anticipate possible price shifts.

While order books enhance transparency, they are also susceptible to market manipulation techniques like spoofing and layering. Spoofing involves placing large orders with no intention of execution to create a false impression of supply or demand, thereby influencing market sentiment. Layering is a similar tactic, where traders place multiple fake orders at different price levels to create artificial movement before canceling them. Regulators, including the SEC and CFTC, have increased surveillance and imposed heavy fines on traders caught engaging in such deceptive practices.

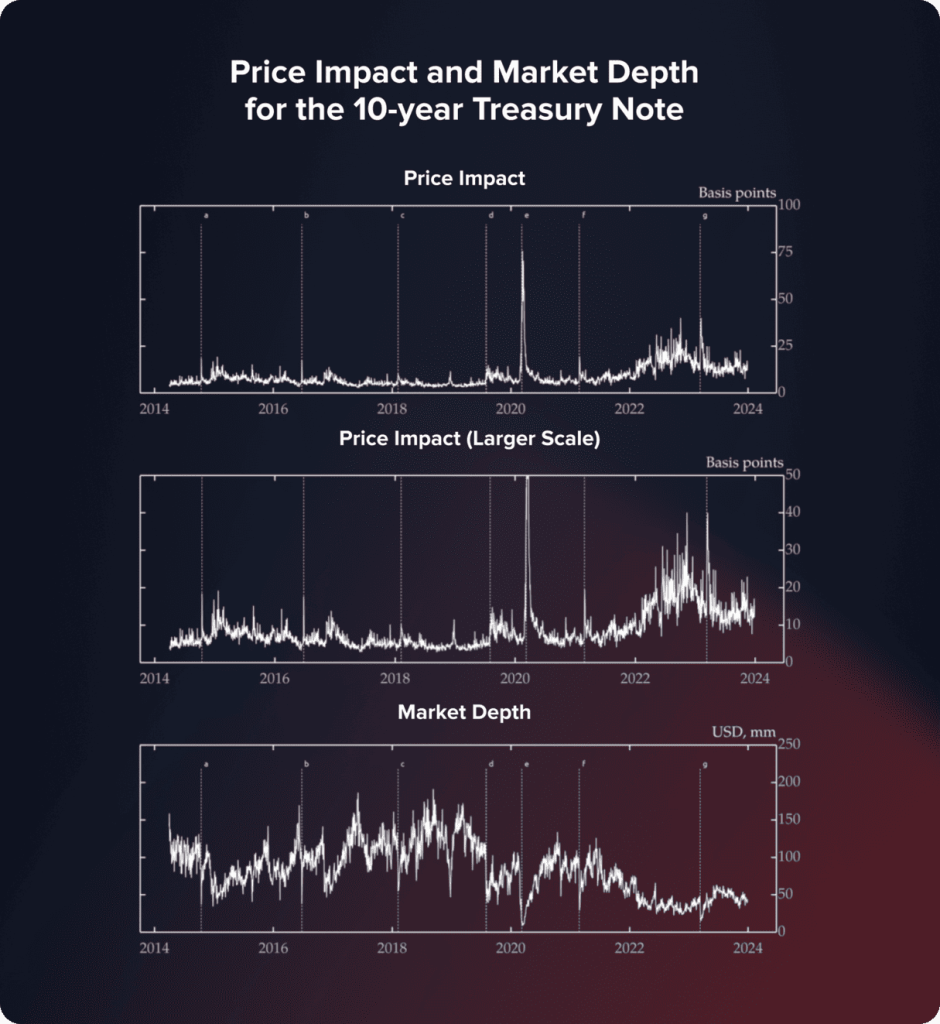

Order book statistics such as market depth and spreads are not theoretical statistics – properly understood, they indicate us how stress-resilient markets are. For example, Fed research on the U.S. Treasury market suggests that during the March 2020 liquidity crisis, market depth fell through the floor while price impact ballooned, making execution costs considerably higher even in the most liquid bond market in the world.

Source: Federal Reserve, Repo Inter Dealer Broker Community; authors’ calculations.

Technology and the Evolution of Order Books

The digital revolution in financial markets has transformed how order books function, significantly enhancing their efficiency and depth. One prominent development is the adoption of algorithmic trading.

A timeline infographic here:

- Manual Trading Floor (pre-1980s) – paper-based, voice brokers.

- Electronic Order Books (1980s–1990s) – Nasdaq, early automation.

- Algorithmic Trading (2000s) – faster execution, rule-based systems.

- High-Frequency & AI (2010s) – microsecond-level trading, predictive models.

- Blockchain Order Books (2020s) – decentralized, tamper-proof records.

Advanced algorithms execute orders incredibly quickly and efficiently, analyzing real-time order book data to identify patterns, optimize trade timing, and manage risks. This technological breakthrough has led to the rise of high-frequency trading, where algorithms capitalize on minute price movements for strategic trades.

Another advancement is smart order routing (SOR). SOR systems scan and compare prices and liquidity across multiple trading venues, directing orders to achieve optimal execution. SOR systems enable traders to exploit price discrepancies and access hidden liquidity across fragmented markets by seamlessly integrating data from various order books.

By using machine learning to examine past order book data and project future price patterns, artificial intelligence (AI) also changes trading approaches. Particularly when evaluating short-term market mood or projecting changes in liquidity, this predictive ability enables traders to make more educated decisions.

By tracking orders as immutable events, blockchain technology offers a distributed substitute for conventional exchanges with open and tamper-proof order books. As this invention supports safe worldwide trading infrastructure, it is becoming more and more important in cryptocurrency markets.

These technical developments have made order books more dynamic and responsive, giving traders previously unheard-of understanding of market movements. Anticipating market changes and improving trading techniques depend on an awareness of these changes, which will help traders to stay competitive in the fast changing financial environment of today.

Machine learning and big data analytics have significantly enhanced order book analysis. AI-powered trading algorithms can now process vast amounts of historical order book data to detect hidden patterns and predict short-term price movements with high accuracy. These advancements have given rise to predictive market-making models that optimize bid-ask spreads dynamically, improving execution efficiency. High-frequency traders and hedge funds heavily rely on these technologies to gain a competitive edge in microsecond-level trading.

Special Considerations

The order book has substantial limitations even if it is meant to improve openness in financial markets. Many institutional trading activities take place in “dark pools,” confidential trading venues where big institutional investors may purchase and sell securities without disclosing their intentions to the wider market until after the sale is finished. Dark pools allow these investors to carry out significant transactions with little effect on market pricing as showing these big orders on public markets would cause price manipulation or anticipatory trading that might reduce the possible value of their trades.

However, dark pools limit the order book’s utility because the public exchange data does not fully represent the actual supply and demand for a particular security. This lack of visibility can obscure potential price movements or trends that traders might otherwise detect from analyzing public order book data alone.

Dark pools play a significant role in modern trading, accounting for a substantial percentage of daily volume in major markets. While they provide benefits like reduced price slippage and anonymity for institutional investors, they also pose concerns about price transparency. Some regulators have imposed rules to limit dark pool activity or require reporting post-trade data to ensure fair market competition. Additionally, traders use iceberg orders—where only a small portion of the total order is visible—to navigate liquidity challenges while executing large trades.

Utility for Traders

For traders, especially those involved in high-frequency or day trading, the order book is nevertheless a priceless instrument despite its constraints. The depth of information in the order book helps traders to make wise selections depending on thorough market depth analysis.

Market Depth and Strategy

Knowing how buy and sell orders are distributed across many price levels helps traders evaluate the liquidity of the market, spot possible trading prospects, and change their approaches. Tight bid-ask spreads, for example, point to great liquidity and inspire aggressive trading techniques. Conversely, wider spreads might necessitate caution and more conservative trading practices.

Support and Resistance Insights

Revealing clusters of buy and sell orders at certain price points, the order book may provide traders vital insights into support and resistance levels. Knowing where major buying or selling pressure is focused can enable traders to modify their trading plans and project probable market reversals or continuation patterns.

Short-Term Market Sentiment

Analyzing order imbalances provides traders with an immediate view of short-term market sentiment. An excess of buy orders over sell orders often suggests bullish momentum, while many sell orders may indicate bearish sentiment. Such data can help traders time their trades effectively.

For those looking for a competitive advantage in the fast-paced trading environment of today, the information offered by the public order book is still very vital even if the advent of dark pools and other private trading platforms presents obstacles. It is a basic tool for developing strategic trading strategies and obtaining better understanding of market behavior.

Regulatory Impacts on Order Books

Transparency and structure of order books have been greatly changed by regulatory developments. For example, European adoption of the Markets in Financial Instruments Directive (MiFID II) sought to boost trading venue competition and openness. This directive required more detailed reporting on transactions and broadened the scope of venues that must maintain comprehensive order books, enhancing market integrity.

Enforcing a standard set of regulations for equities trading, the Regulation National Market System (Reg NMS) mandated public posting of the best bid and ask prices across exchanges in the United States. It also set a “trade-through” regulation prohibiting dealers from carrying out orders at poorer prices than the national best bid and offer (NBBO). These regulations ensure that order books reflect a true and fair picture of market liquidity and price discovery.

However, regulatory requirements have also pushed certain trading activities to alternative venues like dark pools, where large transactions can occur outside the public eye. As a result, regulators must balance transparency and provide a private, efficient marketplace for institutional traders.

For traders, knowing the regulatory environment around order books is essential as it affects access to liquidity, trade execution quality, and the general market performance. Maintaining knowledge of these principles helps traders to modify their plans and seize possibilities while continuing to adhere to the rules of the market.

Order Books in Different Markets

Not all markets display order books in the same way.

Stocks (Equities)

- Centralized order books managed by exchanges (NYSE, LSE).

- Highly regulated and clear (Reg NMS in US, MiFID II in EU).

- Best used for directly examining liquidity and spread.

Forex (Currencies)

- No central order book (decentralized market).

- Liquidity drawn from banks, brokers, and ECNs (Electronic Communication Networks).

- Traders only see the pooled liquidity from their broker’s LPs.

Cryptocurrencies

- Centralized exchanges (Binance, Coinbase) use CLOBs (Central Limit Order Books).

- Decentralized exchanges (DEXs) can utilize blockchain-based order books or automated market makers (AMMs).

- High levels of transparency, but different matching logic from stocks/forex.

| Market | Order Book Type | Transparency | Key Features |

| Stocks | Centralized (CLOB) | High | Regulated, exchange-based |

| Forex | Aggregated (ECNs) | Medium | No single book, fragmented liquidity |

| Crypto | Centralized and Decentralized | Mixed | CEX = CLOB, DEX = AMM or blockchain-based |

In markets for cryptocurrencies, size does not always equal liquidity. One token can appear large on market cap but trade thinly across just a few venues with shallow depth. It is a dangerous fallacy for those who think that market cap is a liquidity metric. Kaiko research highlights these disconnects, here tokens LEO and WBTC rank high on size but low on liquidity by orders of magnitude, reinforcing the need to look at the order book rather than headline numbers.

Conclusion

More than just a set of figures, the order book is a dynamic tool reflecting the real-time mood of buyers and sellers in the market, therefore demonstrating supply and demand dynamics at any one moment. In the financial trading scene, an order book is a necessary tool as it offers a complete view of likely future price swings, therefore enabling traders to plan more successfully.

Updated:

September 9, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]