สมุดคำสั่งซื้อคืออะไร คำจำกัดความและหลักการทำงาน

เนื้อหา

หนังสือสั่งซื้อเป็นองค์ประกอบสำคัญในภูมิทัศน์การซื้อขายทางการเงิน มันให้รายละเอียดบัญชีแยกประเภทของคำสั่งซื้อและขายสำหรับหลักทรัพย์หรือตราสารทางการเงินที่จัดขึ้นตามระดับราคา ด้วยการแสดงความต้องการเชิงลึกของตลาดในหลาย ๆ จุดราคาอิเล็กทรอนิกส์นี้ช่วยเพิ่มความโปร่งใสของตลาดและให้ข้อมูลเชิงลึกเกี่ยวกับจำนวนหุ้นที่เสนอราคาหรือเสนอ ผู้ค้าและนักลงทุนหวังที่จะเลือกตัวเลือกที่ชาญฉลาดในโลกที่มีพลวัตของหุ้นพันธบัตรและการซื้อขายสกุลเงินจะต้องเข้าใจก่อนว่าหนังสือสั่งซื้อทำงานอย่างไร

คำสั่งซื้อหนังสือ

| ด้านข้าง | ราคา | ปริมาณ | คำอธิบาย |

| ประมูล (ซื้อ) | 101.20 | 500 | ผู้ซื้อราคาสูงสุดยินดีจ่าย |

| ประมูล (ซื้อ) | 101 | 350 | ระดับถัดไปของผู้ซื้อ |

| ถาม (ขาย) | 101.40 | 600 | ผู้ขายราคาต่ำสุดยินดีจ่าย |

| ถาม (ขาย) | 101.60 | 450 | ระดับถัดไปของผู้ขาย |

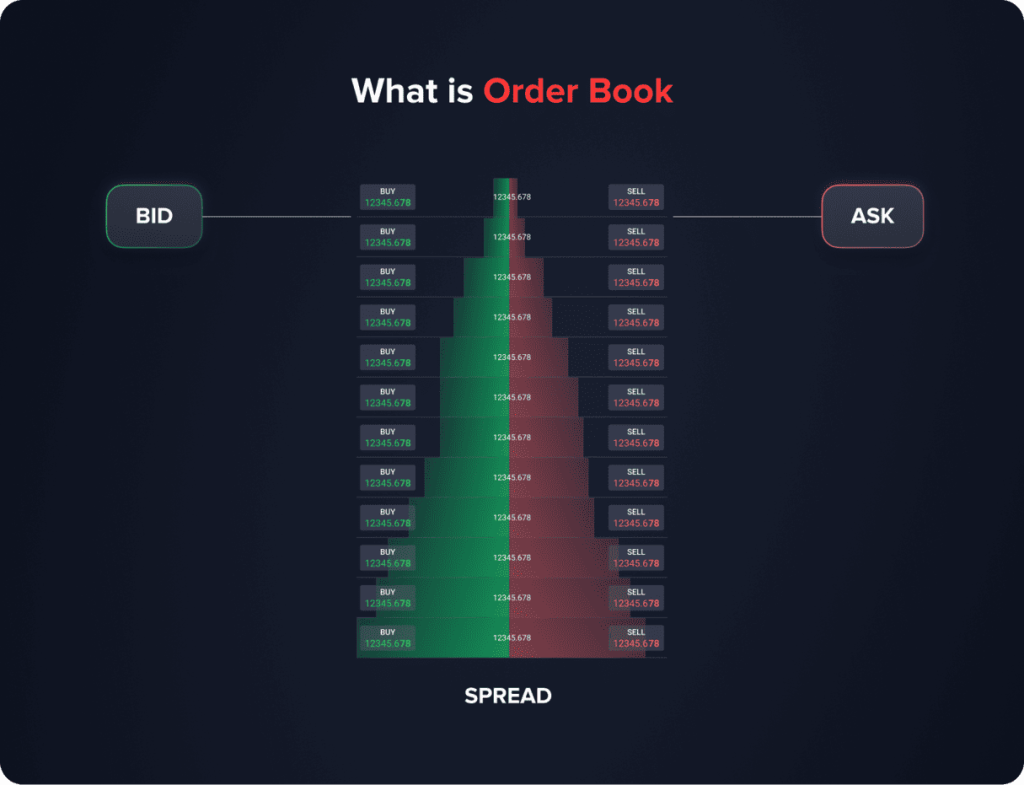

การบันทึกคำสั่งซื้อและขายสดภายในตลาดสำหรับสินทรัพย์ประเภทหนึ่ง - หุ้น, พันธบัตร, สกุลเงินหรือ cryptocurrencies - หนังสือสั่งซื้อเป็นเครื่องมือที่จำเป็นที่ส่งเสริมการซื้อขายที่โปร่งใส วัตถุประสงค์พื้นฐานของหนังสือสั่งซื้อคือการบันทึกและจัดเรียงข้อมูลแบบเรียลไทม์แบบไดนามิกเกี่ยวกับการซื้อและขายราคาสั่งซื้อและปริมาณ การอัปเดตอย่างต่อเนื่องนี้ช่วยให้ผู้ค้าและนักลงทุนมีภาพรวมที่ชัดเจนและทันทีของการเปลี่ยนแปลงอุปสงค์และอุปทานของตลาด

มักจะแสดงตรงข้ามกันในรูปแบบตารางซื้อและขายคำสั่งซื้อมีราคาที่เกี่ยวข้องจัดเรียงทั้งในการขึ้นหรือลดลง ตัวอย่างเช่นซื้อคำสั่งซื้อหรือการเสนอราคาจะถูกโพสต์ด้วยราคาสูงสุดก่อน ขายคำสั่งซื้อหรือถามแสดงราคาต่ำสุดก่อน ข้อตกลงนี้นำเสนอการแสดงภาพที่ชัดเจนของกิจกรรมการตลาดและความเชื่อมั่นแนวทางกลยุทธ์การซื้อขาย สะท้อนให้เห็นถึงระดับราคาที่เฉพาะเจาะจงแต่ละแถวแสดงจำนวนหุ้นหรือหน่วยที่สามารถเข้าถึงได้ในระดับนั้นดังนั้นจึงให้ข้อมูลเกี่ยวกับความลึกของตลาดและสภาพคล่อง "การแพร่กระจาย" การเปลี่ยนแปลงระหว่างการเสนอราคาสูงสุดและการถามต่ำสุดกลายเป็นมาตรวัดความผันผวนและประสิทธิภาพของตลาดที่ดี

You may also like

ประเภทของคำสั่งซื้อในหนังสือ

คำสั่งซื้อในสมุดสั่งซื้ออาจเป็นตลาดหรือ จำกัด คำสั่งซื้อ คำสั่งซื้อของตลาดจะดำเนินการทันทีในราคาที่ดีที่สุดที่มีผลกระทบต่อ 'ด้านบนของหนังสือ' ในทางตรงกันข้ามคำสั่งซื้อที่ จำกัด จะดำเนินการในราคาที่เฉพาะเจาะจงหรือดีกว่าดังนั้นจึงมีการเติมด้านซื้อหรือขายของหนังสือตามการตั้งค่าของผู้ค้า

ประเภทของหนังสือสั่งซื้อ

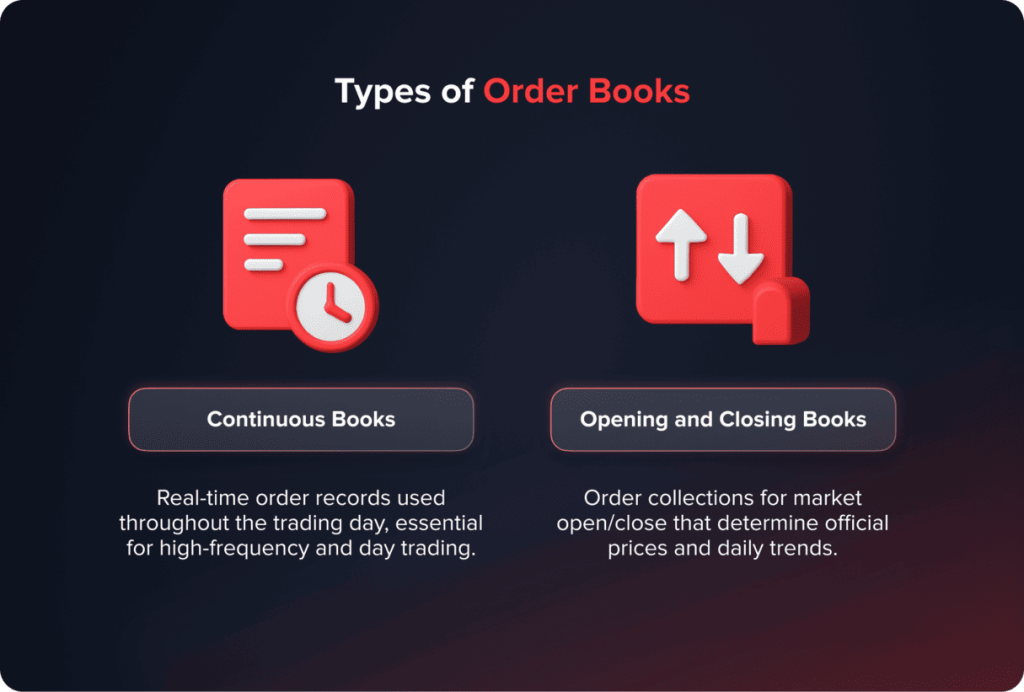

หนังสือสั่งซื้อสามารถแบ่งออกเป็นสองประเภทหลักตามระยะเวลาของการดำเนินการสั่งซื้อ:

- หนังสือต่อเนื่อง: การอัปเดตเหล่านี้แบบเรียลไทม์ตลอดทั้งวันการซื้อขายให้บันทึกการเปลี่ยนแปลงของตลาดอย่างต่อเนื่อง พวกเขาสะท้อนทุกคำสั่งที่เข้ามาและขาออกนำเสนอภาพรวมที่ครอบคลุมของสถานะการพัฒนาของตลาด ประเภทนี้ใช้กันอย่างแพร่หลายในการแลกเปลี่ยนทางอิเล็กทรอนิกส์ส่วนใหญ่เช่น NASDAQ หรือ NYSE และเป็นสิ่งจำเป็นสำหรับการซื้อขายความถี่สูงและการซื้อขายวัน

- หนังสือเปิดและปิด: หนังสือประเภทนี้มีคำสั่งซื้อที่กำหนดไว้โดยเฉพาะสำหรับการดำเนินการในการเปิดหรือปิดของตลาดตามลำดับ คำสั่งซื้อในหนังสือเหล่านี้จะได้รับการดูแลแยกต่างหากจนกว่าจะรวมเข้ากับหนังสืออย่างต่อเนื่องในการเปิดและปิดของตลาดเพื่อสร้างการเปิดและปิดอย่างเป็นทางการ ราคาเหล่านี้มีความสำคัญต่อการประเมินค่าพอร์ตโฟลิโอและการตัดสินใจเชิงกลยุทธ์เนื่องจากระบุแนวโน้มของตลาดรายวัน

โครงสร้างหนังสือสั่งซื้ออาจแตกต่างกันอย่างมากในตลาดการเงินโลก ตัวอย่างเช่นการแลกเปลี่ยนหุ้นในสหรัฐอเมริกาส่วนใหญ่ใช้หนังสือคำสั่งอิเล็กทรอนิกส์ในขณะที่ตลาดเอเชียบางแห่งยังคงรวมระบบการประมูลไฮบริด ในการซื้อขาย Forex ไม่มีหนังสือสั่งซื้อส่วนกลางเนื่องจากลักษณะการกระจายอำนาจของตลาดสกุลเงินดังนั้นผู้ค้าจึงพึ่งพาสภาพคล่องรวมจากหลายแหล่ง การแลกเปลี่ยน cryptocurrency มักจะทำงานด้วยตรรกะของเครื่องยนต์ที่ตรงกันที่แตกต่างกันทำให้มีคุณสมบัติเช่นหนังสือสั่งซื้อกระจายอำนาจในสภาพแวดล้อมการซื้อขายแบบเพียร์ทูเพียร์ การทำความเข้าใจรูปแบบเหล่านี้เป็นสิ่งสำคัญสำหรับผู้ค้าที่ดำเนินงานในสินทรัพย์หลายประเภทหรือตลาดโลก

โครงสร้างหนังสือสั่งซื้อทางเลือก

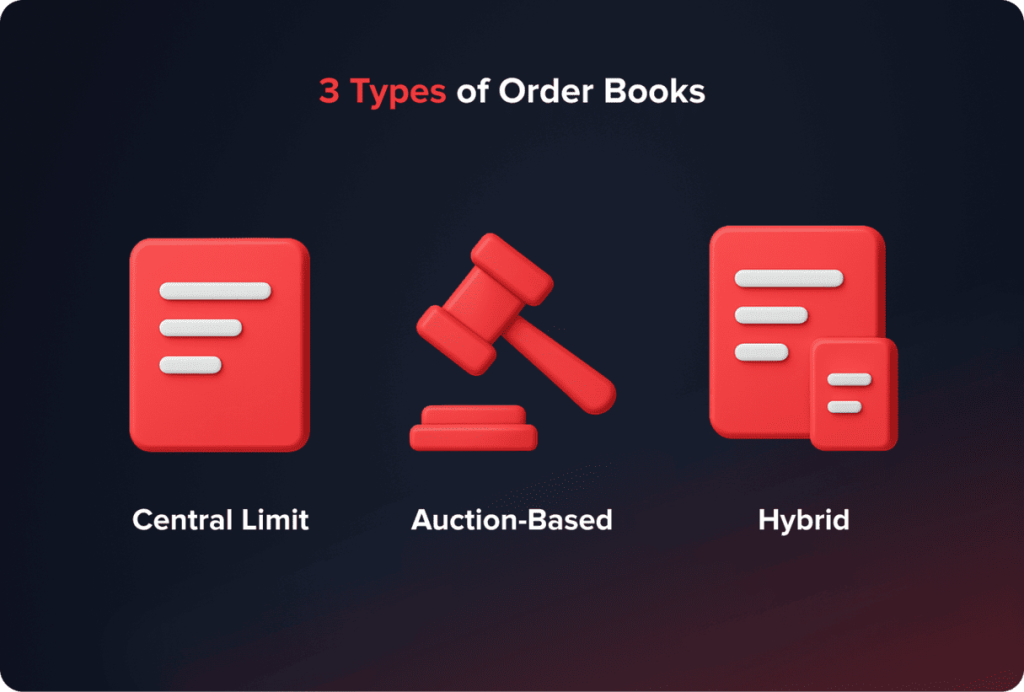

นอกเหนือจากโมเดลมาตรฐานที่กล่าวถึงแล้วยังมีการเปลี่ยนแปลงในโครงสร้างหนังสือที่ตอบสนองความต้องการและกลยุทธ์ของตลาดที่แตกต่างกัน

- สมุดสั่งซื้อขีด จำกัด กลาง (CLOB): CLOB เป็นรูปแบบที่พบบ่อยที่สุดของหนังสือสั่งซื้อการรวมศูนย์ซื้อและขายคำสั่งซื้อเพื่ออำนวยความสะดวกในการค้นพบราคาที่โปร่งใส มีการใช้กันอย่างแพร่หลายในการแลกเปลี่ยนเพื่อรวมคำสั่งซื้อที่มองเห็นได้ทั้งหมดให้ข้อมูลเชิงลึกของตลาดที่ครอบคลุม อย่างไรก็ตามความโปร่งใสของมันอาจทำให้ผู้ค้าสถาบันบางรายเป็นไปได้เนื่องจากผลกระทบของตลาดที่อาจเกิดขึ้น

- หนังสือสั่งซื้อตามประมูล: ใช้กันทั่วไปในระหว่างการเปิดและปิดตลาดหนังสือสั่งซื้อประเภทนี้สะสมคำสั่งซื้อในกรอบเวลาที่กำหนดโดยจับคู่พวกเขาผ่านกระบวนการประมูลในราคาดุลยภาพเดียว มันให้สภาพแวดล้อมการซื้อขายที่ควบคุมลดความผันผวนในขณะที่มั่นใจว่าราคาที่มีประสิทธิภาพ

- หนังสือสั่งไฮบริด: วิธีการไฮบริดผสมผสาน CLOB กับคุณสมบัติเช่นคำสั่งที่ซ่อนอยู่หรือลำดับความสำคัญของการดำเนินการที่แตกต่างกัน สิ่งนี้ช่วยให้การแลกเปลี่ยนสามารถรองรับการตั้งค่าการซื้อขายที่หลากหลายดังนั้นจึงให้ความยืดหยุ่นสำหรับนักลงทุนสถาบันผู้ค้าที่มีความถี่สูงและผู้เข้าร่วมการค้าปลีก

ข้อพิจารณาเพิ่มเติม

หนังสือสั่งซื้ออาจรวมถึงคำสั่งที่ซ่อนอยู่หรือภูเขาน้ำแข็งซึ่งมีเพียงเศษเสี้ยวของจำนวนเงินทั้งหมดที่แสดงและส่วนที่เหลือจะถูกเปิดเผยหลังจากส่วนแรกเสร็จสมบูรณ์ คุณลักษณะนี้ช่วยให้นักลงทุนสถาบันสามารถสั่งซื้อได้โดยไม่ส่งผลกระทบอย่างมากต่อการกำหนดราคาในตลาด ความพร้อมใช้งานของประเภทการสั่งซื้อหลายประเภทและขั้นตอนการดำเนินการเน้นย้ำถึงความจำเป็นในการรู้ว่าหนังสือสั่งซื้อทำงานอย่างไรสำหรับผู้ค้าหรือนักลงทุนที่จริงจัง

วิธีการที่ผู้ค้าใช้หนังสือสั่งซื้อ (ใช้กรณี)

หนังสือสั่งซื้อไม่ได้เป็นเพียงข้อมูลทางเทคนิค: เป็นเครื่องมือที่ใช้งานได้จริงที่ผู้ค้าใช้เพื่อเป็นแนวทางในการตัดสินใจของพวกเขา

1. การถลกหนังและการซื้อขายระหว่างวัน

ผู้ค้าระยะสั้นใช้สมุดสั่งซื้อเพื่อระบุการเปลี่ยนแปลงที่จะเกิดขึ้นในสภาพคล่องหรือคำสั่งซื้อที่ซ่อนอยู่จำนวนมาก ตัวอย่างเช่นการเพิ่มขึ้นของคำสั่งซื้อในราคาที่สำคัญสามารถส่งสัญญาณการตีกลับใกล้เข้ามา

2. การระบุการสนับสนุนและการต่อต้าน

ระดับการสนับสนุนถูกสร้างขึ้นโดยวงคำสั่งซื้อและคำสั่งขายที่แข็งแกร่งแสดงถึงความต้านทาน ผู้ค้าใส่รายการ/ออกใกล้ระดับเหล่านี้

ตัวอย่าง: ผู้ค้าเห็น 10,000 ETH ซื้อคำสั่งซื้อที่ $ 2,000 => ตีความว่าการสนับสนุนและสถานที่หยุดพักด้านล่าง

3. ช่วงเวลาการเข้าสู่ตลาด

ดูความไม่สมดุลของคำสั่ง (การเสนอราคามากกว่าขอ) เพื่อวัดความเชื่อมั่นระยะสั้น - วัวหรือหมี

4. การตรวจสอบสภาพคล่อง

ผู้ค้ารายวันหลีกเลี่ยงเครื่องมือหนังสือบาง ๆ (สเปรดกว้าง) และหันไปหาตลาดที่มีสภาพคล่องที่มีการดำเนินการที่ดี

5. การดำเนินการทางการค้าขนาดใหญ่

สถาบันใช้กลยุทธ์เช่นคำสั่งภูเขาน้ำแข็งเพื่อหลีกเลี่ยงการเปิดเผยขนาดเต็ม ตัวอย่าง: การแยกคำสั่งซื้อ $ 10 ล้านออกเป็นกัดเล็ก ๆ ที่มองเห็นได้

การสั่งซื้อหนังสือทำงานอย่างไร

หนังสือสั่งซื้อให้ภาพรวมของสถานะปัจจุบันของตลาดโดยการจัดหมวดหมู่และการแสดงข้อมูลส่วนต่าง ๆ ของข้อมูลการซื้อขาย

ซื้อคำสั่งซื้อ (เสนอราคา)

เริ่มต้นด้วยราคาสูงสุดที่ผู้ซื้อพร้อมที่จะชำระเงินสำหรับสินทรัพย์ที่แน่นอนคำสั่งซื้อ - ที่รู้จักกันในชื่อการเสนอราคา - เป็นตัวแทนของผู้ซื้อที่เป็นตัวแทนและโพสต์ในคำสั่งลดลง การเสนอราคาเหล่านี้ตรงกับปริมาณการซื้อที่ต้องการ ส่วนการเสนอราคาเปิดเผยระดับความต้องการที่จุดราคาที่แตกต่างกันและให้ข้อมูลเชิงลึกเกี่ยวกับความอยากซื้อของสินทรัพย์

ขายคำสั่งซื้อ (ถาม)

ขายคำสั่งซื้อหรือถามเป็นตัวแทนของข้อเสนอของผู้ขายและจัดเรียงตามคำสั่งซื้อจากน้อยไปมากเริ่มต้นด้วยราคาต่ำสุดที่ผู้ขายยินดีที่จะขาย เช่นเดียวกับการเสนอราคาแต่ละถามจะมาพร้อมกับปริมาณที่สอดคล้องกันเผยระดับอุปทานในจุดราคาต่างๆ ส่วน ASK แสดงให้เห็นว่ามีสินทรัพย์จำนวนเท่าใดสำหรับการขายและราคาเท่าไหร่ให้ข้อมูลเชิงลึกเกี่ยวกับแรงกดดันการขาย

ประวัติความเป็นมา

ส่วนประวัติคำสั่งซื้อบันทึกการทำธุรกรรมที่เสร็จสมบูรณ์ก่อนหน้านี้ทั้งหมดนำเสนอบัญชีประวัติศาสตร์ของการซื้อขายที่ดำเนินการและราคาและปริมาณที่เกี่ยวข้อง ข้อมูลในอดีตนี้ช่วยให้ผู้ค้าวิเคราะห์แนวโน้มราคาที่ผ่านมาและพฤติกรรมการซื้อขายเพื่อระบุรูปแบบหรือทำนายการเคลื่อนไหวของตลาดในอนาคต

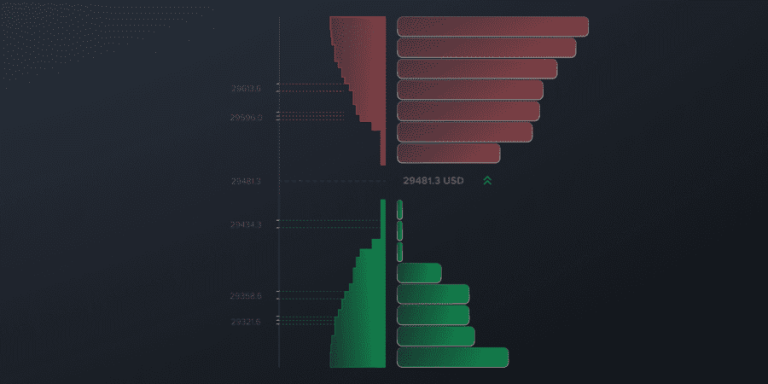

การวิเคราะห์หนังสือสั่งซื้อมีบทบาทสำคัญในการทำความเข้าใจความลึกของตลาด (DOM) และการไหลของคำสั่ง ผู้ค้าใช้ DOM เพื่อประเมินสภาพคล่องในระดับราคาต่างๆให้ข้อมูลเชิงลึกเกี่ยวกับอุปสงค์และอุปทานเกินกว่าการเสนอราคาสูงสุดและถามราคา ในทางกลับกันการวิเคราะห์การไหลของคำสั่งซื้อช่วยให้ผู้ค้ากำหนดทิศทางการตลาดโดยการติดตามคำสั่งซื้อจำนวนมากการซื้อ/ขายเชิงรุกและการเปลี่ยนแปลงโมเมนตัม ผู้ค้ามืออาชีพหลายคนใช้กลยุทธ์ราคาเฉลี่ย (VWAP) ในการดำเนินการซื้อขายขนาดใหญ่อย่างมีประสิทธิภาพโดยไม่ส่งผลกระทบต่อการเคลื่อนไหวของราคาอย่างมีนัยสำคัญ

การเปลี่ยนแปลงของตลาดและตัวชี้วัด

ในหนังสือสั่งซื้อความสัมพันธ์ระหว่างคำสั่งซื้อและขายเผยให้เห็นการเปลี่ยนแปลงของตลาดที่สำคัญและเสนอตัวชี้วัดที่มีค่าสำหรับผู้ค้าและนักลงทุน

- ด้านบนของหนังสือ: ราคาการเสนอราคาสูงสุดและราคาถามต่ำสุดเป็นรูป "ด้านบนของหนังสือ" ซึ่งแสดงการจัดซื้อและขายราคาที่สามารถเข้าถึงได้มากที่สุดในช่วงเวลาใดช่วงเวลาหนึ่ง อัตราเหล่านี้เป็นเครื่องหมายสำคัญของสถานะของตลาดซึ่งช่วยให้ผู้ค้าประเมินเงื่อนไขอุปสงค์และอุปทานได้อย่างรวดเร็ว

- สเปรดเสนอราคา: ความแตกต่างระหว่างราคาเสนอราคาสูงสุดและราคาถามต่ำสุดเรียกว่าสเปรดการเสนอราคา นี้ การแพร่กระจาย is a key metric for understanding market liquidity. A narrow การแพร่กระจาย typically indicates high liquidity and lower trading costs, while a wider การแพร่กระจาย signals lower liquidity and higher transaction costs.

- รองรับและระดับความต้านทาน: การสนับสนุนและระดับความต้านทานหมายถึงช่วงราคาที่ตลาดอาจแสดงการซื้อหรือขายแรงกดดันที่โดดเด่น กลุ่มคำสั่งซื้อจำนวนมากในราคาที่เฉพาะเจาะจงมักจะแนะนำระดับการสนับสนุนที่แข็งแกร่งซึ่งบ่งบอกถึงความมั่นคงที่อาจเกิดขึ้นในราคาที่ลดลง ในทางกลับกันความเข้มข้นของคำสั่งขายที่หรือใกล้กับสัญญาณราคาที่แน่นอนระดับความต้านทานซึ่งอาจทำให้การเคลื่อนไหวของราคาสูงขึ้น

- สั่งความไม่สมดุล: ความไม่สมดุลอย่างมากในการซื้อและขายคำสั่งซื้ออาจบ่งบอกถึงการเปลี่ยนแปลงตลาดระยะสั้น ตัวอย่างเช่นความไม่สมดุลในความโปรดปรานของคำสั่งซื้ออาจบ่งบอกถึงความรู้สึกในแง่ดีในขณะที่คำสั่งขายเกินอาจบ่งบอกถึงความเชื่อมั่นในแง่ร้าย การระบุความไม่สมดุลเหล่านี้ช่วยให้ผู้ค้าสามารถคาดการณ์การเปลี่ยนแปลงราคาที่เป็นไปได้

ในขณะที่หนังสือสั่งซื้อเพิ่มความโปร่งใสพวกเขายังมีความอ่อนไหวต่อเทคนิคการจัดการตลาดเช่นการปลอมแปลงและชั้น การปลอมแปลงเกี่ยวข้องกับการสั่งซื้อจำนวนมากโดยไม่มีความตั้งใจที่จะดำเนินการเพื่อสร้างความประทับใจที่ผิดพลาดของอุปสงค์หรืออุปสงค์ซึ่งจะส่งผลต่อความเชื่อมั่นของตลาด การเลเยอร์เป็นกลยุทธ์ที่คล้ายกันซึ่งผู้ค้าสั่งซื้อสินค้าปลอมหลายระดับในระดับราคาที่แตกต่างกันเพื่อสร้างการเคลื่อนไหวเทียมก่อนที่จะยกเลิก หน่วยงานกำกับดูแลรวมถึง ก.ล.ต. และ CFTC ได้เพิ่มการเฝ้าระวังและกำหนดค่าปรับจำนวนมากให้กับผู้ค้าที่ติดอยู่ในการปฏิบัติที่หลอกลวงเช่นนี้

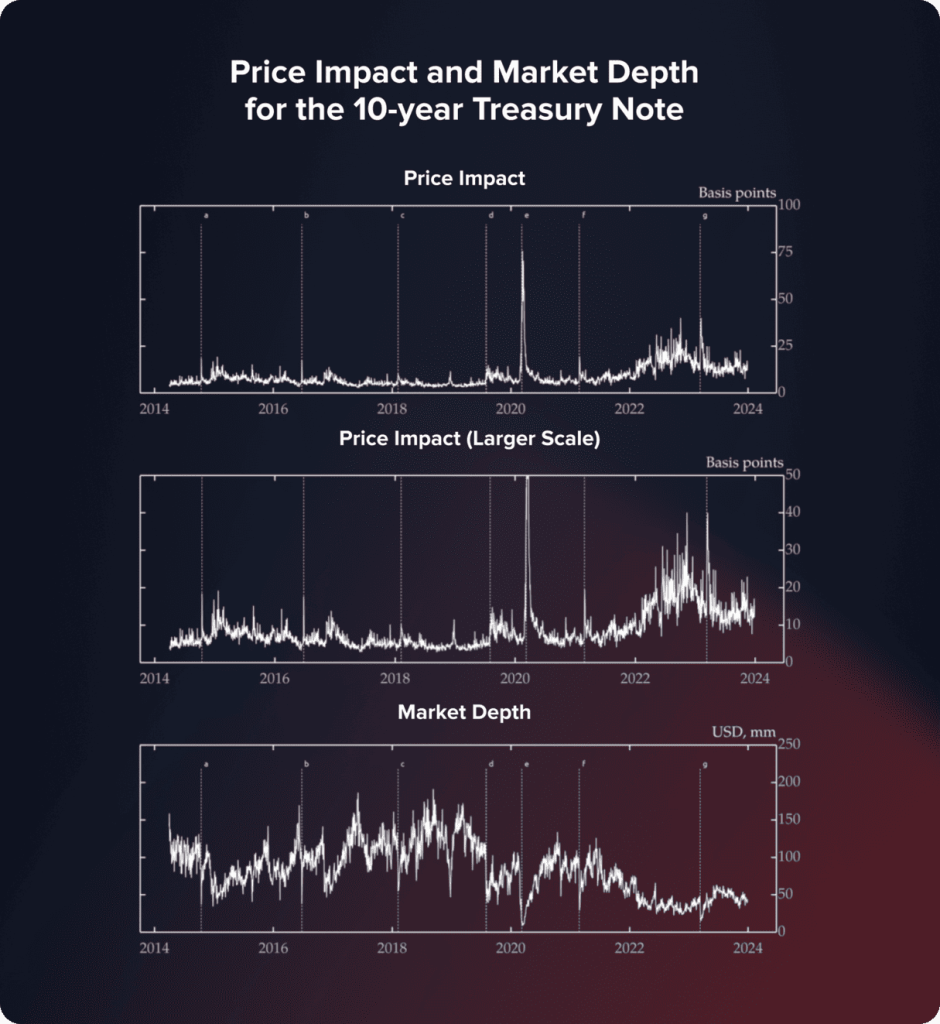

สถิติการสั่งซื้อหนังสือเช่นความลึกของตลาดและสเปรดไม่ใช่สถิติเชิงทฤษฎี - เข้าใจได้อย่างถูกต้องพวกเขาบ่งชี้ว่าตลาดที่มีความเครียดจากความเครียดเป็นอย่างไร ตัวอย่างเช่น, การวิจัยของเฟดเกี่ยวกับตลาดกระทรวงการคลังของสหรัฐอเมริกา ชี้ให้เห็นว่าในช่วงวิกฤตสภาพคล่องในเดือนมีนาคม 2563 ความลึกของตลาดลดลงผ่านพื้นในขณะที่ผลกระทบของราคาบอลลูนทำให้ต้นทุนการดำเนินการสูงขึ้นอย่างมากแม้ในตลาดตราสารหนี้ที่มีสภาพคล่องมากที่สุดในโลก

แหล่งที่มา:Federal Reserve, Repo Inter Inter Maleer Broker; การคำนวณของผู้เขียน

เทคโนโลยีและวิวัฒนาการของหนังสือสั่งซื้อ

การปฏิวัติดิจิทัลในตลาดการเงินได้เปลี่ยนวิธีการทำงานของหนังสือสั่งซื้อเพิ่มประสิทธิภาพและความลึกของพวกเขาอย่างมีนัยสำคัญ การพัฒนาที่โดดเด่นอย่างหนึ่งคือการนำการซื้อขายอัลกอริทึมมาใช้

อินโฟกราฟิกไทม์ไลน์ที่นี่:

- ชั้นการซื้อขายแบบแมนนวล (ก่อนปี 1980)-โบรกเกอร์เสียงที่ใช้กระดาษ

- หนังสือคำสั่งอิเล็กทรอนิกส์ (1980 -1990s) - Nasdaq, ระบบอัตโนมัติก่อน

- อัลกอริทึมการซื้อขาย (2000s) - การดำเนินการที่เร็วขึ้นระบบตามกฎ

- ความถี่สูง & AI (2010s)-การซื้อขายระดับไมโครวินาทีแบบจำลองการทำนาย

- หนังสือสั่งซื้อ blockchain (2020s) - การกระจายอำนาจบันทึกการดัดแปลง

อัลกอริทึมขั้นสูงดำเนินการสั่งซื้ออย่างรวดเร็วและมีประสิทธิภาพอย่างไม่น่าเชื่อวิเคราะห์ข้อมูลสมุดสั่งซื้อแบบเรียลไทม์เพื่อระบุรูปแบบเพิ่มประสิทธิภาพเวลาการค้าและจัดการความเสี่ยง ความก้าวหน้าทางเทคโนโลยีนี้นำไปสู่การเพิ่มขึ้นของการซื้อขายความถี่สูงซึ่งอัลกอริทึมใช้ประโยชน์จากการเคลื่อนไหวของราคานาทีสำหรับการซื้อขายเชิงกลยุทธ์

ความก้าวหน้าอีกประการหนึ่งคือการกำหนดเส้นทางการสั่งซื้ออัจฉริยะ (SOR) SOR Systems สแกนและเปรียบเทียบราคาและสภาพคล่องในหลาย ๆ สถานที่ซื้อขายสั่งให้ดำเนินการเพื่อให้เกิดการดำเนินการที่ดีที่สุด ระบบ SOR ช่วยให้ผู้ค้าสามารถใช้ประโยชน์จากความแตกต่างของราคาและเข้าถึงสภาพคล่องที่ซ่อนอยู่ในตลาดที่แยกส่วนโดยการรวมข้อมูลจากหนังสือสั่งซื้อต่างๆอย่างราบรื่น

โดยการใช้การเรียนรู้ของเครื่องเพื่อตรวจสอบข้อมูลหนังสือคำสั่งซื้อที่ผ่านมาและรูปแบบราคาในอนาคตของโครงการปัญญาประดิษฐ์ (AI) ยังเปลี่ยนวิธีการซื้อขาย โดยเฉพาะอย่างยิ่งเมื่อประเมินอารมณ์ตลาดระยะสั้นหรือการเปลี่ยนแปลงสภาพคล่องความสามารถในการทำนายนี้ช่วยให้ผู้ค้าสามารถตัดสินใจได้มากขึ้น

ด้วยการติดตามคำสั่งซื้อเป็นเหตุการณ์ที่ไม่เปลี่ยนรูปเทคโนโลยีบล็อกเชนนำเสนอแทนการแลกเปลี่ยนแบบกระจายสำหรับการแลกเปลี่ยนทั่วไปด้วยหนังสือสั่งซื้อแบบเปิดและดัดแปลง เนื่องจากสิ่งประดิษฐ์นี้สนับสนุนโครงสร้างพื้นฐานการซื้อขายที่ปลอดภัยทั่วโลกจึงมีความสำคัญมากขึ้นเรื่อย ๆ ในตลาด cryptocurrency

การพัฒนาทางเทคนิคเหล่านี้ทำให้หนังสือสั่งซื้อแบบไดนามิกและตอบสนองมากขึ้นทำให้ผู้ค้าก่อนหน้านี้ไม่เคยได้ยินเกี่ยวกับการเคลื่อนไหวของตลาด การคาดการณ์การเปลี่ยนแปลงของตลาดและการปรับปรุงเทคนิคการซื้อขายขึ้นอยู่กับการรับรู้ถึงการเปลี่ยนแปลงเหล่านี้ซึ่งจะช่วยให้ผู้ค้าสามารถแข่งขันในสภาพแวดล้อมทางการเงินที่เปลี่ยนแปลงอย่างรวดเร็วในปัจจุบัน

การเรียนรู้ของเครื่องจักรและการวิเคราะห์ข้อมูลขนาดใหญ่ได้ปรับปรุงการวิเคราะห์สมุดสั่งซื้ออย่างมีนัยสำคัญ อัลกอริทึมการซื้อขายที่ใช้พลังงาน AI สามารถประมวลผลข้อมูลหนังสือคำสั่งซื้อในอดีตจำนวนมากเพื่อตรวจจับรูปแบบที่ซ่อนอยู่และทำนายการเคลื่อนไหวของราคาระยะสั้นด้วยความแม่นยำสูง ความก้าวหน้าเหล่านี้ได้ก่อให้เกิดรูปแบบการทำตลาดที่คาดการณ์ได้ซึ่งเพิ่มประสิทธิภาพการเสนอราคาให้ดีที่สุดในการปรับปรุงประสิทธิภาพการดำเนินการ ผู้ค้าที่มีความถี่สูงและกองทุนป้องกันความเสี่ยงพึ่งพาเทคโนโลยีเหล่านี้อย่างมากเพื่อให้ได้เปรียบในการแข่งขันในการซื้อขายระดับไมโครวินาที

ข้อพิจารณาพิเศษ

หนังสือสั่งซื้อมีข้อ จำกัด มากมายแม้ว่าจะมีความหมายเพื่อปรับปรุงการเปิดกว้างในตลาดการเงิน กิจกรรมการซื้อขายสถาบันหลายแห่งเกิดขึ้นใน "Dark Pools" สถานที่ซื้อขายที่เป็นความลับซึ่งนักลงทุนสถาบันรายใหญ่อาจซื้อและขายหลักทรัพย์โดยไม่เปิดเผยความตั้งใจของพวกเขาไปยังตลาดที่กว้างขึ้นจนกระทั่งหลังจากการขายเสร็จสิ้น Dark Pools ช่วยให้นักลงทุนเหล่านี้ดำเนินการทำธุรกรรมที่สำคัญโดยมีผลเพียงเล็กน้อยต่อการกำหนดราคาในตลาดเนื่องจากการแสดงคำสั่งซื้อขนาดใหญ่เหล่านี้ในตลาดสาธารณะจะทำให้เกิดการจัดการราคาหรือการซื้อขายล่วงหน้าซึ่งอาจลดมูลค่าการซื้อขายที่เป็นไปได้

อย่างไรก็ตาม Dark Pools จำกัด ยูทิลิตี้ของ Order Book เนื่องจากข้อมูลการแลกเปลี่ยนสาธารณะไม่ได้แสดงถึงอุปสงค์และอุปทานที่แท้จริงสำหรับการรักษาความปลอดภัยโดยเฉพาะ การขาดการมองเห็นนี้สามารถปิดบังการเคลื่อนไหวของราคาหรือแนวโน้มที่ผู้ค้าอาจตรวจจับได้จากการวิเคราะห์ข้อมูลหนังสือคำสั่งสาธารณะเพียงอย่างเดียว

สระว่ายน้ำมืดมีบทบาทสำคัญในการซื้อขายที่ทันสมัยคิดเป็นสัดส่วนของปริมาณรายวันในตลาดที่สำคัญ ในขณะที่พวกเขาให้ประโยชน์เช่นการลดราคาลดราคาและการไม่เปิดเผยตัวตนสำหรับนักลงทุนสถาบันพวกเขายังก่อให้เกิดความกังวลเกี่ยวกับความโปร่งใสของราคา หน่วยงานกำกับดูแลบางคนกำหนดกฎให้ จำกัด กิจกรรมสระว่ายน้ำมืดหรือต้องการการรายงานข้อมูลหลังการค้าเพื่อให้แน่ใจว่าการแข่งขันในตลาดที่เป็นธรรม นอกจากนี้ผู้ค้ายังใช้คำสั่งภูเขาน้ำแข็งซึ่งมีเพียงส่วนเล็ก ๆ ของคำสั่งซื้อทั้งหมดที่มองเห็นได้ - เพื่อนำทางความท้าทายด้านสภาพคล่องในขณะที่ดำเนินการซื้อขายขนาดใหญ่

ยูทิลิตี้สำหรับผู้ค้า

สำหรับผู้ค้าโดยเฉพาะอย่างยิ่งผู้ที่เกี่ยวข้องกับการซื้อขายความถี่สูงหรือวันหนังสือสั่งซื้อยังคงเป็นเครื่องมือที่ล้ำค่าแม้จะมีข้อ จำกัด ความลึกของข้อมูลในสมุดสั่งซื้อช่วยให้ผู้ค้าทำการเลือกที่ชาญฉลาดขึ้นอยู่กับการวิเคราะห์เชิงลึกของตลาดอย่างละเอียด

ความลึกของตลาดและกลยุทธ์

การรู้ว่าการซื้อและขายคำสั่งซื้อมีการแจกจ่ายในหลายระดับราคาช่วยให้ผู้ค้าประเมินสภาพคล่องของตลาดโอกาสในการซื้อขายที่เป็นไปได้และเปลี่ยนแนวทางของพวกเขา ยกตัวอย่างเช่นการสเปรดการเสนอราคาขอให้ชี้ไปที่สภาพคล่องที่ยอดเยี่ยมและสร้างแรงบันดาลใจให้กับเทคนิคการซื้อขายที่ก้าวร้าว ในทางกลับกันสเปรดที่กว้างขึ้นอาจจำเป็นต้องใช้ความระมัดระวังและแนวทางปฏิบัติในการซื้อขายที่อนุรักษ์นิยมมากขึ้น

การสนับสนุนและข้อมูลเชิงลึกการต่อต้าน

การเปิดเผยกลุ่มของการซื้อและขายคำสั่งซื้อในราคาที่แน่นอนหนังสือสั่งซื้ออาจให้ข้อมูลเชิงลึกที่สำคัญแก่ผู้ค้าในระดับการสนับสนุนและระดับการต่อต้าน การรู้ว่าการซื้อหรือการขายแรงกดดันที่สำคัญจะช่วยให้ผู้ค้าสามารถปรับเปลี่ยนแผนการซื้อขายของพวกเขาและโครงการกลับรายการตลาดที่น่าจะเป็นหรือรูปแบบความต่อเนื่อง

ความเชื่อมั่นในตลาดระยะสั้น

การวิเคราะห์ความไม่สมดุลของคำสั่งให้ผู้ค้ามีมุมมองทันทีเกี่ยวกับความเชื่อมั่นในตลาดระยะสั้น คำสั่งซื้อที่มากเกินไปมากกว่าคำสั่งขายมักจะแนะนำโมเมนตัมที่รั้นในขณะที่คำสั่งขายจำนวนมากอาจบ่งบอกถึงความเชื่อมั่นในหมี ข้อมูลดังกล่าวสามารถช่วยให้ผู้ค้ามีเวลาซื้อขายได้อย่างมีประสิทธิภาพ

สำหรับผู้ที่มองหาข้อได้เปรียบในการแข่งขันในสภาพแวดล้อมการซื้อขายที่รวดเร็วของวันนี้ข้อมูลที่นำเสนอโดยหนังสือสั่งซื้อสาธารณะยังคงมีความสำคัญมากแม้ว่าการถือกำเนิดของสระว่ายน้ำมืดและแพลตฟอร์มการซื้อขายส่วนตัวอื่น ๆ นำเสนออุปสรรค มันเป็นเครื่องมือพื้นฐานสำหรับการพัฒนากลยุทธ์การซื้อขายเชิงกลยุทธ์และได้รับความเข้าใจที่ดีขึ้นเกี่ยวกับพฤติกรรมการตลาด

ผลกระทบด้านกฎระเบียบต่อหนังสือสั่งซื้อ

ความโปร่งใสและโครงสร้างของหนังสือสั่งซื้อมีการเปลี่ยนแปลงอย่างมากโดยการพัฒนากฎระเบียบ ตัวอย่างเช่นการยอมรับตลาดในยุโรปใน Instruments Directive (MIFID II) พยายามเพิ่มการแข่งขันและการเปิดกว้าง คำสั่งนี้จำเป็นต้องมีการรายงานโดยละเอียดเพิ่มเติมเกี่ยวกับการทำธุรกรรมและขยายขอบเขตของสถานที่ที่ต้องรักษาหนังสือคำสั่งซื้อที่ครอบคลุมเพิ่มความสมบูรณ์ของตลาด

การบังคับใช้ชุดกฎระเบียบมาตรฐานสำหรับการซื้อขายหุ้นระบบการตลาดแห่งชาติ (REG NMS) ได้รับคำสั่งจากการโพสต์สาธารณะของการเสนอราคาที่ดีที่สุดและขอราคาข้ามการแลกเปลี่ยนในสหรัฐอเมริกา นอกจากนี้ยังกำหนดกฎระเบียบ "การค้าผ่าน" ห้ามมิให้ผู้ค้าดำเนินการสั่งซื้อในราคาที่ยากจนกว่าการเสนอราคาและข้อเสนอที่ดีที่สุดในระดับชาติ (NBBO) กฎระเบียบเหล่านี้ทำให้มั่นใจได้ว่าหนังสือสั่งซื้อสะท้อนภาพที่แท้จริงและยุติธรรมของสภาพคล่องของตลาดและการค้นพบราคา

อย่างไรก็ตามข้อกำหนดด้านกฎระเบียบได้ผลักดันกิจกรรมการซื้อขายบางอย่างไปยังสถานที่ทางเลือกเช่นสระว่ายน้ำมืดซึ่งการทำธุรกรรมขนาดใหญ่สามารถเกิดขึ้นได้นอกสายตาสาธารณะ เป็นผลให้หน่วยงานกำกับดูแลจะต้องสมดุลความโปร่งใสและจัดหาตลาดส่วนตัวที่มีประสิทธิภาพสำหรับผู้ค้าสถาบัน

สำหรับผู้ค้าการรู้สภาพแวดล้อมด้านกฎระเบียบเกี่ยวกับหนังสือสั่งซื้อเป็นสิ่งจำเป็นเนื่องจากมีผลต่อการเข้าถึงสภาพคล่องคุณภาพการดำเนินการทางการค้าและประสิทธิภาพของตลาดทั่วไป การรักษาความรู้เกี่ยวกับหลักการเหล่านี้ช่วยให้ผู้ค้าสามารถปรับเปลี่ยนแผนของพวกเขาและยึดความเป็นไปได้ในขณะที่ยังคงปฏิบัติตามกฎของตลาด

สั่งซื้อหนังสือในตลาดต่าง ๆ

ไม่ใช่ทุกตลาดที่แสดงหนังสือสั่งซื้อในลักษณะเดียวกัน

หุ้น (หุ้น)

- หนังสือสั่งซื้อจากส่วนกลางที่จัดการโดยการแลกเปลี่ยน (NYSE, LSE)

- มีการควบคุมอย่างมากและชัดเจน (Reg NMS ในสหรัฐอเมริกา, MiFID II ใน EU)

- ใช้ดีที่สุดสำหรับการตรวจสอบสภาพคล่องและการแพร่กระจายโดยตรง

Forex (สกุลเงิน)

- ไม่มีหนังสือสั่งซื้อกลาง (ตลาดกระจายอำนาจ)

- สภาพคล่องที่มาจากธนาคารโบรกเกอร์และ ECNs (เครือข่ายการสื่อสารทางอิเล็กทรอนิกส์)

- ผู้ค้าเห็นเฉพาะสภาพคล่องที่รวมจาก LPS ของนายหน้า

cryptocurrencies

- การแลกเปลี่ยนส่วนกลาง (binance, coinbase) ใช้ clobs (หนังสือสั่ง จำกัด กลาง)

- การแลกเปลี่ยนกระจายอำนาจ (DEXs) สามารถใช้หนังสือสั่งซื้อที่ใช้บล็อกเชนหรือผู้ผลิตตลาดอัตโนมัติ (AMM)

- ระดับความโปร่งใสในระดับสูง แต่ตรรกะการจับคู่ที่แตกต่างจากหุ้น/forex

| ตลาด | ประเภทหนังสือสั่งซื้อ | ความโปร่งใส | คุณสมบัติที่สำคัญ |

| สต็อก | รวมศูนย์ (clob) | สูง | มีการควบคุมการแลกเปลี่ยนตาม |

| ช่องว่าง | รวม (ECNs) | ปานกลาง | ไม่มีหนังสือเล่มเดียวสภาพคล่องที่แยกส่วน |

| crypto | รวมศูนย์และกระจายอำนาจ | ผสมกัน | cex = clob, dex = amm หรือ blockchain-based |

ในตลาดสำหรับ cryptocurrencies ขนาดไม่เท่ากับสภาพคล่องเสมอไป โทเค็นหนึ่งสามารถปรากฏขึ้นได้ในตลาดที่มีขนาดใหญ่ แต่การค้าบาง ๆ ในสถานที่เพียงไม่กี่แห่งที่มีความลึกตื้น มันเป็นความเข้าใจผิดที่อันตรายสำหรับผู้ที่คิดว่าตลาดมีการวัดสภาพคล่อง Kaiko Research ไฮไลต์การตัดการเชื่อมต่อเหล่านี้ที่นี่โทเค็น LEO และ WBTC อยู่ในระดับที่สูง แต่มีสภาพคล่องต่ำตามคำสั่งของขนาดเสริมความจำเป็นในการดูหนังสือสั่งซื้อมากกว่าหมายเลขพาดหัว

บทสรุป

มากกว่าเพียงชุดตัวเลขหนังสือสั่งซื้อเป็นเครื่องมือแบบไดนามิกที่สะท้อนถึงอารมณ์แบบเรียลไทม์ของผู้ซื้อและผู้ขายในตลาดดังนั้นแสดงให้เห็นถึงอุปสงค์และอุปทานพลวัตในช่วงเวลาใดเวลาหนึ่ง ในฉากการซื้อขายทางการเงินหนังสือสั่งซื้อเป็นเครื่องมือที่จำเป็นเนื่องจากมีมุมมองที่สมบูรณ์ของการชิงช้าราคาในอนาคตดังนั้นจึงช่วยให้ผู้ค้าสามารถวางแผนได้สำเร็จมากขึ้น

อัปเดต:

9 กันยายน 2568