O que é um livro de ordens? Definição e como funciona

Conteúdo

Um livro de pedidos é um componente vital no cenário de negociação financeira. Ele fornece um livro detalhado de pedidos de compra e venda de valores mobiliários ou instrumentos financeiros organizados pelo nível de preço. Ao mostrar a profundidade da demanda do mercado em vários preços, essa lista eletrônica melhora a transparência do mercado e fornece informações sobre o número de ações que estão sendo oferecidas ou oferecidas. Traders e investidores que desejam fazer escolhas inteligentes nos mundos dinâmicos de ações, títulos e negociações de moeda devem primeiro entender como funciona um livro de pedidos.

Definição do livro de pedidos

| Lado | Preço | Quantidade | Descrição |

| BID (Buy) | 101.20 | 500 | Os compradores de preços mais altos estão dispostos a pagar |

| BID (Buy) | 101 | 350 | Próximo nível do comprador |

| Pergunte (venda) | 101.40 | 600 | Os vendedores de preço mais baixos estão dispostos a pagar |

| Pergunte (venda) | 101.60 | 450 | Próximo nível do vendedor |

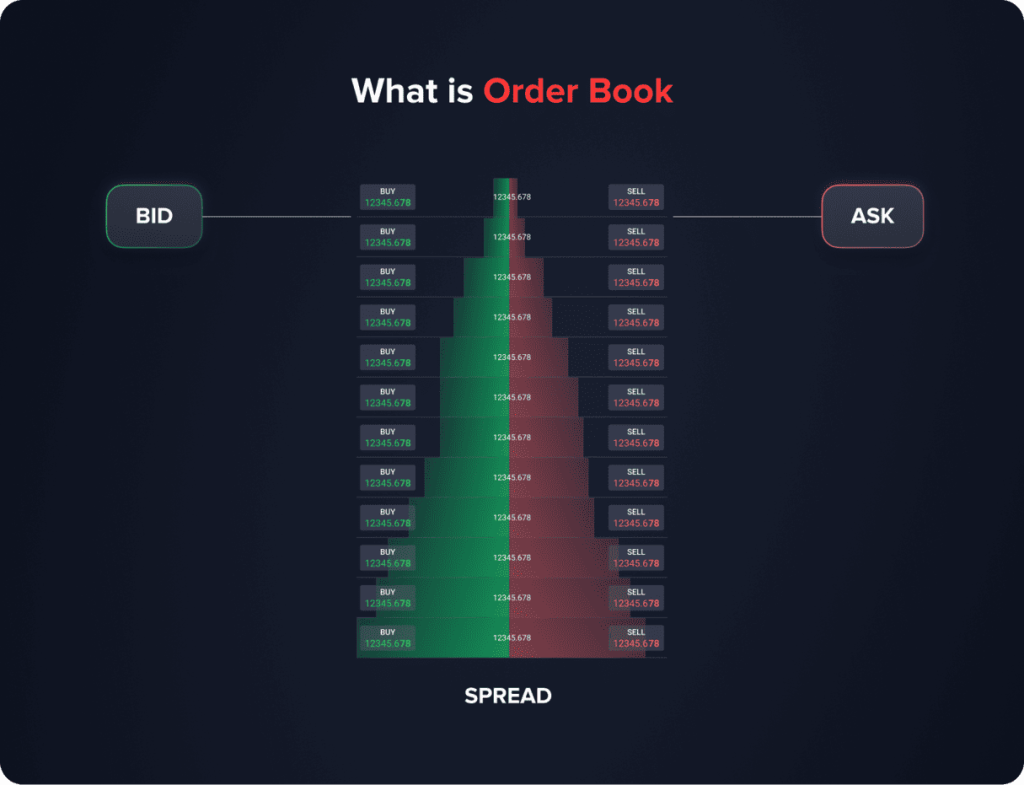

Gravando pedidos de compra e venda ao vivo em um mercado para uma determinada classe de ativos - estoques, títulos, moedas ou criptomoedas - um livro de pedidos é um instrumento necessário que promove o comércio transparente. O objetivo básico de um livro de pedidos é gravar e organizar dinamicamente os dados em tempo real sobre preços e quantidade de pedidos de compra e venda. Esta atualização contínua fornece aos traders e investidores um instantâneo claro e imediato da dinâmica de oferta e demanda do mercado.

Geralmente mostrado oposto um ao outro em estilo tabular, comprar e vender pedidos têm seus preços relacionados organizados em sequência ascendente ou em declínio. Pedidos de compra, ou lances, por exemplo, são publicados com o preço mais alto primeiro; Venda ordens, ou pergunta, mostre o preço mais baixo primeiro. Esse acordo oferece uma representação visual clara da atividade e do sentimento do mercado, orientando as estratégias comerciais. Refletindo um nível de preço específico, cada linha mostra o número de ações ou unidades acessíveis nesse nível, fornecendo informações sobre profundidade e liquidez do mercado. A "propagação", a variação entre a oferta mais alta e a menor pergunta, acaba sendo um bom indicador de volatilidade e eficiência do mercado.

You may also like

Tipos de pedidos no livro

Os pedidos em um livro de pedidos podem ser pedidos de mercado ou limitados. As ordens de mercado são executadas imediatamente pelo melhor preço disponível, afetando o 'topo do livro'. Por outro lado, as ordens limitadas são executadas a um preço específico ou melhor, preenchendo assim o lado de compra ou venda do livro de acordo com as preferências do trader.

Tipos de livros de pedidos

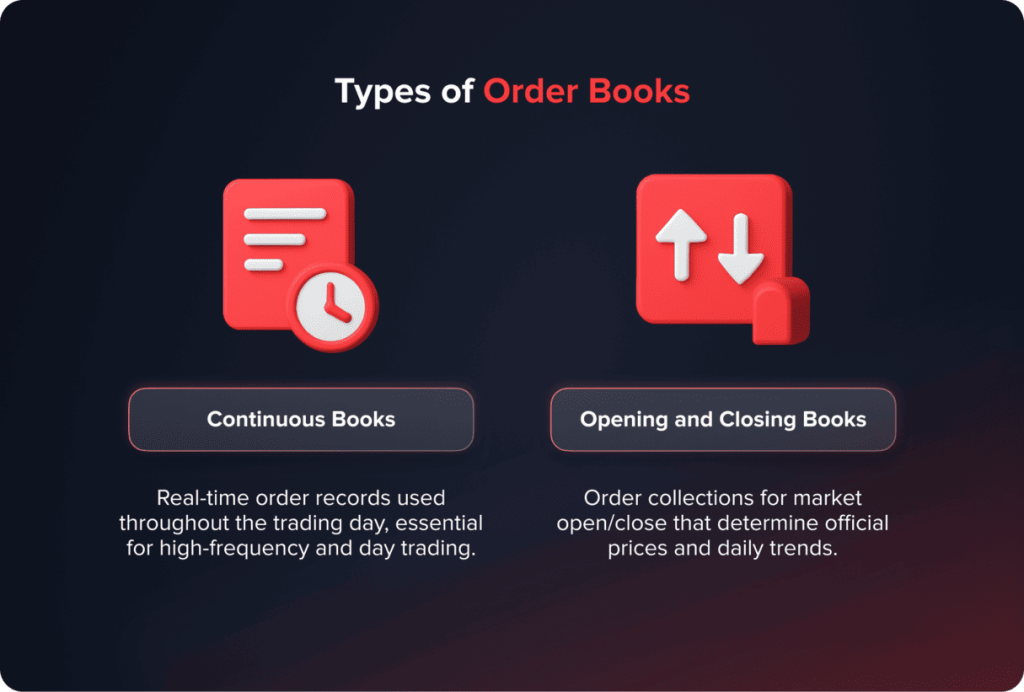

Os livros de pedidos podem ser divididos em duas categorias principais com base no momento da execução de pedidos:

- Livros contínuos: Estas atualizações em tempo real durante o dia de negociação, fornecendo um registro contínuo de mudanças no mercado. Eles refletem toda ordem de entrada e saída, oferecendo uma visão geral abrangente do estado em evolução do mercado. Esse tipo é amplamente utilizado na maioria das trocas eletrônicas, como NASDAQ ou NYSE, e é essencial para negociação de alta frequência e negociação diurna.

- Livros de abertura e fechamento: Esses tipos de livros contêm pedidos especificamente designados para execução na abertura ou fechamento do mercado, respectivamente. Os pedidos nesses livros são mantidos separadamente até serem consolidados com o livro contínuo na abertura e fechamento do mercado para gerar os preços oficiais de abertura e fechamento. Esses preços são vitais para a avaliação do portfólio e a tomada de decisões estratégicas, pois indicam tendências diárias do mercado.

As estruturas dos livros de pedidos podem variar significativamente nos mercados financeiros globais. Por exemplo, as bolsas de valores dos EUA usam principalmente livros de pedidos eletrônicos, enquanto alguns mercados asiáticos ainda incorporam sistemas de leilão híbridos. Na negociação forex, não existe um livro de pedidos centralizado devido à natureza descentralizada dos mercados de moeda; portanto, os comerciantes dependem da liquidez agregada de várias fontes. As trocas de criptomoeda geralmente operam com uma lógica diferente do motor correspondente, permitindo recursos como livros de pedidos descentralizados em ambientes de negociação ponto a ponto. Compreender essas variações é fundamental para os comerciantes que operam em várias classes de ativos ou mercados globais.

Estruturas de livros de pedidos alternativos

Além dos modelos padrão discutidos, existem variações em estruturas de livros de pedidos que atendem a diferentes necessidades e estratégias do mercado.

- Livro de Ordem Limitada Central (CLOB): Um CLOB é a forma mais comum de livro de pedidos, centralizando os pedidos de compra e venda para facilitar a descoberta de preços transparentes. É amplamente utilizado em trocas para agregar todas as ordens visíveis, fornecendo informações abrangentes no mercado. No entanto, sua transparência pode desencorajar alguns comerciantes institucionais devido ao impacto potencial do mercado.

- Livro de pedidos baseado em leilão: Comumente usado durante a abertura e fechamento do mercado, esse tipo de livro de pedidos acumula pedidos em um período de tempo específico, combinando -os por meio de um processo de leilão a um único preço de equilíbrio. Ele fornece um ambiente de negociação controlado, mitigando a volatilidade, garantindo preços eficientes.

- Livro de pedidos híbridos: Uma abordagem híbrida combina um CLOB com recursos como ordens ocultas ou diferentes prioridades de execução. Isso permite que as trocas acomodam várias preferências comerciais, dando flexibilidade para investidores institucionais, comerciantes de alta frequência e participantes do varejo.

Considerações adicionais

Os livros de pedidos também podem incluir ordens ocultas ou iceberg, nas quais apenas uma fração de toda a quantidade é mostrada e o restante é exposto após a conclusão da primeira parte. Esse recurso permite que os investidores institucionais façam grandes ordens sem afetar substancialmente os preços do mercado. A disponibilidade de vários tipos de pedidos e procedimentos de execução ressalta a necessidade de saber como os livros de pedidos funcionam para qualquer comerciante ou investidor sério.

Como os comerciantes usam livros de pedidos (casos de uso)

Os livros de pedidos não são apenas dados técnicos: são ferramentas práticas que os comerciantes usam para orientar suas decisões.

1. Scalping e IntRraday Trading

Os comerciantes de curto prazo usam o livro de pedidos para identificar as próximas mudanças na liquidez ou em grandes ordens ocultas. Por exemplo, um aumento nas ordens de compra por um preço fundamental pode sinalizar um salto iminente.

2. Identificando o suporte e resistência

Os níveis de suporte são criados por faixas de pedidos de compra e pedidos de venda fortes representam resistência. Os comerciantes colocam entradas/saídas perto desses níveis.

Exemplo: um comerciante vê 10.000 pedidos de compra de ETH a US $ 2.000 => interpreta como suporte e coloca a perda de parada abaixo.

3. Tempo de entrada de mercado

Veja os desequilíbrios da ordem (mais lances do que solicitações) para avaliar o sentimento de curto prazo - Bull ou Bear.

4. Verificação de liquidez

Os comerciantes de dia evitam instrumentos finos de livros (spreads amplos) e se voltam para mercados líquidos com boa execução.

5. Grande execução comercial

As instituições usam estratégias como ordens de iceberg para evitar revelar tamanho real. Exemplo: dividindo um pedido de US $ 10 milhões em pequenas mordidas visíveis.

Como os livros de pedidos funcionam

Um livro de pedidos fornece um instantâneo organizado do estado atual do mercado, categorizando e exibindo diferentes seções de informações de negociação.

Comprar pedidos (lances)

Começando com o preço mais alto que um comprador está pronto para pagar por um determinado ativo, pedidos de compra - também conhecidos como lances - representam os juros dos compradores e são publicados em ordem decrescente. Esses lances são comparados com a quantidade desejada de compra. A seção de lances revela os níveis de demanda em pontos de preço variados e fornece informações sobre o apetite de compra por um ativo.

Vender ordens (pergunta)

Vender ordens, ou pergunta, representa as ofertas dos vendedores e são organizados em ordem crescente, começando com o preço mais baixo pelo qual um vendedor está disposto a vender. Como os lances, cada pergunta é acompanhada pelo volume correspondente, revelando os níveis de suprimento em vários preços. A seção Ask ilustra quanto do ativo está disponível para venda e a que preço, fornecendo informações sobre a pressão de venda.

História do pedido

A seção do histórico de pedidos registra todas as transações previamente concluídas, apresentando um relato histórico de negociações executadas e seus respectivos preços e volumes. Esses dados históricos ajudam os comerciantes a analisar tendências anteriores de preços e comportamentos de negociação para identificar padrões ou prever movimentos futuros do mercado.

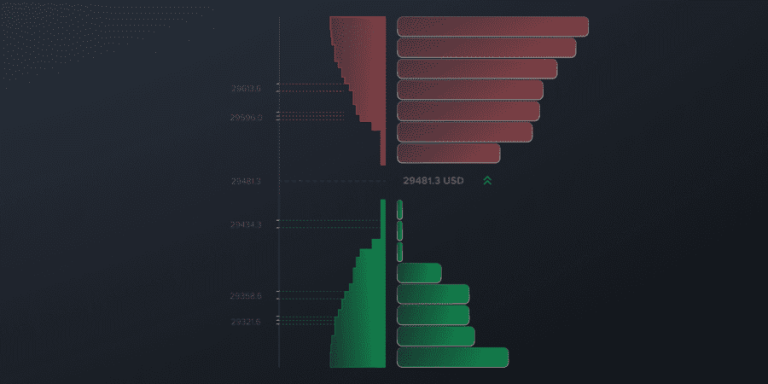

A análise do livro de pedidos desempenha um papel crucial na compreensão da profundidade do mercado (DOM) e do fluxo de pedidos. Os comerciantes usam o DOM para avaliar a liquidez em vários níveis de preços, fornecendo informações sobre oferta e demanda além da oferta superior e solicitar preços. A análise do fluxo de pedidos, por outro lado, ajuda os comerciantes a determinar a direção do mercado, rastreando grandes pedidos, compra/venda agressiva e mudanças de momento. Muitos comerciantes profissionais utilizam estratégias de preço médio (VWAP) ponderadas em volume para executar grandes negociações com eficiência, sem afetar significativamente os movimentos de preços.

Dinâmica e indicadores de mercado

Em um livro de pedidos, a relação entre pedidos de compra e venda revela uma dinâmica importante do mercado e oferece indicadores valiosos para comerciantes e investidores.

- Top do livro: O preço mais alto da oferta e o preço mais baixo de pedidos formam o "topo do livro", que exibe os preços de compra e venda mais competitivos acessíveis a qualquer momento. Essas taxas são marcadores vitais do estado do mercado, que permitem que os comerciantes avaliem rapidamente as condições de demanda e oferta.

- Spread de lances-compra: A diferença entre o preço mais alto do lance e o preço mais baixo de Ask é conhecido como espalhar de oferta-lances. Esse espalhar is a key metric for understanding market liquidity. A narrow espalhar typically indicates high liquidity and lower trading costs, while a wider espalhar signals lower liquidity and higher transaction costs.

- Níveis de apoio e resistência: Os níveis de suporte e resistência se referem às faixas de preços onde o mercado provavelmente mostrará uma pressão notável de compra ou venda. Grandes aglomerados de pedidos de compra a um preço específico geralmente sugerem um forte nível de apoio, indicando que a estabilidade potencial em preços diminui. Por outro lado, uma concentração de pedidos de venda em ou perto de um determinado preço sinaliza um nível de resistência, potencialmente limitando os movimentos de preços ascendentes.

- Pedir desequilíbrio: Um desequilíbrio substancial nos pedidos de compra e venda pode indicar mudanças no mercado de curto prazo. Por exemplo, um desequilíbrio a favor dos pedidos de compra pode indicar sentimentos otimistas, embora um excesso de ordens de venda possa indicar sentimentos pessimistas. A identificação desses desequilíbrios permite que os comerciantes antecipam possíveis mudanças de preço.

Embora os livros de pedidos aumentem a transparência, eles também são suscetíveis a técnicas de manipulação de mercado, como falsificação e camadas. A falsificação envolve fazer grandes ordens sem intenção de execução para criar uma falsa impressão de oferta ou demanda, influenciando assim o sentimento do mercado. As camadas é uma tática semelhante, onde os comerciantes fazem vários pedidos falsos em diferentes níveis de preços para criar movimento artificial antes de cancelá -los. Os reguladores, incluindo a SEC e a CFTC, aumentaram a vigilância e impôs pesadas multas aos comerciantes pegos em se envolver em práticas enganosas.

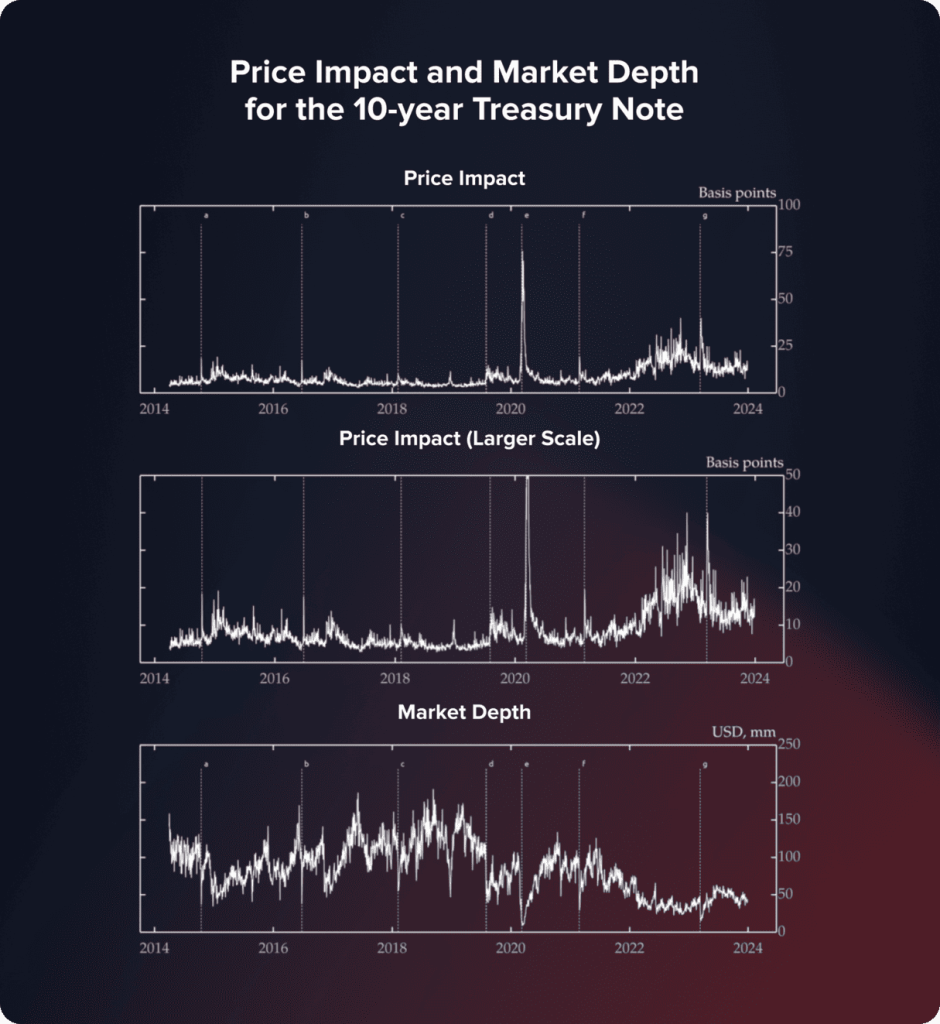

As estatísticas do livro de pedidos, como profundidade e spreads do mercado, não são estatísticas teóricas - devidamente compreendidas, elas nos indicam como os mercados resilantes ao estresse são. Por exemplo, Fed pesquisas no mercado do tesouro dos EUA sugere que, durante a crise de liquidez de março de 2020, a profundidade do mercado caiu no chão enquanto o impacto de preço aumentava, aumentava os custos de execução consideravelmente mais altos, mesmo no mercado de títulos mais líquidos do mundo.

Fonte:Federal Reserve, Comunidade de corretores de revendedores da Repo Inter; cálculos dos autores.

Tecnologia e a evolução dos livros de pedidos

A revolução digital nos mercados financeiros transformou como os livros de pedidos funcionam, aumentando significativamente sua eficiência e profundidade. Um desenvolvimento proeminente é a adoção do comércio algorítmico.

Um infográfico da linha do tempo aqui:

- Piso de negociação manual (antes da década de 1980)-Corretores de voz baseados em papel.

- Livros de pedidos eletrônicos (1980-1990) - NASDAQ, Automação inicial.

- Negociação Algorítmica (2000) - Execução mais rápida, sistemas baseados em regras.

- High-Frequency & AI (2010)-Modelos preditivos de negociação em nível de microssegundos.

- Blockchain Order Books (2020s) - Records descentralizados e à prova de violação.

Os algoritmos avançados executam ordens de forma incrivelmente rápida e eficiente, analisando dados da lista de pedidos em tempo real para identificar padrões, otimizar o tempo comercial e gerenciar riscos. Esse avanço tecnológico levou ao ascensão das negociações de alta frequência, onde os algoritmos capitalizam os movimentos de preços ativos para operações estratégicas.

Outro avanço é o roteamento de pedidos inteligentes (SOR). Os sistemas SOR digitalizam e comparam preços e liquidez em vários locais de negociação, direcionando ordens para alcançar a execução ideal. Os sistemas SOR permitem que os comerciantes explorem discrepâncias de preços e acessem a liquidez oculta em mercados fragmentados, integrando perfeitamente dados de vários livros de pedidos.

Ao usar o aprendizado de máquina para examinar os dados do livro de pedidos anteriores e projetar padrões futuros de preços, a inteligência artificial (IA) também altera as abordagens de negociação. Particularmente ao avaliar o humor do mercado de curto prazo ou projetar mudanças na liquidez, essa capacidade preditiva permite que os comerciantes tomem decisões mais educadas.

Ao rastrear ordens como eventos imutáveis, a Blockchain Technology oferece um substituto distribuído para trocas convencionais com livros de pedidos abertos e à prova de adulteração. Como esta invenção apóia a infraestrutura de negociação mundial segura, ela está se tornando cada vez mais importante nos mercados de criptomoedas.

Esses desenvolvimentos técnicos tornaram os livros de pedidos mais dinâmicos e receptivos, dando aos comerciantes que anteriormente não são ouvidos dos movimentos do mercado. Antecipando as mudanças no mercado e a melhoria das técnicas de negociação depende de uma conscientização dessas mudanças, o que ajudará os comerciantes a permanecer competitivos no ambiente financeiro em rápida mudança de hoje.

O aprendizado de máquina e a análise de big data aprimoraram significativamente a análise de livros de pedidos. Os algoritmos de negociação movidos a IA agora podem processar grandes quantidades de dados históricos da Livro de pedidos para detectar padrões ocultos e prever movimentos de preços de curto prazo com alta precisão. Esses avanços deram origem a modelos preditivos de fabricação de mercado que otimizam a compra de lances-sprais dinamicamente, melhorando a eficiência da execução. Os comerciantes de alta frequência e os fundos de hedge confiam fortemente nessas tecnologias para obter uma vantagem competitiva na negociação em nível de microssegundos.

Considerações especiais

O livro de pedidos possui limitações substanciais, mesmo que seja para melhorar a abertura nos mercados financeiros. Muitas atividades de negociação institucional ocorrem em "piscinas escuras", locais de comércio confidencial, onde grandes investidores institucionais podem comprar e vender títulos sem divulgar suas intenções ao mercado em geral até que a venda seja concluída. Pools escuros permitem que esses investidores realizem transações significativas com pouco efeito nos preços do mercado, pois mostrar essas grandes ordens nos mercados públicos causariam manipulação de preços ou negociação antecipada que possa reduzir o possível valor de seus negócios.

No entanto, os Dark Pools limitam a utilidade do livro de pedidos porque os dados de troca pública não representam totalmente a oferta e a demanda reais por uma segurança específica. Essa falta de visibilidade pode obscurecer movimentos ou tendências potenciais de preços que os comerciantes poderiam detectar apenas a análise dos dados da lista de pedidos públicos.

As piscinas escuras desempenham um papel significativo nas negociações modernas, representando uma porcentagem substancial do volume diário nos principais mercados. Enquanto eles fornecem benefícios como derrapagem reduzida de preço e anonimato para investidores institucionais, eles também apresentam preocupações com a transparência de preços. Alguns reguladores impuseram regras para limitar a atividade escura do pool ou exigir relatórios de dados pós-negociação para garantir a concorrência justa do mercado. Além disso, os comerciantes usam ordens de iceberg - onde apenas uma pequena parte da ordem total é visível - para navegar nos desafios da liquidez ao executar grandes negociações.

Utilidade para comerciantes

Para os comerciantes, especialmente os envolvidos em alta frequência ou negociação diurna, o livro de pedidos é, no entanto, um instrumento inestimável, apesar de suas restrições. A profundidade da informação no livro de pedidos ajuda os comerciantes a fazer seleções sábias, dependendo da análise completa do mercado.

Profundidade e estratégia de mercado

Saber como os pedidos de compra e venda são distribuídos em muitos níveis de preços, ajuda os comerciantes a avaliar a liquidez do mercado, detectar possíveis perspectivas de negociação e alterar suas abordagens. Os spreads apertados de bid-sprais, por exemplo, apontam para uma grande liquidez e inspiram técnicas de negociação agressivas. Por outro lado, spreads mais amplos podem exigir cautela e práticas comerciais mais conservadoras.

Insights de suporte e resistência

Revelando aglomerados de pedidos de compra e venda a determinados preços, o livro de pedidos pode fornecer aos comerciantes informações vitais sobre os níveis de apoio e resistência. Saber onde a pressão importante de compra ou venda está focada pode permitir que os comerciantes modificem seus planos de negociação e provenientes de reversões de mercado ou padrões de continuação do projeto.

Sentimento de mercado de curto prazo

A análise dos desequilíbrios da ordem fornece aos traders uma visão imediata do sentimento de mercado de curto prazo. Um excesso de pedidos de compra sobre ordens de venda geralmente sugere impulso de alta, enquanto muitos pedidos de venda podem indicar sentimentos de baixa. Esses dados podem ajudar os traders a determinar suas negociações de maneira eficaz.

Para aqueles que procuram uma vantagem competitiva no ambiente de negociação em ritmo acelerado de hoje, as informações oferecidas pelo livro de Ordem Pública ainda são muito vitais, mesmo que o advento de piscinas escuras e outras plataformas de negociação privada apresente obstáculos. É uma ferramenta básica para o desenvolvimento de estratégias de negociação estratégicas e obtenção de uma melhor compreensão do comportamento do mercado.

Impactos regulatórios nos livros de pedidos

A transparência e a estrutura dos livros de pedidos foram bastante alterados pelos desenvolvimentos regulatórios. Por exemplo, a adoção européia dos mercados na Diretiva de Instrumentos Financeiros (MIFID II) procurou aumentar a concorrência e a abertura do local de negociação. Essa diretiva exigiu relatórios mais detalhados sobre transações e ampliava o escopo dos locais que devem manter livros de pedidos abrangentes, aprimorando a integridade do mercado.

Aplicando um conjunto padrão de regulamentos para negociação de ações, o Sistema Nacional de Mercado Regulamentado (REG NMS) exigiu a publicação pública da melhor oferta e pedindo preços nas trocas nos Estados Unidos. Ele também estabeleceu um regulamento "comércio" que proíbe os revendedores de cumprir ordens a preços mais pobres do que a melhor oferta e oferta nacional (NBBO). Esses regulamentos garantem que os livros de pedidos reflitam uma imagem verdadeira e justa da liquidez do mercado e da descoberta de preços.

No entanto, os requisitos regulatórios também levaram certas atividades comerciais a locais alternativos, como piscinas escuras, onde grandes transações podem ocorrer fora dos olhos do público. Como resultado, os reguladores devem equilibrar a transparência e fornecer um mercado privado e eficiente para os comerciantes institucionais.

Para os comerciantes, conhecer o ambiente regulatório em torno dos livros de pedidos é essencial, pois afeta o acesso à liquidez, qualidade da execução comercial e desempenho geral do mercado. Manter o conhecimento desses princípios ajuda os comerciantes a modificar seus planos e aproveitar as possibilidades, continuando a aderir às regras do mercado.

Encomendar livros em diferentes mercados

Nem todos os mercados exibem livros de pedidos da mesma maneira.

Ações (ações)

- Livros de pedidos centralizados gerenciados por trocas (NYSE, LSE).

- Altamente regulamentado e claro (Reg nms nos EUA, MiFID II na UE).

- Melhor usado para examinar diretamente a liquidez e a propagação.

Forex (moedas)

- Nenhum livro de pedidos centrais (mercado descentralizado).

- Liquidez extraída de bancos, corretores e ECNs (redes de comunicação eletrônica).

- Os comerciantes veem apenas a liquidez combinada dos LPs de seus corretores.

Criptomoedas

- As trocas centralizadas (Binance, Coinbase) usam CLOBs (Livros de Ordem Limitada Central).

- As trocas descentralizadas (DEXs) podem utilizar livros de pedidos baseados em blockchain ou criadores de mercado automatizados (AMMS).

- Altos níveis de transparência, mas lógica diferente de correspondência de ações/forex.

| Mercado | Tipo de livro de pedidos | Transparência | Principais recursos |

| Ações | Centralizado (CLOB) | Alto | Regulamentado, baseado em troca |

| Forex | Agregado (ECNs) | Médio | Nenhum livro, liquidez fragmentada |

| Cripto | Centralizado e descentralizado | Misturado | Cex = clob, DEX = AMM ou baseado em blockchain |

Nos mercados de criptomoedas, o tamanho nem sempre é igual a liquidez. Um token pode parecer grande no valor de mercado, mas negociar pouco em apenas alguns locais com profundidade superficial. É uma falácia perigosa para quem pensa que o valor de mercado é uma métrica de liquidez. Pesquisa Kaiko Destaques essas desconexões, aqui os tokens Leo e o WBTC classificam o tamanho, mas com pouca liquidez por ordens de magnitude, reforçando a necessidade de examinar o livro do pedido, em vez de os números de manchete.

Conclusão

Mais do que apenas um conjunto de números, o livro de pedidos é uma ferramenta dinâmica que reflete o humor em tempo real dos compradores e vendedores do mercado, demonstrando, portanto, dinâmica de oferta e demanda a qualquer momento. No cenário de comércio financeiro, um livro de pedidos é uma ferramenta necessária, pois oferece uma visão completa das prováveis mudanças futuras de preços, permitindo que os comerciantes planejem com mais sucesso.

Atualizado:

9 de setembro de 2025