วิธีการซื้อขายไบนารีออปชั่น: คู่มือฉบับสมบูรณ์

เนื้อหา

สรุปผู้บริหาร: ตัวเลือกไบนารีโดยย่อ

- พวกเขาคืออะไร: หนึ่งในรูปแบบของการซื้อขายที่คุณวางเดิมพันว่าราคาของสินทรัพย์จะสูงขึ้นหรือต่ำลงในเวลาหมดอายุที่เฉพาะเจาะจง

- พวกเขาทำงานอย่างไร: คงที่ผลตอบแทน (ปกติ 70–90%) ถ้าเป็นเช่นนั้น; สูญเสียการเดิมพัน 100% ถ้าไม่

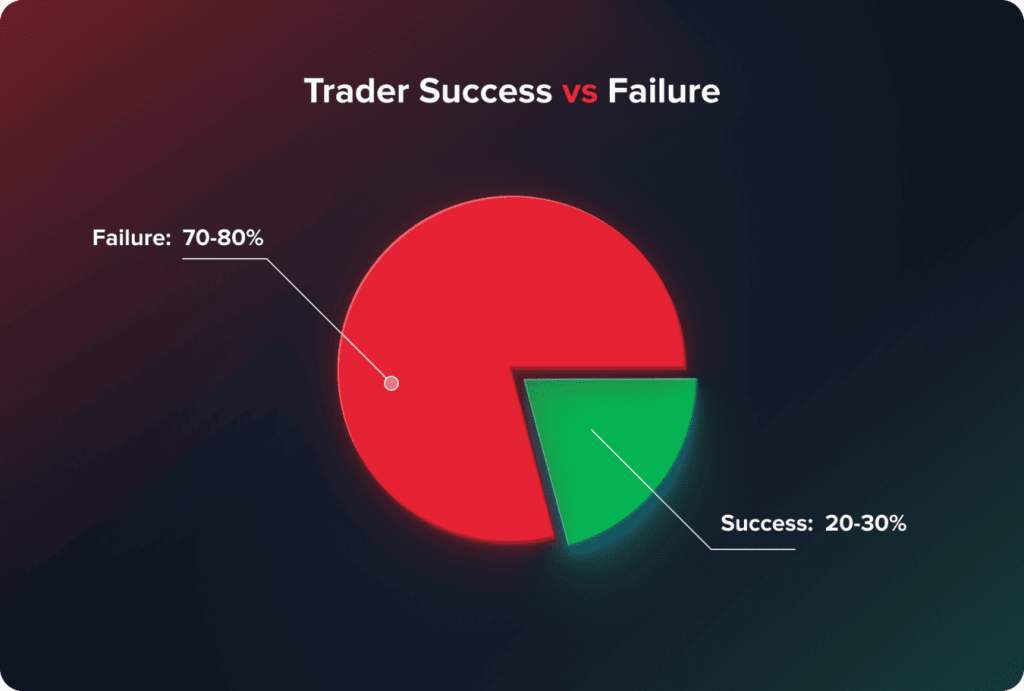

- ความเสี่ยงที่สำคัญ: ความเสี่ยงของการสูญเสียเงินอย่างรวดเร็วเนื่องจากช่วงเวลาสั้น ๆ และทั้งหมดหรือไม่มีอะไรเลย ประมาณ 70% ของผู้ค้าปลีกแพ้

- คำแนะนำขนาดกัดสำหรับผู้มาใหม่:

- เริ่มต้นในบัญชีสาธิตก่อนที่จะเสี่ยงเงินจริง

- ใช้การหมดอายุที่ยาวนานขึ้น (1-4 ชั่วโมง) เพื่อลดเสียงรบกวน

- การค้ากับแนวโน้มแทนที่จะพยายามคาดการณ์ทิศทางของตลาด

- อย่าเสี่ยงมากกว่า 2% ของบัญชีของคุณในการซื้อขายเดียว

ตัวเลือกไบนารีคืออะไร?

คิด ตัวเลือกไบนารี เป็นเงินเดิมพันที่มีเพียงสองผลลัพธ์ คุณคาดการณ์ว่าราคาของสินทรัพย์ทุนจะสูงกว่าหรือต่ำกว่าราคาที่ระบุเมื่อหมดอายุตัวเลือก คุณไม่ได้เป็นเจ้าของสินทรัพย์อย่างที่คุณต้องการเมื่อคุณซื้อขายตามปกติ - คุณเดิมพันการเคลื่อนไหวของราคาเท่านั้น

เราสามารถเพิ่มกล่องไฮไลต์ได้ที่นี่ (สไตล์การมองเห็น) ใต้อินโทรด้วยชื่อเช่นตัวเลือกไบนารีใน 30 วินาทีและเนื้อหาเช่น

- ทำนายการเคลื่อนไหวของราคาสินทรัพย์ภายในเวลาที่กำหนด

- การจ่ายเงินคงที่มักจะ 60-90%

- หมดอายุสั้น ๆ : นาทีถึงชั่วโมง

- ความเสี่ยง: คุณสามารถสูญเสียสัดส่วนการลงทุนได้ 100% ในการซื้อขายเดียว

- ผู้เริ่มต้นควรเริ่มต้นด้วยบัญชีสาธิตและกลยุทธ์การติดตามแนวโน้ม

จากการสำรวจของอุตสาหกรรมพบว่าประมาณ 72% ของผู้ค้ารายใหม่สูญเสียเงินในช่วงสามเดือนแรกของการซื้อขายในตัวเลือกไบนารี เหตุผลหลักรวมถึงการขาดกลยุทธ์ที่มีความคิดดีการซื้อขายทางอารมณ์และความล้มเหลวในการปฏิบัติตามกฎของการจัดการความเสี่ยง

ตัวเลือกกับตัวเลือกไบนารี

| คุณสมบัติ | ตัวเลือกดั้งเดิม | ตัวเลือกไบนารี |

| กรรมสิทธิ์ของสินทรัพย์ | ใช่ | ไม่การทำนายราคาเท่านั้น |

| โครงสร้างการจ่ายเงิน | ตัวแปร | แก้ไขทั้งหมดหรือไม่มีอะไร |

| การหมดอายุ | วันต่อเดือน | ไม่กี่วินาทีถึงชั่วโมง |

| ความซับซ้อน | สูงกว่า | ต่ำกว่า (เดิมพันทิศทางง่าย) |

| โปรไฟล์เสี่ยง | ถูก จำกัด | สัดส่วนการถือหุ้นทั้งหมดที่มีความเสี่ยง |

คุณสมบัติที่สำคัญที่แยกออกจากกัน

ตัวเลือกไบนารีทำงานแตกต่างจากเครื่องมือทางการเงินอื่น ๆ :

- คืนค่าคืน:คุณเรียนรู้ว่าคุณจะชนะมากแค่ไหนก่อนที่คุณจะทำการค้าจริง

- ผลลัพธ์ทั้งหมดหรือไม่มีอะไร:ไม่ว่าคุณจะกู้คืนสิ่งที่คุณชนะหรือสูญเสียทุกอย่าง

- ระยะเวลาอันสั้น:ตัวเลือกหมดอายุในนาทีหรือชั่วโมง

- การตัดสินใจง่าย:เพียงเลือก "สูงกว่า" หรือ "ต่ำกว่า"

แต่อย่าสับสนง่ายๆด้วยง่าย ตลาดการเงินมีความซับซ้อนและแม้แต่ผู้ค้าที่มีประสบการณ์ก็ต้องดิ้นรนเพื่อทำกำไรอย่างสม่ำเสมอ

ตัวเลือกไบนารีใช้งานได้จริงอย่างไร?

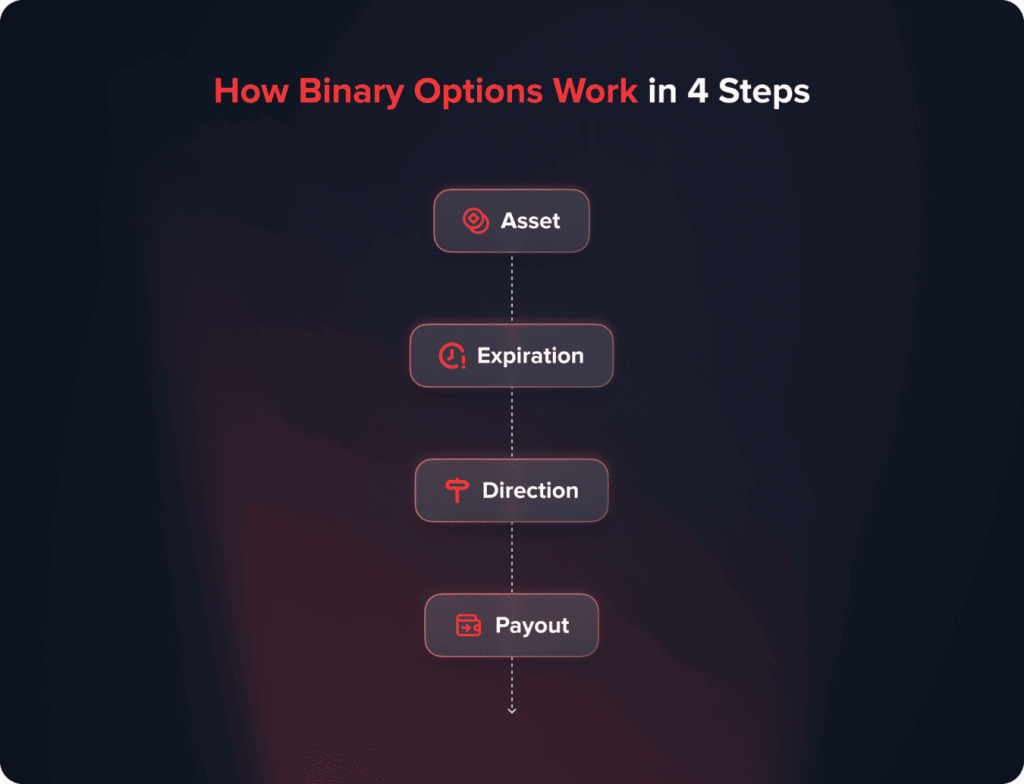

เมื่อคุณวางเดิมพันตัวเลือกไบนารีคุณจะเรียกภาพว่าการกระทำราคาในอนาคตจะเป็นอย่างไร นี่คือวิธีที่มันเกิดขึ้นทีละขั้นตอน:

รายละเอียดของกระบวนการซื้อขาย

ขั้นตอนที่ 1: เลือกสินทรัพย์ของคุณ

ก่อนอื่นคุณมีหุ้นสกุลเงินสินค้าโภคภัณฑ์หรือดัชนีให้เลือก EUR/USD, Gold, Apple Stock หรือ S&P 500 เป็นรายการโปรด สินทรัพย์แต่ละรายการมีพฤติกรรมของมันดังนั้นการตระหนักถึงวิธีการของพวกเขาจะช่วยเพิ่มอัตราความสำเร็จของคุณ

ขั้นตอนที่ 2: เลือกเวลาหมดอายุของคุณ

สิ่งนี้จะกำหนดว่าการทำนายของคุณจะถูกนำไปทดสอบเมื่อใด อาจอยู่ระหว่าง 60 วินาทีและไม่กี่ชั่วโมง ช่วงเวลาที่สั้นกว่าให้ผลลัพธ์ที่รวดเร็ว แต่เพิ่มความผันผวนจากเสียงรบกวนของตลาด

ขั้นตอนที่ 3: เลือกทิศทางของคุณ

- ตัวเลือกการโทร:คุณคาดหวังว่าราคาจะสูงขึ้นเมื่อหมดอายุ

- ใส่ตัวเลือก:คุณคาดหวังว่าราคาจะต่ำกว่าเมื่อหมดอายุ

ขั้นตอนที่ 4: กำหนดจำนวนเงินการลงทุนของคุณ

โบรกเกอร์ส่วนใหญ่มีข้อกำหนดการลงทุนขั้นต่ำ $ 10-25 โปรดทราบว่าคุณสามารถสูญเสียสิ่งเหล่านี้ทั้งหมดในการค้าเพียงครั้งเดียว

กระบวนการจ่ายเงิน

หากการเดาของคุณถูกต้องคุณจะได้รับการลงทุนครั้งแรกและกำไรที่ตกลงกันไว้ ถ้าไม่คุณสูญเสียทุกสิ่งที่คุณลงทุนในการค้านั้นโดยเฉพาะ สมมติว่าคุณเดิมพัน $ 100 ใน EUR/USD ด้วยผลตอบแทน 80% หากถูกต้องคุณจะได้รับคืน $ 180 ($ 100 เริ่มต้น + กำไร $ 80) หากไม่ถูกต้องคุณจะสูญเสีย $ 100 ทั้งหมด

ตัวเลือกไบนารีประเภทไหน?

ความคุ้นเคยกับประเภทต่าง ๆ ทำให้ง่ายต่อการจับคู่กลยุทธ์กับสภาวะตลาดที่แตกต่างกัน

ตัวเลือกสูง/ต่ำ (พบมากที่สุด)

การเดิมพันง่าย ๆ เหล่านี้เป็นเพียงคำถามว่าราคาจะสูงขึ้นหรือต่ำกว่าที่หมดอายุกว่าที่อยู่ในปัจจุบันหรือไม่ พวกเขาจะถูกนำไปใช้อย่างมีประสิทธิภาพมากที่สุดเมื่อคุณมีความคิดเห็นในทิศทางที่มีความเชื่อมั่นสูงเกิดจากการวิเคราะห์ของคุณ

ตัวเลือกการสัมผัส/ไม่มีการสัมผัส

คุณเดิมพันว่าราคาจะถึงระดับหนึ่งก่อนหมดอายุหรือไม่ สิ่งเหล่านี้มีประสิทธิภาพในช่วงเวลาที่บ้าคลั่งเมื่อคุณเห็นการเคลื่อนไหวของราคาป่ามา แต่ยังไม่ชัดเจนในทิศทางในที่สุด

ตัวเลือกช่วง

พวกเขายังเป็นที่รู้จักกันในชื่อตัวเลือกขอบเขตและคำถามเหล่านี้ไม่ว่าราคาจะอยู่ภายในหรือข้ามนอกขอบเขตที่ตั้งไว้ก่อนหน้านี้ พวกเขาดีที่สุดสำหรับตลาดที่มีขอบเขตที่มีระดับการสนับสนุนและการต่อต้านที่ชัดเจน

ตัวเลือกหนึ่งนาที

การซื้อขายที่สั้นมากเหล่านี้มีเวลาเพียง 60 วินาทีในการหมดอายุ ในขณะที่ชื่อฟังดูน่าตื่นเต้นพวกเขาถูกควบคุมโดยเสียงรบกวนของตลาดป่าแทนที่จะวิเคราะห์ผลกำไร ผู้ค้ามืออาชีพส่วนใหญ่หลีกเลี่ยงพวกเขา

เคล็ดลับเกี่ยวกับวิธีเลือกนายหน้าตัวเลือกไบนารีของคุณ

การเลือกนายหน้าของคุณมีความสำคัญต่อความสำเร็จในการซื้อขายของคุณ น่าเศร้าที่ธุรกิจนี้ดึงดูดผู้ประกอบการหลบมากกว่าที่ควรจะเป็นดังนั้นการวิจัยจึงเป็นสิ่งสำคัญยิ่ง

กฎระเบียบมีความสำคัญมากกว่าการตลาด

ก่อนอื่นให้ตรวจสอบการปฏิบัติตามกฎระเบียบ โบรกเกอร์ที่มีชื่อเสียงมีใบอนุญาตจากหน่วยงานกำกับดูแลเช่น CYSEC (สำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์ไซปรัส), FCA (หน่วยงานกำกับดูแลทางการเงิน) และ CFTC (คณะกรรมาธิการการซื้อขายสินค้าโภคภัณฑ์ฟิวเจอร์ส) เว็บไซต์จำนวนมากทำงานโดยไม่มีกฎระเบียบที่เพียงพอ ตรวจสอบการพิมพ์ขนาดเล็กและยืนยันการยืนยันกฎระเบียบอย่างอิสระเสมอ

คุณสมบัติแพลตฟอร์มที่ควรพิจารณา

นี่คือเครื่องมือที่ต้องมีสำหรับแพลตฟอร์มใด ๆ ที่คุณต้องการพิจารณา:

- แผนภูมิหลายสกุลเงินแบบเรียลไทม์

- ฟีดปฏิทินเศรษฐกิจ

- การซื้อขายมือถือ

- เข้าถึงบัญชีสาธิต

การเปรียบเทียบการจ่ายเงิน

ตรวจสอบให้แน่ใจว่าคุณเปรียบเทียบอัตราการจ่ายเงินของโบรกเกอร์ อัตราการจ่ายเงินที่สูงขึ้นโอกาสในการทำกำไรของคุณจะดีขึ้น แต่ระวังแพลตฟอร์มที่มีแนวโน้มว่าอัตราการจ่ายเงินที่ดีเกินกว่าจะเป็นจริงมากกว่า 95%-มักจะมีการจับที่เกี่ยวข้อง

ระวังเว็บไซต์ที่มีการโฆษณาเปอร์เซ็นต์การจ่ายเงินสูงผิดปกติ ในขณะที่การรับประกันผลตอบแทนมากกว่า 90% การทดสอบภายในแสดงแสดงให้เห็นว่าการจ่ายเงินจริงตามมาตรฐานหลังจากเงื่อนไขจะถูกนำไปใช้โดยทั่วไปจะอยู่ในช่วง 70% -85% มากกว่านั้นมักจะเชื่อมโยงกับข้อ จำกัด ลับหรือเงื่อนไขของข้อเสียทางการค้า

ความหลากหลายของสินทรัพย์

ค้นหาโบรกเกอร์ที่มีตัวเลือกการซื้อขายที่หลากหลาย:

- การจับคู่สกุลเงินที่สำคัญ (EUR/USD, GBP/USD)

- หุ้นที่จัดตั้งขึ้น (Apple, Google, Microsoft)

- สินค้า (ทองคำ, น้ำมัน, เงิน)

- ดัชนีทั่วโลก (S&P 500, NASDAQ)

กลยุทธ์การซื้อขายที่พิสูจน์แล้วสำหรับการซื้อขายตัวเลือกไบนารี

การคาดเดาการสุ่มจะไม่ทำให้คุณประสบความสำเร็จในตัวเลือกไบนารี แต่คุณต้องการกลยุทธ์ที่เป็นระบบตามการวิเคราะห์ตลาด นี่คือกลยุทธ์ที่ได้รับการพิสูจน์แล้วว่าคุณสามารถนำมาใช้

แนวโน้มตามกลยุทธ์

กลยุทธ์นี้ใช้ประโยชน์จากแนวโน้มราคาที่ขยายออกไปในทิศทางเดียว แนวโน้มมีแนวโน้มที่จะคงอยู่เมื่อเริ่มต้นทำให้เป็นกลยุทธ์ที่เป็นประโยชน์

ขั้นตอนการใช้งาน:

- ระบุแนวโน้มที่คมชัดโดยใช้ค่าเฉลี่ยเคลื่อนที่

- ซื้อตัวเลือกการโทรในระหว่างแนวโน้มขาขึ้นให้เลือกตัวเลือกระหว่างแนวโน้มขาลง

- ใช้เวลานานในการหมดอายุเพื่อหลีกเลี่ยงเสียงรบกวนของตลาด

- ยืนยันแนวโน้มด้วยตัวบ่งชี้ปริมาณ

ตลาดที่ดีที่สุด:ดัชนีและคู่สกุลเงินมีแนวโน้มที่จะแสดงพฤติกรรมที่มีแนวโน้มที่แข็งแกร่ง

กลยุทธ์การสนับสนุนและการต่อต้าน

ระดับที่สินทรัพย์ได้กลับทิศทางก่อนหน้านี้เป็นโอกาสทางการค้าที่ยอดเยี่ยม ระดับดังกล่าวเป็นระดับจิตวิทยาสำหรับผู้เข้าร่วมตลาด

กระบวนการตั้งค่า:

- ทำเครื่องหมายการสนับสนุนที่สำคัญและระดับความต้านทานในแผนภูมิของคุณ

- ดูการดำเนินการราคาในระดับเหล่านี้

- ซื้อตัวเลือกใส่ในระดับความต้านทาน

- ซื้อตัวเลือกการโทรในระดับสนับสนุน

- ใช้หมดอายุปานกลาง (30-60 นาที)

จุดวิกฤต:รอสัญญาณการปฏิเสธที่ชัดเจนเพื่อเข้าสู่การซื้อขาย การทำลายล้างที่ผิดพลาดมีแนวโน้มที่จะเปลี่ยนการตั้งค่าที่ทำกำไรให้กลายเป็นความสูญเสีย

กลยุทธ์การซื้อขายข่าว

รายงานข่าวทางเศรษฐกิจและการประกาศของ บริษัท สร้างความผันผวนของตลาดทันที ผู้ค้าที่มีความชำนาญวางตำแหน่งตัวเองเพื่อทำกำไรจากเหตุการณ์ที่วัดได้เหล่านี้

เหตุการณ์สำคัญที่จะดู:

- Federal Reserve ประกาศ

- รายงานการจ้างงาน

- การเผยแพร่รายได้ขององค์กร

- การพัฒนาทางการเมือง

ความลับในการดำเนินการ:

- ดูปฏิทินเศรษฐกิจ

- เข้าสู่การซื้อขายทันทีเมื่อมีข่าวประชาสัมพันธ์

- ใช้วันหมดอายุสั้น ๆ เพื่อจับภาพการเคลื่อนไหวครั้งแรก

- อย่าแลกเปลี่ยนเมื่อรู้สึกถึงความผันผวนทางการเมือง

You may also like

วิธีจัดการความเสี่ยงในการซื้อขายตัวเลือกไบนารี

ลักษณะทั้งหมดหรือไม่มีอะไรของตัวเลือกไบนารีทำให้ การบริหารความเสี่ยง จำเป็นต้องวางแผน หากไม่มีการจัดการเงินที่เหมาะสมแม้แต่ระบบที่ชนะก็จะทำลายบัญชีของคุณ

กฎ 2%

อย่าเสี่ยงมากกว่า 2% ของบัญชีการซื้อขายของคุณในการซื้อขายเพียงครั้งเดียว สิ่งนี้จะช่วยให้คุณต้องทนต่อการสูญเสียริ้วโดยไม่ต้องพัง

ในโลกจำลองที่ทุกอย่างอยู่ภายใต้การควบคุมผู้ค้าที่ต่อยอดความเสี่ยงของพวกเขาไม่เกิน 2% ของส่วนของบัญชีต่อการค้ารอดชีวิตจากการสูญเสียการวิ่งนานกว่าผู้ที่เสี่ยง 10% หรือมากกว่า เวลาพิเศษเพื่อความอยู่รอดมักจะเป็นความแตกต่างระหว่างการกู้คืนในภายหลังและเป่าบัญชีออก

ตัวอย่าง: ในบัญชี $ 1,000 จำกัด การซื้อขายแต่ละรายการให้สูงสุด $ 20

เทคนิคการควบคุมอารมณ์

ตัวเลือกไบนารีมีความต้องการทางอารมณ์เนื่องจากพวกเขามีความเสี่ยงอย่างรวดเร็วและมีความเสี่ยงสูง ผู้ค้าที่มีประสบการณ์ใช้เทคนิคในการจัดการแรงกดดันทางจิตวิทยาดังกล่าว

หลุมอารมณ์ทั่วไป:

- Revenge Trading หลังจากขาดทุน

- ความมั่นใจมากเกินไปหลังจากชนะ

- กลัวที่จะพลาด (FOMO)

- เพิ่มการเดิมพันเมื่อพยายามไล่ล่าการสูญเสีย

การแก้ปัญหาเชิงปฏิบัติ:

- กำหนดขีด จำกัด การสูญเสียรายวันและยึดติดกับพวกเขา

- หยุดพักบังคับหลังจากการซื้อขายทางอารมณ์

- เก็บบันทึกการซื้อขายอย่างละเอียด

- ทำแบบฝึกหัดการจัดการความเครียด

เทคนิคการกระจายความเสี่ยง

- การกระจายเวลา:กระจายการซื้อขายในช่วงเวลาหมดอายุที่แตกต่างกันเพื่อลดความเสี่ยงด้านเวลา

- การกระจายสินทรัพย์:การค้าสินทรัพย์ที่ไม่เกี่ยวข้องหลายรายการเพื่อลดผลกระทบเฉพาะภาค

- การกระจายกลยุทธ์:ผสมผสานกลยุทธ์ต่าง ๆ เพื่อปรับสมดุลการแกว่งประสิทธิภาพ

การวิเคราะห์ทางเทคนิคสำหรับตัวเลือกไบนารี

การวิเคราะห์แผนภูมิมีความสำคัญยิ่งกว่าในตัวเลือกไบนารีเนื่องจากข้อกำหนดด้านเวลาที่แม่นยำ คุณต้องพูดถูกเกี่ยวกับทิศทางและเวลา

ตัวบ่งชี้สำคัญ

ค่าเฉลี่ยเคลื่อนที่ (20 และ 50 ช่วงเวลา)

สิ่งเหล่านี้ช่วยระบุทิศทางของแนวโน้ม ซื้อตัวเลือกการโทรเมื่อราคาสูงกว่า ค่าเฉลี่ยเคลื่อนที่ , sell put options when below falling ค่าเฉลี่ยเคลื่อนที่.

RSI (ดัชนีความแข็งแรงสัมพัทธ์)

ตัวบ่งชี้ออสซิลเลเตอร์นี้ตรวจพบเงื่อนไขมากเกินไป (สูงกว่า 70) และเกินกว่า (ต่ำกว่า 30) เงื่อนไข มองหาความแตกต่างระหว่างราคาและ RSI สำหรับการซื้อขายกลับ

วง Bollinger

แถบความผันผวนเหล่านี้ช่วยระบุราคาสุดขั้ว เมื่อพวกเขาสัมผัสกับวงดนตรีด้านบนพวกเขาใช้ตัวเลือกใส่ เมื่อพวกเขาสัมผัสกับวงดนตรีด้านล่างให้ใช้ตัวเลือกการโทร

รูปแบบแผนภูมิที่ใช้งานได้

Pin Bars (เทียนปฏิเสธ)

เทียนหางยาวสะท้อนการปฏิเสธในระดับที่สำคัญ การค้าตรงกันข้ามกับทิศทางของแนวโน้มการซื้อขายที่มีความน่าจะเป็นสูง

ท็อปส์ซูสองเท่าและพื้น

รูปแบบการพลิกกลับโบราณเหล่านี้แสดงการเปลี่ยนแปลงที่อาจเกิดขึ้นในแนวโน้ม ท็อปส์ซูสองเท่าคือการซื้อตัวเลือกการใส่สองชั้นคือตัวเลือกการโทร

รูปแบบการฝ่าวงล้อม

เมื่อราคาแบ่งการสนับสนุนที่สำคัญหรือการต่อต้านด้วยปริมาณการยืนยันโมเมนตัมจะดำเนินต่อไปในทิศทางของการฝ่าวงล้อม

ข้อผิดพลาดทั่วไปที่ฆ่าบัญชี

มีหลายสิ่งที่จะได้รับจากการเรียนรู้จากความผิดพลาดของผู้อื่น ประหยัดเงินและความหงุดหงิดเป็นจำนวนมากโดยไม่ทำผิดพลาดผู้ค้าใหม่ที่ร้ายแรงที่สุดเหล่านี้

กลุ่มอาการของโรคที่มากเกินไป

การปรากฏตัวของตัวเลือกไบนารีดึงดูดผู้ค้าส่วนใหญ่ให้ทำการซื้อขายมากเกินไป ชัยชนะที่มีคุณภาพมากกว่าปริมาณ

สัญญาณเตือน:

- การซื้อขายโดยไม่มีการตั้งค่าที่ชัดเจน

- นำการซื้อขายออกไปจากความเบื่อหน่าย

- เปิดบ่อยขึ้นหลังจากการสูญเสีย

- ไม่สนใจกฎที่กำหนดไว้ล่วงหน้าของคุณ

วิธีแก้ปัญหา:

- กำหนดขีด จำกัด การค้าสูงสุดรายวัน

- การตั้งค่าการค้าที่มีความน่าจะเป็นสูงเท่านั้น

- มีส่วนร่วมในงานอดิเรกอื่น ๆ นอกเหนือจากการซื้อขาย

- ยึดติดกับแผนการซื้อขายของคุณอย่างกระตือรือร้น

ไม่สนใจการจัดการเงิน

ผู้ค้าส่วนใหญ่หมกมุ่นอยู่กับเปอร์เซ็นต์ของการชนะโดยไม่พิจารณาขนาดตำแหน่ง นั่นคือตรรกะย้อนกลับที่นำไปสู่การทำลายบัญชี

คุณสามารถทำกำไรได้ด้วยเปอร์เซ็นต์การชนะ 45% หากคุณฝึกการจัดการเงินที่ดี อย่างไรก็ตามเปอร์เซ็นต์การชนะ 65% อาจส่งผลให้สูญเสียเงินแม้จะมีการควบคุมความเสี่ยงที่ไม่ดี

ติดตาม "ปรมาจารย์" อย่างสุ่มสี่สุ่มห้า

เว็บอิ่มตัวด้วยผู้เชี่ยวชาญที่เรียกว่าซึ่งขายสัญญาณและระบบ อย่างไรก็ตามการซื้อขายที่ประสบความสำเร็จมาจากการสร้างทักษะและความรู้ของคุณ

ธงสีแดงเพื่อหลีกเลี่ยง:

- รับประกันสัญญากำไร

- บริการสัญญาณราคาแพง

- ระบบการซื้อขาย "ลับ"

- ปฏิเสธที่จะแสดงผลลัพธ์ที่พิสูจน์แล้ว

จิตวิทยาการซื้อขายตัวเลือกไบนารี

ตัวเลือกไบนารีการซื้อขายทดสอบความทนทานทางจิตใจของคุณในระดับสูงสุดเมื่อเปรียบเทียบกับกิจกรรมทางการเงินส่วนใหญ่ ปัจจัยทางจิตวิทยาและวิธีการจัดการพวกเขาโดยทั่วไปกำหนดความสำเร็จในระยะยาว

การจัดการการสูญเสียที่หลีกเลี่ยงไม่ได้

การสูญเสียไม่สามารถหลีกเลี่ยงได้ในการซื้อขายไม่ว่าคุณจะมีทักษะเพียงใดก็ตาม วิธีที่คุณจัดการกับการสูญเสียแยกแชมป์เปี้ยนจากผู้แพ้

- โอบกอดการสูญเสียเป็นบทเรียนในการเรียนรู้

- ดูข้อผิดพลาดโดยไม่ต้องตำหนิตนเอง

- เก็บสิ่งต่าง ๆ ไว้ในมุมมองของประสิทธิภาพโดยรวม

- อย่าพยายาม "รับ" กับตลาด

สร้างความมั่นใจอย่างแท้จริง

- เริ่มต้นด้วยบัญชีตัวอย่างเพื่อพัฒนาทักษะ

- เริ่มต้นเล็ก ๆ ด้วยจำนวนเงินจริง

- เพิ่มขนาดตำแหน่งค่อยๆหลังจากผลกำไรซ้ำ ๆ

- เก็บบันทึกที่ถูกต้องเกี่ยวกับสิ่งที่ทำงาน

รักษาวินัย

- พัฒนาแผนการซื้อขายเป็นลายลักษณ์อักษร

- จัดทำรายละเอียดและเกณฑ์การออก

- ใช้การแจ้งเตือนแทนการดูแผนภูมิ

- ดำเนินการตรวจสอบประสิทธิภาพเป็นประจำ

วิธีสร้างแผนการซื้อขายสำหรับตัวเลือกไบนารี

กลยุทธ์ที่มีระเบียบวินัยแยกแยะผู้ชนะจากนักพนัน ทำตามขั้นตอนเหล่านี้เพื่อสร้างแผนการซื้อขายตัวเลือกไบนารีของคุณเอง

กำหนดความคาดหวังที่เป็นจริง

เริ่มต้นด้วยการตั้งค่าเป้าหมายรายเดือน:

- ผู้ค้ารายใหม่: ผลตอบแทนรายเดือน 5-10%

- ผู้ค้าที่มีประสบการณ์:ผลตอบแทนรายเดือน 10-15%

โปรดจำไว้ว่า: ความมั่นคงได้รับผลประโยชน์ที่น่าตื่นเต้น

มีข้อ จำกัด การยอมรับความเสี่ยง:

- ขีด จำกัด การสูญเสียรายวัน:10% ของบัญชี

- วงเงินขาดทุนรายสัปดาห์:20% ของบัญชี

บังคับให้หยุดพักหลังจากขาดทุนติดต่อกัน 5 ครั้ง

มีกรอบกลยุทธ์

การวิเคราะห์ตลาดรายวัน

- ตรวจสอบกิจกรรมปฏิทินเศรษฐกิจ

- ตรวจสอบทิศทางเทรนด์แผนภูมิรายวัน

- กำหนดพื้นที่สนับสนุน/การต่อต้านที่สำคัญ

- ฉลากโอกาสโอกาสสูง

กระบวนการดำเนินการทางการค้า:

- รอสัญญาณตรวจสอบ

- ตรวจสอบอัตราส่วนความเสี่ยง/รางวัล

- ยืนยันการยึดมั่นในขนาดตำแหน่ง

- ทำการค้ากับการหมดอายุที่กำหนดไว้

- บันทึกรายละเอียดการค้าแบบเรียลไทม์

กลยุทธ์ขั้นสูงสำหรับผู้ค้าขั้นสูง

เมื่อคุณได้เรียนรู้พื้นฐานกลยุทธ์ขั้นสูงเหล่านี้สามารถเพิ่มประสิทธิภาพการซื้อขายของคุณ

การวิเคราะห์ความผันผวน

การทำความเข้าใจความผันผวนของตลาดช่วยในการทำนายพฤติกรรมของตัวเลือกและระบุโอกาส

กลยุทธ์ความผันผวนสูง:

- ซื้อตัวเลือก Touch/No-Touch

- ใช้ระยะเวลาหมดอายุสั้น ๆ

- มุ่งเน้นไปที่สินทรัพย์ตามข่าว

กลยุทธ์ความผันผวนต่ำ:

- ตัวเลือกช่วงการซื้อ

- ใช้ระยะเวลาหมดอายุที่ยาวนาน

- มุ่งเน้นไปที่สินทรัพย์ที่มีเสถียรภาพและมีแนวโน้ม

การซื้อขายสหสัมพันธ์

สินทรัพย์บางอย่างเคลื่อนไหวในรูปแบบปกติที่เกี่ยวข้องกับกันและกันโดยเสนอโอกาสที่ไม่ซ้ำกัน

สหสัมพันธ์ทั่วไป:

- EUR/USD และ GBP/USD (บวก)

- USD/JPY และทอง (ลบ)

- ราคาน้ำมันและหุ้นพลังงาน (บวก)

การดำเนินการ:

- ตรวจสอบค่าสัมประสิทธิ์สหสัมพันธ์

- มองหาชั่วคราวชั่วคราว

- SWAP คาดว่าจะมีการบรรจบกัน

You may also like

บทสรุป

ตัวเลือกไบนารีเป็นวิธีที่ยอดเยี่ยมในการเพิ่มโอกาสในตลาดการเงิน แต่มันไม่ใช่แค่เงินง่ายๆ มันต้องมีวินัยความรู้ที่ถูกต้องและการอุทิศตน ด้วยความเข้าใจที่ถูกต้องเกี่ยวกับพลวัตของตลาดและจิตวิทยาที่เหมาะสมคุณสามารถใช้ประโยชน์จากช่องทางการค้าที่ไม่เหมือนใครได้มากที่สุดในเวลาไม่นาน

FAQ

ใช่ แต่ยากมาก โครงสร้างความเสี่ยง/ผลตอบแทนคงที่และผลประโยชน์ทางคณิตศาสตร์สำหรับโบรกเกอร์ทำให้เกิดความท้าทายที่มีผลกำไร ผู้ค้าส่วนใหญ่เสียเงินโดยเฉพาะสามเณร เริ่มต้นด้วยเงินที่คุณเต็มใจที่จะสูญเสียทั้งหมด ในขณะที่ขั้นต่ำมีแนวโน้มที่จะอยู่ที่ $ 100-250 การเริ่มต้นที่ $ 500-1000 ช่วยให้สามารถควบคุมความเสี่ยงได้อย่างมีประสิทธิภาพขณะเรียนรู้

เริ่มต้นด้วยเทรนด์ตามกลยุทธ์โดยใช้การหมดอายุเวลาที่ใหญ่ขึ้น (1-4 ชั่วโมง) สิ่งนี้จะช่วยลดเสียงรบกวนของตลาดและให้การวิเคราะห์ของคุณในการดำเนินการ หลีกเลี่ยงตัวเลือก 60 วินาทีในขั้นต้น

ความแตกต่างระหว่างการซื้อขายและการพนันเป็นหน้าที่ของวิธีการของคุณ การเก็งกำไรที่ไม่คิดคือการพนัน การศึกษาอย่างเป็นระบบที่มีการจัดการความเสี่ยงที่ดีคือการซื้อขาย แต่เป็นสิ่งที่มีความเสี่ยงอย่างยิ่ง

อัปเดต:

4 กันยายน 2568