What is DMA (Direct Market Access)?

Contents

Direct Market Access (DMA) is a trading method that facilitates direct access for market participants to send orders directly to an order book at a financial exchange without the need for intervention from a broker.

DMA is important as ever in the modern-day trading environment because it offers:

- Faster execution, which is essential for high-frequency and intraday trading strategies

- Transparency of real-time market depth and pricing

- More control over the parameters of your trades, including timing

This trading method is frequently leveraged by hedge funds, algorithmic traders, and skilled traders who are looking to improve performance in fast-moving markets.

Defining Direct Market Access

Direct Market Access represents a groundbreaking approach in trading. It enables traders to directly input buy and sell orders into an exchanges order book. This direct pathway differs from the method where brokers mediate and execute trades on behalf of traders. This way the traders can take advantage of market conditions promptly without delays commonly associated with broker managed transactions.

The development of DMA has progressed alongside advancements in trading technology. The evolution of trading systems has not only made DMA possible but also exceptionally efficient. These systems are especially beneficial for institutional investors seeking fast and high volume trade executions. Through DMA, these investors can optimize their trading strategies effectively ensuring rapid responses to market changes.

DMA has had an impact on the markets, bringing about profound changes. It ensures that everyone, from investors to individual traders has an equal opportunity to access the market. This inclusivity plays a role in creating an fair trading environment. Additionally DMA provides traders with a view of actual market prices, enabling them to make informed decisions based on reliable market data.

You may also like

Who Uses DMA?

Direct Market Access is for traders who require fast execution with transparency and the most flexibility possible. It’s popular among professional traders or individuals who rely heavily on tech and performance instead of broker access. So, the main users are:

Institutional Traders

Hedge funds, pension funds, and asset managers use DMA to execute large size orders without the entire market knowing their intentions. Direct interaction with the order book helps reduce market impact and improve execution.

Advanced Retail Traders

Advanced individual traders in particular (those using technical analysis, or short-term strategies) select DMA for the flexibility and control it provides. Additionally, they benefit from accessing complete market depth, better prices, and selecting specific order types and routes.

Algorithmic and High-Frequency Trading Firms

For firms running automated trading operations, every millisecond is critical. Direct market access gives them access to environments where they can execute thousands of trades per second directly with exchange APIs. It is a vital component of algorithmic trading strategies.

Direct Market Access is often accessed through complex trading platforms offered by specialized brokers and institutions. Typical trading platforms integrate real-time data feeds, routing flexibility, and execution tools that are suitable for data-driven and high volume trading contexts.

How DMA Works

In essence DMA functions through electronic trading systems that operate at incredible speeds. When a trader executes an order using a DMA platform, the order is sent directly to the exchanges trading system. This direct transmission bypasses the brokerage firms desks, eliminating intermediaries and any potential delays or manual errors.

The technology behind DMA is intricate and seamlessly integrates with existing financial market structures. These systems grant traders access to real time price feeds, allowing them to monitor market depth and various market data instantly. Such immediate access is invaluable for traders who rely on short term market movements or engage in higi-frequency trading strategies. By observing the unfolding market trends in real, time they can swiftly make decisions based on the information available.

DMAs technology prioritizes not just speed but also precision. DMA enables order execution for strategies relying on specific market entry and exit points. The combination of accuracy and speed makes DMA a valuable tool for traders.

DMA is particularly useful when speed of execution is crucial. For example:

Imagine that a trader sees a sudden dip in EUR/USD after the inflation number comes out – and they can use DMA to instantly put a limit order in the order book at the exchange, which circumvents the delays associated with broker routing, and get (hopefully) filked at an instant at a certain price.

Lastly, institutional traders tend to use DMA, which is often associated with earnings reports or a central bank announcement. A hedge fund might be able to use DMA to put in multiple orders on different assets within seconds, as it is a matter of a few seconds in relation to the move in the market, and not having to wait for a broker to confirm the order.

With DMA, there is no third party to get in the way, and a trader can seize rapidly moving opportunities with greater control, faster than an alternative method, and with precision, especially during price movement induced by market impact events.

DMA vs Traditional Broker-Executed Trading

Traditional broker-executed trading and Direct Market Access are two distinct methods of entering and executing transactions in the financial markets. Let’s look at the two side by side to gain a deeper understanding of the overall process.

Execution Speed

DMA: A key benefit of DMA is its execution speed. By sending orders to the exchanges order book without passing through a brokers desk execution happens instantly. This agility proves advantageous for high frequency traders. Those aiming to capitalize on short term market fluctuations.

Traditional Broker Executed Trading: Orders pass through a broker’s desk, potentially undergoing processing especially for sizable or intricate orders. This process can introduce delays during times of heightened market activity, possibly resulting in slippage, where the order gets filled at a price than intended.

Conclusion: DMA stands out for its execution times making it the favored option for traders seeking accurate order completions, such as day traders or scalpers.

Cost Structure

DMA: Typically boasting lower transaction costs DMA eliminates the necessity for broker involvement in trade execution. Traders using DMA platforms might still encounter fees. These costs are usually balanced out by commission rates. It’s important for traders to consider the expenses related to maintaining the technology and data feeds.

Traditional Broker Executed Trading: Brokers tend to charge commissions or fees per trade, as well as other fees especially if they offer additional services like research, advice or portfolio management. These expenses can accumulate for traders who engage in a high volume of trades.

Conclusion: DMA is typically more cost effective for high volume traders who don’t need the services provided by brokers. However, for traders who value personalized assistance and guidance the higher costs associated with trading, going with a broker may be justifiable.

Transparency

DMA: DMA offers traders access to the exchanges’ order boo, allowing them to view real time bid and ask prices well as market depth. This transparency empowers traders to make decisions and gain an understanding of market dynamics.

Traditional Broker Executed Trading: Brokers often combine multiple orders before executing them on the exchange, which can obscure real time market conditions.Traders may not always have a view of the order book. Know the exact prices at which their orders will get executed.

Conclusion: DMA offers transparency, which’s vital for traders who depend on detailed market information to make informed decisions especially those utilizing technical analysis or market sentiment strategies.

Control Over Trades

DMA: Traders enjoy total control over their orders, allowing them to specify order types, timeframes and execution conditions. This level of autonomy is advantageous for traders seeking to implement strategies or ensure execution.

Traditional Broker Executed Trading: Brokers often make decisions on how and when to execute orders particularly with market orders. While this hands off approach can benefit some traders, it may pose limitations for those desiring control over their trades.

Conclusion: DMA is better suited for traders requiring control over their trading activities and strategies. Conversely traditional broker-executed trading might be preferable for traders who rely on a brokers expertise.

Accessibility Considerations

DMA: Previously DMA was mainly accessible only to investors and large hedge funds due to costs and technological demands. However, the rise of trading platforms has made DMA more reachable for traders as well, although it still requires a certain level of capital and trading expertise.

Traditional Broker Executed Trading: Traditional broker executed trading is widely available to traders at all levels from beginners to professionals. Brokers typically offer resources, research materials and support services that make it easier for novice traders to engage in the markets.

Conclusion: Although DMA has its benefits it may not suit every trader, those new to trading or those who are in need of additional support. Traditional brokers continue to cater to a much larger audience of market participants.

DMA vs. ECN vs. STP: What’s the Difference?

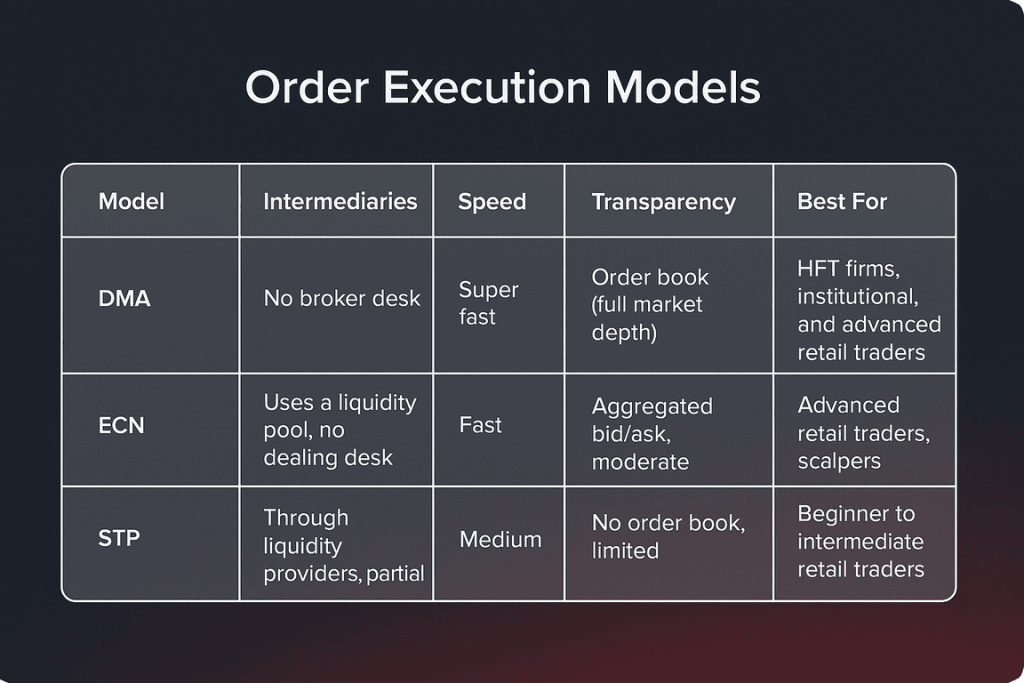

In electronic trading, the degree to which an order execution model can impact pricing, speed, and transparency issues is substantial. In addition, the implications of the order execution model can be immense in these three models – Direct Market Access (DMA), Electronic Communication Network (ECN), and Straight Through Processing (STP) – often causing confusion and interchangeability of the terms. Still, each model provides a different level of accessibility and control.

Here is a quick comparison of the three for you to have a better visual understanding:

So, you should choose:

- DMA if you want precision, transparency, and complete execution control.

- ECN if you want competitive prices and decent fills without needing to see the whole order book.

- Otherwise, STP, if you favor ease of use and do not execute complex strategies.

Benefits of Using DMA

DMA has revolutionized trading by offering benefits that enhance the trading process. From providing market insights to improving cost effectiveness, DMA caters to the needs of present day traders. Let’s delve into these advantages further to understand how DMA is transforming the trading landscape.

Increased Transparency

A key advantage of Direct Market Access is its level of transparency, evident in the direct access it provides to the market’s order book. Traders can view real time bid and ask prices along with order volumes, empowering them to make informed trading decisions and see the market dynamics. This visibility into market depth and liquidity plays a huge role for strategies centered on analyzing market sentiment and price shifts.

Swift Trade Execution

Moreover DMA is renowned for its capability to expedite trade execution smoothly. DMA enables traders to send orders to the market without involving a brokerage firms trading desk. This direct route proves beneficial in times of market volatility when prices fluctuate rapidly, allowing traders to seize opportunities in the market. The speed at which DMA executes trades plays a role in leveraging price shifts and avoiding potential slippage that slower execution methods may entail.

Reduced Transaction Costs

Furthermore DMA often proves cost effectiveness than trading approaches. By cutting out the middleman, DMA reduces transaction costs, making it an appealing option financially for traders dealing with high trading volumes. The collective impact of fees per trade can substantially boost profitability and trading efficiency for active traders.

You may also like

Control Over Trades and Reduced Manipulation

In addition to advantages DMA grants traders autonomy over their trades. They can place order types directly into the market, enabling them to align more precisely with their trading strategies and prevailing market conditions. Moreover, the diminished risk of price manipulation or bias from brokers – issues occasionally encountered in broker dealer setups – stands as another benefit of utilizing DMA. This level of control and reduced bias proves invaluable for traders seeking transparency and independence, in their trading endeavors.

Considerations and Risks of DMA

While DMA has so many beneficial uses, traders must weigh the risks and obligations that come with it. These risks and obligations range from technological requirements, to operational and compliance requirements.

Technology requirements

DMA can only be executed on a high-performance trading setup with a stable, high-speed internet connection. If a trader does not have the technology to support direct execution, the trader is at the mercy of latency, off-market execution, or an entire trading setup failure at the worst possible time (which could prevent you from seizing opportunity, or potentially losing money).

No Broker Intervention

DMA provides full autonomy to the trader. This means that any buying or selling order cannot be verified or acted upon by a broker. Having complete control presents risk after a period of time, as the risk of human error adds up (for example, entering an order that is too long when the market is in a sell-off, buying the wrong order type, or trading too large a position in a volatile market). These kinds of mistakes become incredibly costly.

Extensive Skills Required

Traders must possess substantial skill to execute DMA effectively. Specifically, in terms of understanding market depth/reading market depth, knowing anchor points to enter and exit positions correctly, and not having a broker (or a ‘middle-ground’) between you and the market when managing open positions. Therefore, the ramp-up for less-professional traders may be daunting and risky as they navigate through all of these new levels of complexity.

Market Impact Risk

Traders should be cautioned as DMA traders that if you place large trades without splitting the trade up into smaller orders using algorithms like you would with brokers, the trade itself may move the market price. The risk of a DMA trader to impact the market price may be higher if they are trading larger size orders in a low-liquidity market, making it much easier for a single large order to potentially impact the price against their position.

Regulatory Compliance

DMA involves immediate access to financial exchanges and, as such, is subject to stringent regulatory oversight. Traders are obliged to comply with regulations such as MiFID II in Europe or SEC regulations in the U.S., which govern execution quality and price transparency, reporting requirements, and how you can handle and store data. Failure to comply with those standards can lead to monetary penalties or suspension of access.

DMA Trends in 2025

As markets mature and trading technologies evolve, Direct Market Access is also changing rapidly as it addresses speed, scale, and automation. There are several trends that we see emerging in 2025 that will drive the future of DMA:

AI-Based Execution Strategies

DMA offerings are increasingly incorporating machine learning and AI-based execution algorithms to better time orders, reduce slippage, and adapt to changing liquidity conditions in real time. This means traders can automate complex decision making integration within a direct access ecosystem.

Ultra-Low Latency Infrastructure

Now more than ever, firms are spending heavily on zero-latency connectivity, exchange co-location, and ultra-fast market data. Real-time event processing means that the longer the time taken from signal to execution, the less DMA users can take advantage of high frequency, arbitrageurs, and other trading strategies.

Integration with Algo & API Trading

DMA platforms are now integrated with algorithmic trading engines & open APIs, enabling institutional and quantitative traders to execute at speed, scale, and flexibility.

Democratization of DMA

Essentially, hedge funds are no longer the only game in town for complex or advanced DMA functionality. Retail trading platforms increasingly offer very stripped back DMA style access, adding a degree of complexity that allows the savviest retail traders access to live order books and customizable routing.

Automation and Compliance

As regulations grow increasingly complex across the globe (for example, MiFID II and Dodd Frank, EMIR), DMA providers are building compliance-related tools directly into trading systems such as trade surveillance, trade reporting, and smart order routing with compliance reflectiveness to jurisdictional rules.

In 2025, DMA is about much more than speed – it is about smart execution, scalable infrastructure, and real-time flexibility.

Conclusion

Direct Market Access has transformed the trading arena by offering a combination of efficiency, transparency and control that aligns with the needs of traders. While it demands market knowledge and technological investment the benefits it delivers are undeniable. With the advancements, in trading technology Direct Market Access DMA serves as proof of the progress in the industry. It offers traders a means to carry out trades efficiently and taps into the opportunities presented by market trends.

FAQ

Not exactly. DMA (Direct Market Access) enables traders to send orders directly to the order books of exchanges. At the same time, ECN (Electronic Communication Network) matches buy and sell orders from multiple parties, like banks and other traders. Both move away from traditional brokers, but DMA offers more transparency, processing, and control.

Yes, advanced retail traders can access through brokers offering DMA or trading platforms, but retail accounts often need higher account balances, more trading experience, and more knowledge of order execution or routing.

DMA gives traders direct access to live market order books, while STP (Straight Through Processing) takes client orders and automatically routes trades to liquidity providers on the client’s behalf, without manual monitoring or intervention. In other words, with DMA, the transparency and control are more vested in the client’s trading, compared to using STP, which, to a greater or lesser degree, is more passive by design and automated.

There are a number of Direct Market Access brokers that service institutional clients and advanced retail traders that provide access to global exchanges, with low-latency infrastructure and access to full market depth. Some are Tier 1 institutional brokers, and others are some advanced trading platforms that offer DMA.

Updated:

April 28, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]