The Ultimate Guide to Asset Class Diversification for Brokerages

Contents

Diversification into various asset classes is an investment strategy in pursuit of maximum return for any given level of risk. For brokerages, the benefits accruable from a multi-asset diversified approach are very significant. Traditional investments include asset classes like stocks, bonds, and commodities, while new opportunities involve cryptocurrencies, digital assets, and global investment products. Offering exposure to multiple uncorrelated asset classes confers several important advantages to brokerages.

The following guide describes how leading brokerages have successfully implemented various strategies for diversification to increase market access, stabilize profits, and optimize their competitive positioning to achieve long-term success. The ultimate goal here is to illustrate exactly why offering a wide range of asset classes through a multi-asset model brings unparalleled benefits that every brokerage should undertake.

Why Brokerages Should Diversify

Diversification is a way for brokerages to attain stable and consistent growth. This section explores some of the key advantages a multi-asset approach affords.

1. Risk Management Through Diversification

Diversification among a variety of uncorrelated asset classes offsets certain risks. Against the fall in the price of some, others may appreciate balancing the overall returns. In this respect, offering mutual funds, stocks, bonds, and other digital assets spreads the risks rather than concentrates them in any single sector. Brokerages enjoy stability. Revenues become less volatile as there is always an available profitable opportunity, even in the middle of market turmoil, especially when supported by strong broker risk management strategies. Through diversification, bottom lines are protected in economic cycles.

2. Attracting a Broader Client Base

The expansion of offerings by the broker means opening the doors to investors in every category of risk-return profiles. The fractional share, for example, will enable the buying of pieces of companies or other instruments that have been hitherto out of reach due to cost. Exchanges find a new target in younger audiences, while robo-advisors cater to more passive clients. Gaps are also filled by more specific product categories, with demand for sustainable funds highlighted among the most popular trading asset classes in recent years. In servicing these needs, multi-asset brokers open themselves to their full client potential.

3. Increased Revenue Streams and Stability

With every new product, brokerages open up new sources of trading revenues from service fees or bid-ask spreads, making brokerage fees a central part of long-term profitability. Rather than relying on a single product, the multiple streams are liberated from the whims of external circumstances. Cross-selling reinforces this effect. Brokers can cross-sell complementary listings, creating more active accounts and long-term client relationships. Recurring revenues derive from growing portfolios over time. Revenue predictability also becomes far firmer. Unpredictable industry cycles buffet diversified brokers much less dramatically than their mono-focused competitors.

4. Competitive Advantage and Differentiation

Multi-asset dominance brands firms as valued one-stop shops. Institutional investors appreciate sophisticated platforms that support complex risk management across markets.

Individual clients gain loyalty, knowing that any evolving objective finds its representation. First-mover advantages accrue by pioneering upcoming sectors before mass adoption. Further on, network effects then concentrate liquidity.

5. Flexibility to Adapt to Market Changes

Fluid markets demand reinvention at every turn. Diversification prepares brokers for changing environments with flexible adjustments of exposure. To the extent that prospects open in other quarters, diversified businesses feel less stringent adaptation pressure compared to specialized operations. Flexibility guarantees continued market leadership.

In a nutshell, through such a model, each of the shifting demands of investors would be adequately met while safeguarding sustainable growth, irrespective of the independent factors. It is this resilience on which brokerage success would be built.

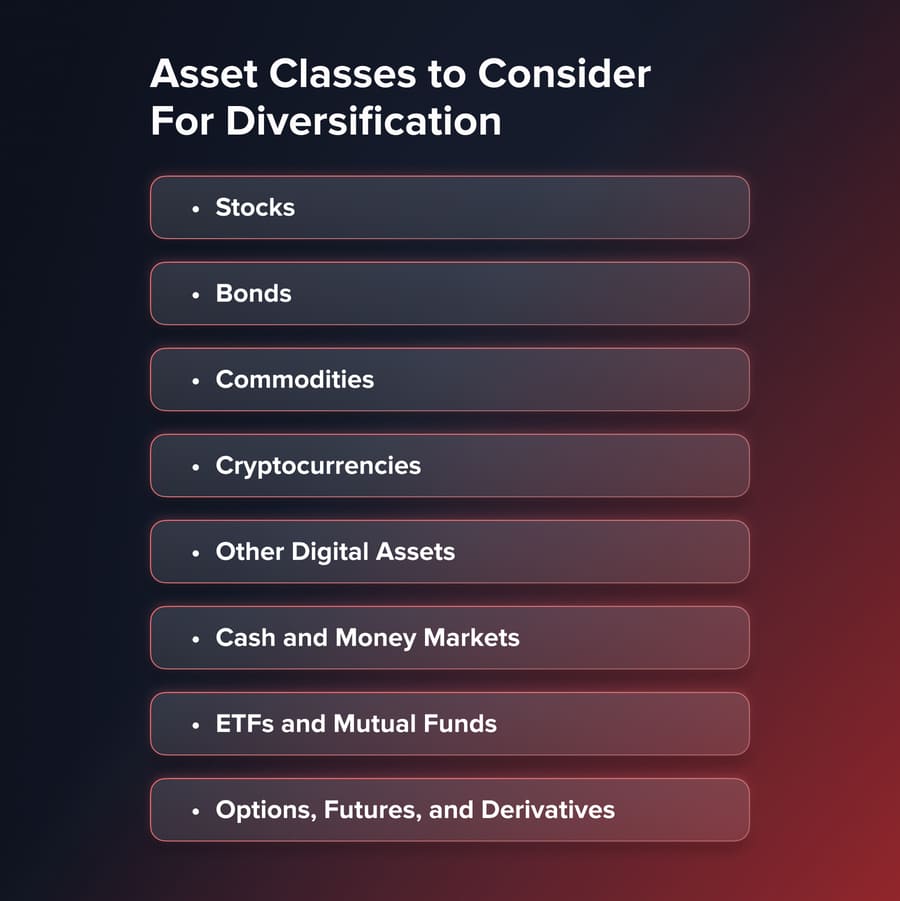

Which Asset Classes Should Brokerages Offer?

When building a diversification strategy, brokers must evaluate asset classes serving demand areas or filling identified gaps. The following merit close examination:

Stocks

- Equities offer fractional/commission-free trading and derivatives, forming the base of most effective stock trading strategies

- Industry, market cap, and international exposures

- Dividend yields, stock lending for supplementary income

Bonds

- Corporate, municipal, and sovereign debt

- Short, medium, long-term maturities

- Actively/passively managed bond funds

Commodities

- Precious metals like gold, silver

- Agriculture including corn, wheat, livestock

- Energy including crude oil, natural gas, and other segments central to energy trading

- Real estate commodities like timberland

Cryptocurrencies

- Bitcoin, Ethereum for mainstream retail

- Altcoins for experienced traders

- Stablecoins bridging traditional, digital currencies

Other Digital Assets

- Platform tokens granting network participation

- Digital art, collectibles, gaming assets

- Security tokenization of private companies

- Decentralized finance protocols

Cash and Money Markets

- Index trackers across sectors, niches

- Active/passive strategies

- Thematic/impact investment vehicles

Options, Futures, and Derivatives

- Hedging instruments across asset classes

- Leveraged/inverse ETFs for experienced traders

You may also like

Case Studies: How Leading Brokers Broke Into New Asset Classes

eToro – Early Crypto Adoption

eToro grew from equities and ETFs by introducing Bitcoin and Ethereum trading in 2017. This established the platform as a retail crypto pioneer. By 2021, crypto accounted for more than 40% of its trading revenues, supported by growing adoption of mechanisms such as liquidity pools.

Interactive Brokers – Breaking Out Into ETFs and Bonds

Interactive Brokers grew steadily from equities to world ETFs, bonds, and options. This diversification benefited the company in luring institutional customers. Today, it serves traders in over 200 countries, with net revenues of over $4 billion a year, well supported by its multi-asset platform.

Robinhood – Fractional Shares and Crypto Growth

Robinhood first made strides with commission-less equities trading, then diversified into fractional shares and crypto. The expansion resonated with young investors and surged user growth to over 23 million accounts in 2021. Offering multi-asset access set it apart in a crowded brokerage landscape.

Single-Asset vs Multi-Asset Brokerage: Key Differences

| Factor | Single-asset brokerage | Multi-asset brokerage |

| Revenue streams | Linked to one asset class (forex alone). Revenues are volatile and cyclical. | Several income streams from stocks, bonds, crypto, ETFs, and derivatives. Less volatile and predictable. |

| Client base | Thin – need to attract a particular type of trader or investor. | Broad – attracts retail traders, institutional clients, and long-term investors. |

| Risk exposure | High – performance tied to one market’s cycles. | Lower – losses in one offset by gains in another. |

| Regulatory needs | Simpler – one license, fewer compliance points. | Complex – several licenses, continuing compliance across jurisdictions. |

| Market adaptability | Limited – has difficulty when the underlying market slows. | Flexible – can pivot focus to growing sectors (crypto, ETFs, ESG funds). |

| Brand perception | Niche player – limited authority outside its core market. | One-stop shop – trusted, comprehensive, future-ready brokerage. |

How to Build a Successful Multi-Asset Brokerage

Entering the competitive financial services industry requires thorough preparation. This guide outlines the essential steps to establish a brokerage catering to clients through diversified offerings.

1. Develop a Business Plan

Clearly define short and long-term goals like client targets, services, regulatory approvals, and technology roadmaps with timelines. Highlight competitive advantages and assess resource requirements.

2. Secure Capital and Licensing

Sufficient funding supports infrastructure build-out. Research licensing is necessary per jurisdiction and asset class from forex to equities. Consult regulators for application support.

3. Select a Core Technology Platform

Advanced platforms automate trading, reporting, and risk controls. Consider integrated solutions or building customized systems in-house or with partners. Back-test system performance and security.

4. Hire a Capable Team

Assemble talented professionals across compliance, software engineering, finance, and client services. Outsource specialized functions initially and scale internal capabilities over time.

5. Roll Out Core Asset Offerings

Prioritize popular sectors supported by selected technology. Provide competitive fees, tools, and educational content. Continuously refine based on demand signals and feedback.

6. Apply for Additional Listings

Obtain relevant licenses and integrate new assets modularly as regulations permit and readiness allow. Ensure phase additions match scope and resource increases.

7. Design Trading Applications

Develop intuitive interfaces for web and mobile optimized per platform. Consolidate account management, research, order entry, and reporting. Automate workflows.

8. Provide Ancillary Services

Complement core offerings with value-adds like margin lending, robo-advisory, PAMM accounts, and third-party integrations. Generate supplementary revenues.

9. Enhance Marketing and Branding

Position the firm through various online and offline campaigns. Collaborate with key partners and affiliates. Automate lead generation and conversions.

10. Continuously Improve

Periodically assess technology, product mix, client preferences, and competitive landscape. Refine strategy, expand functionality accordingly, and scale infrastructure prudently over the long run.

This plan is very focused on a lot of preparation prior to launch and adjustments in the multi-asset brokerage evolution process. Smooth growth follows when one follows each step with due diligence in order.

You may also like

How To Implement an Asset Diversification Strategy

Careful planning is crucial to ensure diversification succeeds for brokerages. This section outlines strategic considerations for a prudent, scalable expansion.

1. Researching In-Demand Assets

The first step for brokers is to identify those promising sectors that are actually substantiated by demand signals. Surveying current clients pinpoints common interests. Competitor offerings provide other signals on favored products. New emerging technologies that demand listing bear consideration. Prioritizing lucrative synergistic additions maximizes returns on investment.

2. Obtaining Necessary Licenses and Approvals

Regulatory compliance varies a great deal between jurisdictions and asset classes. Multinational brokers have to become fully licensed to gain authorization to manage activities worldwide. Cryptocurrencies, for example, are licensed like a money service business. Applications need capital allocations which will be thoroughly scrutinized by regulators. Professional advice sorts through bureaucracy so the company can avoid red tape and costly mistakes in compliance matters. Proper due diligence saves on costly errors.

3. Infrastructure and Technology Requirements

Aggregating different holdings requires technology to bend to dynamic demands. Advanced APIs allow for the fast updating of products. Low-latency trading systems secure liquidity within markets. Robust internal architectures, such as identity management, ensure support functions for payment and reporting, irrespective of external listings. Scalable performance means frictionless user experiences with growth.

4. Integrating Payment Solutions

Choices of payment reflect client preferences influenced by region, generations, and choice of liquidity vehicle. Fiat, digital currencies, and stablecoins all merit onboarding via strategic processing partners. Selection choices are accompanied by considerations around compliance. Wrapping payment choices within platforms streamlines access to purchasing power and eliminates barriers between the investor and opportunity.

5. Operational Considerations

Knowledge pools extend in staff recruitment to match diversification scope. Representatives needed to service clients become proficient across the dispersed securities. Compliance staff must oversee rapidly multiplying regulatory touchpoints. Specialized risk controllers carefully evaluate discrete industry-specific hazards against prudent hedging. Operated divisions dedicated to discrete scopes decentralize as scope increases, too.

6. Multi-Asset Pricing and Fee Structures

Pricing impacts activity and retention. Competitive rates attract new clients. Volume-based or tiered pricing incentivizes loyalty among those customers. Transparency in fees builds trust. Bundled services reduce the client’s cost. Revisit the structures from time to time, and where practicable, model elasticity of demand to optimally price for profitability as the suite of offerings develops.

Continued measurement and refinement in structured preparation lay sound diversification foundations that will see sustainable growth.

7. Best Practices for Effective Asset Diversification

By following tested practices, brokerages can maximize benefits from diversification while mitigating risks. Careful planning in key areas helps optimize strategies for sustainable long-term growth.

8. Phased Rollout and Careful Scaling

The stepped approach introduces new assets in steps as demand is validated rather than all at once. In intervals between phases, the processes are refined according to performance metrics improvement. Measured scaling at every phase prevents overextension of resources before costs can be justified by demand. Support functions should also grow in proportion to maintain the standards while operations develop over time.

9. Monitoring Market Trends and Adjustments

Closely monitoring the analytics and surveys of their preferences allows for adjustments to demand shifts, often guided by market indicators. Quick responses to surging or falling popularity are quickly met. Poor performance in periodic additions should be revisited for replacement potential. Agility captures new opportunities, created from changing circumstances, too.

10. Educating and Onboarding Clients

The attributes of every addition are clarified by clear explanations, stating the risks and strategies for making realistic expectations. The larger context demonstrates diversification resilience. Libraries, seminars, and support make the transitions easy. New customers ease themselves into the expanded offerings.

11. Evaluating Future Opportunities

Regulation and technology monitoring reveal viable long-term sectors. Specialist hires offer market insights. Partnerships expedite complementary access, and acquisitions strengthen niche capabilities.

12. Thorough Licensing Assessments

Exhaustive research specifies licenses per jurisdiction and addition. Prudent application processes consider approval durations. Regulators receive comprehensive documentation addressing all concerns. Expert counsel provides compliant guidance.

13. Implementing Robust Risk Management

Quantitative modeling includes correlated and isolated risks. Each listing is protected with margin and position parameters. Stress tests cover hypothetical situations. Education applies a counterbalance to the forces of volatility.

Diligent adherence establishes the groundwork for optimizing diversification opportunities securely for sustainable multi-asset leadership growth. The maximum long-term benefit is ensured through ongoing refinement.

Mistakes Brokerages Should Avoid When Diversifying

Even top companies can get it wrong when venturing out to new asset classes. The following are the mistakes that usually sidetrack diversification initiatives:

1. Hurrying into Licensing

Certain brokers hurry into new markets without securing the necessary licenses. The consequences are fines, poor reputations, or even shutdowns. Due diligence by regulatory authorities always has priority.

2. Stretching Asset Classes Too Soon

Introducing all the popular products at once stretches technology, compliance, and staff too far. Phased rollout ensures quality, compliance, and smooth execution.

3. Ignoring Payment Infrastructure

Many clients close accounts when deposits and withdrawals are limited. Not integrating fiat, crypto, and local payment models introduces unnecessary friction.

4. Overestimating Simplicity of Compliance

Each jurisdiction has its regulations, and reliable KYC providers are essential to keep operations compliant at scale. Spreading across borders without a strong compliance infrastructure can overload staff and trigger costly errors.

5. Steering Clear of Client Education

Rolling out new asset classes without adequate explanation leaves clients confused and isolated. Webinars, tutorials, and in-product learning facilitate onboarding.

6. Tackling Diversification as a One-Point Task

Markets shift daily. Effective brokers are aware of the trends, exchange weak-performing products, and tweak fee arrangements to stay in sync.

Bottom Line

The advantages brought about by asset class diversification and multi-asset approaches have transformed it into an important strategy for brokerages operating with longevity in their minds. While opening various uncorrelated sectors to clients through one single, unified platform, brokerages distribute their risk while maximizing their opportunities, stabilizing their revenues, and strengthening their value proposition.

Given the transformational forces reshaping today’s financial services landscape, brokerages need to take into account their strengths and gaps and hence the strategic need to diversify thoughtfully with a longer-term view toward competitiveness, responsiveness to changing demands, and prosperity.

FAQ

The main benefit is risk reduction. By offering a number of uncorrelated asset classes, brokerages balance losses in one market with profits in another. This creates smoother revenues, draws in more diverse clients, and ensures long-term expansion in spite of turbulent cycles.

Brokers need to continue offering traditional assets like stocks and bonds while expanding into high-growth areas such as cryptocurrencies, tokenized assets, and ESG funds. These offerings respond to evolving client demand, appeal to younger investors, and position the brokerage as an innovative, competitive market player.

In fact, diversification involves upfront investment in licenses, compliance, and technology infrastructure. But the long-term benefits - more stable revenues, multiple income streams, and improved client loyalty, dwarf the costs. Brokerages that diversify properly build resilience and are better positioned to ride out industry downturns.

Regulatory risks are managed by obtaining proper licenses in each asset class and jurisdiction, hiring compliance professionals, and consulting with legal counsel. A strong compliance infrastructure allows brokers to expand offerings without interruption, avoid fines, and maintain client trust when entering new markets.

Updated:

September 23, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]