Полное руководство по диверсификации классов активов для брокерских компаний

В статье

Диверсификация в различные классы активов является инвестиционной стратегией, направленной на максимизацию доходности при любом уровне риска. Для брокерских компаний преимущества, получаемые от мульти-активного диверсифицированного подхода, являются очень значительными. Традиционные инвестиции включают классы активов, такие как акции, облигации и товары, в то время как новые возможности охватывают криптовалюты, цифровые активы и глобальные инвестиционные продукты. Предоставление доступа к нескольким некоррелированным классам активов предоставляет брокерам несколько важных преимуществ.

В следующем руководстве описывается, как ведущие брокерские компании успешно реализовали различные стратегии диверсификации для увеличения доступа к рынку, стабилизации прибыли и оптимизации своего конкурентного положения для достижения долгосрочного успеха. Основная цель здесь - показать, почему предложение широкого спектра классов активов через многоклассную модель приносит беспрецедентные преимущества, которые каждая брокерская компания должна реализовать.

Почему брокерские компании должны диверсифицироваться

Диверсификация — это способ для брокерских компаний достичь стабильного и последовательного роста. В этом разделе рассматриваются некоторые ключевые преимущества, которые предоставляет многослойный подход.

1. Управление рисками через диверсификацию

Диверсификация среди различных некоррелированных классов активов компенсирует определенные риски. На фоне падения цен на одни активы, другие могут расти, балансируя общую доходность. В этом отношении предложение взаимных фондов, акций, облигаций и других цифровых активов распределяет риски, а не концентрирует их в каком-либо одном секторе. Брокерские компании наслаждаются стабильностью. Доходы становятся менее волатильными, так как всегда есть доступная прибыльная возможность, даже в условиях рыночной нестабильности, особенно когда поддерживаются сильными стратегиями управления рисками брокеров. Благодаря диверсификации, конечные результаты защищены в экономических циклах.

2. Привлечение более широкой клиентской базы

Расширение предложений брокера означает открытие дверей для инвесторов в каждой категории рисково-доходных профилей. Фракционная акция, например, позволит покупать доли компаний или других инструментов, которые ранее были недоступны из-за высокой стоимости. Биржи находят новую целевую аудиторию среди молодежи, в то время как роботизированные консультанты обслуживают более пассивных клиентов. Пробелы также заполняются более специфическими категориями продуктов, при этом спрос на устойчивые фонды выделяется среди самых популярных классов торговых активов в последние годы. Обслуживая эти потребности, мульти-активные брокеры открывают себя для полного потенциала своих клиентов.

3. Увеличение потоков дохода и стабильности

С каждым новым продуктом брокерские компании открывают новые источники торговых доходов от сервисных сборов или спредов, что делает брокерские сборы центральной частью долгосрочной прибыльности. Вместо того чтобы полагаться на один продукт, несколько потоков освобождают от капризов внешних обстоятельств. Кросс-продажи усиливают этот эффект. Брокеры могут продавать дополнительные сопутствующие продукты, создавая более активные счета и долгосрочные отношения с клиентами. Повторяющиеся доходы возникают от роста портфелей с течением времени. Предсказуемость доходов также становится гораздо более устойчивой. Непредсказуемые циклы в отрасли менее драматично воздействуют на диверсифицированных брокеров, чем на их ориентированных на один продукт конкурентов.

4. Конкурентное Преимущество и Дифференциация

Мультиактивные доминирующие бренды компании как ценные универсальные решения. Институциональные инвесторы ценят сложные платформы, которые поддерживают комплексное управление рисками на рынках.

Индивидуальные клиенты получают лояльность, зная, что любой развивающийся объект находит свое представление. Преимущества первопроходцев накапливаются за счет освоения новых секторов до массового принятия. Далее сетевые эффекты сосредоточивают ликвидность.

5. Гибкость для адаптации к изменениям на рынке

Живые рынки требуют переосмысления на каждом шагу. Диверсификация подготавливает брокеров к изменяющимся условиям с гибкими корректировками экспозиции. Поскольку возможности открываются в других сегментах, диверсифицированные компании ощущают менее строгие требования к адаптации по сравнению со специализированными операциями. Гибкость гарантирует сохранение лидерства на рынке.

Вкратце, благодаря такой модели каждая из изменяющихся потребностей инвесторов будет адекватно удовлетворена, при этом обеспечивая устойчивый рост, независимо от независимых факторов. Именно на этой устойчивости будет строиться успех брокерской деятельности.

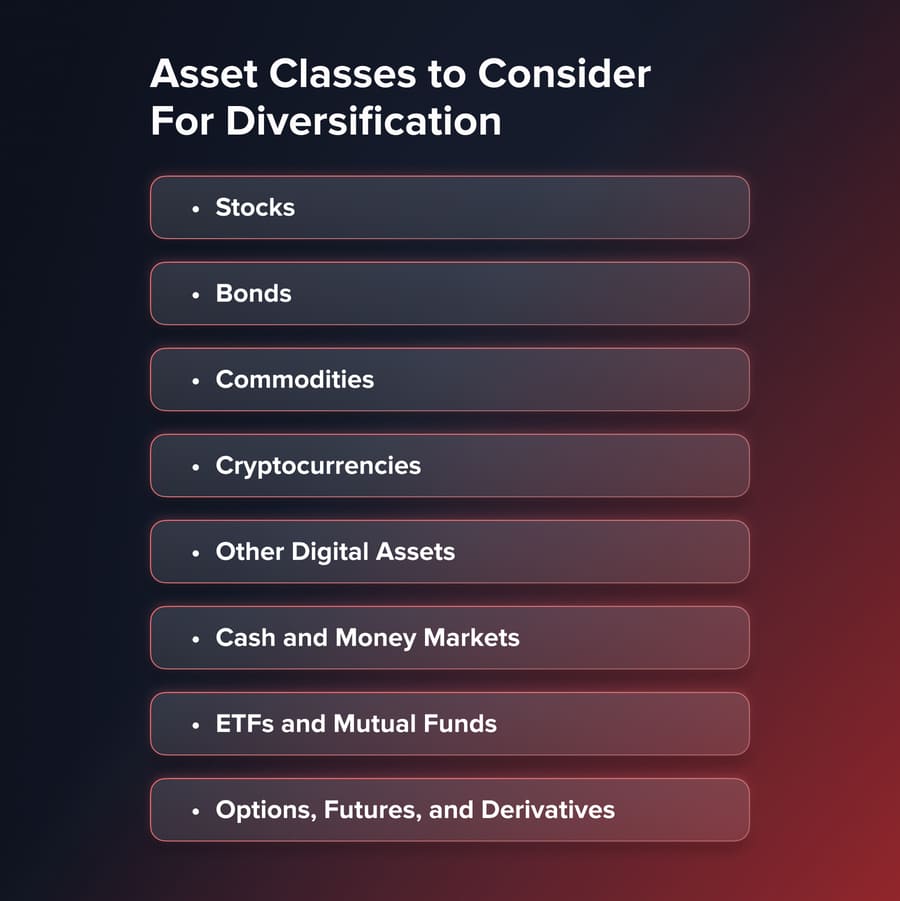

Какие классы активов должны предлагать брокерские компании?

При построении стратегии диверсификации брокеры должны оценивать классы активов, удовлетворяющие потребности или заполняющие выявленные пробелы. Следующие классы требуют тщательного изучения:

Акции

- Акции предлагают дробную/беспроцентную торговлю и деривативы, формируя основу самых эффективных стратегий торговли акциями

- Отрасль, рыночная капитализация и международные риски

- Дивидендные доходности, кредитование акций для дополнительного дохода

Облигации

- Корпоративный, муниципальный и суверенный долг

- Краткосрочные, среднесрочные и долгосрочные сроки погашения

- Активно/пассивно управляемые облигационные фонды

Товары

- Драгоценные металлы, такие как золото, серебро

- Сельское хозяйство, включая кукурузу, пшеницу, скот

- Энергия, включая сырую нефть, природный газ и другие сегменты, центральные для энергетической торговли

- Недвижимость, такая как лесные угодья

Криптовалюты

- Биткойн, Эфириум для массового ритейла

- Альткойны для опытных трейдеров

- Стейблкоины, связывающие традиционные и цифровые валюты

Другие цифровые активы

- Токены платформы, предоставляющие участие в сети

- Цифровое искусство, коллекционные предметы, игровые активы

- Токенизация безопасности частных компаний

- Протоколы децентрализованных финансов

Денежный и валютный рынки

- Индексные трекеры по секторам, нишам

- Активные/пассивные стратегии

- Тематика/инвестиционные инструменты с учетом влияния

Опционы, Фьючерсы и Деривативы

- Хеджирующие инструменты по классам активов

- Левериджные/обратные ETF для опытных трейдеров

You may also like

Кейсы: Как ведущие брокеры вышли на новые классы активов

eToro - Раннее принятие криптовалюты

eToro вырос из акций и ETF, введя торговлю Биткойном и Эфириумом в 2017 году. Это утвердило платформу как пионера розничной криптовалюты. К 2021 году криптовалюта составляла более 40% его торговых доходов, поддерживаемая растущей популярностью механизмов, таких как ликвидные пуулы .

Interactive Brokers - Выход на рынок ETF и облигаций

Interactive Brokers стабильно развивалась от акций до мировых ETF, облигаций и опционов. Это диверсификация принесла компании пользу в привлечении институциональных клиентов. Сегодня она обслуживает трейдеров более чем в 200 странах, с чистыми доходами более 4 миллиардов долларов в год, хорошо поддерживаемыми своей многоактивной платформой.

Robinhood - Долевые акции и рост криптовалюты

Robinhood сначала сделала успехи с торговлей акциями без комиссии, затем расширила свои услуги до дробных акций и криптовалюты. Это расширение нашло отклик у молодых инвесторов и привело к росту числа пользователей до более чем 23 миллионов аккаунтов в 2021 году. Предложение доступа к нескольким активам выделило компанию на переполненном рынке брокерских услуг.

Брокерские услуги с единственным активом против многопрофильных брокерских услуг: ключевые различия

| Фактор | Брокерская компания с одним активом | Брокерская компания с несколькими активами |

| Источники дохода | Связаны с одним классом активов (только Forex). Доходы волатильны и цикличны. | Несколько источников дохода от акций, облигаций, криптовалют, ETF и деривативов. Менее волатильны и предсказуемы. |

| Клиентская база | Узкая - необходимо привлекать определенный тип трейдеров или инвесторов. | Широкая - привлекает розничных трейдеров, институциональных клиентов и долгосрочных инвесторов. |

| Риск | Высокий - производительность привязана к циклам одного рынка. | Низкий - убытки в одном компенсируются прибылью в другом. |

| Регуляторные требования | Проще - одна лицензия, меньше требований к соблюдению норм. | Сложнее - несколько лицензий, постоянное соблюдение норм в разных юрисдикциях. |

| Адаптивность к рынку | Ограниченная - испытывает трудности, когда основной рынок замедляется. | Гибкая - может переключить внимание на растущие сектора (криптовалюты, ETF, фонды ESG). |

| Восприятие бренда | Нишевой игрок - ограниченная авторитетность за пределами своего основного рынка. | Универсальный магазин - надежная, комплексная, готовая к будущему брокерская компания. |

Как построить успешную многопрофильную брокерскую компанию

Вход в конкурентную финансовую сферу требует тщательной подготовки. Этот гид описывает основные шаги для создания брокерской компании, предлагающей клиентам разнообразные услуги.

1. Разработайте бизнес-план

Четко определите краткосрочные и долгосрочные цели, такие как целевые клиенты, услуги, нормативные одобрения и дорожные карты технологий с временными рамками. Подчеркните конкурентные преимущества и оцените потребности в ресурсах.

2. Защита капитала и лицензирование

Достаточное финансирование поддерживает развитие инфраструктуры. Лицензирование исследований необходимо в зависимости от юрисдикции и класса активов, от форекс до акций. Консультируйтесь с регуляторами для получения поддержки по заявкам.

3. Выберите основную технологическую платформу

Современные платформы автоматизируют торговлю, отчетность и контроль рисков. Рассмотрите интегрированные решения или создание индивидуальных систем самостоятельно или с партнерами. Проведите бэктестирование производительности и безопасности системы.

4. Нанять способную команду

Соберите талантливых специалистов в области соблюдения норм, разработки программного обеспечения, финансов и клиентского обслуживания. Сначала передайте специализированные функции на аутсорсинг и постепенно увеличивайте внутренние возможности.

5. Развертывание основных предложений активов

Приоритизируйте популярные секторы, поддерживаемые выбранной технологией. Предоставляйте конкурентоспособные сборы, инструменты и образовательный контент. Постоянно улучшайте на основе сигналов спроса и отзывов.

6. Подать заявку на дополнительные объявления

Получите соответствующие лицензии и интегрируйте новые активы модульно по мере разрешения нормативных актов и готовности. Убедитесь, что добавления фаз соответствуют увеличению объема и ресурсов.

7. Проектирование торговых приложений

Разрабатывайте интуитивно понятные интерфейсы для веба и мобильных устройств, оптимизированные под каждую платформу. Консолидируйте управление аккаунтами, исследования, ввод заказов и отчетность. Автоматизируйте рабочие процессы.

8. Предоставление дополнительных услуг

Дополните основные предложения дополнительными услугами, такими как кредитование под залог, роботизированное консультирование, PAMM-счета и интеграции с третьими сторонами. Генерируйте дополнительные доходы.

9. Усовершенствование маркетинга и брендинга

Позиционируйте компанию через различные онлайн и офлайн кампании. Сотрудничайте с ключевыми партнерами и аффилированными лицами. Автоматизируйте генерацию лидов и конверсии.

10. Постоянно совершенствуйтесь

Периодически оценивайте технологии, ассортимент продуктов, предпочтения клиентов и конкурентную среду. Уточняйте стратегию, расширяйте функциональность соответствующим образом и разумно масштабируйте инфраструктуру в долгосрочной перспективе.

Этот план очень сосредоточен на значительной подготовке перед запуском и корректировках в процессе эволюции мульти-активного брокера. Плавный рост следует, когда каждый шаг выполняется добросовестно в установленном порядке.

You may also like

Как реализовать стратегию диверсификации активов

Тщательное планирование имеет решающее значение для обеспечения успешной диверсификации брокерских компаний. В этом разделе изложены стратегические соображения для разумного, масштабируемого расширения.

1. Исследование востребованных активов

Первый шаг для брокеров - определить те перспективные сектора, которые действительно подтверждаются сигналами спроса. Опрос текущих клиентов выявляет общие интересы. Предложения конкурентов предоставляют другие сигналы о предпочтительных продуктах. Новые развивающиеся технологии, требующие листинга, также заслуживают внимания. Приоритизация прибыльных синергетических дополнений максимизирует возврат инвестиций.

2. Получение необходимых лицензий и разрешений

Соблюдение нормативных требований сильно варьируется в зависимости от юрисдикций и классов активов. Многонациональные брокеры должны получить полную лицензии, чтобы получить разрешение на управление деятельностью по всему миру. Криптовалюты, например, лицензируются как бизнес по оказанию денежных услуг. Заявки требуют капиталовложений, которые будут тщательно проверены регуляторами. Профессиональные консультации помогают разобраться в бюрократии, чтобы компания могла избежать лишних формальностей и дорогостоящих ошибок в вопросах соблюдения нормативных требований. Надлежащая проверка помогает избежать дорогостоящих ошибок.

3. Требования к инфраструктуре и технологиям

Агрегация различных активов требует технологии, способной адаптироваться к динамическим требованиям. Продвинутые API позволяют быстро обновлять продукты. Системы торговли с низкой задержкой обеспечивают ликвидность на рынках. Надежные внутренние архитектуры, такие как управление идентификацией, обеспечивают поддержку функций для платежей и отчетности, независимо от внешних листингов. Масштабируемая производительность означает отсутствие трений в пользовательском опыте с ростом.

4. Интеграция платежных решений

Выборы способов оплаты отражают предпочтения клиентов, которые зависят от региона, поколения и выбора ликвидного инструмента. Фиатные деньги, цифровые валюты и стейблкоины все заслуживают подключения через стратегических партнеров по обработке. Выбор вариантов сопровождается соображениями по соблюдению норм. Интеграция способов оплаты в платформы упрощает доступ к покупательной способности и устраняет барьеры между инвестором и возможностью.

5. Оперативные соображения

Знаниевые пуулы расширяются в области набора персонала, чтобы соответствовать масштабу диверсификации. Представители, необходимые для обслуживания клиентов, становятся профессионалами в области распределенных ценных бумаг. Сотрудники по соблюдению нормативных требований должны контролировать быстро увеличивающееся количество нормативных точек взаимодействия. Специализированные контролеры рисков тщательно оценивают отдельные отраслевые риски по сравнению с разумным хеджированием. Функционирующие подразделения, посвященные отдельным областям, также децентрализуются по мере увеличения масштаба.

6. Ценообразование и структуры сборов для многократных активов

Цены влияют на активность и удержание клиентов. Конкурентные ставки привлекают новых клиентов. Цены, основанные на объеме или ступенчатые, стимулируют лояльность среди этих клиентов. Прозрачность в сборах создает доверие. Упакованные услуги снижают затраты клиента. Периодически пересматривайте структуры и, где это возможно, моделируйте эластичность спроса для оптимального ценообразования с целью получения прибыли по мере развития набора предложений.

Продолжение измерений и уточнений в структурированной подготовке закладывает надежные основы диверсификации, которые обеспечат устойчивый рост.

7. Лучшие практики для эффективной диверсификации активов

Следуя проверенным практикам, брокерские компании могут максимизировать преимущества диверсификации, одновременно снижая риски. Внимательное планирование в ключевых областях помогает оптимизировать стратегии для устойчивого долгосрочного роста.

8. Поэтапный запуск и осторожное масштабирование

Пошаговый подход вводит новые активы поэтапно, по мере подтверждения спроса, а не сразу все вместе. В интервалах между фазами процессы уточняются в соответствии с улучшением показателей производительности. Измеренное масштабирование на каждом этапе предотвращает чрезмерное использование ресурсов до того, как затраты могут быть оправданы спросом. Функции поддержки также должны расти пропорционально, чтобы поддерживать стандарты, пока операции развиваются со временем.

9. Мониторинг рыночных тенденций и корректировки

Тщательный мониторинг аналитики и опросов их предпочтений позволяет корректировать изменения в спросе, часто под руководством рыночных индикаторов . Быстрая реакция на растущую или падающую популярность осуществляется незамедлительно. Плохая производительность периодических добавлений должна быть пересмотрена на предмет потенциальной замены. Гибкость также позволяет использовать новые возможности, возникшие из меняющихся обстоятельств.

10. Обучение и ввод в курс дел клиентов

Атрибуты каждого дополнения уточняются четкими объяснениями, указывающими на риски и стратегии для формирования реалистичных ожиданий. Более широкий контекст демонстрирует устойчивость к диверсификации. Библиотеки, семинары и поддержка облегчают переходы. Новые клиенты легко адаптируются к расширенному ассортименту.

11. Оценка будущих возможностей

Регулирование и мониторинг технологий выявляют жизнеспособные долгосрочные сектора. Нанимание специалистов предоставляет рыночные инсайты. Партнёрства ускоряют доступ к дополнительным ресурсам, а приобретения укрепляют нишевые возможности.

12. Тщательные лицензированные оценки

Исчерпывающее исследование определяет лицензии по юрисдикциям и дополнениям. Осмотрительные процессы подачи заявок учитывают сроки одобрения. Регуляторы получают обширную документацию, касающуюся всех вопросов. Экспертные консультации предоставляют соблюдающее руководство.

13. Реализация надежного управления рисками

Количественное моделирование включает коррелированные и изолированные риски. Каждый листинг защищен маржинальными и позиционными параметрами. Стресс-тесты охватывают гипотетические ситуации. Образование служит противовесом силам волатильности.

Старательное соблюдение создает основу для безопасной оптимизации возможностей диверсификации для устойчивого роста многоактивного лидерства. Максимальная долгосрочная выгода обеспечивается за счет постоянного совершенствования.

Ошибки, которых брокерам следует избегать при диверсификации

Even top companies can get it wrong when venturing out to new asset classes. The following are the mistakes that usually sidetrack diversification initiatives:

1. Спешка с лицензированием

Некоторые брокеры спешат выходить на новые рынки, не получив необходимые лицензии . Последствия могут быть штрафы, плохая репутация или даже закрытие. Добросовестная проверка со стороны регулирующих органов всегда имеет приоритет.

2. Слишком раннее растяжение классов активов

Одновременное представление всех популярных продуктов слишком сильно нагружает технологии, соблюдение норм и персонал. Поэтапный запуск обеспечивает качество, соблюдение норм и плавное выполнение.

3. Игнорирование платёжной инфраструктуры

Многие клиенты закрывают счета, когда депозиты и выводы ограничены. Неинтеграция фиатных, криптовалютных и местных платежных моделей создает ненужное трение.

4. Переоценка простоты соблюдения требований

Каждая юрисдикция имеет свои нормативные акты, и надежные поставщики KYC необходимы для поддержания соблюдения законодательства на большом масштабе. Распространение за границу без крепкой инфраструктуры соблюдения может перегрузить сотрудников и привести к дорогостоящим ошибкам.

5. Избегание обучения клиентов

Выпуск новых классов активов без адекватного объяснения оставляет клиентов в замешательстве и изоляции. Вебинары, учебные пособия и обучение в продукте облегчают процесс адаптации.

6. Решение проблемы диверсификации как однопунктной задачи

Рынки меняются ежедневно. Эффективные брокеры осведомлены о тенденциях, обменивают неэффективные продукты и корректируют условия оплаты, чтобы оставаться в ногу с рынком.

Итог

Преимущества, обеспечиваемые диверсификацией классов активов и многоактивными подходами, превратили это в важную стратегию для брокерских компаний, которые думают о своей долговечности. Открывая различные некоррелированные сектора для клиентов через одну единую платформу, брокерские компании распределяют свои риски , максимизируя свои возможности, стабилизируя свои доходы и укрепляя свое ценностное предложение.

Учитывая трансформационные силы, меняющие ландшафт финансовых услуг сегодня, брокерские компании должны учитывать свои сильные и слабые стороны и, следовательно, стратегическую необходимость продуманного диверсифицирования с долгосрочной точки зрения, направленной на конкурентоспособность, адаптивность к изменяющимся требованиям и процветание.

FAQ

The main benefit is risk reduction. By offering a number of uncorrelated asset classes, brokerages balance losses in one market with profits in another. This creates smoother revenues, draws in more diverse clients, and ensures long-term expansion in spite of turbulent cycles.

Brokers need to continue offering traditional assets like stocks and bonds while expanding into high-growth areas such as cryptocurrencies, tokenized assets, and ESG funds. These offerings respond to evolving client demand, appeal to younger investors, and position the brokerage as an innovative, competitive market player.

In fact, diversification involves upfront investment in licenses, compliance, and technology infrastructure. But the long-term benefits - more stable revenues, multiple income streams, and improved client loyalty, dwarf the costs. Brokerages that diversify properly build resilience and are better positioned to ride out industry downturns.

Regulatory risks are managed by obtaining proper licenses in each asset class and jurisdiction, hiring compliance professionals, and consulting with legal counsel. A strong compliance infrastructure allows brokers to expand offerings without interruption, avoid fines, and maintain client trust when entering new markets.

Обновлено:

23 сентября 2025 г.