คู่มือฉบับสมบูรณ์สำหรับการกระจายประเภทสินทรัพย์สำหรับนายหน้าซื้อขายหลักทรัพย์

เนื้อหา

การกระจายการลงทุนในคลาสสินทรัพย์ที่หลากหลายเป็นกลยุทธ์การลงทุนที่มุ่งหวังผลตอบแทนสูงสุดสำหรับระดับความเสี่ยงที่กำหนด สำหรับบริษัทนายหน้าซื้อขายหลักทรัพย์ ผลประโยชน์ที่เกิดจากวิธีการกระจายการลงทุนในหลายสินทรัพย์นั้นมีความสำคัญมาก การลงทุนแบบดั้งเดิมรวมถึงคลาสสินทรัพย์เช่น หุ้น, พันธบัตร และสินค้าโภคภัณฑ์ ในขณะที่โอกาสใหม่ๆ เกี่ยวข้องกับสกุลเงินดิจิทัล, สินทรัพย์ดิจิทัล และผลิตภัณฑ์การลงทุนทั่วโลก การเสนอให้เข้าถึงคลาสสินทรัพย์ที่ไม่สัมพันธ์กันหลายคลาสนั้นมีข้อดีสำคัญหลายประการต่อบริษัทนายหน้าซื้อขายหลักทรัพย์

คู่มือด้านล่างนี้อธิบายว่าบริษัทนายหน้าชั้นนำได้ใช้กลยุทธ์ต่างๆ สำหรับการกระจายความเสี่ยงเพื่อเพิ่มการเข้าถึงตลาด, สร้างความมั่นคงให้กับกำไร, และปรับตำแหน่งการแข่งขันให้เหมาะสมเพื่อให้บรรลุความสำเร็จในระยะยาวได้อย่างไร เป้าหมายสูงสุดที่นี่คือการแสดงให้เห็นว่าทำไมการนำเสนอ กลุ่มสินทรัพย์ ที่หลากหลายผ่านโมเดลหลายสินทรัพย์จึงนำมาซึ่งประโยชน์ที่ไม่มีใครเทียบได้ซึ่งบริษัทนายหน้าทุกแห่งควรดำเนินการ

ทำไมบริษัทนายหน้าควรมีความหลากหลาย

การกระจายความเสี่ยงเป็นวิธีการที่ทำให้บริษัทนายหน้าได้รับการเติบโตที่มั่นคงและสม่ำเสมอ ส่วนนี้จะสำรวจข้อดีบางประการที่การใช้แนวทางหลายสินทรัพย์มีให้

1. การจัดการความเสี่ยงผ่านการกระจายความเสี่ยง

การกระจายความเสี่ยงในกลุ่มสินทรัพย์ที่ไม่มีความสัมพันธ์กันหลายประเภท ช่วยชดเชยความเสี่ยงบางอย่าง เมื่อราคาของสินทรัพย์บางตัวลดลง สินทรัพย์อื่นอาจมีมูลค่าเพิ่มขึ้นเพื่อช่วยชดเชยผลตอบแทนโดยรวม ในแง่นี้ การนำเสนอหน่วยลงทุน กองทุนรวม หุ้น ตราสารหนี้ และสินทรัพย์ดิจิทัลอื่นๆ ช่วยกระจายความเสี่ยงแทนที่จะมุ่งเน้นไปที่ภาคใดภาคหนึ่งโดยเฉพาะ บริษัทนายหน้าซื้อขายหลักทรัพย์จะมีความมั่นคง รายได้จะมีความผันผวนลดลง เนื่องจากจะมีโอกาสทำกำไรอยู่เสมอ แม้ในช่วงที่ตลาดมีความวุ่นวาย โดยเฉพาะเมื่อได้รับการสนับสนุนจากกลยุทธ์ การจัดการความเสี่ยง ที่แข็งแกร่ง ผ่านการกระจายความเสี่ยง ผลกำไรจะได้รับการปกป้องในรอบเศรษฐกิจ

2. ดึงดูดฐานลูกค้าที่กว้างขึ้น

การขยายข้อเสนอของโบรกเกอร์หมายถึงการเปิดประตูสู่การลงทุนในทุกประเภทของโปรไฟล์ความเสี่ยง-ผลตอบแทน ตัวอย่างเช่น หุ้นแบบแบ่งส่วนจะทำให้สามารถซื้อหุ้นของบริษัทหรือเครื่องมืออื่น ๆ ที่เคยอยู่นอกการเข้าถึงเนื่องจากต้นทุน ตลาดแลกเปลี่ยนพบเป้าหมายใหม่ในกลุ่มผู้ชมที่อายุน้อยกว่า ในขณะที่ที่ปรึกษาอัตโนมัติให้บริการกับลูกค้าที่มีความเป็น Passive มากขึ้น ช่องว่างยังถูกเติมเต็มด้วยหมวดหมู่ผลิตภัณฑ์ที่เฉพาะเจาะจงมากขึ้น โดยมีความต้องการกองทุนที่ยั่งยืนที่เน้นในหมวดสินทรัพย์การซื้อขายที่ได้รับความนิยมมากที่สุดในช่วงไม่กี่ปีที่ผ่านมา ในการให้บริการความต้องการเหล่านี้ โบรกเกอร์หลายสินทรัพย์จึงเปิดตัวเองสู่ศักยภาพลูกค้าอย่างเต็มที่.

3. เพิ่มแหล่งรายได้และความมั่นคง

ด้วยผลิตภัณฑ์ใหม่แต่ละรายการ โบรกเกอร์จะเปิดแหล่งรายได้จากการซื้อขายใหม่ ๆ จากค่าธรรมเนียมบริการหรือส่วนต่างราคาเสนอซื้อและเสนอขาย ทำให้ ค่าธรรมเนียมโบรกเกอร์ เป็นส่วนสำคัญของความสามารถในการทำกำไรในระยะยาว แทนที่จะพึ่งพาผลิตภัณฑ์เดียว รายได้หลาย ๆ ทางจะหลุดพ้นจากอารมณ์ของสถานการณ์ภายนอก การขายข้ามผลิตภัณฑ์ช่วยเสริมสร้างผลกระทบนี้ โบรกเกอร์สามารถขายข้ามรายการที่เสริมกันได้ สร้างบัญชีที่ใช้งานมากขึ้นและความสัมพันธ์กับลูกค้าในระยะยาว รายได้ที่เกิดซ้ำมาจากการเติบโตของพอร์ตการลงทุนเมื่อเวลาผ่านไป การคาดการณ์รายได้ยังกลายเป็นเรื่องที่มั่นคงมากขึ้น วงจรอุตสาหกรรมที่ไม่สามารถคาดเดาได้ทำให้โบรกเกอร์ที่มีความหลากหลายได้รับผลกระทบน้อยกว่าคู่แข่งที่มุ่งเน้นผลิตภัณฑ์เดียว

4. ข้อได้เปรียบในการแข่งขันและการสร้างความแตกต่าง

บริษัทที่มีความโดดเด่นในหลายสินทรัพย์ เป็นร้านค้าแบบครบวงจรที่มีคุณค่า นักลงทุนสถาบันชื่นชมแพลตฟอร์มที่ซับซ้อนซึ่งสนับสนุนการจัดการความเสี่ยงที่ซับซ้อนทั่วทั้งตลาด.

ลูกค้ารายบุคคลได้รับความจ忠ใจ โดยรู้ว่าทุกวัตถุประสงค์ที่พัฒนา มีการแสดงออกที่เหมาะสม ข้อได้เปรียบของผู้ที่ทำเป็นคนแรกจะเกิดขึ้นจากการเป็นผู้นำในภาคส่วนที่กำลังจะมาถึง ก่อนการนำไปใช้ในวงกว้าง ต่อมา ผลกระทบจากเครือข่ายจะทำให้สภาพคล่อง集中

5. ความยืดหยุ่นในการปรับตัวต่อการเปลี่ยนแปลงของตลาด

ตลาดที่มีความเปลี่ยนแปลงต้องการการปรับเปลี่ยนในทุกๆ ด้าน ความหลากหลายช่วยให้โบรกเกอร์เตรียมพร้อมสำหรับสภาพแวดล้อมที่เปลี่ยนแปลงด้วยการปรับเปลี่ยนความเสี่ยงอย่างยืดหยุ่น ในขอบเขตที่โอกาสเปิดในไตรมาสอื่น ๆ ธุรกิจที่มีความหลากหลายจะรู้สึกถึงแรงกดดันในการปรับตัวที่น้อยกว่าหากเปรียบเทียบกับการดำเนินงานที่เฉพาะเจาะจง ความยืดหยุ่นรับประกันความเป็นผู้นำในตลาดอย่างต่อเนื่อง

โดยสรุปแล้ว ผ่านโมเดลเช่นนี้ ความต้องการที่เปลี่ยนแปลงของนักลงทุนแต่ละรายจะได้รับการตอบสนองอย่างเพียงพอ ในขณะที่ยังคงรักษาการเติบโตอย่างยั่งยืน ไม่ว่าจะมีปัจจัยที่เป็นอิสระใดๆ ก็ตาม ความยืดหยุ่นนี้จะเป็นพื้นฐานที่ทำให้ความสำเร็จของบริษัทนายหน้าการลงทุนเกิดขึ้น

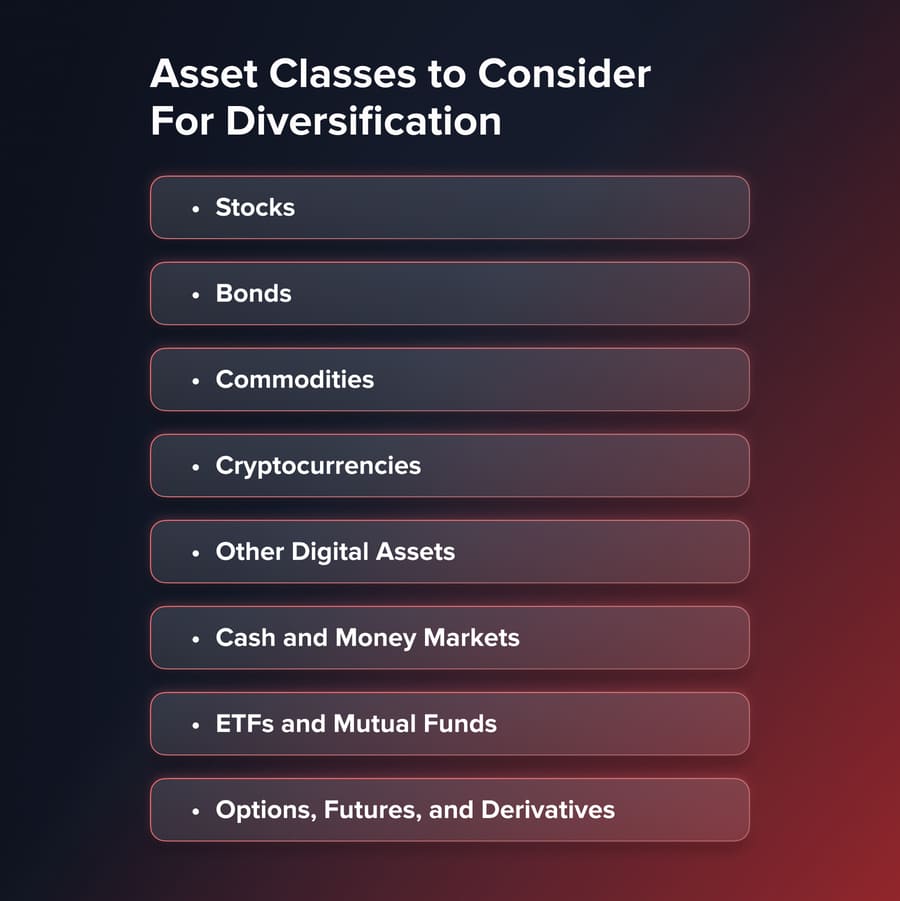

ประเภทสินทรัพย์ใดที่โบรกเกอร์ควรนำเสนอ?

เมื่อสร้างกลยุทธ์การกระจายความเสี่ยง นายหน้าต้องประเมินประเภทสินทรัพย์ที่ตอบสนองความต้องการหรือเติมเต็มช่องว่างที่ระบุไว้ สิ่งต่อไปนี้ควรได้รับการตรวจสอบอย่างใกล้ชิด:

หุ้น

- หุ้นเสนอบริการการซื้อขายแบบส่วนแบ่ง/ไม่มีค่าคอมมิชชั่นและอนุพันธ์ ซึ่งเป็นพื้นฐานของ กลยุทธ์การซื้อขายหุ้น ที่มีประสิทธิภาพที่สุด

- อุตสาหกรรม, มูลค่าตลาด, และการเปิดรับต่างประเทศ

- ผลตอบแทนจากเงินปันผล, การให้ยืมหุ้นเพื่อรายได้เสริม

พันธบัตร

- หนี้องค์กร, หนี้เทศบาล, และหนี้ของรัฐ

- ระยะเวลาสั้น กลาง และยาว

- กองทุนพันธบัตรที่จัดการแบบมีส่วนร่วม/ไม่มีส่วนร่วม

สินค้าโภคภัณฑ์

- โลหะมีค่า เช่น ทองคำ, เงิน

- เกษตรกรรมรวมถึงข้าวโพด, ข้าวสาลี, สัตว์เลี้ยง

- พลังงานรวมถึงน้ำมันดิบ, ก๊าซธรรมชาติ, และส่วนอื่นๆ ที่เป็นศูนย์กลางของ การซื้อขายพลังงาน

- สินทรัพย์อสังหาริมทรัพย์ เช่น ที่ดินป่าไม้

สกุลเงินดิจิทัล

- บิตคอยน์, อีเธอเรียมสำหรับการค้าปลีกทั่วไป

- Altcoins สำหรับเทรดเดอร์ที่มีประสบการณ์

- สเตเบิลคอยน์เชื่อมโยงสกุลเงินดั้งเดิมและสกุลเงินดิจิทัล

ทรัพย์สินดิจิทัลอื่น ๆ

- โทเค็นแพลตฟอร์มที่มอบสิทธิในการเข้าร่วมเครือข่าย

- ศิลปะดิจิทัล, ของสะสม, สินทรัพย์เกม

- การทำโทเค็นความปลอดภัยของบริษัทเอกชน

- โปรโตคอลการเงินแบบกระจายศูนย์

ตลาดเงินและตลาดเงินสด

- ดัชนีติดตามในทุกภาคส่วนและกลุ่มเฉพาะ

- กลยุทธ์เชิงรุก/เชิงรับ

- ยานพาหนะการลงทุนเชิงธีม/ผลกระทบ

ตัวเลือก, ฟิวเจอร์ส, และอนุพันธ์

- เครื่องมือป้องกันความเสี่ยงในกลุ่มสินทรัพย์

- กองทุน ETF แบบเลเวอเรจ/ย้อนกลับสำหรับนักเทรดที่มีประสบการณ์

You may also like

กรณีศึกษา: โบรกเกอร์ชั้นนำเข้าสู่คลาสสินทรัพย์ใหม่อย่างไร

eToro - การนำเข้าคริปโตอย่างเร็ว

eToro เติบโตจากหุ้นและ ETFs โดยการนำเสนอการซื้อขาย Bitcoin และ Ethereum ในปี 2017 ซึ่งทำให้แพลตฟอร์มนี้เป็นผู้นำด้านคริปโตสำหรับผู้ค้าปลีก โดยในปี 2021 คริปโตมีส่วนแบ่งมากกว่า 40% ของรายได้จากการซื้อขาย ซึ่งได้รับการสนับสนุนจากการนำกลไกต่าง ๆ เช่น liquidity pools มาใช้มากขึ้น

Interactive Brokers - การขยายเข้าสู่ ETFs และพันธบัตร

Interactive Brokers เติบโตอย่างต่อเนื่องจากการซื้อขายหุ้นไปสู่ ETFs ทั่วโลก, พันธบัตร, และตัวเลือกต่างๆ การกระจายความเสี่ยงนี้เป็นประโยชน์ต่อบริษัทในการดึงดูดลูกค้าสถาบัน ในปัจจุบัน บริษัทให้บริการนักเทรดในกว่า 200 ประเทศ โดยมีรายได้สุทธิปีละกว่า 4 พันล้านดอลลาร์ ซึ่งได้รับการสนับสนุนอย่างดีจากแพลตฟอร์มหลายสินทรัพย์ของตน

Robinhood - หุ้นแบบแบ่งส่วนและการเติบโตของคริปโต

Robinhood เริ่มก้าวหน้าในด้านการซื้อขายหุ้นที่ไม่มีค่าคอมมิชชั่น จากนั้นก็ขยายไปสู่การลงทุนในหุ้นที่แบ่งเป็นส่วนและสกุลเงินดิจิทัล การขยายตัวนี้ถูกใจนักลงทุนรุ่นใหม่และทำให้จำนวนผู้ใช้งานเพิ่มขึ้นเป็นกว่า 23 ล้านบัญชีในปี 2021 การให้บริการเข้าถึงสินทรัพย์หลายประเภททำให้มันโดดเด่นในตลาดนายหน้าค้าที่มีการแข่งขันสูง

โบรกเกอร์สินทรัพย์เดี่ยว vs โบรกเกอร์สินทรัพย์หลายประเภท: ความแตกต่างที่สำคัญ

| ปัจจัย | โบรกเกอร์ทรัพย์สินเดี่ยว | โบรกเกอร์หลายทรัพย์สิน |

| แหล่งรายได้ | เชื่อมโยงกับกลุ่มสินทรัพย์หนึ่งกลุ่ม (ฟอเร็กซ์เพียงอย่างเดียว) รายได้มีความผันผวนและเป็นวัฏจักร. | หลายแหล่งรายได้จากหุ้น, พันธบัตร, คริปโต, ETFs, และอนุพันธ์ มีความผันผวนและคาดเดาได้น้อยกว่า. |

| ฐานลูกค้า | บาง - ต้องดึงดูดนักเทรดหรือนักลงทุนประเภทเฉพาะ. | กว้าง - ดึงดูดนักเทรดค้าปลีก, ลูกค้าสถาบัน, และนักลงทุนระยะยาว. |

| ความเสี่ยง | สูง - ผลการดำเนินงานผูกติดกับวัฏจักรของตลาดหนึ่ง. | ต่ำกว่า - การขาดทุนในหนึ่งถูกชดเชยด้วยการทำกำไรในอีกหนึ่ง. |

| ความต้องการด้านกฎระเบียบ | ง่ายกว่า - ใบอนุญาตเดียว, จุดการปฏิบัติตามน้อยลง. | ซับซ้อน - หลายใบอนุญาต, การปฏิบัติตามอย่างต่อเนื่องในหลายเขตอำนาจ. |

| ความสามารถในการปรับตัวของตลาด | จำกัด - มีความยากลำบากเมื่อมีการชะลอตัวของตลาดพื้นฐาน. | ยืดหยุ่น - สามารถเปลี่ยนโฟกัสไปยังภาคส่วนที่กำลังเติบโต (คริปโต, ETFs, กองทุน ESG). |

| การรับรู้แบรนด์ | ผู้เล่นเฉพาะกลุ่ม - มีอำนาจจำกัดนอกตลาดหลักของตน. | ร้านค้าครบวงจร - โบรกเกอร์ที่เชื่อถือได้, ครบถ้วน, พร้อมสำหรับอนาคต. |

วิธีสร้างโบรกเกอร์หลายสินทรัพย์ที่ประสบความสำเร็จ

การเข้าสู่อุตสาหกรรมบริการทางการเงินที่มีการแข่งขันต้องการการเตรียมความพร้อมอย่างละเอียด คู่มือนี้จะชี้แจงขั้นตอนที่จำเป็นในการจัดตั้งโบรกเกอร์ที่ให้บริการแก่ลูกค้าผ่านข้อเสนอที่หลากหลาย

1. พัฒนากลยุทธ์ทางธุรกิจ

กำหนดเป้าหมายระยะสั้นและระยะยาวอย่างชัดเจน เช่น เป้าหมายลูกค้า บริการ การอนุมัติจากหน่วยงานกำกับดูแล และแผนงานเทคโนโลยีพร้อมกำหนดเวลา เน้นจุดแข็งทางการแข่งขันและประเมินความต้องการทรัพยากร

2. การรักษาความปลอดภัยของทุนและการออกใบอนุญาต

การจัดหาทุนที่เพียงพอสนับสนุนการสร้างโครงสร้างพื้นฐาน การขอใบอนุญาตวิจัยเป็นสิ่งจำเป็นตามเขตอำนาจและประเภทสินทรัพย์ ตั้งแต่ฟอเร็กซ์ไปจนถึงหุ้น ปรึกษากับหน่วยงานกำกับดูแลเพื่อขอรับการสนับสนุนการสมัคร

3. เลือกแพลตฟอร์มเทคโนโลยีหลัก

แพลตฟอร์มขั้นสูงช่วยในการทำการซื้อขาย การรายงาน และการควบคุมความเสี่ยงโดยอัตโนมัติ พิจารณาโซลูชันที่รวมเข้าด้วยกันหรือการสร้างระบบที่กำหนดเองภายในองค์กรหรือกับพันธมิตร ทดสอบประสิทธิภาพของระบบและความปลอดภัย

4. จ้างทีมที่มีความสามารถ

รวบรวมผู้เชี่ยวชาญที่มีความสามารถในด้านการปฏิบัติตามกฎระเบียบ, วิศวกรรมซอฟต์แวร์, การเงิน, และบริการลูกค้า จัดจ้างฟังก์ชันเฉพาะทางในระยะแรกและเพิ่มขีดความสามารถภายในเมื่อเวลาผ่านไป。

5. เปิดตัวข้อเสนอสินทรัพย์หลัก

ให้ความสำคัญกับภาคส่วนที่มีความนิยมซึ่งได้รับการสนับสนุนโดยเทคโนโลยีที่เลือกมา จัดเตรียมค่าธรรมเนียมที่แข่งขันได้ เครื่องมือ และเนื้อหาทางการศึกษา ปรับปรุงอย่างต่อเนื่องตามสัญญาณความต้องการและความคิดเห็น

6. สมัครรายการเพิ่มเติม

ให้ขอใบอนุญาตที่เกี่ยวข้องและรวมสินทรัพย์ใหม่ในรูปแบบโมดูลตามที่กฎระเบียบอนุญาตและความพร้อมเอื้ออำนวย ให้แน่ใจว่าการเพิ่มเฟสตรงตามขอบเขตและการเพิ่มทรัพยากร.

7. ออกแบบแอปพลิเคชันการเทรด

พัฒนาอินเทอร์เฟซที่ใช้งานง่ายสำหรับเว็บและมือถือที่ปรับให้เหมาะสมกับแต่ละแพลตฟอร์ม รวมการจัดการบัญชี การวิจัย การกรอกคำสั่งซื้อ และการรายงาน อัตโนมัติกระบวนการทำงาน.

8. ให้บริการเสริม

เสริมข้อเสนอหลักด้วยบริการเพิ่มเติมเช่นการให้ยืมเงินเพิ่ม, การให้คำปรึกษาอัตโนมัติ, บัญชี PAMM และการรวมระบบจากบุคคลที่สาม สร้างรายได้เสริม。

9. เพิ่มการตลาดและการสร้างแบรนด์

วางตำแหน่งบริษัทผ่านแคมเปญออนไลน์และออฟไลน์ที่หลากหลาย ร่วมมือกับพันธมิตรและผู้ช่วยที่สำคัญ อัตโนมัติการสร้างลีดและการแปลงผล

10. ปรับปรุงอย่างต่อเนื่อง

ประเมินเทคโนโลยี, การผสมผสานผลิตภัณฑ์, ความชอบของลูกค้า และภูมิทัศน์การแข่งขันเป็นระยะๆ ปรับกลยุทธ์, ขยายฟังก์ชันการทำงานตามนั้น และขยายโครงสร้างพื้นฐานอย่างรอบคอบในระยะยาว

แผนนี้มุ่งเน้นไปที่การเตรียมการอย่างมากก่อนการเปิดตัวและการปรับเปลี่ยนในกระบวนการพัฒนาธุรกิจนายหน้าหลายสินทรัพย์ การเติบโตที่ราบรื่นจะตามมาเมื่อมีการปฏิบัติตามแต่ละขั้นตอนอย่างรอบคอบตามลำดับ

You may also like

วิธีการดำเนินการกลยุทธ์การกระจายการลงทุน

การวางแผนอย่างรอบคอบเป็นสิ่งสำคัญเพื่อให้การกระจายความเสี่ยงประสบความสำเร็จสำหรับบริษัทนายหน้า ส่วนนี้จะสรุปข้อพิจารณาทางกลยุทธ์สำหรับการขยายตัวที่ระมัดระวังและเติบโตได้

1. การวิจัยสินทรัพย์ที่มีความต้องการสูง

ขั้นตอนแรกสำหรับนายหน้าคือการระบุภาคส่วนที่มีแนวโน้มซึ่งมีการสนับสนุนโดยสัญญาณความต้องการ การสำรวจลูกค้าปัจจุบันช่วยระบุความสนใจที่เป็นที่นิยม ข้อเสนอของคู่แข่งให้สัญญาณอื่น ๆ เกี่ยวกับผลิตภัณฑ์ที่ได้รับความนิยม เทคโนโลยีใหม่ที่เกิดขึ้นซึ่งมีความต้องการในการจดทะเบียนควรได้รับการพิจารณา การให้ความสำคัญกับการเพิ่มประสิทธิภาพที่ทำกำไรสูงสุดจะช่วยเพิ่มผลตอบแทนจากการลงทุนให้สูงสุด

2. การขอใบอนุญาตและการอนุมัติที่จำเป็น

การปฏิบัติตามกฎระเบียบจะแตกต่างกันมากระหว่างเขตอำนาจและประเภทสินทรัพย์ โบรกเกอร์ข้ามชาติจะต้องได้รับใบอนุญาตอย่างเต็มที่เพื่อให้ได้รับการอนุญาตในการจัดการกิจกรรมทั่วโลก สกุลเงินดิจิทัล เช่น ถูกออกใบอนุญาตเหมือนกับธุรกิจบริการทางการเงิน การขอใบอนุญาตต้องมีการจัดสรรทุนซึ่งจะถูกตรวจสอบอย่างละเอียดโดยหน่วยงานกำกับดูแล คำแนะนำจากผู้เชี่ยวชาญช่วยให้ผ่านระบบราชการเพื่อให้บริษัทสามารถหลีกเลี่ยงการใช้เวลามากเกินไปและข้อผิดพลาดที่มีค่าใช้จ่ายในการปฏิบัติตามกฎระเบียบ การตรวจสอบที่เหมาะสมช่วยประหยัดจากข้อผิดพลาดที่มีค่าใช้จ่ายสูง.

3. ความต้องการด้านโครงสร้างพื้นฐานและเทคโนโลยี

การรวมสินทรัพย์ที่แตกต่างกันต้องการเทคโนโลยีที่สามารถปรับตัวให้เข้ากับความต้องการที่เปลี่ยนแปลงไป API ขั้นสูงช่วยให้สามารถอัปเดตผลิตภัณฑ์ได้อย่างรวดเร็ว ระบบการซื้อขายที่มีความล่าช้าต่ำช่วยรักษาสภาพคล่องในตลาด สถาปัตยกรรมภายในที่แข็งแกร่ง เช่น การจัดการเอกลักษณ์ ช่วยให้ฟังก์ชันสนับสนุนสำหรับการชำระเงินและการรายงาน โดยไม่คำนึงถึงการจดทะเบียนภายนอก ประสิทธิภาพที่สามารถปรับขนาดได้หมายถึงประสบการณ์ของผู้ใช้ที่ไม่มีอุปสรรคพร้อมกับการเติบโต

4. การรวมโซลูชันการชำระเงิน

ทางเลือกในการชำระเงินสะท้อนถึงความชอบของลูกค้าที่ได้รับอิทธิพลจากภูมิภาค, รุ่น, และการเลือกใช้สื่อการเงินที่มีสภาพคล่อง เงินฟิอัต, สกุลเงินดิจิทัล, และสเตเบิลคอยน์ต่างมีความสำคัญในการเข้าร่วมผ่านพันธมิตรด้านการประมวลผลเชิงกลยุทธ์ ตัวเลือกในการเลือกจะมาพร้อมกับการพิจารณาเกี่ยวกับการปฏิบัติตามกฎระเบียบ การจัดการทางเลือกการชำระเงินภายในแพลตฟอร์มช่วยให้การเข้าถึงอำนาจการซื้อเป็นไปอย่างราบรื่นและกำจัดอุปสรรคระหว่างนักลงทุนและโอกาส.

5. ข้อพิจารณาทางการดำเนินงาน

การขยายแหล่งความรู้ในกระบวนการสรรหาบุคลากรเพื่อให้สอดคล้องกับขอบเขตการกระจายตัวนั้นมีความสำคัญ ตัวแทนที่จำเป็นต้องให้บริการลูกค้าจึงต้องมีความเชี่ยวชาญในหลักทรัพย์ที่กระจายอยู่ Compliance staff ต้องดูแลจุดสัมผัสด้านกฎระเบียบที่เพิ่มขึ้นอย่างรวดเร็ว ผู้ควบคุมความเสี่ยงที่เชี่ยวชาญจะประเมินความเสี่ยงเฉพาะอุตสาหกรรมอย่างรอบคอบเพื่อต่อต้านการป้องกันที่เหมาะสม แผนกที่ดำเนินการซึ่งมุ่งเน้นไปที่ขอบเขตเฉพาะจะกระจายอำนาจเมื่อขอบเขตเพิ่มขึ้นเช่นกัน

6. การตั้งราคาและโครงสร้างค่าธรรมเนียมแบบหลายสินทรัพย์

การตั้งราคา มีผลต่อกิจกรรมและการรักษาลูกค้า อัตราที่แข่งขันได้ดึงดูดลูกค้าใหม่ การตั้งราคาแบบตามปริมาณหรือแบบขั้นบันไดกระตุ้นความภักดีในกลุ่มลูกค้าเหล่านั้น ความโปร่งใสในค่าธรรมเนียมสร้างความไว้วางใจ บริการที่รวมกันช่วยลดต้นทุนของลูกค้า หมั่นทบทวนโครงสร้างเป็นระยะ และในกรณีที่เป็นไปได้ ให้สร้างแบบจำลองความยืดหยุ่นของความต้องการเพื่อกำหนดราคาให้ได้กำไรสูงสุดเมื่อชุดบริการพัฒนาขึ้น

การวัดผลและการปรับปรุงอย่างต่อเนื่องในการเตรียมการที่มีโครงสร้างจะวางรากฐานการกระจายความเสี่ยงที่มั่นคงซึ่งจะเห็นการเติบโตอย่างยั่งยืน

7. แนวทางที่ดีที่สุดในการกระจายสินทรัพย์อย่างมีประสิทธิภาพ

โดยการปฏิบัติตามแนวทางที่ผ่านการทดสอบแล้ว บริษัทนายหน้าสามารถเพิ่มประโยชน์จากการกระจายความเสี่ยงในขณะที่ลดความเสี่ยงได้ การวางแผนอย่างรอบคอบในพื้นที่สำคัญช่วยให้สามารถเพิ่มประสิทธิภาพกลยุทธ์เพื่อการเติบโตที่ยั่งยืนในระยะยาว

8. การเปิดตัวแบบเป็นระยะและการขยายอย่างรอบคอบ

วิธีการแบบขั้นบันไดจะนำเสนอสินทรัพย์ใหม่ในขั้นตอนตามที่มีการตรวจสอบความต้องการแทนที่จะนำเสนอทั้งหมดในครั้งเดียว ในช่วงระหว่างแต่ละขั้นตอน กระบวนการต่างๆ จะถูกปรับปรุงตามการพัฒนาของมาตรฐานการปฏิบัติงาน การขยายขนาดที่วัดได้ในทุกขั้นตอนช่วยป้องกันการใช้ทรัพยากรมากเกินไปก่อนที่ค่าใช้จ่ายจะสามารถพิสูจน์ได้จากความต้องการ ฟังก์ชันการสนับสนุนควรเติบโตในสัดส่วนเพื่อรักษามาตรฐานในขณะที่การดำเนินงานพัฒนาตลอดเวลา.

9. การติดตามแนวโน้มตลาดและการปรับตัว

การติดตามการวิเคราะห์และการสำรวจความชอบอย่างใกล้ชิดช่วยให้สามารถปรับตัวตามการเปลี่ยนแปลงความต้องการได้ โดยมักได้รับการชี้นำจาก ตัวชี้วัดตลาด การตอบสนองอย่างรวดเร็วต่อความนิยมที่เพิ่มขึ้นหรือลดลงจะได้รับการตอบสนองอย่างรวดเร็ว ผลการดำเนินงานที่ไม่ดีในส่วนเสริมตามช่วงเวลาควรได้รับการตรวจสอบใหม่เพื่อหาศักยภาพในการเปลี่ยนแทน ความคล่องตัวช่วยให้สามารถจับโอกาสใหม่ๆ ที่เกิดจากสถานการณ์ที่เปลี่ยนแปลงได้เช่นกัน

10. การศึกษาและการแนะนำลูกค้า

ลักษณะของการเพิ่มเติมแต่ละครั้งได้รับการชี้แจงโดยคำอธิบายที่ชัดเจน ซึ่งระบุถึงความเสี่ยงและกลยุทธ์ในการสร้างความคาดหวังที่เป็นจริง บริบทที่ใหญ่กว่าจะแสดงให้เห็นถึงความยืดหยุ่นในการกระจายความหลากหลาย ห้องสมุด สัมมนา และการสนับสนุนช่วยทำให้การเปลี่ยนแปลงเป็นเรื่องง่าย ลูกค้าใหม่ทำให้ตัวเองคุ้นเคยกับข้อเสนอที่ขยายออกไป

11. การประเมินโอกาสในอนาคต

การควบคุมและการติดตามเทคโนโลยีเปิดเผยภาคส่วนที่มีแนวโน้มในระยะยาว การจ้างงานผู้เชี่ยวชาญเสนอข้อมูลเชิงลึกเกี่ยวกับตลาด การเป็นพันธมิตรช่วยเร่งการเข้าถึงที่เสริมและการเข้าซื้อกิจการช่วยเสริมสร้างความสามารถเฉพาะทาง

12. การประเมินใบอนุญาตอย่างละเอียด

การวิจัยอย่างละเอียดระบุใบอนุญาตตามเขตอำนาจและการเพิ่มเติม กระบวนการขออนุญาตที่รอบคอบพิจารณาระยะเวลาในการอนุมัติ ผู้ควบคุมได้รับเอกสารที่ครอบคลุมซึ่งตอบสนองทุกข้อกังวล คำแนะนำจากผู้เชี่ยวชาญให้แนวทางที่สอดคล้องกับข้อกำหนด

13. การดำเนินการจัดการความเสี่ยงที่แข็งแกร่ง

การสร้างแบบจำลองเชิงปริมาณรวมถึงความเสี่ยงที่มีความสัมพันธ์และความเสี่ยงที่แยกออกจากกัน รายการแต่ละรายการได้รับการป้องกันด้วยมาร์จิ้นและพารามิเตอร์ตำแหน่ง การทดสอบความเครียดครอบคลุมสถานการณ์สมมุติ การศึกษาใช้การชดเชยต่อแรงของความผันผวน

การปฏิบัติตามอย่างขยันขันแข็งจะสร้างพื้นฐานสำหรับการเพิ่มโอกาสในการกระจายการลงทุนอย่างปลอดภัยเพื่อการเติบโตของผู้นำหลายสินทรัพย์อย่างยั่งยืน ผลประโยชน์สูงสุดในระยะยาวจะได้รับการรับประกันผ่านการปรับปรุงอย่างต่อเนื่อง.

ข้อผิดพลาดที่นายหน้าควรหลีกเลี่ยงเมื่อทำการกระจายความเสี่ยง

แม้แต่บริษัทชั้นนำก็อาจทำผิดพลาดเมื่อออกไปสำรวจสินทรัพย์ประเภทใหม่ สิ่งต่อไปนี้คือข้อผิดพลาดที่มักทำให้การริเริ่มการกระจายความเสี่ยงหลุดออกจากเส้นทาง:

1. การรีบไปขอใบอนุญาต

นายหน้าบางรายรีบเข้าสู่ตลาดใหม่โดยไม่จัดทำ ใบอนุญาต ที่จำเป็น ผลที่ตามมาคือค่าปรับ ชื่อเสียงที่ไม่ดี หรือแม้แต่การปิดกิจการ การตรวจสอบอย่างรอบคอบโดยหน่วยงานกำกับดูแลมักมีความสำคัญเป็นอันดับแรกเสมอ

2. การยืดขยายประเภทสินทรัพย์เร็วเกินไป

การแนะนำผลิตภัณฑ์ยอดนิยมทั้งหมดในครั้งเดียวจะทำให้เทคโนโลยี การปฏิบัติตามกฎระเบียบ และพนักงานต้องเผชิญกับภาระหนักเกินไป การเปิดตัวแบบเฟสช่วยรับประกันคุณภาพ การปฏิบัติตามกฎระเบียบ และการดำเนินงานที่ราบรื่น

3. การมองข้ามโครงสร้างพื้นฐานการชำระเงิน

ลูกค้าหลายรายปิดบัญชีเมื่อการฝากและการถอนถูกจำกัด การไม่รวมโมเดลการชำระเงินฟิอัต, คริปโต และท้องถิ่นจะทำให้เกิดความยุ่งยากที่ไม่จำเป็น

4. การประเมินความเรียบง่ายของการปฏิบัติตามเกินจริง

แต่ละเขตอำนาจมีข้อบังคับของตนเอง และ ผู้ให้บริการ KYC ที่เชื่อถือได้มีความสำคัญต่อการรักษาการดำเนินงานให้เป็นไปตามกฎระเบียบในระดับที่ใหญ่ขึ้น การขยายข้ามพรมแดนโดยไม่มีโครงสร้างการปฏิบัติตามกฎระเบียบที่แข็งแกร่งสามารถทำให้พนักงานมีภาระหนักและก่อให้เกิดข้อผิดพลาดที่มีค่าใช้จ่ายสูง

5. การหลีกเลี่ยงการศึกษาแก่ลูกค้า

การเปิดตัวประเภทสินทรัพย์ใหม่โดยไม่มีการอธิบายที่เพียงพอทำให้ลูกค้าสับสนและรู้สึกโดดเดี่ยว เว็บบินาร์, สอนงาน, และการเรียนรู้ในผลิตภัณฑ์ช่วยให้การเริ่มต้นใช้งานเป็นไปอย่างราบรื่น

6. การจัดการการกระจายความเสี่ยงเป็นภารกิจจุดเดียว

ตลาดมีการเปลี่ยนแปลงทุกวัน โบรกเกอร์ที่มีประสิทธิภาพจะทราบถึงแนวโน้ม เปลี่ยนผลิตภัณฑ์ที่มีประสิทธิภาพต่ำ และปรับเปลี่ยนการจัดเรียงค่าธรรมเนียมเพื่อให้สอดคล้องกัน

ข้อสรุป

ข้อได้เปรียบที่เกิดจากการกระจายประเภทสินทรัพย์และแนวทางหลายสินทรัพย์ได้เปลี่ยนแปลงให้กลายเป็นกลยุทธ์ที่สำคัญสำหรับบริษัทนายหน้า (brokerages) ที่ดำเนินการโดยคำนึงถึงความยั่งยืนในอนาคต ในขณะที่เปิดพื้นที่ที่ไม่มีการเชื่อมโยงกันหลายแห่งให้กับลูกค้าผ่านแพลตฟอร์มเดียวที่รวมเป็นหนึ่งเดียว บริษัทนายหน้าจะกระจายความเสี่ยง ของพวกเขาในขณะเดียวกันก็เพิ่มโอกาสของพวกเขา เสถียรภาพรายได้ของพวกเขา และเสริมสร้างคุณค่าที่เสนอให้กับลูกค้า

เมื่อพิจารณาถึงแรงขับเคลื่อนการเปลี่ยนแปลงที่กำลังปรับโฉมภูมิทัศน์บริการทางการเงินในปัจจุบัน บริษัทนายหน้าจำเป็นต้องคำนึงถึงจุดแข็งและช่องว่างของตน และดังนั้นจึงมีความจำเป็นทางยุทธศาสตร์ที่จะต้องกระจายการลงทุนอย่างรอบคอบโดยมีมุมมองระยะยาวต่อความสามารถในการแข่งขัน การตอบสนองต่อความต้องการที่เปลี่ยนแปลง และความเจริญรุ่งเรือง

FAQ

The main benefit is risk reduction. By offering a number of uncorrelated asset classes, brokerages balance losses in one market with profits in another. This creates smoother revenues, draws in more diverse clients, and ensures long-term expansion in spite of turbulent cycles.

Brokers need to continue offering traditional assets like stocks and bonds while expanding into high-growth areas such as cryptocurrencies, tokenized assets, and ESG funds. These offerings respond to evolving client demand, appeal to younger investors, and position the brokerage as an innovative, competitive market player.

In fact, diversification involves upfront investment in licenses, compliance, and technology infrastructure. But the long-term benefits - more stable revenues, multiple income streams, and improved client loyalty, dwarf the costs. Brokerages that diversify properly build resilience and are better positioned to ride out industry downturns.

Regulatory risks are managed by obtaining proper licenses in each asset class and jurisdiction, hiring compliance professionals, and consulting with legal counsel. A strong compliance infrastructure allows brokers to expand offerings without interruption, avoid fines, and maintain client trust when entering new markets.

อัปเดต:

23 กันยายน 2568