¿Qué son los fondos de liquidez? Definición, tipos y beneficios

Contenidos

En el entorno financiero (DeFi), los fondos de liquidez permiten a los usuarios realizar transacciones financieras sin depender de intermediarios convencionales. Estos fondos se almacenan en un contrato inteligente y ofrecen liquidez a plataformas de intercambio (DEX), plataformas de préstamos y otras aplicaciones DeFi. Para desenvolverse en el entorno DeFi es necesario comprender el funcionamiento de los fondos de liquidez.

Definición de fondos de liquidez

Los fondos de liquidez comunitarios son tokens o criptomonedas almacenados en un contrato inteligente. La liquidez que proporcionan permite que se realicen transacciones, lo que facilita el intercambio de criptomonedas. El mercado financiero... La liquidez la mantienen los creadores Quienes compran y venden activos para facilitar la negociación. Los fondos de liquidez en DeFi reducen la necesidad de intermediarios al permitir que los usuarios depositen sus activos en ellos, convirtiéndolos así en proveedores de liquidez.

Las grandes organizaciones financieras, conocidas como proveedores de liquidez, suelen mantener grandes cantidades de activos para facilitar la negociación. Los creadores de mercado obtienen ganancias comprando activos a tasas reducidas y vendiéndolos a precios más altos. Esta configuración garantiza que siempre haya alguien dispuesto a comprar o vender un activo, preservando así la liquidez del mercado.

En cambio, el enfoque DeFi democratiza este sistema. Al aportar sus activos a un fondo de liquidez, cualquier persona que posea criptomonedas puede actuar como proveedor de liquidez (LP). Estos fondos se rigen por contratos inteligentes, que son acuerdos autoejecutables que se inscriben directamente en el código. Una vez que los activos se incluyen en un fondo, el contrato inteligente ejecuta transacciones de forma autónoma y distribuye comisiones entre los LP en función de sus aportaciones.

El enfoque DeFi para los fondos de liquidez es muy amplio. A diferencia de quienes implementan estrategias de creación de mercado que requieren fondos e infraestructura sofisticada, quienes poseen criptomonedas pueden participar en un fondo de liquidez. Gracias a esta accesibilidad, los pequeños inversores tienen la oportunidad de generar fondos que impulsen la liquidez del ecosistema DeFi.

7. Gobernanza y participación comunitaria

En muchos de estos protocolos DeFi, la posesión de tokens LP por parte de los usuarios conlleva derechos de gobernanza que les permiten participar en la toma de decisiones en línea. Esto permite votar sobre cambios en un protocolo, modificaciones en las estructuras de tarifas, la implementación de nuevas funciones u otras decisiones esenciales que determinan la hoja de ruta futura y fomentan un sentido de propiedad y responsabilidad colectivos.

Estos bloques de construcción brindan a los usuarios una sensación de navegar mejor en el panorama de los fondos de liquidez y permiten tomar decisiones informadas basadas en sus beneficios y características, extendiéndose al ecosistema DeFi más amplio.

You may also like

Conceptos clave de los fondos de liquidez

1. Mecánica de comercio descentralizado

Los fondos de liquidez permiten el comercio descentralizado sin intermediarios. Emplean el algoritmo automatizado de creación de mercado para fijar el precio de los activos en función de la oferta y la demanda, lo que a su vez permite un descubrimiento de precios adecuado, justo y transparente.

2. Algoritmos automatizados de creación de mercado

Los fondos de liquidez se basan en sofisticados algoritmos matemáticos que ajustan automáticamente los precios de los activos y mantienen el fondo en una proporción de tokens predeterminada. De esta manera, los mecanismos de los AMM brindan continuidad en la liquidez y una ejecución eficiente de las operaciones, sin la necesidad de creadores de mercado ni libros de órdenes tradicionales.

3. Eficiencia de capital y componibilidad

Los pools de liquidez son más eficientes en términos de capital que los exchanges basados en libros de órdenes. Un subconjunto de usuarios en el pool proporciona liquidez para operar entre sí, sin necesidad de conciliación de órdenes. Esto reduce el capital agregado necesario para alcanzar un volumen de negociación determinado. Gracias a su naturaleza componible, los pools de liquidez se integran fácilmente con otros protocolos y aplicaciones DeFi, lo que aumenta el valor del ecosistema en su conjunto.

4. Incentivos para proveedores de liquidez

Las recompensas se ofrecen de diferentes maneras para los proveedores de liquidez o quienes aportan activos a los pools de liquidez. Pueden incluir una parte de las comisiones de transacción de un pool, agricultura de rendimiento si corresponde y, en ocasiones, incluso derecho a voto en la toma de decisiones del protocolo.

5. Riesgo de pérdida impermanente

Uno de los principales riesgos para la provisión de liquidez es la pérdida no permanente. Esta ocurre cuando se produce una variación significativa en los precios de los activos del fondo en comparación con la tasa de depósito original. Un LP recibirá menos valor al retirar fondos que si los mismos activos se mantuvieran fuera del fondo. Sin duda, esto podría mitigar el riesgo mediante la gestión activa y la diversificación de las carteras.

6. Algoritmos automatizados de creación de mercado

Los fondos de liquidez se basan en sofisticados algoritmos matemáticos que ajustan automáticamente los precios de los activos y mantienen el fondo en una proporción de tokens predeterminada. De esta manera, los mecanismos de los AMM brindan continuidad en la liquidez y una ejecución eficiente de las operaciones, sin la necesidad de creadores de mercado ni libros de órdenes tradicionales.

Cómo funcionan los fondos de liquidez

Cuando los usuarios añaden sus activos a un fondo de liquidez, estos se utilizan para realizar operaciones en las bolsas. Cada operación genera una comisión compartida entre los usuarios. proveedores de liquidez Según su contribución al fondo. Esta configuración garantiza liquidez constante para las operaciones, lo que reduce las fluctuaciones de precios y mejora la eficiencia de las operaciones.

Depósito de activos

El proceso de depósito comienza cuando los usuarios depositan activos en el pool. Normalmente, esto implica suministrar cantidades iguales de dos tokens. Por ejemplo, en un pool ETH/USDT, un usuario depositaría tanto ETH como USDT.

Mantener una combinación de activos es esencial para el funcionamiento del pool.

Acuñación de tokens de liquidez

Cuando los usuarios depositan sus activos, reciben tokens de liquidez (tokens LP) que representan su participación en el fondo y confirman su contribución. Estos tokens se generan en función del valor del activo y otorgan a sus titulares un derecho a participar en el fondo, incluyendo las comisiones cobradas. Con estos tokens, los proveedores de liquidez tienen la flexibilidad de retirar su parte del fondo, junto con las comisiones acumuladas, cuando lo deseen.

Comisiones por ganancias

A medida que se realizan operaciones dentro del fondo de liquidez, se cobran comisiones por transacción. Estas comisiones, un porcentaje de cada operación, se reparten entre los proveedores de liquidez según su participación en el fondo. Este mecanismo automatizado de reparto de comisiones ofrece a los proveedores de liquidez una fuente de ingresos. El aumento de la actividad comercial dentro del fondo genera ingresos para los proveedores de liquidez.

Ejecución de operaciones y saldo del pool

Un comerciante interactúa directamente con el fondo de liquidez al ejecutar una orden en un exchange descentralizado (DEX). Por ejemplo, el proceso de intercambio de ETH por USDT implica retirar ETH del fondo y añadir una cantidad equivalente de USDT tras calcular los costes de transacción. El contrato inteligente que gestiona el fondo gestiona esta transacción para garantizar que se mantenga su saldo. Cuando el precio de ETH cambia, el contrato inteligente ajusta automáticamente las cantidades de ETH y USDT para adaptarse a las condiciones del mercado. Esto garantiza el funcionamiento eficiente del fondo.

Funciones y mecanismos avanzados

Los tokens LP no solo representan la propiedad del usuario en el fondo de liquidez, sino que también sirven como un activo versátil que puede utilizarse en diversas actividades DeFi. Un uso común de los tokens LP es en los protocolos de yield farming y staking, donde los usuarios staking o prestan activos para obtener rendimientos o recompensas en criptomonedas adicionales. Al staking de tokens LP en plataformas, los proveedores de liquidez pueden obtener recompensas además de las comisiones del fondo, lo que aumenta sus ganancias generales. Este doble potencial de ingresos convierte la provisión de liquidez en una opción para los inversores en criptomonedas que buscan maximizar sus ganancias.

Otra característica avanzada que ofrecen los fondos de liquidez es la concesión de derechos de gobernanza a los titulares de LP. En las plataformas DeFi, la tenencia de tokens LP permite a los usuarios participar en las decisiones de gobernanza del protocolo. Esto incluye la votación sobre temas como cambios en la estructura de precios, mejoras del protocolo, nuevos fondos y otras sugerencias de gobernanza. Este modelo democrático garantiza la participación de los usuarios en la formación y gestión de la comunidad de la plataforma.

Tipos de fondos de liquidez

Existen múltiples tipos de fondos de liquidez, cada uno con propósitos dentro del ecosistema DeFi. Conocer las diversas formas de fondos de liquidez permite a las personas elegir las soluciones adecuadas según su tolerancia al riesgo y enfoque de inversión .

Fondos de un solo activo

Los fondos de activos únicos son aquellos en los que los usuarios depositan un tipo de activo. Son comunes en los protocolos de préstamo. Cuando los usuarios aportan sus activos a un fondo de activos único, estos se prestan a los prestatarios. Los intereses que pagan los prestatarios generan ganancias para los proveedores de liquidez.

Características y beneficios clave

- SencillezLos grupos de activos individuales son fáciles de entender debido a que involucran un solo tipo de activo, lo que hace que sea más fácil para los principiantes administrarlos.

- Generación de interésLos activos depositados generan intereses, lo que crea una fuente de ingresos para los LP.

- Exposición reducida:Como los LP están expuestos únicamente al rendimiento de un activo, se simplifica el proceso de mitigación de riesgos.

You may also like

Ejemplo de caso de uso

Un ejemplo de grupos de activos únicos se encuentra en plataformas como Aave o Compuesto . Users have the option to contribute stablecoins, such as USDT o USDC, to the pool, which are subsequently lent to borrowers. The liquidity providers divide the interest earned from these loans.

Fondos de múltiples activos

Los DEX comúnmente utilizan grupos de múltiples activos, donde los usuarios depositan pares de activos para facilitar los intercambios. proveedores de liquidez Apoyan el comercio entre estos activos ofreciendo liquidez en pares de activos. Los PL reciben las comisiones de las transacciones.

Características y beneficios clave

- Facilitación de intercambios de tokens:Diversos grupos de activos juegan un papel en las operaciones DEX, permitiendo la ejecución comercial descentralizada.

- Ganancias por honorarios:Los proveedores de liquidez reciben una parte de las tarifas de transacción por cada operación dentro del grupo.

- Estabilidad de precios:El requisito de contar con activos duales ayuda a mantener la estabilidad de precios dentro del fondo, minimizando las fluctuaciones.

Ejemplo de caso de uso

Uniswap Una plataforma DEX utiliza pools de múltiples activos. Por ejemplo, en un pool de ETH/DAI, los usuarios depositan cantidades de ETH y DAI. Los operadores pueden intercambiar entre estos tokens, mientras que los proveedores de liquidez obtienen comisiones por cada transacción.

Pools de staking

Los pools de staking de tokens implican el bloqueo de tokens para mejorar la seguridad y la funcionalidad de una red. Los participantes suelen recibir tokens adicionales como incentivo por proteger sus tokens durante este proceso. Los pools de staking son esenciales para el funcionamiento de las redes que emplean mecanismos de consenso delegados (DPoS) o de prueba de participación (PoS).

Características y beneficios clave

- Seguridad de la red:Los usuarios contribuyen a proteger la red y verificar las transacciones mediante el staking de tokens.

- Ganando recompensas:Los participantes reciben recompensas en forma de fichas que fomentan su participación activa.

- Baja barrera de entrada:Los grupos de staking a menudo permiten a los usuarios unirse con pequeñas cantidades, lo que hace que la participación sea más inclusiva.

Ejemplo de caso de uso

Ethereum 2.0 Es un excelente ejemplo de un pool de staking. Los usuarios pueden apostar su ETH para recibir recompensas mientras se migra a un modelo de consenso y se mejora la seguridad de la red.

Piscinas híbridas

Algunas plataformas ofrecen pools híbridos que integran las características de los pools de un solo activo y de múltiples activos. Estos pools tienen el potencial de ofrecer mayor adaptabilidad y satisfacer las necesidades específicas del ecosistema DeFi.

Características y beneficios clave:

- Versatilidad:Los pools híbridos se pueden adaptar a las aplicaciones DeFi y ofrecen ventajas tanto en configuraciones de activos únicos como de múltiples activos.

- Rendimientos mejoradosAl combinar diferentes tipos de activos, los fondos híbridos tienen el potencial de generar mayores retornos y perfiles de riesgo diversificados.

Ejemplo de caso de uso

Balancín Destaca en este sentido. Los usuarios pueden crear fondos de liquidez, lo que les permite adaptar sus estrategias de provisión de liquidez a sus preferencias.

Fondos incentivados

Además de las tarifas y los intereses, los fondos de incentivos brindan recompensas, como tokens específicos de la plataforma o incentivos adicionales para atraer liquidez adicional.

Características y beneficios clave

- Recompensas atractivasLos fondos incentivados a menudo ofrecen mayores retornos debido a las recompensas adicionales, lo que atrae a más proveedores de liquidez.

- Mayor liquidez:Los incentivos adicionales ayudan a aumentar la liquidez disponible en el pool, mejorando la eficiencia general de la plataforma.

Ejemplo de caso de uso

Plataformas DeFi populares como Intercambio de sushi y Intercambio de panqueques feature incentivized pools where users can earn platform tokens alongside trading fees. These incentives play a role in boosting liquidity y expanding user participation on the platform.

Factores que influyen en el rendimiento del fondo de liquidez

Volumen de operaciones

El volumen de operaciones es el principal factor determinante del rendimiento del fondo de liquidez. Cuanto mayor sea el número de operaciones realizadas en un período determinado en el fondo de liquidez, mayores serán las comisiones por transacción que genere la plataforma, lo que se traducirá en ganancias para los proveedores.

Volatilidad del precio de los activos

Las fluctuaciones significativas en el precio de los activos del fondo generarán una pérdida temporal para los proveedores de liquidez. Esto significa que, si el precio de los activos se aleja demasiado del ratio de depósito original, al retirarlos, se podría obtener un valor menor que si los activos se mantuvieran fuera del fondo.

Composición de la piscina

La composición más detallada de los activos del fondo de liquidez afecta su perfil de riesgo y rentabilidad en su conjunto. Los fondos que contienen activos más volátiles o con baja correlación pueden ofrecer el potencial de obtener mayores rentabilidades, pero también conllevan mayores riesgos.

Estructura de tarifas

El porcentaje de la comisión de transacción, según lo determina el protocolo, influye directamente en la acumulación de ganancias del proveedor de liquidez. Cuanto mayor sea la comisión, más atractivo será el fondo, mientras que comisiones más bajas pueden reducir el incentivo para proporcionar liquidez.

Competencia

La presencia de pools competitivos que ofrecen pares de activos iguales o similares puede afectar el atractivo y el rendimiento de un pool en particular. Los usuarios eventualmente transferirán su liquidez a los pools que ofrecen las mejores condiciones e incentivos.

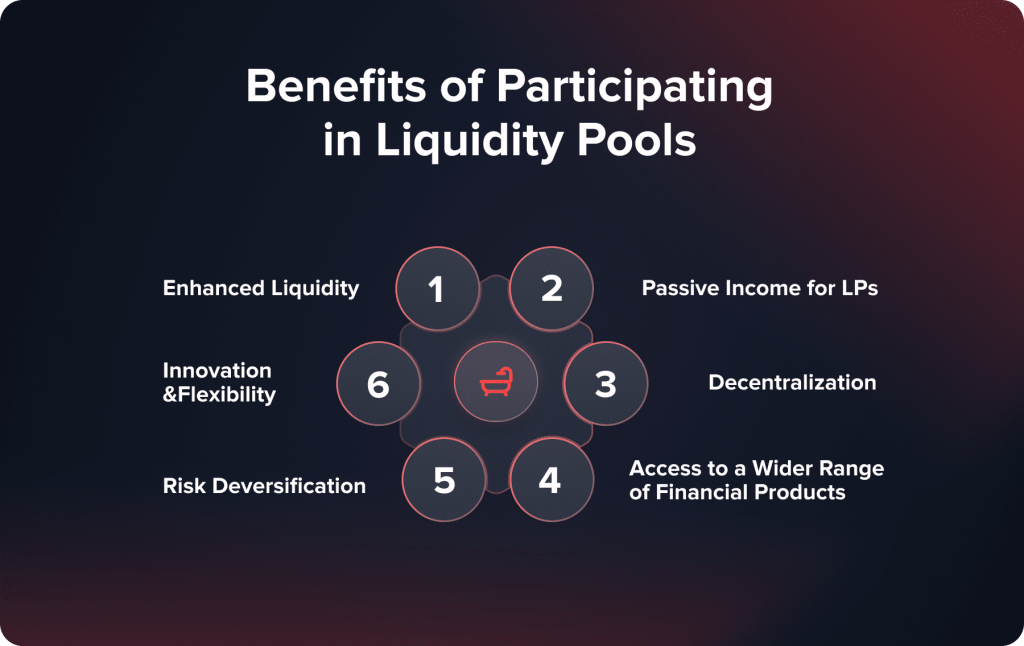

Ventajas de los fondos de liquidez

Tanto los LP como la comunidad DeFi en general se benefician de los fondos de liquidez. Al fomentar la inclusión financiera, impulsar la innovación y facilitar las experiencias de trading, funcionan como un componente de DeFi.

Liquidez mejorada

La capacidad de los fondos de liquidez para agregar fondos de los usuarios es una ventaja crucial, ya que garantiza la disponibilidad de liquidez para operar. Esta agrupación ayuda a reducir el deslizamiento de precios que puede ocurrir cuando las grandes operaciones impactan negativamente los precios del mercado.

Mantener un suministro de activos a través de pools puede facilitar transacciones más fluidas y garantizar una determinación de precios más precisa. Este aspecto es crucial en los exchanges descentralizados, donde la ausencia de creadores de mercado podría provocar fluctuaciones considerables de precios.

Ingresos pasivos para LP

Los proveedores de liquidez pueden obtener una parte de las comisiones de transacción generadas dentro del pool. Estas comisiones, generadas con cada operación, se distribuyen proporcionalmente entre los proveedores de liquidez según su participación en el pool. Esta oportunidad de generar ingresos pasivos puede ser muy atractiva en pools de alto volumen donde las operaciones son frecuentes.

Gestión de riesgos mediante la diversificación

Al agrupar activos con otros usuarios, se distribuyen los riesgos. Se reduce la exposición individual. El rendimiento y los factores de riesgo se comparten entre todos los participantes de un fondo de liquidez. Este enfoque colaborativo ayuda a reducir el impacto de la volatilidad en cualquier activo, lo que resulta en un perfil de rentabilidad estable para los inversores. Por ejemplo, si dentro de un fondo de activos se deprecia un activo, el efecto general en el fondo puede verse compensado por la estabilidad o el crecimiento de otros activos. Esta estrategia de diversificación reduce el riesgo de los fondos de liquidez en comparación con la tenencia de activos.

Innovación y flexibilidad

El uso de contratos inteligentes en fondos de liquidez fomenta la innovación y la adaptabilidad. Los desarrolladores tienen la libertad de introducir productos y servicios que utilizan estos fondos, ofreciendo a los usuarios una gama más amplia de opciones y oportunidades.

Por ejemplo, los pools híbridos pueden combinar elementos de pools de un solo activo y de múltiples activos, ofreciendo soluciones personalizadas para satisfacer las diversas demandas del mercado. Además, la naturaleza programable de los contratos inteligentes permite la incorporación de funcionalidades como protección contra pérdidas impermanentes, optimización automatizada del rendimiento y modelos de comisiones personalizables. Esta adaptabilidad fomenta un entorno DeFi donde se pueden crear e implementar rápidamente productos financieros innovadores.

Beneficios adicionales

TransparenciaCada transacción y modificación dentro de los fondos de liquidez se documenta en la blockchain, lo que garantiza la transparencia y la trazabilidad. Este sistema de registro transparente permite a los usuarios validar la seguridad y la fiabilidad de las actividades del fondo.

Eficiencia:Los fondos de liquidez simplifican el proceso de negociación al proporcionar liquidez comercial, lo que reduce el tiempo y la complejidad que implica unir compradores y vendedores en un mercado. sistema de libro de pedidos .

Riesgos de los fondos de liquidez

Los riesgos relacionados con los fondos de liquidez también están presentes. Si bien estos fondos ofrecen oportunidades para generar ingresos y son esenciales en el ecosistema DeFi, conllevan sus propios riesgos. Es crucial que cualquiera que desee convertirse en un LP comprenda estos riesgos. A continuación, se presentan algunos riesgos clave asociados con los fondos de liquidez y maneras de gestionarlos eficazmente:

1. Pérdida impermanente

Uno de los riesgos que enfrentan los LP es la pérdida temporal. Esto ocurre cuando los precios de los activos en un fondo de liquidez se desvían de sus precios de depósito. Estas desviaciones pueden dar lugar a que, al retirar sus activos, el proveedor reciba menos valor que si simplemente los hubiera mantenido fuera del fondo.

2. Vulnerabilidades de los contratos inteligentes

Los contratos inteligentes impulsan la liquidez y son acuerdos autoejecutables codificados en la cadena de bloques. Aunque están diseñados para ser seguros, pueden presentar errores y vulnerabilidades que los hackers podrían explotar para vaciar el fondo, causando pérdidas a los inversores. Por ejemplo, en 2020. bZx sufrió un ataque de préstamos flash Debido a una falla en su contrato, la empresa perdió un millón de dólares. Estos incidentes subrayan la importancia de auditar los contratos antes de participar en fondos de liquidez.

3. Volatilidad del mercado

Las fluctuaciones repentinas de precios pueden generar pérdidas, como se mencionó anteriormente. También pueden afectar el valor general de los activos del fondo, lo que podría causar importantes reveses financieros para los LP. Por ejemplo, cuando el mercado experimenta una recesión, el valor de los activos en un fondo de liquidez podría desplomarse rápidamente, lo que provoca una disminución del valor total total (TVL) y afecta la estabilidad del fondo.

4. Riesgos regulatorios

Las DeFi y los fondos de liquidez funcionan en un contexto que puede generar incertidumbre regulatoria. Los gobiernos y organismos reguladores a nivel mundial aún están decidiendo cómo supervisar y regular las operaciones DeFi. Esta ambigüedad podría provocar alteraciones en el estado de determinadas plataformas DeFi o incluso de los activos dentro de los fondos.

Conclusión

Comprender el significado, las variaciones, las ventajas y los riesgos del sector DeFi permite a las personas tomar decisiones y desenvolverse eficazmente en él. Los fondos de liquidez ofrecen oportunidades y ventajas que enriquecen la experiencia DeFi, tanto para operadores que buscan transacciones fluidas como para proveedores de liquidez que buscan ingresos adicionales.

Actualizado:

13 de enero de 2025