How to Choose a Trading Platform Solution? – Tips for Beginners

Contents

Trading platforms are critical software solutions that facilitate brokerage firms in the online offering of clients’ access to global financial markets and effectively manage operations.

With many products available in the market, the huge choice is a quandary in itself, so choosing the appropriate trading platform solution requires deliberation of several factors.

This detailed guide would assist brokerages looking to navigate their way through the selection process by stating the key factors against which vendors should be examined. In the sections that follow, you will learn how trading platforms work, review common types, identify the essential criteria for assessment, and finally, recommend shortlisting solutions optimized for individual business needs and delivering outstanding trader experiences.

What are Trading Platforms?

A trading platform is an online, networked system for performing securities transactions through integrated computer programs. It provides the infrastructure whereby brokers intermediate between traders and financial markets in transmitting live pricing data and executing buy/sell orders electronically on behalf of clients. Top systems have robust database architectures that support transparency, enhanced security features, and secondary liquidity provision.

There are several tradable instruments, such as equities, options, forex pairs, or even cryptocurrencies, that traders gain access to in real time through customized interfaces. Added features include research tools, charting, order placing, and historical performance metrics for decision making. In total, trading platforms offer an electronic marketplace able to facilitate participation across borders with the help of strategic partners.

Types of Trading Platforms

There are generally two main categories of trading platforms: proprietary and commercial. Proprietary (also called “prop”) platforms are designed and developed by large brokers, banks and financial institutions themselves. They are used internally for purposes like testing trading strategies. Commercial platforms, on the other hand, are created by independent software vendors and aimed at retail traders or professional investors.

Trading platforms can also be classified based on the device or interface used to access them. Desktop platforms require installation on a computer, while web-based platforms can be used directly through a web browser without downloading any software. Then there are mobile apps specifically optimized for trading on phones and tablets through portable interfaces.

The type of platform suited for a particular trader depends on their goals, preferred location and the types of trading activities that are performed. While desktop versions typically offer the most advanced features, modern web and app-based solutions strive to narrow the gap in functionality for increased flexibility.

You may also like

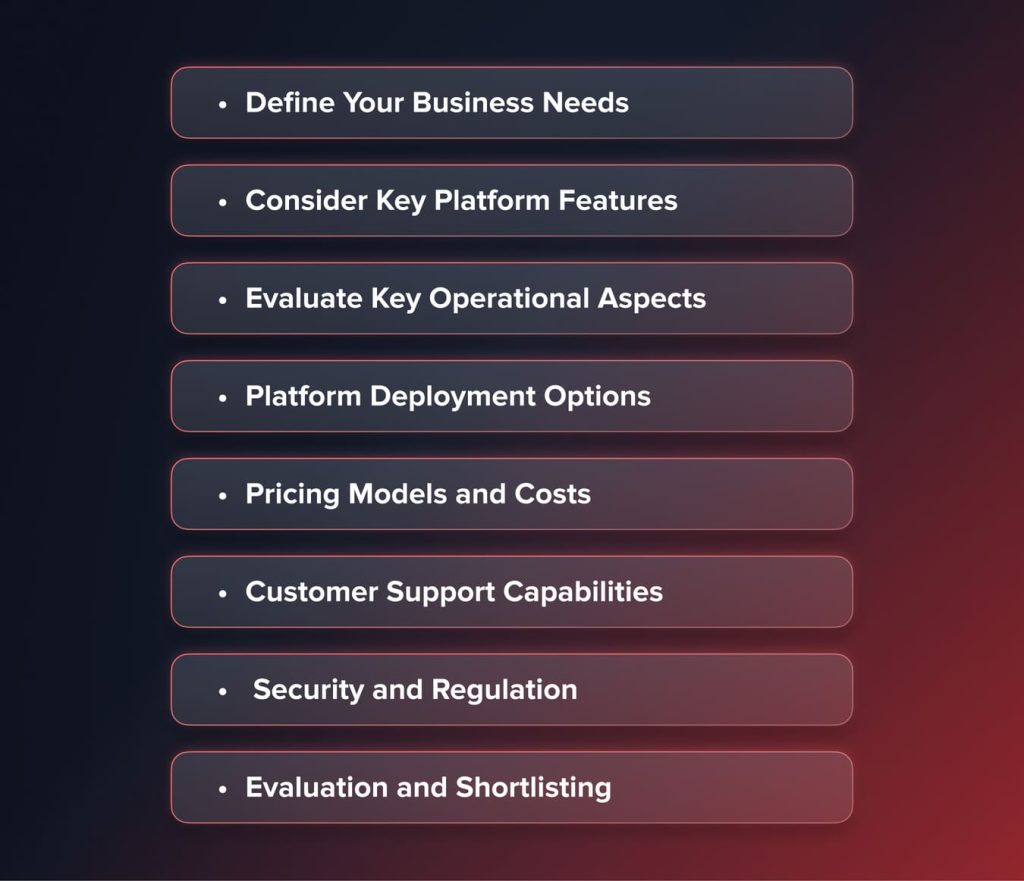

Factors to Consider for Choosing a Trading Platform Solution

Choosing the right trading platform is essential for traders and investors seeking an optimal trading environment tailored to their individual needs and goals. With many options available in the market, each with unique features and functionalities, making an informed selection can appear challenging. However, breaking down the process into key areas of consideration makes narrowing down options more straightforward. Now let’s take it one after the other.

1. Define Your Business Needs

For brokerages, the definition starts inward. It involves the delineation of tradable assets, target client profiles, preferred payment alternatives, and trade order types that align with strategies before vendors are approached.

Will offerings revolve around forex, CFDs on commodities, or even include cryptocurrencies? Will the target audience be mainly casual or full-time speculators with different compliance requirements?

Knowing these use cases sets expectations for platform capability. Proper requirement documentation ensures vetted support for risk governance standards, such as automatic liquidation points or negative balance insurance; solution providers may make clear, customized recommendations.

2. Consider Key Platform Features

Beyond internal criteria, brokers survey feature sets across offerings. Comprehensive asset coverage increases possibilities, while direct access to exchange liquidity multiplies scaling potential. Pre-built advanced charting is paired with economic indicators and news streams to equip analysis-based decision making. It comes with a highly customizable interface in relation to individual needs or roles that are helpful in fostering specialization.

Moreover, seamless payment integrations make onboarding and withdrawal easy. Ensemble leaderboards and copy-trading functionality foster the building of communities as educational materials nurture the development of skills. Mobile responsiveness allows access from anywhere at any time. The combination of such features is important in optimizing trader experiences that lie at the core of retention and referrals.

3. Evaluate Key Operational Aspects

Beyond front-end functions, consideration involves back-office administration efficiencies. Robust user permissions and group controls uphold regulations while monitoring trading volumes, open positions and revenues through customizable executive dashboards provide real-time visibility. Straight-through order execution tied to external exchanges or banks simplifies confirmation processing.

Support for multiple fiat and cryptocurrencies accommodates global liquidity needs. Extracting performance and risk exposure reports assists compliance, while multilingual digital account opening and integrated customer service portals enhance client services. Locating servers within jurisdictions simplifies adhering to local standards too.

4. Platform Deployment Options

Choices between on-premise infrastructure management and cloud deployments must be founded on the value each brings. While privately hosted solutions shift upgrade/scaling responsibilities, the upfront hardware costs and the need for dedicated personnel come at a dear price to budgets. On the other side, while cloud platforms moved network operation worries to trustworthy vendors, ongoing usage-based licensing fee arrangements do retain flexibility.

Other considerations would be the replication of data across geographically distinct disaster recovery sites to ensure continuity; the frequent security patching and its visibility to avoid any exploits, and its availability on desktop terminals or mobile devices. Proper due diligence against business scenarios identifies the best configuration.

5. Pricing Models and Costs

To be able to predict accurate budgets, clarity on pricing models is essential. Upfront licensing fees for the initial deployment services come into play with recurring software-as-a-service costs based on users. Revenue-sharing deals are another alternative, in which small percentages of the turnover that is realized are paid to platform providers in lieu of bearing infrastructure costs.

Knowing the timelines for the settlement of bills, any possible extra costs for customization requests, and cost savings through bulk subscription packages helps in making optimum pricing choices and assessments of affordability. Highly competitive landscapes also demand competitive rates which can maintain profit margins; these are critical to attracting signups.

You may also like

6. Customer Support Capabilities

Adequate support functioning ranks among top priorities. Dedicated telephone lines, email ticketing systems, and live online assistance, available over extended hours, provide instant guidance for any transaction-related queries. Proactive notification systems that allow clients to be informed ahead of time of schedules for maintenance or product updates instil confidence.

Multilingual customer service professionals better handle localization complexities that exist around the world, thereby increasing accessibility. Integrated help desks with searchable knowledge bases expedite troubleshooting one might conduct on their own. Regulatory or account verification aid eases onboarding. Domain expertise in certified representatives infuses reliability and retention.

After all, the measurement of the vendor support service level agreements against needs determines the reliability.

7. Security and Regulation

Protection is fundamental to building and maintaining long-term, trusted partnerships. System encryptions protecting sensitive user credentials and financial transactions transmitted are at par with existing industry baselines. Data redundancy sprawling across geographically removed hosting facilities gives impetus to accessibility assurance even during a localized outage.

A reasonable interval patching of the discovered vulnerabilities keeps defences up. The maintenance of certifications under global watchdogs like CySEC or FINRA, using recognized auditing standards like ISO 27001, instils certainty. Multi-factor authentication and granular permission settings strengthen control, while the logging of activities allows for anomaly detection. Combined with disaster recovery procedures, all of this fortification instils a good deal of confidence.

8. Evaluation and Shortlisting

The full vetting would mean hands-on testing of the platform, evaluation of tools at one’s disposal, and running hypothetical trades simulating all administrative functions before there is commitment of budgets long term. Pre-scheduled product walkthroughs, centring on a firm’s profile, add to its validity. Looking through public reviews on rating sites and forums gives unbiased reviews.

Benchmarking against competitors would allow the assessment of standards in the industry. Hearing from existing clients about real experiences and quality of support gives qualitative insights that might be too difficult to determine otherwise.

Additionally, the testing of smooth third-party integrations, such as CRMs or specialized risk management systems, reduces the need for future troubleshooting. Only upon undergoing exhaustive custom demos and trials against documented needs can a shortlist of an optimum solution for really lengthened negotiations emerge.

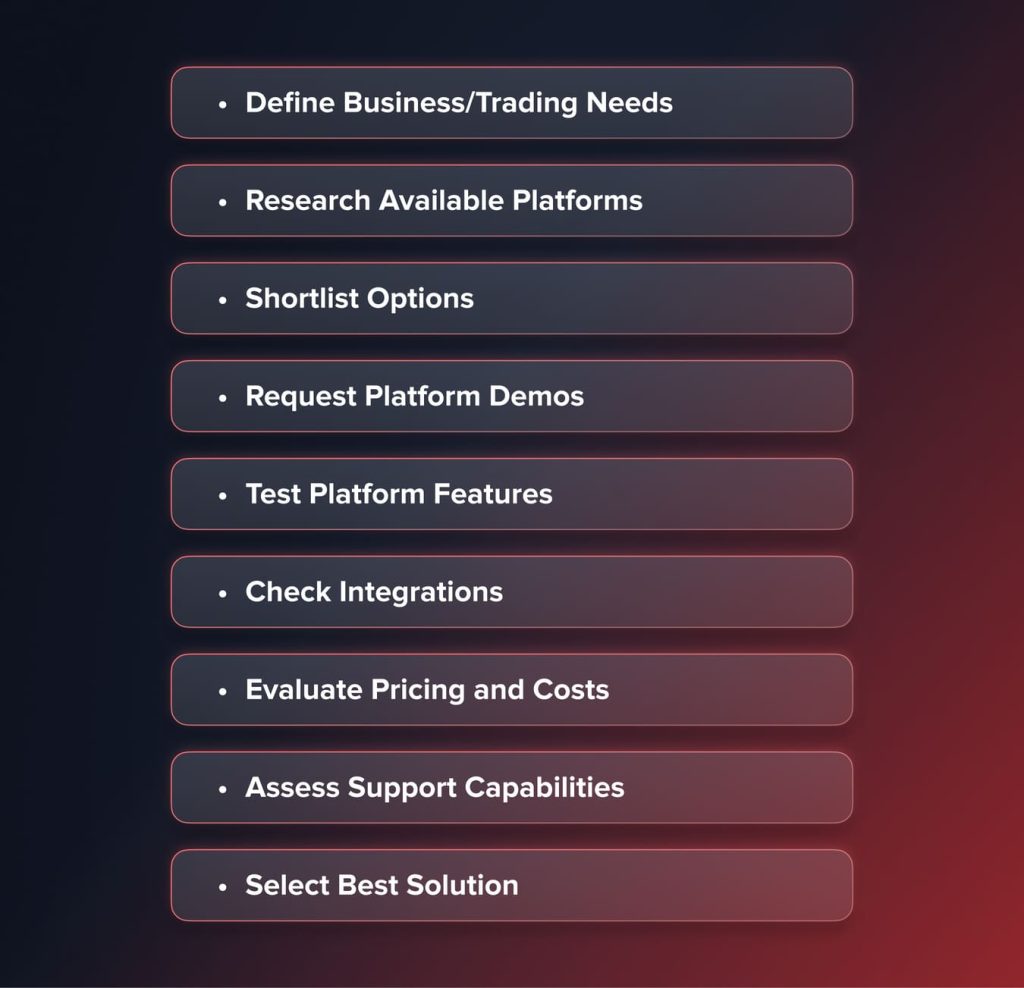

How to Decide on a Trading Platform Solution

Choosing the optimal trading platform impacts success. This guide outlines systematically evaluating solutions to select the best fit. Objectives covered are defining needs precisely, shortlisting through due diligence then picking the solution that excels across requirements.

1. Define Business/Trading Needs

Write out a full trading plan with respect to strategies, preferred instruments, and volumes projected over a month. Mention technical capabilities to flexibly adapt. Enumerate the key capabilities for low-latency executions, charting indicators, and risk controls. Mention the languages that, together with their recurring report styles and compliance stringent assets, will be required. Precision avoids overlooking areas that will hinder goals.

2. Research Available Platforms

Search the websites of vendors, forums, social media, and publications within the industry. Systematically learn popular solutions and write up notes on what assets are offered, types of orders, desktop and app interface user face, and which exchanges are supported that will help filter out compatible platforms. Record the payment methods supported, types of accounts, promotional tools, and customer reviews. Conducting exhaustive research expands options awareness.

3. Shortlist Options

Filter documented longlist preferentially. For example, direct market access to some bourses etc. and cryptocurrency coverage taking priority. Consider a minimum of the top three platforms that give you 70% of your needs for feasibility testing. Reevaluation keeps things fluid by continual adaptation to changing requirements before commitment.

4. Request Platform Demos

Arrange customized demos to clearly elaborate on the needs. Questions should be asked to confirm the capabilities claimed, infrastructure security assurances, and track records. Observe order types, workflows across desktop and mobile, examples of customization control, and quality of educational support. Assess functional suitability and operational suitability with rigour.

5. Test Platform Features

Sign up for trial accounts simulating live operational conditions, place sample trades that assess order flows, confirmations throughput, and the accuracy of risk checks enforcing and reporting. Then, backtest strategies, noting historical simulation reliability and screen customization usability. Finally, assess the user experience comprehensively to ensure that interfaces optimize performance.

6. Check Integrations

The Validate APIs also support customized automated trading applications that can integrate strategies without a hitch. Confirm that connectivity to accounting solutions for performance metric extractions and CRM portals for client communications is faultlessly enabled. Such accomplishments of streamlined processes pay off in scalability for growth.

7. Evaluate Pricing and Costs

Request itemized pricing sheets that factor in initial setup fees and recurring license tiers factoring users, assets, and order volumes. Account support services, compliance consultancy packages, and hardware requirements need to be accounted for. Understand correct infrastructure investments, maintenance spending, and projected profitability. Negotiation stances are determined by competitiveness.

8. Assess Support Capabilities

Inquire about support response times, availability of multilingual agents, recurring client engagement programs and training/mentoring. Request demos of the helpdesk facilities for guided resolution to issues. Speak to existing customers who can honestly rate knowledge, competence and effectiveness of resolutions.

9. Select Best Solution

Carefully evaluate shortlisted platforms against documented specifications and requirements prior to any contractual commitments. Select the solution that tops all needs, technical skills, pricing viability, and well-balanced support assurances that will be able to power ambitions sustainably into the future.

Strong due diligence enables the identification of the best possible trading platform, which will be tailored precisely for strategic visions and risk appetites. Commitments made right after diligent evaluations lay the basis for long-term success and prosperity.

Conclusion

The procurement of a trading platform is instrumental in the very first step to creating sustainable competitive advantages for any brokerage. The best approach is to clearly define the business models and operational needs at the beginning. The primary research should test the field in detail against such needs based on customized presentations and pilot deployments.

The dialogue with existing clients yields qualitative insights too difficult to measure otherwise. Only those options that have nailed-down clear feature-set alignments, low total ownership costs, strong protections, and scalable support standards for the future are worthy of longer-term partnerships. From the very outset, adopting the best solutions will enable efficient delivery of quality client service that will power organic growth for years to come.

Updated:

December 19, 2024

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]