Все, что вам нужно знать о маржинальной торговле

В статье

Маржинальная торговля означает, что вам необходимо инвестировать маржу (определенный процент от общих инвестиционных затрат), а остальные средства заимствуются у брокерской компании или у криптобиржи.

Когда речь заходит о торговле, пользователи имеют два пути: спотовая торговля и маржинальная торговля. Многие торговые платформы объединяют оба пути, позволяя своим клиентам выбирать один из способов или предпочитать гибридную модель.

Почему растет популярность маржинальной торговли, и каковы основные преимущества и риски, связанные с таким типом инвестиций?

Быстрые выводы

- Маржинальная торговля = заемный капитал => Вы платите часть размера сделки и берете остальное в долг у брокера или криптобиржи.

- Эффект рычага увеличивает результаты => Он максимизирует как прибыль, так и убытки в зависимости от движения цены.

- Два типа маржи => Изолированная маржа содержит риск для одной позиции, в то время как кросс-маржа назначает риск на весь ваш баланс.

- Существуют скрытые расходы => Ожидайте торговые сборы, комиссии, а также ставки по финансированию, которые снижают чистую прибыль.

Риск ликвидации является наибольшим риском => Как только собственный капитал упадет ниже требуемой маржи, ваш брокер может автоматически закрыть позицию.

Что такое маржинальная торговля?

Маржинальная торговля позволяет вам открыть позицию, не оплачивая полную стоимость актива. Вы вносите маржу (пропорцию от стоимости сделки) и занимаете оставшуюся сумму у вашего брокера или биржи. Это увеличивает вашу экспозицию на рынке - и ваш риск.

Как это работает (шаг за шагом, просто)

- Выберите актив и кредитное плечо (например, 5x, 10x, 30x).

- Внесите первоначальный маржинальный депозит.

- Остальное покрывается платформой.

- Ваша прибыль/убыток рассчитывается на полный размер вашей позиции, а не на ваш маржинальный размер.

- Если собственный капитал опускается ниже поддерживающей маржи, вы получаете маржинальный вызов или ликвидацию.

Важные формулы (полезные для читателей)

- Размер позиции = Маржа x Кредитное плечо

- Требуемый маржин = Номинальная стоимость + Кредитное плечо

Пример (BTC)

- Купить 0.5 BTC по цене $60,000 = $30,000.

- 10-кратное кредитное плечо => требуемый маржин ≈ $3,000.

- 100x кредитное плечо => необходимый маржин ≈ $300.

- Те же колебания цен, большие колебания P/L, потому что доходность применяется к номиналу в $30,000.

Еще один простой пример (акции)

- Купите акций TSLA на сумму $10,000 с кредитным плечом 5x => маржа = $2,000.

- Движение цены на +2% ≈ +200$ при номинале 10,000$ (+10% на ваш маржинальный залог в 2,000$, до вычета сборов).

- A -2% движение ≈ -200$ (-10% на марже). Убытки могут накапливаться, если рынок продолжит падать.

You may also like

Внимание: Большее плечо снижает первоначальные затраты, но увеличивает риск маржин-коллов и принудительной ликвидации. Всегда учитывайте комиссии/финансирование в вашем безубыточном уровне.

Как работает кредитное плечо на практике

Плечо представлено в виде отношения (например, 1:10). Оно определяет, сколько из позиции вы оплачиваете своими деньгами и сколько — за счет заемных средств.

- 1:10 кредитное плечо - вы инвестируете 10% своих собственных средств, 90% заимствованных.

- 1:30 кредитное плечо - розничный лимит в большинстве юрисдикций ЕС (CySEC, ESMA).

- 1:2000 кредитное плечо - предлагается некоторыми оффшорными брокерами, но крайне рискованно.

Примеры прибыли и убытков

Кредитное плечо усиливает каждое движение на рынке:

- С кредитным плечом 10x, +2.5% роста цены = +25% прибыли на вашем марже.

- С 20-кратным кредитным плечом, падение цены на -3% = -60% убытка на вашем марже.

Правило большого пальца: Чем выше кредитное плечо, тем меньше маржи вам нужно - но тем быстрее может изменяться ваш баланс счета и тем выше риск ликвидации.

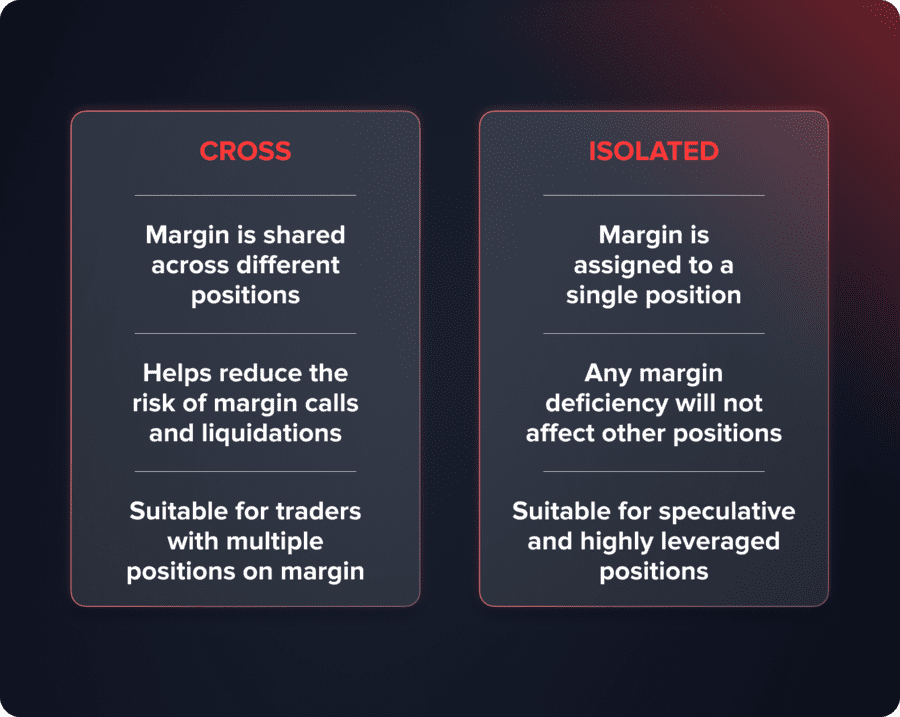

Изолированная маржа против кросс-маржи. Какой тип маржи лучше выбрать?

Когда трейдер открывает маржинальную позицию, доступны два возможных варианта – он может выбрать либо изолированную маржу, либо кросс-маржу. В чем разница между этими вариантами и какой тип маржи является наилучшим решением?

Изолированная маржа позволяет трейдеру определить точную сумму денег, используемую в качестве маржи. Платформа не может списывать больше средств.

Кросс-маржа означает, что ваша маржинальная позиция может использовать средства из вашего депозита. В таком случае весь депозит рассматривается как маржа. Эта настройка несколько похожа на управляемые счета , где балансы по счету используются для поддержания позиций.

Давайте сравним эти типы на примерах.

- Трейдер открывает маржинальную позицию и инвестирует 100 долларов, выбирая тип изолированной маржи. Когда инвестированные 100 долларов не покрывают убытки, платформа принудительно закрывает позицию, и трейдер теряет вложенные средства.

- Трейдер открывает маржинальную позицию и инвестирует 100 долларов, но выбирает перекрестное маржинальное обеспечение. Общий депозит составляет 500 долларов, что означает, что платформа будет использовать другие средства для покрытия убытков в случае, если цена актива пойдет в противоположном направлении.

Какое решение лучше всего подходит для трейдера? Обе типы маржи, изолированная и кросс-маржа, имеют свои преимущества и недостатки. Изолированный тип позволяет трейдерам полностью контролировать свои позиции и добавлять маржу по мере необходимости. Что касается кросс-маржи, она минимизирует риски; в то же время этот тип не является лучшим решением, когда трейдер открывает множество позиций. То же касается высоких кредитных плечей – когда трейдер использует высокий множитель (1:20 и выше), кросс-маржа может быстро съесть его депозит.

Долгие и короткие позиции в маржинальной торговле

Маржинальная торговля позволяет вам зарабатывать как на бычьем, так и на медвежьем рынках - чего нельзя достичь с помощью спотовой торговли:

- Длинная позиция - Вы покупаете актив, ожидая, что его цена вырастет. Вы получаете прибыль, когда продаете его позже по более высокой цене.

- Короткая позиция - Вы продаете заимствованные активы, ожидая, что цена упадет. Вы получаете прибыль, когда покупаете их дешевле, чтобы вернуть на биржу или брокеру.

Важно отметить: Спотовые трейдеры могут зарабатывать только на растущих рынках, в то время как маржинальные трейдеры могут торговать в любом направлении - покупать на восходящих трендах и продавать на нисходящих.

Сборы и комиссии, связанные с маржинальной торговлей

Заемные деньги никогда не бывают бесплатными. В маржинальной торговле вы столкнетесь с несколькими типами затрат, которые могут существенно повлиять на ваши чистые результаты:

- Торговые комиссии - Платформы взимают плату за открытие и удержание позиций.

Пример: Kraken берет 0.02% за открытие + 0.02% каждые 4 часа.

- Комиссии за финансирование - Распространены в фьючерсных контрактах. Эти платежи уравновешивают разницу между спотовыми и фьючерсными ценами.

Трейдеры могут платить или получать финансирование в зависимости от рыночных условий.

- Брокерские комиссии - Некоторые брокеры взимают фиксированные сборы или процент от размера позиции.

Совет: Всегда учитывайте эти сборы в вашем расчете прибыли/убытка. При высоком левередже сборы накапливаются так же, как и прибыль с убытками.

Преимущества маржинальной торговли

Маржинальная торговля предлагает трейдерам возможности, которые недоступны на спотовых рынках:

- Торгуйте большими позициями с меньшим капиталом - Кредитное плечо позволяет вам контролировать большие позиции, имея лишь небольшую часть цены.

- Зарабатывайте деньги как на растущих, так и на падающих рынках - покупайте на бычьих рынках или продавайте на медвежьих.

- Получите доступ к более широким стратегиям - Маржа позволяет использовать стратегии на рынках форекс, акций, индексов и криптовалют.

- Низкий барьер для входа - Небольшие депозиты могут быть использованы для открытия крупных позиций.

Итог: Торговля с использованием маржи увеличивает вашу гибкость, эффективность капитала и выбор стратегий.

Риски маржинальной торговли

Хотя маржинальная торговля предоставляет возможности, она также связана со значительными рисками, о которых должны быть осведомлены все трейдеры:

- Кредитное плечо усиливает убытки - Насколько оно увеличивает прибыль, кредитное плечо также увеличивает убытки, когда рынок движется против вас.

- Принудительная ликвидация может произойти быстро - Даже незначительные колебания цен могут привести к автоматической ликвидации вашей позиции.

- Маржинальные требования - Брокеры могут потребовать от вас добавить больше средств для удержания позиции. Невыполнение этого требования приведет к ликвидации.

- Искушение чрезмерной торговли - начинающие открывают слишком много позиций, увеличивая риск и подвергая себя большему риску.

Ключевой момент: Большой кредитный рычаг снижает требования к капиталу, но делает управление рисками необходимым. Каковы уровень маржи и цена ликвидации как основные риски маржинальной торговли?

You may also like

Объяснение Margin Call и Ликвидации

Торговля с использованием маржи означает, что трейдер использует средства, заимствованные у брокера или криптобиржи. Два ключевых термина определяют ваш риск в маржинальной торговле:

- Цена ликвидации - Цена актива, при которой ваш маржинальный баланс полностью исчерпывается, и ваш брокер принудительно закрывает вашу позицию.

- Маржин-колл - Предупреждение о том, что вам необходимо внести больше денег, чтобы удержать вашу сделку открытой. Игнорирование этого может привести к ликвидации.

Пример

- Вы купили акции TSLA по $209 с кредитным плечом 20x.

- Ваша маржа = $41.8 (вместо $836).

- Снижение цены на 5% уничтожает вашу маржу.

- Цена ликвидации = $198.55.

Вывод: Следите за уровнем маржин-колла и ценой ликвидации в любое время - они определяют, как долго ваша позиция может выдержать неблагоприятные колебания цен.

Практические советы для более безопасной маржинальной торговли

Маржинальная торговля более рискованна, но вы можете снизить риски, следуя некоторым лучшим практикам:

- Начните с низкого кредитного плеча (1:3 - 1:5) - Высокие множители не для новичков.

- Всегда устанавливайте ордера на стоп-лосс - Защищает ваш капитал от резких колебаний.

- Торгуйте с регулируемыми брокерами - Обеспечивает справедливое ценообразование, хорошую ликвидность и защиту для инвесторов.

- Сначала практикуйтесь на демонстрационных счетах - Безрисковое тестирование стратегий перед торговлей на реальных счетах.

- Избегайте кросс-маржи при торговле несколькими позициями - предотвращает убытки от каскадного распространения по всему вашему балансу.

Главный совет: Ваше внимание должно быть сосредоточено на управлении рисками, а не на максимальном преследовании плеча.

Итог

Маржинальная торговля расширяет возможности, доступные трейдерам. Они получают доступ к гораздо большим капиталам и могут получать прибыль как на бычьих, так и на медвежьих рынках. С другой стороны, маржинальная торговля подразумевает более высокие риски – пользователи могут легко потерять свои депозиты. Этот режим торговли определенно полезен, но трейдерам необходимо проводить глубокий анализ и строго следовать стратегиям управления рисками .

FAQ

Разрешена ли маржинальная торговля повсюду?

No. Регламенты различаются в зависимости от страны. Например, ESMA (ЕС) и ASIC (Австралия) ограничивают розничное плечо до 1:30. Оффшорные брокеры (те, которые находятся за пределами этих регионов) могут предлагать значительно более высокое плечо, но обычно без таких же защит для инвесторов. Правила лицензирования, такие как те, которые применяются при получении лицензии брокера, часто определяют максимальное плечо.

Могу ли я потерять больше, чем мой депозит?

Да, это возможно с кросс-маржей и высоким кредитным плечом, так как убытки могут затянуть весь баланс вашего счета. При изолированной марже ваши убытки ограничены конкретной суммой, выделенной для этой сделки. Эти риски также объясняют, почему брокеры соединяют маржинальные счета с жесткими KYC-проверками для соблюдения норм.

Как маржинальная торговля отличается от фьючерсов?

Торговля с маржой включает заимствование для увеличения спотовой позиции. Торговля фьючерсами использует контракты, которые не требуют заимствования, но имеют сборы за финансирование (для поддержания синхронизации цен на фьючерсы и спот) и обычно имеют даты истечения.

Обновлено:

22 сентября 2025 г.