กลับ

Contents

แท่งเทียน Hanging Man: คำจำกัดความและกลยุทธ์

Vitaly Makarenko

Chief Commercial Officer

Demetris Makrides

Senior Business Development Manager

รูปแบบแท่งเทียน Hanging Man เป็นรูปแบบแท่งเทียนกลับตัวที่ทำนายการเปลี่ยนแปลงอย่างต่อเนื่องจากแนวโน้มขาขึ้นไปสู่แนวโน้มขาลง

ประเด็นสำคัญ:

- เชิงเทียนรูปคนแขวนมีลักษณะอย่างไร?

- จะเข้าใจรูปแบบได้อย่างถูกต้องอย่างไร?

- รูปแบบแท่งเทียนรูปคนแขวนมีข้อดีข้อเสียอะไรบ้าง?

- มีเครื่องดนตรีและลวดลายใดบ้างที่นำมาผสมผสานกับการแขวนรูปคน?

- จะเปิดคำสั่งซื้อตามรูปแบบแท่งเทียนรูปคนแขวนได้อย่างไร?

เชิงเทียน Hanging Man คืออะไร?

รูปแบบแท่งเทียนรูปคนแขวนอยู่ในประเภทของรูปแบบการกลับตัวที่ปรากฏขึ้นในจุดสูงสุดของแนวโน้มขาขึ้น และแจ้งให้ผู้ซื้อทราบว่าราคาสินทรัพย์กำลังเข้าใกล้อุปสรรคที่ไม่สามารถปีนขึ้นไปได้ และฝ่ายขาขึ้นก็หมดแรงเพียงพอแล้วและไม่สามารถขยับราคาไปข้างหน้าได้

บนกราฟ รูปแบบจะดูเหมือนแท่งเทียนที่มีตัวแท่งเล็กและเงาล่างยาว สิ่งสำคัญคือสีของแท่งเทียนไม่สำคัญ เพราะแท่งเทียนที่แขวนอยู่สามารถเป็นได้ทั้งสีเขียว (ขาขึ้น) และสีแดง (ขาลง) ซึ่งในทั้งสองกรณี รูปแบบนี้หมายถึงรูปแบบการกลับตัวของขาลง

เมื่อมองดูรูปแบบจะมีลักษณะคล้ายกับคนแขวนคอที่มีขาห้อยลงมา ซึ่งเป็นเหตุผลว่าทำไมรูปแบบแท่งเทียนจึงได้รับฉายาว่า

ลักษณะของเชิงเทียนรูปคนแขวน

นี่คือลักษณะทั่วไปที่สุดที่ช่วยให้ผู้ซื้อขายระบุแท่งเทียนรูปคนแขวนได้:

- รูปแบบนี้ปรากฏเฉพาะบนจุดสูงสุดของแนวโน้มขาขึ้นเท่านั้น

- แท่งเทียนขนาดเล็กเกิดขึ้นที่ด้านบนของช่วงราคา

- เงาด้านบนของแท่งเทียนควรจะหายไปหรือแทบจะมองไม่เห็น

- เงาของแท่งเทียนที่อยู่ด้านล่างควรยาวกว่าตัวแท่งเทียนอย่างน้อยสองเท่า

นอกจากนี้ ผู้ซื้อขายจำเป็นต้องเข้าใจว่ายิ่งแท่งเทียนมีขนาดเล็กและเงาล่างยาวเท่าใด สัญญาณการกลับตัวก็จะยิ่งแข็งแกร่งมากขึ้นเท่านั้น

รูปแบบแท่งเทียนดังกล่าวอาจปรากฏในตลาดการเงินที่แตกต่างกันและในกรอบเวลาที่หลากหลาย

บันทึก! เทรดเดอร์อาจพบแท่งเทียนเดียวกันนี้ที่ด้านล่างของแนวโน้มขาลง ด้วยตัวแท่งขนาดเล็ก เงาด้านบนแทบจะมองไม่เห็น และเงาด้านล่างยาว แท่งเทียนนี้จึงมีชื่อเรียกอีกอย่างว่า “ค้อน” ความแตกต่างระหว่างแท่งเทียนรูปคนแขวนกับแท่งเทียนรูปค้อนอยู่ที่ตำแหน่งที่รูปแบบปรากฏเท่านั้น

รูปแบบแท่งเทียน Hanging Man จะปรากฏขึ้นเมื่อใด?

รูปแบบแท่งเทียนแบบนี้หมายความว่าแนวโน้มขาขึ้นกำลังจะสิ้นสุดลงและคาดการณ์การกลับตัวของแนวโน้มที่กำลังดำเนินอยู่ ขณะเดียวกัน รูปแบบนี้เองก็ไม่ได้บ่งชี้ 100% ว่าราคาสินทรัพย์จะเปลี่ยนทิศทางการเคลื่อนไหว เทรดเดอร์จำเป็นต้องหาหลักฐานยืนยันการกลับตัวของแนวโน้ม

ตัวอย่างเช่น แท่งเทียนรูปคนแขวน (hanging man candlestick) อาจปรากฏเป็นส่วนหนึ่งของรูปแบบ “ดาวราตรี” หรือรูปแบบแท่งเทียนขาลงสามแท่ง นอกจากนี้ เทรดเดอร์ยังสามารถระบุรูปแบบอื่นๆ เช่น “ดาวตก” และ “Bearish Engulfing” ร่วมกับแท่งเทียนรูปคนแขวนได้อีกด้วย

การอธิบายทางจิตวิทยาของรูปแบบที่ปรากฏ

จากมุมมองทางจิตวิทยา การเปิดการซื้อขายเริ่มต้นที่จุดสูงสุด ภายในหนึ่งวัน ฝ่ายขาลงจะกดดันราคาสินทรัพย์อย่างรุนแรง ซึ่งนำไปสู่การขายออกในช่วงต้นและกลางวัน เมื่อสิ้นสุดการซื้อขาย ฝ่ายขาขึ้นจะกลับเข้าสู่สถานะเดิม ขณะเดียวกัน แม้จะมีการโต้กลับของฝ่ายขาขึ้น ตลาดก็ยังคงอยู่ภายใต้การควบคุมของฝ่ายขาลง

สถานการณ์ตลาดที่กล่าวถึงข้างต้นเป็นคำอธิบายที่ชัดเจนถึงสิ่งที่เกิดขึ้นเมื่อผู้ซื้อขายระบุแท่งเทียนรูปคนแขวนบนแผนภูมิ

ในกรณีต่อไป การซื้อขายรายวัน หากเปิดต่ำกว่าแท่งเทียนรูปคนแขวน หมายความว่าผู้เล่นในตลาดหลายรายกำลังเผชิญกับการขาดทุน รูปแบบนี้ถือเป็นสัญญาณสำหรับการปิดสถานะ จากนั้นผลที่ตามมาของการปิดสถานะและการชำระบัญชีก็เกิดขึ้น และนำไปสู่การลดลงอย่างรุนแรงของราคา ส่งผลให้แนวโน้มขาขึ้นเปลี่ยนเป็นแนวโน้มขาลง

การผสมผสานแท่งเทียนรูปคนแขวนกับรูปแบบอื่นๆ

เทรดเดอร์มืออาชีพคุ้นเคยกับการมองหาจุดยืนยันก่อนเปิดสถานะ จุดยืนยันสำหรับรูปแบบ Hanging Man คืออะไร?

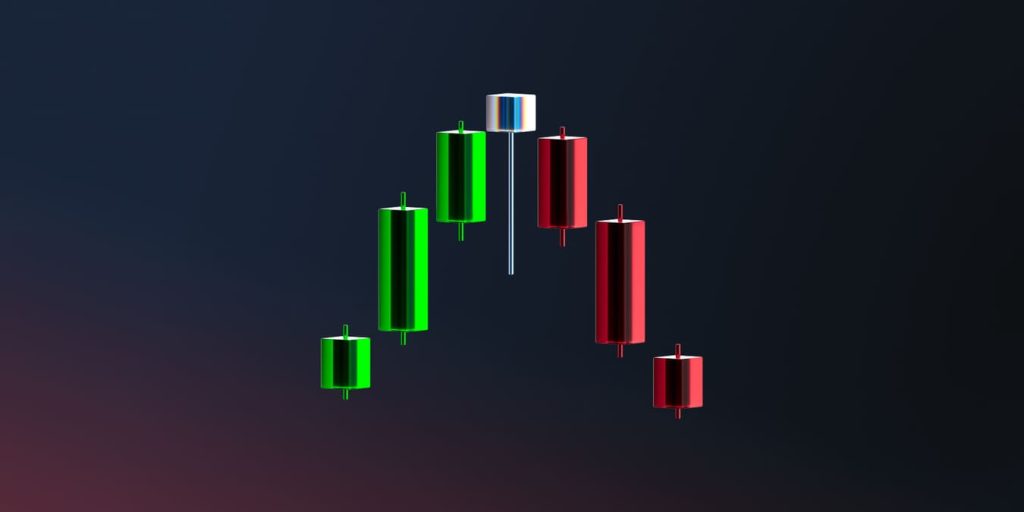

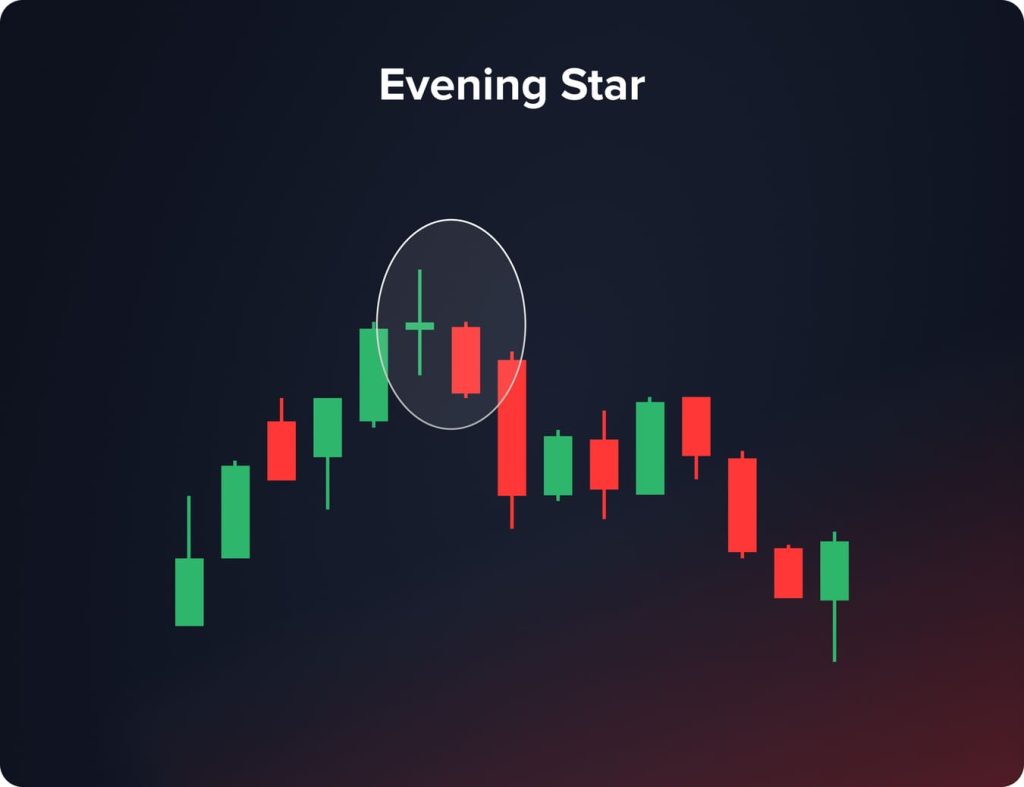

รูปแบบดาวตอนเย็น

ก่อนอื่นเลย เราต้องเข้าใจก่อนว่ารูปแบบ Evening Star ประกอบด้วยอะไรบ้าง นั่นก็คือรูปแบบแท่งเทียนสามแท่ง

- แท่งเทียนแรกเป็นแท่งเทียนขาขึ้นยาว

- แท่งเทียนที่สองมีตัวแท่งสั้น และสามารถเป็นได้ทั้งขาขึ้นและขาลง สะท้อนถึงความไม่แน่นอนของตลาด

- แท่งเทียนที่ 3 มีลักษณะเป็นแท่งเทียนขาลงยาว

แท่งเทียนรูปคนแขวนอาจปรากฏเป็นองค์ประกอบที่สองของรูปแบบดาวราตรี ในกรณีนี้ รูปแบบนี้ถือเป็นสัญญาณที่แข็งแกร่งสำหรับการกลับตัวของแนวโน้มในอนาคต

รูปแบบท็อปคู่

Double Top เป็นรูปแบบขาลงที่ทรงพลังอีกรูปแบบหนึ่ง ซึ่งเกิดขึ้นเมื่อราคาสินทรัพย์แตะจุดสูงสุดสองครั้งแล้วเคลื่อนไหวในทิศทางตรงกันข้าม เมื่อเปรียบเทียบกับรูปแบบกราฟอื่นๆ Double Top อาจประกอบด้วยแท่งเทียนหลายแท่ง บนกราฟ คุณอาจเห็น W กลับหัวได้

เมื่อแท่งเทียนรูปคนแขวนปรากฏขึ้นภายในรูปแบบ Double Top สัญญาณการกลับตัวจะแข็งแกร่งเป็นพิเศษ

การผสมผสานระหว่างชายแขวนคอกับมารุโบซุหมีและฮารามิหมี

แท่งเทียน Marubozu แนวขาลงคือแท่งเทียนที่มีลำตัวยาวซึ่งปรากฏขึ้นทันทีหลังจากการเคลื่อนไหวของแนวโน้มขาขึ้น

Harami คือแท่งเทียนกลับตัวอีกแท่งหนึ่งที่ราคาลดลงเล็กน้อย เมื่อพูดถึง Harami ที่เป็นขาลง แท่งเทียนจะเป็นสีเขียวและอยู่ถัดลงมาจากแท่งเทียนสีแดง

แล้วบทบาทของแท่งเทียนรูปคนแขวนล่ะ? แท่งเทียนนี้อาจปรากฏขึ้นหลังจากแท่งเทียน Marubozu ที่เป็นขาลงและแท่งเทียน Harami ที่เป็นขาลง การรวมกันแบบนี้เป็นการบอกเทรดเดอร์ว่าแนวโน้มกำลังจะเปลี่ยนเป็นขาลง

ลักษณะเด่นที่ช่วยเสริมความแข็งแกร่งให้กับรูปแบบแท่งเทียน Hanging Man

นอกจากการผสมผสานระหว่างแท่งเทียนรูปคนแขวนกับรูปแบบกราฟอื่นๆ แล้ว ยังมีปัจจัยบางอย่างที่ช่วยเสริมสัญญาณนี้ ปัจจัยเหล่านั้นคืออะไร?

- เมื่อมีช่องว่างระหว่างแท่งเทียนรูปคนแขวนกับแท่งเทียนก่อนหน้า การกลับตัวของแนวโน้มจะเห็นได้ชัดเจนขึ้น ยิ่งช่องว่างนั้นใหญ่ขึ้นเท่าไหร่ โอกาสที่แนวโน้มจะกลับตัวก็ยิ่งมีมากขึ้นเท่านั้น

- เงาด้านบนของแท่งเทียนรูปคนแขวนควรจะหายไปหรือสั้นมาก ในรูปแบบดั้งเดิมของแท่งเทียนจะไม่มีเงาด้านบน

- ขนาดของแท่งเทียนมีความสำคัญ ยิ่งแท่งเทียนมีขนาดเล็ก สัญญาณการกลับตัวก็จะยิ่งแรงขึ้น

- ความยาวของเงาล่างก็สำคัญเช่นกัน เงาล่างควรยาวกว่าตัวแท่งเทียนอย่างน้อยสองเท่า ยิ่งเงาล่างยาวเท่าไหร่ สัญญาณก็ยิ่งแรงขึ้นเท่านั้น

- ศักยภาพของการเคลื่อนไหวขาลงนั้นขึ้นอยู่กับแนวโน้มขาขึ้นก่อนหน้าโดยตรง ยิ่งการเคลื่อนไหวขาขึ้นก่อนหน้านั้นรุนแรงมากเท่าใด โอกาสที่แนวโน้มขาลงจะเกิดหลังจากแท่งเทียนรูปคนแขวนก็จะยิ่งมากขึ้นเท่านั้น

- ในทางกลับกัน สีของแท่งเทียนรูปคนแขวนไม่สำคัญ ลวดลายสามารถเป็นสีเขียวได้ ( รั้น ) และสีแดง (ขาลง) แต่ในทางกลับกัน แท่งเทียนขาลงเป็นสัญญาณที่แข็งแกร่งกว่ามาก ซึ่งบ่งชี้ถึงแรงกดดันจากผู้ขายที่แข็งแกร่งต่อตลาด

ข้อดีและข้อเสียของแท่งเทียนรูปคนแขวน

ข้อดีหลักๆ ของรูปแบบนี้ มีดังต่อไปนี้:

- แท่งเทียนรูปคนแขวนช่วยให้ผู้ซื้อขายค้นหาจุดกลับตัวที่ดีที่สุดในการเปิดสถานะ

- รูปแบบนี้มีประสิทธิผลมากกว่าในกรอบเวลาที่สูงกว่า (เช่น กรอบเวลา H4 หรือ D1)

- รูปแบบคนแขวนคอจัดอยู่ในประเภทของรูปแบบการกลับตัวแบบคลาสสิกซึ่งถูกนำมาใช้ในทางปฏิบัติหลายครั้ง ซึ่งเป็นเหตุว่าทำไมความแม่นยำของสัญญาณจึงสูงกว่าเมื่อเทียบกับรูปแบบอื่นๆ มาก

- ในกรณีส่วนใหญ่ รูปแบบนี้มีประสิทธิภาพเพียงพอโดยไม่ต้องมีสัญญาณเพิ่มเติมใดๆ ขณะเดียวกัน เทรดเดอร์ที่ระมัดระวังจะอาศัยสัญญาณขาลงเพิ่มเติมก่อนเปิดสถานะ

จุดอ่อนของแท่งเทียนรูปคนแขวนมีอะไรบ้าง?

- รูปแบบดังกล่าวสามารถให้สัญญาณเท็จแก่ผู้ซื้อขายได้ โดยเฉพาะเมื่อพูดถึงกรอบเวลาที่ต่ำ

- ก่อนที่จะเปิดสถานะตามรูปแบบแท่งเทียนรูปคนแขวน ผู้ซื้อขายจำเป็นต้องเข้าใจบริบทของตลาดทั้งหมด

- ผู้ซื้อขายอาจตีความรูปแบบนี้ตามความรู้สึกของตนเอง เนื่องจากผู้ซื้อขายแต่ละคนจะพิจารณาถึงความแข็งแกร่งและความสำคัญของรูปแบบนี้ด้วยตนเอง

ตัวบ่งชี้ทางเทคนิคเพื่อยืนยันรูปแบบคนแขวนคอ

นอกเหนือจากรูปแบบกราฟกราฟแล้ว เทรดเดอร์มืออาชีพยังนิยมใช้อินดิเคเตอร์ทางเทคนิคที่ยืนยันสัญญาณจากแท่งเทียนรูปคนแขวน (Hanging Man Candlestick) ต่อไปนี้คืออินดิเคเตอร์การกลับตัวที่ดีที่สุด:

- RSI (Relative Strength Index) ตัวบ่งชี้นี้วัดความเร็วและการเปลี่ยนแปลงของการเคลื่อนไหวของราคา ตั้งแต่ 0 ถึง 100 โดยอาศัยการวัดค่า RSI เทรดเดอร์จะเข้าใจว่าสินทรัพย์นั้นอยู่ในภาวะซื้อมากเกินไป (overbought) หรือขายมากเกินไป (oversold)

- แม็คดี ( ค่าเฉลี่ยเคลื่อนที่ การบรรจบกัน (Convergence) การแยกตัว (Divergence) ตัวบ่งชี้ดังกล่าวแสดงถึงความสัมพันธ์กันระหว่าง MA ทั้งสอง และแสดงในรูปแบบฮิสโทแกรม

- สุ่ม (Stochastic) คือเครื่องมือออสซิลเลเตอร์ที่เปรียบเทียบราคาปิดของสินทรัพย์กับราคาภายในช่วงเวลาที่กำหนด

ขั้นตอนหลักในการระบุรูปแบบบนแผนภูมิ

มาวิเคราะห์กันว่าจะระบุรูปแบบนี้บนกราฟได้อย่างไร ตัวอย่างเช่น เราใช้กราฟราคาเบรนท์และกรอบเวลารายวัน (D1)

ขั้นตอนที่ 1. ระบุแนวโน้มขาขึ้นในปัจจุบัน

สิ่งสำคัญที่สุดคือเราต้องค้นหาแนวโน้มขาขึ้นที่ชัดเจน ใช้การวิเคราะห์ทางเทคนิคหรือรูปแบบกราฟอื่นๆ เพื่อให้แน่ใจว่าราคาของสินทรัพย์เคลื่อนไหวอยู่ในแนวโน้มขาขึ้น

ขั้นตอนที่ 2. หาเชิงเทียนรูปคนแขวน

เมื่อระบุแนวโน้มขาขึ้นได้แล้ว เราจำเป็นต้องหารูปแบบ Hanging Man ที่ด้านบนสุดของแนวโน้มขาขึ้น เราเห็นแท่งเทียน Hanging Man ที่ด้านบนของแนวโน้มขาขึ้น แท่งเทียนมีเงาบนที่แทบมองไม่เห็น ตัวแท่งขนาดกลาง และเงาล่างที่ยาว สีของแท่งเทียนเป็นสีเขียว ซึ่งเป็นสาเหตุที่สัญญาณไม่แรงพอ

ขั้นตอนที่ 3. รับการยืนยันสัญญาณและเปิดตำแหน่ง

ไม่ว่าสัญญาณจะแรงแค่ไหน เทรดเดอร์มืออาชีพก็ยังต้องหาการยืนยันผ่านรูปแบบอื่นๆ หรือเครื่องมือทางเทคนิคการกลับตัว

ตัวอย่างเช่น เราเพิ่มเครื่องมือ RSI เพื่อทำความเข้าใจว่าแท่งเทียนรูปคนแขวนนั้นให้สัญญาณจริงหรือเท็จ

ตราสารนี้แสดงค่าที่ 61.61 ซึ่งเป็นเหตุผลที่เราสรุปได้ว่าสินทรัพย์นั้นถูกซื้อมากเกินไป เมื่อใช้ร่วมกับอินดิเคเตอร์ RSI สัญญาณจากแท่งเทียนรูปคนแขวนจะแข็งแกร่งขึ้นมาก

จุดเข้าที่ดีที่สุดสำหรับการเปิดสถานะคืออะไร? เทรดเดอร์มืออาชีพแนะนำให้รับการยืนยันจากแท่งเทียนขาลงถัดไป แล้วจึงเปิดสถานะ ตั้งค่าของคุณ การหยุดการขาดทุน ไปจนถึงระดับบนสุดของตัวเชิงเทียนรูปคนแขวน ส่วน การทำกำไร เครื่องมืออาจวางไว้ที่ระดับความต้านทานที่ใกล้ที่สุด

ข้อสรุป

Hanging man เป็นรูปแบบการกลับตัวแบบดั้งเดิมที่ส่งสัญญาณที่ชัดเจนแก่เทรดเดอร์เพื่อคาดการณ์การเปลี่ยนแปลงจากแนวโน้มขาขึ้นเป็นแนวโน้มขาลง ตัวรูปแบบนี้ค่อนข้างแข็งแกร่ง โดยเฉพาะในกรอบเวลาที่สูงขึ้น แต่เทรดเดอร์มืออาชีพมักยืนยันสัญญาณด้วยรูปแบบและตัวบ่งชี้ทางเทคนิคเพิ่มเติม

FAQ

รูปแบบการกลับตัวแบบแขวนคอ (Hanging Man) จัดอยู่ในประเภทของรูปแบบการกลับตัวแบบดั้งเดิม ซึ่งเป็นเหตุผลว่าทำไมสัญญาณที่ได้จากรูปแบบดังกล่าวจึงเป็นหนึ่งในสัญญาณที่แข็งแกร่งที่สุด อย่างไรก็ตาม เทรดเดอร์มืออาชีพแนะนำให้ยืนยันสัญญาณด้วยรูปแบบและเครื่องมือเพิ่มเติม

แท่งเทียนรูปคนแขวนอาจเป็นส่วนหนึ่งของ Evening Star หรือ Double Top ซึ่งเป็นรูปแบบการกลับตัวที่แข็งแกร่ง สำหรับตัวบ่งชี้ทางเทคนิค รูปแบบนี้ได้รับการยืนยันโดยเครื่องมือ RSI, MACD และ Stochastic

รูปแบบนี้มีประสิทธิภาพอย่างยิ่งในตลาดการเงินทุกประเภท สำหรับกรอบเวลา ขอแนะนำให้เทรดเดอร์ใช้กรอบเวลาที่สูงขึ้น โดยเริ่มจากกรอบเวลา 4 ชั่วโมง

อัปเดต:

3 กุมภาพันธ์ 2568