การหยุดการซื้อขายคืออะไร? ทำไมหุ้นถึงหยุดการซื้อขายและมันหมายความว่าอย่างไรสำหรับคุณ

เนื้อหา

การหยุดการซื้อขายคือเมื่อการแลกเปลี่ยนหยุดการซื้อขายในหุ้นชั่วคราวหรือในกรณีที่หายากทั้งตลาด มันไม่ใช่ข้อบกพร่องและไม่ใช่เรื่องสุ่ม มันเป็นการหยุดชั่วคราวที่ตั้งใจซึ่งเกิดขึ้นเมื่อราคาขยับเร็วเกินไป ข้อมูลที่สำคัญกำลังจะถูกเปิดเผย หรือหน่วยงานกำกับดูแลต้องการเวลาในการเข้าแทรกแซง

จากภายนอก การหยุดดูเหมือนจะเกิดขึ้นอย่างกะทันหัน ในวินาทีหนึ่งหุ้นกำลังซื้อขายตามปกติ ในวินาทีถัดไปมันกลับถูกหยุดนิ่ง สำหรับนักเทรด ช่วงเวลานั้นอาจรู้สึกไม่สบายและบางครั้งก็เครียด แต่เจตนาที่อยู่เบื้องหลังการหยุดนั้นเรียบง่าย: ชะลอให้ช้าลงเพื่อให้ราคาสามารถปรับตัวใหม่ตามข้อมูล ไม่ใช่จากความตื่นตระหนก

การหยุดส่วนใหญ่ใช้เวลาสักครู่ บางครั้งอาจนานกว่านั้น การระงับจากหน่วยงานกำกับดูแลอาจยืดเยื้อไปหลายวัน สิ่งที่สำคัญคือการทำความเข้าใจว่าทำไมการหยุดจึงเกิดขึ้น เพราะนั่นมักจะบอกคุณได้ว่ามีอะไรเกิดขึ้นถัดไป

อะไรเป็นสาเหตุของการหยุดการซื้อขาย? เหตุผลที่แท้จริงที่หุ้นหยุดการซื้อขาย

หุ้นไม่ได้หยุด "เพียงเพราะว่า" การหยุดแต่ละครั้งจะตกอยู่ในหมวดหมู่เฉพาะที่กำหนดโดยกฎเกณฑ์ของตลาดหลักทรัพย์และหน่วยงานกำกับดูแล เมื่อคุณรู้จักหมวดหมู่เหล่านั้น การหยุดจะไม่รู้สึกลึกลับอีกต่อไปและเริ่มรู้สึกคาดเดาได้

มีสามเหตุผลหลักที่การซื้อขายถูกระงับ

1. การหยุดการซื้อขายสำหรับข่าวที่รอดำเนินการหรือที่เผยแพร่

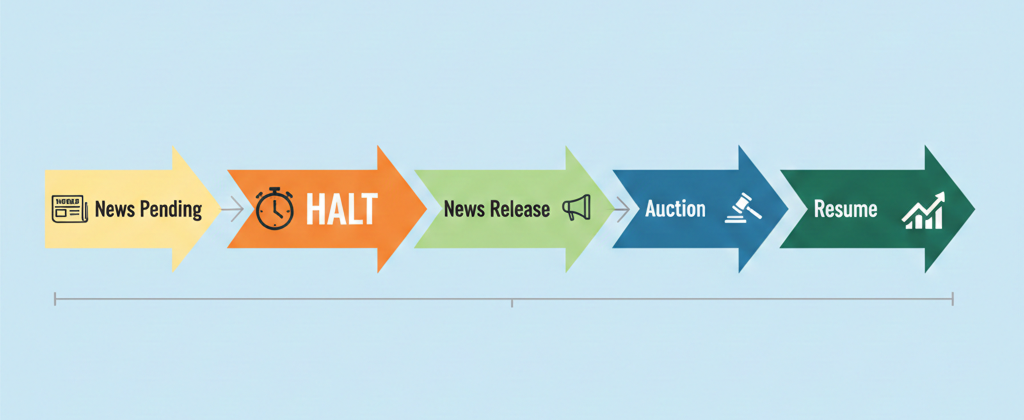

นี่คือประเภทของการหยุดที่พบบ่อยที่สุด และในหลายกรณี มันไม่ใช่สิ่งที่เทรดเดอร์ควรกลัว

เมื่อบริษัทกำลังจะประกาศข่าวสารที่สำคัญ ข้อมูลที่อาจส่งผลกระทบต่อราคาหุ้นอย่างมีนัยสำคัญ ตลาดหลักทรัพย์อาจทำการหยุดการซื้อขายเพื่อให้ทุกคนได้รับข้อมูลนั้นพร้อมกัน

สิ่งนี้มักเกิดขึ้นประมาณ:

- ความประหลาดใจด้านรายได้

- การควบรวมกิจการหรือการเข้าซื้อกิจการ

- การตัดสินใจของ FDA สำหรับหุ้นไบโอเทค

- การยื่นขอล้มละลาย

- การลาออกของผู้บริหารหรือพัฒนาการทางกฎหมาย

โดยไม่มีการหยุดชะงัก นักเทรดที่เห็นข่าวก่อนจะสามารถเทรดได้ก่อนผู้ที่ยังไม่เห็น ทำให้เกิดตลาดที่ไม่เป็นธรรม

ตัวอย่าง:

หุ้นไบโอเทคหยุดซื้อขายที่ 8:30 น. เพื่อรอข่าวที่รอดำเนินการ ในเวลา 8:45 น. บริษัทประกาศการอนุมัติจาก FDA การซื้อขายเริ่มต้นขึ้นอีกครั้งที่ 9:05 น. ผ่านการประมูล ซึ่งอนุญาตให้ผู้ซื้อและผู้ขายพบกันที่ราคาใหม่ที่สมจริงมากขึ้น

การหยุดแบบนี้ไม่ใช่การจำกัดการซื้อขาย — แต่เป็นการป้องกันความยุ่งเหยิงก่อนที่ข่าวจะถูกดูดซึมอย่างเต็มที่。

2. การหยุดการซื้อขายที่เกิดจากความผันผวนที่รุนแรง (Circuit Breakers)

นี่คือที่ที่เทรดเดอร์ส่วนใหญ่ได้สัมผัสกับการหยุดทำการเป็นครั้งแรก。

เมื่อหุ้นเคลื่อนที่ไปไกลเกินไปหรือเร็วเกินไป (ไม่ว่าจะขึ้นหรือลง) มันสามารถกระตุ้นให้เกิดการหยุดชะงักของความผันผวนโดยอัตโนมัติ ในสหรัฐอเมริกา ระบบนี้เรียกว่า Limit Up–Limit Down (LULD).

การหยุดเหล่านี้เกิดขึ้นเนื่องจากตลาดสมัยใหม่เคลื่อนไหวเร็วกว่าช่วงเวลาที่มนุษย์สามารถตอบสนองได้ อัลกอริธึม ความเหลื่อมล้ำบาง และการซื้อขายตามโมเมนตัมสามารถดันราคาให้สูงเกินระดับที่เหมาะสมในเวลาไม่กี่วินาที

เมื่อเกิดเหตุการณ์นั้น การแลกเปลี่ยนจะเข้ามาแทรกแซง

สถานการณ์ทั่วไปที่เกิดการหยุดความผันผวน:

- หุ้นที่มีการลอยตัวต่ำ

- IPO

- หุ้นมีม

- หุ้นขนาดเล็กที่มีการซื้อขายน้อย

- หุ้นที่กำลังเป็นที่นิยมในสื่อสังคมออนไลน์

ตัวอย่าง: นี่ไม่ใช่เรื่องเกี่ยวกับการทำลายโมเมนตัม - แต่มันเกี่ยวกับ การให้โอกาสตลาดได้หายใจ. นี่คือจุดหยุดที่เทรดเดอร์ไม่อยากเห็นจริงๆ เมื่อ SEC หรือการแลกเปลี่ยนหยุดหุ้นด้วยเหตุผลด้านกฎระเบียบ มักหมายความว่ามีคำถามที่ร้ายแรงและยังไม่ได้รับคำตอบเกี่ยวกับงบการเงิน การเปิดเผยข้อมูล หรือการจัดการที่เป็นไปได้ การหยุดเหล่านี้สามารถใช้เวลานานถึง 10 วันทำการ และบางครั้งอาจนานกว่านั้น. แตกต่างจากการหยุดชั่วคราวเนื่องจากความผันผวน การระงับตามกฎระเบียบมักจะเปิดใหม่อย่างไม่ดี ในบางกรณี การซื้อขายไม่เคยกลับมาเริ่มต้นอีกเลย ธงแดง: เมื่อหุ้นหยุดการซื้อขาย โบรกเกอร์ของคุณจะมักจะแสดง รหัสหยุด รหัสเหล่านี้บอกคุณว่ากำลังเกิดอะไรขึ้น—ถ้าคุณรู้วิธีการอ่านมัน การหยุดหุ้นแต่ละตัวเกิดขึ้นทุกวัน การหยุดทั่วทั้งตลาดเกิดขึ้นน้อยกว่ามาก—และน่าตื่นเต้นมากกว่า สิ่งเหล่านี้ถูกกระตุ้นโดยการลดลงอย่างรวดเร็วใน S&P 500 และใช้กับหุ้นของสหรัฐอเมริกาทุกตัว กฎเหล่านี้มีอยู่เพื่อหยุดการขายที่เกิดจากความตื่นตระหนกอย่างเต็มที่เมื่อความกลัวเข้าครอบงำ ผู้ค้าส่วนใหญ่จำได้ถึงเดือนมีนาคม 2020 เมื่อเกิดการหยุดชั่วคราวในตลาดหลายครั้งระหว่างการขายในช่วง COVID การหยุดเหล่านั้นไม่ได้หยุดการลดลง—แต่ช่วยป้องกันการล่มสลายของสภาพคล่องทั้งหมด การทำงานของการจำกัดขึ้น–จำกัดลง (LULD) จริงๆ เป็นอย่างไร LULD ทำหน้าที่เหมือนกับ ขีดจำกัดความเร็ว สำหรับหุ้นแต่ละตัว. การแลกเปลี่ยนคำนวณช่วงราคาที่เคลื่อนไหวตามราคาตลาดเฉลี่ยล่าสุดของหุ้น สำหรับหุ้นส่วนใหญ่ที่มีราคามากกว่า $3 การเคลื่อนไหวที่อนุญาตคือ 5% หรือ 10%. นี่คือสิ่งที่เกิดขึ้นทีละขั้นตอน: กระบวนการนี้ช่วยลดการเกิดการล่มของระบบและการกระโดดที่ผิดธรรมชาติซึ่งเกิดจากหนังสือสั่งซื้อที่บางเฉียบ การหยุดพักไม่ใช่เหตุการณ์ที่เกิดขึ้นน้อยครั้ง - มันเกิดขึ้นทุกวัน. 27–28 มกราคม 2026 ตัวอย่าง: ตัวอย่างเหล่านี้แสดงทั้งสองด้านของการหยุด: การหยุดชั่วคราวที่วางแผนไว้สำหรับข้อมูล และการหยุดชั่วคราวที่ตอบสนองสำหรับการควบคุมราคา. เมื่อการซื้อขายหยุดลง มันรู้สึกเหมือนไม่มีอะไรเกิดขึ้น - แต่จริงๆ แล้วมันไม่เป็นความจริงทั้งหมด. การหยุดไม่ได้ปกป้องคุณในระหว่างการหยุดชะงัก. หุ้นที่หยุดการซื้อขายที่ราคา $50 สามารถเปิดใหม่ที่ราคา $40 หรือ $70 โดยไม่ต้องมีการซื้อขายระหว่างนั้น การดำเนินการจะเกิดขึ้นที่ราคาใหม่ ไม่ใช่ที่ราคาหยุดของคุณ นี่คือจุดที่เทรดเดอร์หลายคนถูกจับได้โดยไม่ทันตั้งตัว。 เมื่อหุ้นพื้นฐานหยุดลง, การซื้อขายออปชั่นก็หยุดลงเช่นกัน. นี่สร้างปัญหาหลายประการ: ในขณะที่ตัวเลือกยังคงสามารถใช้ได้ แต่ความไม่แน่นอนเกี่ยวกับราคา ทำให้การตัดสินใจเป็นเรื่องที่ยาก - โดยเฉพาะอย่างยิ่งสำหรับสัญญาที่มีอายุสั้น. คำแนะนำที่เป็นประโยชน์: การหยุดชะงักนั้นไม่สบายใจ - แต่การตอบสนองทางอารมณ์มักทำให้มันแย่ลงมากขึ้น ช่วงเวลาที่แย่ที่สุดในการคิดคือ 30 วินาทีแรกหลังจากที่หุ้นเปิดใหม่อีกครั้ง ความเชื่อผิดๆ เกี่ยวกับการหยุดการซื้อขาย การเข้าใจกลไกดีกว่าการเดาผลลัพธ์。 การหยุดการซื้อขายไม่ได้มีไว้เพื่อปกป้องนักเทรดแต่ละคน แต่มีไว้เพื่อปกป้อง โครงสร้างตลาด. พวกเขาชะลอความตื่นตระหนก บังคับให้ข้อมูลถูกดูดซึม และป้องกันไม่ให้การค้นหาราคาแตกออกจากกันโดยสิ้นเชิง สำหรับเทรดเดอร์ พวกเขาเป็นเครื่องเตือนใจถึงสิ่งที่ง่ายต่อการลืมเมื่อ ตลาดเคลื่อนไหวอย่างรวดเร็ว: สภาพคล่องสามารถหายไปในทันที - แต่ว่าความเสี่ยงนั้นไม่หายไป. เมื่อคุณเข้าใจว่าการหยุดทำงานอย่างไรและตอบสนองอย่างไร พวกเขาจะไม่เป็นเหตุการณ์ที่น่าตกใจอีกต่อไปและกลายเป็นสิ่งที่คุณสามารถวางแผนได้

3. การหยุดซื้อขายเนื่องจากปัญหาด้านกฎระเบียบหรือความถูกต้อง

หากประกาศหยุดมีการกล่าวถึง “การปกป้องนักลงทุน” หรือ “ข้อกังวลเกี่ยวกับข้อมูล” โดยไม่มีรายละเอียดเฉพาะ ควรระมัดระวัง.คำอธิบายรหัสการหยุดการซื้อขาย: ตัวอักษรหมายความว่าอย่างไร

รหัส เหตุผล สิ่งที่มักจะส่งสัญญาณ T1 ข่าวรอดำเนินการ ประกาศกำลังจะมาถึง T2 ข่าวเปิดเผย ตลาดกำลังย่อยข้อมูล T5 หยุดชั่วคราว LULD ราคาขยับเร็วเกินไป LUDP หยุดความผันผวน เบรกอัตโนมัติ H10 การระงับ SEC ความเสี่ยงทางกฎระเบียบอย่างร้ายแรง การหยุดการซื้อขายทั่วตลาดคืออะไร? (อธิบายเบรกเกอร์วงจร)

ระดับวงจรตัดการทำงานทั่วตลาด

ตัวอย่างการหยุดการซื้อขายในโลกจริงล่าสุด (มกราคม 2026)

เกิดอะไรขึ้นกับการซื้อขายของคุณในช่วงหยุดการซื้อขาย

สิ่งที่คุณไม่สามารถทำได้

คุณสามารถทำอะไรได้บ้าง

ทำไมการเปิดใหม่จึงเป็นอันตราย

การหยุดการซื้อขายมีผลต่อผู้ค้าตัวเลือกอย่างไร

การถือออปชันในช่วงที่มีข่าวที่ทราบกันดีเป็นความเสี่ยงที่คำนวณได้ แต่การทำเช่นนั้นโดยบังเอิญไม่ใช่ควรทำอย่างไรเมื่อหุ้นที่คุณถือถูกระงับ

การตอบสนองที่สงบและมีประสิทธิภาพ

ข้อสรุปสุดท้าย: ทำไมการหยุดซื้อขายจึงมีอยู่

FAQ

ใช่ ข่าวมักจะหยุดบ่อยนอกเวลาปกติ

ปกติประมาณห้านาที แม้ว่าจะมีการขยายเวลาได้

No. Halts are short. Suspensions can last days.

ใช่ โดยเฉพาะในช่วงที่มีความผันผวนสูง.

อัปเดต:

17 กุมภาพันธ์ 2569