Churn: มันหมายถึงอะไรจริง ๆ, วิธีวิเคราะห์มัน, และวิธีที่แพลตฟอร์มลดมัน

เนื้อหา

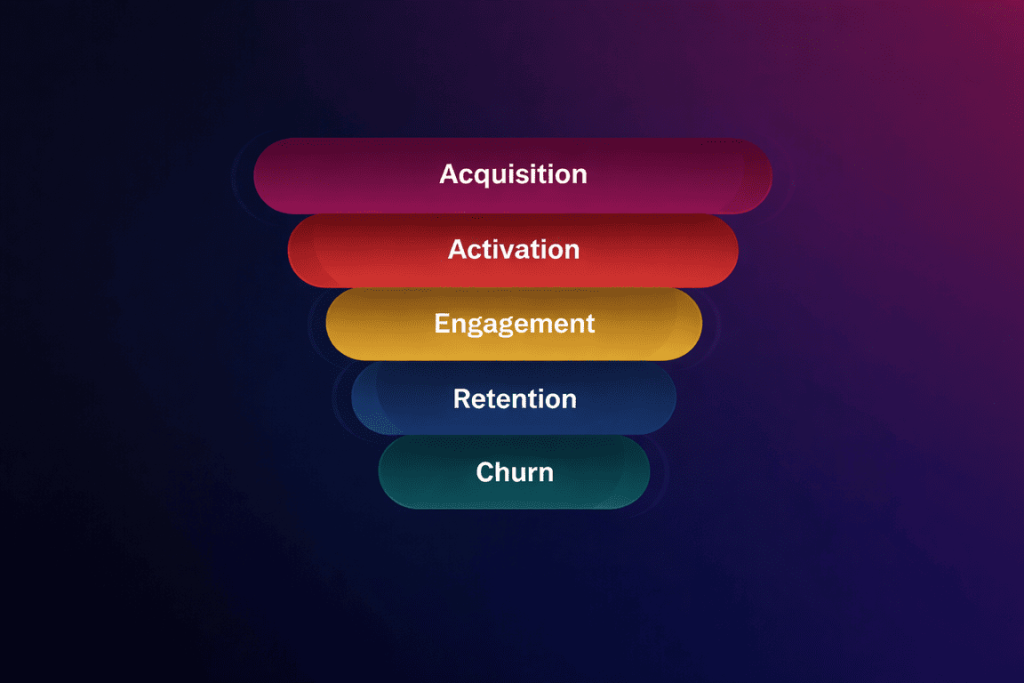

การเลิกใช้งานคืออัตราที่ลูกค้าหยุดใช้ผลิตภัณฑ์หรือบริการของคุณ.

พูดง่ายๆ คือ: มันแสดงให้เห็นว่าผู้คนออกจากไปเร็วแค่ไหน หากลูกค้าออกไปเร็วกว่าอัตราที่คุณสามารถทดแทนได้ ธุรกิจจะค่อยๆ สูญเสียไป แม้ว่าการขายจะดูดีในเอกสาร.

สำหรับผู้ประกอบการดิจิทัล การสูญเสียลูกค้าไม่ใช่แค่ตัวชี้วัด แต่มันคือสัญญาณ มันบอกคุณได้ว่าผู้คนได้รับคุณค่าจริง ๆ หลังจากการคลิกครั้งแรก การฝากเงิน หรือการเข้าสู่ระบบหรือไม่

Churn คืออะไร? คำอธิบายแบบง่ายๆ

Churn ตอบคำถามง่ายๆ ข้อหนึ่ง:

คุณสูญเสียลูกค้าไปกี่รายในช่วงเวลาหนึ่ง?

สูตรที่พบบ่อยที่สุดมีลักษณะดังนี้: ลูกค้าที่สูญเสีย ÷ ลูกค้าในช่วงเริ่มต้นของระยะเวลา

ตัวอย่าง:

- คุณเริ่มต้นเดือนด้วยผู้ใช้ 1,000 คน

- 60 หยุดใช้แพลตฟอร์ม

- การเลิกใช้รายเดือน = 6%

แค่นั้นแหละ ไม่มีความลับ แต่มีรายละเอียดสำคัญที่ผู้ก่อตั้งหลายคนมักมองข้าม

คุณสามารถวัดอัตราการเลิกใช้งานใน ผู้ใช้ หรือใน เงิน。

- การสูญเสียลูกค้า: มีคนจำนวนเท่าไหร่ที่ออกไป

- การสูญเสียรายได้: รายได้ที่เกิดขึ้นซ้ำๆ ที่หายไป

ในโมเดลการสมัครสมาชิกและโบรกเกอร์ส่วนใหญ่, การสูญเสียรายได้มีความสำคัญมากกว่า. การสูญเสียบัญชีขนาดใหญ่หนึ่งบัญชีอาจทำให้เจ็บปวดมากกว่าการสูญเสียบัญชีขนาดเล็กสิบบัญชี.

คุณอาจจะสนใจ

ทำไมการเลิกใช้บริการถึงสำคัญกว่าที่คุณคิด

การเลิกใช้บริการส่งผลกระทบทุกอย่างอย่างเงียบๆ:

- ค่าชีวิตตลอดช่วงเวลา (LTV)

- ประสิทธิภาพการตลาด

- ระยะเวลาคืนทุนจากโฆษณา

- ความสามารถในการคาดการณ์กระแสเงินสด

- การประเมินมูลค่าบริษัท

นี่คือความจริงที่โหดร้าย: หากการเลิกใช้สูง การเติบโตเป็นเรื่องปลอม.

คุณกำลังเติมน้ำในถังที่มีรูอยู่ที่ก้นอย่างต่อเนื่อง。

ผู้ประกอบการดิจิทัลหลายคนหมกมุ่นอยู่กับการได้มาซึ่งลูกค้า โฆษณา, ช่องทาง, สร้างสรรค์ ในขณะเดียวกันผู้ใช้กลับหนีไปหลังจากสัปดาห์แรก

การแก้ไขการเลิกใช้บริการมักจะดีกว่าการขยายการเข้าชมเสมอ ทุกครั้ง.

ประเภทหลักของการเลิกใช้ที่คุณควรเข้าใจ

การเลิกใช้งานโดยสมัครใจ vs. การเลิกใช้งานโดยไม่สมัครใจ

- การเลิกใช้งานโดยสมัครใจ: ผู้ใช้ตัดสินใจที่จะออก

- การเลิกใช้โดยไม่สมัครใจ: สาเหตุทางเทคนิค (การชำระเงินล้มเหลว, บัตรที่ถูกบล็อก, ปัญหาการปฏิบัติตาม)

ในหลายธุรกิจ, 10–30% ของการเลิกใช้บริการเป็นการเลิกใช้บริการที่ไม่สมัครใจ ซึ่งสามารถแก้ไขได้ด้วยระบบที่ดีกว่า.

การสูญเสียรวมเทียบกับการสูญเสียสุทธิ

- การสูญเสียรวม: ผู้ใช้หรือรายได้ที่สูญหายทั้งหมด

- Net churn: การสูญเสียลบกับการขยายจากผู้ใช้ที่มีอยู่

แพลตฟอร์มที่แข็งแกร่งมุ่งหวังที่จะมี อัตราการเลิกใช้บริการรวมต่ำ และในอุดมคติ อัตราการเลิกใช้บริการสุทธิเป็นลบ ซึ่งการอัปเกรดมีมากกว่าการสูญเสีย.

การเลิกใช้บริการแต่เนิ่นๆ กับการเลิกใช้บริการในภายหลัง

ความแตกต่างนี้มีความสำคัญมาก

- การเลิกใช้งานในช่วงต้น เกิดขึ้นในวันหรือสัปดาห์แรก

- การเลิกใช้งานในภายหลัง เกิดขึ้นหลังจากใช้งานไปหลายเดือน

การเลิกใช้งานในช่วงแรกมักจะเป็นความล้มเหลวในการเริ่มต้นใช้งาน.

อัตราการเลิกใช้ที่ “ดี” คืออะไร?

ไม่มีหมายเลขสากล แต่มีรูปแบบที่มีอยู่

| รูปแบบธุรกิจ | อัตราการเลิกใช้บริการรายเดือนทั่วไป |

| B2B SaaS | 1–3% |

| B2C SaaS | 3–7% |

| แพลตฟอร์มโบรกเกอร์ค้าปลีก | 4–10% |

| ผลิตภัณฑ์การซื้อขายที่มีความเสี่ยงสูง | 8–15% |

แพลตฟอร์มโบรกเกอร์อยู่ในพื้นที่ที่ยากลำบาก.

เงินมีส่วนเกี่ยวข้อง อารมณ์มีส่วนเกี่ยวข้อง การสูญเสียเป็นสิ่งที่หลีกเลี่ยงไม่ได้

นั่นคือเหตุผลที่ การจัดการการเลิกใช้งานในตัวกลาง ไม่ใช่งานเสริม แต่มันคือโครงสร้างพื้นฐานหลัก。

วิธีการวิเคราะห์การสูญเสียลูกค้าอย่างถูกต้อง (ไม่ใช่แค่สูตร)

การวิเคราะห์กลุ่ม: หยุดมองที่ค่าเฉลี่ย

ค่าเฉลี่ยซ่อนปัญหา。

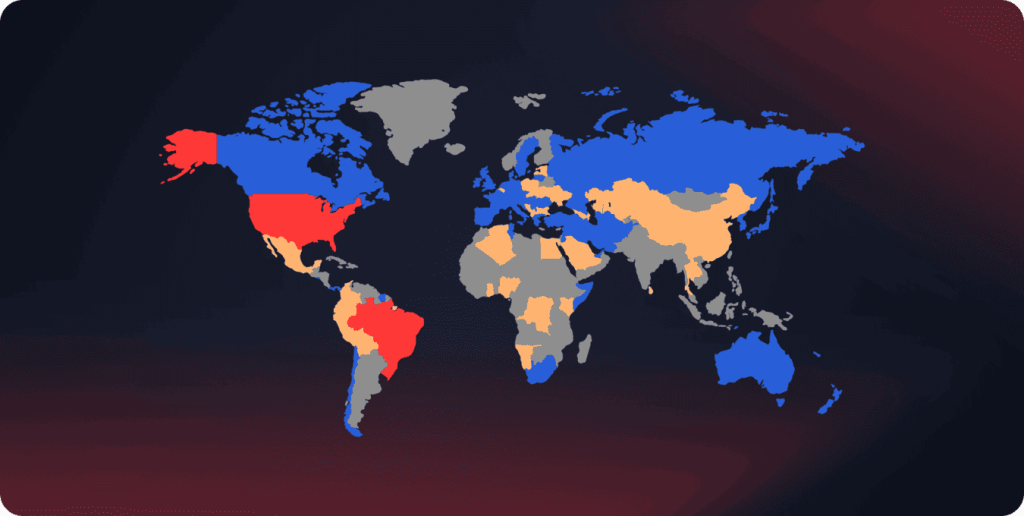

การวิเคราะห์กลุ่มผู้ใช้แบ่งกลุ่มผู้ใช้โดย:

- เดือนที่ลงทะเบียน

- ช่องทางการเข้าซื้อ

- ประเทศหรือข้อบังคับ

- ประเภทสินค้า

คุณอาจค้นพบว่า:

- ผู้ใช้จากการค้นหาที่ต้องชำระเงินมีอัตราการเลิกใช้บริการเร็วเป็นสองเท่า

- หนึ่งในเวอร์ชันการนำเข้าสู่ระบบทำได้แย่มาก

- บางภูมิภาคออกเดินทางก่อนภูมิภาคอื่น

นี่คือที่ที่ข้อมูลเชิงลึกที่แท้จริงปรากฏขึ้น.

สัญญาณพฤติกรรมก่อนการเลิกใช้

การเลิกใช้บริการเกิดขึ้นได้ยากในชั่วข้ามคืน.

มีสัญญาณเตือน:

- การเข้าสู่ระบบมีความถี่น้อยลง

- การซื้อขายหรือการดำเนินการช้าลง

- หยุดข้อความสนับสนุน

- อีเมลไม่ได้เปิดอ่าน

เมื่อผู้ใช้ "เลิกใช้" การตัดสินใจมักจะถูกทำขึ้นหลายสัปดาห์ก่อนหน้านั้น

แพลตฟอร์มที่ดีไม่รอการยกเลิก.

พวกเขาจะดำเนินการเมื่อพฤติกรรมเปลี่ยนแปลง.

ความจริงในระดับเซกเมนต์

การเลิกใช้บริการไม่สม่ำเสมอ

บ่อยครั้ง:

- ผู้เริ่มต้นหมุนเวียนเร็ว

- ผู้ใช้ระดับกลางอยู่ได้นานที่สุด

- ผู้ใช้ที่มีความเสี่ยงสูงจะเลิกใช้บริการอย่างรุนแรงหลังจากการขาดทุน

แบ่งกลุ่มผู้ใช้ตาม พฤติกรรม ไม่ใช่แค่ตามประชากรศาสตร์ นั่นคือที่ที่มีประโยชน์อยู่

ทำไมลูกค้าถึงออกจากบริการ (นอกเหนือจากที่เห็นได้ชัด)

ผู้คนชอบที่จะตำหนิ:

- ราคาทั้งหมด

- การแข่งขัน

- สภาพตลาด

นั่นมักจะไม่ใช่เหตุผลที่แท้จริง.

ในทางปฏิบัติ การเลิกใช้งานเกิดขึ้นเนื่องจากผู้ใช้:

- รู้สึกหลงทาง

- รู้สึกโง่

- รู้สึกโชคร้าย

- รู้สึกเหมือนไม่มีใครสนใจ

- รู้สึกเครียด

โดยเฉพาะในผลิตภัณฑ์ทางการเงิน.

ผู้คนไม่ได้เลิกใช้บริการเพราะพวกเขาสูญเสียเงิน.

พวกเขาเลิกใช้บริการเพราะพวกเขาไม่เข้าใจ ทำไม พวกเขาถึงสูญเสียมัน.

แพลตฟอร์มโบรกเกอร์ป้องกันการสูญเสียลูกค้าในทางปฏิบัติอย่างไร

แพลตฟอร์มโบรกเกอร์ เผชิญกับปัญหาเฉพาะอย่างหนึ่ง.

การเลิกใช้บริการไม่ใช่แค่เหตุผลทางตรรกะ.

มันเกี่ยวข้องกับอารมณ์.

นี่คือวิธีที่แพลตฟอร์มที่แข็งแกร่งจัดการกับมัน.

7–14 วันแรกคือทุกสิ่ง

ผู้ใช้ส่วนใหญ่ที่เลิกใช้งานจะทำเช่นนั้นในช่วงต้น.

นายหน้าชั้นนำมุ่งเน้นอย่างมากที่:

- การเริ่มต้นใช้งานที่ง่าย

- ระบุขั้นตอนถัดไป

- การกระทำแรกที่รวดเร็ว

- การเปลี่ยนจากเดโมสู่ของจริงที่รู้สึกปลอดภัย

เป้าหมายไม่ใช่กำไร เป้าหมายคือความมั่นใจ หากผู้ใช้รอดชีวิตจากสองสัปดาห์แรก การรักษาผู้ใช้จะเพิ่มขึ้นอย่างมาก

คุณอาจสนใจ

การติดตามพฤติกรรมแบบเรียลไทม์

แพลตฟอร์มโบรกเกอร์สมัยใหม่ติดตาม:

- สตรีคชนะ/แพ้

- การเพิ่มความเสี่ยง

- ช่องว่างที่ไม่ทำกิจกรรมยาวนาน

- การเปลี่ยนแปลงพฤติกรรมที่ฉับพลัน

เมื่อรูปแบบเปลี่ยนแปลง ระบบจะตอบสนอง:

- การศึกษา

- คำเตือนความเสี่ยง

- การติดต่อผู้จัดการ

- การปรับกลยุทธ์

นี่ไม่ใช่การเฝ้าระวัง นี่คือการเข้าแทรกแซงตั้งแต่เนิ่นๆ

ความเห็นของผู้เชี่ยวชาญ #1

ในหลายแพลตฟอร์มโบรกเกอร์ที่ฉันเคยทำงานด้วย ตัวทำนายการเลิกใช้งานที่ใหญ่ที่สุดไม่ใช่การขาดทุน – แต่มันคือความเงียบ ผู้ใช้ที่หยุดมีปฏิสัมพันธ์ แม้จะชนะแล้ว ก็กระจายตัวเร็วกว่า those who complained.

ผู้จัดการบัญชีในฐานะผู้เชี่ยวชาญด้านการรักษาลูกค้า

ในธุรกิจนายหน้าหลายแห่ง ผู้จัดการบัญชีถูกเข้าใจผิด

งานจริงของพวกเขาไม่ได้อยู่ที่การผลักดันปริมาณ.

มันคือ:

- การอธิบายผลลัพธ์

- การจัดการความคาดหวัง

- ทำให้ปฏิกิริยาทางอารมณ์สงบลง

- การทำให้ผู้ใช้มีสติ

การสนทนาสั้นๆ ระหว่างมนุษย์หลังจากวันที่ ทำการซื้อขาย ที่ไม่ดีสามารถยืดอายุการเป็นลูกค้าออกไปได้เป็นเดือน.

การทำงานอัตโนมัติช่วยได้ มนุษย์ยังคงมีความสำคัญ.

แรงจูงใจที่สนับสนุนพฤติกรรม (ไม่ใช่การติดยา)

โบนัสอาจทำให้เกิดผลเสียหากใช้อย่างไม่ถูกต้อง

นายหน้าที่ชาญฉลาดใช้:

- รางวัลตามกิจกรรม

- การศึกษาเป็นกุญแจสำคัญ

- เครื่องมือบรรเทาการสูญเสีย

- ระดับความภักดี

จุดสนใจไม่ใช่ “ค้าขายมากขึ้น”。

แต่เป็น “ค้าขายอย่างชาญฉลาดและอยู่ได้นานขึ้น”。

การรักษาลูกค้าไว้สำคัญกว่าปริมาณระยะสั้น.

การศึกษาเป็นทรัพย์สินในการรักษา

การศึกษาเปลี่ยนแปลงเส้นโค้งการหมุนเวียน。

แพลตฟอร์มที่ลงทุนใน:

- สัมมนาออนไลน์

- คำอธิบายตลาด

- การวิเคราะห์กลยุทธ์

- การวิเคราะห์หลังการซื้อขาย

ดูผู้ใช้:

- รักษาความสงบ

- ค้าขายเป็นเวลานานขึ้น

- ลดการสูญเสียอารมณ์

การศึกษาเปลี่ยนความสับสนให้เป็นบริบท และบริบททำให้ผู้คนอยู่รอบๆ

ข้อมูลเชิงลึกจากผู้เชี่ยวชาญ #2

นายหน้าคนหนึ่งเห็นการลดลงของการขาดทุนหลังจากเพิ่มคำอธิบายสั้นๆ หลังจากการขาดทุน ไม่ใช่คอร์ส เพียงแค่ 2–3 ประโยคที่อธิบายว่าเกิดอะไรขึ้น ผู้ใช้ไม่ได้ชนะมากขึ้น — แต่พวกเขายังคงอยู่.

ความเชื่อมั่นในแพลตฟอร์มและประสบการณ์ผู้ใช้

ไม่มีอะไรเร่งการเลิกใช้บริการได้ดีเท่ากับความเจ็บปวดทางเทคนิค.

ผู้ใช้จะออกจากระบบอย่างรวดเร็วเมื่อพวกเขาเห็น:

- แพลตฟอร์มค้าง

- ความประหลาดใจจากการสลิปเพจ

- การแสดงผล P&L ที่สับสน

- การถอนเงินช้า

โบรกเกอร์ที่แข็งแกร่งมักจะหมกมุ่นเกี่ยวกับ:

- ความเสถียร

- ความโปร่งใส

- ความเร็ว

- หมายเลขที่ชัดเจน

ความไว้วางใจเป็นสกุลเงินในการรักษาผู้ใช้ หากสูญเสียไปเพียงครั้งเดียว ผู้ใช้ก็จะหายไป

ความผิดพลาดทั่วไปที่แพลตฟอร์มโบรกเกอร์ทำเมื่อเกิดการเลิกใช้

- ไล่ตามผู้ใช้ใหม่ในขณะที่มองข้ามผู้ใช้ที่มีอยู่

- ปฏิบัติต่อผู้ค้าทุกคนเหมือนกัน

- ตอบสนองเฉพาะหลังจากที่เกิดการเลื่อน

- การใช้ส่วนลดแทนคุณค่า

- การมองข้ามตัวกระตุ้นทางอารมณ์

ปัญหาการสูญเสียลูกค้าส่วนใหญ่ สามารถคาดการณ์ได้ พวกเขาแค่ไม่ได้รับการแก้ไขในเวลาที่เหมาะสม

กรอบงานง่ายๆ เพื่อลดการเลิกใช้บริการ

- ตัดสินใจว่าการเลิกใช้บริการหมายถึงอะไรสำหรับธุรกิจของคุณ

- ติดตามมันโดยกลุ่ม ไม่ใช่ค่าเฉลี่ย

- ระบุสัญญาณเตือนล่วงหน้า

- แบ่งกลุ่มผู้ใช้ตามพฤติกรรม

- ผสมผสานการทำงานอัตโนมัติร่วมกับสัมผัสของมนุษย์

- ตรวจสอบเมตริกการเก็บรักษาเป็นรายเดือน

การรักษาลูกค้าไม่ใช่แค่วิธีการ มันคือระบบ.

ทำไมการสูญเสียลูกค้าถึงสำคัญมากสำหรับธุรกิจนายหน้า

ในธุรกิจนายหน้าซื้อขายหลักทรัพย์ การเปลี่ยนแปลงลูกค้า (churn) มีผลต่อ:

- การเปิดเผยตามข้อบังคับ

- ผลตอบแทนการลงทุนด้านการตลาด

- ชื่อเสียงของแบรนด์

- การประเมินค่าในระยะยาว

ถ้าคุณกำลัง สร้างหรือขยายแพลตฟอร์มโบรกเกอร์ การเลิกใช้บริการไม่ใช่ความรู้ที่เลือกได้ มันเป็นพื้นฐาน.

ความคิดสุดท้าย

การเติบโตดูน่าประทับใจ การรักษาลูกค้าเป็นการสร้างธุรกิจที่แท้จริง แพลตฟอร์มโบรกเกอร์ที่อยู่รอดในระยะยาวไม่ใช่แค่การได้มาซึ่งผู้ใช้เท่านั้น แต่พวกเขา เข้าใจพวกเขา นำทางพวกเขา และทำให้พวกเขามีความมั่นคง.

FAQ

มันคือความเร็วที่ลูกค้าออกไป.

ไม่มี การเปลี่ยนแปลงบางอย่างเป็นเรื่องปกติ การเปลี่ยนแปลงในช่วงต้นและอารมณ์คืออันตรายที่แท้จริง.

เงิน, ความเสี่ยง, อารมณ์, และความสับสน.

ควรตรวจสอบการเลิกใช้บ่อยแค่ไหน?

รายเดือนเป็นอย่างน้อย รายสัปดาห์สำหรับผลิตภัณฑ์ในระยะเริ่มต้น

ไม่ แต่สามารถจัดการ คาดการณ์ และลดได้

แทบจะตลอดเวลามีการเปลี่ยนแปลง.

อัปเดต:

4 กุมภาพันธ์ 2569