Los 15 mejores indicadores de TradingView

Contenidos

Los operadores profesionales abren posiciones basándose en las señales de diferentes indicadores tecnológicos. El análisis técnico es la mejor manera de estudiar y predecir los movimientos y tendencias de precios. TradingView es una plataforma que ofrece acceso a más de cien instrumentos tecnológicos y herramientas gráficas, lo que la convierte en la plataforma analítica más utilizada.

¿Cuáles son los mejores indicadores de TradingView en los que confían los traders al desarrollar sus estrategias?

- Promedio móvil

- Índice de fuerza relativa

- Oscilador estocástico

- Convergencia Divergencia de Media Móvil

- Nube Ichimoku

- Volumen

- Bandas de Bollinger

- SAR parabólico

- Aroon

- Índice de movimiento direccional

- Caimán Williams

- Volumen en equilibrio

- Canales de Keltner

- Supertendencia

- Retroceso de Fibonacci

MA (promedio móvil)

La media móvil es uno de los indicadores tecnológicos más antiguos. R. Donchian y J. Hurst fueron los primeros expertos que la integraron en el análisis técnico en la década de 1930.

El indicador se basa en el precio promedio de un período seleccionado. La media móvil es un indicador de tendencia que suaviza la volatilidad y ayuda a determinar las fluctuaciones futuras del precio. La media móvil simple (SMA) es la variante más utilizada del indicador. También existen la EMA (exponencial), la SMMA (suavizada), la WMA (ponderada) y otras variantes.

En el gráfico, el indicador de media móvil adopta la siguiente forma (por ejemplo, SMA 20):

Ajustes configurables:Tipo, Longitud, Fuente.

Ventajas

- El indicador suaviza la línea de movimiento de precios ignorando los ruidos del mercado y las subidas y bajadas repentinas de precios.

Contras

- El indicador MA responde más lentamente a los cambios bruscos de precios que ocurren en los puntos de reversión del mercado.

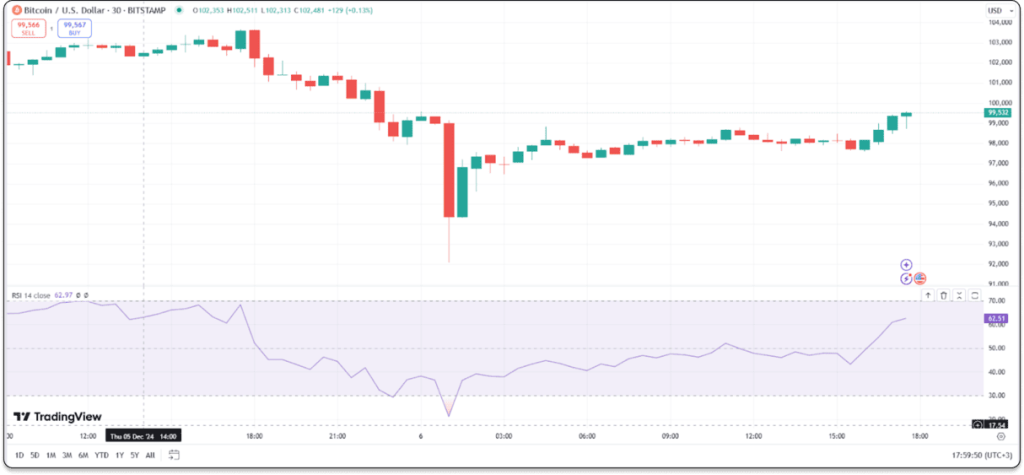

Índice de fuerza relativa (RSI)

El indicador RSI fue introducido por JW Wilder en 1978. Los principios del indicador fueron descritos en su libro “Nuevos conceptos en sistemas de trading técnico”.

El Índice de Fuerza Relativa (RSI) es un oscilador de impulso que mide la magnitud y la velocidad de las fluctuaciones de precios. Este instrumento mide las variaciones de precio de un activo en un período determinado, divide el aumento promedio entre la disminución promedio y muestra los resultados de 0 a 100. Los operadores utilizan el índice RSI para determinar cuándo un activo está sobrecomprado o sobrevendido.

En el gráfico, el indicador RSI adopta la siguiente forma (configuración predeterminada):

Ajustes configurables:Longitud RSI, Fuente.

Ventajas

- El indicador es simple y conveniente tanto para principiantes como para profesionales.

- El RSI proporciona a los traders datos sobre el último impulso de precios.

- El instrumento ayuda a determinar divergencias.

Contras

- En un mercado con tendencia, el RSI es menos efectivo.

- El indicador no tiene en cuenta los volúmenes.

Oscilador estocástico

El oscilador estocástico fue creado por GK Lane a finales de la década de 1950. Hoy en día, este indicador sigue siendo uno de los instrumentos tecnológicos más utilizados.

¿Qué ofrece este instrumento a los operadores? El estocástico identifica la interdependencia entre el último precio de cierre y los precios mínimo y máximo dentro del período de tiempo determinado. Los resultados se muestran en porcentajes. El indicador indica a los operadores si un activo está sobrecomprado o sobrevendido para abrir posiciones de reversión.

En el gráfico, el oscilador estocástico adopta la siguiente forma (configuración predeterminada):

Ajustes configurables:%K Longitud, %K Suavizado, %D Longitud.

Ventajas

- El indicador proporciona a los traders un conjunto de señales diferentes: áreas de sobrecompra y sobreventa, divergencia, etc.

- El estocástico es compatible con cualquier marco temporal.

Contras

- El instrumento es suficientemente efectivo sólo cuando se combina con otros indicadores técnicos.

- Cuando se utiliza en ciertos períodos de tiempo, el oscilador proporciona a los operadores muchas señales falsas.

Convergencia/divergencia de medias móviles (MACD)

El indicador MACD se basa en dos promedios móviles y se muestra en una ventana separada debajo de un gráfico.

El instrumento muestra el histograma, lo que ayuda a los operadores a comprender la convergencia y divergencia entre dos medias móviles. Cuando se produce la divergencia, las barras del histograma son más altas y viceversa. Por esta razón, las barras del histograma MACD suben durante fuertes fluctuaciones de precios y se mantienen cortas durante las fluctuaciones.

En el gráfico, el MACD adopta la siguiente forma (configuración predeterminada):

Ajustes configurables: Longitud rápida, Longitud lenta, Fuente, Suavizado de señal, Tipo MA del oscilador, Tipo MA de línea de señal.

Ventajas

- El indicador ayuda a los comerciantes a identificar las tendencias actuales del mercado.

- MACD se utiliza para evaluar un impulso de tendencia.

Contras

- El instrumento entra en la categoría de los rezagados.

- El MACD puede proporcionar a los traders muchas señales falsas.

You may also like

Nube Ichimoku

Ichimoku Cloud es un indicador tecnológico fundado por el analista japonés Goichi Hosoda en la década de 1960. Este instrumento consta de cinco líneas y funciona como un sistema completo para analizar el mercado.

El instrumento se utiliza para identificar tanto las tendencias del mercado como los impulsos de entrada y salida. Además, los operadores utilizan la Nube Ichimoku para predecir los niveles de soporte y resistencia cercanos. El sistema contiene indicadores adelantados y rezagados, lo que permite a los operadores obtener una visión completa de lo que ocurre.

En el gráfico, la nube Ichimoku adopta la siguiente forma (configuración predeterminada):

Ajustes configurables:Longitud de la línea de conversión, Longitud de la línea base, Longitud del tramo anterior B, Tramo posterior.

Ventajas

- Las señales proporcionadas por Ichimoku Cloud son bastante fuertes.

- Los comerciantes pueden identificar fácilmente los niveles de soporte y resistencia que se probarán.

Contras

- El indicador es algo complicado, especialmente para principiantes.

- Los comerciantes deben combinar Ichimoku Cloud con otros instrumentos tecnológicos.

Volumen

El indicador de volumen proporciona a los operadores información sobre el volumen de operaciones en un mercado seleccionado. Los operadores comprenden la liquidez y la actividad del mercado de un activo específico. El instrumento fue fundado por Richard Wyckoff a principios del siglo XX.

El instrumento se muestra como un histograma debajo del gráfico de un activo. Muestra el número total de acciones/contratos negociados en un período determinado. En el análisis técnico, el instrumento Volumen ayuda a los operadores a identificar la fuerza de las tendencias, las rupturas de precios, la liquidez del mercado y los patrones de divergencia.

En el gráfico, el indicador de volumen adopta la siguiente forma (configuración predeterminada):

Ajustes configurables:Longitud MA.

Ventajas

- El indicador de volumen es uno de los instrumentos más fáciles de interpretar.

- El instrumento es efectivo en todos los marcos temporales y es compatible con otros instrumentos tecnológicos.

Contras

- En los mercados descentralizados el indicador da muchas señales falsas.

- El instrumento pertenece a los rezagados que reflejan datos pasados del mercado.

Bandas de Bollinger

Las Bandas de Bollinger son un indicador de volatilidad fundado por John Bollinger en la década de 1980. Su interpretación es muy sencilla, ya que el instrumento indica a los operadores cuándo un activo está sobrecomprado o sobrevendido.

El indicador consta de tres líneas: la media móvil simple y dos líneas de desviación estándar (positiva y negativa). Estas tres líneas forman un canal donde se supone que se mueve el precio de un activo. Cuando el precio alcanza el límite superior, el activo está sobrecomprado. Si alcanza el límite inferior, el activo está sobrevendido.

En el gráfico, el instrumento Bandas de Bollinger toma la siguiente forma (configuración predeterminada):

Ajustes configurables:Longitud, Tipo MA básico, Fuente, Desviación estándar, Desplazamiento.

Ventajas

- Uno de los indicadores tecnológicos más sencillos, adecuado para principiantes.

- Las bandas de Bollinger se utilizan en muchas estrategias comerciales cuando se combinan con otros instrumentos.

Contras

- Las bandas de Bollinger son efectivas en mercados volátiles.

- Cuando el precio de un activo alcanza el límite superior o inferior del canal, este puede romperse. El indicador puede proporcionar señales falsas a los operadores.

SAR parabólico

El SAR Parabólico es un indicador tecnológico que ayuda a los operadores a identificar tendencias y señales para comprar y vender. A diferencia del MACD o el estocástico, este oscilador determina la dirección de la tendencia y el punto de reversión con la mayor precisión posible (hasta una barra).

Los puntos de Stop y Reversión Parabólicos aparecen en el gráfico. En tendencias alcistas, los puntos SAR Parabólicos se ubican debajo de las barras, y viceversa. Las correcciones y reversiones se marcan con el punto que salta al lado opuesto.

En el gráfico, el SAR parabólico adopta la siguiente forma (configuración predeterminada):

Ajustes configurables: Inicio, Incremento, Valor máximo.

Ventajas

- El indicador ayuda a los operadores a mantener una posición dentro de una tendencia.

- El SAR Parabólico tiene en cuenta tanto la dinámica del desarrollo de la tendencia como su duración.

- Los traders reciben un mínimo de señales falsas.

Contras

- El indicador no es efectivo en un mercado plano.

- En marcos temporales más pequeños, el SAR Parabólico se caracteriza por una alta sensibilidad a los ruidos del mercado.

Aroon

Aroon es una herramienta tecnológica que permite identificar una tendencia actual del mercado, su fuerza y dirección. Además, muestra si una tendencia domina el mercado o si no hay movimientos de tendencia.

El instrumento mide el tiempo transcurrido entre máximos y mínimos de precio dentro de un período determinado. Aroon consta de dos líneas: Aroon Up y Aroon Down. Estas corresponden a la tendencia alcista y bajista, respectivamente. Cada línea muestra la intensidad de la tendencia alcista o bajista.

En el gráfico, Aroon adopta la siguiente forma (configuración predeterminada):

Ajustes configurables: Longitud.

Ventajas

- Aroon ayuda a los comerciantes a identificar fácilmente las tendencias del mercado.

- Cuando las configuraciones son correctas, el indicador proporciona señales reales fuertes.

Contras

- A veces las señales se retrasan.

- Durante movimientos planos el instrumento puede dar señales falsas.

You may also like

Índice de movimiento direccional (DMI)

El DMI es un indicador tecnológico que se utiliza para evaluar la dirección y la fuerza de una tendencia del mercado. Fue fundado por J.W. Wilder Jr.

El indicador consta de tres elementos: indicador direccional positivo (+DI), indicador direccional negativo (-DI) e índice direccional promedio (ADX). El instrumento ayuda a los operadores a comprender qué presión predomina en el mercado, ya sea alcista o bajista.

En el gráfico, DMI adopta la siguiente forma (configuración predeterminada):

Ajustes configurables:Suavizado ADX, Longitud DI.

Ventajas

- DMI es un instrumento eficaz para identificar la tendencia dominante del mercado.

- El indicador ayuda a los operadores a evaluar la fuerza de una tendencia. La intersección de las líneas +DI y -DI sirve como señal de entrada y salida.

Contras

- El DMI es un indicador rezagado, por eso el instrumento es menos efectivo en mercados volátiles.

- Cuando las cotizaciones de los activos se mueven en un rango estrecho, DMI puede generar señales falsas.

Caimán Williams

Alligator es uno de los indicadores de Bill Williams más utilizados y consta de tres promedios móviles (SMMA).

La media móvil rápida simboliza los labios del caimán. Originalmente tenía una longitud de 5. La media móvil rápida (SMMA) tiene una longitud de 8 y simboliza los dientes del caimán. La tercera SMMA tiene una longitud de 13 y se denomina mandíbula del caimán.

Williams Alligator es un sistema comercial completamente funcional que puede generar señales por sí solo.

En el gráfico, Williams Alligator adopta la siguiente forma (configuración predeterminada):

Ajustes configurables:Longitud de la mandíbula, Longitud de los dientes, Longitud de los labios, Desplazamiento de la mandíbula, Desplazamiento de los dientes, Desplazamiento de los labios.

Ventajas

- El indicador no necesita otras confirmaciones; sirve como una estrategia comercial completamente funcional.

- Dentro de tendencias claras alcistas y bajistas, el instrumento es el más efectivo.

Contras

- Los traders se enfrentan a muchas señales falsas.

- Williams Alligator es un instrumento rezagado.

Indicador de volumen en equilibrio

On Balance Volume es uno de los instrumentos básicos para el análisis del diferencial de volumen. El indicador fue fundado por Joe Granville en 1963.

El OBV calcula la relación entre las variaciones de precio y los volúmenes de negociación correspondientes. Según la teoría basada en el instrumento OBV, las variaciones rápidas de volumen provocan movimientos bruscos de precios.

En el gráfico, el volumen en equilibrio adopta el siguiente formato (configuración predeterminada):

Ajustes configurables: Tipo, Longitud, Desviación estándar de BB.

Ventajas

- El instrumento proporciona a los operadores una amplia diversidad de señales.

- El OBV proporciona señales bastante precisas en marcos temporales más altos.

Contras

- En caso de un aumento rápido de volúmenes, el indicador puede dar señales falsas.

- OBV no es adecuado para activos caracterizados por baja liquidez.

Canales de Keltner

Los Canales de Keltner son una envolvente basada en medias móviles (EMA) y vinculada a la volatilidad de un activo. El instrumento fue fundado por Chester Keltner en la década de 1960.

El indicador se clasifica como instrumento de tendencia. Cuando el precio de un activo supera el límite superior o inferior del canal, los operadores reciben una señal sólida para abrir una posición.

En el gráfico, los canales de Keltner toman la siguiente forma (configuración predeterminada):

Ajustes configurables: Longitud, Multiplicador, Fuente

Ventajas

- El indicador da señales fuertes cuando comienza la tendencia del mercado.

- Los canales de Keltner son efectivos tanto para los movimientos de tendencia como para los mercados planos.

Contras

- El instrumento no es útil cuando el fondo fundamental es demasiado fuerte.

- En caso de configuraciones incorrectas, los canales Keltner dan demasiadas señales falsas.

Supertendencia

Supertrend es un indicador que se construye con la ayuda de los instrumentos Average True Range y Commodity Channel Index.

Tanto los traders principiantes como los profesionales utilizan Supertrend para identificar la tendencia actual del mercado. Cuando el precio de un activo cruza la línea del indicador, los traders reciben una señal para abrir o cerrar sus posiciones. Supertrend es uno de los instrumentos más fáciles de entender y aplicar.

En el gráfico, Supertrend adopta la siguiente forma (configuración predeterminada):

Ajustes configurables: Longitud ATR, Factor.

Ventajas

- El instrumento es fácil de entender y da señales fuertes.

- Supertrend es compatible con diferentes mercados y marcos temporales.

Contras

- Supertrend es un instrumento rezagado.

- En mercados laterales y agitados, el indicador genera muchas señales falsas.

Retroceso de Fibonacci

El retroceso de Fibonacci es un instrumento que se utiliza para identificar niveles de soporte y resistencia. El indicador se basa en los niveles de Fibonacci.

En el gráfico, el retroceso de Fibonacci toma la siguiente forma (configuración predeterminada):

Ajustes configurables: Desviación, Profundidad.

Ventajas

- El indicador identifica eficazmente los niveles de soporte y resistencia.

Contras

- Los comerciantes necesitan combinar el instrumento con otros indicadores tecnológicos.

¿Cómo utilizar las señales comerciales correctamente?

Los instrumentos de TradingView proporcionan a los operadores diversas señales, pero hay tres formas principales de operar con la ayuda de señales comerciales:

- Generación de señales según su propio sistema analítico. Cualquier combinación de indicadores técnicos en TradingView permite crear señales de trading y enviarlas a proveedores de automatización para la implementación inmediata del algoritmo configurado por el usuario.

- Señales de proveedores de primera línea. Existen plataformas analíticas especializadas que estudian el mercado y generan señales de trading sencillas para ejecutar sistemas de trading automatizados.

- Señales de expertos y analistas destacados. Analistas, inversores y entusiastas de las criptomonedas suelen publicar consejos gratuitos para su audiencia y vender señales de pago.

¿Cuál es la mejor opción? Los traders principiantes pueden usar todos los métodos mencionados para mejorar sus habilidades. Los traders profesionales se acostumbran a generar señales de trading por su cuenta.

El resultado final

TradingView es una plataforma que ofrece acceso a más de cien instrumentos de análisis técnico; sin embargo, no es necesario usar tantos indicadores como sea posible. En la práctica, los traders profesionales construyen la gran mayoría de sus señales con la ayuda de varios indicadores.

FAQ

Todos los indicadores técnicos tienen ventajas y desventajas. Su eficacia depende del marco temporal, el mercado financiero y otros factores importantes. Además, ningún instrumento ofrece señales 100 % precisas.

Muchos indicadores tecnológicos pueden generar señales comerciales por sí solos; mientras tanto, los profesionales prefieren combinarlos con otros instrumentos para evitar señales falsas.

Los traders pueden encontrar numerosas estrategias que combinan ciertos indicadores tecnológicos. Además, pueden experimentar combinando diversos indicadores para encontrar la mejor combinación para su estilo de trading.

Actualizado:

19 de diciembre de 2024