Los mejores indicadores de day trading para usar

Contenidos

Los operadores intradía que operan en los mercados financieros dinámicos deben utilizar indicadores adecuados. El análisis del comportamiento del mercado depende en gran medida de indicadores como las medias móviles, el RSI, el MACD, las bandas de Bollinger, los indicadores de volumen, el oscilador estocástico y los niveles de Fibonacci. Estos indicadores ayudan a los operadores a interpretar datos complejos, proyectar fluctuaciones de precios e identificar los momentos ideales de entrada y salida. Este artículo explora estos importantes indicadores, examinando sus usos únicos, sus beneficios y cómo integrarlos con éxito en sus planes de trading.

Lista de los mejores indicadores de day trading:

- Promedios móviles

- Índice de fuerza relativa

- Bandas de Bollinger

- Indicadores de volumen

- Oscilador estocástico

- Niveles de retroceso de Fibonacci

- Convergencia Divergencia de Media Móvil

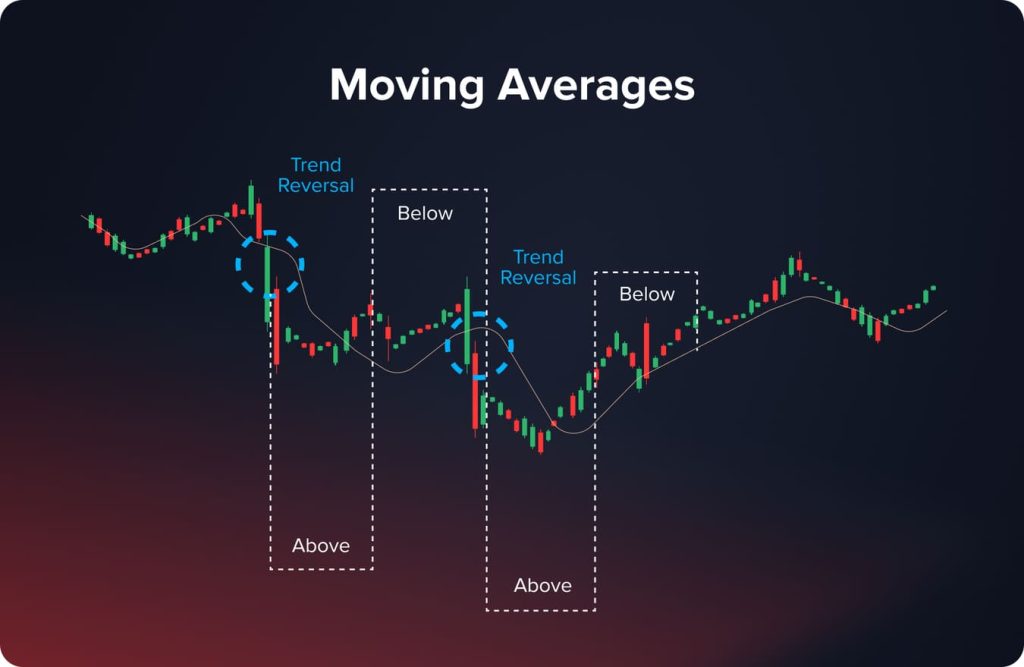

Promedios móviles

Los indicadores básicos, llamados medias móviles, sirven para suavizar los datos de precios, determinando así la dirección de una tendencia. Al calcular el precio promedio de un valor durante un período determinado, ayudan a los operadores a detectar tendencias alcistas o bajistas. La media móvil simple (SMA), que aproxima el precio promedio durante un período determinado y otorga la misma ponderación a todos los puntos de datos, y la media móvil exponencial (EMA), que otorga mayor ponderación a los precios más recientes, aumentando así la sensibilidad a los datos más recientes, son dos variedades principales.

Los niveles de soporte y resistencia pueden representarse dinámicamente mediante medias móviles. Cuando el precio se mantiene por encima de la media móvil, podría indicar una próxima tendencia alcista; una acción del precio por debajo de ella podría indicar una próxima tendencia bajista. La combinación de las medias móviles de 50 y 200 días permite a los operadores detectar cruces de la muerte bajistas o cruces dorados alcistas.

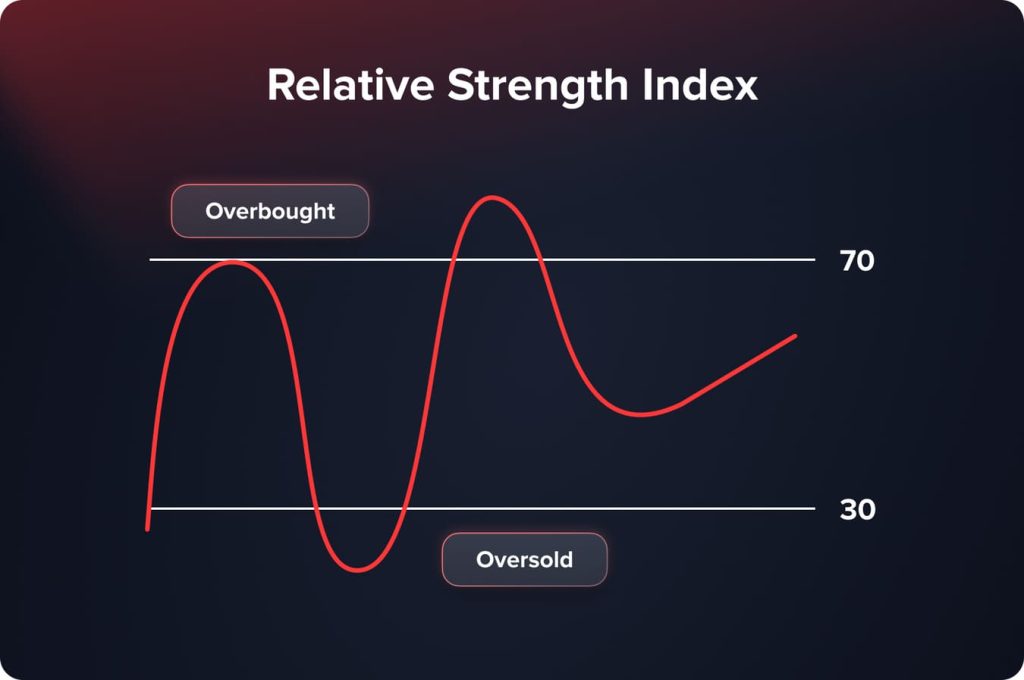

Índice de fuerza relativa

El RSI, que evalúa el ritmo y la variación de los movimientos de precios en una escala de 0 a 100, es un oscilador de momentum. Ayuda a detectar condiciones de mercado de sobrecompra y sobreventa. Un RSI superior a 70 sugiere condiciones de sobrecompra, es decir, que el activo está caro y requiere una corrección de precio. Un RSI inferior a 30 sugiere que el activo está barato, lo que implica una posible subida de precio y circunstancias de sobreventa. El RSI proporciona información sobre la fuerza de una tendencia actual, así como sobre posibles puntos de reversión, lo que lo hace útil para una estrategia de trading inteligente. Las lecturas del RSI permiten detectar señales de reversión; se puede validar la fuerza de la tendencia; se pueden encontrar puntos de entrada y salida adecuados; en consecuencia, se mejora la precisión de las estrategias de trading.

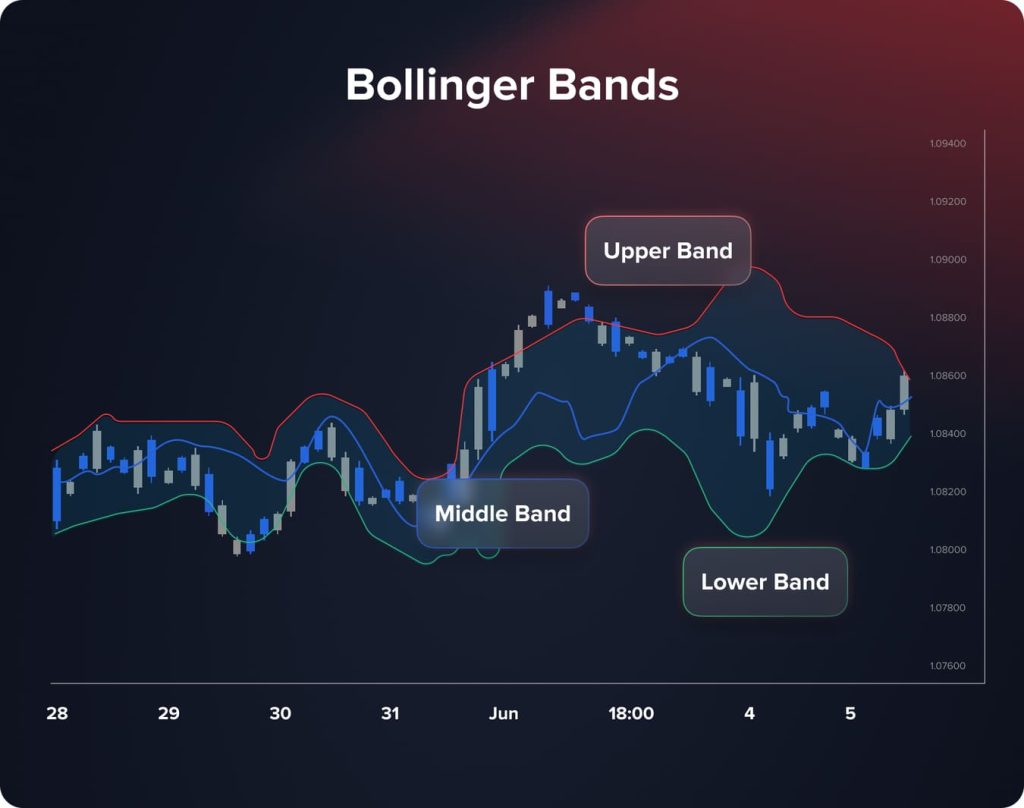

Bandas de Bollinger

Las bandas de Bollinger, que suelen ser una media móvil simple (SMA) de 20 días, constan de tres líneas que se presentan en un gráfico de precios: una banda media, una banda superior y una inferior, establecidas dos desviaciones estándar por encima y por debajo de la banda central. El crecimiento y la contracción de las bandas dependen de la volatilidad del mercado; se expanden en momentos de alta volatilidad y se contraen en momentos de baja volatilidad. Tocar la banda inferior podría indicar sobreventa; el precio podría estar sobrevalorado al acercarse a la banda superior.

Las Bandas de Bollinger ayudan a los operadores a analizar la volatilidad y a encontrar posibles puntos de reversión o ruptura. Una buena sincronización de las operaciones depende de la capacidad de los operadores para analizar la volatilidad del mercado, encontrar posibles rupturas y cambios de tendencia, y reconocer posiciones de sobrecompra o sobreventa mediante el análisis de la interacción entre el precio y los rangos.

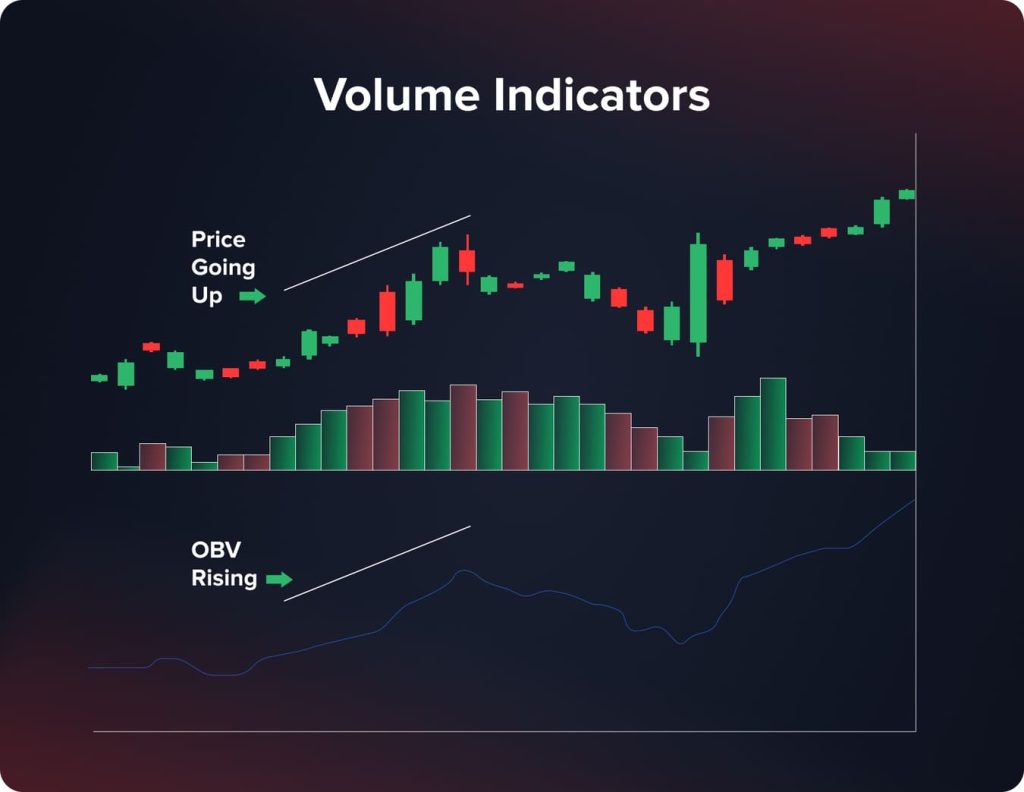

Indicadores de volumen

Mediante el análisis del volumen de un activo vendido durante un período determinado, los indicadores de volumen ayudan a comprender el estado de los mercados. Al aumentar el volumen en días alcistas y disminuirlo en días bajistas, el volumen en balance (OBV) mide la presión de compra y venta, mostrando así el flujo total de volumen.

Útil para evaluar la calidad de la ejecución de operaciones, el Precio Promedio Ponderado por Volumen (VWAP) calcula el precio promedio ponderado por el volumen total de transacciones. Si bien la caída del volumen puede indicar una pérdida de impulso, un volumen alto generalmente respalda tendencias sólidas.

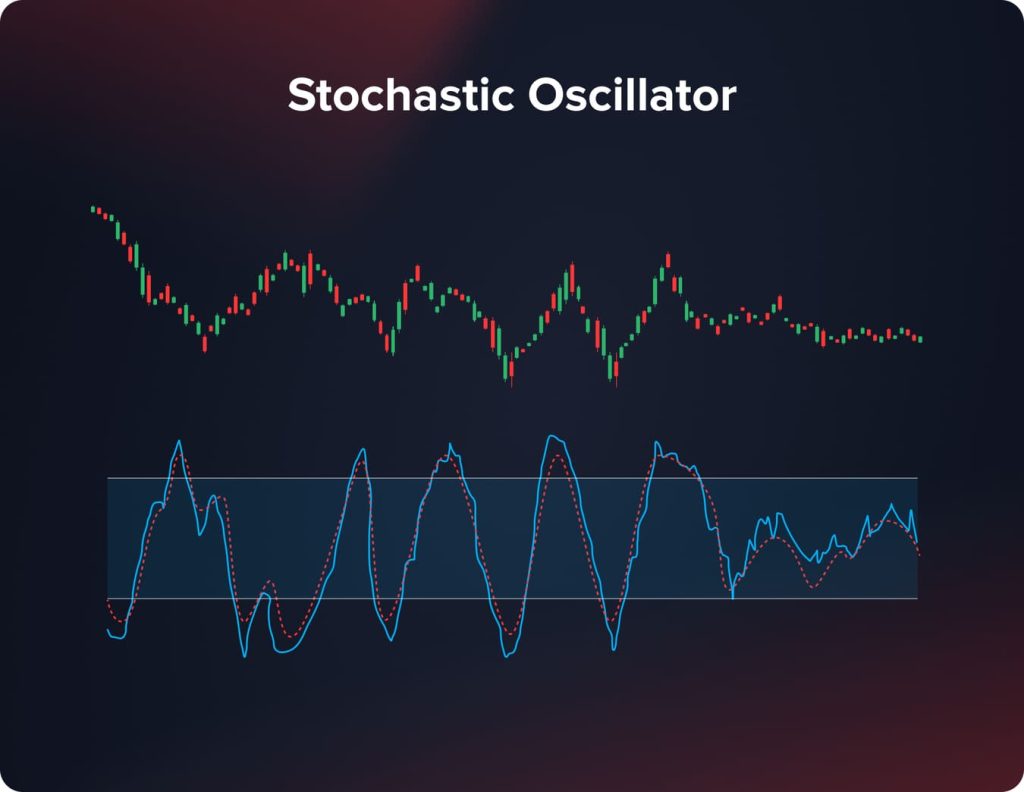

Oscilador estocástico

El Oscilador Estocástico incorpora indicadores de momentum para rastrear los precios de cierre de los activos en relación con su rango durante un período determinado. Su rango va de 0 a 100; las lecturas inferiores a 20 sugieren sobreventa y las superiores a 80, sobrecompra. Cuando el indicador supera ciertos umbrales, sugiere posibles cambios de tendencia. El Oscilador Estocástico ayuda a identificar posiciones de sobrecompra y sobreventa, a cronometrar entradas y salidas según los cambios de momentum y a validar las señales de otros indicadores. Comprender los factores que impulsan las fluctuaciones de precios subyacentes ayuda a los operadores a tomar decisiones de trading más precisas.

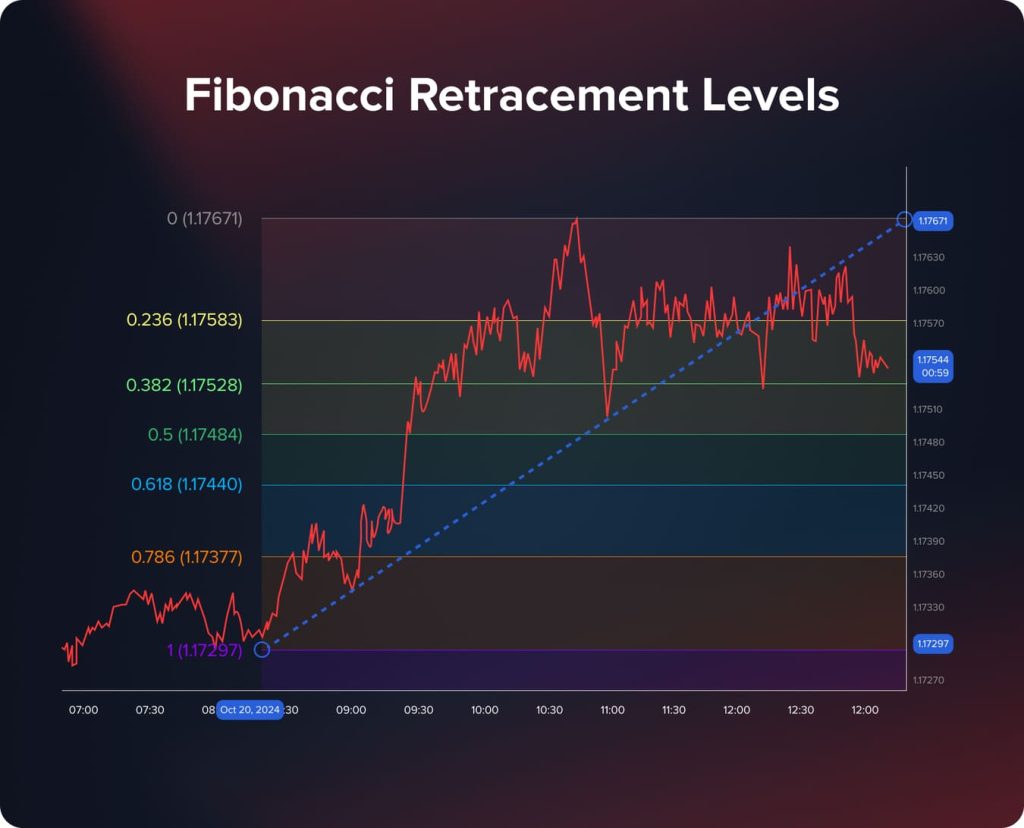

Niveles de retroceso de Fibonacci

niveles de Fibonacci Son líneas horizontales que ilustran la mayor probabilidad de soporte y resistencia, según ratios de Fibonacci significativos como 23,6%, 38,2%, 50%, 61,8% y 78,6%. Estos niveles permiten a los operadores proyectar, dentro de una tendencia más larga, el grado probable de retroceso o corrección del mercado. Utilizando los ratios de Fibonacci y la distancia entre movimientos de precios notables, los operadores pueden identificar posibles regiones de soporte y oposición. Incluir los niveles de Fibonacci en las estrategias de trading mejora la eficacia del análisis técnico, ayuda a predecir correcciones y reversiones de precios, planificar puntos de entrada y salida en mercados dinámicos y mejora la precisión de la investigación técnica.

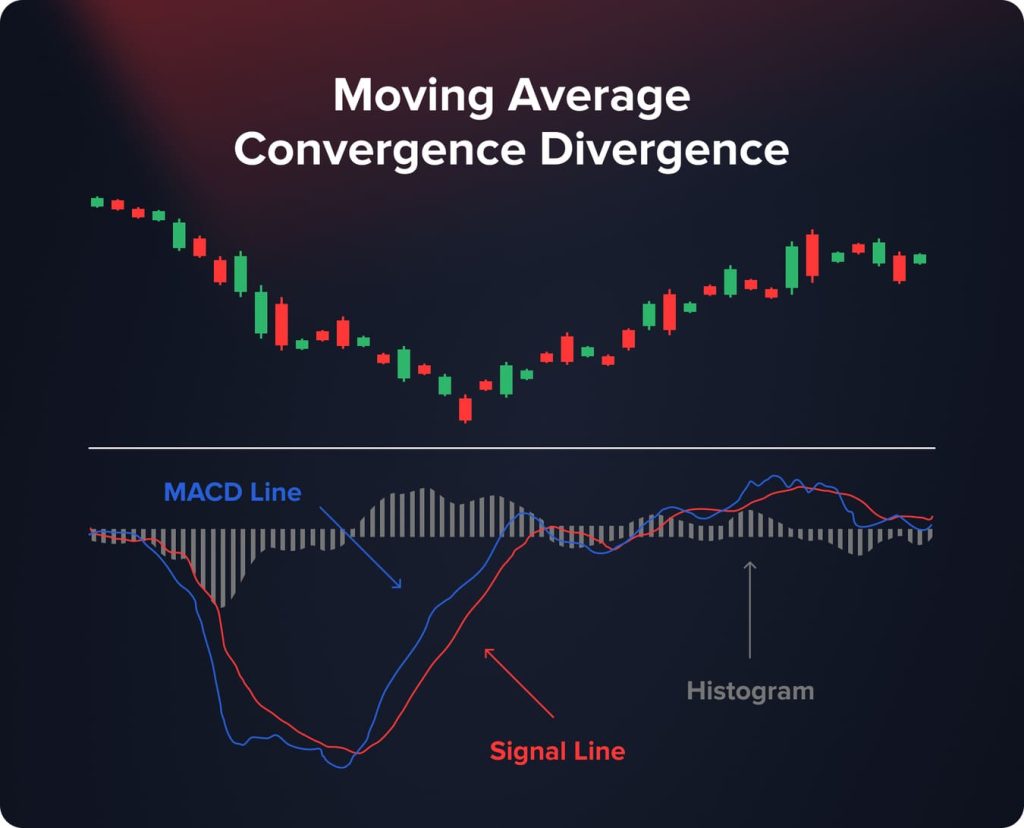

Convergencia Divergencia de Media Móvil

La Convergencia Divergencia de la Media Móvil, o MACD, es un indicador ampliamente utilizado que permite a los operadores detectar cambios en el momentum y la tendencia general de una acción. Contrasta la Media Móvil Exponencial (EMA) de 12 períodos con la EMA de 26 períodos de un activo.

Al buscar cruces entre la línea MACD y la línea de señal, los operadores encuentran posibles señales de compra y venta. Un cruce de la línea MACD por encima de la línea de señal podría indicar un impulso alcista creciente y una posible oportunidad de compra. Por otro lado, si cae por debajo, podría indicar una posible oportunidad de venta y un impulso bajista creciente. Analizar estas indicaciones ayuda a los operadores a decidir si abrir o cerrar posiciones con mayor conocimiento.

¿Qué indicador es el más preciso?

Encontrar la indicación más precisa es una dificultad habitual para los operadores, ya que ningún instrumento puede anticipar con exactitud los cambios en el mercado. Cada indicador tiene diferentes ventajas y su rendimiento depende de ciertos métodos de negociación y circunstancias del mercado. La precisión de un indicador suele depender de factores como el período analizado, la volatilidad de los activos y la naturaleza de las tendencias o rangos del mercado.

Para los mercados que muestran un movimiento direccional obvio, por ejemplo, los indicadores de seguimiento de tendencias como MACD y Promedios móviles Son más fiables. Predecir si la tendencia continuará o se revertirá ayuda a los operadores a capitalizar los patrones de precios a largo plazo. Por otro lado, osciladores como el RSI y el oscilador estocástico pueden ofrecer sugerencias más precisas en mercados con rangos o laterales, al detectar niveles de sobrecompra y sobreventa.

Al validar la fuerza de las fluctuaciones de precios, los indicadores de volumen aumentan su precisión. Dado que reflejan una mayor confianza en el mercado, una variación de precios acompañada de un gran volumen suele percibirse como más significativa que una con un volumen bajo.

Confiar únicamente en un indicador puede generar señales falsas, ya que estos interpretan datos históricos de precios y no son predictores infalibles de movimientos futuros. Las condiciones del mercado pueden cambiar rápidamente, lo que reduce la eficacia de un indicador.

En definitiva, el indicador más preciso es aquel que se alinea con su estrategia de trading, se adapta al entorno actual del mercado y ha demostrado su eficacia mediante su propio análisis. Combinar indicadores técnicos con una sólida gestión de riesgos y, cuando corresponda, con el análisis fundamental, aumenta la probabilidad de tomar decisiones de trading bien informadas.

You may also like

MACD vs. RSI: ¿cuál es mejor?

Los objetivos del operador y el estado del mercado determinarán cuál de los dos indicadores, el MACD y el RSI, debe utilizar. Para detectar cambios de tendencia y evaluar la fuerza de la tendencia a mediano plazo, el MACD es perfecto. Destaca por mostrar cambios en el impulso dentro de una tendencia. Por el contrario, el RSI es más adecuado para identificar situaciones de sobrecompra y sobreventa, lo que resulta útil para cronometrar entradas y salidas, así como para opciones de trading a corto plazo. Muchos operadores consideran que la combinación de ambos indicadores ofrece una visión más completa. El MACD mejora la fiabilidad de las señales de trading al verificar las tendencias que identifica el RSI. Combinar las ventajas del MACD y el RSI ayudará a los operadores a mejorar su capacidad para tomar decisiones de trading inteligentes.

¿Qué indicadores utilizan los traders profesionales?

Para desarrollar estrategias de trading rentables, los traders profesionales utilizan datos de mercado, herramientas de investigación sofisticadas e indicadores técnicos. Su método suele consistir en desarrollar herramientas adaptadas a ciertos estilos de trading, combinar el análisis técnico con elementos fundamentales para obtener una visión completa del mercado y combinar numerosos indicadores para confirmar las señales.

Los indicadores técnicos son importantes, pero los operadores expertos suelen utilizar el análisis fundamental para mejorar sus decisiones de trading. Analizan la dinámica del mercado, los informes de resultados empresariales, la publicación de datos económicos y los eventos geopolíticos. La combinación de indicadores técnicos con el conocimiento fundamental permite anticipar con mayor precisión los cambios en el mercado. Por ejemplo, una señal alcista de los indicadores técnicos podría verse reforzada si el análisis fundamental sugiere un crecimiento económico positivo o un sólido rendimiento corporativo.

Los profesionales suelen adaptar los indicadores a sus estrategias de trading específicas y a los activos que negocian. Pueden ajustar los períodos de las medias móviles para captar mejor las tendencias en diferentes marcos temporales o modificar la sensibilidad del RSI para reducir las señales falsas en mercados volátiles. La personalización de los indicadores les permite responder con mayor eficacia a las particularidades del mercado y aumenta la relevancia de las señales generadas.

Los traders expertos obtienen una ventaja competitiva utilizando herramientas e indicadores sofisticados. Uno de ellos es la Nube Ichimoku, una indicación completa en un solo gráfico que proporciona información sobre la dirección de la tendencia, los niveles de soporte y resistencia, el momentum y las posibles señales de trading. Esto permite a los traders evaluar rápidamente el sentimiento general del mercado e identificar posibles rupturas. También emplean puntos pivote, que se obtienen sumando los precios máximos, mínimos y de cierre del día anterior, para ayudar a identificar niveles cruciales de soporte y resistencia para la jornada de trading actual, lo que permite a los traders expertos identificar niveles de precios donde el mercado puede experimentar fluctuaciones significativas.

You may also like

Aspectos psicológicos y disciplina en el trading

Un buen day trading requiere una sólida base psicológica y una actitud disciplinada, además de conocimientos técnicos y un buen uso de indicadores. Los obstáculos emocionales, como el miedo a las pérdidas, la codicia por ganancias excesivas, el sobreoperar por entusiasmo o la parálisis por análisis, abundan entre los traders. Estos sentimientos pueden distorsionar el juicio y provocar decisiones precipitadas, independientemente de un plan de trading bien definido. Superar estos obstáculos psicológicos requiere disciplina, lo cual es fundamental. Seguir una estrategia de trading establecida ayuda a tomar decisiones imparciales basadas en el análisis, en lugar de en el sentimiento.

Gestionar las expectativas y establecer objetivos razonables ayuda a evitar la búsqueda de metas inalcanzables que podrían causar frustración o comportamientos imprudentes. Desarrollar la resiliencia emocional ayuda a los traders a concentrarse en el éxito a largo plazo, mantener la calma bajo presión y recuperarse rápidamente de los errores.

Los traders que identifican sus propios sesgos y factores psicológicos pueden desarrollar estrategias para minimizar su impacto, programando descansos frecuentes, practicando la atención plena o llevando un diario de trading para revisar decisiones y resultados. En definitiva, un método disciplinado y psicológicamente equilibrado mejora la toma de decisiones y contribuye significativamente a asegurar el éxito en el trading.

Conclusión

Tomar decisiones inteligentes y rápidas en los mercados financieros, siempre cambiantes, depende de la elección de los indicadores adecuados para el day trading. Comprender y utilizar correctamente estos instrumentos puede ayudar a los operadores a mejorar su capacidad para gestionar riesgos, identificar las mejores oportunidades de trading y predecir las fluctuaciones de precios. El rendimiento del trading puede mejorar considerablemente combinando diversos indicadores, modificándolos para adaptarse a ciertos estilos de trading y combinándolos con técnicas sólidas de gestión de riesgos. El éxito en el day trading depende de la formación continua, la experiencia y la aplicación rigurosa de estrategias cuidadosamente planificadas.

FAQ

Dado que el rendimiento depende de la correcta integración de un indicador en un plan de trading, considerando las circunstancias del mercado y los estilos de trading personales, ningún indicador es intrínsecamente el más rentable. Muchas veces, el éxito se logra integrando numerosos indicadores y una excelente gestión del riesgo, en lugar de depender únicamente de uno.

Los gráficos de velas suelen considerarse los mejores para el day trading, ya que brindan a los traders información visual completa sobre los movimientos de precios y patrones en períodos de tiempo cortos, lo que les ayuda a tomar decisiones rápidas e informadas.

Sí, el day trading puede ser rentable, pero es difícil y conlleva riesgos. El éxito en el day trading suele depender del aprendizaje continuo, la práctica y el cumplimiento de rigurosas normas de gestión de riesgos. Antes de dedicarte al day trading como profesión a tiempo completo, deberías informarte bien sobre los mercados y hablar con especialistas financieros para comprender los riesgos.

Actualizado:

19 de diciembre de 2024