Cómo comerciar, invertir y obtener ganancias con metales preciosos en 2026

Contenidos

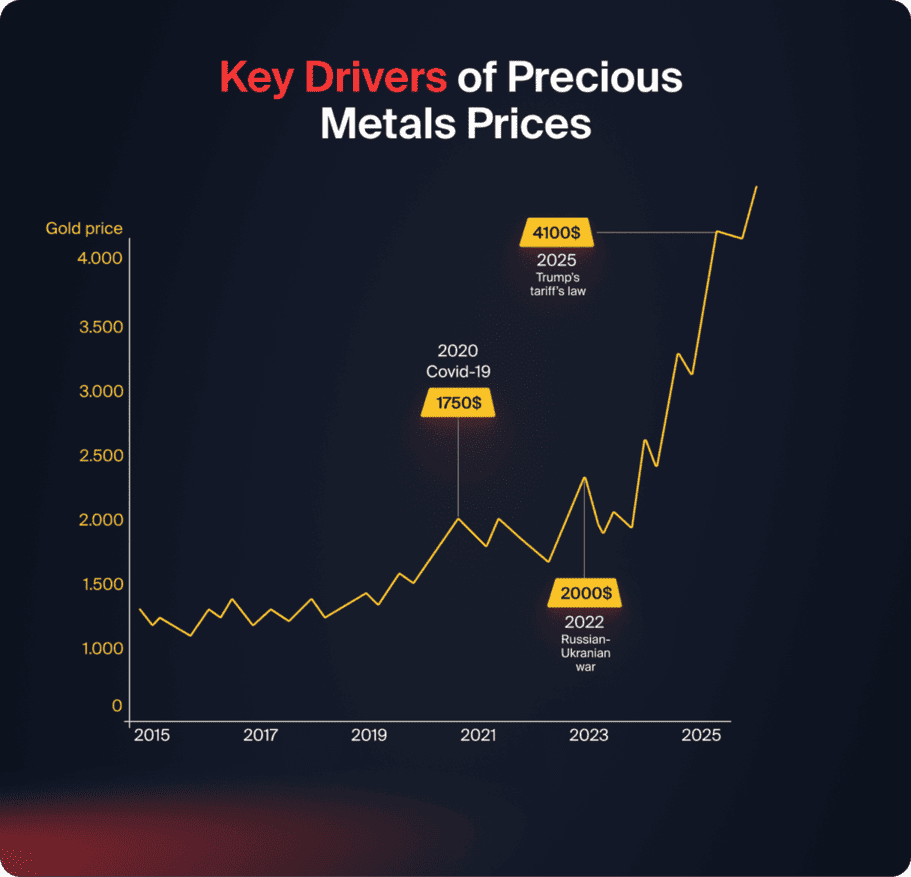

El oro se cotiza actualmente alrededor de $4000/onza, un precio que no se esperaba hasta mediados de 2026 según las previsiones de JPMorgan para 2025. Por lo tanto, los metales preciosos presentan tanto a los operadores como a los inversores buenas perspectivas para el próximo año. Sin embargo, las compras récord de los bancos centrales, la inflación continua, la incertidumbre geopolítica y la creciente demanda industrial, especialmente de plata, han sido los principales impulsores de los precios hacia un nuevo ciclo alcista de varios años.

Antes de operar o invertir en metales preciosos en 2026, recomendamos educarte sobre cómo realmente operar o invertir en ellos. Esta guía te enseñará precisamente lo que deberías saber.

¿Por qué son los metales preciosos una buena inversión en 2026?

Los metales preciosos se consideran una buena inversión en 2026 por las siguientes razones:

Fuerte Momentum de Precio

Con el oro ya por encima de $4,000/oz en 2025, el mercado de metales ha entrado en uno de los ciclos más explosivos de la historia. Como se indicó anteriormente, grandes organizaciones como JPMorgan no habían predicho este nivel hasta mediados de 2026. Sin embargo, muchos analistas e instituciones financieras predicen precios más altos tanto para el oro como para la plata en 2026. Los impulsores de precios mencionados anteriormente probablemente seguirán influyendo en los metales preciosos en 2026.

Bancos Centrales Comprando a Niveles Récord

La acumulación sin precedentes de los bancos centrales es el principal motor de la perspectiva de los metales preciosos para 2026. Según la Encuesta de Reservas de Oro de los Bancos Centrales 2024, los bancos centrales compraron más de 1,000 toneladas de oro en 2023, entre las cantidades más altas registradas. A lo largo de 2025 y 2026, se espera que la demanda se mantenga muy alta, en torno a 710 toneladas por trimestre. Esta compra institucional sostenida subraya la confianza a largo plazo en el oro como activo de reserva y proporciona un sólido contexto para la fortaleza de los precios hacia 2026.

Cobertura contra la Inflación y el Riesgo Geopolítico

Por el momento, los metales preciosos continúan siendo uno de los mejores refugios contra la inflación, la depreciación de la moneda y la incertidumbre geopolítica. Con el aumento de las tensiones globales, la expansión de los déficits fiscales y la alta inflación en todas las principales economías, la demanda de los inversores por reservas de valor que mantengan el poder adquisitivo ha aumentado. Los metales, particularmente el oro, son un activo estratégico hacia la estabilidad a largo plazo y la protección de la cartera ya que se desempeñan bien durante períodos de inestabilidad económica.

La Demanda Industrial Soporta el Valor a Largo Plazo

La tecnología moderna y la transición energética global están impulsando la demanda de plata y otros metales industriales. Debido a sus usos críticos en industrias de alto crecimiento, las escaseces de suministro de plata persisten. Por lo tanto, la plata verá una gran apreciación a largo plazo, ya que los metales industriales serán aún más vitales para los sistemas energéticos globales.

Diversificación de Portafolio

En comparación con activos más convencionales como acciones y bonos, los metales preciosos tienen una combinación única de estabilidad, diversificación y baja correlación. Por lo tanto, son componentes esenciales de las carteras de trading e inversión a largo plazo. Los metales te ofrecen exposición a uno de los ciclos de materias primas más fuertes en la memoria reciente, mientras reducen la volatilidad de la cartera durante mercados erráticos.

También te puede gustar

Principales impulsores de los precios de metales preciosos

Los principales indicadores económicos tienen un impacto directo en los metales. Sin embargo, los operadores pueden predecir mejor la dirección del mercado al comprender estas relaciones.

Datos de inflación

Los datos de inflación como el IPC se utilizan para monitorear la tasa a la que los precios de bienes y servicios aumentan. Un aumento en dichos datos significaría una disminución en el poder adquisitivo de una moneda. Y dado que los metales preciosos como el oro y la plata son vistos como una protección contra la inflación, una tasa de inflación creciente del dólar estadounidense tiende a aumentar sus precios.

Tasas de Interés & Rendimientos Reales

Los metales preciosos se vuelven más atractivos cuando los rendimientos reales caen. Las tasas de interés más bajas reducen el costo de oportunidad de mantener activos que no generan rendimiento, como el oro. Esta dinámica se desarrolló en 2024–2025, con el oro cotizando por encima de $4,000/onza antes de lo esperado debido a las expectativas de recortes de tasas.

Fortaleza del Dólar Estadounidense

Debido a que se valoran en dólares estadounidenses, los metales aumentan de valor cuando el dólar se deprecia. Un dólar más débil incrementa la demanda al hacer que el oro y la plata sean más baratos para los consumidores extranjeros. Por ejemplo, el estímulo sin precedentes en 2020 hizo que el dólar cayera y ayudó a empujar el oro bien más allá de $2,050 por onza.

Tensión Geopolítica y Incertidumbre Global

Los metales preciosos tradicionalmente prosperan en la inestabilidad geopolítica, ya que los inversores buscan activos refugio. Eventos como guerras, revoluciones políticas y resultados electorales inesperados canalizan dinero hacia el oro y la plata. La guerra ruso-ucraniana provocó un aumento significativo en el precio del oro en 2022, mientras que las tensiones internacionales sostenidas extendieron el apoyo a los metales como activos refugio.

Demanda industrial

La demanda industrial, especialmente de metales como el paladio, el platino y la plata, tiende a tener un impacto significativo en el mercado. Se destacó que el uso industrial de la plata, impulsado por la energía solar, la fabricación de electrónica y la producción de vehículos eléctricos, alcanzó un récord de 680.5 millones de onzas en 2024. Esto ha contribuido a la continua escasez de suministro. Los convertidores catalíticos y las tecnologías de hidrógeno aumentan la demanda de platino. Los precios generalmente aumentarán cuando la demanda industrial crezca más rápido que la oferta.

Compras por el Banco Central

Las tendencias de precios del oro a largo plazo están en gran medida impulsadas por la acción de los bancos centrales. Según la Encuesta de Reservas de Oro de los Bancos Centrales 2024, se compraron más de 1,000 toneladas en 2023, uno de los totales más altos registrados. Se espera que esta demanda trimestral se mantenga cerca de 710 toneladas hasta 2026. Impulsado por esta compra sostenida, el oro superó los $4,000/oz mucho antes de lo previsto, mostrando el impacto de los bancos centrales en el mercado de metales.

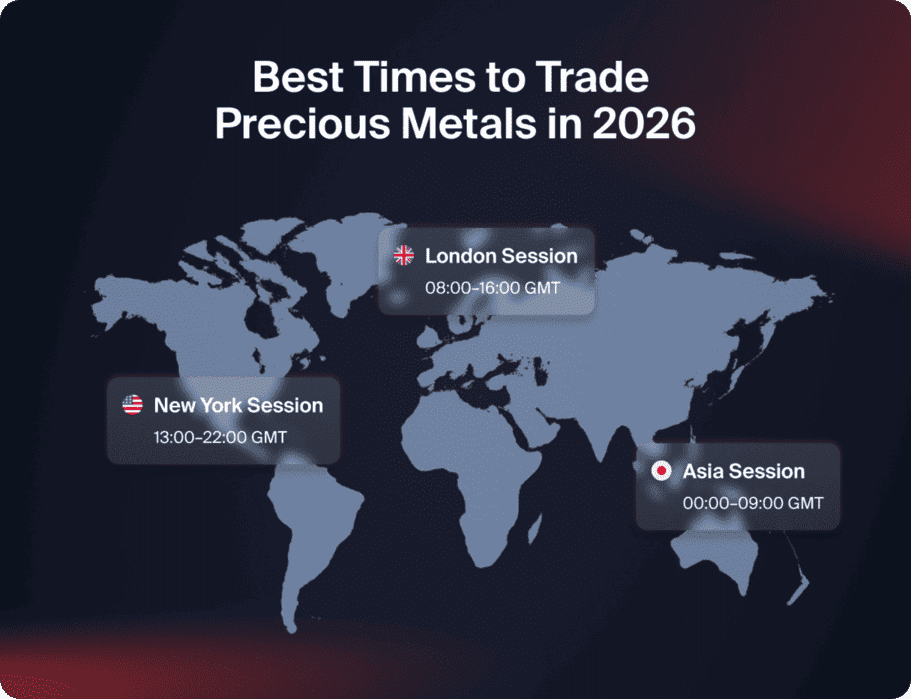

Mejores momentos para negociar metales preciosos en 2026

Echemos un vistazo a los diferentes horarios para el comercio de metales preciosos y sus cualidades.

Sesión de Londres

La sesión de Londres es la ventana más crucial para el comercio de metales porque el 35–40% del volumen mundial de oro se negocia durante esta sesión. De hecho, Londres opera entre las 08:00 y las 16:00 GMT. Con el pico de liquidez y actividad institucional, los diferenciales ajustados y un considerable movimiento direccional caracterizan esta sesión. Debido a que impulsa el descubrimiento de precios global, Londres es un buen lugar para el comercio basado en el impulso, con grandes instituciones que frecuentemente establecen la tendencia del día aquí.

Sesión de Nueva York

La sesión de Nueva York, que abarca desde las 13:00 hasta las 22:00 GMT, especialmente durante la apertura de COMEX y las horas de superposición con Londres, es la parte más errática del día de negociación. Los anuncios de la Reserva Federal y los informes económicos de EE. UU. generalmente provocan movimientos bruscos en los precios. El oro y la plata pueden moverse fácilmente entre $20 y $40 en minutos. La sesión se adapta mejor a estrategias impulsadas por noticias, rupturas y operaciones a corto plazo.

Sesión Asiática

La sesión asiática es la más tranquila pero crucial para determinar la dirección temprana del mercado y va desde las 00:00 hasta las 09:00 GMT. La acción del precio suele ser más suave, más predecible, especialmente durante las horas de Tokio y Shanghái, aunque la liquidez se reduce. Esta sesión es útil para los traders de swing que buscan tendencias consistentes, dado que China e India son los grandes consumidores de oro; frecuentemente refleja la demanda física real y el sentimiento regional.

Cómo comerciar con metales preciosos paso a paso en 2026

Paso 1 — Elige un activo para negociar

Decide primero que nada cómo te gustaría obtener exposición a los metales preciosos. Los CFD son los más flexibles; utilizando apalancamiento, los traders pueden operar con las fluctuaciones de precios sin la propiedad real del metal. Los futuros atraen a traders sofisticados que desean una liquidez profunda y contratos estandarizados. Para un enfoque a largo plazo y de bajo mantenimiento, los ETF serían apropiados, mientras que para la preservación de la riqueza, los metales físicos en forma de lingotes serían mejores. Los metales tokenizados están ganando popularidad; permiten la propiedad digital de lingotes reales.

Paso 2 — Elige una Plataforma de Trading

Una buena plataforma de trading debería estar regulada, ofrecer diferenciales ajustados en oro y plata, y ejecutar órdenes rápidamente en condiciones de mercado volátiles. Una fuerte liquidez mantiene el deslizamiento bajo, mientras que las herramientas avanzadas de gráficos ayudan a los traders a analizar patrones de precios y tendencias. Las mejores plataformas combinan fiabilidad, bajos costos y potentes características de análisis.

Paso 3 — Desarrollo de Estrategia de Trading

Una estrategia de trading clara te ayuda a evitar tomar decisiones emocionales. El trading de tendencias implica seguir la dirección dominante del mercado, mientras que el trading de rango es excepcionalmente adecuado para ocasiones en las que hay niveles claros de soporte y resistencia. El trading de ruptura aprovecha los movimientos bruscos resultantes de que el precio rompa niveles clave, mientras que el scalping intentará hacer pequeñas ganancias a lo largo del día. Las estrategias basadas en noticias, por otro lado, buscarían volatilidad alrededor de eventos importantes como anuncios relacionados con la inflación, nóminas no agrícolas o anuncios de la FOMC.

Paso 4 — Realizar Análisis de Mercado

Operar de manera rentable requiere una mezcla de análisis técnico y fundamental. El análisis técnico utiliza gráficos, zonas de soporte y resistencia, promedios móviles e indicadores como el MACD y el RSI para definir puntos de entrada y salida. El análisis fundamental examina la inflación, las tasas de interés, las políticas de los bancos centrales y las demandas industriales que determinan la dirección general del mercado. Usar ambos juntos proporcionará una visión más profunda y precisa del mercado.

Paso 5 — Administra Tu Riesgo

Una gestión de riesgos efectiva significa éxito a largo plazo. Las órdenes de stop-loss protegen tu cuenta contra grandes pérdidas, y un tamaño de posición adecuado asegura que ninguna operación individual perjudique tu cartera. Es imperativo gestionar el apalancamiento, ya que niveles altos del mismo pueden aumentar fuertemente no solo tus ganancias, sino también tus pérdidas. Estar diversificado entre oro, plata, platino y otros metales también ayuda a reducir riesgos al distribuir la exposición.

También te puede gustar

Cómo Invertir en Metales Preciosos para Obtener Ganancias a Largo Plazo

Promedio de Costo en Dólares (DCA)

La promediación del costo en dólares simplemente significa invertir en metales comprando regularmente montos fijos del metal. Esta práctica suaviza la volatilidad en los precios y asegura una acumulación constante; uno puede comprar más cuando el nivel de precios baja y beneficiarse de los precios en aumento durante un período de tiempo. DCA es ideal para el inversor a largo plazo que busca obtener una exposición constante sin cronometrar el mercado.

Estrategia de Compra y Mantenimiento

También es particularmente adecuado para el oro, que tradicionalmente ha mantenido su valor y ha tenido un buen rendimiento durante las recesiones. Los inversores compran oro u otros metales y luego los mantienen durante años, contando con fundamentos a largo plazo, incluida la demanda de los bancos centrales y los ciclos de inflación, para crear apreciación. Al hacerlo, el inversor obtiene estabilidad con un crecimiento de capital más gradual.

Diversificación de Portafolio

Los metales preciosos añaden fortaleza a una cartera diversificada al ofrecer protección contra las caídas en acciones, bonos o monedas, reduciendo así el riesgo. La cantidad para los inversores conservadores podría ser del 5-10%, mientras que para carteras moderadas, generalmente se utiliza del 10-15%. Aquellos que esperan que los metales superen el rendimiento pueden invertir del 15-25% dependiendo de su tolerancia al riesgo y objetivos.

Exposición a Múltiples Metales

Un portafolio de metales diversificado utiliza más que solo oro. Donde el oro proporciona estabilidad, la adición de plata y platino crea un mayor potencial de crecimiento. La plata aporta una fuerte demanda industrial y un mayor potencial en mercados alcistas, mientras que el platino ofrece oportunidades de valor con exposición a tecnologías emergentes como las pilas de combustible de hidrógeno. Un enfoque de múltiples metales combina seguridad con crecimiento a largo plazo.

Errores Comunes que Reducen las Ganancias en el Comercio de Metales Preciosos

A pesar de los mercados fuertes, muchos traders pierden dinero debido a pasar por alto algunos de los principios básicos del trading. A continuación se presentan errores comunes que deben evitarse al negociar metales preciosos en 2026.

Usando Demasiado Apalancamiento

El apalancamiento aumenta el potencial de ganancias, pero también aumenta el potencial de pérdidas. Muchos traders se sobreexponen y descubren que incluso pequeños movimientos de precios, especialmente en metales más volátiles como la plata y el paladio, pueden provocar reducciones sustanciales en el tamaño de su cuenta. Se requiere un uso conservador del apalancamiento para prevenir reducciones rápidas en su cuenta.

Trading Durante Baja Liquidez

Los períodos de baja liquidez, como las sesiones de cierre o los días festivos, tienden a crear spreads más amplios, deslizamientos y movimientos impredecibles. Los metales preciosos muestran un comportamiento más confiable durante las ventanas de alta liquidez, como Londres y COMEX, donde la acción del precio es más clara y la ejecución es más eficiente.

No Prestar Atención a las Noticias Económicas

Los metales reaccionan de manera aguda a los informes de inflación, a los datos de empleo, a las publicaciones del PIB y a los anuncios de los bancos centrales. Ignorar estos eventos significa que los traders corren el riesgo de verse atrapados en una volatilidad repentina. Monitorear el calendario económico y planificar en torno a las publicaciones importantes ayuda a evitar pérdidas no deseadas.

Comercio de FOMO

El FOMO hace que los traders entren después de grandes movimientos, a menudo a precios desfavorables. Los repuntes de metales preciosos tienen una mala tendencia a revertirse rápidamente, por lo que las persecuciones de impulso sin confirmación generan perdedores. Sin embargo, la paciencia y la disciplina producen mejores resultados.

Operar Durante Eventos de Alto Impacto Sin un Plan

Los eventos en las noticias, como el IPC, el NFP o las decisiones del FOMC, pueden crear oscilaciones intradía extremas. Simplemente mantener la posición durante estos eventos sin una estrategia a menudo conduce a grandes retrocesos. La reducción de tamaño, stops más ajustados o salir antes de los anuncios sirven para proteger el capital.

No establecer órdenes de stop-loss

Uno de los errores más costosos en el comercio de metales es omitir las órdenes de stop-loss. La volatilidad puede convertir pequeñas pérdidas en grandes en un abrir y cerrar de ojos. La disciplina de stop-loss limita el riesgo a la baja, permitiendo a los comerciantes evitar decisiones emocionales.

Sin embargo, hay 5 reglas de trading de 5 días que debes conocer que podrían ayudarte a evitar estos costosos errores. De hecho, mejorarían tus resultados de trading si se siguen religiosamente.

Conclusión

Al entrar en 2026, los metales preciosos continúan siendo una de las mejores inversiones porque ofrecen un nivel de estabilidad, crecimiento a largo plazo y protección en una economía global que a menudo es inestable. Los aumentos a largo plazo por encima del mercado estarán impulsados por la compra de bancos centrales, la inflación, el riesgo geopolítico y el cambio global hacia la energía limpia. Los traders que entienden la dinámica de los precios de los metales y utilizan estrategias disciplinadas pueden aprovechar tanto los cambios a corto plazo como los aumentos de precios a largo plazo.

FAQ

Lo más probable es que la inflación siga aumentando y que los bancos centrales sigan comprando mucho oro. La oferta de metales es ajustada y el riesgo geopolítico está aumentando. Todo esto hará que 2026 sea un gran año para los comerciantes de metales.

La plata a menudo tiene los mayores porcentajes de ganancias porque es volátil y tiene una alta demanda en la industria. El oro, sin embargo, sigue siendo el metal más estable y líquido, con tendencias que siempre están impulsadas por la economía. La mayoría de los comerciantes opera en ambos, poniendo el movimiento constante hacia arriba contra la posibilidad de una ganancia mayor.

Esto depende de tus objetivos y tolerancia al riesgo. Los analistas a menudo recomiendan que se asigne del 5% al 20% de un portafolio diversificado a metales. Los inversores conservadores pueden favorecer del 5% al 10%, mientras que aquellos que deseen una mayor protección o que quieran aprovechar un rendimiento fuerte pueden invertir del 15% al 20% o más.

Ambos son potencialmente rentables. El trading es el método de aprovechar las oscilaciones de precios a corto plazo, mientras que la inversión a largo plazo ayuda a preservar la riqueza y capturar ciclos de crecimiento de varios años. Muchos inversores combinan los dos, operando activamente pero manteniendo posiciones largas para mayor estabilidad.

Los precios de los metales preciosos siguen los principales impulsores económicos como la inflación, las tasas de interés y los eventos geopolíticos, siendo así amigables para los principiantes. Herramientas como CFDs, ETFs, trading de copia e inversiones fraccionarias facilitan el inicio con pequeñas cantidades y a riesgo controlado.

Actualizado:

8 de enero de 2026