Volver

Contents

Línea de avance/declinación (A/D): definición y qué te dice

Demetris Makrides

Senior Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

La línea de avance/descenso (A/D) es un indicador tecnológico que muestra la variación diaria entre el número de valores al alza y a la baja (por ejemplo, acciones). Este instrumento ayuda a los operadores a comprender la situación general del mercado, identificar la tendencia actual y predecir posibles reversiones.

Conclusiones clave:

- ¿Qué es el indicador de línea A/D?

- ¿Cuál es la fórmula para la línea de avance/declinación (A/D)?

- ¿Cuáles son los beneficios y limitaciones de la línea A/D?

- ¿Cómo utilizar el indicador en la práctica?

- ¿Cómo agregar la línea de avance/declinación (A/D) a Metatrader?

- ¿Con qué indicadores combinar la línea A/D?

¿Qué significa la línea de avance/declinación (A/D)?

La línea A/D es un indicador que muestra a los operadores la amplitud del mercado financiero. Este instrumento representa la diferencia entre el número de activos que suben y bajan.

El indicador Avance/Declive (Línea) se remonta a la década de 1930, cuando se utilizaba principalmente para predecir la actividad del mercado en la Bolsa de Valores de Nueva York. Richard Russel popularizó la Línea A/D en la década de 1960 a través de sus "Cartas sobre la Teoría de Dow". Russel destacó la eficacia de este instrumento para comprender la salud del mercado y confirmar la fortaleza de la tendencia.

Desde entonces, la línea A/D se entiende como un instrumento importante y eficaz que se combina con otros indicadores tecnológicos para obtener señales precisas.

¿Cómo calcular la fórmula de la línea de avance/declinación (A/D)?

Para calcular el indicador de la línea A/D es necesario seguir algunos pasos sencillos:

- Identifique el número de emisiones en avance y descenso dentro de un día de negociación.

- Calcule los anticipos netos. Utilice la siguiente fórmula:

NA = NA – ND

- NA – Anticipos Netos;

- norteA – the norteumber of Advancing issues within a trading day;

- norteD – the norteumber of Declining issues within a trading day.

- Descubra el valor del indicador Línea de Avance/Declive del día de negociación anterior.

- Calcule el indicador de la línea A/D según la siguiente fórmula:

ANUNCIOdo = ANUNCIOPAG + NA

- ANUNCIOdo – ANUNCIO current;

- ANUNCIOPAG – ANUNCIO previous;

- NA – Anticipos Netos.

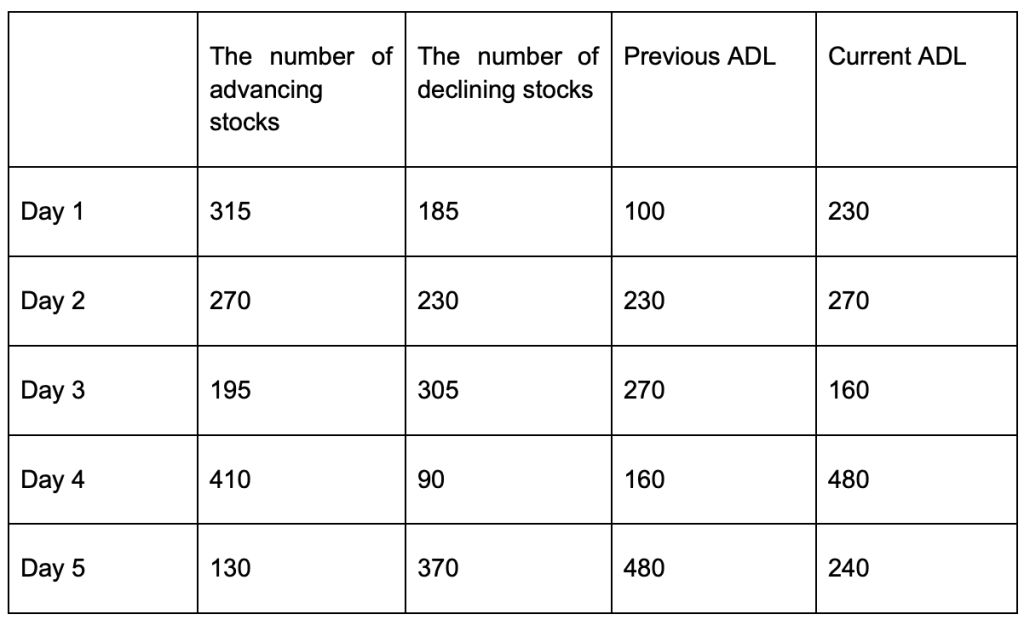

El ejemplo de cómo calcular el indicador de línea A/D

Con la fórmula mencionada, podemos calcular la línea A/D en la práctica. Por ejemplo, necesitamos calcular el indicador del S&P 500. ¿Qué debemos hacer primero?

- Identifiquemos el número de acciones que subieron y bajaron en un día de negociación. Tenemos 315 acciones que subieron de precio y 185 que bajaron.

- El siguiente paso consiste en calcular los anticipos netos (315 – 185). El valor de NA es 130.

- Luego necesitamos encontrar el ADL del día anterior (A/DPAG). El gráfico muestra que el valor del indicador ADL para el día de negociación anterior es 100.

- Por lo tanto, para calcular el valor actual de la Línea A/D, debemos sumar los Avances Netos y el ADL anterior (130 + 100 = 230). El indicador de la Línea de Avance/Declive es 230.

Para calcular los siguientes valores de ADL, solo necesitamos el número de acciones que suben y bajan. Estos son los resultados que ilustra la tabla:

¿Cómo utilizar el indicador de línea A/D en la práctica?

Esta sencilla fórmula nos ayuda a calcular los valores de las líneas de avance y descenso. ¿Qué debe hacer un operador con la información recibida?

El indicador de línea A/D ayuda a un comerciante a identificar la tendencia actual y comprender qué tan fuerte es esa tendencia.

Veamos algunos escenarios posibles al utilizar el instrumento Línea de Avance/Declinación:

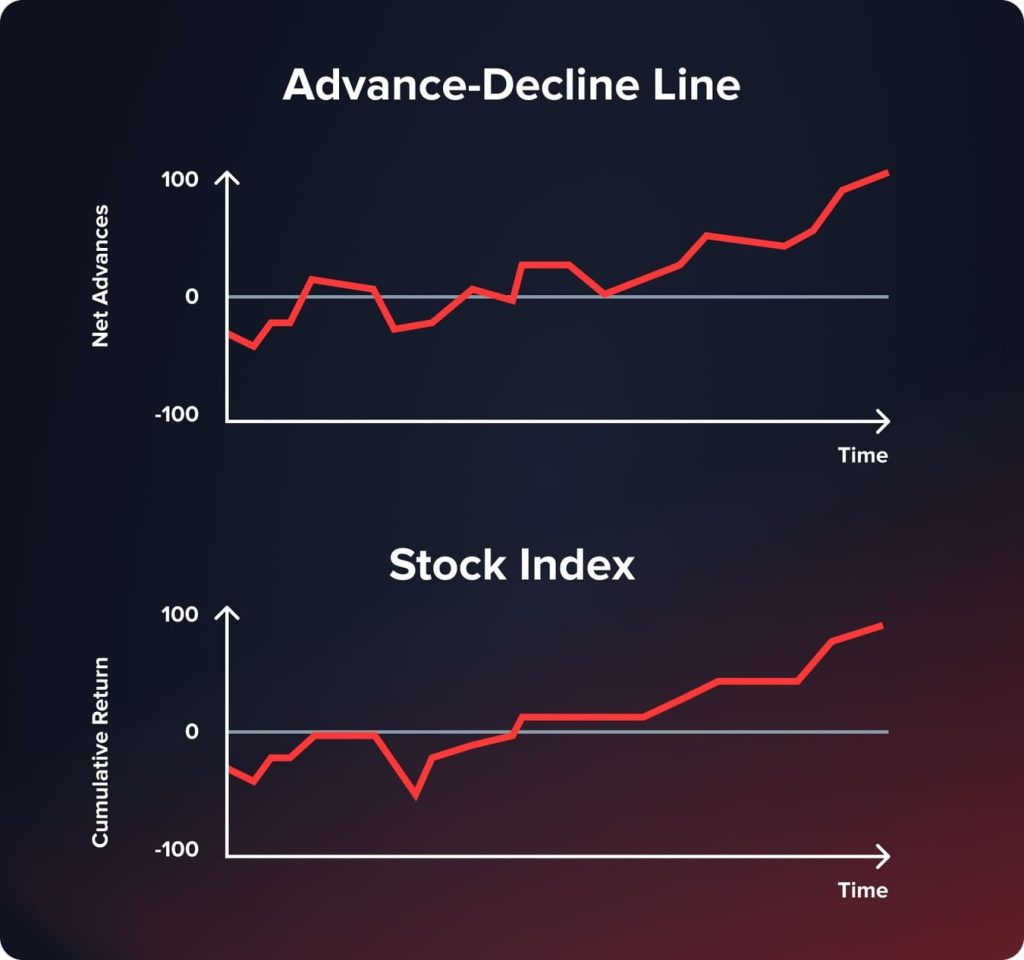

- Un conjunto de otros indicadores muestra que la tendencia alcista domina el mercado. Según la línea A/D, la gran mayoría de los valores están avanzando. En tal situación, el indicador confirma otros instrumentos, y el operador debería abrir posiciones largas.

- Los indicadores indican al operador que la tendencia alcista domina el mercado; mientras tanto, la línea de avance/descenso muestra que el número de valores al alza y a la baja es casi igual, o incluso que los valores a la baja son los principales. Esta situación se denomina divergencia bajista. La tendencia alcista del mercado no es lo suficientemente fuerte. Existe una alta probabilidad de un cambio de tendencia en curso. Los operadores deberían abrir posiciones cortas.

- Según la cantidad de indicadores, los operadores comprenden que la tendencia bajista está presente en el mercado, mientras que la línea A/D les informa que la mayoría de los indicadores están avanzando. Por eso, se puede predecir un cambio de tendencia de bajista a alcista.

Al utilizar el indicador de línea de avance/declive, un operador recibe información excepcionalmente importante:

- El indicador confirma la tendencia actual o muestra que su fuerza está disminuyendo y se acerca a la reversión.

- En caso de divergencia, la reversión de la tendencia en curso es solo cuestión de tiempo en la gran mayoría de los casos.

Los beneficios y limitaciones de la línea A/D

¿Cuáles son las principales ventajas y limitaciones del indicador? Entre las principales ventajas se pueden destacar las siguientes:

- El indicador ofrece una perspectiva más amplia del mercado. Gracias al indicador de línea A/D, el operador puede comprender la situación de todo el sector, no de un activo en particular.

- El instrumento ayuda a los operadores a predecir futuros cambios de tendencia. La línea de avance/descenso es un indicador bastante preciso que permite predecir si una tendencia continúa o se acerca al punto de reversión.

- La línea A/D es un instrumento eficaz para confirmar tendencias. Los traders profesionales suelen utilizar este indicador como instrumento auxiliar para confirmar la tendencia del mercado previamente identificada con otros instrumentos tecnológicos.

En cuanto a las limitaciones, se deben tener en cuenta los siguientes inconvenientes:

- Las acciones excluidas de la bolsa afectan los cálculos de la línea A/D. Cuando un activo se excluya del sector, seguirá afectándolo, ya que se tuvo en cuenta en cálculos anteriores.

- El indicador otorga la misma ponderación a todos los valores. Muchos índices asignan ponderaciones diferentes a los valores según su capitalización bursátil. En cuanto a la Línea A/D, otorga la misma ponderación a todos los activos.

- Existe la posibilidad de señales falsas. En momentos de volatilidad del mercado, el indicador puede proporcionar señales falsas a los operadores. Además, la línea A/D se basa únicamente en la diferencia entre activos al alza y a la baja.

¿Cómo agregar el indicador al Metatrader?

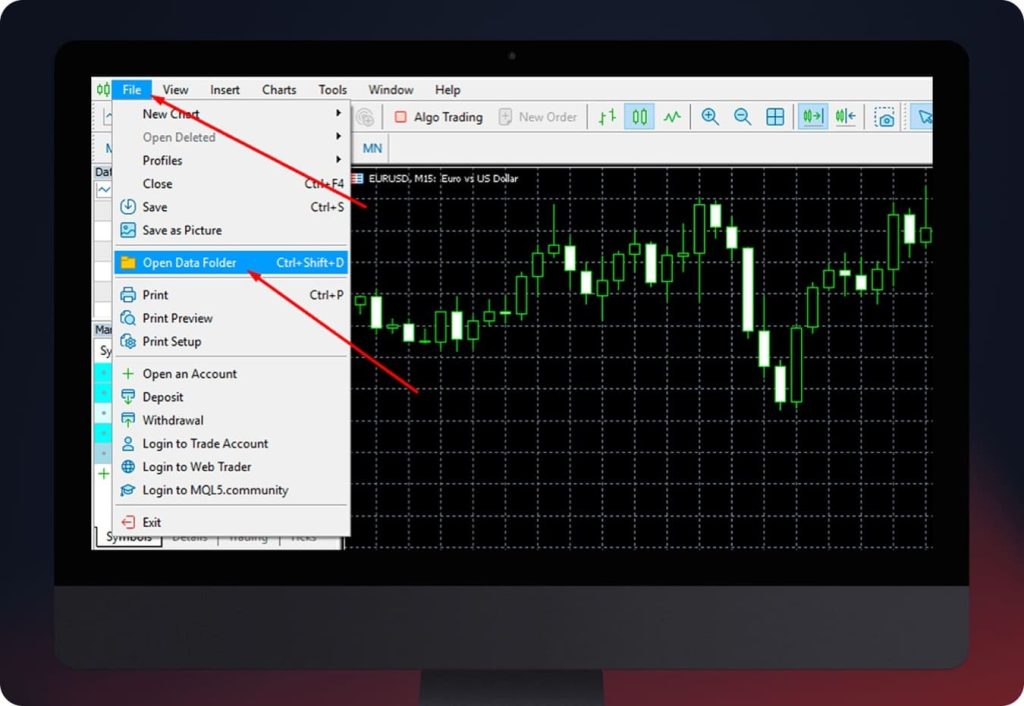

La línea de avance/declive no se encuentra entre los indicadores incluidos por defecto en la lista de instrumentos de Metatrader. Para añadir el instrumento, el operador debe seguir estos sencillos pasos:

- Descargue el archivo de una fuente confiable. Preste atención a la versión de su plataforma de trading. Si se trata de Metatrader 5, descargue el archivo compatible con la plataforma.el Versión. Debería obtener un archivo ex4 o mql.

- Abra su terminal Metatrader.

- Haga clic en el botón “Archivo” y luego seleccione “Abrir carpeta de datos”.

- En la nueva ventana encontrará la lista de carpetas. Abra la carpeta "MQL5" (MQL4). Luego, vaya a la carpeta "Indicadores".

- Mueva un archivo que haya descargado previamente a la carpeta.

- Recargue Metatrader para encontrar la línea A/D entre los instrumentos disponibles.

¿Qué indicadores combinar con la línea de avance/declive?

La línea A/D se utiliza habitualmente como confirmación de tendencia, junto con otros indicadores de análisis técnico. ¿Cuáles son estos instrumentos?

- Medias Móviles. La media móvil (MA) es uno de los indicadores más utilizados que informa a los operadores sobre el precio promedio de un activo; la línea se actualiza constantemente.

- MACD. El indicador de convergencia/divergencia de medias móviles (MACD) se basa en las medias móviles y muestra la dirección y la fuerza de la tendencia del mercado.

- RSI. El Índice de Fuerza Relativa (RSI) es un oscilador que muestra las zonas de sobrecompra y sobreventa entre 0 y 100. El activo está sobrecomprado cuando el indicador supera la línea de 70 y sobrevendido cuando el RSI está por debajo de la línea de 30.

Apliquemos los indicadores mencionados anteriormente al gráfico para entender cómo combinarlos con la línea A/D.

Cómo leer el gráfico: el ejemplo de una estrategia de trading basada en la línea de avance/declinación

Según la estrategia de trading, debemos aplicar la MA 10, la MA 5, el RSI y la línea A/D al gráfico. Se obtiene la siguiente situación:

¿Qué debemos hacer para abrir posiciones largas/cortas?

Abra una posición corta cuando:

- La línea MA 5 cruza la línea MA 10 de arriba a abajo.

- El índice RSI muestra que el activo está en la zona de sobrecompra.

- La línea A/D va hacia abajo.

El cruce de la media móvil (MA) y el RSI predicen el cambio de tendencia en curso, de alcista a bajista; mientras tanto, un operador necesita la línea de avance/descenso para confirmar la situación en general. Cuando la línea A/D baja, el número de valores a la baja es mucho mayor; por ello, el mercado está listo para un cambio de tendencia.

Abra una posición larga cuando:

- La línea MA 5 cruza la línea MA 10 desde abajo hacia arriba.

- El índice RSI muestra que el activo está en la zona de sobreventa.

- La línea A/D va hacia arriba.

El cruce de MA y RSI predicen la actual reversión de la tendencia desde plana a ascendente, y la línea A/D confirma tal situación de mercado, ya que el indicador muestra el predominio de los valores en avance.

En resumen: ¿debería un trader utilizar la línea A/D en el análisis técnico?

La línea de avance/declive es un instrumento eficaz que, en teoría, puede utilizarse de forma independiente; sin embargo, los traders profesionales prefieren aplicar la línea A/D como instrumento de confirmación. Activan un conjunto de indicadores técnicos (p. ej., MA 5 + MA 10 + RSI) que les ayuda a predecir futuros cambios de tendencia, y la línea A/D se utiliza para confirmar la señal.

FAQ

La línea de avance/declive es el indicador de amplitud más utilizado, generalmente combinado con otros instrumentos de análisis técnico. Al considerar si un indicador es el mejor, cabe destacar que cada uno tiene sus propias ventajas y limitaciones.

El instrumento puede ser bastante preciso; mientras tanto, su precisión se ve afectada por diferentes factores, incluido el alcance de los datos utilizados, los marcos de tiempo, los activos, las circunstancias del mercado, etc. Los traders profesionales entienden la línea A/D como un indicador confiable, pero la utilizan dentro de una estrategia con otros instrumentos para obtener señales lo más precisas posible.

Sí, se puede utilizar la línea de avance/declive en todos los mercados financieros; mientras tanto, los traders profesionales dicen que el indicador es el más efectivo en el mercado de valores.

Actualizado:

28 de febrero de 2025