Software de Corretora Forex: Principais Componentes da Plataforma de Corretagem

Conteúdo

Introdução

A indústria de corretagem forex explodiu nos últimos 20 anos graças à tecnologia e à penetração global da internet. A negociação forex passou de uma atividade dominada por bancos e grandes instituições financeiras para uma que está disponível para traders e investidores de varejo em todo o mundo, com baixos depósitos mínimos e acesso 24/7 em dispositivos móveis.

No entanto, esse crescimento também trouxe uma intensa supervisão regulatória sobre as corretoras para proteger os clientes e manter a integridade do mercado. A tecnologia é a espinha dorsal que ajuda as corretoras a cumprir regras rigorosas e oferecer serviços personalizados. Este artigo discutirá alguns dos componentes-chave do software moderno de corretagem forex que as ajudam a operar seus escritórios frontal, intermediário e back office.

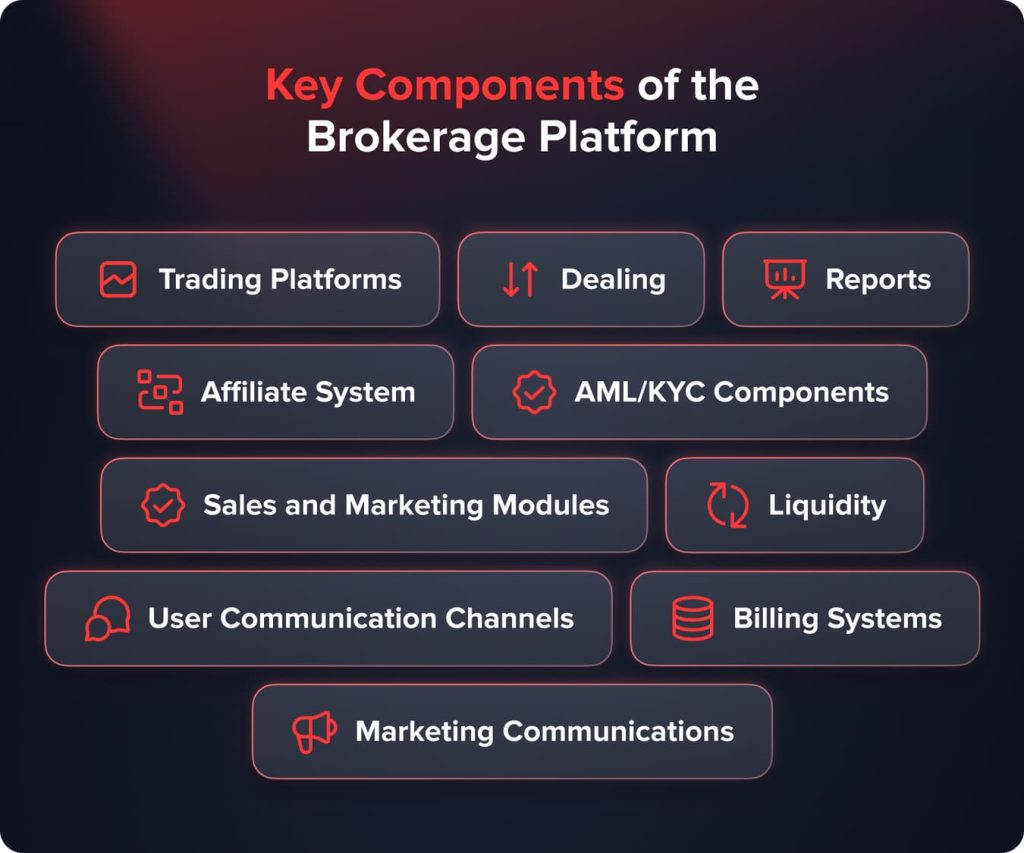

Componentes Chave da Plataforma de Corretagem

Antes de discutirmos cada um deles, aqui está uma visão geral concisa dos módulos mais essenciais que qualquer plataforma moderna de corretora forex deve ter:

| Função | Por que é importante | Exemplos de Recursos |

| Plataforma de Negociação | Ponto único de acesso para clientes negociarem com os mercados e enviarem ordens. | Aplicativos multi-dispositivo, gráficos avançados, negociação com um clique, cobertura multi-ativo. |

| Módulos de CRM & Vendas | Permite gestão de leads, clientes e retenção. | Rastreamento de leads, formulários personalizados, e-learning, acordos eletrônicos, ferramentas promocionais. |

| Relatórios | Garante conformidade, transparência e rastreamento de desempenho. | Histórico de negociações, extratos de conta, resumos de P/L, exportações em massa em PDF/CSV/XML |

| Conformidade KYC/AML | Seguir regras e manter crimes financeiros sob controle. | Verificação de identidade, triagem de listas de vigilância, monitoramento ativo, notificações automáticas |

| Gestão de Liquidez | Assegura execução eficiente de ordens e bons preços. | Acesso API a vários LPs, execução de baixa latência, conectividade ECN/STP. |

| Sistemas de Faturamento | Gerencia depósitos, saques e contabilidade. | Suporte a múltiplas moedas, carteiras eletrônicas/cartões, relatórios fiscais, pagamentos de afiliados. |

Checklist: Recursos de Software de Corretora Forex Indispensáveis vs. Opcionais

Ao escolher o software de corretora de forex, algumas funcionalidades são necessárias para conformidade e confiança do cliente, enquanto outras são recursos "bons de ter" que podem adicionar à experiência do usuário ou à eficácia de marketing.

Recursos Essenciais (para todos os corretores licenciados):

- Plataforma de negociação (multi-dispositivo, estável, ultra-baixa latência)

- Recursos de conformidade KYC/AML (verificação de identidade, triagem de listas de vigilância, monitoramento contínuo)

- Gestão de liquidez (conexões multi-LP, roteamento STP/ECN)

- Relatórios & trilhas de auditoria (pronto para reguladores, exportações em massa, permissões baseadas em funções)

- Sistemas de cobrança (depósitos/saques seguros, conformidade fiscal, verificações de fraudes)

Recursos Desejáveis (vantagem competitiva):

- Programa de afiliados com rastreamento avançado & estruturas de comissão flexíveis

- CRM & automação de vendas para nutrição e retenção de leads

- Módulos de E-learning & bases de conhecimento para treinar traders

- Gestão de riscos ou análises preditivas impulsionadas por IA

- Automação de marketing (email marketing, webinars, entrega de conteúdo personalizado)

Esta lista pode ajudar os corretores a avaliar rapidamente se os fornecedores de software atendem aos requisitos essenciais e oferecem também recursos voltados para o crescimento. Para corretores que consideram a velocidade de lançamento, uma plataforma de negociação white label é frequentemente a maneira mais rápida de lançar com os recursos principais já em funcionamento.

1. Plataformas de Negociação

No coração da oferta de qualquer corretora de forex está a plataforma de negociação que dá aos clientes acesso direto aos mercados de forex à vista e futuros de moedas. Os principais tipos são plataformas de negociação web para uso em navegadores de desktop e aplicativos dedicados para desktop e dispositivos móveis. As melhores plataformas têm gráficos independentes com mais de 50 indicadores técnicos, negociação com um clique, profundidade de mercado, integração de feeds de notícias e opções de personalização de gráficos.

O preço é um diferencial chave, com modelos que incluem spreads fixos/variáveis, comissão por negociação ou preços de spread zero ECN, dependendo do tipo de conta. Outras considerações são tamanhos mínimos/máximos de negociação, montantes de alavancagem e estrutura de taxas de swap/overnight.

A responsividade é crítica, pois qualquer atraso pode ser custoso. As plataformas modernas se concentram em latência ultra-baixa a partir de código otimizado e proximidade direta do servidor. A personalização permite plataformas de marca branca sob o próprio nome da marca do corretor e a construção de complementos como estratégias de negociação automatizadas.

Plataformas avançadas oferecem cobertura de ativos flexível além de forex para commodities, índices, ações e criptomoedas, apoiando uma diversificação de classes de ativos mais ampla para corretoras. A integração vai além da simples execução de ordens, também incluindo a obtenção de feeds de preços, verificações de risco, acompanhamento de portfólio, relatórios e faturamento em uma única interface. A cobertura de múltiplos ativos torna os corretores atraentes para empresas de negociação proprietária profissionais e gerentes de fundos, além de especuladores individuais.

Você também pode gostar

Integração com MT4/MT5 e Outras Ferramentas

Para a maioria dos corretores, MT4 e MT5 continuam sendo o centro de sua infraestrutura de negociação. Empresas de marca branca (WL) oferecem acesso turnkey a essas plataformas, mas a verdadeira vantagem está em como elas se conectam com a outra infraestrutura de corretagem.

- Sistemas de CRM - Implementações de WL integram MT4/MT5 com módulos de gerenciamento de relacionamento com o cliente, de modo que os corretores tenham a capacidade de acompanhar leads, trazer clientes a bordo e fornecer suporte de forma contínua a partir de um único painel.

- Fornecedores de Liquidez - APIs FIX e integrações de bridge permitem a roteirização direta de negociações executadas no MT4/MT5 para pools de liquidez. Spreads baixos, execução em alta velocidade e redução de slippage são garantidos.

- Ferramentas de Gestão de Risco - Integração permite que os corretores vejam a exposição em tempo real, estabeleçam limites de risco e automatizem estratégias de hedge contra as posições dos clientes.

- Conformidade & Relatórios - Os detalhes das negociações MT4/MT5 são transmitidos automaticamente para os módulos de relatórios, produzindo relatórios prontos para auditoria para os reguladores sem intervenção humana.

Ao considerar uma solução de corretagem white label MT4/MT5, não se trata apenas de ter acesso à plataforma - trata-se de garantir que a integração com CRM, liquidez, conformidade e ferramentas de risco seja sempre perfeita e preserve a escalabilidade e conformidade dos negócios.

2. Lidando

A função de negociação é uma parte crítica das operações de corretagem de forex que permite a execução de ordens de clientes e as conecta a provedores de liquidez. A qualidade da execução muitas vezes depende de quão eficientemente a mesa de negociação pode acessar liquidez do lado comprador e do lado vendedor por meio de contrapartes.

Quando um trader faz uma ordem de compra ou venda através da plataforma de negociação do corretor, o sistema de negociação imediatamente busca o preço e direciona a ordem para as contrapartes de liquidez relevantes. Em seguida, ele faz a ponte da confirmação entre o trader e o provedor de liquidez, e notifica ambas as partes quando a negociação é encerrada.

Os corretores usam diferentes estratégias de negociação com base em seu modelo de negócios e mercado-alvo. A abordagem mais comum é o processamento direto (STP), onde o corretor atua como um intermediário, servindo como um canal para transmitir diretamente os pedidos dos clientes para bancos, ECNs ou outras fontes de liquidez sem intermediação.

Isso oferece aos traders a execução mais rápida a taxas interbancárias. Alguns corretores usam uma estratégia ECN ou formador de mercado em vez disso, assumindo o outro lado das operações dos clientes e lucrando com o spread de compra e venda. Isso expõe os traders a spreads mais amplos do que STP, mas garante execução durante a compressão de liquidez.

A conformidade com os requisitos regulatórios é outro aspecto que os corretores precisam considerar ao construir sistemas de negociação. As verificações de risco pré-negociação realizam níveis de margem, limites de tamanho de posição e previnem saldos de conta negativos na submissão de pedidos. Os controles pós-negociação validam a negociação em relação aos limites de conformidade.

A reportagem integra-se com bancos de dados de negociação para fornecer aos reguladores trilhas de auditoria transparentes de todas as transações. A execução rápida e confiável também depende de conectividade de baixa latência com fontes de liquidez, que é uma área de foco chave para a equipe de tecnologia.

3. Relatórios

A conformidade exige que os corretores de forex gerem vários relatórios sobre a atividade dos clientes e extratos de conta. As plataformas de negociação integradas com soluções de relatórios poderosas extraem e agregam dados do sistema de negociação de backend. Alguns dos principais relatórios incluem a contabilidade de todas as negociações abertas e fechadas, com lucros/prejuízos calculados. Também há relatórios para as posições abertas atuais e o desempenho histórico de diferentes traders.

Relatórios adicionais são para atividades de depósito/saque e um registro completo das movimentações de fundos. Os corretores precisam fornecer aos titulares de contas extratos regulares que correspondam à visão geral do portfólio no aplicativo. Os sistemas permitem fácil personalização dos formatos e campos dos relatórios. Os traders podem filtrar por intervalos de datas personalizados, propriedades de negociação ou pares de moedas envolvidos. Exportação em massa em vários formatos, como PDF, CSV, XML e outros, para processamento automatizado adicional ou auditoria manual.

A precisão dos dados em relatórios é crítica do ponto de vista da conformidade. As soluções de relatórios conectam-se diretamente aos bancos de dados centrais onde os perfis dos clientes e os detalhes das transações estão armazenados. Isso permite a extração de dados completos prontos para auditoria para satisfazer os reguladores ou resolver discrepâncias comerciais. O controle de permissões detalhadas regula o acesso a diferentes tipos de relatórios com base em funções de usuários, como gerentes de conformidade ou auditores externos. No geral, a automação de relatórios economiza muitas horas de trabalho manual, garantindo a consistência e a segurança das informações sensíveis.

4. Sistema de Afiliados

Sistemas de afiliados são uma ferramenta de marketing custo-efetiva chave para corretores de forex. Através de programas de afiliados, os corretores incentivam editores e influenciadores a promover ofertas em troca de comissões sobre depósitos de clientes referidos ou volume de negociação. O rastreamento avançado dentro das plataformas dos corretores permite que os afiliados incorporem banners e links personalizáveis em seus sites e perfis sociais.

Plataformas de afiliados robustas têm estruturas de comissão flexíveis que pagam taxas mais altas para afiliados de alto desempenho. Os sistemas podem atribuir tráfego bruto de clientes e verificar conversões. Os corretores podem executar campanhas direcionadas com afiliados seletivos. A integração com CRM e outros sistemas de corretores fornece aos afiliados um painel para ver métricas de desempenho e histórico de pagamentos.

Enquanto o marketing de afiliados reduz os custos de aquisição de clientes, sua implementação técnica é desafiadora. A atribuição falha sem parâmetros consistentes, como o rastreamento de cookies dos caminhos de clique entre dispositivos. Manter conexões diretas com afiliados e estatísticas em tempo real exige uma infraestrutura de servidor robusta.

A conformidade com as regulamentações publicitárias em várias jurisdições adiciona complexidade. Plataformas avançadas resolvem esses problemas com APIs flexíveis, interfaces de aplicativos personalizadas e soluções de terceiros. Priorizar percepções e pagamentos de afiliados ajuda os corretores a expandir suas parcerias.

Você também pode gostar

5. Componentes de AML/KYC

Corretores de Forex devem aderir a rígidos requisitos de AML e requisitos de KYC para prevenir a lavagem de dinheiro e o financiamento do terrorismo. A conformidade começa com a identificação adequada do cliente durante a integração, onde a identificação é verificada e eles são examinados em listas de vigilância globais. As plataformas dos corretores automatizam as verificações de KYC integrando-se a bancos de dados externos. Toda a documentação relacionada ao cliente, como prova de endereço e origem dos fundos, é armazenada e acessível para revisão.

A monitorização de transações em andamento é feita através da perfuração de volumes de negociação, frequências e fluxos de dinheiro. Qualquer desvio significativo do comportamento esperado do cliente aciona um alerta para a equipe de conformidade para revisão manual. Motores avançados baseados em regras apoiam a AML enquanto também alimentam estruturas mais amplas de gestão de risco que mantêm as operações resilientes.

Gerar relatórios de conformidade periódicos é outra função importante para reguladores e auditorias internas. As plataformas extraem dados segregados de interações e transações durante o período de revisão. A geração de relatórios automatizada economiza muitas horas de trabalho manual e garante formatação padronizada.

A integração com autoridades investigativas no exterior fortalece ainda mais a estrutura para impedir transferências de dinheiro ilegais entre fronteiras. Priorizar soluções de conformidade robustas, mas personalizáveis, ajuda os corretores a manter suas licenças regulatórias, mitigando riscos antecipadamente.

6. Módulos de Vendas e Marketing

Módulos de vendas são um sistema centralizado para corretores gerenciarem relacionamentos com clientes existentes e potenciais. Poderosas capacidades de CRM para rastrear leads desde o contato inicial até a análise de necessidades e recomendações de produtos. As plataformas têm formulários e pesquisas personalizáveis para capturar informações de qualidade. As equipes de vendas recebem leads atribuídos e podem adicionar notas de interação, tarefas e códigos promocionais personalizados para acompanhamento posterior.

Métricas no painel ajudam os gerentes a direcionar leads e avaliar o desempenho. As plataformas combinam ganhos e insights comportamentais de campanhas de afiliados, anúncios ou webinars. Isso ajuda a identificar os canais com maior conversão para o orçamento futuro. Os fluxos de trabalho são simplificados para considerar requisitos regulatórios, como verificação de identidades e avaliação da apetite ao risco antes de produtos complexos.

Ferramenta de vendas avançada para e-learning e assinatura de documentos. Os módulos suportam o upload de conteúdo educacional para diferentes mercados e perfis de risco de clientes. Acordos eletrônicos para capturar consentimento legível e com carimbo de data/hora para maior transparência. A gestão geral de vendas ajuda na retenção de clientes e na venda cruzada. E demonstra práticas empresariais responsáveis para os reguladores com um registro centralizado das recomendações feitas.

Estudo de Caso: Como o Right Software Aumentou o Crescimento dos Corretores

Um corretor de forex de médio porte estava sofrendo com baixa retenção de clientes e relatórios de afiliados voláteis. Os leads eram gerenciados pela equipe de vendas em planilhas, e os afiliados reclamavam de pagamentos atrasados e estatísticas de conversão ilógicas.

Eles fizeram um upgrade para uma plataforma de corretagem integrada que combinava:

- Um CRM com atribuição automática de leads,

- Painéis de afiliados em tempo real com planos de comissão flexíveis,

- Integração faturada para automatizar pagamentos.

Resultados em 6 meses

- O faturamento dos clientes caiu 15% porque os representantes de vendas conseguiram acompanhar mais cedo.

- A atividade de afiliados aumentou em 40% devido ao rastreamento limpo e aos pagamentos pontuais.

- As auditorias de conformidade foram mais suaves porque todos os dados de comércio e faturamento foram inseridos em um único sistema de relatórios.

Esta história de sucesso de software de corretora de forex ilustra como até mesmo o ajuste mais simples em uma plataforma integrada pode aumentar a retenção, reduzir a fricção e fortalecer as relações com afiliados.

7. Liquidez

A liquidez refere-se à quantidade de volume negociável em um mercado e é fundamental para que os corretores de forex possam executar as ordens de compra e venda dos traders de forma contínua. As fontes são tipicamente bancos de primeira linha que oferecem spreads apertados em pequenos montantes nominais e plataformas ECN maiores que agregam fluxos institucionais globais. Alguns corretores também utilizam corretores parceiros ou formadores de mercado para absorver temporariamente as negociações.

As principais plataformas de corretagem têm várias conexões de API com fornecedores de liquidez para alternar entre eles em tempo real. Isso garante a execução de ordens mesmo durante deslocamentos de mercado, quando uma fonte pode ficar fora do ar ou ter spreads mais amplos. A otimização de latência com feeds de liquidez direta e a co-localização de motores de correspondência ajudam a acelerar os tempos de negociação para scalpers ou algoritmos.

A integração avançada com alianças de liquidez de referência permite que os corretores acessem membros do consórcio durante períodos de estresse. Enquanto isso, bancos proprietários e unidades de corretagem oferecem fontes alternativas para obter preços equilibrados em duas vias e não depender apenas de terceiros. No geral, o software de corretagem é fundamental por meio de pipelines de multi-liquidez e infraestrutura resiliente para fornecer profundidade e estabilidade para traders profissionais.

8. Canais de Comunicação do Usuário

Os traders precisam de suporte através de múltiplos canais para atender às suas necessidades. As plataformas de corretoras têm chat online, sistema de tickets por e-mail, opções de retorno de chamada e fóruns comunitários moderados pelo suporte ao cliente. Através de perfis online, os clientes podem atualizar suas informações pessoais, redefinir senhas ou habilitar autenticação adicional, como códigos de dois fatores para acesso seguro.

Ferramentas de notificação personalizadas avançadas mantêm os traders informados sobre atividades importantes em sua conta, como respostas a solicitações de serviço, alertas de margem ou atualizações do sistema de negociação. Bases de conhecimento multilíngues para resolver problemas comuns de forma independente. Os operadores também podem criar programas de notificação direcionados e lançar campanhas para novos produtos, webinars de negociação ou condições de mercado.

A conformidade com as regulamentações de privacidade requer um alto nível de segurança e personalização nas interfaces do usuário. Logins baseados em função, monitoramento de atividades e controle de acesso a dados privados para proteger informações sensíveis.

Grupos de traders podem ser criados para ter supervisão conjunta de contas sem compartilhar credenciais e preferências individuais. Localização para melhorar a experiência do usuário para clientes globais, apoiando idiomas preferidos durante o registro e ao longo da jornada. No geral, isso é o que os reguladores gostam.

9. Sistemas de Faturamento

Um processo de depósito e retirada sem costura é fundamental para a experiência do usuário nas plataformas de corretoras. Os clientes esperam opções como transferências bancárias, carteiras eletrônicas populares e cartões de débito/crédito de grandes bancos locais. Portais de pagamento para processar transações de forma segura e cumprir com os protocolos de conheça seu pagamento. A configuração também considera requisitos específicos de moeda e jurisdição.

Módulos de faturamento avançados vão além do financiamento para incluir faturas, reembolsos de pagamento de afiliados e rastreamento de despesas. Esquemas de integração para recuperar detalhes bancários de liquidação para desembolso programático. Painéis para mostrar aos afiliados uma visibilidade transparente das comissões baseadas em referências. Comerciantes recebem relatórios reconciliados em conformidade com as especificações fiscais em todas as regiões.

A conformidade com as IFRS, os padrões locais de contabilidade e as medidas antifraude exige um robusto sistema de contabilidade e auditoria. Localização para personalizar interfaces por idioma, formatação numérica e precisão de cálculo. Cálculos fiscais dinâmicos com base na localização do cliente para apresentar declarações estatutárias precisas. Faturamento geral para atender a múltiplas necessidades de monetização e mostrar aos reguladores que o monitoramento de transações é sanitizado como um negócio licenciado globalmente.

Erros que os Corretores Cometem com Software

Embora existam soluções de software poderosas, muitos corretores estão atolados pelos mesmos erros evitáveis ao escolher ou instalar seu software:

Escolhendo o provedor mais barato:

Implementações de baixo custo comprometem a velocidade de execução, a precisão dos relatórios ou os módulos de conformidade. Elas podem levar a despesas futuras não visíveis e à perda de reputação.

Descontando necessidades de conformidade:

Uma plataforma de AML/KYC, relatórios e conformidade regulatória sem módulos de conformidade robustos pode correr o risco de cancelamento da licença ou imposição de multas. Os módulos de conformidade nunca devem ser opcionais, mas sempre obrigatórios.

Negligenciar a integração de liquidez:

Sem acesso direto a múltiplos provedores de liquidez, os corretores devem suportar spreads mais amplos, execução mais lenta e clientes descontentes, especialmente em tempos de turbulência.

Falta de planejamento de escalabilidade:

Algumas plataformas são adequadas para uma pequena base de clientes, mas não acomodarão volumes maiores. Os corretores precisam de sistemas que escalem para a expansão, para que não sejam sobrecarregados com migrações caras no futuro.

Evitar essas armadilhas de software de corretores de forex economiza tempo e dinheiro para as empresas, ao mesmo tempo em que proporciona estabilidade a longo prazo e conformidade regulatória.

10. Comunicações de Marketing

As plataformas de corretagem têm poderosos módulos de marketing digital para nutrir leads e clientes. Os recursos incluem modelos de e-mail pré-projetados, páginas de destino, pop-ups e registros para webinars/eventos. As campanhas podem ser agendadas automaticamente com base no comportamento do usuário ou lançadas manualmente em todo o site. Rastreamento abrangente para acompanhar aberturas de e-mail, taxas de cliques e engajamento em webinars para medir o desempenho.

Análises baseadas em dados nos painéis de marketing mostram a atribuição para gastos futuros. Relatórios de funil para identificar gargalos que precisam de nutrição adicional ou personalização de conteúdo. Plataformas para consolidar anúncios, campanhas de afiliados e propriedades próprias em uma única visão. Orçamento baseado em projetos para mostrar aos stakeholders.

Bancos de dados de conteúdo central para curar artigos educacionais, infográficos, vídeos e ideias de negociação otimizados para busca e compartilhamento social. Conteúdo a ser visualizado e publicado de forma integrada em seções dedicadas do site, aplicativos móveis e parceiros de sindicância externa.

Análise para rastrear a demografia e os interesses dos leitores para refinar canais e tópicos. Ferramentas de globalização para distribuir conteúdo multilíngue e ciente da localização para expandir o alcance dos programas de conteúdo. No geral, uma abordagem completa de automação de marketing para gerar leads em grande escala é necessária.

Considerações Regulatórias para Software de Corretoras de Forex

A regulamentação ocupa um lugar central na construção de plataformas de corretores de forex. O software pode ser exigido para atender a alguns requisitos de conformidade relacionados à execução, relatórios e integração de clientes, dependendo da jurisdição do país.

União Europeia (regras da ESMA):

Os corretores são obrigados a fornecer proteção contra saldo negativo, limites de alavancagem padronizados (por exemplo, 1:30 para varejo), bem como relatórios extensivos de negociações sob a MiFID II. Salvaguardas integradas e relatórios automatizados devem estar em vigor nas plataformas.

Estados Unidos (CFTC & NFA):

O mercado dos EUA é mais regulamentado, com níveis de adequação de capital, auditorias frequentes e total transparência nos métodos de precificação. O software de corretagem deve apresentar trilhas de auditoria robustas e segregação segura de fundos dos clientes.

Jurisdicionais offshore (por exemplo, Seychelles, Belize):

Regimes regulatórios mais brandos, comumente favorecidos por novos corretores iniciantes. No entanto, as plataformas precisam de módulos de AML/KYK para atender aos requisitos internacionais de combate à lavagem de dinheiro e evitar perda de reputação.

Ásia-Pacífico (Cingapura, Austrália, Japão):

A conformidade com a AML e a proteção dos investidores são enfatizadas pelos reguladores. A verificação automatizada de KYC, o monitoramento de transações suspeitas e a integração com bancos de dados governamentais são funcionalidades de software essenciais.

O software adaptativo que permite o cumprimento das exigências locais ajuda os corretores a permanecer licenciados, expandir globalmente e reduzir a exposição regulatória.

Tendências Futuras em Plataformas de Corretagem Forex

O software de corretoras de Forex continua avançando a uma taxa rápida para acompanhar as expectativas emergentes dos clientes, bem como os requisitos dos órgãos reguladores. Algumas das tendências mais importantes que afetam as plataformas de próxima geração são:

Gestão de Risco Orientada por IA:

Plataformas avançadas já estão usando aprendizado de máquina para monitorar a exposição dos clientes, detectar comportamentos de negociação suspeitos e prever estresse de liquidez. Notificações alimentadas por IA ajudam os corretores a gerenciar riscos de forma mais proativa.

Liquidações Baseadas em Blockchain:

A tecnologia de livro-razão distribuído está sendo testada para automatizar a liquidação pós-negociação, reduzir erros de reconciliação e aumentar a transparência sobre o movimento de fundos. Isso tem o potencial de reduzir substancialmente os custos de back-office nos próximos anos.

Corretora Mobile-First:

Como a maioria dos traders de varejo agora acessa os mercados em smartphones, as plataformas estão se concentrando em aplicativos de negociação nativos para dispositivos móveis com um processo de cadastro simples, login biométrico e equivalência total de recursos com desktops.

O futuro do software de negociação forex será ditado por uma gestão de risco mais inteligente, plataformas de liquidação mais rápidas e desenvolvimento voltado para dispositivos móveis - permitindo que os corretores se expandam com segurança enquanto atendem às demandas dos traders de hoje.

Conclusão

No competitivo mundo de hoje, os corretores de forex precisam de plataformas de software poderosas e altamente personalizáveis para conduzir suas operações de forma eficiente e em conformidade. Para atender clientes em diversas geografias e níveis de experiência, os corretores precisam agregar todas as funcionalidades acima em um sistema integrado e fácil de usar.

Com tecnologia de ponta, os corretores podem permanecer competitivos com spreads baixos, alta disponibilidade e desenvolvimento de novos produtos. O crescimento responsável requer verificação de identidade, gerenciamento de riscos e relatórios transparentes para manter licenças globalmente.

A tecnologia é a espinha dorsal das corretoras para crescer de forma sustentável, protegendo os ativos dos clientes e a integridade do mercado. Com a escolha certa da plataforma de forex, os corretores podem escalar suas operações com custos mínimos para atender a uma base de clientes em rápida expansão em todo o mundo.

FAQ

A maioria dos corretores utiliza uma mistura de plataformas de negociação (como MT4, MT5 ou plataformas personalizadas), software de gerenciamento de liquidez, software de CRM e módulos de conformidade (KYC/AML). As opções de marca branca geralmente incluem todos esses sob um único pacote.

Os preços variam com base nas características e licenciamento. Uma solução MT4/MT5 de marca branca começará em vários milhares de dólares por mês, enquanto plataformas proprietárias muito personalizadas custam seis cifras.

MT4 é o padrão para negociação forex, enquanto o MT5 é mais completo, com tipos de ordens adicionais, integração de calendário econômico e uma cobertura de ativos mais ampla (ações, futuros, commodities). Ambos ainda são mantidos pela maioria dos corretores.

Sim. O software de corretora white label permite que novos entrantes entrem rapidamente ao revender uma plataforma existente sob sua própria marca. Geralmente, consiste em infraestrutura de negociação, acesso à liquidez e módulos de conformidade mínimos.

Atualizado:

3 de outubro de 2025