Forex Broker Software: Key Components of Brokerage Platform

Contents

Introduction

The forex brokerage industry has exploded over the last 20 years thanks to technology and global internet penetration. Forex trading has moved from being an activity dominated by banks and large financial institutions to one that’s available to retail traders and investors worldwide with low minimum deposits and 24/7 access on mobile devices.

However, this growth has also brought in intense regulatory oversight on brokerages to protect clients and maintain market integrity. Technology is the backbone that helps brokerages comply with strict rules and deliver bespoke services. This article will discuss some of the key components of modern forex brokerage software that helps them run their front, middle and back offices.

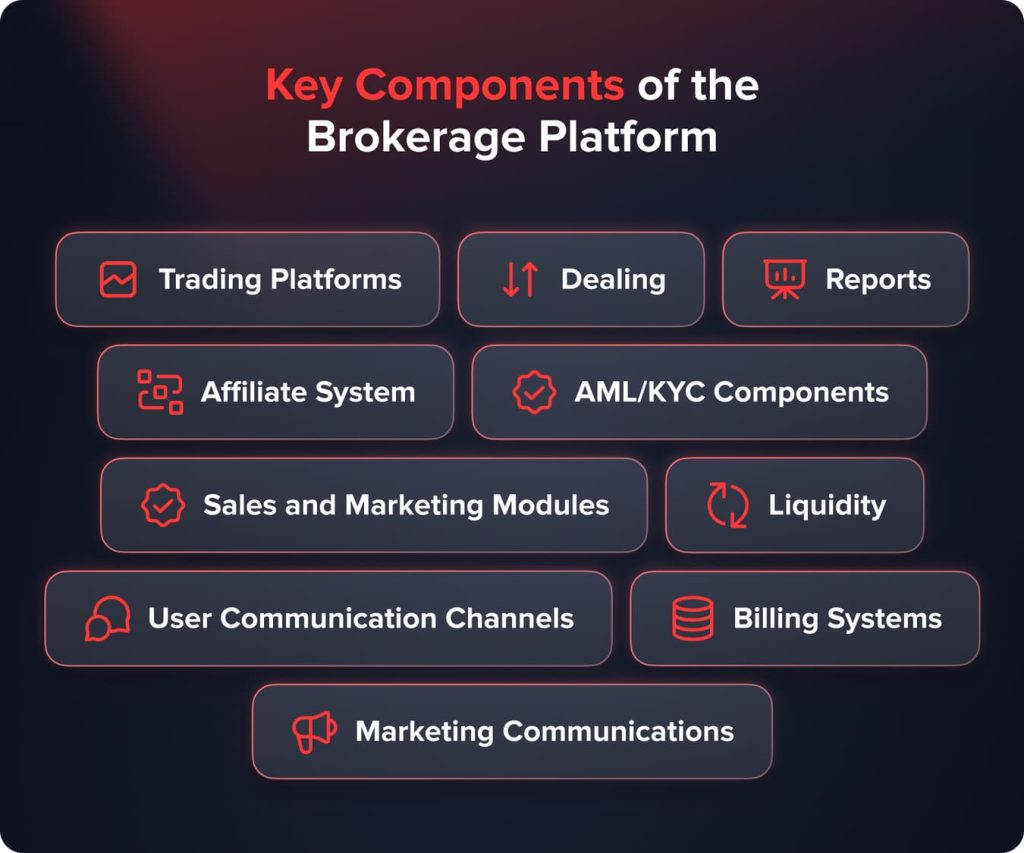

Key Components of the Brokerage Platform

Before we discuss each of them, here’s a concise overview of the most essential modules any modern forex broker platform should have:

| Function | Why It Matters | Example Features |

| Trading Platform | Single point of access for customers to trade with markets and submit trades. | Multi-device apps, advanced charting, one-click trading, multi-asset coverage. |

| CRM & Sales Modules | Allows lead, client, and retention management. | Lead tracking, custom forms, e-learning, electronic agreements, promotional tools. |

| Reporting | Guarantees compliance, transparency, and tracking of performance. | Trade history, account statements, P/L summaries, bulk exports in PDF/CSV/XML |

| KYC/AML Compliance | Adheres to rules and maintains financial crime at bay. | ID verification, watchlist screening, active monitoring, automatic notifications |

| Liquidity Management | Ensures efficient order execution and good prices. | API access to several LPs, low-latency execution, ECN/STP connectivity. |

| Billing Systems | Handles deposits, withdrawals, and accounting. | Multi-currency support, e-wallets/cards, tax reporting, affiliate payouts. |

Checklist: Must-Have vs. Nice-to-Have Forex Broker Software Features

When choosing forex broker software, some features are necessary for compliance and client trust, while others are “nice-to-have” features that can add user experience or marketing effectiveness.

Must-Have Features (for all licensed brokers):

- Trading platform (multi-device, stable, ultra-low latency)

- KYC/AML compliance features (ID verification, watchlist screening, continuous monitoring)

- Liquidity management (multi-LP connections, STP/ECN routing)

- Reporting & audit trails (regulator-ready, bulk exports, role-based permissions)

- Billing systems (secure deposits/withdrawals, tax compliance, fraud checks)

Nice-to-Have Features (competitive edge):

- Affiliate program with advanced tracking & flexible commission structures

- CRM & sales automation for lead nurturing & retention

- E-learning modules & knowledge bases for training traders

- Risk management or predictive analytics driven by AI

- Marketing automation (email marketing, webinars, personalization content delivery)

This list can help brokers at a glance assess whether software vendors meet the must-haves and offer growth-driven niceties as well. For brokers considering speed to market, a white label trading platform is often the fastest way to launch with core features already in place.

1. Trading Platforms

At the heart of any forex broker’s offering is the trading platform that gives clients direct access to spot forex and currency futures markets. The main types are web trading platforms for use via desktop browsers and dedicated desktop and mobile apps. Top platforms have independent charting with over 50 technical indicators, one-click trading, market depth, news feeds integration and draw customization options.

Pricing is a key differentiator with models including fixed/variable spreads, commission per trade or ECN zero spread pricing depending on the account type. Other considerations are minimum/maximum trade sizes, leverage amounts and swap/overnight fee structure.

Responsiveness is critical as any lag can be costly. Modern platforms focus on ultra-low latency from optimized code and direct server proximity. Customization allows white labelling platforms under the broker’s own brand name and building add-ons like automated trading strategies.

Advanced platforms offer flexible asset coverage beyond forex to commodities, indices, stocks and cryptocurrencies, supporting broader asset class diversification for brokerages. Integration goes beyond just order execution, also price feed sourcing, risk checks, portfolio tracking, reporting and billing on a single interface. Multi-asset coverage makes brokers attractive to professional proprietary trading firms and fund managers besides individual speculators.

You may also like

Integration with MT4/MT5 and Other Tools

To most brokers, MT4 and MT5 remain the center of their trading infrastructure. White label (WL) businesses offer turnkey access to these platforms, but the actual advantage is in how they connect with other brokerage infrastructure.

- CRM Systems – WL implementations integrate MT4/MT5 with customer relationship management modules so that brokers have the ability to track leads, bring clients on board, and provide support on a continuous basis from one dashboard.

- Liquidity Providers – FIX API and bridge integrations enable direct trade routing of trades executed on MT4/MT5 into liquidity pools. Low spreads, high-speed execution, and reduced slippage are assured.

- Risk Management Tools – Integration allows brokers to see exposure in real time, place risk limits, and automate hedging strategies against client positions.

- Compliance & Reporting – MT4/MT5 trade details are streamed automatically into reporting modules, producing audit-ready reports for regulators without human intervention.

When looking at an MT4/MT5 white label brokerage solution, it’s not just having access to the platform – it’s about ensuring integration with CRM, liquidity, compliance, and risk tools is always seamless and preserves business scalability and compliance.

2. Dealing

The dealing function is a critical part of forex brokerage operations that enables the execution of client orders and connects them to liquidity providers. Execution quality often depends on how efficiently the dealing desk can access buy-side and sell-side liquidity through counterparties.

When a trader places a buy or sell order through the broker’s trading platform, the dealing system instantly sources the price and routes the order to the relevant liquidity counterparties. It then bridges the confirmation between the trader and liquidity provider, and notifies both ends when the trade is closed out.

Brokers use different dealing strategies based on their business model and target market. The most common approach is straight-through processing (STP) where the broker acts as an intermediary, acting as a conduit to directly transmit client orders to banks, ECNs or other liquidity sources without intermediation.

This gives traders the fastest execution at interbank rates. Some brokers use an ECN or market maker strategy instead, taking the other side of client trades and profit from the bid-ask spread. This exposes traders to wider spreads than STP but guarantees execution during liquidity squeezes.

Compliance with regulatory requirements is another aspect brokers need to consider when building dealing systems. Pre-trade risk checks perform margin levels, position sizing limits and prevent negative account balances on order submission. Post-trade controls validate the trade against compliance thresholds.

Reporting integrates with dealing databases to provide regulators with transparent audit trails of all trades. Fast and reliable execution also depends on low-latency connectivity to liquidity sources which is a key area of focus for the tech team.

3. Reports

Compliance requires forex brokers to generate various reports on client activity and account statements. Trading platforms integrated with powerful reporting solutions pull and aggregate data from the backend dealing system. Some of the main reports include accounting of all open and closed trades with profits/losses calculated. There are also reports for current open positions and the historical performance of different traders.

Additional reports are for deposit/withdrawal activities and a full audit trail of fund movements. Brokers need to provide account holders with regular statements matching the in-app portfolio overview. The systems allow easy customization of report formats and fields. Traders can filter by custom date ranges, trade properties or involved currency pairs. Bulk export in multiple formats like PDF, CSV, XML and others for further automated processing or manual auditing.

Data accuracy across reports is critical from a compliance perspective. Reporting solutions connect directly to the core databases where client profiles and transaction details are stored. This allows the pulling of full audit-ready data to satisfy regulators or resolve trade discrepancies. Fine-grained permissions control access to different report types based on user roles like compliance managers or external auditors. Overall automated reporting saves many hours of manual work while ensuring consistency and security of sensitive information.

4. Affiliate System

Affiliate systems are a key cost-effective marketing tool for forex brokers. Through affiliate programs, brokers incentivize publishers and influencers to promote offers in exchange for commissions on referred client deposits or trading volume. Advanced tracking within broker platforms allows affiliates to embed customisable banners and links across their websites and social profiles.

Robust affiliate platforms have flexible commission structures that pay higher rates to top-performing affiliates. Systems can attribute raw client traffic and verify conversions. Brokers can run targeted campaigns with selective affiliates. Integration with CRM and other broker systems gives affiliates a dashboard to see performance metrics and payout history.

While affiliate marketing reduces customer acquisition costs, its technical implementation is challenging. Attribution fails without consistent parameters like cookies tracking click paths across devices. Maintaining direct affiliate connections and real-time stats requires robust server infrastructure.

Compliance with advertising regulations across multiple jurisdictions adds complexity. Advanced platforms solve these issues with flexible APIs, custom application interfaces and third-party solutions. Prioritising affiliate insights and payouts helps brokers grow their partnerships.

You may also like

5. AML/KYC Components

Forex brokers must adhere to strict AML and KYC requirements to prevent money laundering and terrorism financing. Compliance starts with proper client identification during onboarding where ID is verified and they are screened against global watchlists. Broker platforms automate KYC checks by integrating with external databases. All client-related documentation such as address and source of funds proof are stored and accessible for review.

Ongoing transaction monitoring is done by profiling trading volumes, frequencies and money flows. Any significant deviation from expected client behaviour triggers an alert to the compliance team for manual review. Advanced rules-based engines support AML while also feeding into broader broker risk management frameworks that keep operations resilient.

Generating periodic compliance reports is another important function for regulators and internal audits. Platforms pull segregated data from interactions and transactions during the review period. Automated reporting saves many hours of manual work and ensures standardised formatting.

Integration with offshore investigative authorities further strengthens the framework to stop illegal cross-border money transfers. Prioritising robust yet customisable compliance solutions helps brokers maintain their regulatory licenses by mitigating risks ahead of time.

6. Sales and Marketing Modules

Sales modules are a centralised system for brokers to manage relationships with existing and prospective clients. Powerful CRM capabilities to track leads from initial contact to needs analysis and product recommendations. Platforms have customisable forms and surveys to capture quality information. Sales teams get assigned leads and can add interaction notes, tasks and custom promo codes for follow-up later.

Metrics in the dashboard help managers route leads and evaluate performance. Platforms combine earnings and behavioural insights from affiliate campaigns, ads or webinars. This helps to identify the highest converting channels for future budgeting. Workflows are streamlined to consider regulatory requirements such as verifying identities and assessing risk appetite before complex products.

Advanced e-learning and document signing a sales tool. Modules support uploading educational content for different markets and client risk profiles. Electronic agreements to capture legible and timestamped consent for added transparency. Overall sales management helps with client retention and cross-selling. And shows responsible business practices to regulators with a centralised record of recommendations made.

Case Study: How Right Software Boosted Broker Growth

A medium-sized forex broker was suffering from low customer retention and volatile affiliate reporting. Leads were managed by their sales team on spreadsheets, and affiliates complained of late payments and illogical conversion statistics.

They upgraded to an integrated brokerage platform that combined:

- A CRM with auto-assignment of leads,

- Real-time affiliate dashboards with flexible commission plans,

- Billed-for integration to automate payments.

Results in 6 months

- Client turnover decreased 15% because sales representatives were able to follow up earlier.

- Affiliate activity picked up by 40% because of clean tracking and on-time payments.

- Compliance audits ran smoother because all trade and billing data entered one report system.

This forex broker software success story illustrates how even the simplest adjustment to an integrated platform can boost retention, reduce friction, and fortify affiliate relationships.

7. Liquidity

Liquidity refers to the amount of tradable volume in a market and is key for forex brokers to fill traders’ buy and sell orders seamlessly. Sources are typically tier-one banks which provide tight spreads on small notional amounts and larger ECN platforms which aggregate global institutional flows. Some brokers also use fellow brokerages or market makers to absorb trades temporarily.

Top brokerage platforms have multiple API connections with liquidity providers to switch between them in real time. This ensures order execution even during market dislocations when one source may go down or have wider spreads. Latency optimisation with direct liquidity feeds and co-location of matching engines helps to speed up trade times for scalpers or algorithms.

Advanced integration with ref liquidity alliances allows brokers to tap into consortium members during stress. Meanwhile, proprietary banks and broker units provide alternative sources to get balanced two-way pricing and not rely on third parties alone. Overall broker software is key via multi-liquidity pipelines and resilient infrastructure to deliver depth and stability for professional traders.

8. User Communication Channels

Traders need support through multiple channels to suit their needs. Broker platforms have web chat, email ticketing, call-back options and community forums moderated by customer support. Through online profiles, clients can update their personal information, reset passwords or enable additional authentication like two-factor codes for secure access.

Advanced personalised notification tools keep traders informed of important activity on their account, such as responses to service requests, margin alerts or trading system updates. Multilingual knowledge bases to resolve common issues independently. Operators can also create targeted notification programs and launch campaigns for new products, trading webinars or market conditions.

Compliance with privacy regulations requires a high level of security and customisation across user interfaces. Role-based logins, activity monitoring and control of private data access to protect sensitive information.

Trader groups can be created to have joint account oversight without sharing credentials and individual preferences. Localization to enhance user experience for global clients by supporting preferred languages at registration and throughout the journey. Overall this is what regulators like.

9. Billing Systems

A seamless deposit and withdrawal process is key to user experience on broker platforms. Clients expect options like wire transfers, popular e-wallets and debit/credit cards from major local banks. Payment gateways to process transactions safely and comply with know-your-payment protocols. Configuration also considers currency and jurisdiction-specific requirements.

Advanced billing modules go beyond funding to include invoices, affiliate payout reimbursements and expense tracking. Integration schemas to retrieve settlement bank details for programmatic disbursement. Dashboards to show affiliate marketers transparent visibility of reference-based commissions. Merchants get reconciled reports compliant with tax specs across regions.

Compliance with IFRS, local bookkeeping standards and anti-fraud measures requires a robust accounting and audit trail. Localization to customise interfaces by language, numeric formatting and calculation precision. Dynamic tax calculations based on client location to file accurate statutory returns. Overall billing to fulfil multiple monetization needs and show regulators that transaction monitoring is sanitised as a licensed business globally.

Mistakes Brokers Make with Software

While there are powerful software solutions, many brokers are bogged down by the same avoidable errors when choosing or installing their software:

Choosing the cheapest provider:

Low-cost implementations compromise on execution speed, reporting precision, or compliance modules. They may lead to future unseen expenses and loss of reputation.

Discounting compliance needs:

An AML/KYC, reporting, and regulatory compliant platform without robust compliance modules can risk cancellation of the license or imposition of fines. Compliance modules should never be optional but always mandatory.

Neglecting liquidity integration:

Without direct access to multiple liquidity providers, brokers must endure wider spreads, slower execution, and discontented customers, especially in times of turmoil.

Lacking scalability planning:

Some platforms are suitable for a small client base but will not accommodate larger volumes. Brokers need systems that scale to expansion so they are not burdened with costly migrations in the future.

Avoiding these forex broker software pitfalls saves companies both time and money, while delivering long-term stability and regulatory compliance.

10. Marketing Communications

Brokerage platforms have powerful digital marketing modules to nurture leads and customers. Features include pre-designed email templates, landing pages, pop-ups and webinar/event registrations. Campaigns can be scheduled automatically based on user behaviour or manually launched sitewide. Comprehensive tracking to track email opens, click rates and webinar engagement to measure performance.

Data-driven analytics in marketer dashboards show attribution for future spending. Funnel reports to identify bottlenecks that need additional nurturing or content personalisation. Platforms to roll up ads, affiliate campaigns and owned properties into one view. Project-based budgeting to show stakeholders.

Central content databases to curate educational articles, infographics, videos and trading ideas optimised for search and social sharing. Content to be previewed and published seamlessly to dedicated site sections, mobile apps and external syndication partners.

Analytics to track reader demographics and interests to refine channels and topics. Globalisation tools to distribute multilingual, location-aware content to expand the reach of content programs. Overall, a full marketing automation approach to generate leads at scale is necessary.

Regulatory Considerations for Forex Broker Software

Regulation takes center stage when building forex broker platforms. Software can be required to meet some compliance requirements concerning execution, reporting, and client onboarding depending on the jurisdiction of the country.

European Union (ESMA rules):

Brokers are obliged to provide negative balance protection, standardized leverage limits (e.g., 1:30 for retail) as well as extensive reportage of trades under MiFID II. Integrated safeguards and automated reports must be in place on the platforms.

United States (CFTC & NFA):

The U.S. market is more regulated, with capital adequacy levels, frequent audits, and full transparency of pricing methods. Broker software must feature robust audit trails and secure client fund segregation.

Offshore jurisdictions (e.g., Seychelles, Belize):

More lenient regulatory regimes, commonly favored by new start-up brokers. However, platforms need AML/KYK modules to meet international anti-money laundering requirements and avoid reputational loss.

Asia-Pacific (Singapore, Australia, Japan):

AML compliance and protection of investors are emphasized by regulators. Automated verification of KYC, suspicious transaction monitoring, and integration with government databases are essential software functionalities.

Adaptive software that enables local compliance requirements helps brokers remain licensed, expand globally, and reduce regulatory exposure.

Future Trends in Forex Brokerage Platforms

Forex broker software keeps advancing at a rapid rate to keep up with emerging client expectations as well as the requirements of regulatory bodies. Some of the most important trends that affect next-generation platforms are:

AI-Driven Risk Management:

Advanced platforms are already using machine learning to monitor client exposure, detect suspicious trading behavior, and predict liquidity distress. AI-powered notifications help the brokers manage risk more proactively.

Blockchain-Based Settlements:

Distributed ledger technology is being tested for automating post-trade settlement, reducing reconciliation errors, and increasing transparency over fund movement. This has the potential to lower back-office costs within the next few years substantively.

Mobile-First Brokerage:

Since the majority of retail traders now access markets on smartphones, the platforms are concentrating on mobile-native trading apps with simple onboarding, biometric login, and full feature equivalence with desktops.

The future of forex trading software will be dictated by smarter risk management, faster settlement platforms, and mobile-first development – enabling brokers to expand safely while meeting the demands of today’s traders.

Conclusion

In today’s competitive world, forex brokers need powerful, highly customisable software platforms to run their operations efficiently and compliant. To cater to clients across geographies and experience levels, brokers need to aggregate all the features above into one integrated and user-friendly system.

With cutting-edge technology, brokers can stay competitive with low spreads, high uptime and new product development. Responsible growth requires identity verification, risk management and transparent reporting to maintain licenses globally.

Technology is the backbone of brokerages to grow sustainably while protecting client assets and market integrity. With the right choice of forex platform, brokers can scale their operations with minimal overhead to serve an exponentially growing customer base around the world.

FAQ

Most brokers utilize a mix of trading platforms (like MT4, MT5, or customized platforms), liquidity management software, CRM software, and compliance modules (KYC/AML). White label options usually include all these under one package.

Prices vary based on features and licensing. A white label MT4/MT5 solution will start at several thousand dollars per month, while very customized proprietary platforms cost six figures.

MT4 is the standard for forex trading, while MT5 is fuller-featured, with additional order types, economic calendar integration, and broader asset coverage (stocks, futures, commodities). Both are still maintained by most brokers.

Yes. White label broker software enables new entrants to enter rapidly by reselling an existing platform under their own brand. It generally consists of trading infrastructure, access to liquidity, and minimal compliance modules.

Updated:

October 3, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]