Trading

9 February, 2026

6 min read

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]

Trading

30 January, 2026

45 min read

50 Chart Patterns and How to Trade Them (2026 Guide)

Chart patterns remain one of the most effective sets of tools available to traders in 2026. This is because, even with the advent of algo trading, AI trade signals, and other indicators, market behavior is still driven by psychology, market liquidity, and market structure. By recognizing these market patterns, traders can predict and profit from […]

Trading

8 January, 2026

9 min read

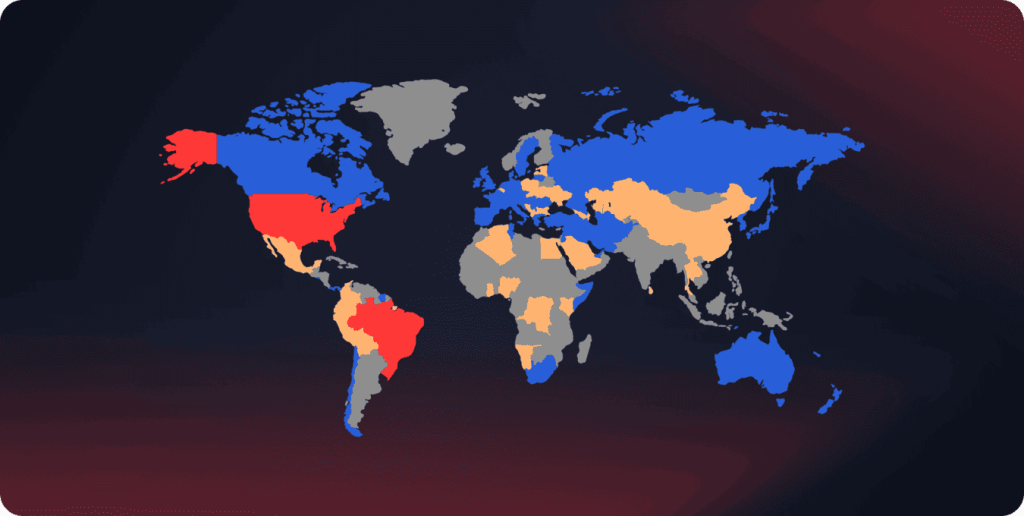

Stock Market Hours: When Does The Market Open?

Most major stock markets are open Monday to Friday, with opening times depending on the exchange and its time zone. For example, US stock markets open at 9:30 AM ET, while the London Stock Exchange opens at 8:00 AM UK time. There is no regular stock trading on weekends. Below, you’ll find a clear, practical […]