Bitcoin Liquidation Heatmap and How to Use It for Profitable Trading in 2026

В статье

Cryptocurrency markets move fast, and Bitcoin is no exception. With billions in leveraged positions open at any time, sudden spikes and crashes often seem unpredictable to most traders. On November 21, 2025, the crypto market experienced one of its largest wipeouts of the year. This affected more than 391,000 traders, with over US$2.0 billion in leveraged positions liquidated within 24 hours, highlighting just how quickly these events can unfold.

But beneath the surface, there are patterns, specifically where large volumes of leveraged positions are likely to be liquidated. The Bitcoin Liquidation Heat Map is one of the few tools that allow traders to understand such patterns and tendencies. In this comprehensive guide, you’ll learn what the Bitcoin liquidation heatmap is, how it works, and how to apply it for profitable trades.

What Is the Bitcoin Liquidation Heatmap?

The Bitcoin Liquidation Heatmap provides an illustration of the levels that are expected for the forced closure of leveraged long and short positions. These heatmaps are created by analyzing open interest, leverage data, and historical liquidation patterns across various derivative exchanges.

In simple terms:

- It shows where traders place leveraged orders.

- It highlights clusters of liquidation levels.

- It reveals zones where Bitcoin’s price is likely to “gravitate” because large numbers of positions could be wiped out.

The heatmap effect, however, comes from color intensity; the brighter (or “hotter”) the zone, the higher the potential liquidation concentration.

How Does Bitcoin Liquidations Work?

In crypto derivatives trading, traders frequently use high leverage, such as 10x, 50x, or even 100x, which amplifies both profits and losses. Because leveraged positions have very small margins supporting them, even a small move against the trader can trigger a forced closure. When the price reaches a trader’s liquidation level, the exchange automatically closes the position to prevent the account from going negative, and this event is called a liquidation.

Each liquidation acts like a market order, adding immediate buying or selling pressure. For instance, of the total US$1.7 billion liquidated in a single day in September 2025, US$1.6 billion came from long positions. Hence, when large groups of traders are positioned at similar levels, their liquidations can trigger simultaneously, causing:

- Liquidation cascades, where one liquidation triggers another

- Stop hunts, where price spikes sweep out clustered orders

- Rapid directional movement is often seen as sharp wicks or sudden trend accelerations.

However, the Bitcoin liquidation heatmap visualizes where these liquidation levels cluster, helping traders anticipate potential volatility zones and understand where big moves are likely to originate.

Why Liquidation Heatmaps Matter in Bitcoin Trading

Liquidation heatmaps matter because liquidity drives price movement. Bitcoin tends to move toward areas of high liquidity where there are many stops, liquidations, or clustered orders.

These maps help traders to:

Anticipate Future Price Targets Before They Happen

Instead of guessing where the price might move next, liquidation heatmaps show where the market is already incentivized to go. For instance, if a large cluster of short liquidations sits above the current price, it creates upward pressure. Likewise, clusters below price create downward magnet zones.

Understand Market Psychology and Trader Behavior

Liquidation heatmaps reveal where retail traders place their stops, which levels overleveraged traders are defending, where institutional players may hunt liquidity, and how market makers might engineer moves to capture trapped positions. By visualizing this behavior, heatmaps help you think more like the smart money and less like the reactive crowd.

Avoid Entering at “Danger Zones” Where Reversals Are Likely

Many losing trades happen because traders buy into resistance or short into support without realizing these areas contain massive liquidation pools. Liquidation heatmaps highlight where fakeouts are likely, where whipsaw movements occur, and where volatility spikes tend to appear, helping traders avoid low-quality setups and prevent emotional, impulsive mistakes.

You may also like

Spot Profitable Setups Earlier and With More Confidence

Some of the most successful crypto strategies depend on knowing where liquidity sits. A liquidation heatmap, however, provides early signals such as price drifting toward a large liquidity pool, compression around a cluster before a breakout, and rapid liquidation cascades that confirm direction. By reading these signals, you can position yourself before the major move instead of reacting to volatility after it happens.

How the Bitcoin Liquidation Heatmap Works

A Bitcoin liquidation heatmap is built by gathering and processing massive amounts of data from the derivatives market. These maps are designed to show where large concentrations of leveraged positions are likely to be liquidated, giving you a visual representation of market pressure and potential price targets.

Where Does Heatmap Data Come From?

Liquidation heatmap platforms collect real-time and historical data from multiple sources across the crypto ecosystem, including:

- Perpetual futures markets

These markets offer 24/7 leveraged trading, and in 2025, derivatives accounted for ~75-80% of total crypto exchange trading volume. This implies that liquidations occur constantly and must be monitored continuously. - Major derivatives exchanges (Binance, Bybit, OKX, etc.)

Each exchange has slightly different liquidation mechanisms and leverage offerings, so aggregating data creates a more accurate and complete picture. - Order book and liquidation engines

These systems track live order flow and identify when forced liquidation orders are triggered. - Open interest monitoring systems

Open interest helps determine how many positions remain open at different price levels and how much leverage is likely involved. As of October 2025, the Bitcoin futures open interest reached a record high of ~US$94.12 billion, indicating substantial amounts of leverage at risk of liquidation.

Using this data, advanced algorithms calculate liquidation prices, sizes, leverage ratios, and historical liquidation events. This information is then processed and displayed visually on the heatmap, allowing you to see the “hot zones” of potential volatility.

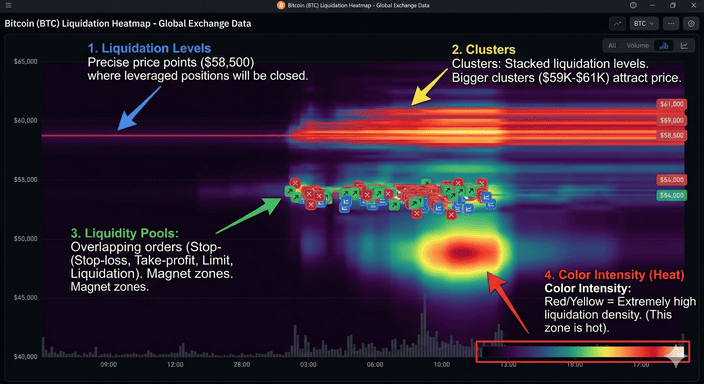

Key Components: Levels, Zones & Liquidity Pools

A liquidation heatmap includes several elements that work together to show where the most important activity is concentrated:

Liquidation Levels:

These are the precise price points where leveraged positions will be closed by the exchange. They act like invisible pressure points in the market.

Clusters:

Clusters form when multiple liquidation levels stack together. The bigger the cluster, the more likely the price is to be drawn to that area, since a large number of traders would be liquidated at once.

Liquidity Pools:

These are areas where different types of orders overlap:

- Stop-loss orders

- Take-profit orders

- Liquidation levels

- Resting limit orders

Liquidity pools often become magnet zones, attracting price movement.

Color Intensity (Heat):

The heatmap uses color gradients to represent the density of liquidation activity. While color schemes vary, the general idea is:

- Red/Yellow: Extremely high liquidation density

- Green/Blue: Medium density

- Black/Purple: Little to no liquidation activity

The brighter and hotter the color, the stronger the attraction for price movement.

How to Read a Bitcoin Liquidation Heatmap for Profitable Trading

Reading a Bitcoin liquidation heatmap effectively is one of the fastest ways to identify high-probability trading setups. Below is a straightforward, step-by-step approach to understanding what the heatmap is really showing you.

Step-by-Step Guide to Reading BTC Heatmaps

Identify the brightest zones:

These represent the largest concentration of liquidation levels and are often the first areas that price will target.

Look for clusters above and below the current price:

Clusters above the price point to vulnerable short positions, while clusters below highlight where overleveraged longs may be liquidated. This immediately reveals directional bias.

Compare the current price to major liquidation pools:

If price is drifting toward a large liquidity pool, it suggests a potential “magnet effect” where the market is drawn to that level.

Check how the price reacted to these zones in the past:

Historical reactions help confirm whether a particular cluster tends to act as support, resistance, or a sweep area.

Analyze multiple timeframes:

Larger timeframe clusters like 4H, 12H, and the daily charts are far more significant. Shorter timeframe charts are representative of short-term liquidity and tend to be noisy.

By following these steps, traders gain a clear view of where Bitcoin is likely to move and which areas offer the best risk-to-reward opportunities.

Profitable Trading Strategies Using Bitcoin Liquidation Heatmaps

By understanding how liquidations cluster and how price interacts with these zones, traders can build high-probability strategies across multiple timeframes. Below are some of the most effective methods for using Bitcoin liquidation heatmaps to enhance profitability.

Scalping

Scalpers rely on quick, precise moves, and liquidation heatmaps offer pinpoint clarity on where those moves are likely to happen. Because the market often wicks into liquidation zones before reversing, scalpers can use this behavior to their advantage. They often:

- Buy just below liquidation pools, capturing rebounds when price sweeps liquidity.

- Sell just above liquidation clusters, capitalizing on short unwinds.

- Ride small, predictable moves that form when liquidity is repeatedly tapped.

- Look for sharp wicks into liquidation zones, a common signal of absorption or exhaustion.

These tactics work well because liquidation pools act like magnets, but price frequently rejects them sharply once the liquidity has been cleared. This creates fast, low-risk profit opportunities ideal for high-frequency trading.

Day Trading

Day traders use liquidation heatmaps to predict intraday volatility and identify the most likely turning points or breakout levels. Effective day traders typically:

- Wait for the price to approach a major liquidation cluster, where volatility is inevitable.

- Monitor exhaustion or reversal signals, such as weakening momentum or absorption.

- Trade the breakout or rejection, depending on how the price reacts to the cluster.

- Use reasonable stop losses, placing them outside of key liquidity zones to avoid being swept.

Because heatmaps highlight where traders are overleveraged or trapped, they act as a roadmap for intraday price behavior, allowing traders to anticipate explosive moves rather than react to them.

You may also like

Swing Trading

Liquidation clusters often align with important market levels and can serve as powerful markers for swing traders. Large clusters frequently overlap with:

- Historical support or resistance zones

- Psychological levels, such as round numbers

- Fibonacci retracement confluence

- Previous highs and lows or key liquidity areas

Swing traders use these clusters to plan:

- Entries at high-probability levels

- Profit targets based on likely liquidity sweeps

- Stop-loss placement outside major liquidation zones to reduce fakeout risk

Because liquidation clusters highlight where traders are trapped, they help swing traders position themselves more intelligently in anticipation of medium-term moves.

The Pro's Checklist Before Entering a Trade

Before you click "buy" or "sell" based on a heatmap cluster, run through this quick checklist:

- Persistence: Has this cluster been on the map for more than 12 hours? (Avoids "fake" liquidity).

- Confluence: Does the cluster align with a Daily/Weekly support level or a psychological "round number" (e.g., $90,000 or $100,000)?

- The "Gap" Check: Is there a "liquidity gap" (a dark area on the heatmap) between the current price and the next cluster? Price tends to move very quickly through these gaps.

Best Tools to Use for Bitcoin Liquidation Heatmaps

Platform selection is critical for the effective analysis of liquidation data and making trading decisions. Various platforms provide distinct features, ranging from the basic heatmap display to the sophisticated order flow and derivatives analysis. This section provides an overview of the leading platforms and how your heatmap can be customized.

Top Platforms Offering BTC Liquidation Heatmaps

Below are some of the most popular and most trusted trading platforms that retail as well as professional traders use.

- CoinGlass — Has one of the most intuitive heatmap displays for liquidation, coupled with historical data that provides traders with an idea of the liquidity trend.

- Hyblock Capital — For sophisticated liquidity maps, levels of liquidation, and positioning information for whales, which makes it popular with seasoned traders.

- TensorCharts — Provides real-time heatmaps integrated with order flow, Delta, and volume tools, making it useful for scalpers and day traders.

- TradingLite — Combines heatmaps with visual liquidity layers and a highly intuitive interface, ideal for tracking market maker behavior.

- Laevitas — Offers institutional-grade derivatives analytics, including volatility dashboards, options flow, and liquidation projections.

Each platform offers different strengths, so the best choice depends on your preferred trading style. Scalpers may prefer real-time platforms like TensorCharts, while swing traders may value historical insights from CoinGlass or Hyblock.

How to Set Up Your Heatmap for Maximum Clarity

A heatmap is only useful if it’s easy to read and interpret. Here are practical tips to optimize your setup:

- Use a clean color palette:

Too many colors can create visual noise. Simpler gradients make liquidation clusters easier to spot. - Avoid overly short timeframes:

Short intervals (like 1–5 minute charts) can create misleading micro-clusters. Longer timeframes reveal more reliable liquidity structures. - Adjust sensitivity settings:

Lower sensitivity highlights only the most important zones, reducing clutter and focusing your attention on meaningful clusters. - Compare multiple exchanges when possible:

Different platforms may have slightly different liquidation levels. Cross-referencing helps confirm liquidity accuracy. - Mark significant clusters manually:

Drawing levels or zones on your chart ensures you don’t lose track of key liquidation areas when the heatmap updates.

The more precise and cleaner your heatmap display, the quicker you'll be able to make informed, profitable trading decisions.

Tactical Setups for Profitable Trading

While a heatmap tells you where the "liquidity magnets" are, tactical success comes from knowing how to enter and exit.Here are three high-probability setups used by professional crypto traders:

The Liquidity Sweep Reversal (Scalping/Day Trading)

This is the most common tactical use of a heatmap. Traders look for a sharp price move that "clears" a bright cluster and immediately shows signs of exhaustion.

- The Setup: Identify a high-density yellow/red cluster just above or below a consolidation range.

- The Action: Wait for the price to wick into the cluster.

- The Confirmation: Look for a Relative Strength Index (RSI) divergence. If price hits the liquidation zone but RSI fails to make a new high/low, the "fuel" (liquidations) has been spent.

- Trade: Enter in the opposite direction of the wick, targeting the VWAP (Volume Weighted Average Price)as your first take-profit.

The Short Squeeze Accelerator (Momentum Trading)

Liquidations don't always cause reversals; they often act as "nitrous oxide" for a trend.

- The Setup: Bitcoin is in a clear uptrend (Price > 200-period EMA). A massive cluster of short liquidations sits just above a psychological resistance level (e.g., $95,000).

- The Action: Enter a "Breakout Trade" when the price touches the edge of the cluster.

- The Logic: As shorts are liquidated, they are forced to buy to close their positions. This creates a "cascade" that pushes the price through the resistance much faster than normal buying would.

- Trade: Long on the breakout, with a stop-loss moved to "break-even" as soon as the cluster is 50% consumed.

The "Safety Zone" Stop-Loss Placement

One of the best tactical uses of a heatmap isn't for entries, but for risk management.

- Tactical Rule: Never place your stop-loss inside or just before a bright liquidation cluster.

- Why? Market makers and "Whale" algorithms hunt these zones to fill their own orders. If your stop-loss is sitting at $89,950 and there is a massive liquidation pool at $90,000, you are almost guaranteed to be "hunted."

- The Action: Place your stop-loss on the "Dark Side" of the pool—the area on the heatmap with no color/low activity. If the price moves through the entire cluster and hits your stop in the "cold" zone, the trend has truly shifted and your trade thesis is invalidated.

Comparison: Intent vs. Vulnerability

To truly master these tactics, your readers must distinguish between the two types of market data:

| Feature | Order Book (Level 2) | Liquidation Heatmap |

| Data Type | Limit Orders (Intent) | Forced Orders (Vulnerability) |

| Reliability | Low (Orders can be "spoofed" or canceled) | High (Forced by the exchange) |

| Psychology | Shows where traders want to buy/sell | Shows where traders must exit |

| Visual Signal | Buy/Sell Walls | Liquidity Pools / Heat Zones |

The Magnet Effect: Why Price Seeks Liquidity

While basic heatmaps show where liquidations are, it is crucial to understand why price often aggressively seeks these levels. In a decentralized market, large institutional players and market makers require "exit liquidity" to fill their massive orders without causing significant slippage.

High-density liquidation clusters represent a concentration of "forced" market orders. For a large buyer, a cluster of short liquidations is the perfect opportunity to fill a long position because those liquidated shorts become "buy" orders, providing the necessary liquidity to absorb a massive entry. This is often why we see price "sweep" a zone before reversing—the big players have successfully filled their bags.

Advanced Confluence: Combining Heatmaps with the Cumulative Volume Delta (CVD)

To increase the accuracy of heatmap signals, professional traders often overlay the Cumulative Volume Delta (CVD). While the heatmap shows potential liquidation zones, the CVD shows actual aggressive buying or selling.

- Bullish Divergence: If the price is approaching a large "long" liquidation cluster (a hot zone below the price) but the CVD starts to trend upward, it suggests that "limit buyers" are absorbing the selling pressure. This often marks a high-probability "bottom" where the heatmap cluster acts as a floor rather than a trap.

- The Trap Signal: If price hits a "hot" short liquidation zone and the CVD spikes but price fails to move higher, it indicates "aggressive absorption." This is a classic sign that whales are using the liquidation event to sell their positions to retail traders.

The Math Behind the Map: Why 2026 Leverage is Different

As we move through 2026, the complexity of liquidation data has evolved. Unlike the 100x "casino leverage" of previous years, the current market is dominated by 3x to 10x institutional leverage.

- The 25% Rule: For a trader using 4x leverage, a 25% move against them triggers liquidation.

- Volatility Weighting: Heatmaps now factor in "Volatility-Adjusted Leverage." In high-volatility environments, exchanges often increase maintenance margin requirements, meaning clusters can "ignite" earlier than expected.

Conclusion

The use of bitcoin liquidation heatmaps provides significant benefit for navigating the volatile and leverage-driven crypto markets. This process makes it clear where high volumes of liquidation levels and liquidity pools are, and as such, it uncovers the unseen forces that influence the markets. Rather than responding to the unpredictable nature of the markets, traders can prepare for the targets and make decisions based on their understanding of where liquidity is building. Though the heatmap for liquidation is not an independent trading model, it is highly effective if used with proper risk management, trend analysis, order flow, VWAP, and market structure analysis.

FAQ

A liquidation heatmap highlights where large groups of leveraged traders are likely to be liquidated, revealing the price levels that act as “magnets” for future movement. By visualizing these liquidity pockets, traders can anticipate volatility, identify high-probability targets.

Absolutely. Liquidation clusters form in every market condition because traders continue to use leverage regardless of direction. In bull markets, short squeezes become more common; in bear markets, long squeezes dominate.

Heatmaps enhance technical analysis but do not replace it. They show where price is likely to move, but not when it will move or why. Combining heatmaps with indicators like RSI, VWAP, market structure, and order flow leads to a more complete and profitable trading strategy.

During high-momentum or news-driven events, the price may slice through multiple clusters quickly, triggering cascades. Heatmaps show vulnerability zones, but do not guarantee reactions at every level.

While they look similar, they track different things. An Order Book Heatmap shows "intent" – it visualizes limit orders (buy and sell walls) that traders have manually placed. These orders can be canceled at any time. A Liquidation Heatmap shows "vulnerability"—it visualizes the price points where traders must exit because their collateral is exhausted. Liquidation levels are often more reliable "magnets" because, unlike limit orders, they cannot be pulled or canceled once the price hits the trigger.

Most professional platforms update in near real-time (every 30 seconds to 1 minute). For strategy: Scalpers should use the 1h or 4h maps to catch local "wicks." Swing Traders should focus on the weekly or monthly views. A common mistake is focusing on a 5-minute cluster that lacks enough volume to actually move the market. Always look for "persistent" clusters that remain on the map for several hours.

Yes and no. Bitcoin is the "General" of the market; when a massive BTC liquidation cluster is hit, the resulting volatility usually drags the entire Altcoin market with it. However, high-cap alts like Ethereum (ETH) or Solana (SOL) have their own specific liquidation heatmaps. It is often profitable to look for "divergence" – for example, if BTC has cleared its liquidations but ETH still has a massive "hot zone" above it, ETH may have more "fuel" for a solo rally.

This is known as "Front-running the Liquidity." Savvy whales and high-frequency trading bots know exactly where those liquidation clusters are. If they see a massive cluster at $95,000, they may start buying at $94,800 to catch the move, or selling at $95,200 to exit. This can cause the price to bounce or reject just shy of the "brightest" spot on your map.

Обновлено:

9 февраля 2026 г.