Voltar

Contents

Grid Trading: O que é e como funciona

Iva Kalatozishvili

Business Development Manager

Demetris Makrides

Senior Business Development Manager

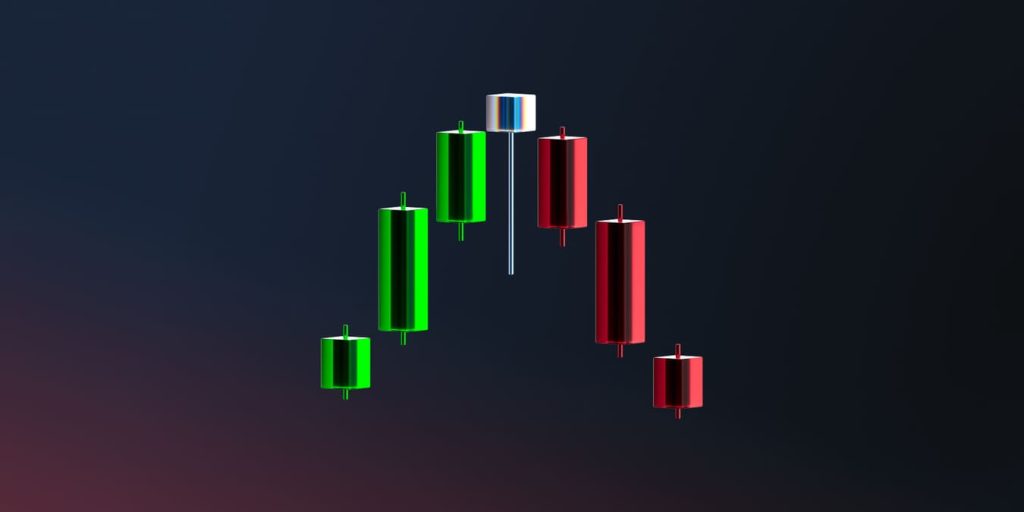

A negociação em grade é uma estratégia de negociação sistemática e amplamente utilizada. Ela oferece a opção de capitalizar a volatilidade do mercado sem precisar prever a direção dos preços. Este método envolve a emissão de uma série de ordens de compra e venda em níveis predefinidos. Isso forma uma "grade" que garante lucros com as flutuações de preços.

A negociação em grade é um sucesso nos mercados de forex, criptomoedas e ações devido ao seu método organizado.

O que é Grid Trading?

A negociação em grade é uma estratégia de negociação automatizada. Ela simplesmente emite múltiplas ordens de compra e venda em intervalos de preço específicos. Quando o preço se move dentro de uma faixa definida, você gera lucro. Outros métodos de negociação exigem pontos de entrada e saída precisos. No entanto, a negociação em grade depende exclusivamente das flutuações do mercado.

Conceitos-chave da negociação em grade

Compreender os fundamentos da negociação de rede é essencial para uma implementação bem-sucedida. Os principais componentes incluem:

- Níveis de grade - Níveis de preços predeterminados onde ordens de compra e venda são colocadas.

- Faixa de preço - Os limites superior e inferior dentro dos quais a grade é estruturada.

- Espaçamento da grade (intervalos) - A distância entre cada ordem de compra e venda.

- Tamanho do pedido - A quantidade de ativos comprados ou vendidos em cada nível.

- Automação - O uso de bots de negociação para gerenciar ordens de forma eficiente.

- Meta de lucro - Garantir que cada negociação concluída garanta um lucro pequeno, mas consistente.

- Gestão de Riscos - Você pode usar stop-loss e alocação de capital.

Como funciona o Grid Trading?

A negociação em grade segue um princípio simples. Ordens de compra são colocadas abaixo do preço de mercado atual. Já as ordens de venda são colocadas acima dele. Assim que uma ordem de compra é acionada, o sistema automaticamente coloca uma ordem de venda a um preço mais alto.

Etapas para configurar a negociação em grade

Para implementar a negociação em rede de forma eficaz, siga estas etapas:

- Selecione um par de negociação - Escolha um ativo com liquidez e volatilidade suficientes.

- Determinar um preço base - Identificar um preço de referência em torno do qual a rede será estruturada.

- Defina a faixa de preço - Defina os limites superior e inferior da grade.

- Escolha o espaçamento da grade - Decida a distância entre cada ordem de compra e venda.

- Definir quantidade do pedido - Determine quanto investir por operação.

- Habilitar automação - Use um bot de negociação ou execução manual para gerenciar ordens.

- Monitorar o desempenho - Ajuste regularmente as configurações com base nas condições de mercado.

Uma vez configurado, o sistema executa negociações continuamente. Você lucra com as flutuações do mercado.

Tipos de estratégias de negociação de grade

A negociação em grade pode ser adaptada a diferentes condições de mercado. As duas estratégias principais incluem:

Negociação em grade com a tendência

Esta estratégia se alinha à tendência predominante do mercado. É a opção perfeita para movimentos de alta ou baixa.

- Identifique a tendência - Você pode usar indicadores técnicos para confirmar a direção do mercado.

- Definir ordens na direção da tendência - Coloque ordens de compra em uma tendência de alta e ordens de venda em uma tendência de baixa.

- Ajuste os níveis da grade dinamicamente - Modifique o espaçamento com base nas condições de mercado.

- Use ordens de stop-loss - Evite perdas excessivas se a tendência se reverter.

- Implementar a Gestão de Riscos - Defina pontos de saída para garantir lucros e reduzir a exposição.

Negociação em grade contra a tendência

Essa abordagem lucra com reversões de preços, o que a torna adequada para mercados variáveis.

- Identificar uma Zona de Consolidação - Procure áreas onde o preço se move lateralmente.

- Coloque ordens em níveis de resistência e suporte - Compre no suporte e venda na resistência.

- Otimizar o espaçamento da grade - Ajuste com base nas flutuações históricas de preços.

- Monitore as rupturas do mercado - Esteja preparado para sair caso surja uma tendência forte.

- Diversifique os pares de negociação - Você pode reduzir riscos negociando vários ativos com configurações semelhantes.

Cada estratégia tem seu próprio perfil de risco-recompensa. Portanto, você deve escolher com base nas condições de mercado e na tolerância ao risco.

Técnicas avançadas de negociação em grade

Para traders que buscam maximizar retornos, técnicas avançadas podem aumentar ainda mais a eficácia da negociação em grade.

Cobertura com negociação em grade

A cobertura envolve o uso de múltiplas estratégias de grade para reduzir a exposição geral ao risco.

- Estratégia de Rede Dupla - Execute grades longas e curtas simultaneamente.

- Combinação de grade e tendência - Combine negociação de grade com estratégias de acompanhamento de tendências.

- Usando opções para proteção - Utilize opções para se proteger contra movimentos extremos de preços.

- Ajustando grades para eventos de mercado - Modifique o espaçamento antes dos principais anúncios econômicos.

- Dimensionamento de posição ajustado ao risco - Modifique os tamanhos dos pedidos com base nos níveis de volatilidade.

Escalonamento de negociação em grade para diferentes mercados

A negociação em grade é altamente versátil e pode ser adaptada a diversas classes de ativos.

- Forex - Funciona bem devido às frequentes oscilações de preços.

- Criptomoeda - Ideal para ativos de alta volatilidade, como Bitcoin e Ethereum.

- Ações - Pode ser aplicado a ações com limite de intervalo.

- Commodities - Eficaz em mercados com movimentos cíclicos de preços.

- Índices - Adequado para flutuações de preços estáveis nos principais índices.

Aplicações do mundo real da negociação em grade

Estudo de caso: Negociação em grade no mercado de criptomoedas

Considere um trader usando uma estratégia de negociação de grade em Bitcoin:

- Ativo - Bitcoin (BTC)

- Preço base - $ 50.000

- Faixa de preço - $ 48.000 a $ 52.000

- Espaçamento da grade - $ 500

- Pedidos

- Ordens de compra - $ 49.500, $ 49.000, $ 48.500.

- Ordens de venda - $ 50.500, $ 51.000, $ 51.500

Você obterá lucro com cada movimento de preço, já que o preço flutua. Com o tempo, você pode ajustar os níveis da sua grade para corresponder às condições de mercado em evolução.

Incorporando Inteligência Artificial na Negociação em Grade

A IA está revolucionando as estratégias de investimento ao processar grandes volumes de dados financeiros em tempo real. Mais de 90% dos gestores de investimentos já começaram a integrar a IA em seus processos (54% já a utilizam). A IA não é mais um conceito futurista, mas uma ferramenta essencial nas negociações modernas.

Além da automação, a IA utiliza aprendizado de máquina para se adaptar às mudanças nas condições de mercado. Isso ajuda a aprimorar a execução de negociações e a gestão de riscos. Ferramentas baseadas em IA estão aprimorando a capacidade de tomada de decisão dos traders. Investidores de varejo agora têm acesso à IA por meio de robôs-consultores e também de ETFs gerenciados por IA. No entanto, os investidores institucionais ainda mantêm uma vantagem significativa devido ao acesso superior aos dados.

Embora a IA possa otimizar estratégias de investimento, ela não é infalível. Os traders devem combinar insights de IA com a gestão de risco tradicional e a inteligência humana. Além disso, o aumento de golpes impulsionados por IA significa que os investidores devem verificar a legitimidade das plataformas com tecnologia de IA antes de investir.

Bots de negociação em grade: escolhendo as ferramentas de automação certas

A automação desempenha um papel fundamental no sucesso da negociação em grade, com bots de negociação lidando com tarefas repetitivas e reduzindo a tomada de decisões emocionais. No entanto, escolher o bot certo é essencial para maximizar os retornos. Alguns recursos importantes a serem observados incluem:

- Parâmetros de grade personalizáveis permitem ajustes de espaçamento, faixa de preço e tamanho do pedido.

- As Ferramentas de Gerenciamento de Risco oferecem a opção de configurações de stop-loss, trailing stop e alocação de capital.

- Os recursos de backtesting podem ajudar você a otimizar estratégias usando dados históricos.

- E alguns bots avançados ajustam os níveis da grade dinamicamente.

Seja usando um bot de troca integrado ou uma plataforma de terceiros, selecionar um bot confiável e seguro pode melhorar significativamente sua eficiência de negociação na grade.

Vantagens da negociação em grade

A negociação em grade oferece vários benefícios que a tornam uma estratégia preferida entre os traders.

Por que os comerciantes escolhem a negociação em grade

- Automação - Bots de negociação gerenciam as negociações. Isso reduz a tomada de decisões emocionais.

- Lucro com a volatilidade - Funciona bem tanto em mercados de tendência quanto em mercados de variação.

- Não há necessidade de previsões de mercado - Concentra-se nos movimentos de preços e não na direção.

- Adaptabilidade - Adequado para diversas classes de ativos, incluindo forex, criptomoedas e ações.

- Oportunidades de lucro consistentes - Gera retornos a partir de pequenas flutuações de preços.

- Gestão de Riscos Flexível - Ajuste o tamanho da grade e o dimensionamento da posição para corresponder às condições do mercado.

- Escalabilidade - Pode ser aplicado em portfólios pequenos e grandes com modificações mínimas.

- Diversificação - Os traders podem aplicar a negociação em grade em vários ativos para distribuir o risco.

Essas vantagens fazem da negociação em grade uma estratégia confiável para traders que buscam ganhos estáveis.

O papel das plataformas de negociação eletrônica na negociação em grade moderna

A ascensão das plataformas de negociação eletrônica remodelou a forma como as estratégias de negociação são executadas. Bolsas como a London Metal Exchange estão pressionando por mais negociações eletrônicas. Melhorar a transparência de preços e a disponibilidade de dados são fatores-chave para uma negociação eficaz em rede.

Com acesso a dados em tempo real e execução automatizada de ordens, agora você pode refinar suas estratégias de grade. À medida que a negociação eletrônica continua a dominar, aproveitar esses avanços será crucial para se manter competitivo na negociação baseada em grade.

Aproveitando ferramentas de visualização do livro de ordens na negociação em grade

Ferramentas de visualização do livro de ordens estão transformando a forma como os traders analisam a liquidez do mercado e os fluxos de ordens. Essas plataformas fornecem mapas de calor em tempo real. Isso ajuda os traders a identificar níveis de preços significativos e mudanças no sentimento do mercado. Ao integrar essas ferramentas às estratégias de negociação em grade, você pode identificar os níveis e espaçamentos ideais da grade. Refinando sua abordagem para obter melhores resultados.

Além do simples acompanhamento do livro de ordens, essas ferramentas oferecem recursos avançados, como pontos de volume e indicadores personalizáveis. Ao implementá-los, fica mais fácil identificar bolsões ocultos de liquidez e mudanças repentinas no mercado. Com essas informações aprimoradas sobre o mercado, você pode executar negociações com mais precisão e ajustar suas grades dinamicamente. Assim, você pode ter certeza de que está capitalizando cada movimento do mercado.

Riscos e desafios da negociação em rede

A negociação em grade traz vários benefícios.

Armadilhas comuns a serem observadas

- Tendências de Mercado - Um forte movimento de preços fora da faixa da rede pode levar a perdas significativas.

- Altos custos de transação - Negociações frequentes aumentam as taxas, reduzindo a lucratividade geral.

- Gestão Complexa - Requer monitoramento de várias posições abertas simultaneamente.

- Risco de liquidação - Em negociações alavancadas, oscilações excessivas de preços podem acionar chamadas de margem.

- Superexposição - Muitas negociações abertas podem aumentar o risco de mercado se não forem gerenciadas adequadamente.

- Deslizamentos e atrasos na execução - As ordens podem ser executadas a preços desfavoráveis durante alta volatilidade.

- Estresse psicológico - Mesmo com a automação, os traders precisam fazer ajustes sob pressão.

Conclusão

A negociação em grade sempre foi uma estratégia poderosa. Ela aproveita a volatilidade do mercado para gerar lucros consistentes. Assim, você pode otimizar seus resultados entendendo sua mecânica e selecionando a abordagem correta. A negociação em grade possui uma excelente capacidade de abordagem estruturada.

FAQ

A negociação em grade é uma estratégia de negociação popular. Basicamente, envolve a colocação de ordens de compra e venda em níveis de preço predefinidos. Isso cria uma "grade" de negociações. Garante lucros com as flutuações do mercado sem a necessidade de previsões precisas de preços.

Sim, a negociação em grade pode ser usada por iniciantes. Funciona bem, especialmente se combinada com bots de negociação. No entanto, novos traders devem começar com um capital pequeno e entender a gestão de riscos antes de escalar.

A negociação em grade é comumente usada em forex, criptomoedas e ações. Mas muitos traders também a implementam para commodities e índices. Funciona melhor em mercados voláteis ou variáveis, onde as flutuações de preços ocorrem com frequência.

O espaçamento da grade depende da volatilidade do ativo e do estilo de negociação. Uma grade mais estreita captura negociações mais frequentes, enquanto uma grade mais ampla reduz os custos de transação e a exposição ao risco.

Sim, muitas plataformas de negociação e bots oferecem automação para negociação em grade. A automação ajuda a gerenciar múltiplas ordens com eficiência e elimina a necessidade de decisões emocionais.

Os riscos incluem fortes tendências de mercado que rompem a estrutura da grade, altos custos de transação e riscos de liquidação em negociações alavancadas. A superexposição devido ao excesso de negociações abertas também é um risco que você deve considerar.

A negociação em grade pode ser lucrativa se gerenciada corretamente. No entanto, seu sucesso depende das condições de mercado, da gestão de risco adequada e de ajustes regulares na estratégia.

A negociação de grade a favor da tendência acompanha o momentum do mercado. Assim, você coloca ordens de compra em tendências de alta e ordens de venda em tendências de baixa. A negociação de grade contra a tendência lucra com reversões de preços em mercados variáveis.

Não, a negociação na rede pode ser iniciada com um pequeno investimento. Mas ter capital suficiente ajuda a manter as negociações durante as flutuações do mercado e a evitar riscos de liquidação.

Atualizado:

3 de fevereiro de 2025