CPA vs RevShare: Какая модель брокерского партнёрства подходит вам?

В статье

Индустрия партнерского маркетинга в настоящее время оценивается примерно в $17 миллиардов и ожидается, что она достигнет $27.78 миллиардов к 2027 году. Для современных брокерских компаний партнерская программа стала основной стратегией привлечения клиентов, составляя до 30% новых регистраций (или даже больше). Это часто достигается при более низкой стоимости привлечения клиентов (CAC) по сравнению с платной рекламой или кампаниями в социальных сетях. Тем не менее, успех зависит не только от наличия программы, но и от выбора правильной модели вознаграждения партнеров.

Этот гид проводит вас через CPA против RevShare (и гибридные комбинации), объясняет, что они на самом деле означают для вашего брокерского бизнеса, и показывает, как структурировать партнерские стимулы для прибыльного и устойчивого роста.

Что такое модели аффилированного брокерства?

Партнёрские модели относятся к тому, как партнёры, такие как блоги, создатели контента, вводящие брокеры и влиятельные лица, получают вознаграждение за привлечение новых трейдеров к брокерской компании. Наиболее распространённые модели:

- CPA (Стоимость за приобретение)

- RevShare (Доля дохода)

- и Гибрид (CPA + RevShare)

Каждая модель изменяет стимулы для партнеров и профили рисков, что, в свою очередь, влияет на качество привлеченных трейдеров, их пожизненную ценность (LTV) и долгосрочную прибыльность.

Что такое CPA в программах брокерского партнерства?

CPA (стоимость за приобретение) является одной из самых распространенных моделей, по которой партнеры получают фиксированную, авансовую выплату, когда направленный трейдер завершает заранее определенное действие. Такое действие обычно включает одобрение KYC в сочетании с первым депозитом, или в некоторых случаях, квалификационную начальную сделку или минимальный объем торговли.

Тем не менее, CPA предназначен для ответа на вопрос “Сколько стоит брокеру привлечь финансируемого трейдера?” Таким образом, он предоставляет брокерам прямую, измеримую связь между расходами на маркетинг и привлечением пользователей, связывая выплаты с четко определенными этапами.

Как работает CPA?

Предположим, вы управляете партнёрской программой для вашего брокера, запущенной на платформе для торговли под собственным брендом, и вы предлагаете партнёрам структуру комиссий на основе CPA.

При такой настройке предположим, что партнер зарабатывает 500 долларов за каждого нового депозитора (FTD), которого он привлекает. Но для тех, кто постоянно отправляет более высокие объемы квалифицированных трейдеров, они могут зарабатывать до 600 долларов за FTD в течение месяца. Следовательно, выплата CPA может быть поэтапной.

На третьем месяце программы аффилиат рекомендует 15 потенциальных трейдеров, с записями ниже:

- 13 завершенных регистраций

- 3 идентифицирован как существующий пользователь

- 2 сделать депозиты ниже требуемого минимума

Это оставляет 8 квалифицированных FTD за месяц. Однако, поскольку партнер попадает в категорию CPA $500, общая выплата за этот месяц составит:

8 квалифицированных трейдеров × $500 = $4,000.

Преимущества CPA

1. Идеально для брокерских компаний на ранних стадиях: Для новых брокерских компаний CPA предлагает простой способ обеспечить ликвидность и активность пользователей без сложных долгосрочных комиссионных структур. Это помогает быстро проверить рынки и каналы.

2. Полезно, когда маржи остаются узкими: Когда маржи узкие или операционные расходы высоки, бизнес-модель CPA позволяет брокерам ограничивать затраты на приобретение. Это предотвращает их зависимость от долгосрочных потоков доходов, которые могут негативно сказаться на марже.

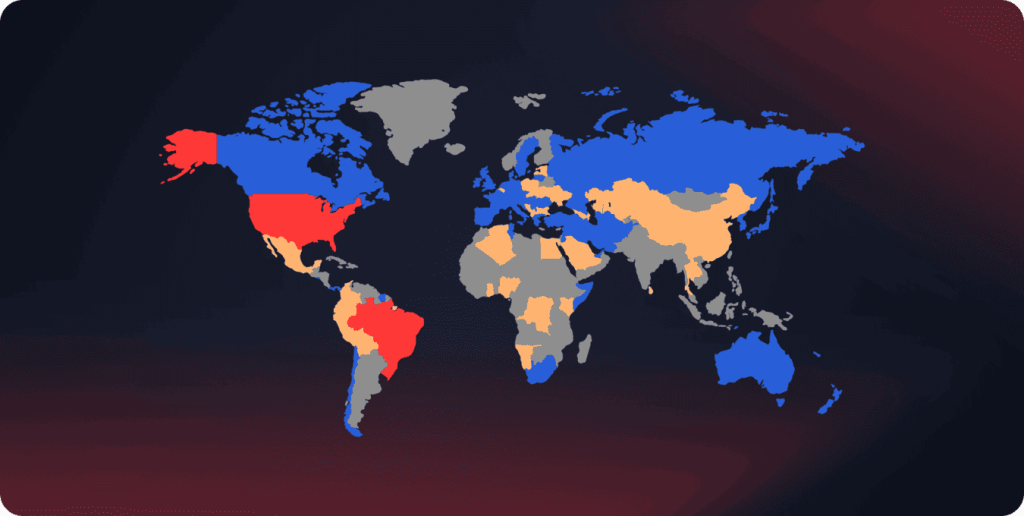

3. Хорошо подходит для быстрого расширения рынка: Модель CPA больше подходит для выхода на новые географические или конкурентные рынки, где приоритетом является быстрое приобретение рынка, а не оптимизация пожизненной ценности клиента.

4. Оптимизация для аффилиатов: Некоторые аффилиаты считают, что CPA предпочтительнее из-за его быстрых и гарантированных условий оплаты, что позволяет аффилиатам легко увеличивать свой трафик.

Вам также может понравиться

Ограничения и риски CPA

1. Ограниченный стимул для качества долгосрочных трейдеров: Поскольку партнёры получают оплату только один раз, нет прямого стимула нацеливаться на качественных трейдеров, которые останутся надолго. Это особенно актуально в отсутствие других регулирующих механизмов.

2. Объем может влиять на стоимость: Партнеры могут больше беспокоиться о количестве конверсий, чем о качестве пользователя, если выплаты CPA не связаны с строгими требованиями к квалификации, такими как минимальный депозит или требования к торговле.

3. Потенциальное злоупотребление трафиком, если не управлять: Если не контролировать, кампании CPA могут привлекать пользователей с низким намерением или способствовать нежелательному поведению, что может сделать необходимыми проверку и защиту от мошенничества.

Что такое RevShare в брокерских партнерских программах?

RevShare (Доля дохода) - это модель аффилированного маркетинга, основанная на результатах, в которой партнеры зарабатывают процент от чистого дохода, генерируемого трейдерами, которых они привлекают, при условии, что эти трейдеры остаются активными на платформе.

Вместо единовременной выплаты, связанной с приобретением, RevShare связывает доходы партнеров непосредственно с торговой активностью, объемом и долговечностью. Это делает его принципиально отличным от CPA, так как он предназначен для оптимизации стоимости жизни трейдера (LTV), а не краткосрочных конверсий.

Поэтому он предназначен для ответа на вопрос “Какой долгосрочный доход может генерировать каждый рекомендованный трейдер.”

Как работает RevShare?

Предположим, что ваше биржевое агентство работает на торговой платформе с белой маркой и управляет партнерской программой с комиссионной ставкой RevShare в 25% от чистого дохода, полученного от каждого трейдера, направленного в агентство партнером. Это могут быть комиссии за спред или другие применимые сборы.

Если аффилиат привел 5 новых трейдеров в течение месяца, и все они завершили регистрацию и пополнили свои счета. В течение следующих 30 дней были зафиксированы следующие статистические данные:

- 2 трейдера активно торгуют и генерируют $800 чистой прибыли

- 2 трейдера торгуют время от времени и генерируют $400 чистой прибыли

- 1 трейдер остается неактивным и генерирует $0

Это приводит к $1,200 чистой брокерской выручки за месяц. При 25% RevShare партнер зарабатывает $1,200 × 25% = $300 за этот месяц.

Если эти трейдеры остаются активными, партнер продолжает зарабатывать RevShare месяц за месяцем, не needing отправлять дополнительные лиды.

Таким образом, выплаты по партнерским программам напрямую связаны с реальной торговой активностью и фактической выручкой, обеспечивая, чтобы затраты на привлечение клиентов увеличивались в соответствии с производительностью, а не только с объемом. Однако проценты RevShare различаются в зависимости от программы и типа партнера.

Преимущества RevShare

1. Содействует привлечению более качественного трафика: Партнёры получают вознаграждение за долговечность трейдеров, а не только за регистрации. Это обычно приводит к снижению оттока и более высокому качеству трейдеров в целом.

2. Идеально для зрелых брокерских компаний: По мере того как брокерские компании растут и получают ясность в вопросах маржи и LTV, RevShare становится мощным инструментом для устойчивого роста, выравнивая затраты на привлечение клиентов прямо с генерацией дохода.

3. Укрепляет партнерства между аффилиатами и брокерами: RevShare превращает аффилиатов в долгосрочных партнеров, а не просто источники трафика. Многие аффилиаты инвестируют больше в образование, контент и создание сообщества, чтобы помочь трейдерам добиваться успеха, поскольку их доходы зависят от этого.

4. Естественное масштабирование с объемом торговли: По мере увеличения рыночной активности или повышения уровня трейдеров, RevShare органически масштабируется без необходимости пересмотра затрат на приобретение.

Ограничения RevShare

1. Менее предсказуемые выплаты: Поскольку доходы зависят от поведения трейдеров и рыночных условий, затраты на RevShare могут колебаться от месяца к месяцу. Это делает прогнозирование более сложным по сравнению с CPA.

2. Задержка в реализации доходов: В отличие от CPA, RevShare не приносит немедленных результатов. Требуется время, чтобы рекомендованные трейдеры начали торговать последовательно и генерировать значительный доход.

3. Операционная сложность: Точные программы RevShare требуют прозрачных расчетов чистой выручки, надежного отслеживания активности трейдеров и автоматизированных, подлежащих аудиту систем расчета. Однако, поскольку RevShare ориентирован на удержание, вознаграждая партнеров за глубину, а не за ширину, его быстро становится трудно управлять в больших масштабах.

CPA против RevShare: Что должны учитывать брокеры

Таблица ниже сравнивает модели CPA и RevShare для руководства по принятию решений в брокерских компаниях относительно выбора модели:

| Фактор | CPA | Revshare |

| Предсказуемость затрат | Высокая | Переменная |

| Время выплаты | Немедленно | Постоянно |

| Тип стимула | Приобретение | Удержание |

| Качество трейдеров | Ориентированное на объем | Ориентированное на ценность |

| Лучшее соответствие | Запуск и расширение | Масштаб и долгосрочный рост |

Являются ли гибридные партнерские модели лучшим вариантом?

На практике многие успешные партнерские программы брокеров не полагаются исключительно на CPA или RevShare, а используют оба метода. Гибридные структуры созданы для того, чтобы сбалансировать краткосрочные стимулы по привлечению с долгосрочной ценностью трейдеров, что делает их особенно эффективными на конкурентных рынках или при масштабировании новых платформ.

Как работает гибридная модель?

Типичная гибридная комиссия может выглядеть следующим образом:

| Компонент | Структура | Описание |

| CPA | $100 за первого депозитора (FTD) | Выплачивается сразу после того, как трейдер завершает KYC и пополняет счет |

| RevShare | 20% от чистого дохода | Выплачивается ежемесячно в течение 12 месяцев на основе фактической торговой активности |

Предположим, что один из партнеров привел 5 новых трейдеров в вашу брокерскую компанию в течение данного месяца, и все они завершили регистрацию и сделали квалификационные депозиты. На основании структуры в таблице выше, у нас есть:

Выплата CPA:

- $100 × 5 FTDs = $500 авансом

Выплата RevShare:

- В течение следующих 12 месяцев трейдеры генерируют $3,000 чистой прибыли

- Партнёр зарабатывает 20% × $3,000 = $600 остаточный

Общие доходы от партнерской программы составят $500 (CPA) + $600 (RevShare) = $1,100.

Для брокера эта структура обеспечивает:

- Немедленные расходы ограничены $500

- Долгосрочные выплаты связаны с фактической торговой активностью, что связывает затраты с доходами

- Стимулы побуждают партнеров направлять трейдеров, которые будут активно торговать и оставаться вовлеченными

Почему гибридные модели работают

Гибридная модель работает по следующим причинам:

1. Платежи на фронте для быстрого роста трафика: Партнеров стимулирует система выплат на фронте. Это даст им возможность вернуть свои маркетинговые расходы, а не ждать месяцы до первой выплаты. Это дает брокеру быстрый старт на рынке.

2. Остаточные доходы в долгосрочной перспективе: Награда RevShare побуждает аффилиата привлекать качественные лиды и поддерживать активность трейдеров. Это приведет к лучшим показателям удержания и снижению оттока, что в конечном итоге увеличит долгосрочную ценность брокера (LTV).

3. Сбалансированный риск для брокеров и партнеров: Гибридные бизнес-модели позволяют брокерам удерживать первоначальные затраты на привлечение низкими и при этом стимулировать своих партнеров сосредоточиться на создании лояльной клиентской базы на долгий срок. В то же время партнер зарабатывает диверсифицированный доход с сочетанием гарантированных краткосрочных выплат и потенциальных выплат, зависящих от результатов.

4. Гибкость для динамической настройки стимулов: Гибридная модель может быть динамически настроена в зависимости от рыночной производительности и других факторов. Например, брокер может предложить более высокую ставку CPA для более конкурентных рынков и более высокий RevShare для ценных трейдеров.

Вам также может понравиться

Как выбрать между CPA, RevShare или гибридом

Выбор модели партнерства выходит за рамки личных предпочтений, поскольку он влияет на уровень трейдеров, затраты на привлечение и общую прибыльность. Таким образом, чтобы выбрать модель партнерства, вам необходимо:

Учитывайте стадию вашего роста

- Брокерские компании на ранней стадии: Для брокерских компаний на ранней стадии CPA часто является лучшим выбором, когда важны скорость и предсказуемость. Это позволяет вам быстро наращивать объем торгов, тестировать маркетинговые каналы и привлекать партнеров без долгосрочных обязательств по оплате.

- Зрелые брокерские компании: Как только ваша брокерская компания установит маржи и объем торговли, RevShare становится более мощным. Он согласует интересы аффилиатов с удержанием трейдеров и их пожизненной ценностью, обеспечивая масштабирование стоимости привлечения с доходом.

Оценка ограничений денежного потока

- CPA требует предварительных вложений: Выплаты производятся немедленно после того, как трейдер выполнит квалификационные условия. Это может создать нагрузку на денежный поток, если объемы велики, но это обеспечивает предсказуемые затраты на привлечение клиентов.

- Отсрочка выплат Revshare: RevShare - это план отсрочки, при котором брокер выплачивает средства только тогда, когда трейдеры генерируют доход. Это отличный план при наличии финансовых ограничений, но он требует надежных процессов мониторинга для обеспечения гарантированных выплат.

- Гибридные модели: Небольшой CPA для финансирования партнерской активности плюс постоянный RevShare для стимулирования удержания, балансируя краткосрочный денежный поток с долгосрочной прибыльностью.

Оценка качества трафика

- Низкокачественный или стимулируемый трафик: CPA может быстро исчерпать ваш бюджет, если источники трафика, которые продвигают партнеры, низкого качества. Без минимальных требований к депозиту или KYC-фильтров брокеры могут привлекать клиентов с коротким сроком жизни.

- Высококачественный трафик: Партнеры, которые привлекают свой трафик через контентный маркетинг, маркетинг влияния или устоявшуюся аудиторию, как правило, получают больше преимуществ от модели RevShare. Таким образом, такие партнеры стимулируют взаимодействие вместо простых регистраций, поскольку выплаты связаны с фактической торговой активностью.

- Гибридная стратегия: Используйте CPA в качестве стимула для привлечения первоначальных пользователей, а затем используйте RevShare, чтобы обеспечить качество трейдеров, которых привлекают аффилиаты.

Учитывайте рыночные условия

- Высококонкурентные рынки: Когда цена CPA высока или трудно получить, гибридная модель стимулирования может помочь снизить риски и сделать вашу партнерскую программу более привлекательной для партнеров.

- Новые или недорогие географии: CPA может быть достаточным для привлечения партнеров, поскольку маржи легче поддерживать.

- Высокий LTV или волатильные рынки: На таких рынках RevShare связывает выплаты партнерам с полученной выручкой, тем самым избегая переплат по неприбыльным или ушедшим аккаунтам.

Лучший и наиболее практичный подход требует, чтобы вы начали с CPA, если ваша основная цель — быстрое приобретение и выход на рынок. Затем вы можете перейти к RevShare по мере роста вашей платформы, чтобы максимизировать LTV. Однако, когда вам нужны как скорость приобретения, так и качественное удержание, особенно на конкурентных или дорогих рынках, гибридный подход становится вашей моделью по умолчанию.

Заключение

Партнерский маркетинг является высокоэффективным способом содействия росту, а выбор правильного типа партнерского маркетинга, будь то CPA, RevShare или гибрид, зависит от маркетинговой цели, качества трейдеров и стадии самой маркетинговой операции. CPA является предсказуемым и краткосрочным источником привлечения, RevShare — долгосрочным источником дохода, а гибриды занимают промежуточное положение.

В конечном итоге, хотя аффилиатные стратегии увеличивают вашу пользовательскую базу, наивысшая прибыльность приходит от владения вашей платформой. С решением для брокериджа под белую марку вы сохраняете 100% дохода от торговли, контролируете структуры комиссий и эффективно масштабируетесь, не полагаясь на сторонние системы. Аффилиатные программы могут способствовать росту, но владение платформой определяет, сколько вы действительно сохраняете.

FAQ

CPA (Cost Per Acquisition) платит аффилиатам фиксированную сумму за каждого квалифицированного трейдера, обеспечивая предсказуемые затраты и быстрые регистрации. RevShare (Revenue Share) выплачивает процент от чистой выручки, генерируемой трейдерами, вознаграждая аффилиатов за долгосрочную активность и удержание.

Гибридные модели объединяют CPA и RevShare, предлагая авансовые выплаты, а также постоянный доход. Они идеально подходят, когда брокеры хотят быстро привлекать клиентов, обеспечивая при этом, чтобы партнеры сосредоточились на качестве долгосрочных трейдеров.

Брокеры на ранней стадии частоbenefit от CPA, чтобы быстро наращивать объем торгов без долгосрочных финансовых обязательств. По мере того как брокерская компания становится более зрелой, переход на RevShare или гибридные модели помогает максимизировать ценность трейдера на протяжении всей жизни.

Точный мониторинг, прозрачная отчетность, автоматизированные расчеты и гибкие правила комиссий имеют важное значение. Платформы, такие как Quadcode, упрощают управление CPA, RevShare и гибридными программами без переплат или недостаточной мотивации партнеров.

Владение платформой позволяет брокерам сохранять 100% дохода от торговли, полностью контролировать структуры комиссий и эффективно масштабировать программы. Партнёрские стратегии способствуют росту, но владение платформой обеспечивает максимальную прибыльность.

Обновлено:

10 февраля 2026 г.