MT4 เทียบกับ MT5: มีความแตกต่างอย่างไร?

เนื้อหา

แพลตฟอร์มเทรดยอดนิยมที่เข้าถึงได้ทั่วโลกคือ MT4 และ MT5 เดิมที MetaTrader 4 ออกแบบมาเพื่อเทรดเดอร์ FX แต่มีการเปลี่ยนแปลงไปตามกาลเวลา และ MetaTrader 5 ถูกสร้างขึ้นเพื่อครอบคลุมหุ้น ฟิวเจอร์ส คริปโทเคอร์เรนซี และสินค้าโภคภัณฑ์ สิ่งสำคัญคือต้องเข้าใจความแตกต่างระหว่างสองตัวเลือกนี้ เพราะการเลือกแพลตฟอร์มเทรดที่เหมาะสมกับความต้องการของพวกเขาอาจช่วยให้เทรดเดอร์ปรับปรุงประสิทธิภาพการเทรดและเพิ่มผลกำไรโดยรวมได้

วัตถุประสงค์และการเข้าถึงตลาด

MT4 ถูกสร้างขึ้นมาเพื่อการซื้อขายสกุลเงินเฟียตโดยเฉพาะ มีเครื่องมือทางการเงินที่หลากหลาย ครอบคลุมการทำธุรกรรมฟอเร็กซ์และการวิเคราะห์ตลาดสกุลเงินอย่างมีประสิทธิภาพ MT4 นำเสนอราคาแบบเรียลไทม์ กราฟแสดงราคาอย่างละเอียดพร้อมกรอบเวลาที่หลากหลาย และประเภทคำสั่งซื้อขายที่หลากหลายเพื่อให้เหมาะกับสไตล์การซื้อขายที่หลากหลาย รองรับคู่สกุลเงินได้หลากหลาย อินเทอร์เฟซที่ใช้งานง่ายช่วยให้ทั้งนักเทรดฟอเร็กซ์มือใหม่และเทรดเดอร์ผู้มากประสบการณ์ที่มองหาฟังก์ชันการทำงานที่เชื่อถือได้และใช้งานง่าย

ซึ่งได้รับการปรับปรุงเพิ่มเติมใน MetaTrader 5 แพลตฟอร์มนี้ให้การเข้าถึงสินทรัพย์หลากหลายประเภทสำหรับการซื้อขาย ผู้ใช้สามารถกระจายพอร์ตการลงทุนในสินทรัพย์หลากหลายประเภทได้ เนื่องจากสามารถเข้าถึงตลาดการเงินมากมายได้จากแพลตฟอร์มเดียว MT5 ให้ข้อมูลเชิงลึกเกี่ยวกับสภาพคล่องของตลาดและการเคลื่อนไหวของคำสั่งซื้อขายโดยเชื่อมต่อกับทั้งตลาดแลกเปลี่ยนกลางและตลาด OTC มีเครื่องมือต่างๆ เช่น เครื่องมือ Depth of Market ซึ่งเป็นประโยชน์อย่างยิ่งสำหรับการซื้อขายหุ้นและสัญญาซื้อขายล่วงหน้า ซึ่งความเข้าใจในเชิงลึกของตลาดเป็นสิ่งสำคัญ

- MT4: เน้นการซื้อขายฟอเร็กซ์ เหมาะสำหรับผู้ซื้อขายสกุลเงิน

- MT5: แพลตฟอร์มสินทรัพย์หลายประเภท เหมาะสำหรับการซื้อขายฟอเร็กซ์ หุ้น สินค้าโภคภัณฑ์ และฟิวเจอร์ส

เครื่องมือวิเคราะห์ทางเทคนิคและพื้นฐาน

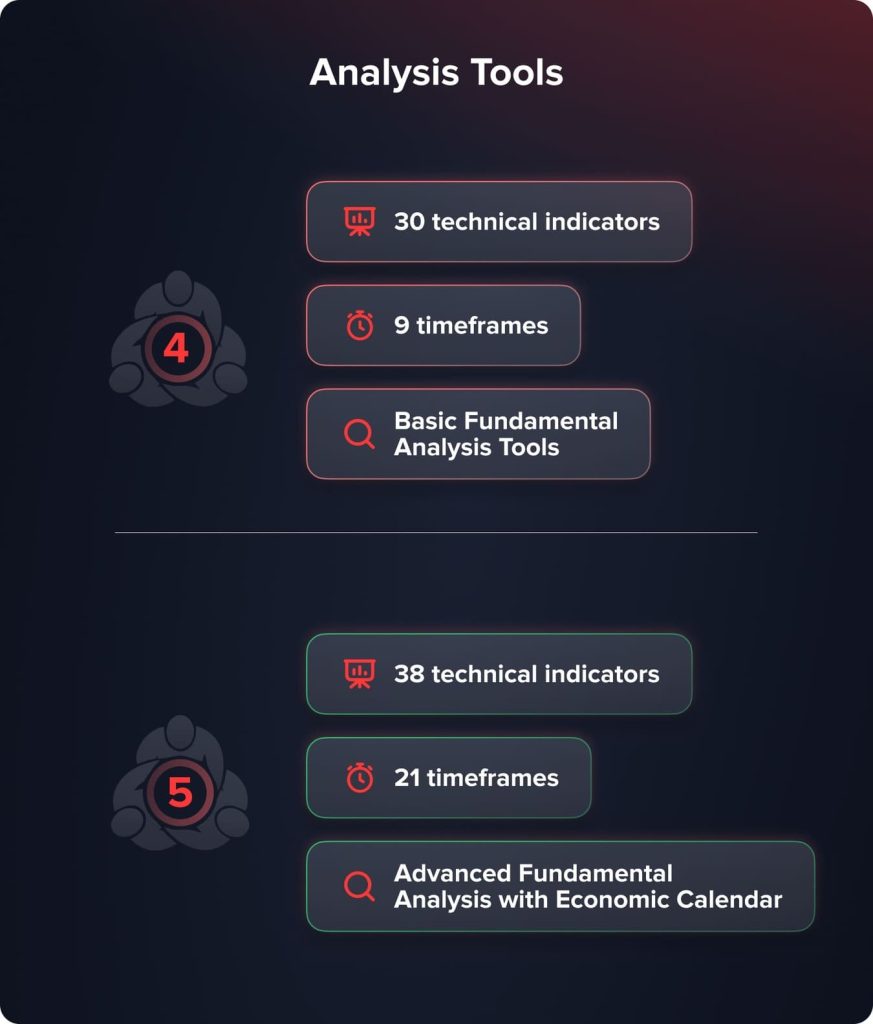

นอกจากเครื่องมือสร้างแผนภูมิแล้ว MT4 ยังมอบอินดิเคเตอร์ทางเทคนิคที่หลากหลายสำหรับเทรดเดอร์ ซึ่งออกแบบมาเพื่อการเทรดฟอเร็กซ์โดยเฉพาะ อินดิเคเตอร์ทางเทคนิคในตัว 30 ตัว และฟีเจอร์กราฟิก 31 รายการ ช่วยให้การวิเคราะห์ทางเทคนิคของคู่สกุลเงินต่างๆ เป็นไปอย่างครบถ้วน

MT4 ช่วยให้เทรดเดอร์สามารถวิเคราะห์รูปแบบตลาดได้หลายช่วงเวลา โดยรองรับกรอบเวลา 9 กรอบ ตั้งแต่หนึ่งนาทีไปจนถึงหนึ่งเดือน สำหรับผู้ที่มีความรู้พื้นฐานด้านการเขียนโปรแกรม แพลตฟอร์มนี้ยังอนุญาตให้ปรับแต่งอินดิเคเตอร์และสร้างกลยุทธ์การซื้อขายอัตโนมัติโดยใช้ภาษาโปรแกรม MQL4 ซึ่งค่อนข้างใช้งานง่าย

เสนอขาย 38 ตัวบ่งชี้ทางเทคนิค และรายการกราฟิก 44 รายการ MT5 ขยายขีดความสามารถในการวิเคราะห์เหล่านี้ด้วยการนำเสนอเครื่องมือที่หลากหลายยิ่งขึ้นสำหรับการวิจัยตลาดเชิงลึก ครอบคลุม 21 กรอบเวลา ช่วยให้เทรดเดอร์มีอิสระมากขึ้นในการตรวจสอบข้อมูล ตั้งแต่กราฟรายนาทีไปจนถึงกราฟรายเดือน

MT5 รองรับการแสดงผลกราฟพร้อมกันสูงสุด 100 กราฟ จึงสามารถติดตามตลาดและตราสารต่างๆ ได้อย่างครอบคลุม ด้วยการทำให้เทรดเดอร์ได้รับข้อมูลทันเหตุการณ์ทางเศรษฐกิจและข่าวประชาสัมพันธ์ที่อาจส่งผลกระทบต่อตลาดการเงินต่างๆ MT5 ยังนำปฏิทินเศรษฐกิจและบริการข่าวสารทางการเงินที่ครอบคลุมมาไว้ในแพลตฟอร์มโดยตรง จึงรองรับการวิเคราะห์ปัจจัยพื้นฐาน

- MT4: ตัวบ่งชี้ทางเทคนิค 30 ตัว; กรอบเวลา 9 กรอบ; เครื่องมือวิเคราะห์พื้นฐาน

- MT5: ตัวบ่งชี้ทางเทคนิค 38 ตัว; กรอบเวลา 21 กรอบ; การวิเคราะห์พื้นฐานขั้นสูงพร้อมปฏิทินเศรษฐกิจ

ภาษาการเขียนโปรแกรมและการซื้อขายอัตโนมัติ

ทั้ง MT4 และ MT5 ใช้ Expert Advisors (EA) ซึ่งเป็นระบบที่ออกแบบมาเพื่อดำเนินการซื้อขายอัตโนมัติโดยใช้อัลกอริทึมที่กำหนดไว้ล่วงหน้า อย่างไรก็ตาม ทั้งสองระบบใช้ภาษาโปรแกรมที่แตกต่างกัน ซึ่งส่งผลต่อความซับซ้อนและความสามารถของอัลกอริทึมที่อาจพัฒนาได้

MT4 รันภาษาโปรแกรม MQL4 MQL4 เป็นโปรแกรมเชิงขั้นตอนและค่อนข้างเรียบง่าย ทำให้เทรดเดอร์มือใหม่สามารถใช้งาน MQL4 ได้ MQL4 ช่วยให้ผู้ใช้ออกแบบ EA และอินดิเคเตอร์เฉพาะบุคคลเพื่อนำแผนการเทรดและกลยุทธ์ต่างๆ ไปปรับใช้โดยอัตโนมัติ ความเรียบง่ายและการสนับสนุนจากชุมชนที่แข็งแกร่งของ MQL4 ทำให้เข้าถึงสื่อการสอน บทช่วยสอน และ EA สำเร็จรูปมากมายได้อย่างง่ายดาย

You may also like

ในทางตรงกันข้าม MT5 ใช้ภาษาโปรแกรม MQL5 MQL5 ได้รับการพัฒนาและรองรับการเขียนโปรแกรมเชิงวัตถุขั้นสูง จึงช่วยสร้างหุ่นยนต์ซื้อขายและตัวบ่งชี้ที่ซับซ้อนยิ่งขึ้น ความสามารถขั้นสูงของ MQL5 ช่วยให้สามารถออกแบบอัลกอริทึมที่ซับซ้อนและควบคุมวิธีการซื้อขายต่างๆ ได้มากขึ้น

ยิ่งไปกว่านั้น MT5 ยังมีเครื่องมือทดสอบกลยุทธ์แบบมัลติเธรดที่ช่วยให้สามารถทดสอบย้อนหลังและปรับแต่ง EA ได้พร้อมกันได้อย่างรวดเร็วและมีประสิทธิภาพมากขึ้นในหลายคู่สกุลเงินและหลายช่วงเวลา สภาพแวดล้อมการทดสอบที่ซับซ้อนนี้ช่วยให้เทรดเดอร์สามารถตรวจสอบและปรับแต่งวิธีการเทรดอัตโนมัติได้อย่างแม่นยำยิ่งขึ้น

- MT4: ใช้ MQL4; การเขียนโปรแกรมที่ง่ายกว่า; การสนับสนุนชุมชนอย่างครอบคลุมสำหรับ EA

- MT5: ใช้ MQL5; การเขียนโปรแกรมขั้นสูง; ความสามารถในการทดสอบกลยุทธ์ที่ได้รับการปรับปรุง

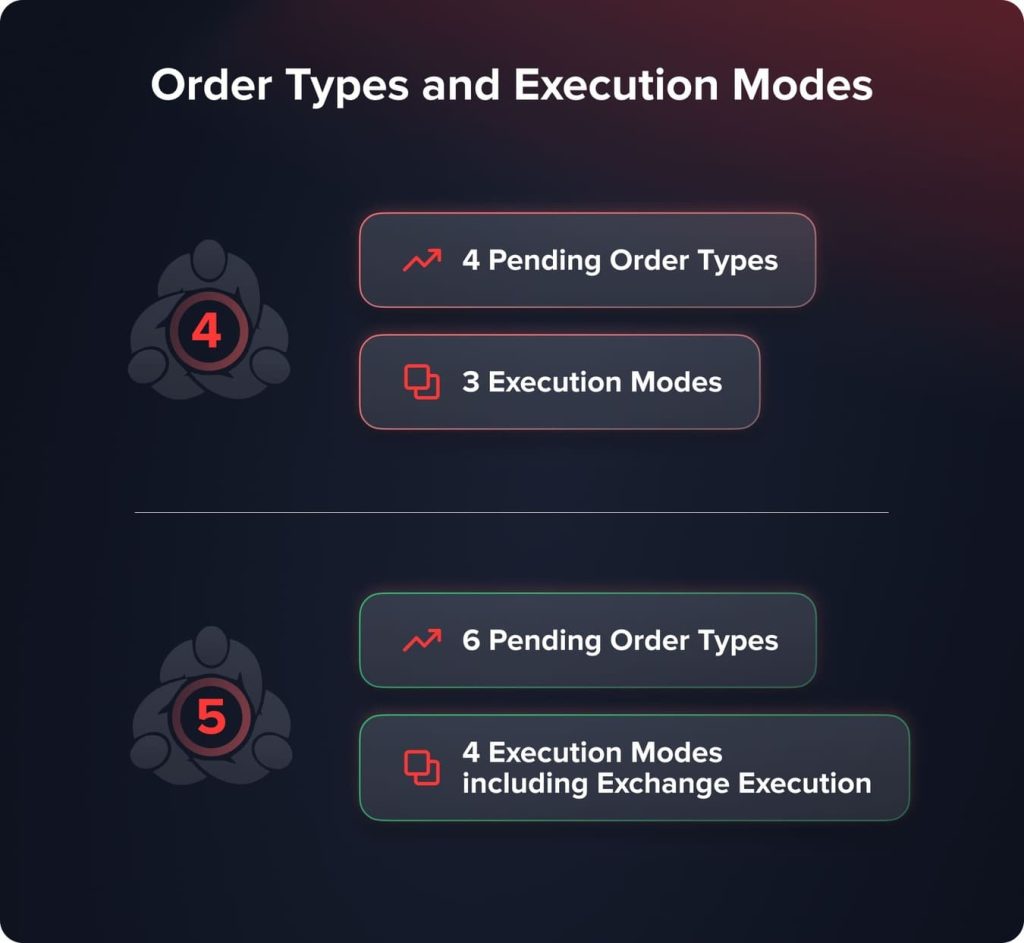

ประเภทคำสั่งซื้อและโหมดการดำเนินการ

Buy Limit, Sell Limit, Buy Stop และ Sell Stop คือคำสั่งรอดำเนินการพื้นฐานสี่รูปแบบที่ MT4 นำเสนอแก่เทรดเดอร์ คำสั่งเหล่านี้มอบความยืดหยุ่นให้กับเทรดเดอร์โดยขึ้นอยู่กับการเคลื่อนไหวของตลาดที่คาดการณ์ไว้ โดยให้เทรดเดอร์สามารถดำเนินการซื้อขายในอนาคตได้ในระดับราคาที่กำหนดไว้ ตัวอย่างเช่น คำสั่ง Buy Limit ช่วยให้เทรดเดอร์ซื้อสินค้าในราคาที่ต่ำกว่าราคาตลาดปัจจุบัน โดยหวังว่าราคาจะลดลงถึงระดับหนึ่งก่อนที่จะเพิ่มขึ้น ในทางกลับกัน คำสั่ง Sell Limit ช่วยให้คุณขายในราคาที่สูงกว่าราคาตลาด โดยคาดว่าราคาจะเพิ่มขึ้นก่อนที่จะลดลง

MT4 นำเสนอโหมดการดำเนินการสามโหมด: การดำเนินการทันที ซึ่งดำเนินการซื้อขายในราคาที่แสดง การดำเนินการตามคำขอ ซึ่งช่วยให้ผู้ซื้อขายสามารถขอใบเสนอราคาได้ก่อนที่จะวางคำสั่งซื้อ และการดำเนินการตามตลาด ซึ่งดำเนินการคำสั่งซื้อในราคาตลาดปัจจุบันโดยไม่มีการเสนอราคาซ้ำ โดยให้ความสำคัญกับความเร็วในการดำเนินการมากกว่าการกำหนดราคาที่แน่นอน

ด้วยการเพิ่มประเภทคำสั่งซื้อขายรอดำเนินการอีกสองประเภท ได้แก่ Buy Stop Limit และ Sell Stop Limit MT5 จึงขยายคุณสมบัติเหล่านี้ออกไป การรวมส่วนต่างๆ ของคำสั่ง stop และคำสั่ง limit เข้าด้วยกัน ทำให้เทรดเดอร์สามารถกำหนดตำแหน่งเข้าซื้อขายที่แม่นยำยิ่งขึ้น และใช้เทคนิคการซื้อขายขั้นสูงได้ เมื่อได้ราคา stop ที่กำหนดไว้แล้ว คำสั่ง Buy Stop Limit จะกลายเป็นคำสั่ง Buy Limit เพื่อให้เทรดเดอร์สามารถทำกำไรจากการเคลื่อนไหวของตลาดที่คาดการณ์ไว้ได้อย่างมีประสิทธิภาพมากขึ้น

You may also like

สิ่งสำคัญอย่างยิ่งสำหรับการซื้อขายบนตลาดกลาง เช่น หุ้น สินค้าโภคภัณฑ์ และสัญญาซื้อขายล่วงหน้า ปัจจุบัน MT5 ได้นำเสนอตัวเลือกการดำเนินการเพิ่มเติมที่เรียกว่า Exchange Execution วิธีการนี้รับประกันว่าคำสั่งซื้อขายจะดำเนินการตามกฎของตลาด จึงทำให้เทรดเดอร์สามารถเข้าถึงข้อมูลเชิงลึกของตลาดและสภาพคล่องได้โดยตรง

MT5 ช่วยเพิ่มความยืดหยุ่นและความแม่นยำในการซื้อขายด้วยการนำเสนอประเภทคำสั่งซื้อขายล่วงหน้าและเทคนิคการดำเนินการที่หลากหลายยิ่งขึ้น เทรดเดอร์สามารถใช้เทคนิคที่ซับซ้อนยิ่งขึ้นซึ่งเหมาะสมกับสถานการณ์ตลาดและประเภทสินทรัพย์ที่แตกต่างกันได้ โดยเฉพาะอย่างยิ่งในตลาดที่มีการเปลี่ยนแปลงอย่างรวดเร็วหรือผันผวน ตัวเลือกเพิ่มเติมใน MT5 ช่วยปรับปรุงการบริหารความเสี่ยงและช่วยให้การดำเนินการซื้อขายมีประสิทธิภาพมากขึ้น จึงเป็นประโยชน์อย่างยิ่ง

MT5 ช่วยเพิ่มความยืดหยุ่นและความแม่นยำในการซื้อขายด้วยชุดคำสั่งรอดำเนินการและกลไกการดำเนินการที่หลากหลายยิ่งขึ้น เทรดเดอร์สามารถใช้วิธีการขั้นสูงที่เหมาะกับสถานการณ์ตลาดเฉพาะบางประเภทได้ ประเภทสินทรัพย์ ตัวเลือกเพิ่มเติมใน MT5 ช่วยให้สามารถจัดการความเสี่ยงได้ดีขึ้นและดำเนินการซื้อขายได้อย่างมีประสิทธิภาพมากขึ้น ซึ่งเป็นประโยชน์อย่างยิ่งในตลาดที่เคลื่อนไหวเร็วหรือผันผวน

- MT4: ประเภทคำสั่งรอดำเนินการ 4 ประเภท โหมดการดำเนินการ 3 โหมด

- MT5: ประเภทคำสั่งที่รอดำเนินการ 6 ประเภท โหมดการดำเนินการ 4 โหมด รวมถึงการดำเนินการแลกเปลี่ยน

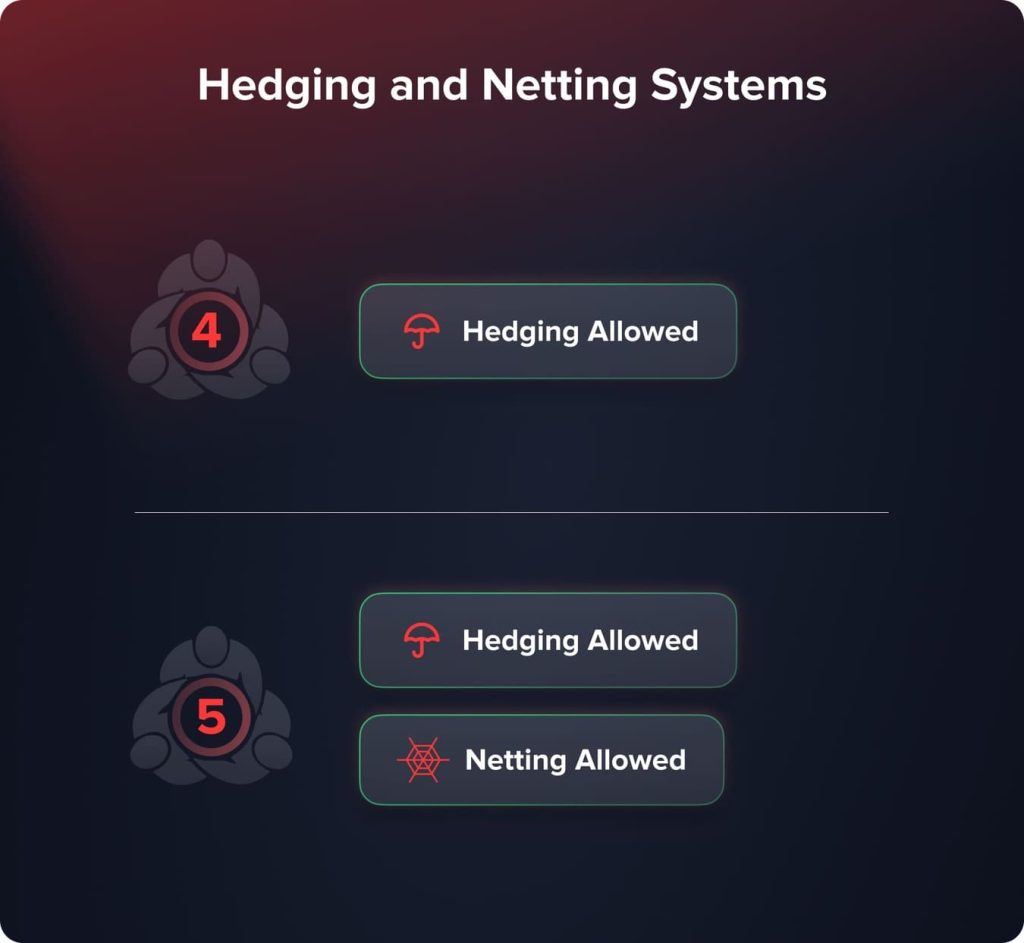

ระบบป้องกันความเสี่ยงและตาข่าย

การป้องกันความเสี่ยง (Hedging) คือเทคนิคที่เทรดเดอร์เปิดสถานะหลายสถานะในสินทรัพย์ทางการเงินเดียวกันในทิศทางที่แตกต่างกันพร้อมกัน ซึ่งสามารถทำได้ผ่าน MT4 ในคู่สกุลเงินเดียวกัน เทรดเดอร์จึงสามารถรักษาสถานะซื้อ (Long) และสถานะขาย (Short) ได้พร้อมกัน เทรดเดอร์ Forex มักใช้การป้องกันความเสี่ยงเป็นเทคนิคมาตรฐานในการลดความเสี่ยง เนื่องจากช่วยลดการสูญเสียที่อาจเกิดขึ้นจากความผันผวนของตลาดเชิงลบได้โดยไม่ต้องปิดสถานะเริ่มต้น การป้องกันความเสี่ยงช่วยให้เทรดเดอร์มีความยืดหยุ่นในกลยุทธ์การซื้อขาย ทำกำไรจากความผันผวนของตลาดระยะสั้น และปกป้องสินทรัพย์จากความผันผวน

เดิมที MT5 ถูกออกแบบมาเพื่อใช้ระบบหักกลบหนี้ (netting) จึงเหมาะสมกว่าสำหรับตลาดซื้อขายแลกเปลี่ยน เช่น ตลาดหุ้น สินค้าโภคภัณฑ์ และตลาดฟิวเจอร์ส เทรดเดอร์ที่ใช้ระบบหักกลบหนี้จะมีสถานะเปิดเพียงหนึ่งสถานะต่อรายการทางการเงิน หากมีการทำธุรกรรมใหม่ในตราสารเดียวกัน สถานะปัจจุบันจะถูกปิดหรือเปลี่ยนแปลง แทนที่จะสร้างสถานะแยกต่างหาก วิธีการนี้เป็นที่นิยมใช้กันอย่างแพร่หลายในตลาดที่ยังไม่มีการใช้หรืออนุญาตให้มีการป้องกันความเสี่ยงอย่างแพร่หลาย และสอดคล้องกับกฎของตลาดหลักทรัพย์รวมศูนย์หลายแห่ง

You may also like

แต่ด้วยความต้องการอันมหาศาลของชุมชนนักเทรด MT5 จึงรองรับการป้องกันความเสี่ยง (hedging) ด้วยเช่นกัน ความก้าวหน้านี้ช่วยให้เทรดเดอร์สามารถเลือกวิธีการป้องกันความเสี่ยงและวิธีหักบัญชี (netting) ที่เหมาะสมที่สุดกับความต้องการเฉพาะของตนและตลาดที่ตนซื้อขาย การป้องกันความเสี่ยงนี้ช่วยให้เทรดเดอร์ฟอเร็กซ์และบุคคลอื่นๆ ที่ใช้วิธีการนี้มีโอกาสควบคุมความเสี่ยงได้ดียิ่งขึ้น เทรดเดอร์สามารถเปิดสถานะได้ไม่จำกัดหลายรายการในตราสารเดียวกัน ในทิศทางเดียวกันหรือตรงกันข้าม โดยไม่มีข้อจำกัด

- MT4: อนุญาตให้ป้องกันความเสี่ยงได้

- MT5: รองรับทั้งระบบป้องกันความเสี่ยงและระบบหักกลบ

อินเทอร์เฟซผู้ใช้และประสบการณ์

MT4 โดดเด่นด้วยความเรียบง่ายและใช้งานง่าย อินเทอร์เฟซที่ชัดเจนดึงดูดเทรดเดอร์ที่มีระดับความรู้ที่แตกต่างกัน การออกแบบแพลตฟอร์มเน้นการเข้าถึงและประโยชน์ใช้สอย จึงมอบเลย์เอาต์ที่เป็นระเบียบเรียบร้อยและค้นหาเครื่องมือและองค์ประกอบสำคัญต่างๆ ได้ง่าย แถบเครื่องมือและแผนภูมิที่ปรับแต่งได้บนอินเทอร์เฟซผู้ใช้ของ MT4 ช่วยให้เทรดเดอร์สามารถปรับแต่งพื้นที่ทำงานได้ตามต้องการโดยไม่ต้องเพิ่มองค์ประกอบที่ซับซ้อนโดยไม่จำเป็น ความเรียบง่ายนี้ทำให้ MT4 ดึงดูดเทรดเดอร์มือใหม่เป็นพิเศษ เพราะช่วยลดขั้นตอนการเรียนรู้และช่วยให้เทรดเดอร์สามารถดำเนินธุรกรรมได้อย่างมั่นใจ

ยิ่งไปกว่านั้น MT4 ใช้ทรัพยากรระบบน้อยลง ซึ่งรับประกันการทำงานที่ราบรื่นแม้ในระบบที่ประสิทธิภาพต่ำกว่าหรือล้าสมัย เทรดเดอร์หลายรายเลือกใช้ MT4 เนื่องจากประสิทธิภาพของระบบช่วยลดปัญหาทางเทคโนโลยีที่อาจส่งผลกระทบต่อการดำเนินการซื้อขาย

MT5 นำเสนอฟีเจอร์เพิ่มเติมและตัวเลือกการปรับแต่งที่ได้รับการปรับปรุง มอบประสบการณ์การใช้งานที่ทันสมัยและซับซ้อนยิ่งขึ้น แพลตฟอร์มนี้มุ่งหวังที่จะมอบประสบการณ์การใช้งานที่ดียิ่งขึ้น ตอบโจทย์เทรดเดอร์ที่ต้องการฟังก์ชันที่ซับซ้อนยิ่งขึ้นและควบคุมสภาพแวดล้อมการซื้อขายของตนเองได้มากขึ้น ฟีเจอร์การสร้างแผนภูมิที่ขยายเพิ่มเติมของอินเทอร์เฟซ MT5 ช่วยให้เข้าถึงช่วงเวลาและเครื่องมือวิเคราะห์ที่หลากหลายยิ่งขึ้น พร้อมแสดงแผนภูมิจำนวนมากพร้อมกัน

โปรแกรมนี้ยังมอบการจัดการคำสั่งซื้อขายที่ซับซ้อนและข้อมูลเชิงลึกของตลาด จึงทำให้เทรดเดอร์ได้รับข้อมูลครบถ้วนและง่ายดาย แม้ว่าอินเทอร์เฟซที่ได้รับการปรับปรุงของ MT5 จะให้ข้อมูลเชิงลึกและความยืดหยุ่นในการวิเคราะห์ที่มากขึ้น แต่ก็อาจต้องใช้ทรัพยากรคอมพิวเตอร์มากขึ้น ซึ่งจะส่งผลต่อประสิทธิภาพการทำงานบนระบบที่ด้อยประสิทธิภาพหรือระบบรุ่นเก่า หากฮาร์ดแวร์ของเทรดเดอร์ไม่เป็นไปตามข้อกำหนดของระบบที่เพิ่มขึ้นของแพลตฟอร์ม เทรดเดอร์อาจต้องใช้เวลานานขึ้นหรือตอบสนองได้น้อยลง

- MT4: อินเทอร์เฟซที่เรียบง่ายและเป็นมิตรต่อผู้ใช้ ใช้ทรัพยากรน้อยลง

- MT5: อินเทอร์เฟซขั้นสูงพร้อมฟีเจอร์เพิ่มเติม ความต้องการทรัพยากรที่สูงขึ้น

ความเข้ากันได้และการสนับสนุน

เป็นเวลาหลายปีที่ MT4 เป็นมาตรฐานอุตสาหกรรมสำหรับระบบการซื้อขาย โบรกเกอร์ทั่วโลกต่างให้การสนับสนุนอย่างเต็มที่ ความน่าเชื่อถือและอายุการใช้งานที่ยาวนานของ MT4 ก่อให้เกิดชุมชนผู้ใช้ขนาดใหญ่ ซึ่งนำไปสู่การสร้างระบบนิเวศขนาดใหญ่ของปลั๊กอินอิสระ อินดิเคเตอร์แบบกำหนดเอง และ EA

ฐานข้อมูลที่ครอบคลุมนี้ช่วยให้เทรดเดอร์สามารถพัฒนาและปรับแต่งสภาพแวดล้อมการเทรดของตนเองได้อย่างมาก MT4 เป็นที่คุ้นเคย ดังนั้น แหล่งข้อมูลการสอน บทช่วยสอน และความช่วยเหลือจากชุมชนจึงเข้าถึงได้ง่ายสำหรับเทรดเดอร์ทุกระดับ โบรกเกอร์ต่างให้ความสำคัญกับประวัติการทำงานที่แข็งแกร่งและทักษะการผสานรวมที่ราบรื่น ซึ่งช่วยให้มั่นใจได้ว่า MT4 จะรักษาความเป็นผู้นำในตลาดการเทรดฟอเร็กซ์อย่างต่อเนื่อง

แม้ว่า MT5 จะได้รับความนิยมเพิ่มขึ้นเรื่อยๆ แต่ก็ยังไม่ได้รับการยอมรับในระดับโลกเทียบเท่ากับ MT4 เนื่องจากการเปลี่ยนแปลงโครงสร้างพื้นฐานครั้งใหญ่ที่จำเป็นและฐานผู้ใช้ MT4 ที่มีอยู่อย่างมั่นคง ทำให้โบรกเกอร์หลายรายลังเลที่จะยอมรับ MT5 แต่ความต้องการฟีเจอร์ที่ได้รับการพัฒนาและความสามารถในการซื้อขายสินทรัพย์หลายประเภทของ MT5 กำลังผลักดันให้ได้รับการยอมรับมากขึ้น โบรกเกอร์กำลังขยายผลิตภัณฑ์ของตนให้รองรับ MT5 เนื่องจากเทรดเดอร์ที่ต้องการเข้าถึงตราสารทางการเงินที่หลากหลายยิ่งขึ้นและเครื่องมือวิเคราะห์ที่ได้รับการปรับปรุงให้ดีขึ้น บังคับให้พวกเขาต้องทำเช่นนั้น

ความพร้อมใช้งานของเครื่องมือจากภายนอก ปลั๊กอิน และ EA กำลังขยายตัวมากขึ้น เนื่องจากผู้ใช้จำนวนมากขึ้นย้ายไปยัง MT5 แม้ว่าระบบสนับสนุนของ MT5 จะไม่ครอบคลุมเท่าระบบนิเวศของ MT4 แต่กำลังเติบโตอย่างรวดเร็วและมอบเครื่องมือเพิ่มเติมให้กับเทรดเดอร์เพื่อพัฒนากลยุทธ์การเทรดของพวกเขา

- MT4: รองรับอย่างกว้างขวาง มีเครื่องมือของบุคคลที่สามมากมาย

- MT5: การเติบโตในการนำมาใช้; การขยายการสนับสนุนโบรกเกอร์

บทสรุป

การเลือกแพลตฟอร์มที่สอดคล้องกับวัตถุประสงค์การเทรดของคุณมากที่สุดนั้นขึ้นอยู่กับความเข้าใจในความแตกต่างระหว่าง MT4 และ MT5 เทรดเดอร์ Forex ยังคงมองว่า MT4 เป็นตัวเลือกที่แข็งแกร่งและเชื่อถือได้ สำหรับผู้ที่ต้องการเทรดหลายสินทรัพย์ MT5 มีตัวเลือกให้เลือกมากกว่า การตรวจสอบเครื่องมือและคุณลักษณะเฉพาะของแต่ละแพลตฟอร์มจะช่วยให้คุณตัดสินใจได้อย่างชาญฉลาดและยกระดับความสำเร็จในการเทรดของคุณ

FAQ

เทรดเดอร์ Forex ที่ต้องการแพลตฟอร์มที่เรียบง่าย ใช้งานง่าย พร้อมการสนับสนุนจากชุมชนมากมาย และต้องการทรัพยากรน้อยกว่า อาจพบว่า MT4 เหมาะสมกว่า สำหรับผู้ที่เทรดในหลายตลาด MT5 มีเครื่องมือที่ซับซ้อน การซื้อขายสินทรัพย์หลากหลาย และฟังก์ชันการทำงานขั้นสูง ท้ายที่สุดแล้ว MT5 เหมาะกับผู้ใช้ที่ต้องการฟีเจอร์ขั้นสูงและการเข้าถึงตลาดที่หลากหลายยิ่งขึ้น

เทรดเดอร์ที่ใช้ทั้งสองระบบต่างกล่าวว่า MT4 และ MT5 มีภาษาโปรแกรมเฉพาะตัว ข้อแตกต่างคือภาษาโปรแกรมของ MT4 นั้นใช้งาน พัฒนา และติดตั้งได้ง่ายกว่า จึงเหมาะสำหรับเทรดเดอร์ที่ไม่มีประสบการณ์ เนื่องจากตั้งค่าความสามารถได้เพียงไม่กี่ขั้นตอน

คุณสามารถเทรดบนแพลตฟอร์ม MT4 และ MT5 ได้พร้อมกัน คุณจำเป็นต้องเปิดบัญชีเทรดแยกสำหรับแต่ละแพลตฟอร์ม เนื่องจากบัญชี MT4 และ MT5 ไม่สามารถแลกเปลี่ยนได้เนื่องจากความแตกต่างด้านสถาปัตยกรรมและรูปแบบข้อมูล

อัปเดต:

19 ธันวาคม 2567