MT4 vs MT5: Qual é a diferença?

Conteúdo

Sem dúvida, as plataformas de negociação mais populares disponíveis globalmente são a MT4 e a MT5. A MetaTrader 4 foi inicialmente projetada para traders de câmbio, mas mudou com o tempo, e a MetaTrader 5 foi criada para abranger ações, futuros, criptomoedas e commodities. É importante entender as diferenças entre essas duas opções, pois selecionar a plataforma de negociação certa para suas necessidades pode ajudar os traders a melhorar o desempenho e aumentar seus lucros gerais.

Finalidade e acesso ao mercado

A MT4 foi criada especialmente para a negociação de moedas fiduciárias. Ela oferece uma gama completa de instrumentos para a execução eficaz de transações forex e pesquisa do mercado de câmbio. A MT4 oferece cotações de preços em tempo real, gráficos completos com diversos períodos e uma variedade de tipos de ordens para atender a diversos estilos de negociação. Ela suporta diversos pares de moedas. Sua interface fácil de usar permite que tanto iniciantes no mercado forex quanto traders experientes que buscam recursos confiáveis e simples.

Isso foi aprimorado ainda mais no MetaTrader 5. Esta plataforma oferece acesso a diversos tipos de ativos para negociação. Seus usuários podem diversificar seus portfólios em diversas classes de ativos, pois têm acesso a diversos mercados financeiros a partir de uma única plataforma. O MT5 fornece insights sobre a liquidez do mercado e a movimentação de ordens, conectando-se a bolsas centralizadas e mercados de balcão. Ferramentas como a ferramenta de Profundidade de Mercado estão disponíveis. Isso é particularmente benéfico para a negociação de ações e futuros, onde a compreensão da profundidade do mercado é essencial.

- MT4: Focado em negociação forex; ideal para traders de moedas.

- MT5: plataforma multiativos; adequada para negociação de forex, ações, commodities e futuros.

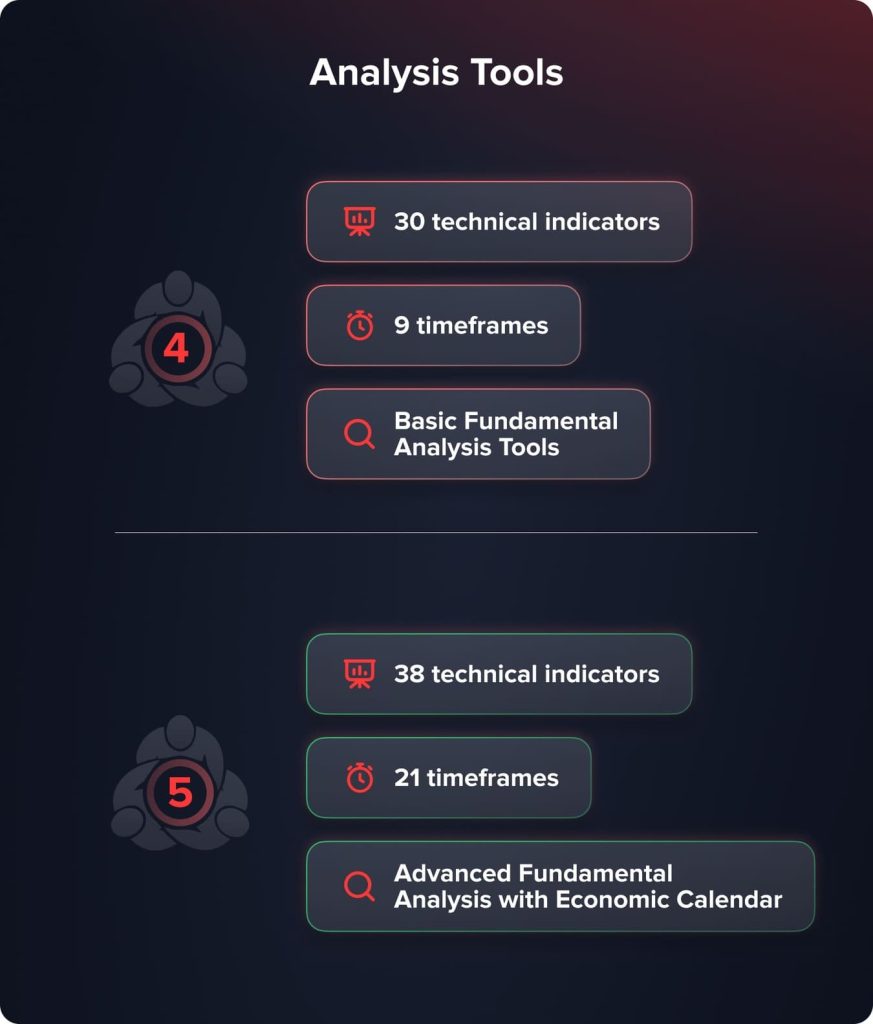

Ferramentas de Análise Técnica e Fundamental

Além das ferramentas de gráficos, o MT4 oferece aos traders uma ampla gama de indicadores técnicos projetados especificamente para operações em Forex. Seus 30 indicadores técnicos integrados e 31 recursos gráficos proporcionam uma análise técnica completa de pares de moedas.

A MT4 permite que os traders observem padrões de mercado em diversos períodos, suportando nove períodos de tempo que variam de um minuto a um mês. Para indivíduos com conhecimentos básicos de programação, a plataforma também permite a personalização de indicadores e a criação de estratégias de negociação automatizadas usando a linguagem de programação MQL4, que é relativamente fácil de usar.

Oferta 38 indicadores técnicos Com 44 itens gráficos, o MT5 expande esses recursos analíticos, oferecendo um espectro mais amplo de instrumentos para pesquisas de mercado aprofundadas. Ele abrange 21 períodos de tempo, permitindo aos traders mais liberdade para analisar dados, desde gráficos de um minuto até intervalos mensais.

O MT5 suporta a exibição de até 100 gráficos simultaneamente, permitindo um monitoramento completo do mercado e dos instrumentos. Ao manter os traders informados sobre eventos econômicos e comunicados de notícias que podem afetar diferentes mercados financeiros, o MT5 também traz um calendário econômico completo e serviços de notícias financeiras diretamente para a plataforma, apoiando assim a análise fundamentalista.

- MT4: 30 indicadores técnicos; 9 períodos de tempo; ferramentas básicas de análise fundamental.

- MT5: 38 indicadores técnicos; 21 períodos de tempo; análise fundamentalista avançada com calendário econômico.

Linguagem de Programação e Negociação Automatizada

Utilizando Expert Advisors (EAs), que são sistemas projetados para executar automaticamente atividades de negociação usando algoritmos predefinidos, tanto o MT4 quanto o MT5 oferecem negociação automatizada. No entanto, eles empregam linguagens de programação diferentes, o que afeta a complexidade e a capacidade dos algoritmos que podem ser desenvolvidos.

O MT4 utiliza a linguagem de programação MQL4. A linguagem MQL4 é procedural e relativamente simples, o que a torna acessível a traders iniciantes em programação. Ela permite que os usuários criem EAs e indicadores personalizados para implementar automaticamente diversos planos e estratégias de negociação. A simplicidade da MQL4 e o forte suporte da comunidade facilitam o acesso a diversos materiais, tutoriais e EAs pré-construídos.

You may also like

Em contrapartida, o MT5 utiliza a linguagem de programação MQL5. Mais avançada e com suporte à programação orientada a objetos, a MQL5 ajuda a criar robôs de negociação e indicadores mais sofisticados. Os recursos aprimorados da MQL5 permitem projetar algoritmos complexos e ter mais controle sobre diversos métodos de negociação.

Além disso, o MT5 inclui um testador de estratégias multithread que permite backtesting mais rápido e eficaz, além da otimização simultânea do EA em diversos pares de moedas e períodos. Este ambiente de teste sofisticado permite que os traders verifiquem e aprimorem suas abordagens de negociação automatizada com mais precisão.

- MT4: usa MQL4; programação mais simples; amplo suporte da comunidade para EAs.

- MT5: usa MQL5; programação mais avançada; recursos aprimorados de testes de estratégia.

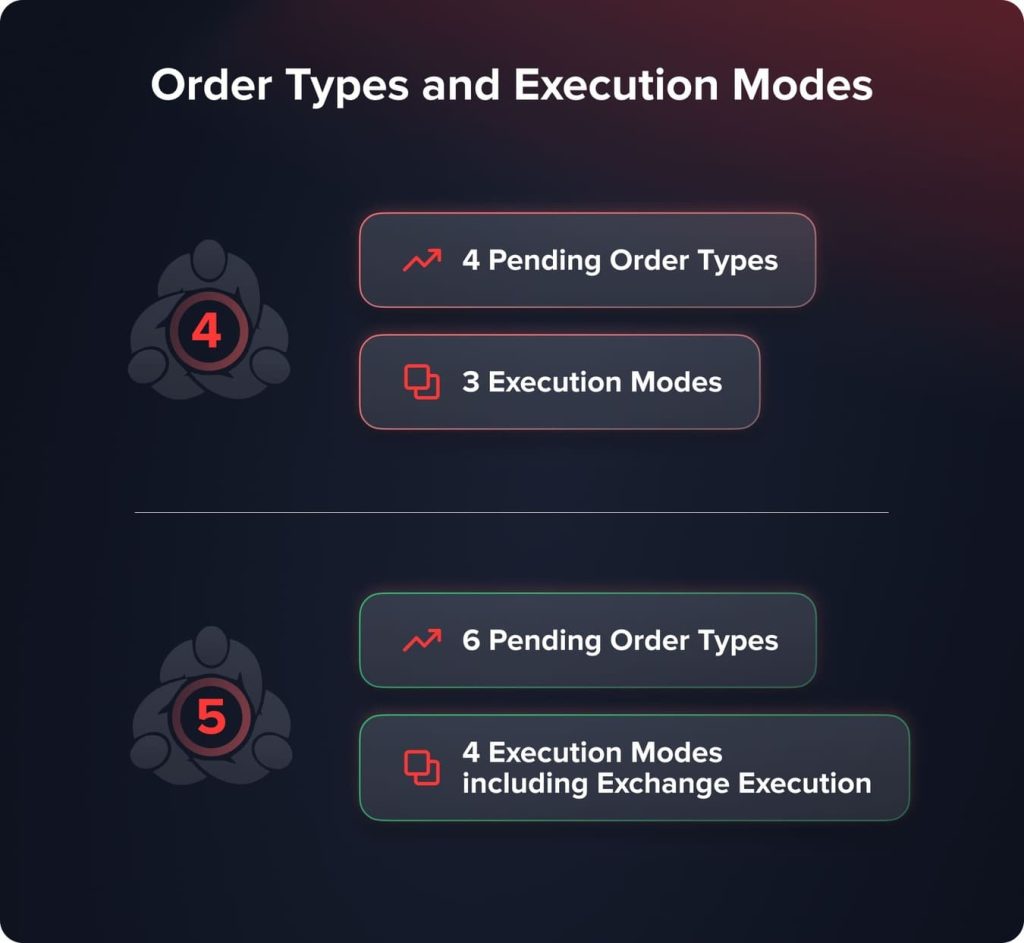

Tipos de ordens e modos de execução

Buy Limit, Sell Limit, Buy Stop e Sell Stop são quatro formas fundamentais de ordens pendentes que o MT4 oferece aos traders. Essas ordens proporcionam flexibilidade aos traders, dependendo dos movimentos esperados do mercado, permitindo que realizem negociações futuras em níveis de preço definidos. Uma ordem Buy Limit, por exemplo, permite que um trader compre um item a um preço inferior ao preço de mercado atual, esperando que o preço caia para um determinado nível antes de subir. Por outro lado, uma ordem Sell Limit permite que você venda por um preço superior ao preço de mercado vigente, esperando que o preço suba antes de cair.

O MT4 oferece três modos de execução: Execução Instantânea, que executa negociações no preço exibido; Solicitação de Execução, que permite que os negociadores solicitem uma cotação antes de fazer uma ordem; e Execução de Mercado, que executa ordens no preço de mercado atual sem recotações, priorizando a velocidade de execução em vez do preço exato.

Ao adicionar mais dois tipos de ordens pendentes — Buy Stop Limit e Sell Stop Limit — o MT5 amplia essas características. Combinando partes de ordens stop e ordens limitadas, essas ordens híbridas permitem que os traders estabeleçam pontos de entrada mais precisos e utilizem técnicas avançadas de negociação. Assim que o preço de stop designado é atingido, uma ordem Buy Stop Limit, por exemplo, torna-se uma ordem Buy Limit, permitindo que os traders lucrem com os movimentos projetados do mercado com maior controle.

You may also like

Crucial para negociações em bolsas centralizadas, como ações, commodities e futuros, o MT5 agora apresenta uma opção de execução adicional conhecida como Execução de Bolsa. Este método garante que as ordens sejam executadas de acordo com as regras da bolsa, dando aos traders acesso direto às informações de profundidade e liquidez do mercado.

O MT5 melhora a flexibilidade e a precisão das negociações, oferecendo um espectro mais amplo de tipos de ordens pendentes e técnicas de execução. Técnicas mais sofisticadas, adaptadas a diferentes circunstâncias de mercado e classes de ativos, permitem o uso por traders. Particularmente em mercados turbulentos ou em rápida evolução, as opções adicionais do MT5 ajudam a aprimorar a gestão de riscos e permitem uma execução de negociações mais eficaz, facilitando, assim, seus benefícios.

O MT5 melhora a flexibilidade e a precisão das negociações, oferecendo um conjunto mais diversificado de tipos de ordens pendentes e mecanismos de execução. Os traders podem utilizar métodos mais avançados, adequados a determinadas circunstâncias de mercado e tipos de ativos . As opções adicionais no MT5 facilitam uma melhor gestão de riscos e permitem uma execução mais eficiente de negociações, o que é particularmente benéfico em mercados voláteis ou de rápida movimentação.

- MT4: 4 tipos de ordens pendentes; 3 modos de execução.

- MT5: 6 tipos de ordens pendentes; 4 modos de execução, incluindo Execução de Bolsa.

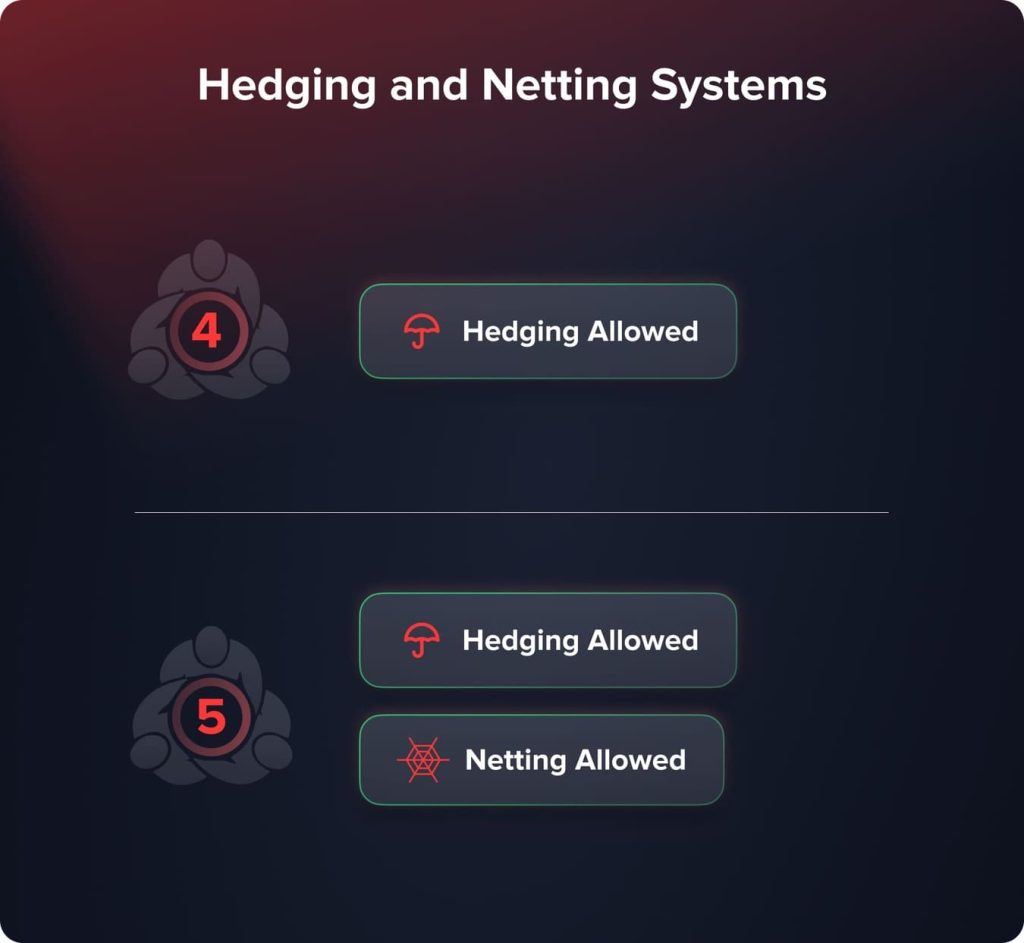

Sistemas de cobertura e redes

O hedge — uma técnica na qual os traders abrem várias posições no mesmo ativo financeiro em diferentes direções simultaneamente — é possível graças ao MT4. No mesmo par de moedas, um trader pode, portanto, manter simultaneamente uma posição de compra (longa) e uma posição de venda (vendida). Os traders de Forex costumam usar o hedge como uma técnica padrão de redução de risco, pois permite minimizar possíveis perdas decorrentes de oscilações negativas do mercado sem fechar suas posições iniciais. O hedge ajuda os traders a manter a flexibilidade em suas táticas de negociação, lucrar com oscilações de mercado de curto prazo e proteger seus ativos contra a volatilidade.

Originalmente concebido com um sistema de compensação, o MT5 é mais adequado para mercados negociados em bolsa, como ações, commodities e futuros. Os traders que operam com o sistema de compensação têm apenas uma posição aberta por item financeiro. Caso uma nova transação seja realizada no mesmo instrumento, ela fechará ou alterará a posição atual, em vez de gerar uma separada. Este método é uma prática comum em mercados onde o hedge não é amplamente utilizado ou permitido e está em conformidade com as regras de muitas bolsas centralizadas.

You may also like

Mas, dada a grande demanda da comunidade de traders, o MT5 agora também permite hedging. Esse avanço permite que os traders decidam qual dos métodos de hedging e netting melhor se adapta às suas necessidades específicas e aos mercados em que operam. Ao permitir o hedging, o MT5 oferece aos traders de Forex e outros que dependem dessa abordagem a oportunidade de controlar melhor os riscos. Os traders podem abrir posições múltiplas ilimitadas no mesmo instrumento, na mesma direção ou em direções opostas, sem restrições.

- MT4: Hedge permitido.

- MT5: Suporta sistemas de hedge e de compensação.

Interface e experiência do usuário

Reconhecida por sua simplicidade e facilidade de uso, a MT4 possui uma interface clara e atraente para traders com diferentes níveis de conhecimento. O design da plataforma enfatiza a acessibilidade e a utilidade, oferecendo aos usuários um layout organizado, no qual ferramentas e elementos importantes são fáceis de encontrar. Barras de ferramentas e gráficos personalizáveis na interface da MT4 permitem que os traders adaptem seu espaço de trabalho às suas preferências sem adicionar elementos desnecessariamente complexos. Essa simplicidade torna a MT4 especialmente atraente para novos traders, pois encurta a curva de aprendizado e permite que eles executem transações com confiança.

Além disso, a MT4 utiliza menos recursos do sistema, o que garante uma operação perfeita mesmo em sistemas menos potentes ou desatualizados. Muitos traders utilizam a MT4, pois sua eficiência reduz problemas tecnológicos que poderiam afetar as operações de negociação.

Oferecendo recursos adicionais e opções de personalização aprimoradas, o MT5 oferece uma experiência de usuário mais contemporânea e sofisticada. A plataforma foi projetada para proporcionar uma experiência de usuário aprimorada, atendendo a traders que precisam de funções mais complexas e maior controle sobre seu ambiente de negociação. Os recursos gráficos estendidos da interface do MT5 permitem acessar um espectro maior de períodos e ferramentas analíticas, além de exibir diversos gráficos simultaneamente.

O programa também oferece gerenciamento sofisticado de ordens e informações de profundidade de mercado, oferecendo aos traders dados completos na ponta dos dedos. Embora a interface aprimorada do MT5 ofereça mais profundidade analítica e flexibilidade, ele pode exigir mais recursos computacionais, o que afetaria o desempenho em sistemas menos competentes ou mais antigos. Caso o hardware não atenda aos requisitos de sistema aprimorados da plataforma, os traders podem ter tempos de carregamento mais longos ou menor capacidade de resposta.

- MT4: Interface simples e amigável; menor uso de recursos.

- MT5: Interface avançada com mais recursos; maiores requisitos de recursos.

Compatibilidade e Suporte

Por muitos anos, a MT4 tem sido o padrão da indústria para sistemas de negociação; corretoras em todo o mundo a apoiam fortemente. Sua confiabilidade e longevidade geraram uma comunidade de usuários considerável que, por sua vez, contribuiu para a construção de um enorme ecossistema de plugins independentes, indicadores personalizados e EAs.

Esta extensa base de recursos permite que os traders aprimorem e personalizem significativamente seu ambiente de negociação. A MT4 é familiar, portanto, recursos instrucionais, tutoriais e assistência da comunidade são facilmente acessíveis para traders de todos os níveis. As corretoras valorizam seu sólido histórico e suas habilidades de integração fluidas, que ajudam a garantir sua supremacia contínua no setor de negociação forex.

Embora a MT5 esteja crescendo em popularidade, ela ainda não atingiu o mesmo nível de suporte global que a MT4. Devido às grandes mudanças necessárias na infraestrutura e à base de usuários bem estabelecida da MT4, diversas corretoras têm relutado em aceitá-la. No entanto, a demanda por recursos aprimorados e capacidades de negociação multiativos oferecidas pela MT5 está impulsionando a crescente aceitação. As corretoras estão expandindo seus produtos para incorporar a MT5, à medida que os traders buscam acesso a um espectro mais amplo de instrumentos financeiros e ferramentas analíticas aprimoradas os forçam a fazê-lo.

A disponibilidade de ferramentas de terceiros, plugins e EAs está aumentando à medida que mais usuários migram para o MT5. Embora não seja tão abrangente quanto o ecossistema do MT4, o sistema de suporte do MT5 está crescendo rapidamente e oferece aos traders mais ferramentas para aprimorar suas estratégias de negociação.

- MT4: Amplamente suportado; extensas ferramentas de terceiros.

- MT5: Adoção crescente; suporte de corretores em expansão.

Conclusão

A escolha da plataforma mais adequada aos seus objetivos de negociação depende do conhecimento das diferenças entre a MT4 e a MT5. Os traders de Forex ainda consideram a MT4 uma opção sólida e confiável; para aqueles que desejam negociar multiativos, a MT5 oferece mais opções. Analisar as ferramentas e características específicas de cada plataforma pode ajudá-lo a fazer uma escolha acertada e a melhorar seu sucesso nas negociações.

FAQ

Traders de Forex que buscam uma plataforma simples e intuitiva, com bastante suporte da comunidade e menos necessidade de recursos, podem achar o MT4 mais adequado. Para quem opera em diversos mercados, o MT5 oferece ferramentas sofisticadas, negociação multiativos e funcionalidades avançadas. No fim das contas, o MT5 é mais indicado para usuários que precisam de recursos mais avançados e acesso a mais mercados.

Traders que usam ambos os sistemas afirmam que a MT4 e a MT5 possuem linguagens de programação exclusivas. A diferença é que a linguagem de programação da MT4 é mais simples de usar, desenvolver e instalar, tornando-a perfeita para traders inexperientes, pois requer apenas alguns passos para configurar seus recursos.

Você pode negociar simultaneamente nas plataformas MT4 e MT5. Você precisará criar contas de negociação individuais para cada plataforma, pois as contas MT4 e MT5 não são negociáveis devido a diferenças arquitetônicas e de formato de dados.

Atualizado:

19 de dezembro de 2024