How to Start a Forex Business in 2026?

Contents

Entering the business of forex in 2026 is a challenge and an opportunity. The market is expanding fast driven by technology-facilitated trading, new regulations and rising global participation. Competition has never been more intense and to survive, one requires more than a license and a platform.

This guide explores establishing a modern brokerage from scratch. It covers significant decisions such as business models, regulation, technology, liquidity partnerships, and client acquisition to give you a good foundation upon which to start and expand a compliant forex business in 2026.

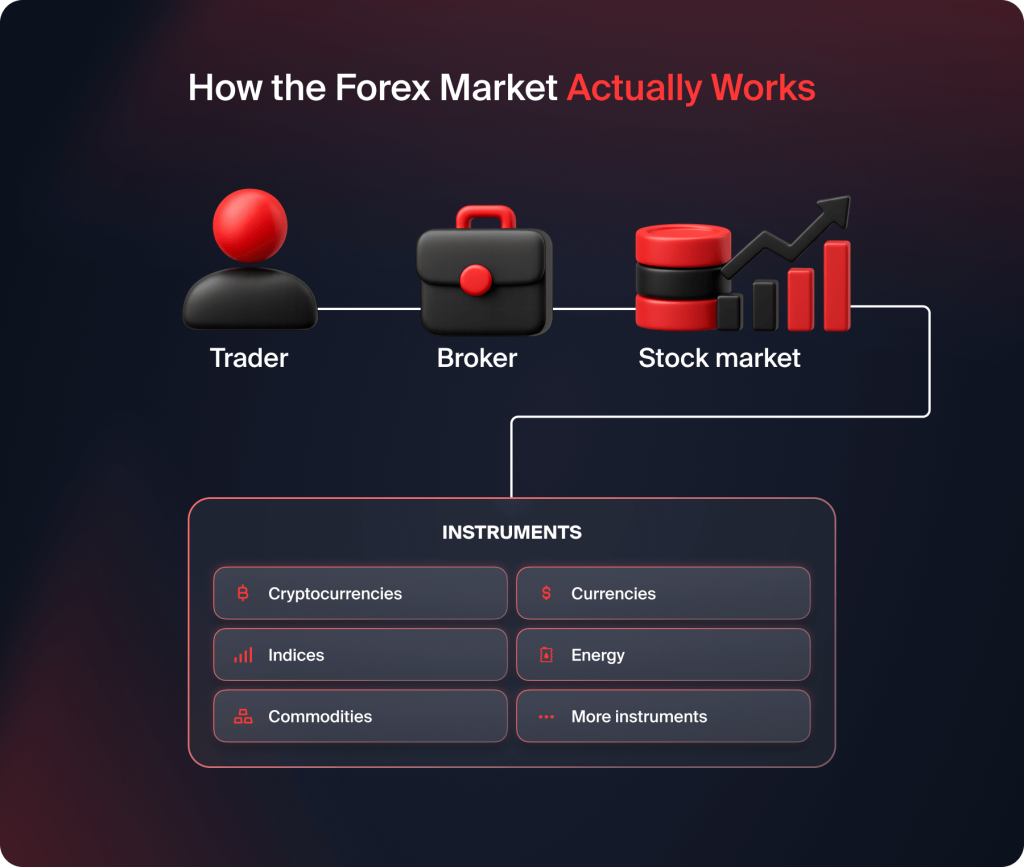

What Is a Forex Business?

A forex business is a company that gives traders access to the global foreign exchange market. It acts as a liaison between individual or institutional customers and the greater financial world where currencies are bought and sold. Most forex businesses are brokerages, connecting traders with liquidity providers, banks or other brokers.

Forex businesses come in different forms, but the majority are:

- Retail forex brokers offer individual traders through online platforms.

- Institutional brokers who work with hedge funds, banks and major trading houses.

- Technology and liquidity providers support brokers with trading facilities and information.

Essentially, a forex business makes profits from spreads, commissions, and other services, such as swaps or premium accounts. A healthy brokerage offers traders tight spreads, fast execution, advanced platforms and good-quality customer service.

Modern-day forex companies now like to diversify into currency trading aside from other trading options like CFDs, commodities, crypto pairs and indices from a single trading platform. The boundaries between forex, fintech and multi-asset trading continue to blur daily, hence why 2026 presents such enticing prospects for new entrants.

Business Models in Forex

Before launching a forex business, it is important to choose the right model. Each one has its own structure, costs and level of control. Understanding these models helps you decide how to position your brand and what kind of technology and regulation you need.

Market Maker Model

In the market maker setup, the broker acts as the counterparty to client trades. The firm provides its own liquidity and earns profit from spreads and client losses. It offers higher margins but also higher risk because the broker carries exposure on its own books. This model requires strong risk management and deep liquidity.

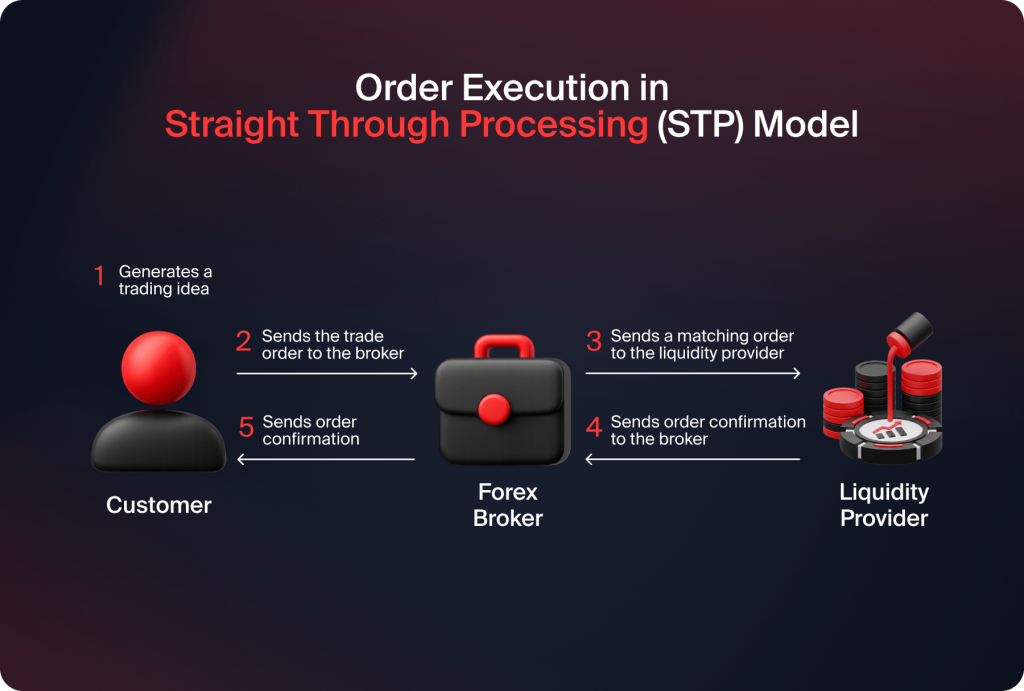

STP (Straight Through Processing) Model

An STP broker connects clients directly to liquidity providers without internal dealing. Orders are processed automatically, which increases transparency and reduces conflict of interest. Profit comes mainly from markups or commissions per trade. This model is popular with brokers who want to maintain credibility and compliance.

ECN (Electronic Communication Network) Model

An ECN broker gives traders access to a pool of liquidity providers where they can trade against one another. It is the most transparent model, offering tight spreads and market-based pricing. However, it requires more advanced infrastructure and higher capital investment.

Hybrid Model

A hybrid forex model is a brokerage firm that combines both the A-Book and B-Book models. It seeks to establish a middle ground between risk management, flexibility and transparency in handling trades. It has become the most adopted model by modern-day forex brokers because it is very flexible to accommodate different clients and market conditions.

In a hybrid setup, the broker can trade externally through A-Book liquidity providers or internally (B-Book). The choice is decided by trade size, profitability and client profile. Large volume or stable profitable traders are generally routed to the A-Book to reduce market exposure, while small or inexperienced traders are traded internally so that the broker can profit on spreads and market movement.

White Label and Turnkey Solutions

Launching a brokerage from scratch can be expensive. White label or turnkey solutions let you operate under another company’s technology and license while building your own brand. Providers such as Quadcode.com offer ready-made platforms, liquidity connections and back-office tools that allow new businesses to launch faster with lower initial costs.

Regulation and Licensing

Starting a forex business in 2026 requires a financial services license and strict compliance with regional rules. Regulators now focus heavily on capital adequacy, client fund protection, AML/KYC, cybersecurity and transparent governance. Choosing the right jurisdiction defines your costs, credibility and launch speed.

United States (CFTC and NFA)

Brokers serving U.S. clients must register with the CFTC and NFA.

- Minimum capital: USD 20 million plus 5% of retail liabilities over USD 10 million, according to Inreg.

- Key requirements: AML/KYC, segregated client funds, cybersecurity and margin control.

This market offers high trust but demands major investment and strict oversight.

European Union and the United Kingdom

Brokers in the EU and UK are regulated under MiFID II/MiFIR by bodies such as the FCA or BaFin.

- Capital: About €730,000 for full licenses, according to Rue.

- Main obligations: Segregated funds, audited reports, management testing and leverage limits (1:30).

Licensing usually takes six to twelve months and grants strong credibility in global markets.

Middle East (UAE)

Licensing is available through the SCA or DFSA.

- Capital: Around USD 2 million, according to EoneFX.

- Requirements: Local office, qualified management and strong cybersecurity systems.

The UAE continues to attract fintech and forex companies targeting MENA and Asia.

Offshore Jurisdictions

Regions like Mauritius, Seychelles and Belize offer quick and affordable licensing.

- Capital: EUR 17,000–50,000.

They are suitable for startups, though they offer less investor protection and no passporting rights.

Global Trends in 2026

Regulators now require:

- Verified cybersecurity audits.

- Transparent order execution reporting.

- Strong conflict-of-interest policies for hybrid models.

In short, Tier-1 regulators such as the CFTC, FCA and DFSA offer high credibility but higher costs. Offshore options remain practical for fast, lower-budget market entry, data confirmed by TradeTechFX.

Technology and Infrastructure

The pillar of any modern forex business is technology. Traders in 2026 expect seamless execution, fast order execution and full transparency. To provide for these, the brokers must build a sound infrastructure which includes trading platforms, liquidity, security systems and analytics tools.

Core Components of a Forex Technology Stack

- Trading Platform – Your frontline is the platform. MT4 or MT5 still is what everybody uses, but increasingly now they are shifting to white-label platforms that are customizable for the extra flexibility and control. Next-generation web and mobile platforms with AI-driven analytics are the new norm.

- Liquidity Bridge and Aggregator – A liquidity bridge connects the broker’s trading server to the liquidity providers, offering deep prices and smooth execution. A powerful aggregator enables you to solicit quotes from numerous providers, minimizing slippage and maximizing spreads.

- CRM and Back Office – A solid customer relationship management (CRM) system tracks client activity, automates onboarding and enables KYC verification. The back office must efficiently process deposits, withdrawals, trade history and compliance reporting.

- Risk and Analytics Tools – Emerging risk engines use machine learning to scan trade exposure in real time. They help in the detection of high-risk clients, A-Book and B-Book order management and liquidity needs forecasting.

- Cybersecurity Infrastructure – Encryption of data, two-factor authentication and intrusion prevention systems are now standards. Regulators also expect periodic system audits and cybersecurity certifications.

Turnkey Technology Solutions

Building everything from the ground up is expensive. Turnkey providers such as Quadcode.com offer ready-to-launch brokerage infrastructure covering trading platforms, CRM, liquidity links and compliance integrations. This approach reduces your startup costs and shortens your launch timeline without sacrificing on performance or reliability.

Integration and Scalability

As your client base grows, your systems must scale. Cloud-based servers, API integrations and modular architecture allow your brokerage to expand globally while maintaining uptime and speed.

Liquidity and Partnerships

Liquidity is the oxygen of any forex company. Without deep and reliable liquidity, traders suffer from poor executions, wide spreads and slippage that can ruin a broker’s reputation overnight. It is therefore one of the highest priorities when opening shop in 2026 to develop close relationships with reliable technology and liquidity providers.

Understanding Forex Liquidity

Liquidity is the accessibility with which currency pairs can be sold or bought without affecting market prices. A broker’s access to liquidity determines execution quality and spread competitiveness. In 2026, liquidity aggregation technology allows brokers to aggregate several sources into one deep pool, offering customers tighter prices and faster trades.

Choosing the Right Liquidity Provider

When evaluating providers, focus on:

- Depth of liquidity – Access to multiple Tier-1 bank, ECN and institutional venues.

- Execution speed – Low latency and minimal slippage are critical to client satisfaction.

- Pricing transparency – Vendors must offer transparent markups and reporting.

- Integration support – APIs and bridges that integrate perfectly into your platform and CRM.

Good providers also offer credit lines and leverage structures that support your growth while managing exposure.

Partnerships That Drive Growth

Beyond liquidity, your brokerage will rely on several key partnerships:

- Payment processors for deposits and withdrawals in multiple currencies.

- Regtech and KYC vendors for onboarding and compliance automation.

- Marketing affiliates to expand reach and attract global clients.

Strategic alliance with reliable partners can significantly improve operational efficiency and profitability.

Capital, Costs and Funding

Starting a forex business in 2026 requires careful financial planning. While technology and licensing costs have become more flexible, competition and compliance demands mean you still need a solid capital base to operate sustainably.

Initial Capital Requirements

The amount of startup capital depends on your chosen jurisdiction and business model.

- Tier-1 regulators (like the FCA, CFTC or DFSA) typically require between USD 1 – 20 million in regulatory capital.

- Mid-tier regulators (such as CySEC or ASIC) may require around EUR 125,000 – 730,000.

- Offshore regulators (like Seychelles or Mauritius) can approve licenses with EUR 20,000 – 50,000.

Beyond regulatory minimums, you’ll also need working capital for operations, technology and marketing.

Key Startup Expenses

Typical cost breakdown for a new forex brokerage includes:

- Technology setup – trading platform, bridge, CRM and hosting (USD 25,000 – 90,000).

- Licensing and legal – registration, compliance documents and audits (USD 30,000 – 50,000).

- Liquidity access – setup fees and ongoing monthly commissions.

- Marketing and acquisition – website, ads, affiliate commissions and onboarding campaigns.

- Staff and support – compliance officers, IT engineers, customer service and finance.

Funding Your Brokerage

If you lack the capital to start independently, consider:

- Private investors or venture capital specializing in fintech startups.

- Partnerships with experienced brokers who want to expand into new regions.

- White-label or turnkey arrangements by firms that allow firms to begin with smaller starting capital and gradually increase stake.

Managing Cash Flow

During the first 6 – 12 months, liquidity fees, compliance costs and marketing spend can be high. Focus on building stable trading volume, optimizing spreads and exposure management. A well-planned budget and conservative growth strategy will keep operations feasibility in line with the growth of the firm.

Risk Management and Compliance Systems

Effective risk management is the strongest pillar of a forex company. By 2026, traders need full transparency and regulators insist on real-time monitoring of exposure, liquidity, and client activity. Whether or not a broker is able to directly manage these factors determines its reputation and ultimate success.

Modern forex companies use advanced risk engines that track positions, liquidity and client orders as they happen. Automated alerts help prevent imbalances, while built-in hedging systems protect against large swings in currency prices. For hybrid brokers, these tools also decide when to route trades externally (A-Book) or internalize them (B-Book) to keep risk within safe limits.

Compliance is equally as critical. Brokers must be able to prove that all transactions are in line with international standards on KYC, AML and client fund protection. Automation is at the forefront now. Trade verification, data storage and daily reporting are often the responsibility of AI systems that determine suspicious activity and allow communication with the regulator.

Even the best forex platform can’t do well without a constant stream of live traders. In 2026, client acquisition is no longer screaming advertisements. It’s credibility, education and constant interaction. Brokers who build trust and provide value earn long-term loyalty.

Building a Marketing Strategy

Successful forex brokers use a mix of organic and paid strategies to grow their user base. Digital visibility remains key, your website must rank well on search engines. It should load quickly and provide transparent information about spreads, platforms and regulation.

Focus on three main channels:

- Content marketing – Create useful guides, webinars and daily market insights that position your brand as an authority.

- Affiliate programs – Partner with experienced affiliates who can promote your brand in new markets through performance-based campaigns.

- Social proof and community – Use testimonials, trading challenges and transparent reporting to build trust among new traders.

The Role of Education

Forex education continues to be one of the strongest conversion tools. Offering free resources such as tutorials, webinars and demo accounts helps turn curious visitors into loyal traders. A well-informed client trades more often and stays longer.

Retaining Clients

Retention is more profitable than acquisition. Offer loyalty programs, dedicated account managers and fast support. Track user behavior through CRM analytics to identify inactive clients and re-engage them with personalized offers.

Launch Strategy and Minimum Viable Product (MVP)

Once your technology, regulation and liquidity setup are ready, it’s time to launch — but smart brokers in 2026 no longer go all-in from day one. The best approach is to start small with a Minimum Viable Product (MVP) that allows you to test your systems, marketing and user experience before scaling.

Why Start with an MVP

An MVP lets you validate your trading infrastructure and customer onboarding process under real market conditions. Instead of building a large operation immediately, you can attract a limited group of early users, gather feedback and refine the product. This reduces costs, minimizes risk and ensures stability when you expand.

Steps to a Successful Launch

- Soft Launch – Begin with a controlled rollout in one region or segment. Monitor system performance, execution speed and support response times.

- Collect Feedback – Use surveys, analytics and CRM data to understand what traders value most.

- Refine and Optimize – Adjust spreads, leverage settings and UX based on feedback.

- Expand Gradually – Once performance and satisfaction reach targets, scale operations and marketing globally.

Scaling and Growth

Once your forex business gains traction, scaling becomes the next priority. Growth in 2026 is about expanding into new markets, diversifying products and strengthening your brand through automation and partnerships.

Expanding to New Jurisdictions

After a successful soft launch, the next step is to apply for additional licenses or set up representative offices in key financial hubs. Regions such as Dubai, Cyprus and Singapore are attractive because they offer access to international clients while maintaining strong regulatory standards. Always ensure your new licenses align with your target audience and long-term strategy.

Adding New Asset Classes

Many modern brokers are no longer limited to forex. Adding CFDs, crypto pairs, indices and commodities allows you to attract more traders and increase revenue per client. Multi-asset trading platforms give your brand a competitive advantage and help you retain customers who prefer a single, unified account.

Investing in Automation

Scaling requires efficiency. Automate as much as possible, from KYC verification and deposits to email marketing and reporting. Cloud-based CRM systems and AI-driven analytics make it easier to track growth, optimize campaigns and maintain compliance at scale.

Building Partnerships

Forming alliances with fintech firms, payment processors and liquidity providers can open doors to new opportunities. Partnerships often reduce costs and speed up access to local markets.

Challenges and Pitfalls to Avoid

Starting a forex business in 2026 can be highly rewarding, but the road is filled with challenges that many new brokers underestimate. Understanding these pitfalls early helps you avoid costly mistakes and build long-term stability.

- Underestimating Regulation – Many startups choose cheap offshore licenses without realizing how limited they are. Weak regulation reduces credibility and blocks access to major payment and liquidity partners. Always plan for an upgrade to a Tier-1 or Tier-2 license as soon as your business grows.

- Insufficient Capital – Running a brokerage is expensive. Between liquidity fees, staff and marketing, many brokers run out of cash before they reach profitability. Plan for at least 12 months of operating expenses and secure a financial buffer to handle unexpected market conditions.

- Poor Technology Choices – A weak platform or unreliable bridge can destroy client trust overnight. Choose providers with proven uptime, fast execution and 24/7 technical support. Partnering with technology experts like Quadcode.com ensures that your systems remain stable and scalable as your user base grows.

- Ignoring Risk Management – Many brokers fail to monitor exposure or segregate client funds properly. This leads to compliance breaches and financial loss. Set up real-time risk monitoring from day one.

- Weak Client Retention – Focusing only on acquisition while neglecting retention is a common mistake. Keep traders engaged with educational tools, loyalty programs and responsive support. A satisfied trader stays longer and refers others.

Future Trends in Forex Business (2026 and Beyond)

The forex industry continues to evolve quickly. In 2026, brokers that adapt to new technologies, client preferences and regulatory expectations will lead the market. Here are the most significant trends shaping the future of forex businesses.

Artificial Intelligence and Automation

AI is transforming how brokers manage risk, analyze markets and serve clients. Smart algorithms now optimize spreads, automate compliance tasks and personalize trading recommendations. Brokers using AI-based chat assistants and data-driven analytics are already seeing higher retention and efficiency.

Tokenization and DeFi Integration

Digital assets are no longer separate from forex. Tokenized currency pairs, blockchain settlements and decentralized liquidity pools are merging with traditional trading systems. Forward-thinking brokers are adopting hybrid infrastructures that allow seamless trading between fiat and crypto instruments.

ESG and Ethical Trading

Regulators and investors increasingly expect transparency and sustainability. In 2026, brokers are being evaluated not only on performance but also on governance, client fairness and environmental responsibility. Ethical trading models and ESG-aligned operations will become key brand differentiators.

Embedded Forex in Fintech Apps

Fintech platforms and neobanks are integrating forex directly into their apps. Instead of standalone brokers, clients expect multi-purpose platforms that combine trading, payments and portfolio management. This creates opportunities for partnerships and white-label collaborations between brokers and fintechs.

Global Consolidation

The number of independent small brokers will shrink as compliance costs rise. Larger, well-capitalized firms with strong technology and regulation will dominate. However, niche brokers with specialized offerings or regional focus will still thrive if they provide real value and trust.

Conclusion

Starting a forex business in 2026 is no longer about just launching a trading platform. Success depends on building a regulated, transparent and technology-driven operation that inspires trust and delivers value to traders.

Every key area, from licensing and liquidity to marketing and risk control, must work together. A well-planned strategy allows you to scale gradually, reduce risk and create long-term growth. The most successful brokers in 2026 will combine automation, education and compliance with an exceptional client experience.

FAQ

How much capital is needed to start a forex business in 2026? Startup costs depend on the jurisdiction and model you choose. A regulated brokerage in Europe or the UAE may need between USD 500,000 and 2 million, while offshore options can start around EUR 20,000 - 50,000. Additional funds are required for technology, liquidity and marketing.

If you are targeting serious traders, choose a Tier-1 or Tier-2 jurisdiction such as Cyprus (CySEC), the UK (FCA) or the UAE (DFSA). Offshore regions like Mauritius or Seychelles offer faster, lower-cost setup but less credibility.

Brokers earn revenue from spreads, commissions and swap fees. Some use hybrid models that combine external execution (A-Book) and internalized trades (B-Book) to balance profit and risk.

Yes, Turnkey and white-label solutions from providers like QuadCode.com allow you to launch quickly with built-in trading platforms, CRM and liquidity access, reducing startup costs and complexity.

The main risks include poor liquidity, weak regulation, technology failures and insufficient risk management. Non-compliance with AML or client protection rules can also lead to heavy penalties or loss of license.

Updated:

November 11, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]